Source: Company reports/Fung Global Retail & Technology

2Q16 RESULTS

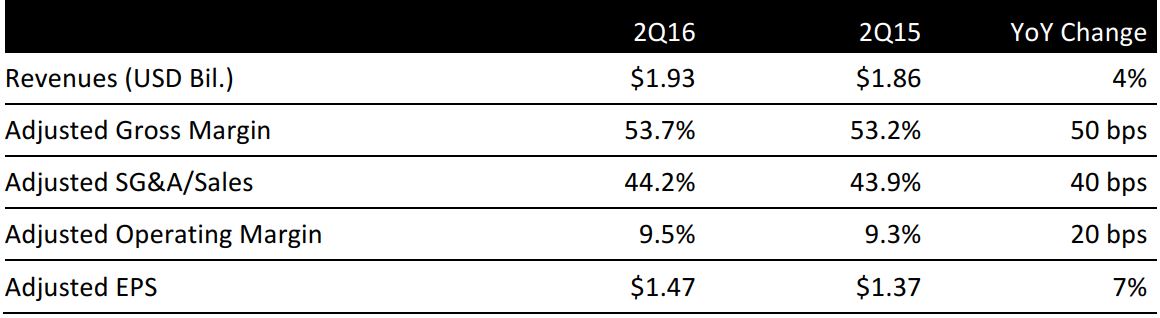

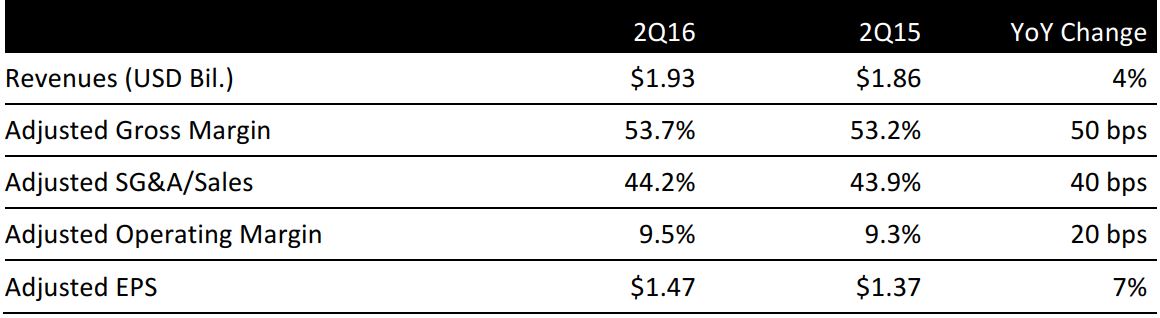

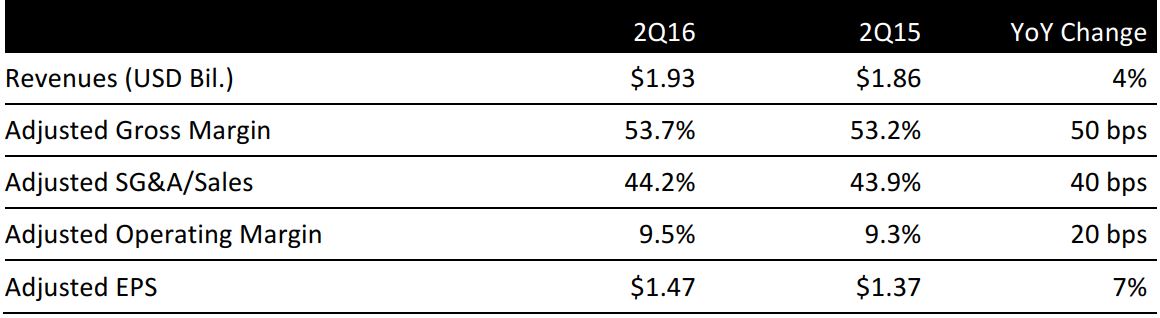

PVH Corp. reported 2Q16 revenues of $1.93 billion, up 4% year over year but below the $1.94 billion consensus estimate. Revenue in the Calvin Klein business increased by 12% (15% on a constant-currency basis) year over year, to $726 million. Calvin Klein North America revenue increased by 11% (12% in constant -currency), to $398 million. Calvin Klein International revenue increased to $328 million (up 13%, or 17% in constant currency). The division saw an 11% increase in comparable-store sales that was driven by growth across Europe and Asia.

Revenue for Tommy Hilfiger increased by 6% (7% on a constant-currency basis), to $860 million. Growth in the wholesale business was partially offset by continued softness in the US retail business. North America comparable-store sales declined by 7% year over year, driven by continued weakness in traffic and consumer-spending trends in Tommy Hilfiger’s US stores in international tourist locations. Tommy Hilfiger International revenue increased by 10% (11% on a constant-currency basis), to $453 million. This was driven by continued strong growth in Europe, including an 8% increase in comparable-store sales, and by the company’s April 2016 acquisition of the 55% interest in its joint venture for Tommy Hilfiger in China that it did not already own.

The revenue increases at Calvin Klein and Tommy Hilfiger were offset by Heritage Brand revenue decreases of 14% for the quarter. The decreases were attributed to exit of the Izod retail business and the discontinuation of several licensed product lines in the dress furnishings business. Additionally, the overall neckwear category was soft compared with the prior-year period. An 11% increase in Van Heusen comparable in-store sales during the period helped to offset these decreases.

Despite acquiring inventory as part of the Tommy Hilfiger in China acquisition, inventory levels remained relatively flat year over year.

2016 Outlook

For the third quarter, PVH guided for EPS of $2.35–$2.40, which includes $0.45 impact from foreign exchange. The company’s third-quarter revenue guidance increased by 3% on a GAAP basis.

For FY16, the company increased its EPS guidance to $6.55–$6.65, which includes an impact of $1.60 per share related to foreign currency exchange. This is up from previous EPS guidance of $6.45–$6.55, which included a $1.55 negative impact from foreign exchange. PVH increased its revenue guidance by 2% on a GAAP basis.

PVH continues to reinvest in its brands and the business, and highlighted the following recent initiatives: marketing investments and commercial initiatives on each of its brands, a creative team leadership change at Calvin Klein, the launch of the Gigi Hadid capsule collection, a fall 2016 womenswear campaign for Tommy Hilfiger, and ongoing digital commerce efforts.