DIpil Das

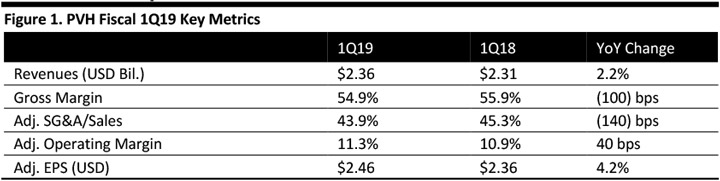

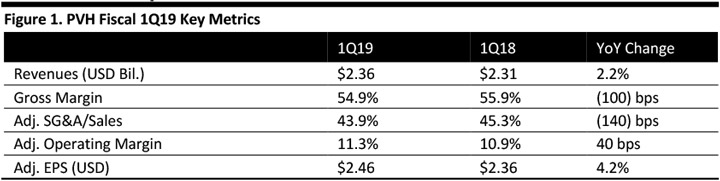

[caption id="attachment_89596" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

PVH reported 1Q19 revenues of $2.36 billion versus $2.31 billion in the same period last year, up 2.2% and modestly missing the $2.37 billion consensus estimate. EPS was $2.46, compared to $2.36 in the same period last year, up 4.2% and beating the $2.45 consensus estimate.

Gross margin deteriorated 100 bps to 43.9%. Adjusted operating margin was 11.3%, expanding 40 bps year over year.

In the US, business suffered from weaker international tourist traffic and higher tax bills for many US consumers as reduced withholding taxes in 2018 generated lower tax refunds – and sometimes required tax payments. The cooler spring weather also had a negative impact. As a result, the company saw soft traffic and conversion trends across the business, especially in the outlet retail channel.

In Europe, the company saw great momentum for Tommy Hilfiger and Calvin Klein and continued to capture market share.

In China, the company saw further softness after the Chinese New Year for both brands. With manufacturing gradually leaving China, factories are downsizing or closing facilities, which has a negative impact on the overall economy. The company has several plans for China, including recruiting local brand ambassadors, new CRM and loyalty programs and further digital investments.

The stronger US dollar pressured fiscal year earnings by an incremental $0.10 per share compared to prior guidance for the current fiscal year, in addition to $0.05 due to tariffs on products imported from China, specifically, a 25% tariff starting in May on accessories and handbags.

Inventory on May 5, 2019 increased 5.5% to $1.6 billion from last year.

Additions to the c-suite

The company hired its first Chief Digital Officer, Marie Gulin-Merle, to create and drive unique consumer shopping experiences. Revenues from digital channels grew over 20% in company-owned and operated businesses and account for slightly more than 10% of total revenues. Also, Stefan Larsson will join in the newly created role of president, responsible for managing PVH's branded businesses and global regions, with each of the three brand CEOs and each of the regions as direct reports. Stefan will be groomed to become CEO in the next three to four years, however, the current CEO, Emanuel ‘Manny’ Chirico just signed a new five-year employment agreement with PVH.

Brand Details

Revenue in the Tommy Hilfiger business rose 4% (9% currency neutral) to $1.1 billion. Tommy Hilfiger International revenue was $680 million, up 4% (12% currency neutral) compared to the prior year period, driven by strong performance in Europe. Tommy Hilfiger North America revenue rose 3% (3% currency neutral) to $372 million. Growth in the North America wholesale business partially offset the 4% decline in North America comparable store sales. Adjusted EBIT grew from $139 million to $147 million, driven by strong performance in the international business.

Calvin Klein revenue of $890 million was flat year over year, up 4% on a constant-currency basis. Calvin Klein International revenue was down 2% (up 6% on a currency neutral basis) to $466 million while comps decreased 4%. The negative impact from foreign currency exchange rates and weakness in China offset growth in Europe. Calvin Klein North America revenue increased 2% (3% currency neutral) to $424 million, driven by growth in the wholesale business, partially offset by the 5% decline in North America comparable store sales. Adjusted EBIT was $119 million, up from $109 million from the prior year period, driven by lower expenses.

Revenue in the Heritage Brands business grew 1% to $415 million, driven by growth in the wholesale business, offset the negative impact from a 6% decline in comparable store sales. Dress furnishings, especially neckwear, and retail businesses are experiencing headwinds. EBIT was down from $42 million to $40 million.

Outlook

The company adjusted guidance for fiscal 2019:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

PVH reported 1Q19 revenues of $2.36 billion versus $2.31 billion in the same period last year, up 2.2% and modestly missing the $2.37 billion consensus estimate. EPS was $2.46, compared to $2.36 in the same period last year, up 4.2% and beating the $2.45 consensus estimate.

Gross margin deteriorated 100 bps to 43.9%. Adjusted operating margin was 11.3%, expanding 40 bps year over year.

In the US, business suffered from weaker international tourist traffic and higher tax bills for many US consumers as reduced withholding taxes in 2018 generated lower tax refunds – and sometimes required tax payments. The cooler spring weather also had a negative impact. As a result, the company saw soft traffic and conversion trends across the business, especially in the outlet retail channel.

In Europe, the company saw great momentum for Tommy Hilfiger and Calvin Klein and continued to capture market share.

In China, the company saw further softness after the Chinese New Year for both brands. With manufacturing gradually leaving China, factories are downsizing or closing facilities, which has a negative impact on the overall economy. The company has several plans for China, including recruiting local brand ambassadors, new CRM and loyalty programs and further digital investments.

The stronger US dollar pressured fiscal year earnings by an incremental $0.10 per share compared to prior guidance for the current fiscal year, in addition to $0.05 due to tariffs on products imported from China, specifically, a 25% tariff starting in May on accessories and handbags.

Inventory on May 5, 2019 increased 5.5% to $1.6 billion from last year.

Additions to the c-suite

The company hired its first Chief Digital Officer, Marie Gulin-Merle, to create and drive unique consumer shopping experiences. Revenues from digital channels grew over 20% in company-owned and operated businesses and account for slightly more than 10% of total revenues. Also, Stefan Larsson will join in the newly created role of president, responsible for managing PVH's branded businesses and global regions, with each of the three brand CEOs and each of the regions as direct reports. Stefan will be groomed to become CEO in the next three to four years, however, the current CEO, Emanuel ‘Manny’ Chirico just signed a new five-year employment agreement with PVH.

Brand Details

Revenue in the Tommy Hilfiger business rose 4% (9% currency neutral) to $1.1 billion. Tommy Hilfiger International revenue was $680 million, up 4% (12% currency neutral) compared to the prior year period, driven by strong performance in Europe. Tommy Hilfiger North America revenue rose 3% (3% currency neutral) to $372 million. Growth in the North America wholesale business partially offset the 4% decline in North America comparable store sales. Adjusted EBIT grew from $139 million to $147 million, driven by strong performance in the international business.

Calvin Klein revenue of $890 million was flat year over year, up 4% on a constant-currency basis. Calvin Klein International revenue was down 2% (up 6% on a currency neutral basis) to $466 million while comps decreased 4%. The negative impact from foreign currency exchange rates and weakness in China offset growth in Europe. Calvin Klein North America revenue increased 2% (3% currency neutral) to $424 million, driven by growth in the wholesale business, partially offset by the 5% decline in North America comparable store sales. Adjusted EBIT was $119 million, up from $109 million from the prior year period, driven by lower expenses.

Revenue in the Heritage Brands business grew 1% to $415 million, driven by growth in the wholesale business, offset the negative impact from a 6% decline in comparable store sales. Dress furnishings, especially neckwear, and retail businesses are experiencing headwinds. EBIT was down from $42 million to $40 million.

Outlook

The company adjusted guidance for fiscal 2019:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

PVH reported 1Q19 revenues of $2.36 billion versus $2.31 billion in the same period last year, up 2.2% and modestly missing the $2.37 billion consensus estimate. EPS was $2.46, compared to $2.36 in the same period last year, up 4.2% and beating the $2.45 consensus estimate.

Gross margin deteriorated 100 bps to 43.9%. Adjusted operating margin was 11.3%, expanding 40 bps year over year.

In the US, business suffered from weaker international tourist traffic and higher tax bills for many US consumers as reduced withholding taxes in 2018 generated lower tax refunds – and sometimes required tax payments. The cooler spring weather also had a negative impact. As a result, the company saw soft traffic and conversion trends across the business, especially in the outlet retail channel.

In Europe, the company saw great momentum for Tommy Hilfiger and Calvin Klein and continued to capture market share.

In China, the company saw further softness after the Chinese New Year for both brands. With manufacturing gradually leaving China, factories are downsizing or closing facilities, which has a negative impact on the overall economy. The company has several plans for China, including recruiting local brand ambassadors, new CRM and loyalty programs and further digital investments.

The stronger US dollar pressured fiscal year earnings by an incremental $0.10 per share compared to prior guidance for the current fiscal year, in addition to $0.05 due to tariffs on products imported from China, specifically, a 25% tariff starting in May on accessories and handbags.

Inventory on May 5, 2019 increased 5.5% to $1.6 billion from last year.

Additions to the c-suite

The company hired its first Chief Digital Officer, Marie Gulin-Merle, to create and drive unique consumer shopping experiences. Revenues from digital channels grew over 20% in company-owned and operated businesses and account for slightly more than 10% of total revenues. Also, Stefan Larsson will join in the newly created role of president, responsible for managing PVH's branded businesses and global regions, with each of the three brand CEOs and each of the regions as direct reports. Stefan will be groomed to become CEO in the next three to four years, however, the current CEO, Emanuel ‘Manny’ Chirico just signed a new five-year employment agreement with PVH.

Brand Details

Revenue in the Tommy Hilfiger business rose 4% (9% currency neutral) to $1.1 billion. Tommy Hilfiger International revenue was $680 million, up 4% (12% currency neutral) compared to the prior year period, driven by strong performance in Europe. Tommy Hilfiger North America revenue rose 3% (3% currency neutral) to $372 million. Growth in the North America wholesale business partially offset the 4% decline in North America comparable store sales. Adjusted EBIT grew from $139 million to $147 million, driven by strong performance in the international business.

Calvin Klein revenue of $890 million was flat year over year, up 4% on a constant-currency basis. Calvin Klein International revenue was down 2% (up 6% on a currency neutral basis) to $466 million while comps decreased 4%. The negative impact from foreign currency exchange rates and weakness in China offset growth in Europe. Calvin Klein North America revenue increased 2% (3% currency neutral) to $424 million, driven by growth in the wholesale business, partially offset by the 5% decline in North America comparable store sales. Adjusted EBIT was $119 million, up from $109 million from the prior year period, driven by lower expenses.

Revenue in the Heritage Brands business grew 1% to $415 million, driven by growth in the wholesale business, offset the negative impact from a 6% decline in comparable store sales. Dress furnishings, especially neckwear, and retail businesses are experiencing headwinds. EBIT was down from $42 million to $40 million.

Outlook

The company adjusted guidance for fiscal 2019:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

PVH reported 1Q19 revenues of $2.36 billion versus $2.31 billion in the same period last year, up 2.2% and modestly missing the $2.37 billion consensus estimate. EPS was $2.46, compared to $2.36 in the same period last year, up 4.2% and beating the $2.45 consensus estimate.

Gross margin deteriorated 100 bps to 43.9%. Adjusted operating margin was 11.3%, expanding 40 bps year over year.

In the US, business suffered from weaker international tourist traffic and higher tax bills for many US consumers as reduced withholding taxes in 2018 generated lower tax refunds – and sometimes required tax payments. The cooler spring weather also had a negative impact. As a result, the company saw soft traffic and conversion trends across the business, especially in the outlet retail channel.

In Europe, the company saw great momentum for Tommy Hilfiger and Calvin Klein and continued to capture market share.

In China, the company saw further softness after the Chinese New Year for both brands. With manufacturing gradually leaving China, factories are downsizing or closing facilities, which has a negative impact on the overall economy. The company has several plans for China, including recruiting local brand ambassadors, new CRM and loyalty programs and further digital investments.

The stronger US dollar pressured fiscal year earnings by an incremental $0.10 per share compared to prior guidance for the current fiscal year, in addition to $0.05 due to tariffs on products imported from China, specifically, a 25% tariff starting in May on accessories and handbags.

Inventory on May 5, 2019 increased 5.5% to $1.6 billion from last year.

Additions to the c-suite

The company hired its first Chief Digital Officer, Marie Gulin-Merle, to create and drive unique consumer shopping experiences. Revenues from digital channels grew over 20% in company-owned and operated businesses and account for slightly more than 10% of total revenues. Also, Stefan Larsson will join in the newly created role of president, responsible for managing PVH's branded businesses and global regions, with each of the three brand CEOs and each of the regions as direct reports. Stefan will be groomed to become CEO in the next three to four years, however, the current CEO, Emanuel ‘Manny’ Chirico just signed a new five-year employment agreement with PVH.

Brand Details

Revenue in the Tommy Hilfiger business rose 4% (9% currency neutral) to $1.1 billion. Tommy Hilfiger International revenue was $680 million, up 4% (12% currency neutral) compared to the prior year period, driven by strong performance in Europe. Tommy Hilfiger North America revenue rose 3% (3% currency neutral) to $372 million. Growth in the North America wholesale business partially offset the 4% decline in North America comparable store sales. Adjusted EBIT grew from $139 million to $147 million, driven by strong performance in the international business.

Calvin Klein revenue of $890 million was flat year over year, up 4% on a constant-currency basis. Calvin Klein International revenue was down 2% (up 6% on a currency neutral basis) to $466 million while comps decreased 4%. The negative impact from foreign currency exchange rates and weakness in China offset growth in Europe. Calvin Klein North America revenue increased 2% (3% currency neutral) to $424 million, driven by growth in the wholesale business, partially offset by the 5% decline in North America comparable store sales. Adjusted EBIT was $119 million, up from $109 million from the prior year period, driven by lower expenses.

Revenue in the Heritage Brands business grew 1% to $415 million, driven by growth in the wholesale business, offset the negative impact from a 6% decline in comparable store sales. Dress furnishings, especially neckwear, and retail businesses are experiencing headwinds. EBIT was down from $42 million to $40 million.

Outlook

The company adjusted guidance for fiscal 2019:

- Revenue growth of 3%, 5% at constant foreign exchange rates, 6% (9% currency neutral) revenue growth for Tommy Hilfiger, flat (up 2% currency neutral) for Calvin Klein and flat for Heritage Brands.

- Non-GAAP EPS in the $10.20-10.30 range, lowered from previous guidance of $10.30-10.40.

- $105 million of pre-tax costs in connection with the Calvin Klein restructuring, including a noncash lease asset impairment from the closure of the flagship store on Madison Avenue in New York, severance, inventory markdowns etc.

- $55 million of pre-tax costs related to the US store closures.

- Around $150 million in additional revenue from acquisitions.