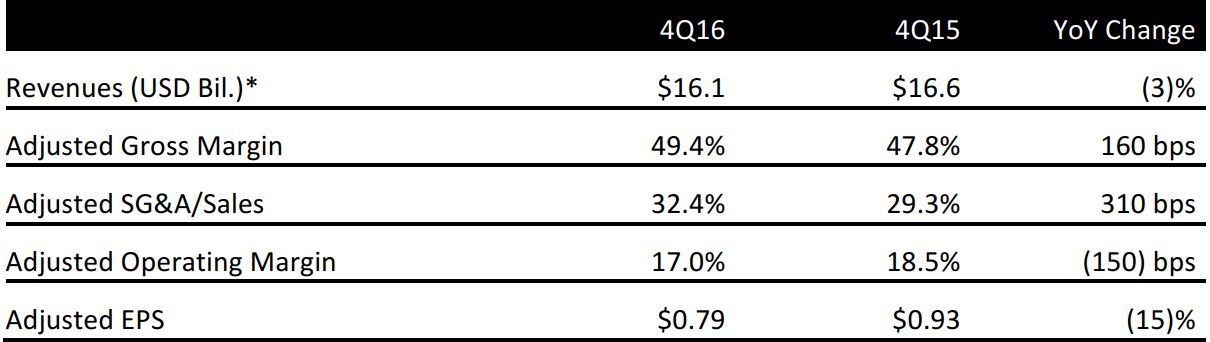

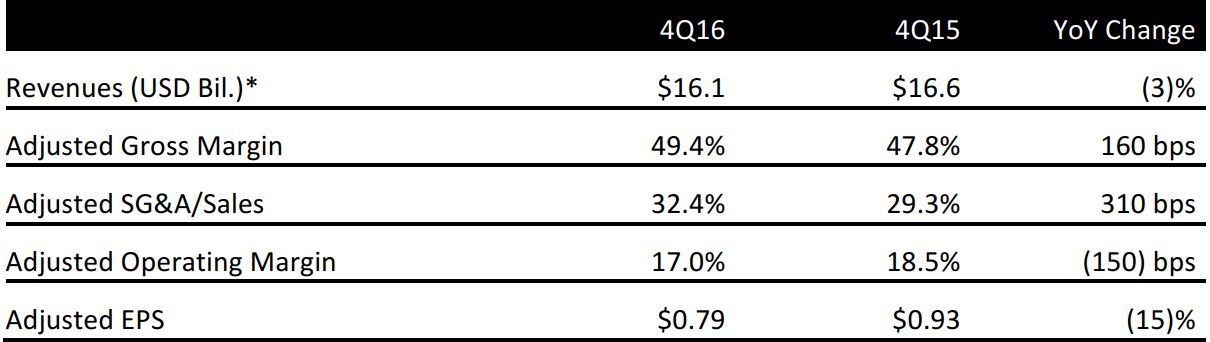

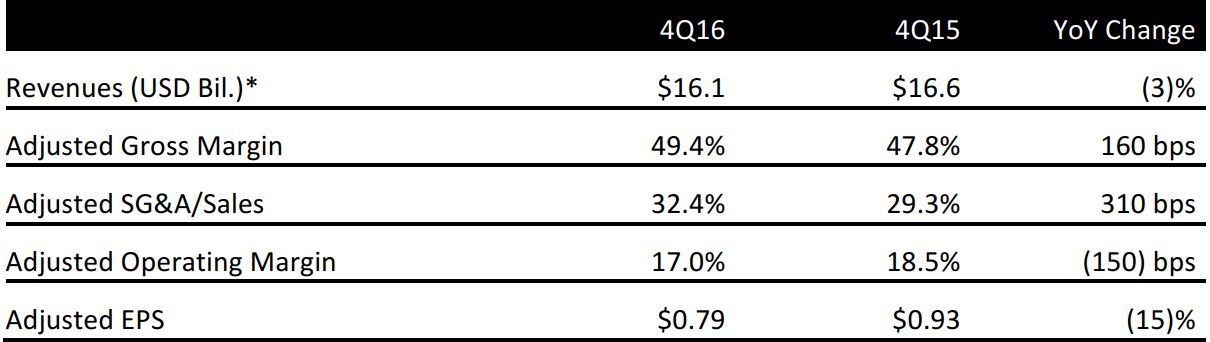

*Does not include currency effects

Source: Company reports

4Q16 RESULTS

P&G reported fiscal 4Q16 core EPS of $0.79, a decrease of 15% year over year that was attributed to an increase in marketing investments, lower gains from brand divestitures and a higher core effective tax rate versus the comparison period. Currency-neutral core EPS decreased by 8%, excluding the impact of foreign exchange.

The company reported net sales of $16.1 billion, down3% year over year. The decline was primarily due to the impact of foreign exchange rates, a deconsolidation of the company’s Venezuelan operations and minor brand divestitures. Despite the decline, revenues still beat the consensus estimate of $15.83 billion. Organic sales grew by 2% on a 2% increase in organic volume.

SEGMENT RESULTS

Beauty: Organic sales grew by 1% and pricing also saw a 1% increase. These increases were offset by a negative 3% impact from lower organic volume. Organic sales increases in Personal Care and the superpremium SK-II skincare brand were partially offset by organic sales declines in the Olay brand.

Grooming: Organic sales increased by 7%, driven by higher pricing and volume. The Fusion FlexBall innovation expansion was strong in developing markets. The Fusion ProShield launch was affected by competitive activity in North America. Organic sales of the Braun brand increased due to innovation-driven volume increases.

Health Care: Organic sales increased by 8% and volume increased by 5% overall. Oral Care organic sales were up versus the prior year, driven by increased marketing, strong innovation results, and increased pricing. Personal Health Care organic sales increased due to a late cough and cold season and higher pricing, mainly in developing markets.

Fabric Care and Home Care: Organic sales grew by 1% due to an increase in organic volume. Fabric Care organic sales remained unchanged, as increased organic volume from premium product innovation and increased marketing support was offset by pricing investments. Home Care sales increased primarily due to strong innovation-driven growth in the Dish Care business.

Baby, Feminine and Family Care: Organic sales and volume increased by 1% percent year over year. Baby Care and Feminine Care organic sales both increased due to innovation-driven volume growth. Family Care organic sales decreased, as volume growth in the US was offset by pricing investments and a decline in Mexico due to the discontinuation of certain product lines.

FY17 OUTLOOK

P&G did not provide guidance for 1Q17. The company is forecasting organic sales growth of approximately 2% for FY17. It expects the combined headwinds of foreign exchange and minor brand divestitures to reduce sales growth by about one percentage point. The company estimates total growth of approximately 1% for FY17, and said it expects full-year core EPS growth in the mid-single digits versus FY16 core EPS of $3.67.

P&G noted that core EPS growth in 1Q17 will be disproportionately affected by foreign exchange headwinds, which do not fully annualize until later in the year, and by the impact of lost finished product sales to its Venezuelan subsidiaries.