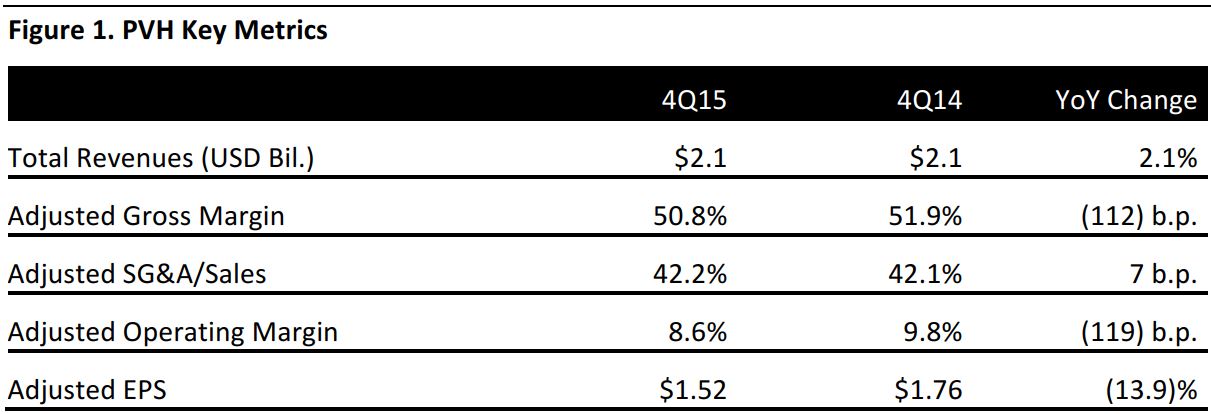

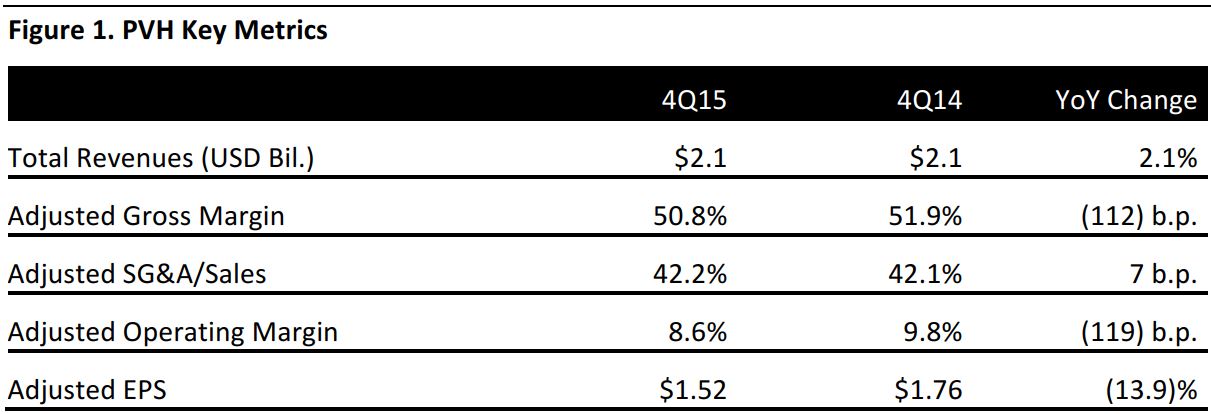

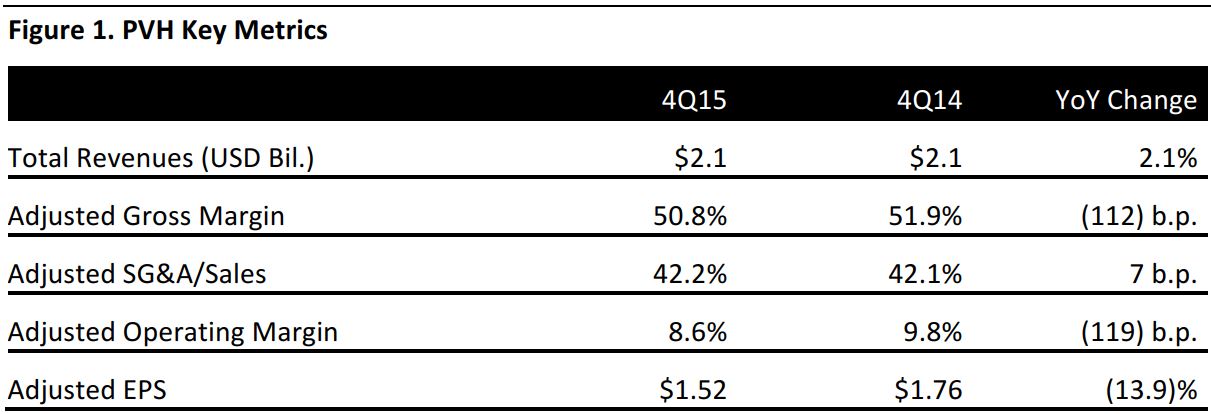

Source: Company reports

4Q15 RESULTS

Management commented that it was pleased with the overall results given the challenging retail environment in the US. The strong performance was primarily driven by growth in the Calvin Klein business. In 4Q15, revenues in the Calvin Klein business grew 21% on a constant currency basis to $806 million, in which the North American wholesale division grew over 20%. On the retail side, revenue growth was driven by square footage expansion at company-operated stores.

The Tommy Hilfiger business grew revenues 5% on a constant currency basis to $919 million. North American comps declined 7% year-over-year due to weak tourist purchases and high levels of promotion at the stores.

Heritage Brands’ revenue was down 10% to $447 million, primarily due to rationalization of the business, including the exit from the Izod retail business and the discontinuation of several licenses.

Adjusted EPS of $1.52 exceeded both guidance and the consensus estimate.

2015 RESULTS

Total revenue in 2015 increased by 4% on a constant currency basis to $8.2billion, driven by a 9% increase in the Calvin Klein business, a 4% increase in the Tommy Hilfiger business, partially offset by a 4% decline in Heritage Brands.

Adjusted EPS was $7.05 for the full year, down from the previous year’s EPS of $7.30. Adjusted for foreign exchange rates, adjusted EPS would have been $8.43 in 2015.

GUIDANCE

Management expects revenues to grow 2% on a constant currency basis in 2016. By segment, the Calvin Klein business is projected to increase about 6%, the Tommy Hilfiger business is expected to grow by 3% (on a constant currency basis) and the Heritage Brands business is expected to decline by 7% on a GAAP basis. Full-year EPS is expected to be between $6.30 and $6.50.

For 1Q2016, revenues are expected to increase by 3% on a constant currency basis or 1% on a GAAP basis. Revenues from the Calvin Klein business and the Tommy Hilfiger business are expected to grow at 12% and 2%, respectively, while the Heritage Brands business is expected to decline by 9% (based on constant currency).