albert Chan

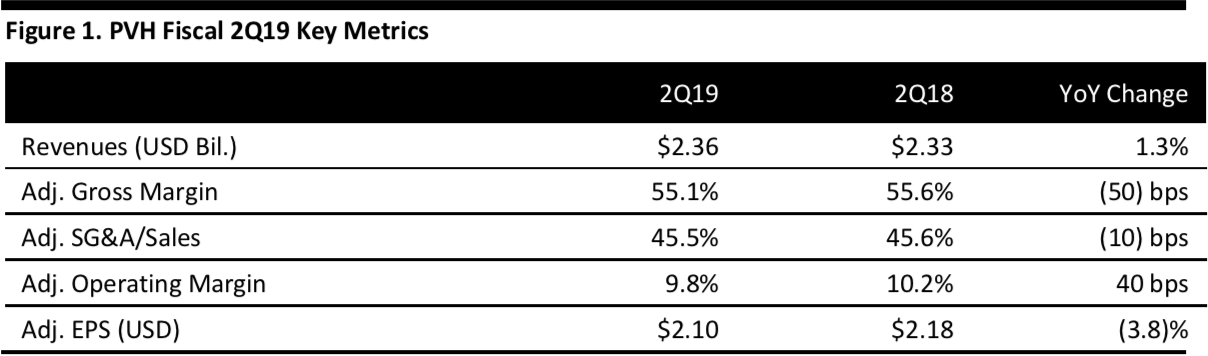

[caption id="attachment_95441" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

2Q19 revenues increased modestly to $2.36 billion, as currency clipped about 200 basis points (bps) from revenue growth, worth some $5 million and $0.06 per share. Adjusted 2Q19 EPS declined 3.8% to $2.10 versus $2.18, beating the $1.88 consensus estimate and $0.20 above the company’s guidance.

Business in Europe drove results as North America endured weak store traffic trends and heightened promotional activity that escalated during the quarter. International tourists represent 35-40% of traffic at PVH’s outlet locations and traffic from this customer group continued to decelerate during 2Q. Traffic trends in China further decelerated from 1Q and PVH projects that 2Q trends will continue for the remainder of the year.

Tommy Hilfiger continues to outpace consolidated results, achieving 8% revenue growth (10% constant currency) to $1.11 billion. Comps were 9% internationally, however, the Tommy Hilfiger business in North America declined 5% to $413 million, dragged down by an 8% comp decline. Tommy Hilfiger operating profits increased 12% to $158 million in tandem with a 50 bps operating margin expansion to 14.2% of sales, driven by a 340 bps expansion at Tommy Hilfiger International, offset by a 350 bps margin contraction at Tommy Hilfiger North America.

Revenues decreased 6% at Calvin Klein to $873 million (down 4% on a constant currency basis) and operating profit declined 4% to $101 million, for an operating margin of 11.5%, up 10 bps, driven by an 80 bps margin expansion at Calvin Klein International. The brand is enjoying traction with core and basic denim styles and the mix of basics to fashion is more brand appropriate. The initial reaction to women’s jeans (to launch in 4Q) is encouraging and initial product placement at retail is well ahead of initial plans.

Revenues in the Heritage Brands business were flat at $381 million, comps declined 2% and operating profit declined 46% to $18 million, reflecting gross margin pressure with the promotional environment in both the retail and wholesale channels.

Digital sales represent about 10% of total revenues, with robust growth continuing to track at rates exceeding 20% in owned and operated businesses throughout 2Q. Key partners, Amazon, Tmall and Zalando, among others, focus on the PVH power brands, Tommy Hilfiger and Calvin Klein, and the third-party business models are as or slightly more profitable than some wholesale partners. CEO Manny Chirico said: “The margins are actually margin-neutral or margin enhancing.”

Inventories of $1.86 billion rose 7.6% or $131 million.

Outlook

PVH lowered its F19 guidance to reflect a significantly more conservative outlook and now guides for adjusted EPS of $9.30-9.40 from previous guidance of $10.20-10.30.

The revised guidance reflects PVH’s significantly more conservative outlook based on several headwinds, including the volatility in the macro environment; the weakening global retail landscape; and, increased escalation of US-China trade tensions, including an estimated $0.20 cumulative impact from the proposed tariffs.

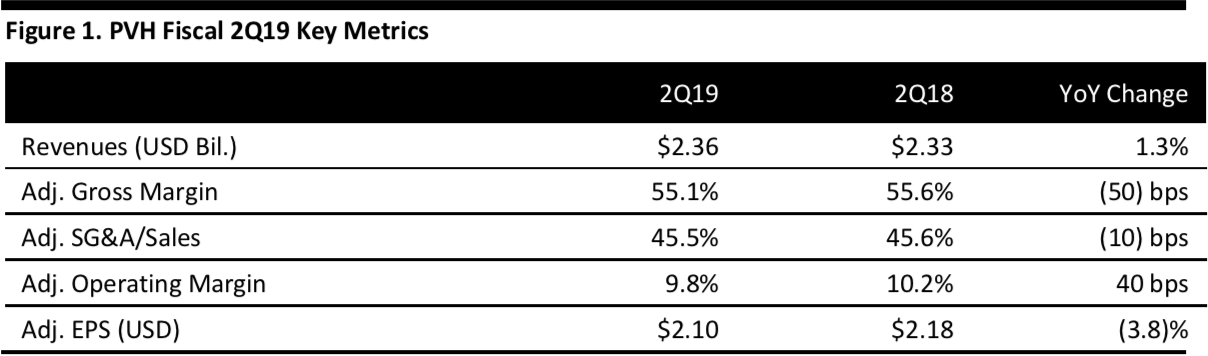

Source: Company reports/Coresight Research[/caption]

2Q19 Results

2Q19 revenues increased modestly to $2.36 billion, as currency clipped about 200 basis points (bps) from revenue growth, worth some $5 million and $0.06 per share. Adjusted 2Q19 EPS declined 3.8% to $2.10 versus $2.18, beating the $1.88 consensus estimate and $0.20 above the company’s guidance.

Business in Europe drove results as North America endured weak store traffic trends and heightened promotional activity that escalated during the quarter. International tourists represent 35-40% of traffic at PVH’s outlet locations and traffic from this customer group continued to decelerate during 2Q. Traffic trends in China further decelerated from 1Q and PVH projects that 2Q trends will continue for the remainder of the year.

Tommy Hilfiger continues to outpace consolidated results, achieving 8% revenue growth (10% constant currency) to $1.11 billion. Comps were 9% internationally, however, the Tommy Hilfiger business in North America declined 5% to $413 million, dragged down by an 8% comp decline. Tommy Hilfiger operating profits increased 12% to $158 million in tandem with a 50 bps operating margin expansion to 14.2% of sales, driven by a 340 bps expansion at Tommy Hilfiger International, offset by a 350 bps margin contraction at Tommy Hilfiger North America.

Revenues decreased 6% at Calvin Klein to $873 million (down 4% on a constant currency basis) and operating profit declined 4% to $101 million, for an operating margin of 11.5%, up 10 bps, driven by an 80 bps margin expansion at Calvin Klein International. The brand is enjoying traction with core and basic denim styles and the mix of basics to fashion is more brand appropriate. The initial reaction to women’s jeans (to launch in 4Q) is encouraging and initial product placement at retail is well ahead of initial plans.

Revenues in the Heritage Brands business were flat at $381 million, comps declined 2% and operating profit declined 46% to $18 million, reflecting gross margin pressure with the promotional environment in both the retail and wholesale channels.

Digital sales represent about 10% of total revenues, with robust growth continuing to track at rates exceeding 20% in owned and operated businesses throughout 2Q. Key partners, Amazon, Tmall and Zalando, among others, focus on the PVH power brands, Tommy Hilfiger and Calvin Klein, and the third-party business models are as or slightly more profitable than some wholesale partners. CEO Manny Chirico said: “The margins are actually margin-neutral or margin enhancing.”

Inventories of $1.86 billion rose 7.6% or $131 million.

Outlook

PVH lowered its F19 guidance to reflect a significantly more conservative outlook and now guides for adjusted EPS of $9.30-9.40 from previous guidance of $10.20-10.30.

The revised guidance reflects PVH’s significantly more conservative outlook based on several headwinds, including the volatility in the macro environment; the weakening global retail landscape; and, increased escalation of US-China trade tensions, including an estimated $0.20 cumulative impact from the proposed tariffs.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

2Q19 revenues increased modestly to $2.36 billion, as currency clipped about 200 basis points (bps) from revenue growth, worth some $5 million and $0.06 per share. Adjusted 2Q19 EPS declined 3.8% to $2.10 versus $2.18, beating the $1.88 consensus estimate and $0.20 above the company’s guidance.

Business in Europe drove results as North America endured weak store traffic trends and heightened promotional activity that escalated during the quarter. International tourists represent 35-40% of traffic at PVH’s outlet locations and traffic from this customer group continued to decelerate during 2Q. Traffic trends in China further decelerated from 1Q and PVH projects that 2Q trends will continue for the remainder of the year.

Tommy Hilfiger continues to outpace consolidated results, achieving 8% revenue growth (10% constant currency) to $1.11 billion. Comps were 9% internationally, however, the Tommy Hilfiger business in North America declined 5% to $413 million, dragged down by an 8% comp decline. Tommy Hilfiger operating profits increased 12% to $158 million in tandem with a 50 bps operating margin expansion to 14.2% of sales, driven by a 340 bps expansion at Tommy Hilfiger International, offset by a 350 bps margin contraction at Tommy Hilfiger North America.

Revenues decreased 6% at Calvin Klein to $873 million (down 4% on a constant currency basis) and operating profit declined 4% to $101 million, for an operating margin of 11.5%, up 10 bps, driven by an 80 bps margin expansion at Calvin Klein International. The brand is enjoying traction with core and basic denim styles and the mix of basics to fashion is more brand appropriate. The initial reaction to women’s jeans (to launch in 4Q) is encouraging and initial product placement at retail is well ahead of initial plans.

Revenues in the Heritage Brands business were flat at $381 million, comps declined 2% and operating profit declined 46% to $18 million, reflecting gross margin pressure with the promotional environment in both the retail and wholesale channels.

Digital sales represent about 10% of total revenues, with robust growth continuing to track at rates exceeding 20% in owned and operated businesses throughout 2Q. Key partners, Amazon, Tmall and Zalando, among others, focus on the PVH power brands, Tommy Hilfiger and Calvin Klein, and the third-party business models are as or slightly more profitable than some wholesale partners. CEO Manny Chirico said: “The margins are actually margin-neutral or margin enhancing.”

Inventories of $1.86 billion rose 7.6% or $131 million.

Outlook

PVH lowered its F19 guidance to reflect a significantly more conservative outlook and now guides for adjusted EPS of $9.30-9.40 from previous guidance of $10.20-10.30.

The revised guidance reflects PVH’s significantly more conservative outlook based on several headwinds, including the volatility in the macro environment; the weakening global retail landscape; and, increased escalation of US-China trade tensions, including an estimated $0.20 cumulative impact from the proposed tariffs.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

2Q19 revenues increased modestly to $2.36 billion, as currency clipped about 200 basis points (bps) from revenue growth, worth some $5 million and $0.06 per share. Adjusted 2Q19 EPS declined 3.8% to $2.10 versus $2.18, beating the $1.88 consensus estimate and $0.20 above the company’s guidance.

Business in Europe drove results as North America endured weak store traffic trends and heightened promotional activity that escalated during the quarter. International tourists represent 35-40% of traffic at PVH’s outlet locations and traffic from this customer group continued to decelerate during 2Q. Traffic trends in China further decelerated from 1Q and PVH projects that 2Q trends will continue for the remainder of the year.

Tommy Hilfiger continues to outpace consolidated results, achieving 8% revenue growth (10% constant currency) to $1.11 billion. Comps were 9% internationally, however, the Tommy Hilfiger business in North America declined 5% to $413 million, dragged down by an 8% comp decline. Tommy Hilfiger operating profits increased 12% to $158 million in tandem with a 50 bps operating margin expansion to 14.2% of sales, driven by a 340 bps expansion at Tommy Hilfiger International, offset by a 350 bps margin contraction at Tommy Hilfiger North America.

Revenues decreased 6% at Calvin Klein to $873 million (down 4% on a constant currency basis) and operating profit declined 4% to $101 million, for an operating margin of 11.5%, up 10 bps, driven by an 80 bps margin expansion at Calvin Klein International. The brand is enjoying traction with core and basic denim styles and the mix of basics to fashion is more brand appropriate. The initial reaction to women’s jeans (to launch in 4Q) is encouraging and initial product placement at retail is well ahead of initial plans.

Revenues in the Heritage Brands business were flat at $381 million, comps declined 2% and operating profit declined 46% to $18 million, reflecting gross margin pressure with the promotional environment in both the retail and wholesale channels.

Digital sales represent about 10% of total revenues, with robust growth continuing to track at rates exceeding 20% in owned and operated businesses throughout 2Q. Key partners, Amazon, Tmall and Zalando, among others, focus on the PVH power brands, Tommy Hilfiger and Calvin Klein, and the third-party business models are as or slightly more profitable than some wholesale partners. CEO Manny Chirico said: “The margins are actually margin-neutral or margin enhancing.”

Inventories of $1.86 billion rose 7.6% or $131 million.

Outlook

PVH lowered its F19 guidance to reflect a significantly more conservative outlook and now guides for adjusted EPS of $9.30-9.40 from previous guidance of $10.20-10.30.

The revised guidance reflects PVH’s significantly more conservative outlook based on several headwinds, including the volatility in the macro environment; the weakening global retail landscape; and, increased escalation of US-China trade tensions, including an estimated $0.20 cumulative impact from the proposed tariffs.