DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

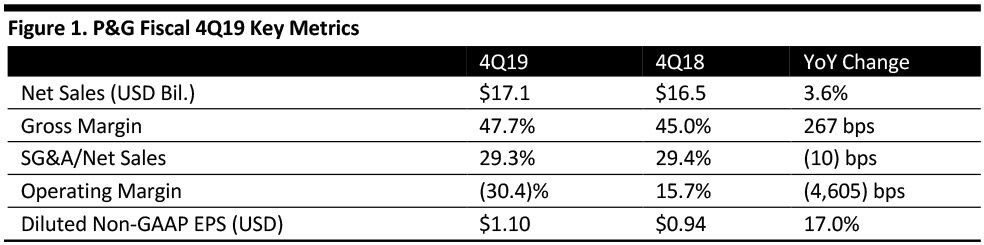

4Q19 Results

P&G reported net sales of $17.1 billion for the three months ended June 30, 2019, up 3.6% year over year and beating the consensus estimate of $16.9 billion. Organic sales were up 7% versus last year. The gross margin on net sales increased 267 bps to 47.7% and the operating margin fell 4,605 bps to (30.4%). Diluted non-GAAP EPS was $1.10, up 17.0% versus the same period last year and beating the consensus estimate of $1.05. Management commented the fourth quarter of fiscal 2019 delivered the strongest quarter of organic sales growth in over a decade.

FY19 Results

P&G reported net sales of $67.7 billion for fiscal year 2019, up 1.1% year over year. Organic sales increased 5% year over year. Gross margin on net sales increased 10 bps to 48.6% and operating margin fell 1,190 bps to 8.1%. Diluted non-GAAP EPS was $4.52, up 7.0% versus last year. Management said the company will continue to focus on superiority, productivity, constructive disruption and improving P&G’s organization and culture to deliver sustainable, balanced top-line and bottom-line growth.

4Q19 Segment Review

P&G’s strong results were driven by its beauty, healthcare and fabric and home care segments.

- Beauty segment recorded net sales of $3.2 billion, up 2.9% year over year in 4Q19. Organic sales increased 8% over last year due to market growth, innovation and increased pricing in skin and personal care and hair care products.

- Grooming segment recorded net sales of $1.6 billion, down 3.2% year over year in 4Q19. Organic sales increased 4% over last year due to growth in developed regions and price increases for shave care and appliance products.

- Health care segment recorded net sales of $2.0 billion, up 12.7% year over year. Organic sales increased 10% over last year due to innovation and growth in developed regions for both oral care and personal health care products.

- Fabric and home care segment recorded net sales of $5.7 billion, up 5.4% year over year. Organic sales increased 10% over last year due to innovation and increased pricing for both Fabric Care and Home Care products.

- Baby, feminine and family care segment recorded net sales of $4.5 billion, up 0.8% year over year. Organic sales increased 5% versus the same period in the prior year, driven by innovation, growth of premium products and increased pricing in the segment.

Outlook

The company gave the following guidance for fiscal year 2020 ending June 30, 2020:

- Net sales growth of 3-4% over fiscal year 2019.

- Organic sales growth in the range of 3-4%.

- Diluted non-GAAP EPS to increase 4-9%.