Nitheesh NH

Introduction

The US beauty and personal care market has witnessed the emergence of a number of private-label brands in recent years, often with organic and all-natural offerings. In this report, we outline the scale and potential of private labels in the US beauty and personal care industry and assess beauty brands’ initiatives to defend their market share. We also highlight key advantages and challenges for retailers offering private labels in the beauty and personal care sector.The Penetration of Private Labels in the US Beauty and Personal Care Market Is Low

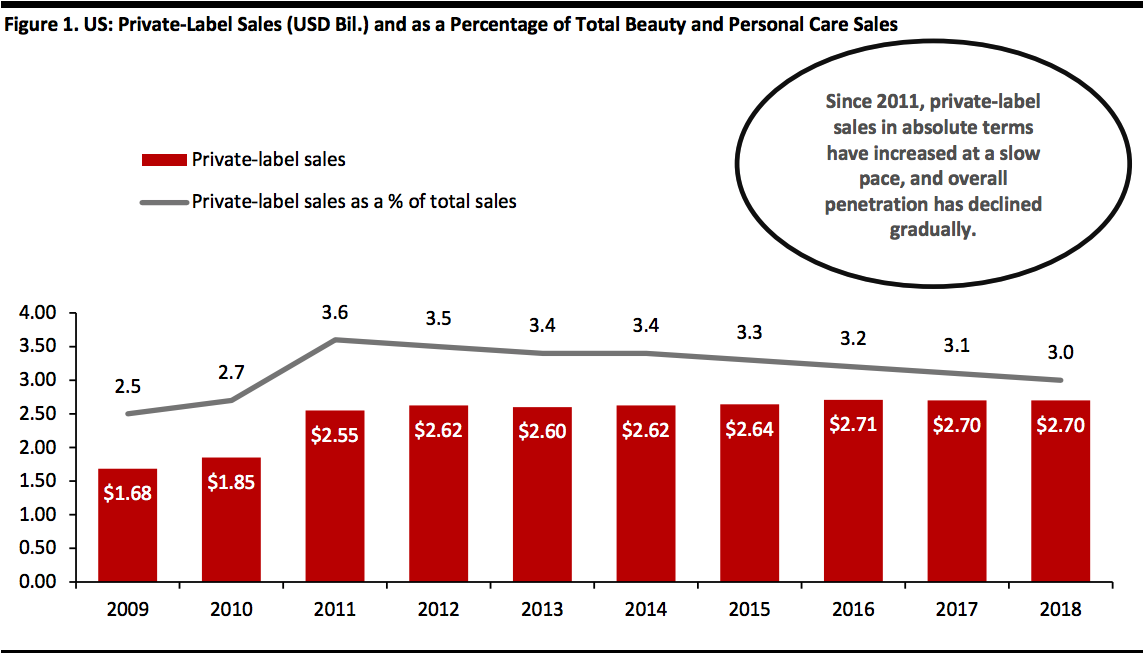

Private labels account for a small share of the US beauty and personal care market: just 3% of all sales in 2018 (latest data available), according to Euromonitor International. This equated to $2.7 billion of private-label sales in the category. During times of recession, private labels tend to grow as a share of total beauty and personal care sales, with more consumers choosing lower-priced products; they may then stick with those brands after the recession has ended. For example, we saw an uptick in private-label penetration following the most recent recession of 2008–09: In 2009, private-label penetration in US beauty and personal care sales was 2.5%, and this increased to 3.6% by 2011, according to Euromonitor International. However, since 2011, private-label sales in absolute terms have increased at a slow pace, and overall penetration has declined gradually. The beauty category that saw the highest private-label growth in recent years is skin care. Private-label skincare sales increased from $444 million in 2009 to 616.3 million in 2018, representing a CAGR of 3.7%. The skincare market is evolving as consumers prioritize skin health and beauty wellness. [caption id="attachment_103126" align="aligncenter" width="700"] Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

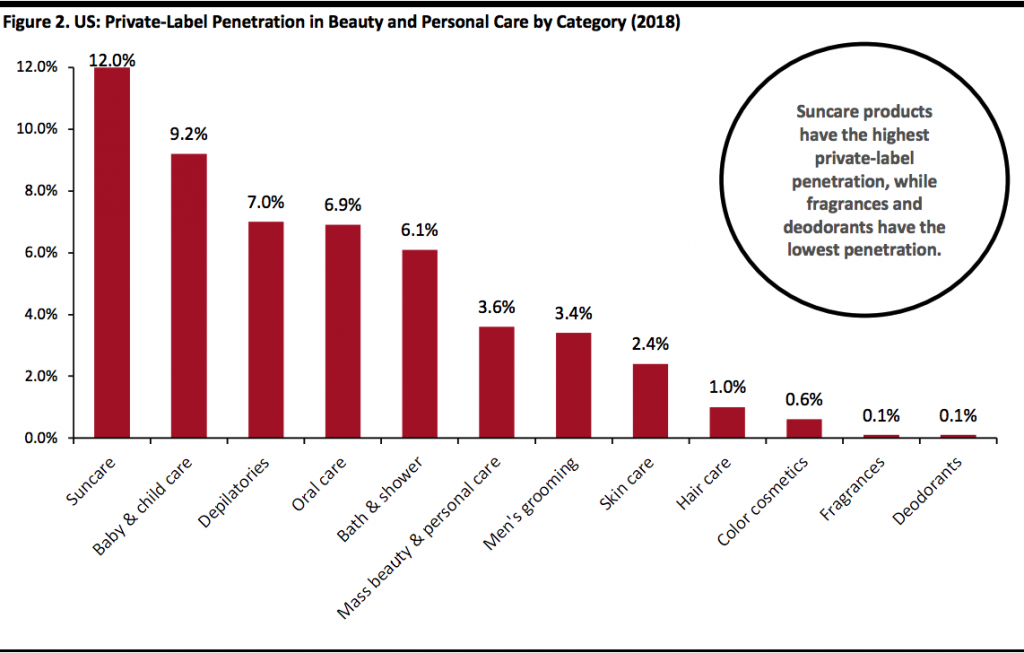

Private-label penetration in beauty and personal care varies across the constituent categories. Suncare products saw the highest private-label penetration of 12% as of 2018, while fragrances and deodorants had the lowest penetration at 0.1%. Private labels in skin care and bath and shower categories accounted for 2.4% and 6.1% of the total sales in 2018, respectively.

[caption id="attachment_103127" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

Private-label penetration in beauty and personal care varies across the constituent categories. Suncare products saw the highest private-label penetration of 12% as of 2018, while fragrances and deodorants had the lowest penetration at 0.1%. Private labels in skin care and bath and shower categories accounted for 2.4% and 6.1% of the total sales in 2018, respectively.

[caption id="attachment_103127" align="aligncenter" width="700"] Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

Private-label penetration tends to be higher for categories that are less dependent on innovation and where price is the crucial driver of consumer demand. The overall low penetration of private labels in the beauty and personal care market could be partially attributed to the importance of brand image for consumers in categories such as fragrances and color cosmetics, where price has less influence on demand.

There are a few other reasons why private labels might have an overall low penetration in the beauty and personal care market:

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

Private-label penetration tends to be higher for categories that are less dependent on innovation and where price is the crucial driver of consumer demand. The overall low penetration of private labels in the beauty and personal care market could be partially attributed to the importance of brand image for consumers in categories such as fragrances and color cosmetics, where price has less influence on demand.

There are a few other reasons why private labels might have an overall low penetration in the beauty and personal care market:

- The US beauty and personal care market is becoming increasingly fragmented. Fragmentation restrains the development of innovative, sophisticated and tiered private-label ranges. Furthermore, the US has a very small beauty discounter segment—the presence of discounters pushes up private labels’ share of the total market.

- As highlighted above, beauty looks to be a sector in which shoppers attach a high degree of importance to the brand—whether because of perceived efficacy or the prestige attached to highly marketed and premium brands—and so are less sensitive to price. Strong beauty brands, such as L’Oréal and Estée Lauder, have high pricing power and market share (a combined 19.3% as of 2018, according to Euromonitor International).

- Direct-to-consumer (DTC) business models may have helped established brands to defend their share of total beauty and personal care sales against private labels by forming deeper relationships with their customers. Estée Lauder’s DTC business has grown more than 40% in recent years, and in fiscal year 2019, it witnessed 1.3 billion web visits. CEO Fabrizio Freda said that the company’s DTC business has the potential to help Estée Lauder collect vast amounts of customer data and enhance its equity building. Similarly, L’Oréal’s DTC business is a major driver for the company’s luxury beauty brands and provides an opportunity to offer personalized and exclusive products to shoppers. Through DTC, L’Oréal is able to gather data on its customers that enables the company to launch data-driven marketing and sophisticated loyalty programs.

- Recent launches of innovative, at-home beauty products—such as L'Oréal’s Color&Co and Perso—also pose a challenge to private labels, which typically see success in brick-and-mortar retail. As more technology and customization are put into consumers’ homes, it may become increasingly difficult for retailers to attract shoppers to buy beauty products in physical stores.

Beauty Private Labels from Leading Retailers

While private labels are not new in the beauty sector, many retailers have successfully repositioned their private-label brands in recent years, from low-priced, me-too products to premium-quality merchandise that is offered at more-economical prices than leading beauty brands. Amazon entered the private-label beauty segment with the launch of its Belei line of skincare products in March 2019. The Belei line comprises 12 different items—including moisturizers, masks, face serums, cleansing and facial wipes—which are priced between $9 and $40. Amazon claims that the new line offers “clean” beauty and wellness at mass-market price points: The collection is free of sulfates, parabens and phthalates and is not tested on animals. Amazon’s move into private-label skin care was driven by recent growth in this beauty category on Amazon.com. In the first quarter of fiscal year 2018, derma skincare sales on the e-commerce platform grew 84% year over year, while mass skincare sales witnessed 36% growth, according to data analytics company OneClickRetail. We believe that Belei is developed by analyzing consumer data of the best-selling, best-reviewed skincare stock-keeping units (SKUs) on Amazon’s website. In a company press release, Kara Trousdale, Head of Beauty for Private Brands on Amazon.com, said:We took a simple, no-nonsense approach when creating Belei, developing products with ingredients that are both proven to deliver results and also offer customers great value for the quality.

According to data analysis by Coresight Research published in March 2019 in collaboration with competitive intelligence provider DataWeave, 212,818 beauty and personal care products across 2,499 brands spanning eight major beauty categories are listed on Amazon.com in the US. As highlighted in the “Amazon Beauty” report, our consumer survey found that Amazon is the second-most shopped retailer in the US for beauty, grooming and personal care products, behind Walmart, as measured by the proportion of respondents buying from the retailer in the prior 12 months. [caption id="attachment_103128" align="aligncenter" width="700"] Amazon’s Belei private-label skincare brand

Amazon’s Belei private-label skincare brandSource: Amazon[/caption] Walmart launched its private-label skincare line, Earth to Skin, in August 2019. The company’s entry into the beauty sector comes only a few months after Amazon launched Belei. Earth to Skin also claims to be rooted in “clean beauty” formulas and excludes parabens, phthalates, petrolatum, mineral oil, sulfates and gluten. The line is not tested on animals. Walmart’s private label touts itself as a “luxurious” brand that “selects powerful ingredients from the earth to formulate [its] clean, safe, uncompromising products.” The Earth to Skin line comprises 28 different products, including toners, facial cleansers, day creams, serums, eye creams and night creams. Walmart’s skincare products are available at much lower price points than Amazon’s Belei line. Walmart offers Earth to Skin starter kits, which include four sample-sized products from one collection for $9.98. [caption id="attachment_103129" align="aligncenter" width="700"]

Walmart’s Earth to Skin private-label skincare brand

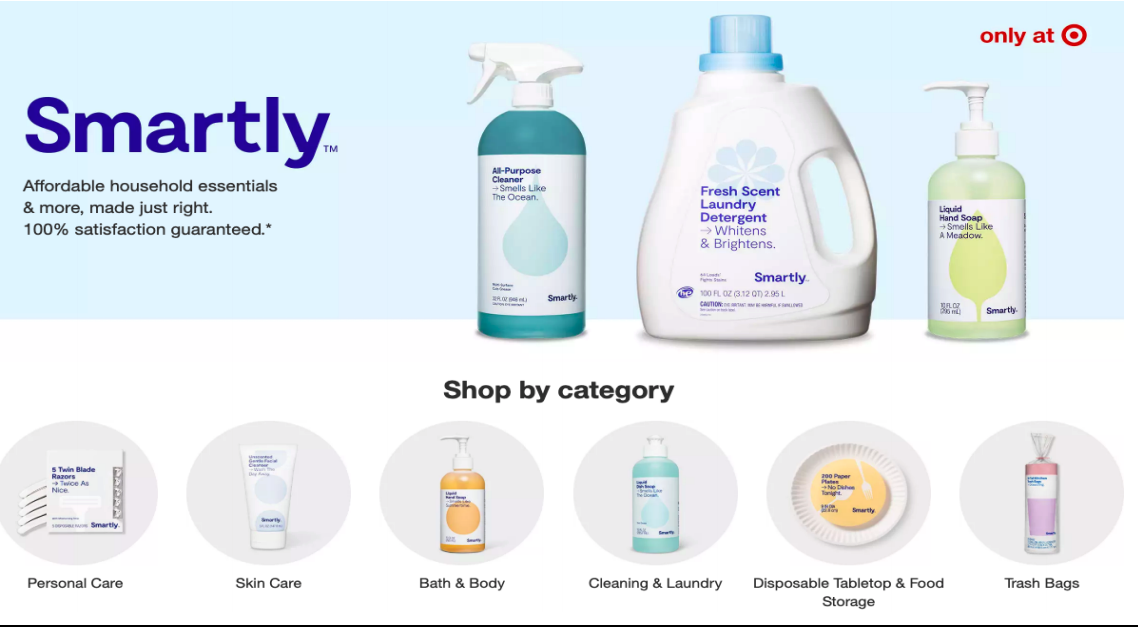

Walmart’s Earth to Skin private-label skincare brandSource: Walmart[/caption] Target launched a low-price personal-care and home-care line under its Smartly private label in October 2018. Smartly personal care consists of more than 70 items, including body lotion and razor blades. Most Smartly products are priced under $2 and cost roughly 70% less than comparable products from national beauty brands, according to the company. These products are also sold in smaller pack sizes. Target’s Smartly was positioned to target budget-conscious millennial consumers, and the line witnessed early positive reactions from consumers, according to a 2018 survey by market intelligence firm Numerator. The survey found that Smartly products exceeded expectations for 60% of buyers, with only 4% stating that the products performed worse than expected. Furthermore, 76% of buyers cited the low prices of Smartly products as being a major purchase driver. [caption id="attachment_103130" align="aligncenter" width="700"]

Target’s Smartly private-label brand encompasses a number of ranges across different product categories, including skin care and personal care.

Target’s Smartly private-label brand encompasses a number of ranges across different product categories, including skin care and personal care.Source: Target[/caption] In the spring of 2019, Dollar General launched its own makeup brand, Believe Beauty. The line includes eye shadows, lipsticks, foundations, nail polishes and skincare products and is available at all 15,500-plus of the company’s US stores. Believe Beauty comprises over 140 different products, with 77 of these only available in store. Dollar General displays the Believe Beauty collection in dedicated sections in its stores, located at the ends of aisles to boost the prominence of the brand. The company’s management said that Dollar General developed Believe Beauty to attract millennials and retain its existing customers, and to boost its profit margins. [caption id="attachment_103131" align="aligncenter" width="700"]

Dollar General’s Believe Beauty private-label makeup collection

Dollar General’s Believe Beauty private-label makeup collectionSource: Dollar General[/caption] Ulta Beauty’s private-label Ulta Beauty Collection offers products across beauty categories, including skin care, hair care, color cosmetics, bath and body products and salon styling tools. Ulta manages the full development cycle of these products—from concept development through production—in order to deliver differentiated packaging and formulas. The company also offers exclusive products, such as IT Brushes for Ulta Beauty, CHI for Ulta Beauty and Tarte Double Duty Beauty cosmetics. Together, the Ulta Beauty Collection and Ulta Beauty-exclusive products contributed 6.5% or $437 million of the company’s total sales in 2018. In the company’s latest annual report, published in March 2019, management commented that the Ulta Beauty Collection is a strategically important category for growth, and the company continues to upgrade and enhance its private labels. [caption id="attachment_103132" align="aligncenter" width="700"]

The Ulta Beauty Collection

The Ulta Beauty CollectionSource: Ulta Beauty[/caption] Launched in 2002, Sephora’s private-label brand, Sephora Collection, is the company’s most affordable line but offers its highest profit margins, according to Sephora. The line comprises more than 500 beauty products, with over 700 SKUs across various categories, including makeup, skin care, hair care, fragrance and bath and body. The company rebranded Sephora Collection in 2016 to simplify the beauty shopping experience and make the private label more millennial-friendly. With this repositioning, Sephora Collection launched two new mobile-first e-commerce tools, Swipe It Shop It and The Beauty Uncomplicator. The former allows shoppers to browse the Sephora Collection with ease, by swiping left and right to browse and select products. The Beauty Uncomplicator is a three-step questionnaire that works as a product search tool. In selected stores, the company also offers Sephora’s Virtual Artist and Virtual Assistant for Sephora Collection, allowing shoppers to virtually try on products through augmented reality technology. Recently, Sephora re-evaluated ingredient requirements for its private-label products as a part of a sustainability initiative: The company is avoiding or restricting concentrations of over 50 ingredients that it considers to be harmful. [caption id="attachment_103133" align="aligncenter" width="700"]

Sephora Collection

Sephora CollectionSource: Sephora[/caption]

Why Private Labels Are Important for Retailers

Private labels in beauty and personal care can yield a number of benefits for retailers:- Preserve margins—Private-label products tend to generate higher margins than third-party-branded products for retailers. This is because private labels incur lower advertising and marketing costs as well as lower slotting fees, and there is no cut of revenue owed to a third-party beauty brand. For example, we believe Amazon’s move into the skincare with Belei offers it the opportunity to sell beauty products at higher margins, despite high costs associated with launching the brand.

- Filling the gap—Private-label products can help retailers to fill out assortment where variety is lacking and monetize knowledge of their customers through tailored product development. By offering brand exclusivity, private labels can also help drive traffic into stores.

- Empowering retailers—The launch of private labels enhances a retailer’s bargaining power in negotiating with brands and manufacturers.

Retailers Offering Private Labels Have an Edge over Beauty Brands

Private-label products can give retailers an edge over beauty brands in a number of ways:- Access to customer data—Retailers have access to exhaustive data regarding consumer preferences, behavior and purchases, which can be used to offer customized and personalized products. For example, through its Beauty Insider rewards program, Sephora collects customer data such as hair color, eye color and skin tone to generate an individual profile for each member, based on which it is able to offer personalized product recommendations.Similarly, Ulta Beauty’s mobile app features several quizzes for users to discover products, set detailed preferences and virtually try on products. Ulta also partnered with Google Cloud in early 2019 to analyze and transform its customer loyalty data into valuable insights.

- Cost competitiveness—Retailers are able to sell private-label products at lower prices than their branded counterparts, owing to lower distribution overheads, fewer intermediaries and lower marketing costs. The competitive prices of private labels in comparison to other beauty brands make them attractive to shoppers.

- Market reach and loyalty programs—Owing to the popularity of multi-brand outlets, retailers can build a strong customer base from having a market presence across different geographies. For example, beauty retailers have been able to capture large audiences through their membership programs.

- The membership base in Ulta Beauty’s Ultamate Rewards loyalty program surged by 120% over the last five years to 33 million members, as of 2019. Sephora’s Beauty Insider membership base grew by 79% to 25 million in the same period, according to market intelligence firm WARC. With negligible customer acquisition and retention costs, these retailers have widespread market reach for their private labels. (Read our assessment of the tiered loyalty programs of Ulta Beauty and Sephora here.)

Beauty Private Labels in the E-Commerce Sector

Like brick-and-mortar retailers, online platforms also collect massive amounts of consumer data but through product feedback and social media posts. For example, online beauty brand Glossier crowdsources product ideas via Instagram, where it has more than 1.5 million followers. Glossier enhances customer engagement by establishing a continuous dialogue with its users on social media. Some online startups offer plainly packaged high-end cosmetics and grooming products at a more affordable price point than physical retailers. For example, Brandless, which sells only private-label generic products, recently introduced its natural and plant-based beauty and wellness collection. The skincare line includes face wash and scrub, moisturizing cream, body butter and lip balm. These products are sold for $3 apiece and are free of sulfates, dyes, parabens, formaldehyde, synthetic fragrances and nearly 400 other possibly harmful elements. Furthermore, social media is enabling small and low-priced brands to gain loyal followings online. For example, US-based e.l.f. Cosmetics, which sells products under $10, has 5.2 million followers on Instagram. Over the years, e.l.f. Cosmetics has used this influence to garner interest from bargain hunters and has paved the way for large retailers to offer their own affordable private-label brands.Key Challenges for Private Labels

There are a number of potential challenges for private-label brands:- The individuality of private labels—The success of private labels is greatly dependent on the reputation of the retailer. Some beauty customers may prefer a private label over other brands only if it is being offered by a well-known retailer.

- Changing consumer behavior—Rapidly changing consumer preferences and demand means that products can become dated quickly and lose shoppers’ interest, posing risks for retailers that develop and promote their own private label.

- Maintaining quality at competitive prices—Although competitive pricing is perhaps easier to achieve for retailers with private labels than it is for brands, retailers must strike a suitable balance between affordability and quality in order to retain customer loyalty. Furthermore, there is increasing interest in innovation in the beauty sector, which is difficult to deliver while keeping price points low.

Key Things To Consider When Developing a Private-Label Brand

When developing a private-label brand, beauty retailers must take the following factors into consideration:- The long-term vision of the company—Retailers should have a long-term vision of the market positioning of the private label, in order to generate sustainable revenues.

- Adequate visibility of private labels—Retailers must make their private-label products clearly visible to potential customers. For example, Amazon highlights its private-label brands through the “Top rated from our brands” section of the website. Retailers can also leverage physical stores to give their private labels prominent display and shelf space: In 2018, Ulta Beauty moved its private-label line to a larger space along a lit black wall, with updated packaging.

- Competitive pricing—The price of private-label beauty products should be competitive so that the brand is able to penetrate the market smoothly.

- Product designs—Retailers should assess current beauty market trends, consumer demand and the competition within the particular product category. These insights should then influence private-label product designs. • Furthermore, private-label labs offer retailers flexibility in adjusting a beauty formula, thus giving them a competitive edge. Retailers should be able to respond to new beauty trends—for example, emerging interest in CBD as an ingredient or in the concept of “clean” beauty—and re-formulate or adjust a private-label product quickly to accommodate this.

- Appropriate sourcing strategy—When developing private-label products, retailers should choose the right sourcing strategy that may take advantage of their ability to work with multiple manufacturers. For example, through its accelerator program, Amazon invites manufacturers to create products exclusively for its collection of private brands.

Global Beauty Brands Introduce Initiatives To Defend Their Market Share

In recent years, there has been a notable rise in the number of mergers and acquisitions (M&A) and incubations from leading global beauty brands. 2019 was a year of some high-profile, global beauty brand acquisitions, particularly in the premium skincare space:- France-based L’Occitane acquired UK-based skincare brand Elemis for $900 million in November.

- Japan-based Shiseido acquired Drunk Elephant, a pioneer in “clean beauty,” for $845 million in October.

- In July, Colgate-Palmolive, which has increased its M&A activity in recent years, made an announcement to acquire anti-aging skincare brand Filorga for $1.69 billion.

- To expand its skincare offerings, Unilever bought luxury beauty brand Tatcha for $500 million in June.

- L’Oréal set a benchmark for the whole industry through its acquisition of Canada-based augmented reality and artificial intelligence company ModiFace, signaling that technology will be integral to the future of beauty and personal care.

- L’Oreal launched Seed Phytonutrients, partnering with independent, organic, American farmers to harness local seeds to create natural beauty products.

- Unilever’s Skinsei is a personalized skincare monthly subscription service that allows beauty consumers to customize their plans to best suit their needs.

- Revlon’s Flesh offers 127 products across 18 different beauty categories through its own DTC channels.

L'Oréal’s latest data is for FY18, ended on December 31, 2018 (FY19 results had not yet been reported at the time of writing). Estée Lauder’s most recent completed fiscal year ended on June 30, 2019.

L'Oréal’s latest data is for FY18, ended on December 31, 2018 (FY19 results had not yet been reported at the time of writing). Estée Lauder’s most recent completed fiscal year ended on June 30, 2019.Source: Company reports[/caption]