Nitheesh NH

[caption id="attachment_82066" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

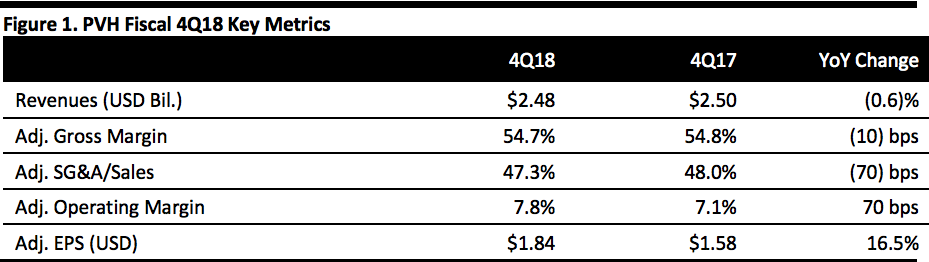

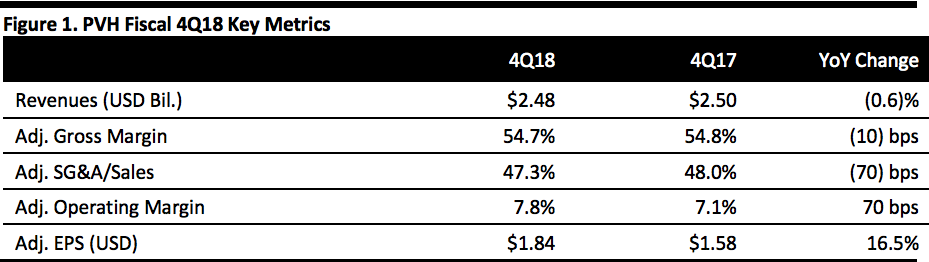

PVH reported 4Q18 revenues of $2.48 billion versus $2.50 billion in the same period last year, beating the $2.41 billion consensus. The 53-week F2017 negatively impacted 4Q18 revenue comparisons by approximately $125 million. Excluding the calendar shift, revenue would have risen 4.4%.

EPS of $1.84 compares with $1.58 in the same period last year, up 16.5% and beating the $1.76 consensus estimate.

Details from the Quarter

With global brand awareness exceeding 80%, Tommy Hilfiger exited F2018 on a strong note and enters FY19 with global opportunity. Brand revenue of $1.17 billion rose 5% on a constant currency basis, but was penalized by a $60 million shortfall related to the impact of the 53rdweek in F2017. Tommy Hilfiger International revenue rose 7% at constant currency to $702 million, driven by strong performance across all regions and channels. Tommy Hilfiger NA revenue rose 1.8% to $447 million.

Tommy Hilfiger adjusted EBIT margin rose 270 bps to 14.7% with both regions contributing to the margin expansion. Tommy Hilfiger International adjusted EBIT margin rose 310 bps to 16.3% and Tommy Hilfiger NA, up 190 bps to 12.1%. The brand is outperforming the competition and capturing market share. Comp store sales rose 16% for Tommy Hilfiger International and 5% for Tommy Hilfiger NA. In Europe, the order book is up more than 10% and fall/winter orders are up close to 15%. Tommy Hilfiger Asia accounts for nearly 10% of overall Tommy Hilfiger revenues. Results in China benefit from investments in retail and digital businesses, including taking back licensee businesses to directly operated businesses in certain tier-1 and tier-2 cities in FY18, as well as marketing efforts focused on regional ambassadors, brand activations and interactive brand events.

Calvin Klein revenue of $953 million was flat year over year on a constant-currency basis and included the negative impact of $50 million from the 53rdweek in F2017. On a constant currency basis, Calvin Klein International revenue increased 6% to $523 million and Calvin Klein NA revenue decreased 7% to $430 million. International comps increased 6% and Calvin Klein NA comps decreased 1%. The brand beat management’s revised expectations despite continued softness in the Calvin Klein Jeans business in North America.

Calvin Klein total brand adjusted EBIT was $84.4 million, and the adjusted EBIT margin expanded 80 bps to 8.9%, driven by Calvin Klein NA, where the adjusted EBIT margin expanded 120 bps to 7.2%. The Calvin Klein International adjusted EBIT margin expanded 20 bps to 10.2%.

PVH is focused on restoring the core Calvin Klein business and highlighting iconic products with a more seductive and provocative aesthetic. To that end, the company will be the exclusive apparel sponsor at the Coachella music festival in April. At the same time, the company will exit the top-tier of the brand’s business (including closing the flagship on New York’s Madison Avenue) as this high-end business doesn’t resonate with the brand’s core consumer.

Revenue in the Heritage Brands business decreased 4.7% to $363 million, comps were flat and the segment was penalized approximately $15 million due to the 53rdweek in 2017. EBIT swung from $7.6 million to a segment loss before interest and taxes and corporate expenses of $7.7 million.

Inventories of $1.73 million rose 8.9% or $141 million.

Outlook

The initial FY19 guidance includes:

Non-GAAP EPS in the $10.30-10.40 range, up 7-8% and including a negative impact of foreign currency of $0.22. Excluding the negative impact of foreign currency, EPS is projected to grow approximately 10-11%.

PVH anticipates 4% revenue growth, 5% on a constant currency basis. The company expects an addition of approximately $150 million of revenue related to pending Australia and greater China acquisitions, partially offset by a decrease of approximately $100 million related to its intention to license the Calvin Klein women's jeans business in 2H19, and the closure of the Calvin Klein collection business. Tommy Hilfiger revenues are expected to increase 6% and 8% on a constant currency basis; Calvin Klein revenues to grow 2% and 3% on a constant currency basis, driven by strong international growth, and the Heritage business is expected to achieve 3% revenue growth.

The EBIT margin is expected to increase approximately 20-30 bps. The Tommy Hilfiger operating margin is planned to decrease 10-20 basis points, including the negative impact from the pending Australia and greater China acquisitions as these businesses shift from a licensing model to a directly operated model. The Calvin Klein operating margin is expected to increase 80-90 bps and for the Heritage business, 10-20 bps.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

PVH reported 4Q18 revenues of $2.48 billion versus $2.50 billion in the same period last year, beating the $2.41 billion consensus. The 53-week F2017 negatively impacted 4Q18 revenue comparisons by approximately $125 million. Excluding the calendar shift, revenue would have risen 4.4%.

EPS of $1.84 compares with $1.58 in the same period last year, up 16.5% and beating the $1.76 consensus estimate.

Details from the Quarter

With global brand awareness exceeding 80%, Tommy Hilfiger exited F2018 on a strong note and enters FY19 with global opportunity. Brand revenue of $1.17 billion rose 5% on a constant currency basis, but was penalized by a $60 million shortfall related to the impact of the 53rdweek in F2017. Tommy Hilfiger International revenue rose 7% at constant currency to $702 million, driven by strong performance across all regions and channels. Tommy Hilfiger NA revenue rose 1.8% to $447 million.

Tommy Hilfiger adjusted EBIT margin rose 270 bps to 14.7% with both regions contributing to the margin expansion. Tommy Hilfiger International adjusted EBIT margin rose 310 bps to 16.3% and Tommy Hilfiger NA, up 190 bps to 12.1%. The brand is outperforming the competition and capturing market share. Comp store sales rose 16% for Tommy Hilfiger International and 5% for Tommy Hilfiger NA. In Europe, the order book is up more than 10% and fall/winter orders are up close to 15%. Tommy Hilfiger Asia accounts for nearly 10% of overall Tommy Hilfiger revenues. Results in China benefit from investments in retail and digital businesses, including taking back licensee businesses to directly operated businesses in certain tier-1 and tier-2 cities in FY18, as well as marketing efforts focused on regional ambassadors, brand activations and interactive brand events.

Calvin Klein revenue of $953 million was flat year over year on a constant-currency basis and included the negative impact of $50 million from the 53rdweek in F2017. On a constant currency basis, Calvin Klein International revenue increased 6% to $523 million and Calvin Klein NA revenue decreased 7% to $430 million. International comps increased 6% and Calvin Klein NA comps decreased 1%. The brand beat management’s revised expectations despite continued softness in the Calvin Klein Jeans business in North America.

Calvin Klein total brand adjusted EBIT was $84.4 million, and the adjusted EBIT margin expanded 80 bps to 8.9%, driven by Calvin Klein NA, where the adjusted EBIT margin expanded 120 bps to 7.2%. The Calvin Klein International adjusted EBIT margin expanded 20 bps to 10.2%.

PVH is focused on restoring the core Calvin Klein business and highlighting iconic products with a more seductive and provocative aesthetic. To that end, the company will be the exclusive apparel sponsor at the Coachella music festival in April. At the same time, the company will exit the top-tier of the brand’s business (including closing the flagship on New York’s Madison Avenue) as this high-end business doesn’t resonate with the brand’s core consumer.

Revenue in the Heritage Brands business decreased 4.7% to $363 million, comps were flat and the segment was penalized approximately $15 million due to the 53rdweek in 2017. EBIT swung from $7.6 million to a segment loss before interest and taxes and corporate expenses of $7.7 million.

Inventories of $1.73 million rose 8.9% or $141 million.

Outlook

The initial FY19 guidance includes:

Non-GAAP EPS in the $10.30-10.40 range, up 7-8% and including a negative impact of foreign currency of $0.22. Excluding the negative impact of foreign currency, EPS is projected to grow approximately 10-11%.

PVH anticipates 4% revenue growth, 5% on a constant currency basis. The company expects an addition of approximately $150 million of revenue related to pending Australia and greater China acquisitions, partially offset by a decrease of approximately $100 million related to its intention to license the Calvin Klein women's jeans business in 2H19, and the closure of the Calvin Klein collection business. Tommy Hilfiger revenues are expected to increase 6% and 8% on a constant currency basis; Calvin Klein revenues to grow 2% and 3% on a constant currency basis, driven by strong international growth, and the Heritage business is expected to achieve 3% revenue growth.

The EBIT margin is expected to increase approximately 20-30 bps. The Tommy Hilfiger operating margin is planned to decrease 10-20 basis points, including the negative impact from the pending Australia and greater China acquisitions as these businesses shift from a licensing model to a directly operated model. The Calvin Klein operating margin is expected to increase 80-90 bps and for the Heritage business, 10-20 bps.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

PVH reported 4Q18 revenues of $2.48 billion versus $2.50 billion in the same period last year, beating the $2.41 billion consensus. The 53-week F2017 negatively impacted 4Q18 revenue comparisons by approximately $125 million. Excluding the calendar shift, revenue would have risen 4.4%.

EPS of $1.84 compares with $1.58 in the same period last year, up 16.5% and beating the $1.76 consensus estimate.

Details from the Quarter

With global brand awareness exceeding 80%, Tommy Hilfiger exited F2018 on a strong note and enters FY19 with global opportunity. Brand revenue of $1.17 billion rose 5% on a constant currency basis, but was penalized by a $60 million shortfall related to the impact of the 53rdweek in F2017. Tommy Hilfiger International revenue rose 7% at constant currency to $702 million, driven by strong performance across all regions and channels. Tommy Hilfiger NA revenue rose 1.8% to $447 million.

Tommy Hilfiger adjusted EBIT margin rose 270 bps to 14.7% with both regions contributing to the margin expansion. Tommy Hilfiger International adjusted EBIT margin rose 310 bps to 16.3% and Tommy Hilfiger NA, up 190 bps to 12.1%. The brand is outperforming the competition and capturing market share. Comp store sales rose 16% for Tommy Hilfiger International and 5% for Tommy Hilfiger NA. In Europe, the order book is up more than 10% and fall/winter orders are up close to 15%. Tommy Hilfiger Asia accounts for nearly 10% of overall Tommy Hilfiger revenues. Results in China benefit from investments in retail and digital businesses, including taking back licensee businesses to directly operated businesses in certain tier-1 and tier-2 cities in FY18, as well as marketing efforts focused on regional ambassadors, brand activations and interactive brand events.

Calvin Klein revenue of $953 million was flat year over year on a constant-currency basis and included the negative impact of $50 million from the 53rdweek in F2017. On a constant currency basis, Calvin Klein International revenue increased 6% to $523 million and Calvin Klein NA revenue decreased 7% to $430 million. International comps increased 6% and Calvin Klein NA comps decreased 1%. The brand beat management’s revised expectations despite continued softness in the Calvin Klein Jeans business in North America.

Calvin Klein total brand adjusted EBIT was $84.4 million, and the adjusted EBIT margin expanded 80 bps to 8.9%, driven by Calvin Klein NA, where the adjusted EBIT margin expanded 120 bps to 7.2%. The Calvin Klein International adjusted EBIT margin expanded 20 bps to 10.2%.

PVH is focused on restoring the core Calvin Klein business and highlighting iconic products with a more seductive and provocative aesthetic. To that end, the company will be the exclusive apparel sponsor at the Coachella music festival in April. At the same time, the company will exit the top-tier of the brand’s business (including closing the flagship on New York’s Madison Avenue) as this high-end business doesn’t resonate with the brand’s core consumer.

Revenue in the Heritage Brands business decreased 4.7% to $363 million, comps were flat and the segment was penalized approximately $15 million due to the 53rdweek in 2017. EBIT swung from $7.6 million to a segment loss before interest and taxes and corporate expenses of $7.7 million.

Inventories of $1.73 million rose 8.9% or $141 million.

Outlook

The initial FY19 guidance includes:

Non-GAAP EPS in the $10.30-10.40 range, up 7-8% and including a negative impact of foreign currency of $0.22. Excluding the negative impact of foreign currency, EPS is projected to grow approximately 10-11%.

PVH anticipates 4% revenue growth, 5% on a constant currency basis. The company expects an addition of approximately $150 million of revenue related to pending Australia and greater China acquisitions, partially offset by a decrease of approximately $100 million related to its intention to license the Calvin Klein women's jeans business in 2H19, and the closure of the Calvin Klein collection business. Tommy Hilfiger revenues are expected to increase 6% and 8% on a constant currency basis; Calvin Klein revenues to grow 2% and 3% on a constant currency basis, driven by strong international growth, and the Heritage business is expected to achieve 3% revenue growth.

The EBIT margin is expected to increase approximately 20-30 bps. The Tommy Hilfiger operating margin is planned to decrease 10-20 basis points, including the negative impact from the pending Australia and greater China acquisitions as these businesses shift from a licensing model to a directly operated model. The Calvin Klein operating margin is expected to increase 80-90 bps and for the Heritage business, 10-20 bps.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

PVH reported 4Q18 revenues of $2.48 billion versus $2.50 billion in the same period last year, beating the $2.41 billion consensus. The 53-week F2017 negatively impacted 4Q18 revenue comparisons by approximately $125 million. Excluding the calendar shift, revenue would have risen 4.4%.

EPS of $1.84 compares with $1.58 in the same period last year, up 16.5% and beating the $1.76 consensus estimate.

Details from the Quarter

With global brand awareness exceeding 80%, Tommy Hilfiger exited F2018 on a strong note and enters FY19 with global opportunity. Brand revenue of $1.17 billion rose 5% on a constant currency basis, but was penalized by a $60 million shortfall related to the impact of the 53rdweek in F2017. Tommy Hilfiger International revenue rose 7% at constant currency to $702 million, driven by strong performance across all regions and channels. Tommy Hilfiger NA revenue rose 1.8% to $447 million.

Tommy Hilfiger adjusted EBIT margin rose 270 bps to 14.7% with both regions contributing to the margin expansion. Tommy Hilfiger International adjusted EBIT margin rose 310 bps to 16.3% and Tommy Hilfiger NA, up 190 bps to 12.1%. The brand is outperforming the competition and capturing market share. Comp store sales rose 16% for Tommy Hilfiger International and 5% for Tommy Hilfiger NA. In Europe, the order book is up more than 10% and fall/winter orders are up close to 15%. Tommy Hilfiger Asia accounts for nearly 10% of overall Tommy Hilfiger revenues. Results in China benefit from investments in retail and digital businesses, including taking back licensee businesses to directly operated businesses in certain tier-1 and tier-2 cities in FY18, as well as marketing efforts focused on regional ambassadors, brand activations and interactive brand events.

Calvin Klein revenue of $953 million was flat year over year on a constant-currency basis and included the negative impact of $50 million from the 53rdweek in F2017. On a constant currency basis, Calvin Klein International revenue increased 6% to $523 million and Calvin Klein NA revenue decreased 7% to $430 million. International comps increased 6% and Calvin Klein NA comps decreased 1%. The brand beat management’s revised expectations despite continued softness in the Calvin Klein Jeans business in North America.

Calvin Klein total brand adjusted EBIT was $84.4 million, and the adjusted EBIT margin expanded 80 bps to 8.9%, driven by Calvin Klein NA, where the adjusted EBIT margin expanded 120 bps to 7.2%. The Calvin Klein International adjusted EBIT margin expanded 20 bps to 10.2%.

PVH is focused on restoring the core Calvin Klein business and highlighting iconic products with a more seductive and provocative aesthetic. To that end, the company will be the exclusive apparel sponsor at the Coachella music festival in April. At the same time, the company will exit the top-tier of the brand’s business (including closing the flagship on New York’s Madison Avenue) as this high-end business doesn’t resonate with the brand’s core consumer.

Revenue in the Heritage Brands business decreased 4.7% to $363 million, comps were flat and the segment was penalized approximately $15 million due to the 53rdweek in 2017. EBIT swung from $7.6 million to a segment loss before interest and taxes and corporate expenses of $7.7 million.

Inventories of $1.73 million rose 8.9% or $141 million.

Outlook

The initial FY19 guidance includes:

Non-GAAP EPS in the $10.30-10.40 range, up 7-8% and including a negative impact of foreign currency of $0.22. Excluding the negative impact of foreign currency, EPS is projected to grow approximately 10-11%.

PVH anticipates 4% revenue growth, 5% on a constant currency basis. The company expects an addition of approximately $150 million of revenue related to pending Australia and greater China acquisitions, partially offset by a decrease of approximately $100 million related to its intention to license the Calvin Klein women's jeans business in 2H19, and the closure of the Calvin Klein collection business. Tommy Hilfiger revenues are expected to increase 6% and 8% on a constant currency basis; Calvin Klein revenues to grow 2% and 3% on a constant currency basis, driven by strong international growth, and the Heritage business is expected to achieve 3% revenue growth.

The EBIT margin is expected to increase approximately 20-30 bps. The Tommy Hilfiger operating margin is planned to decrease 10-20 basis points, including the negative impact from the pending Australia and greater China acquisitions as these businesses shift from a licensing model to a directly operated model. The Calvin Klein operating margin is expected to increase 80-90 bps and for the Heritage business, 10-20 bps.