albert Chan

Introduction

Private labels in the US cover a vast variety of categories, ranging from food and household goods to health and beauty products. In this report, we outline the scale and potential of private labels in US consumer packaged goods (CPG). We discuss why retailers are moving into private labels, and how CPG brands can respond.

Private-Label Sales Keep Growing in the US

US CPG private-label sales growth by value has been accelerating, jumping from 2.2% in 2015 to 5.8% in 2018, according to IRI.

CPG private-label annual sales by value grew four times faster in the US year over year than national brands, as of October 7, 2018, according to IRI. This has implications for CPG brand owners which once had a symbiotic relationship with retailers: The retailers who once were valued partners may now pose a threat to their brands through private-label products.

Private Labels from Major Retailers in the US

Top retailers have rolled out their own private labels across different product categories in CPG, and these enjoy a high degree of shopper loyalty. More than half (53%) of US shoppers visit a particular retailer specifically to buy its own brands, according to research company Daymon. Furthermore, 85% of shoppers trust private brands as much as national brands and 81% buy them on every, or almost every, shopping trip.

Costco and Kroger are among those to have built strong CPG private labels. Sales of Costco’s private label Kirkland Signature had a significant share by value of total sales in 2018 – some 27.5% of total sales, according to the company’s annual report. Kroger reported its private labels accounted for 26.6% of sales by value in the third quarter, ended December 2018 (the last time it disclosed this in a quarterly report).

Below, we list recently launched CPG private labels from Target, Kroger, Walmart and Natural Grocers.

Target launched a low-priced personal care private-label brand called Smartly in October 2018. The line consists of basics, such as body lotion, paper plates and razor blades. Those products are priced under $2, and cost roughly 70% less than national brands, according to Target.

[caption id="attachment_97716" align="aligncenter" width="700"] Source: Target[/caption]

Source: Target[/caption]

In September 2019, Target launched a food and beverage brand called Good & Gather. The brand includes more than 2,000 items ranging from organic snacks to fresh salad mixes and frozen meals.

Kroger launched a private label men’s shaving and grooming line called Bromley’s For Men in July 2018. The private label offers premium razors and replaceable blades, shaving accessories and skincare.

[caption id="attachment_97717" align="aligncenter" width="700"] Kroger’s private label Bromley's For Men shaving and grooming collection

Kroger’s private label Bromley's For Men shaving and grooming collectionSource: Kroger[/caption]

Walmart launched a private-label skincare line called Earth to Skin in August 2019. The line features 28 products, including toners, face cleansers, day creams, serums, eye creams and night creams.

In September 2018, Natural Grocers, one of the leading natural and organic retailers in the US, launched a private-label line of organic products that focuses on pantry staples, and frozen and fresh items.

[caption id="attachment_97718" align="aligncenter" width="700"] Natural Grocers’s private label

Natural Grocers’s private labelSource: Natural Grocers[/caption]

| Case study: Costco’s Kirkland Signature |

|

Costco launched its Kirkland Signature private-label line in 1995, and now the brand is a driver of foot traffic to Costco, building a reputation for quality at low prices. In 2018, Kirkland accounted for about 27.5% of company sales, well above the industry average of 17% recorded by Daymon. Several factors have contributed to the success of Kirkland Signature, including: High Quality: Costco controls every aspect of the product line: ingredients, production, packaging, and more. It partners with top manufacturers around the world and co-brands with premium brands such as Starbucks. Low Prices: Kirkland Signature sells for at least 20% less than name brands at Costco, according to the company. In 2018, Kirkland sales exceeded $39 billion, compared to $35 billion in 2017. The brand had a sales growth rate of more than 10% in 2018, slightly higher than the sales growth rate for all Costco merchandise at 9.7%, according to company reports. |

Why is Private Label Becoming a Phenomenon?

The obvious reason shoppers buy private-label products is price: Around 83% of US consumers surveyed by IRI in 2018 said they buy private-label products to save money. Private labels sell for as much as one-third lower than name brands, according to Retail Dive.

For retailers, private labels provide better margins: CPG retailers can make margins of 25-30% from private labels, compared to only 1.3% from national brands, according to CB Insights. Lower marketing costs are a major reason for the fatter margins.

Shoppers Turn to Private Labels During Recessions

It is unsurprising that consumers buy more private-label products during recessions. In the 1981–1982 US recession, the worst economic downturn since the Great Depression (up to that time), private labels peaked at 17% of US supermarket sales by value, according to the Harvard Business Review. This compared to an average 14% of supermarket sales in the two decades ended 1996.

We saw another uptick during the more recent recession of 2008-09: Between September 2008 and September 2009, private-label sales increased from 21.6% to 22.8% of all CPG unit sales at US retailers, according to IRI. Before the recession, private-label CPG unit sales were increasing steadily but at a slower rate, up just 30 bps from 21.3% in 2006 to 21.6% in 2008.

With concerns of another recession, US shopper migration to private labels may accelerate. However, this time the context will be different: CPG private labels are already growing, according to a number of market-measurement firms, and this could limit any incremental uplift during an economic downturn.

What Advantages Do Retailers Enjoy Over Brand Owners?

Retailers have the advantage of customer data from transactions and loyalty programs, which gives retailers a powerful database they can analyse to better understand customers, something CPG brands cannot match. That said, unlike many CPG brand owners, retailers depend on external manufacturers to develop and produce private-label products.

Retailers face lower costs for marketing and distributions to end-consumers. Retailers can also leverage physical stores to give their private labels prominent shelf and display space.

The Rise of Premium Private Label

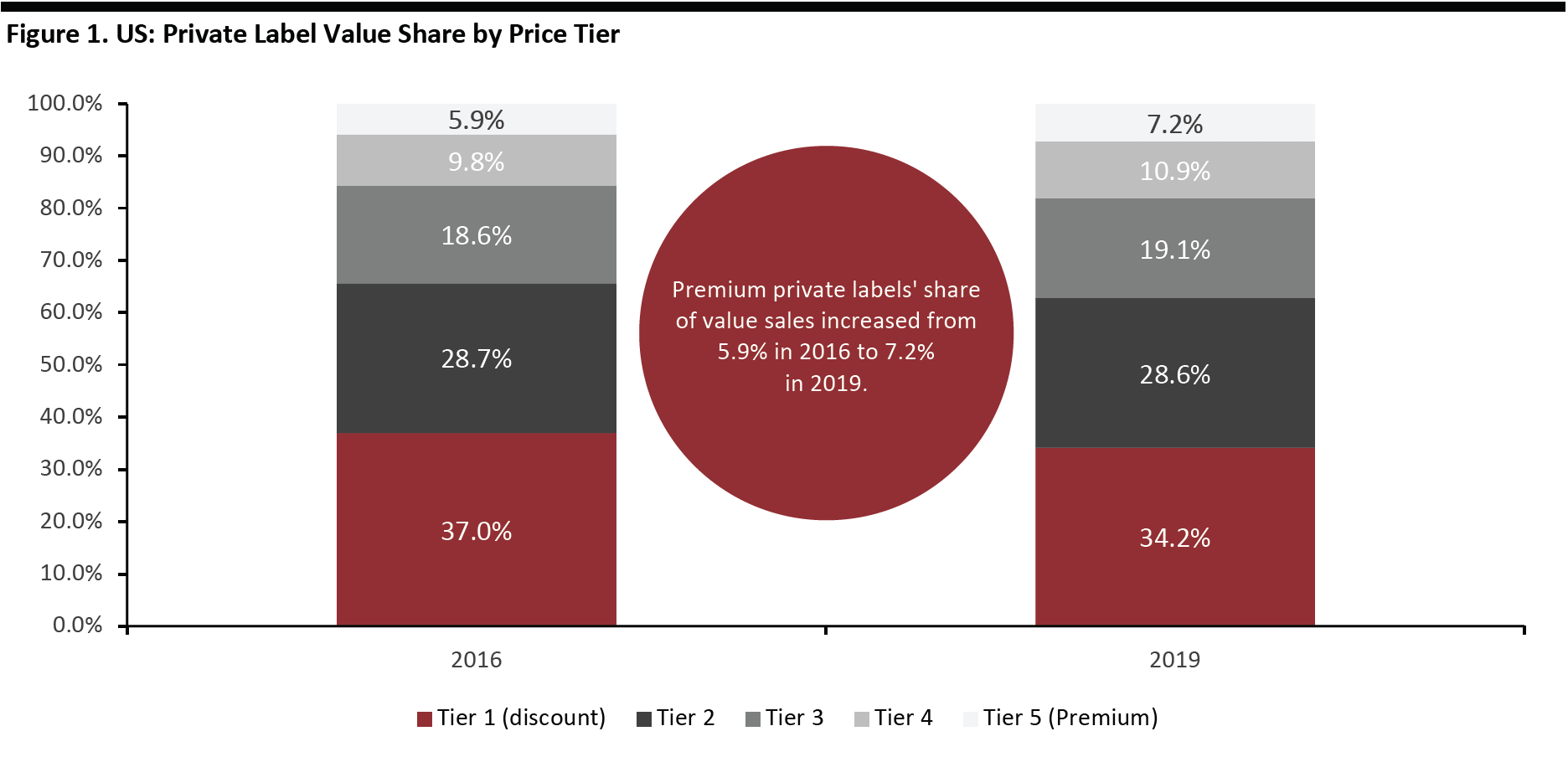

The rise of higher-end private-label products has contributed to consumers’ inclination to spend more on private labels. Premium private-label products have grown their share of total private-label sales 1.3 percentage points to 7.2% since 2016, though low-priced private-label products still represent the largest share of private-label sales in the US, at 34.2%.

[caption id="attachment_97719" align="aligncenter" width="700"] 52 weeks ended May 25, 2019 vs. 3 years ago

52 weeks ended May 25, 2019 vs. 3 years agoSource: Nielsen[/caption]

Private Label’s Share Will Increase as Discounters Prosper

The presence of grocery discounters such as Aldi and Lidl has a meaningful impact on private label’s share of a country’s overall CPG market. The strength of discounters — who predominantly sell private-label products — is a major factor behind a high level of private-label penetration in Germany. Compared to countries such as Germany, the UK and France, the US has a nascent grocery discounter sector.

Aldi had just a 2% market share in the US in 2017, according to consulting firm A.T. Kearney, and Lidl entered the US market only in the summer of 2017. This relatively small presence of hard discounters depresses private label’s share of the overall market in the US.

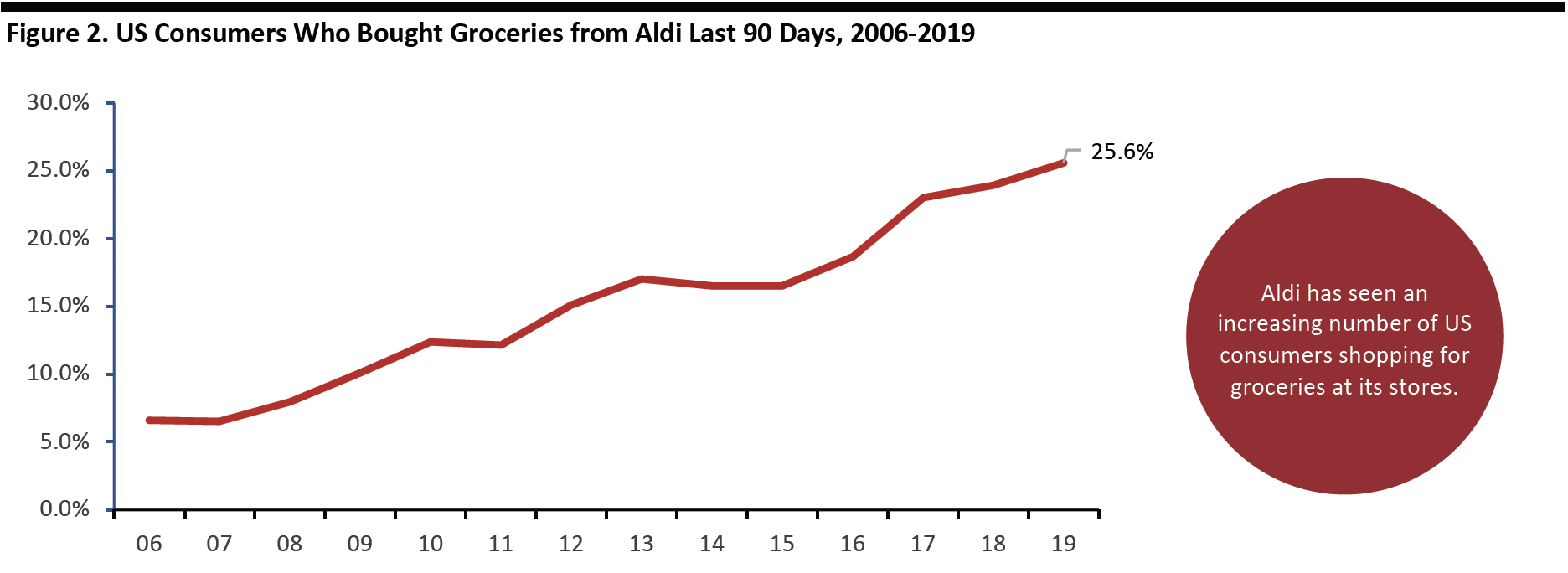

However, Aldi and Lidl are on the march in the US. Aldi plans to grow its footprint from more than 1,800 stores to about 2,500 stores by 2022. Aldi has also seen an increasing number of US consumers shopping for groceries at its stores, with 25.6% consumers surveyed saying they shopped at Aldi in the 90 days to August 2019, up from 23.9% of the same period in 2018, according to Prosper.

Lidl is growing, too. In November 2018, Lidl announced its acquisition of 27 Best Market stores in New York and New Jersey in a move to strengthen its presence in the market. The retailer now expects to hit the 100 store mark by the end of 2020.

[caption id="attachment_97720" align="aligncenter" width="703"] Base: 8,529 US Internet users ages 18 and above in August of each year.

Base: 8,529 US Internet users ages 18 and above in August of each year.Source: Prosper Insights & Analytics[/caption]

E-Commerce Platforms Provide Opportunities for CPG Private Label for Further Growth

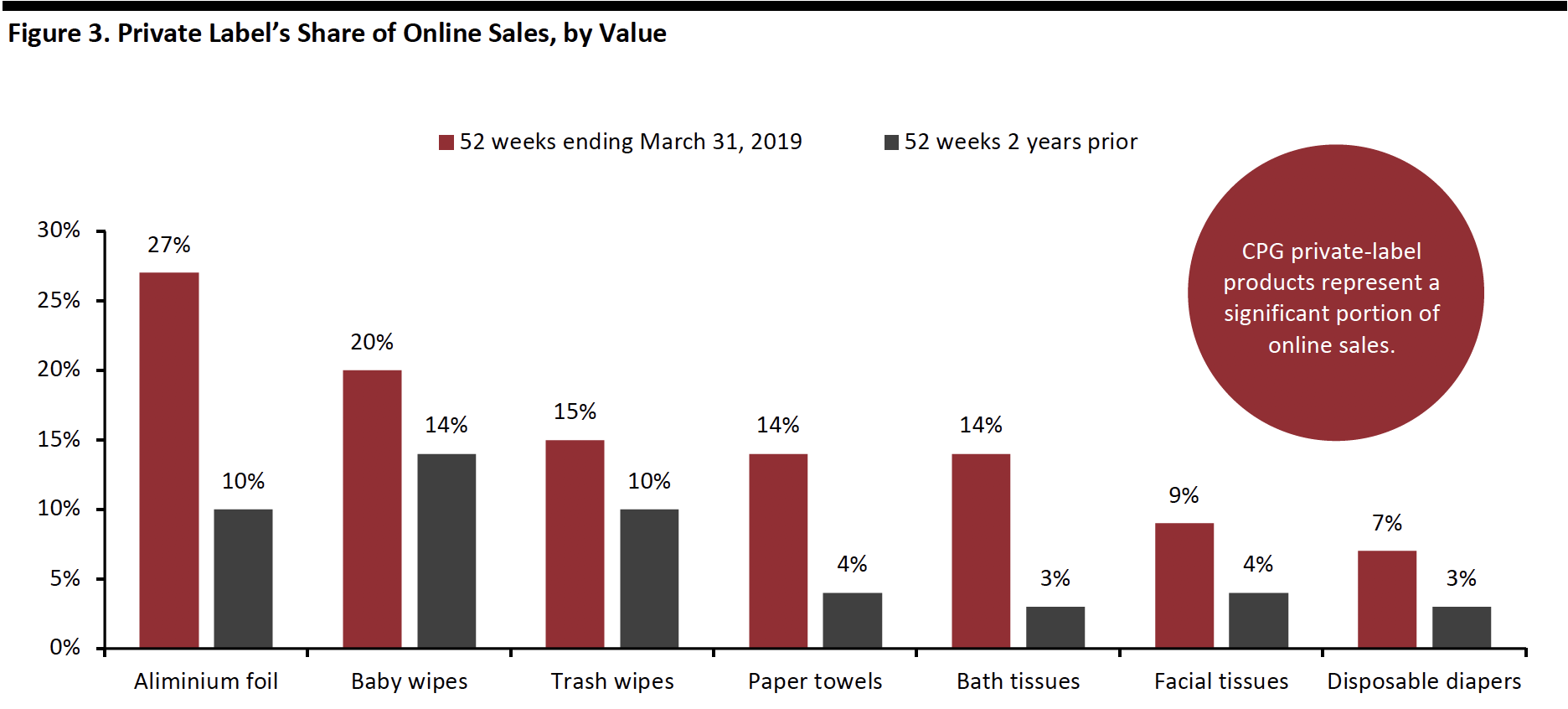

E-commerce players that continue to expand their CPG footprint at pace are creating a platform ripe for further private-label growth. CPG private label's online dollar share more than doubled in two years, according to Nielsen: CPG private-label sales accounted for 3% of online value sales in the 52-week period ending March 31, 2019, up from 1.3% two years ago.

For certain categories, CPG private-label products are generating a significant portion of online sales: 27% of online dollar sales of aluminium foil are now private label, up from 10% two years ago.

[caption id="attachment_97721" align="aligncenter" width="700"] Source: Nielsen[/caption]

Source: Nielsen[/caption]

Retailers collect massive amounts of consumer data – but so do online platforms. And, like retailers, online platforms have been launching private-label brands, often competing with brands they also carry. Private labels allow e-commerce platforms to have more “room” to play in terms of pricing, allowing them to offer more products at low prices.

Amazon launched the Amazon Basics private-label line in 2009, leveraging its substantial database of consumer buying patterns to build out its private-label strategy.

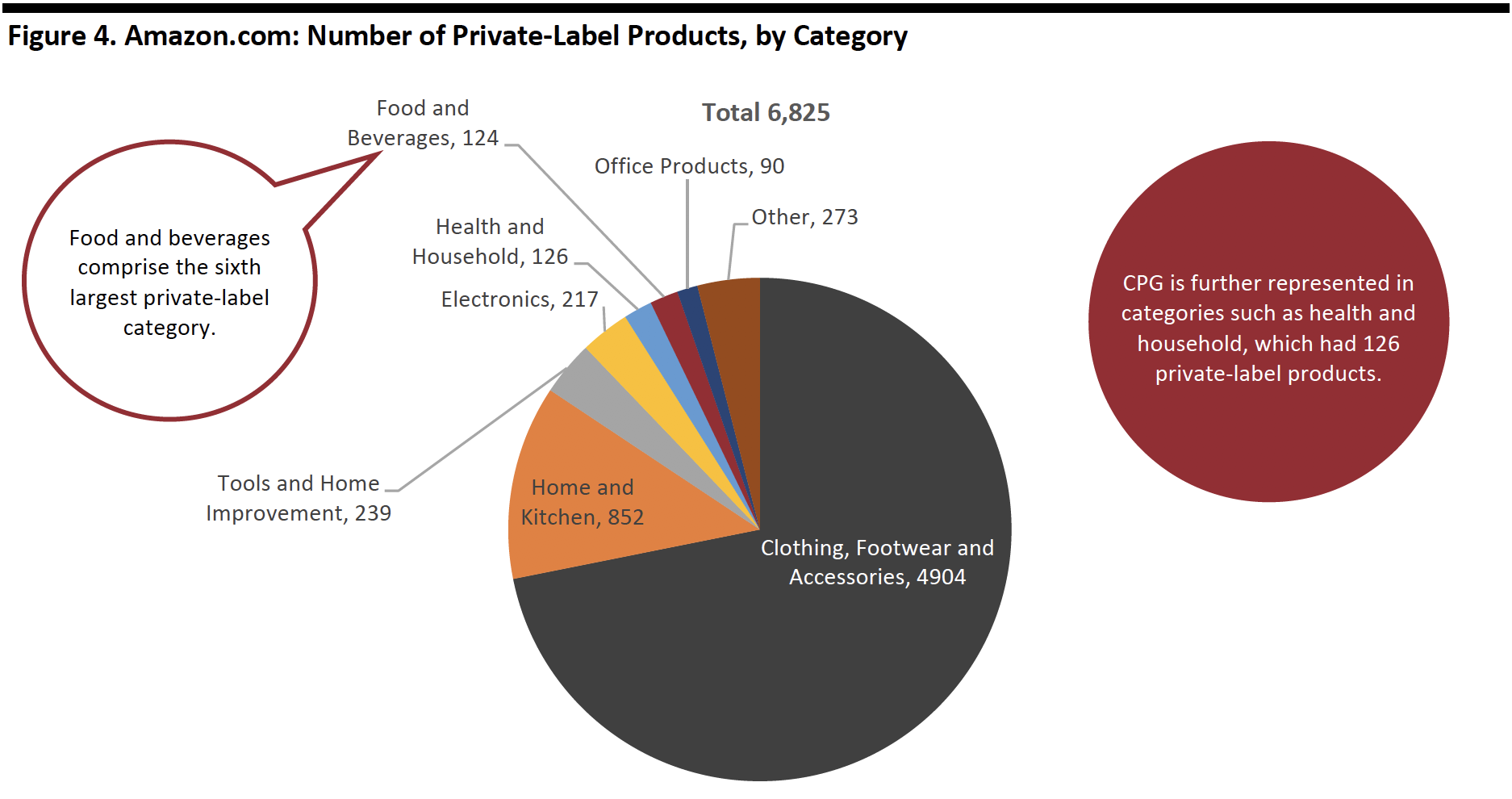

Our 2018 analysis of Amazon’s private-label offering looked at 74 private labels with around 6,825 products on Amazon’s US site, although they are predominantly in non-CPG categories such as apparel. Amazon’s private labels reportedly generated $7.5 billion in sales in 2018 and are poised to reach $25 billion by 2022, according to TJI Research.

Our research found food and beverages was the sixth largest private-label category on Amazon.com by number of products as of June 2018, with 124 products. CPG private-label products also include categories such as health and household, with 126 private-label products. Private-label CPG brands on Amazon include perishable food brand Wickedly Prime as well as snacks brand Happy Belly.

[caption id="attachment_97722" align="aligncenter" width="700"] As of June 2018

As of June 2018Source: DataWeave/Coresight Research[/caption]

How CPG Brands Are Responding to Retailers’ Private Labels

In response to the private-label threat, CPG brands have been adding direct-to-consumer channels to develop their consumer contact points, and have been investing in innovation and data technology. We cover this subject in greater detail in our report Digital Disrupts Consumer Packaged Goods.

CPG Brands Add Direct-to-Consumer Channel

One of the biggest shifts is that big CPG brands are growing their direct-to-consumer e-commerce websites to better control the buying process, customer experience and, most importantly, customer transaction data.

- Unilever acquired Dollar Shave Club in 2016 and plans to leverage the platform to sell its bathroom brands, such as Axe, Dove and Noxema. Dollar Shave Club sells razors and other personal products for men by subscription using home delivery.

- In 2010, P&G launched its own online shopping site, called eStore, to offer US consumers brands such as Tide, Crest and Oral-B. The company also opened a store on Tmall in 2012.

- Colgate will trial selling its teeth-whitening products through New York-based startup Hubble’s platform. In 2018, Colgate invested in Hubble, which operates a subscription model for contact lens delivery.

- Kellogg’s opened a cereal café called Kellogg’s NYC in Manhattan in late 2017. Kellogg’s created the store to offer unique experiences – along with Instagramable backdrops.

Kellogg’s NYC

Kellogg’s NYCSource: Kellogg’s[/caption]

Innovations and Product Differentiation Are the Key

In addition to developing DTC channels, globally established CPG giants need to innovate products and differentiate themselves to avoid competing with private labels on price and to drive brand loyalty. For example, Clorox is continually innovating its Scentiva range of household cleaning products to offer interesting new scents, such as “Fresh Brazilian Blossoms,” which private labels do not offer.

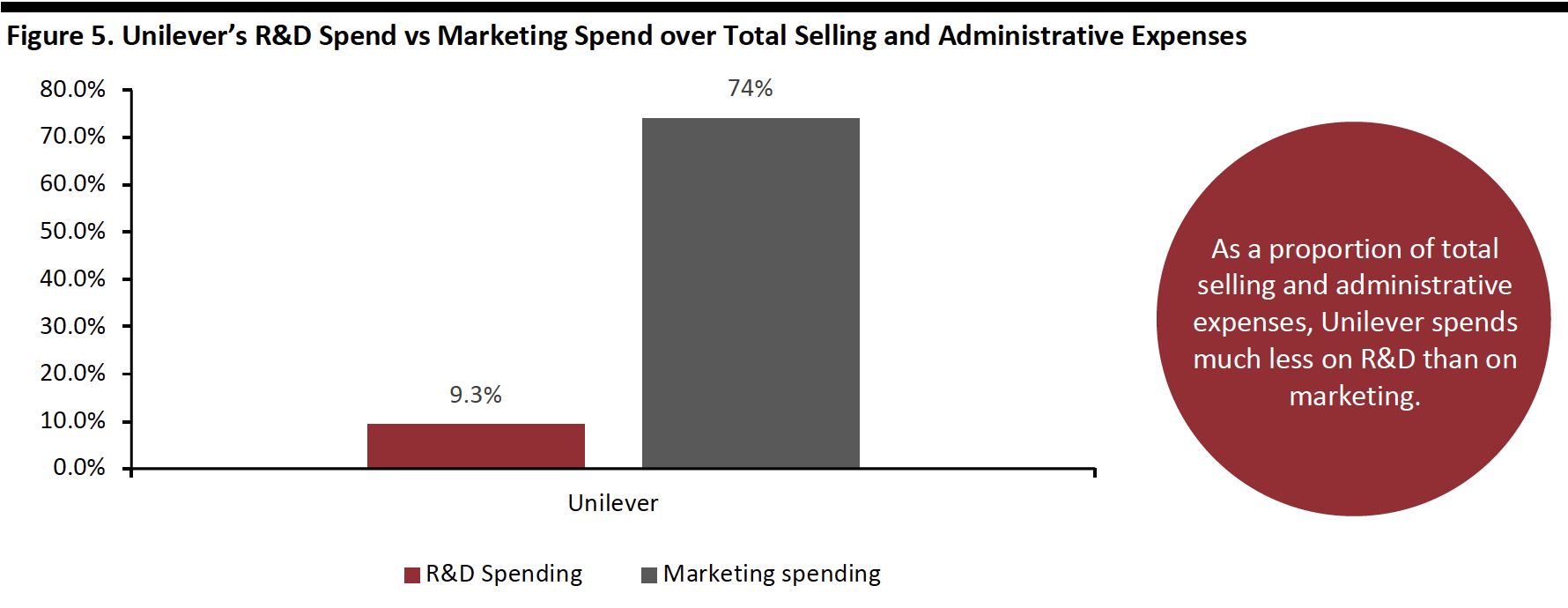

That said, CPG brands have actually spent little on R&D: Unilever’s R&D spend was just 9.3% of total selling and administrative expenses, yet spending on marketing and advertising was close to 74% of total selling and administrative expenses in 2018, according to company reports. Colgate-Palmolive spent just $277 million on R&D in 2018, 83% less than ad spend at $1,590 million on advertising in 2018, according to the company’s annual report.

[caption id="attachment_97724" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

We believe CPG brands will need to ramp up R&D investment to compete with private labels, to continually bring innovation and product differentiation to drive brand loyalty.

Key Insights

Private labels are a serious challenge for CPG brands, taking a considerable share of the market. Retailers have an advantage in capturing consumer insights to develop private label products. Compared to traditional brands, private labels carry lower cost for advertising, marketing and slotting fees. Faced with stiffening private label competition, CPG brands are extending sales channels, such as adding direct-to-consumer channels and investing in R&D to bring innovation and product differentiation.