Source: Company reports/Fung Global Retail & Technology

1Q17 Results

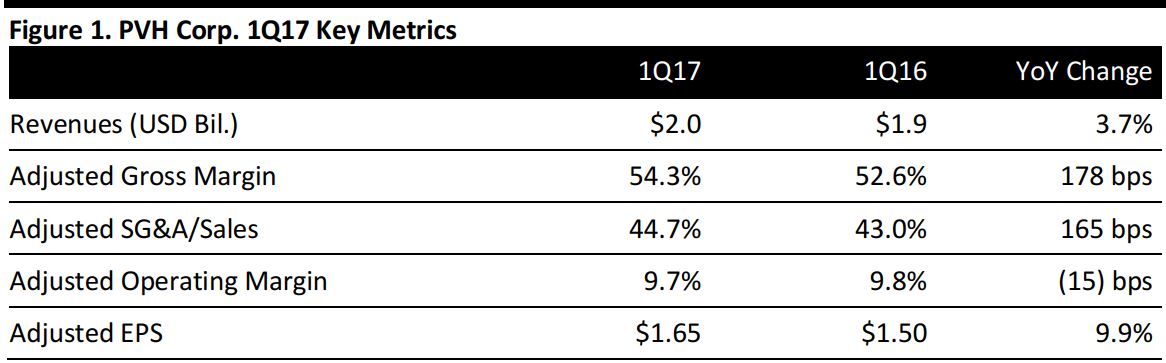

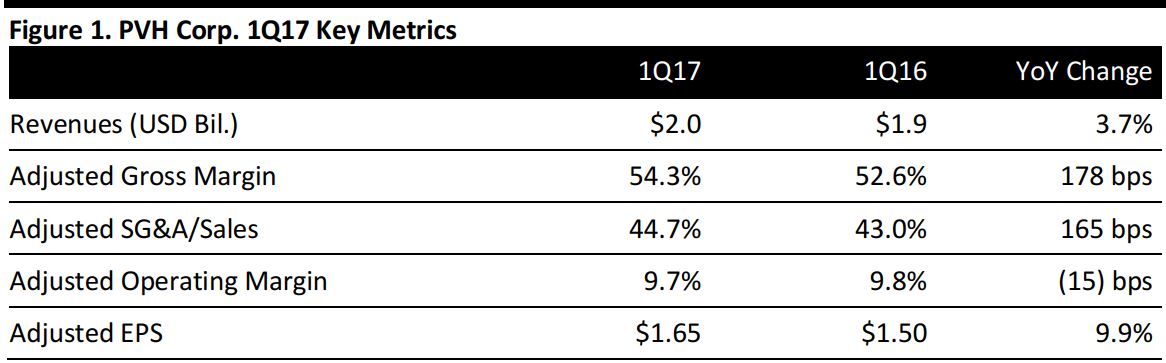

PVH Corp. reported 1Q17 revenues of $2.0 billion, up 3.7% year over year and slightly above the $1.96 billion consensus estimate. Revenues increased by 5% on a constantcurrency basis.

Adjusted EPS was $1.65, ahead of the $1.60 consensus estimate and up 9.9% year over year. GAAP EPS was $0.89, down from $2.83 in the year-ago quarter. GAAP EPS guidance was $0.73–$0.75 and non-GAAP EPS guidance was $1.58–$1.60.

The company’s inventory level decreased by 2% from the year-ago period.

Management commented that strong momentum in the Calvin Klein and Tommy Hilfiger businesses enabled PVH Corp. to exceed both its sales and earnings guidance despite a volatile macroeconomic environment and a highly promotional US retail market.

Results by Segment

- Calvin Klein: Revenue increased by 5% (up 6% on a constant currency basis), to $756 million, which includes a reduction of approximately $15 million resulting from the November 2016 deconsolidation of the Calvin Klein business in Mexico. Calvin Klein international revenue increased by 11%, to $380 million (up 13% on a constant currency basis), primarily due to continued strength in Europe and China. International comparable store sales increased by 3%. North America revenue decreased by 1% compared with the prior-year period (and decreased by the same percentage on a constant currency basis), to $375 million, primarily due to the Mexico deconsolidation and a 5% decline in North America comparable store sales.

- Tommy Hilfiger: Revenue increased by 6%, to $842 million (up 9% on a constant currency basis). International revenue increased by 15%, to $524 million (up 19% on a constant currency basis), driven by strong performance across all channels and markets in Europe, plus a full quarter of revenue from the April 2016 acquisition of a 55% interest in the company’s former Tommy Hilfiger joint venture in China. International comparable store sales increased by 14%. North America revenue decreased by 5% (and decreased by 5% on a constant currency basis), to $318 million. The North America revenue decline was primarily due to a reduction of the directly operated womenswear wholesale business in the US and Canada in connection with the licensing of that business to G-III Apparel Group and a 4% comparable store sales decline.

- Heritage Brands: Revenue decreased by 3%, to $391 million, principally from a planned shift in the timing of shipments from the first quarter into the second quarter. Comparable store sales were flat.

Outlook

Full Year

Revenue in 2017 is expected to increase by approximately 3% (and by approximately 5% on a constant currency basis) compared with 2016. Revenue is expected to total approximately $8.4 billion versus the consensus estimate of $8.3 billion, despite a reduction in revenue due to the effects of the Mexico deconsolidation and the G-III license.

Management expects 2017 EPS to be hurt by $0.35 per share due to unfavorable exchange rates.

The company raised its full-year GAAP EPS guidance to $6.24–$6.34 from $6.20–$6.30 previously, and raised its non-GAAP EPS guidance to $7.40–$7.50 from $7.30–$7.40 previously, above the $7.40 consensus estimate.

2Q17

Revenue in 2Q17 is projected to increase by approximately 5% (and by approximately 7% on a constant currency basis) year over year, to about $2 billion, despite a reduction in revenue due to the effects of the Mexico deconsolidation and the G-III license. The consensus estimate calls for 2Q17 revenue of $1.96 billion.

GAAP EPS is expected to be $1.35–$1.38 and non-GAAP EPS is expected to be $1.60–$1.63, which includes a $0.07 currency headwind and an extra $20 million in marketing expense from the Calvin Klein business. Consensus expects non-GAAP EPS of $1.57.