DIpil Das

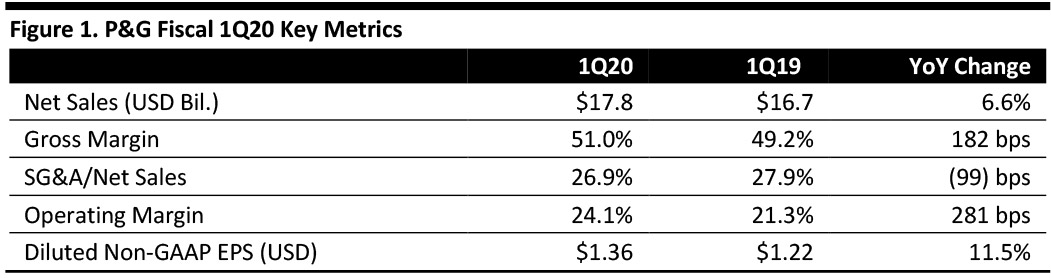

[caption id="attachment_98486" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

1Q20 Results

P&G reported net sales of $17.8 billion for the three months ended September 30, 2019, up 7% year over year and beating the consensus estimate of 5% year on year growth. Organic sales were up 7% versus last year. The gross margin on net sales increased 182 basis points (bps) to 51.0% and the operating margin was up 281 bps to 24.1%. Diluted Non-GAAP EPS was $1.36, up 11.5% versus last year and beating consensus estimate of $1.24.

Management commented that the competitive figures of 1Q20 enabled the company to increase their outlook for fiscal year results for 2020.

1Q20 Segment Review

P&G’s strong results were driven by its beauty, health care and fabric and home care segments.

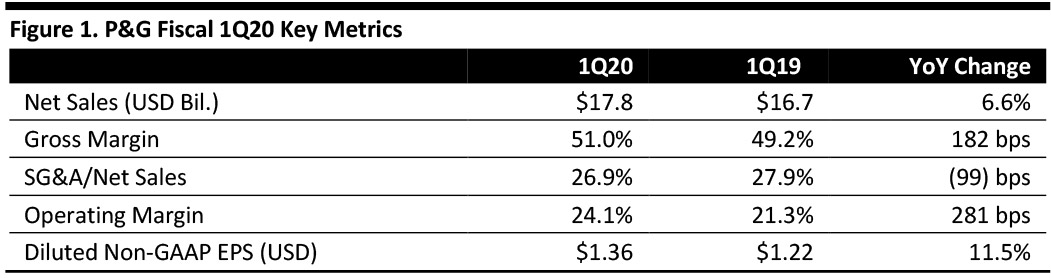

Source: Company reports/Coresight Research[/caption]

1Q20 Results

P&G reported net sales of $17.8 billion for the three months ended September 30, 2019, up 7% year over year and beating the consensus estimate of 5% year on year growth. Organic sales were up 7% versus last year. The gross margin on net sales increased 182 basis points (bps) to 51.0% and the operating margin was up 281 bps to 24.1%. Diluted Non-GAAP EPS was $1.36, up 11.5% versus last year and beating consensus estimate of $1.24.

Management commented that the competitive figures of 1Q20 enabled the company to increase their outlook for fiscal year results for 2020.

1Q20 Segment Review

P&G’s strong results were driven by its beauty, health care and fabric and home care segments.

Source: Company reports/Coresight Research[/caption]

1Q20 Results

P&G reported net sales of $17.8 billion for the three months ended September 30, 2019, up 7% year over year and beating the consensus estimate of 5% year on year growth. Organic sales were up 7% versus last year. The gross margin on net sales increased 182 basis points (bps) to 51.0% and the operating margin was up 281 bps to 24.1%. Diluted Non-GAAP EPS was $1.36, up 11.5% versus last year and beating consensus estimate of $1.24.

Management commented that the competitive figures of 1Q20 enabled the company to increase their outlook for fiscal year results for 2020.

1Q20 Segment Review

P&G’s strong results were driven by its beauty, health care and fabric and home care segments.

Source: Company reports/Coresight Research[/caption]

1Q20 Results

P&G reported net sales of $17.8 billion for the three months ended September 30, 2019, up 7% year over year and beating the consensus estimate of 5% year on year growth. Organic sales were up 7% versus last year. The gross margin on net sales increased 182 basis points (bps) to 51.0% and the operating margin was up 281 bps to 24.1%. Diluted Non-GAAP EPS was $1.36, up 11.5% versus last year and beating consensus estimate of $1.24.

Management commented that the competitive figures of 1Q20 enabled the company to increase their outlook for fiscal year results for 2020.

1Q20 Segment Review

P&G’s strong results were driven by its beauty, health care and fabric and home care segments.

- Beauty recorded net sales of $3.6 billion, up 7.9% year over year in 1Q20. Organic sales increased 10% over last year due to premium innovation and positive product mix in skin and personal care, in addition to innovation and devaluation-driven price increases for hair care.

- Grooming recorded net sales of $1.5 billion, down 2% year over year in 1Q20. Organic sales increased 1% over last year. The benefits of devaluation-driven price increases, increased pricing and positive mix were offset by related unit volume declines and competitive activity.

- Health care recorded net sales of $2.2 billion, up 20.4% year over year. Organic sales increased 9% over last year due to volume growth and positive mix in oral care, innovation, higher retailer inventory versus the prior base period for the cough and cold season, and strong growth in North America for personal health care.

- Fabric and home care recorded net sales of $5.8 billion, up 6.3% year over year. Organic sales increased 8% over last year due to innovation and market growth for fabric care, and increased pricing and innovation in home care products.

- Baby, feminine and family care recorded net sales of $4.6 billion, up 4.0% year over year. Organic sales increased 5% versus the prior year, driven by innovation and increased pricing in the segment.

- Net sales growth of up to 3-5% versus the prior fiscal year, compared with the previous estimate of up 3-4%.

- Organic sales growth in the range of 3-5%, compared with the previous estimate of up 3-4%.