DIpil Das

[caption id="attachment_85196" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

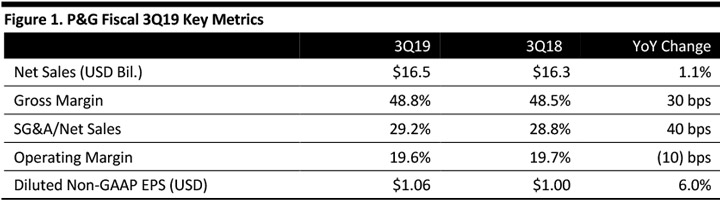

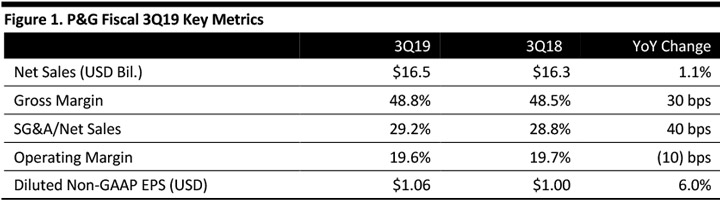

P&G reported net sales of $16.5 billion for the three months ended March 31, 2019, up 1.1% year over year and beating the consensus estimate of $16.3 billion. The gross margin on net sales increased 30 basis points to 48.8% and the operating margin fell 10 basis points to 19.6%. Diluted non-GAAP EPS was $1.06, up 6.0% versus last year and beating the consensus estimate of $1.04. Management said the result was driven by the company’s focus on superiority, productivity and improvement in its organizational culture.

Segment Review

P&G’s strong results were driven by its beauty, healthcare and fabric and home care segments.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

P&G reported net sales of $16.5 billion for the three months ended March 31, 2019, up 1.1% year over year and beating the consensus estimate of $16.3 billion. The gross margin on net sales increased 30 basis points to 48.8% and the operating margin fell 10 basis points to 19.6%. Diluted non-GAAP EPS was $1.06, up 6.0% versus last year and beating the consensus estimate of $1.04. Management said the result was driven by the company’s focus on superiority, productivity and improvement in its organizational culture.

Segment Review

P&G’s strong results were driven by its beauty, healthcare and fabric and home care segments.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

P&G reported net sales of $16.5 billion for the three months ended March 31, 2019, up 1.1% year over year and beating the consensus estimate of $16.3 billion. The gross margin on net sales increased 30 basis points to 48.8% and the operating margin fell 10 basis points to 19.6%. Diluted non-GAAP EPS was $1.06, up 6.0% versus last year and beating the consensus estimate of $1.04. Management said the result was driven by the company’s focus on superiority, productivity and improvement in its organizational culture.

Segment Review

P&G’s strong results were driven by its beauty, healthcare and fabric and home care segments.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

P&G reported net sales of $16.5 billion for the three months ended March 31, 2019, up 1.1% year over year and beating the consensus estimate of $16.3 billion. The gross margin on net sales increased 30 basis points to 48.8% and the operating margin fell 10 basis points to 19.6%. Diluted non-GAAP EPS was $1.06, up 6.0% versus last year and beating the consensus estimate of $1.04. Management said the result was driven by the company’s focus on superiority, productivity and improvement in its organizational culture.

Segment Review

P&G’s strong results were driven by its beauty, healthcare and fabric and home care segments.

- Beauty Segment: The Beauty segment recorded net sales of $3.1 billion, up 4.3% year over year. Organic sales increased 9% over last year due to premium innovation in skin and personal care, positive product mix, increased pricing for the SK-II brand and increased pricing for hair care products.

- Grooming Segment: The grooming segment recorded net sales of $1.4 billion, down 8.1% year over year. Organic sales decreased 1% over last year due to negative mix effects in some categories and volume declines.

- Health Care Segment: The health care segment recorded net sales of $2.1 billion, up 9.4% year over year. Organic sales increased 5% over last year due to the addition of the Merck OTC business and innovations in premium toothpaste and toothbrushes, which drove volume growth.

- Fabric and Home Care Segment: The fabric and home care segment recorded net sales of $5.4 billion, up 2.3% year over year. Organic sales increased 7% over last year due to innovation, increased pricing and positive product mix effects.

- Baby, Feminine and Family Care Segment: The baby, feminine and family care segment recorded net sales of $4.4 billion, down 2.3% year over year. Organic sales increased 2% versus the prior year, driven by increased pricing and positive product mix of premium feminine care products, innovations and increased pricing of family care products.