PRIMARK COULD GRAB $1 BILLION IN SALES FROM US RIVALS

STEADY, MODEST STORE OPENINGS COULD DRIVE MARKET SHARE GAINS

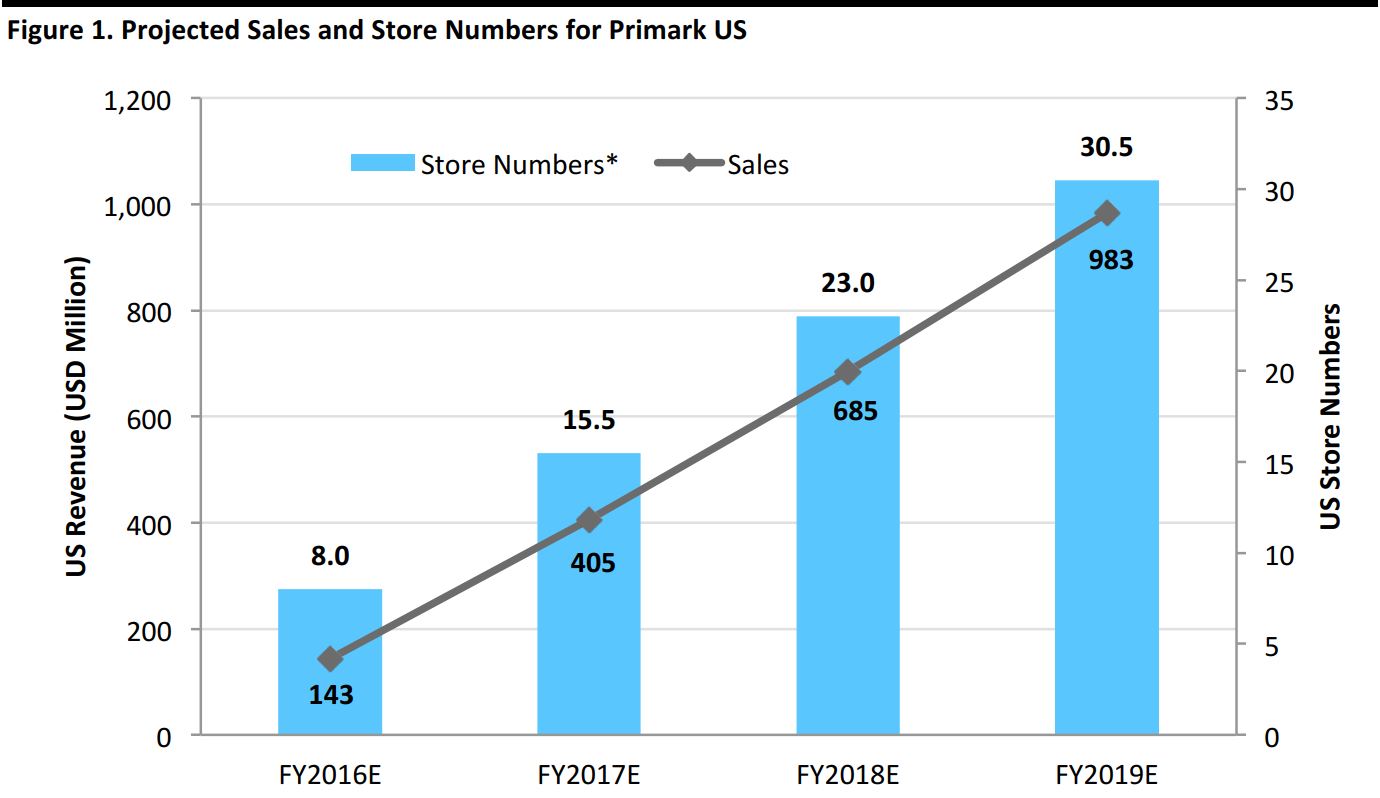

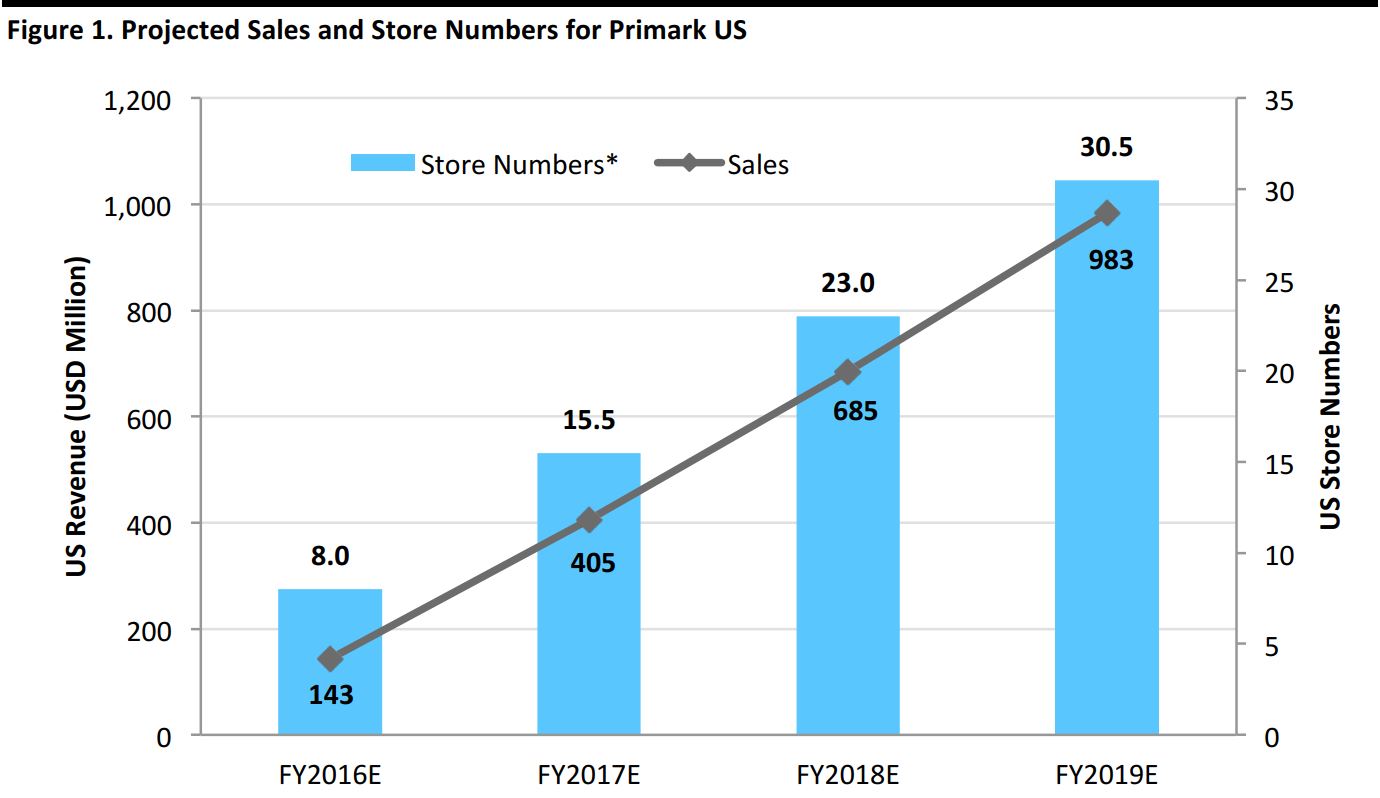

Primark opened its first US store on September 10, 2015, and has so far announced plans to open up to 10 stores in the country, with eight of these confirmed so far. We are bullish on Primark’s prospects in the American market. Its mix of low prices, fast fashion and core staples is likely to resonate with US consumers who have shown consistent unwillingness to grow their spending on apparel.

This could result in Primark generating around $1 billion in annual sales by the end of its fourth full year in the US, we estimate. We believe the underlying assumptions for our calculations err toward the conservative, although the average number of stores that will be opened each year is a major uncertainty.

We explain our calculations and assumptions in more detail below, but, in summary, our projections assume an average of 7.5 stores opened per year and a short lag before US stores ramp up to Primark’s average sales per international store.

*Our projections assume that 7.5 stores will be opened each year on average, so some years do not have complete/rounded store totals.

Source: Company reports/FBIC Global Retail & Technology

Some context for those projections:

- Walmart generated apparel sales of around $20.2 billion in fiscal year 2015, we estimate from its filings. Gap Inc. is the leading specialist retail chain, and had $11.4 billion in US apparel sales in 2014, according to Euromonitor International.

- Total apparel and footwear sales in the US will total $338 billion in 2015 and reach $381 billion in 2019 (excluding sales tax), according to Euromonitor International.

- So, $1 billion in sales for Primark in 2019 equates to a potential market share of 0.3% in that year.

Here is the basis for our math:

- In fiscal year 2015, Primark’s non-UK stores each generated, on average, £20.9 million (US$32.4 million) in sales, we estimate.

- Primark’s total reported comps have averaged 3.2% over the past five years, and we extrapolate international sales per store forward based on an assumption that this underlying growth will continue.

- The company has reported “very high sales densities” in some of its newest stores. Given that the US market is quite different from its European counterpart, we err on the side of caution and factor in a small ramp-up to average sales per store for Primark US: our calculations assume that Primark US will underindex against the company’s average non-UK sales per store very slightly until fiscal year 2017.

- Primark has confirmed eight store openings in the US, and we assume these will be completed before the end of fiscal year 2016.

- We assume an average of 7.5 US store openings per fiscal year thereafter.

- Our store number estimates are totals for fiscal year-ends, so our annual revenue estimates are based on average store numbers for each fiscal year—i.e., the midpoint between the two closest fiscal year-ends.

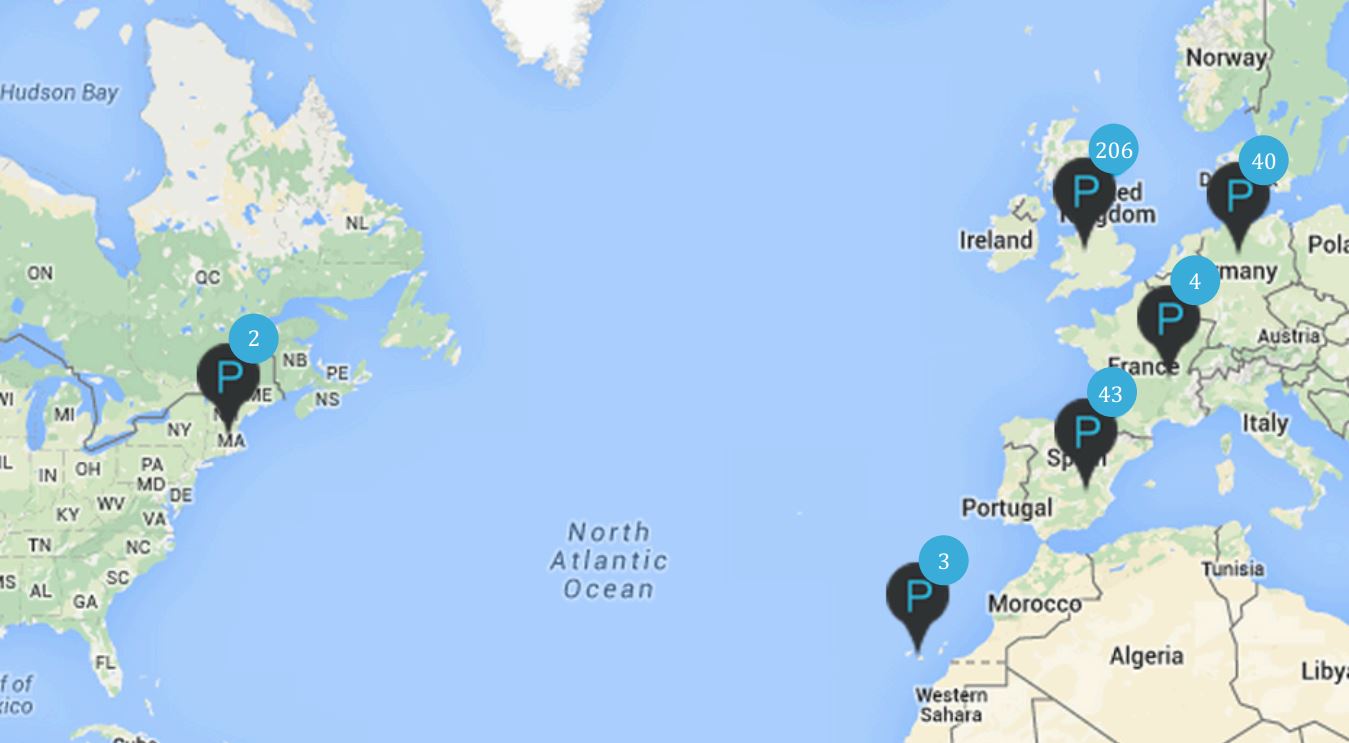

Source: primark.com

- We think 7.5 new stores per year is a reasonable estimate, based on multiple data points:

- First, this is in the same ballpark as the eight announced store openings.

- Second, two of Primark’s major Continental European markets are Germany, where store openings have averaged 4.3 per year since Primark first opened there, and Spain, where it has opened, on average, 3.2 stores per year since launching in the country—an aggregate of 7.5 stores per year. The countries have populations that are just 25% and 15% the size of the US’s, respectively, suggesting greater scope for store openings in the American market.

- Third, we do not see Primark gaining scale in an entirely new continent, with the associated shipping and distribution costs, by opening only a small number of stores.

Who Will Lose This $1 Billion in Sales?

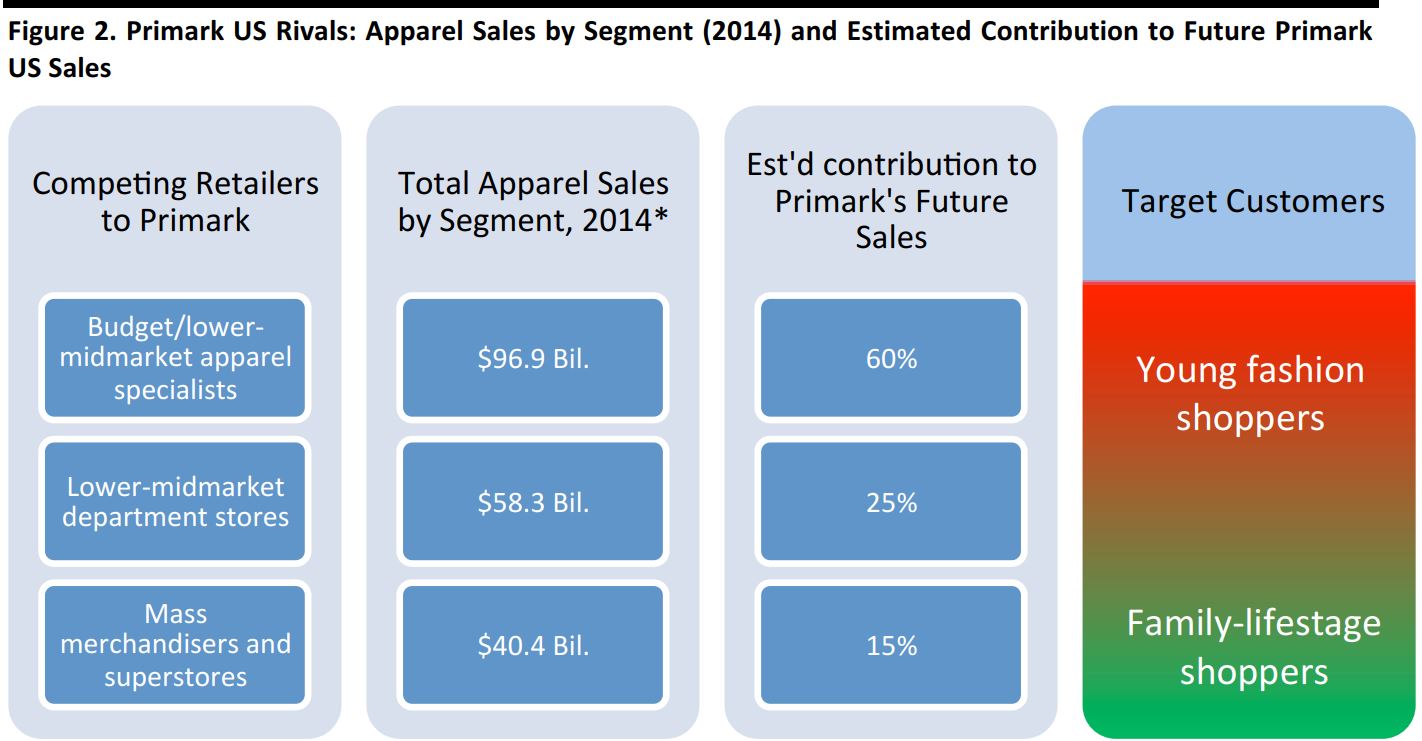

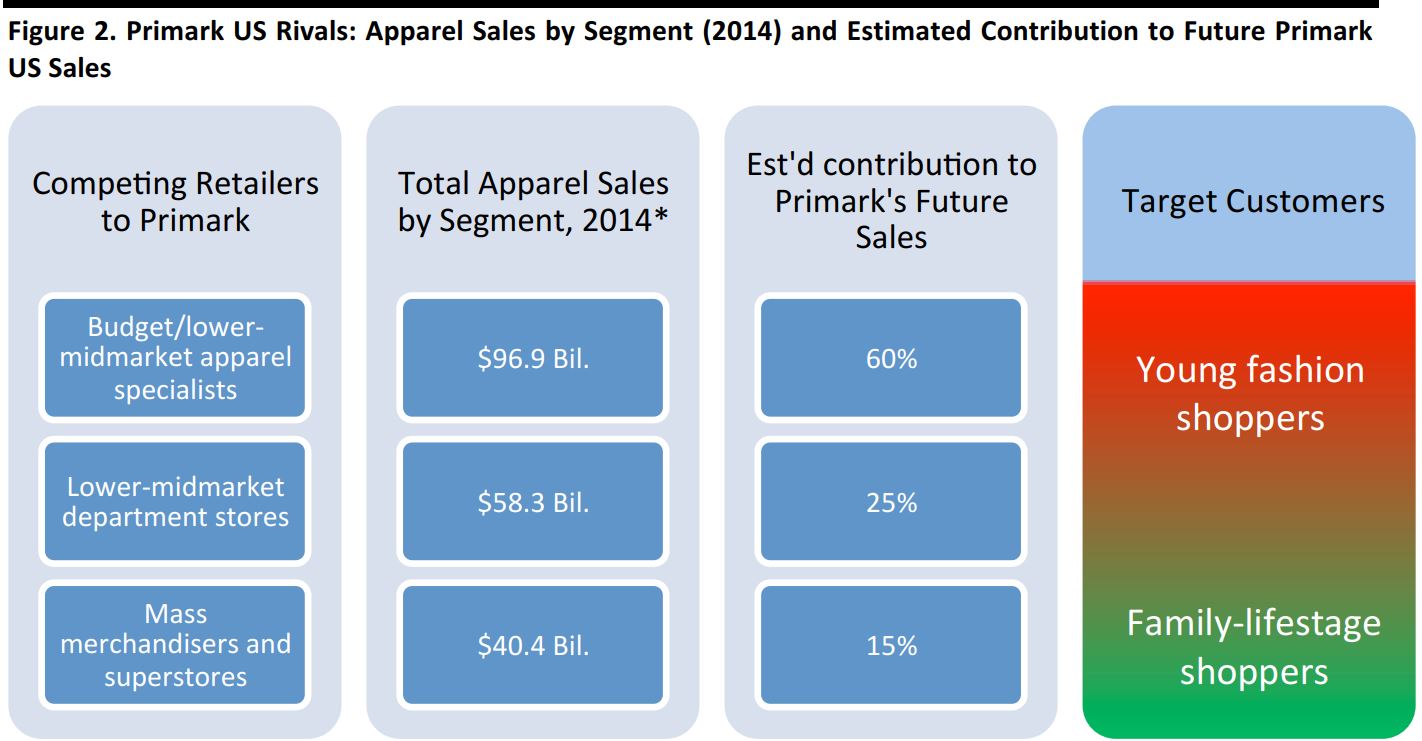

Rivals in three major channels stand to lose out if Primark grows to the scale we anticipate it will: apparel specialists, department stores and mass merchandisers/superstores.

With a fast-fashion ethos, Primark pursues the younger shopper—though far from exclusively. So, we perceive the greatest threats are to apparel specialists similarly focused on a frugal, younger shopper. As a ballpark estimate, we think 60% of Primark’s gains may come at the expense of rivals such as these, with the remainder split between department stores and superstores.

Primark also caters to family-life-stage shoppers—offering strong kidswear ranges, for instance. So, itis also a threat to department stores and mass merchandisers, but since these retailers are focused on slightly older shoppers, we think they face less of a threat than do fashion specialty stores. Mass merchandisers with a cheap-chic image and slightly younger shoppers stand to lose more than those with a more middle-of-the-road offering and a more conservative customer base.

Below, we chart the current scale of each of these three sectors in apparel, and their potential loss in sales to Primark in the coming years.

*Apparel only, excluding footwear. Figures are for that total segment, e.g., total apparel specialists and total department stores, not just “lower midmarket.”

Source: Euromonitor International/company reports/FBIC Global Retail & Technology

A PRIMARK PRIMER

In Summary

Prices Are Compelling

Primark’s success has been built on ultralow prices combined with fashionability. Because Primark’s prices are so attractive, impulse purchasing is high. In our store visits, we have observed that browsing shoppers are hard-pressed to limit their purchases, so they often heap another item onto their already overflowing shopping baskets.

But it is not just low prices that set the company apart. Primark’s strengths are that it mixes compelling prices with a fast-fashion outlook, bringing new ranges to stores frequently and offering on-trend product that young shoppers want to buy. These fashion ranges are complemented by a strong range of basics. This is not about drab, supermarket-style clothing; it is about semi-disposable clothing with a convincing fashion edge.

Stores Help Build the Brand

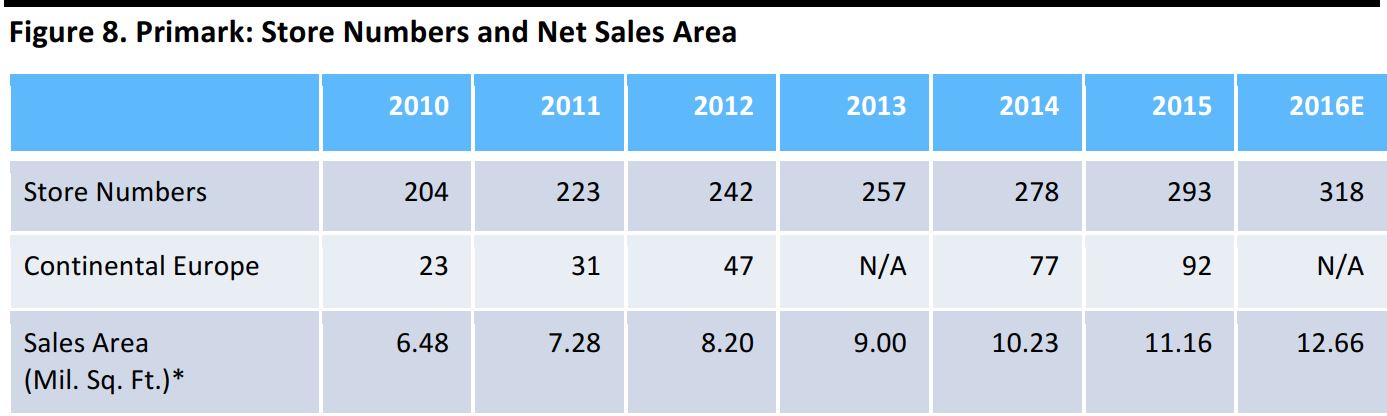

Primark stores are typically big, multi-floor spaces—and they have been getting bigger in recent years, in part as a result of the strategy to put flagships in major European cities. The average Primark store offered a little over 37,000 square feet of net selling space in the first half of 2015, we calculate, up from just under 32,000 square feet at year-end 2010.

Moreover, the glossy, feature-heavy appearance of these stores shows that Primark does not neglect the in-store experience, despite its low-price positioning. For shoppers, such environments only amplify the feeling of getting more for their money.

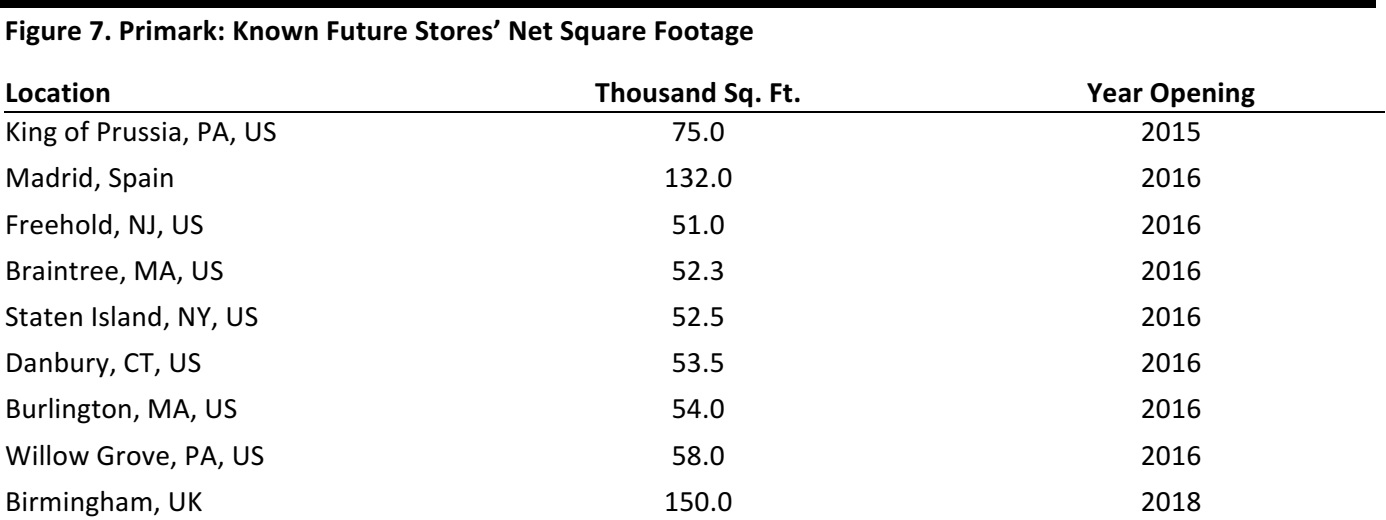

Primark’s new US stores will be even bigger than the already substantial average. Seven of its first stores in the US will be sublet from existing Sears department stores, and the average size of these will be nearly 57,000 square feet, we estimate. We expect the biggest, at King of Prussia Mall, to come in at 75,000 square feet of net selling space.

New Stores Perform Well

Far from needing to take time for new space to mature, Primark consistently reports higher densities in new stores. In a recent trading update, the company said it had seen “very high sales densities” in stores opened within the past year, and it also recently said that some of these new stores “now regularly feature in Primark’s top 20 stores by annualized sales.”

The quality of store fit and the amount of square footage may have contributed to the success the company has seen in its new stores, but a more important factor is that Primark has been expanding into areas where shoppers have not formerly had access to its stores. This will be the case as it opens stores in the US and Italy over the next 12 months.

It Is Not H&M or Zara

Some commentators have been tempted to put H&M, Zara and Primark in one “European fast-fashion” bucket. For instance, some analysts have speculated that Primark’s entry into the US will prompt H&M to cut prices in the States. We think this belies a misunderstanding of the distinct positioning of each of these retailers and understates Primark’s value positioning. (It also overlooks the fact that H&M and Primark already coexist across much of Europe.)

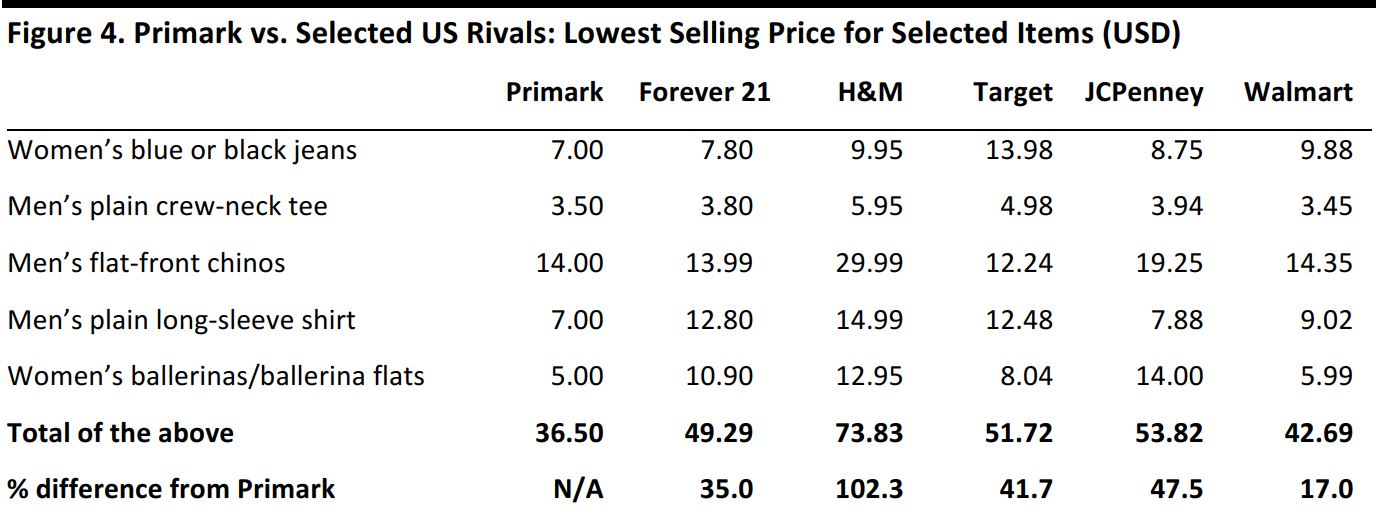

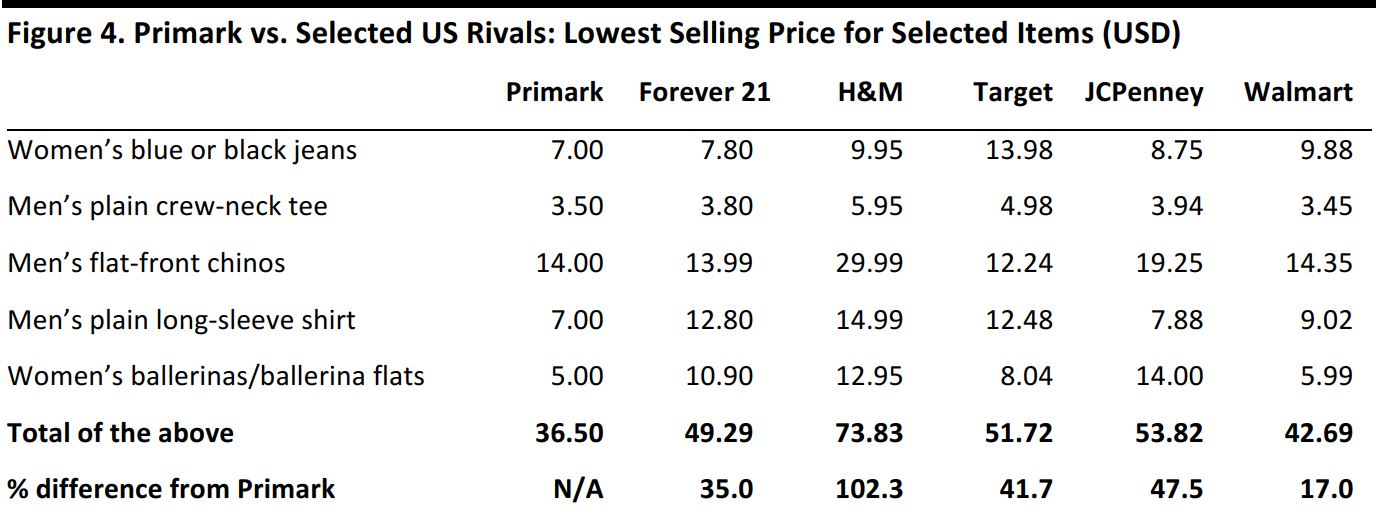

A recent study by Morgan Stanley found H&M to be, on average, 107% more expensive than Primark across 100 items and three European cities. Our own flash price comparison, shown later, found H&M to be 102% more expensive and Forever 21 to be 38% more expensive than Primark in the US. We do not think this suggests that H&M will weaken as Primark expands—these retailers are simply pitched at different levels.

Prospects in New Markets

We think Primark stands a very good chance of succeeding in the US market. Its distinctive mix of ultralow prices, fast-fashion elements and broad choice (broader than Forever 21, for instance) stand it in good stead. American shoppers have shown themselves unwilling to grow their spending on clothing in the recent past. Primark caters to this frugal sentiment while allowing shoppers to continue to buy into fashion.

Italy will be a tougher market to crack, we think. Italians have long been willing to prioritize spending on appearance, including apparel: in 2014, for instance, just over 6% of Italians’ total spending went to clothing and footwear, compared to a little over 3% among Americans.

Primark is likely to carve a niche among hard-pressed, recession-hit Italian consumers and, because of its price positioning, it can help consolidate the lower end of what remains an unusually fragmented apparel market—it can steal share from traditional markets, for instance. At the same time, we think it will be an uphill struggle to convince some Italians to shop at Primark. In short, Italy will prove to be a test of the retailer’s appeal. If it can crack Italy, it can succeed almost anywhere.

Product and Pricing

Primark focuses on semi-disposable fashion, but its product offering spans for malwear (suits, shirts and ties), lingerie, beauty products, costume jewelry, shoes, accessories (handbags are prominent), travel luggage and housewares (soft furnishings and decorative items).

Based on store visits, we estimate that Primark’s typical space mix breaks down approximately as follows:

- Womenswear (including beauty and jewelry): 60% of store space

- Menswear: 25%

- Childrenswear: 10%

- Housewares and luggage: 5%

Source: Company reports/FBIC Global Retail & Technology

Our flash price survey of a handful of items suggests that Forever 21 is about35% more expensive than Primark and that H&M charges 102% more in the US. We caution that this is based on a limited sample of items (see table below for details). Our H&M finding, however, is in the same ballpark as the 107% price difference that Morgan Stanley found, as noted above.

The price difference versus Walmart is much narrower, but Primark’s fashion credentials will be a key advantage against superstore players such as Walmart.

Research was conducted online, and so may not reflect Primark’s full range, given the limited product selection on its website. Reduced-price items were excluded in order to reflect standard selling prices. Research was undertaken on September 21, September 24 and October 1, 2015.

Source: Company websites/FBIC Global Retail & Technology

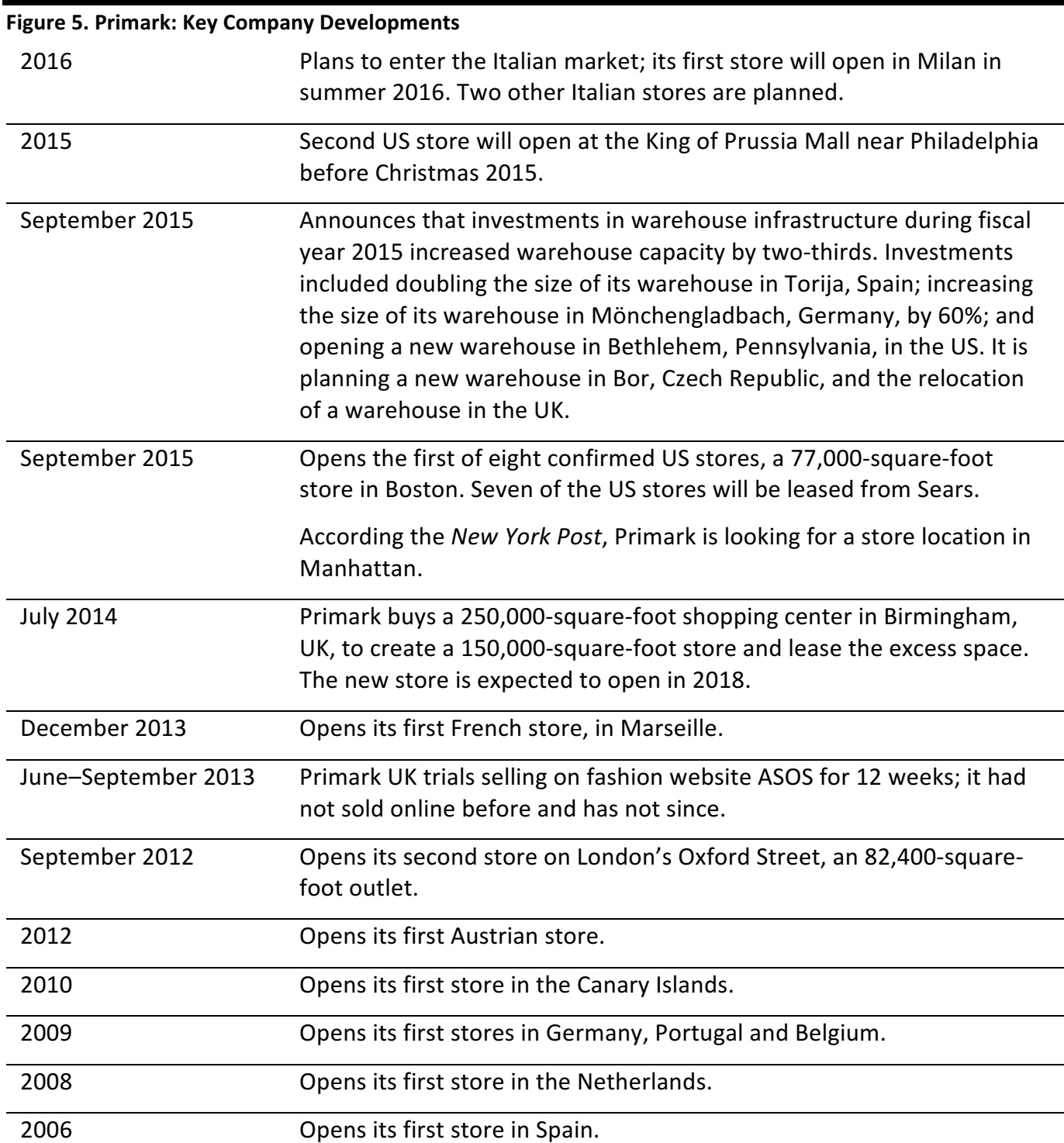

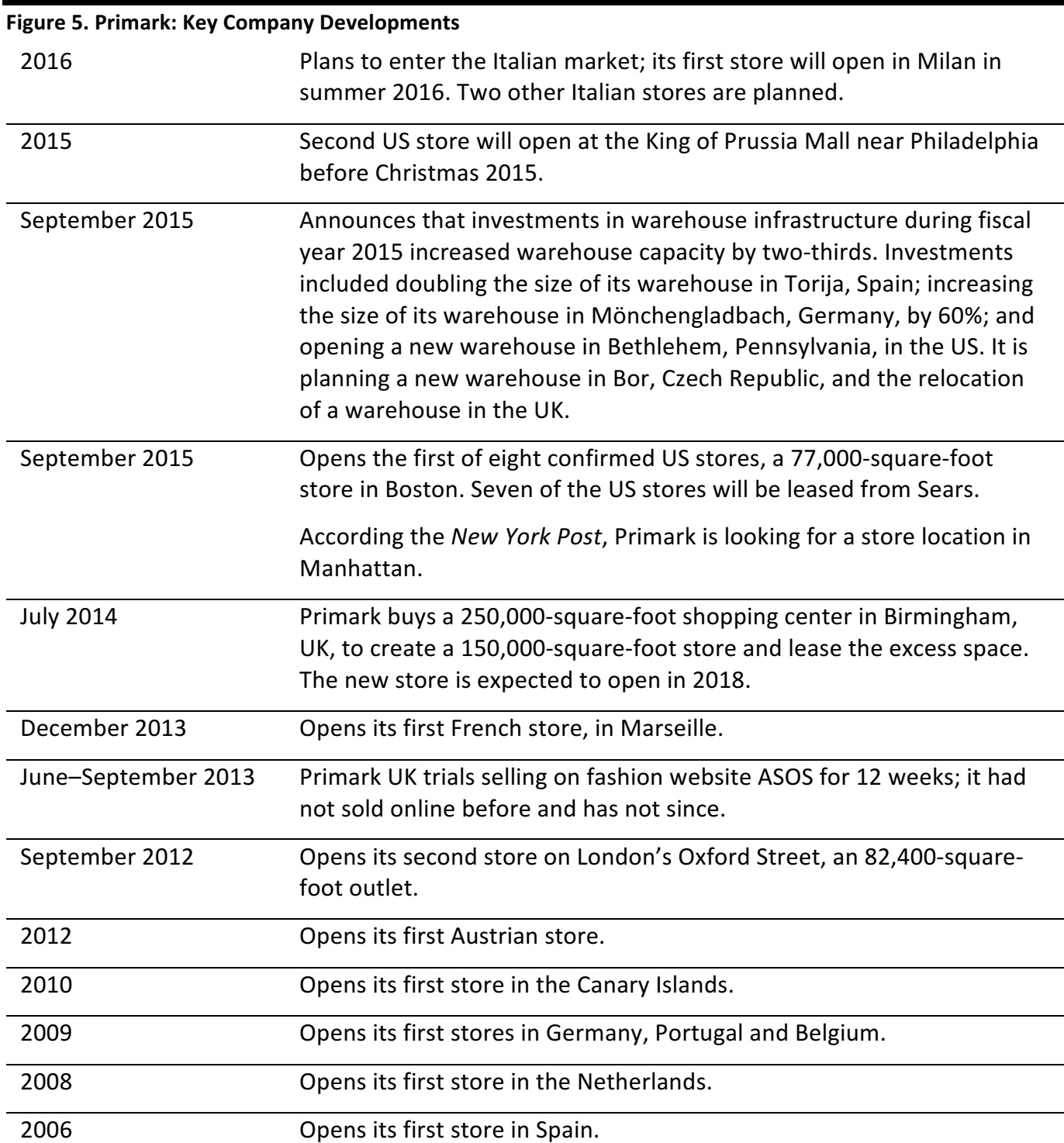

KEY DEVELOPMENTS

Source: FBIC Global Retail & Technology

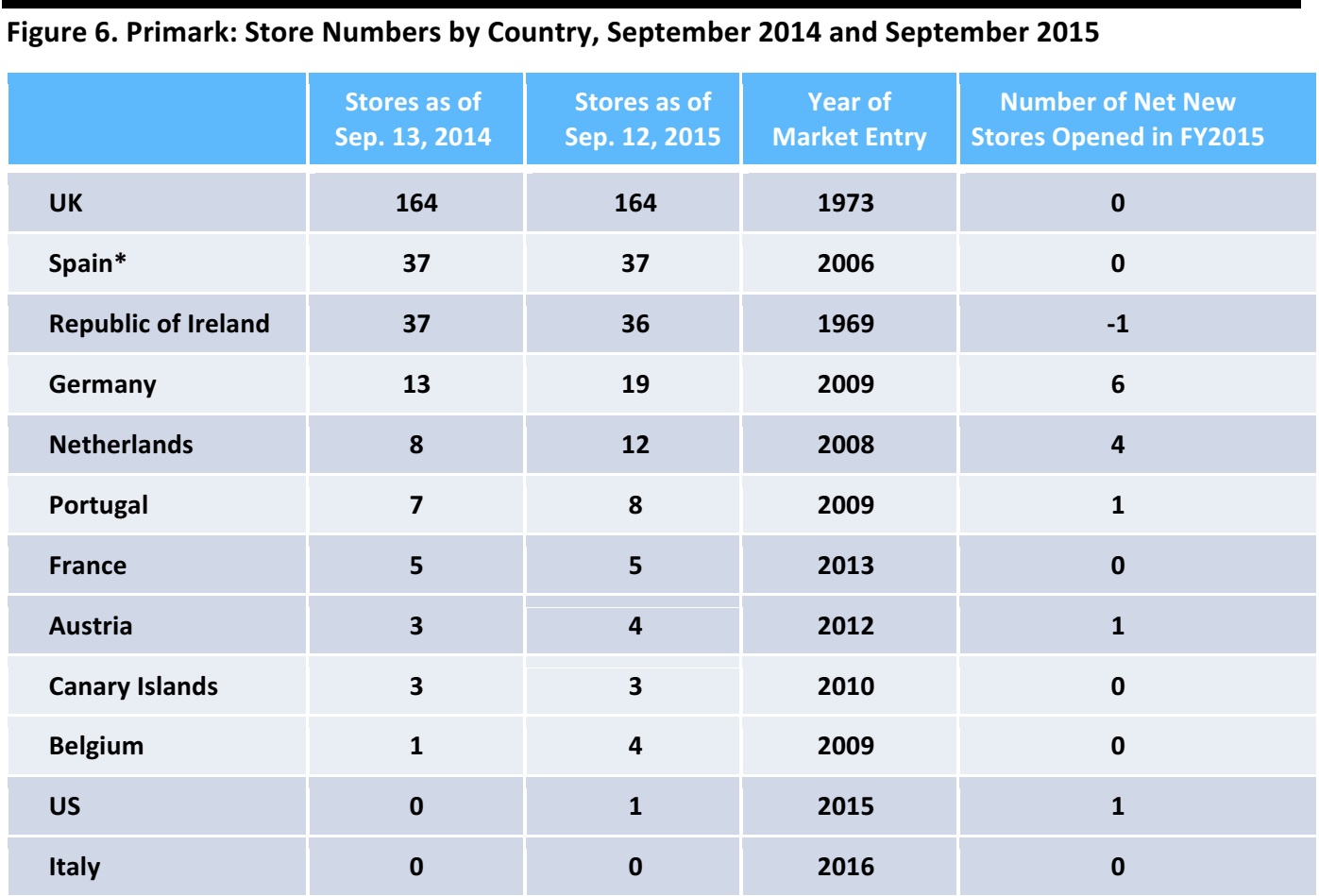

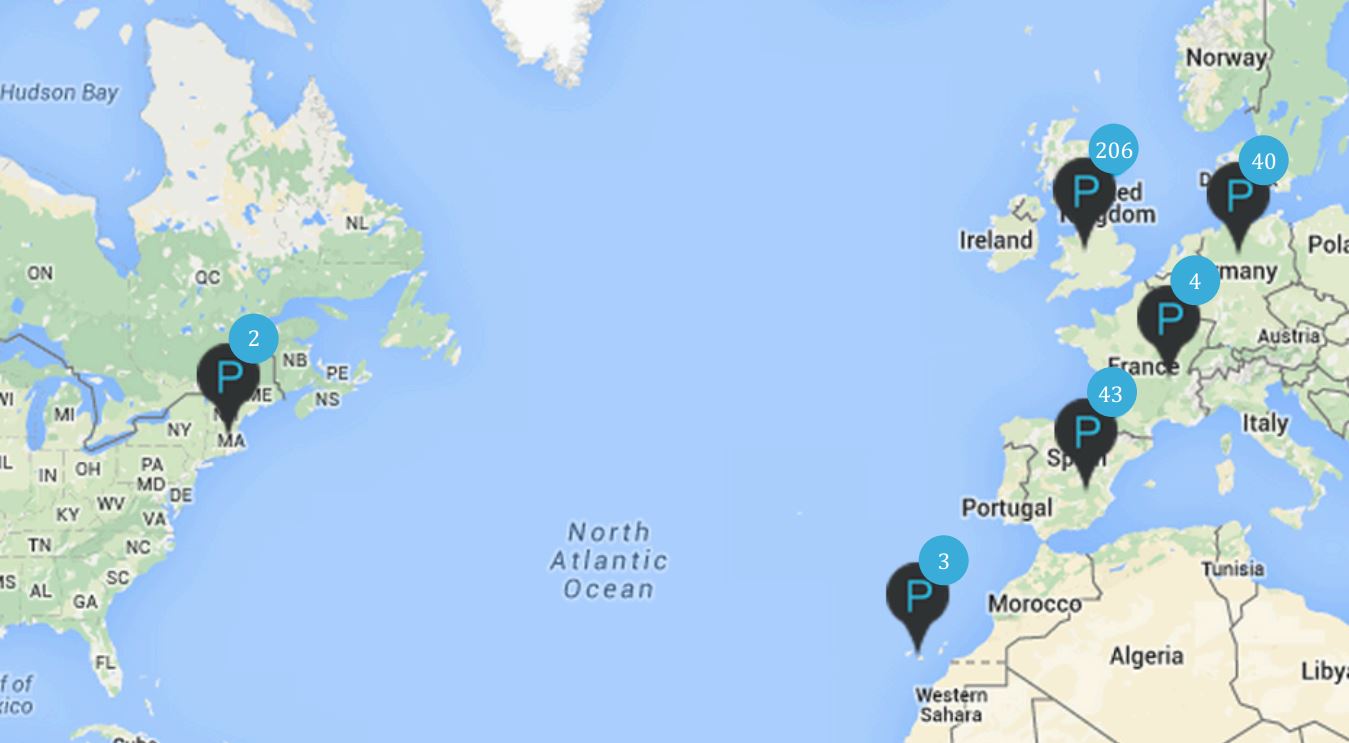

International Store Portfolio

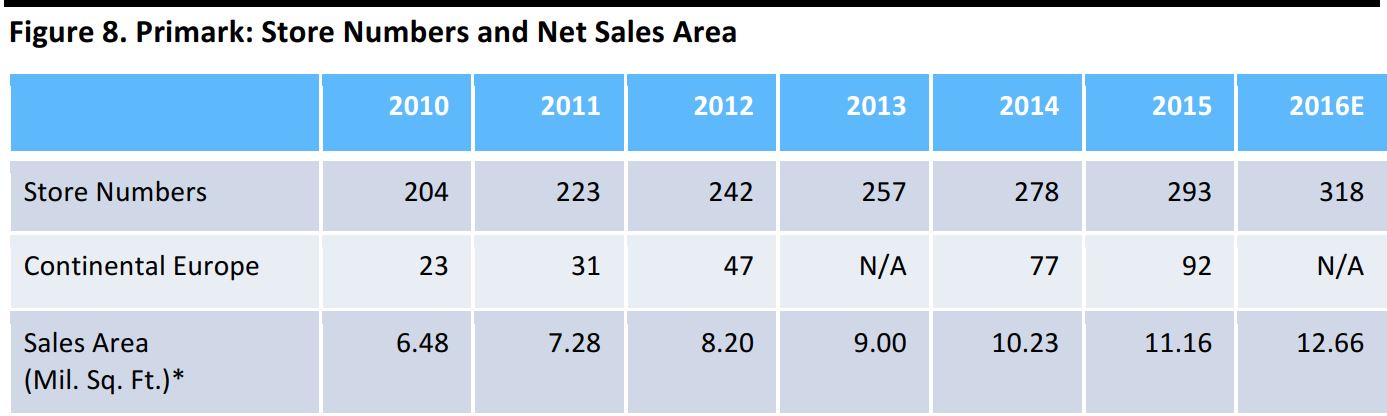

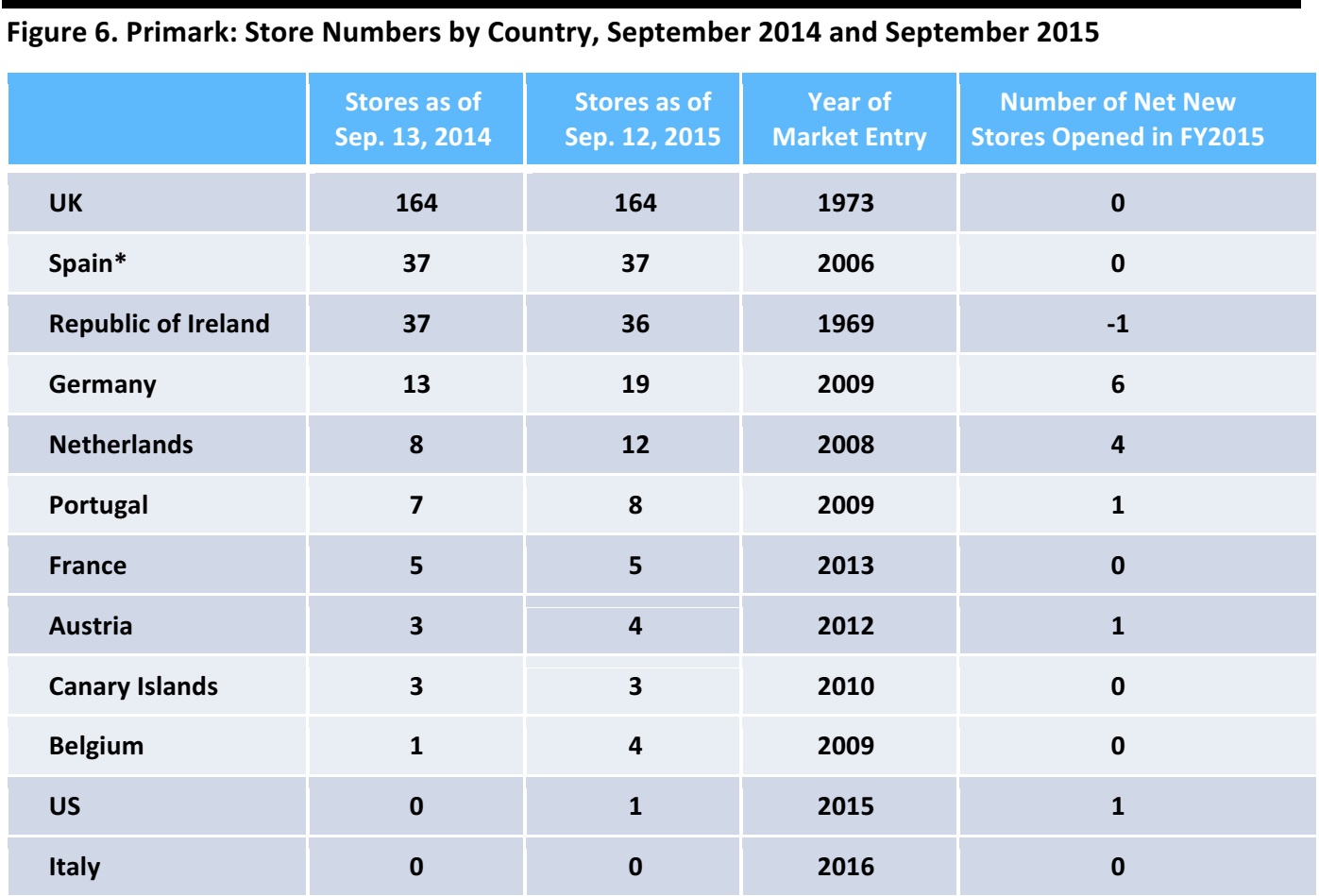

A net total of 15 new stores were added in fiscal year 2015: six in Germany, four in the Netherlands, one in Portugal, one in Austria, three in Belgium and one in the US; Irish store numbers decreased by one.

*Excluding the Canary Islands

Source: Company reports/FBIC Global Retail & Technology

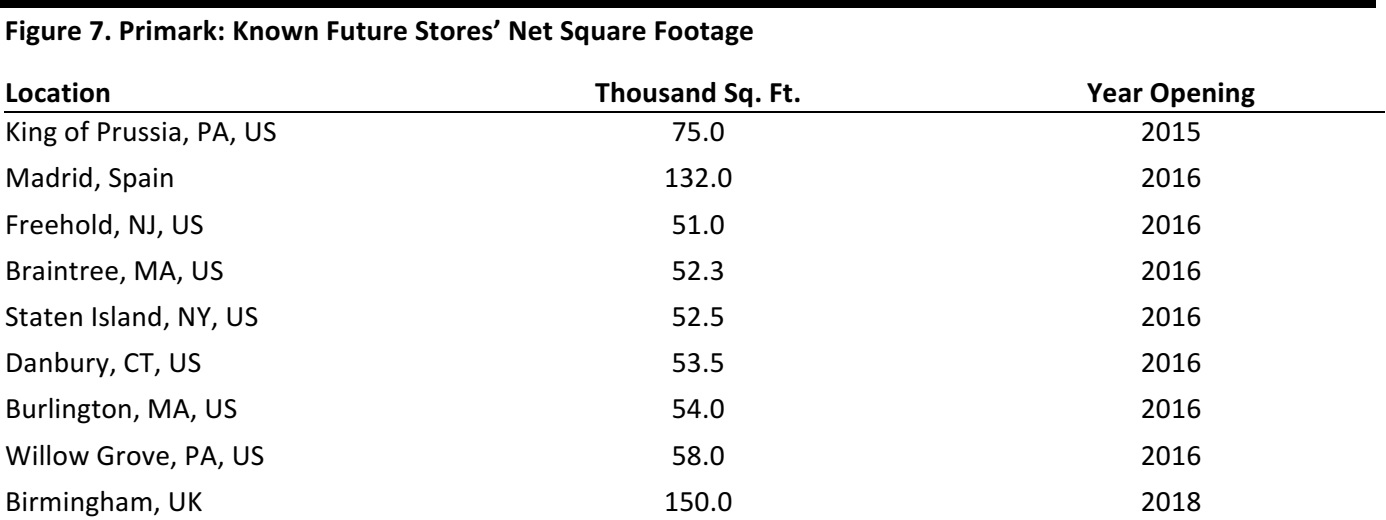

New Store Sizes

Stores opened in the recent past have varied in size from 31,000 square feet in Walsall, UK, to 80,000 square feet in Dresden, Germany, and 82,400 square feet on London’s Oxford Street. New stores opened in 2015 averaged 62,000 sq. ft. each, versus 38,000 sq. ft. for total group stores(NB, we have not adjusted for store relocations in the total added space in fiscal year 2015, due to absence of data).

Some data estimated from gross square footage

Source: Company reports/FBIC Global Retail & Technology

Primark’s planned store for Birmingham, UK, is shown below.

Source: Newprimark.co.uk

Continental Europe Driving Portfolio Growth

Continental Europe accounted for just 31% of total Primark stores, or 36% of total selling space, as of September 2015, suggesting there is plenty of opportunity to grow the portfolio. In its recent full-year results, the company said it has “an extensive pipeline of new stores to be opened over the next few years,” with 1.5 million square feet scheduled to open in the next financial year.

*Data provided by the company have been approximate in some recent years.

Source: Company reports/FBIC Global Retail & Technology

Key Metrics

Impressive financial metrics have been the reward for Primark’s distinctive proposition.

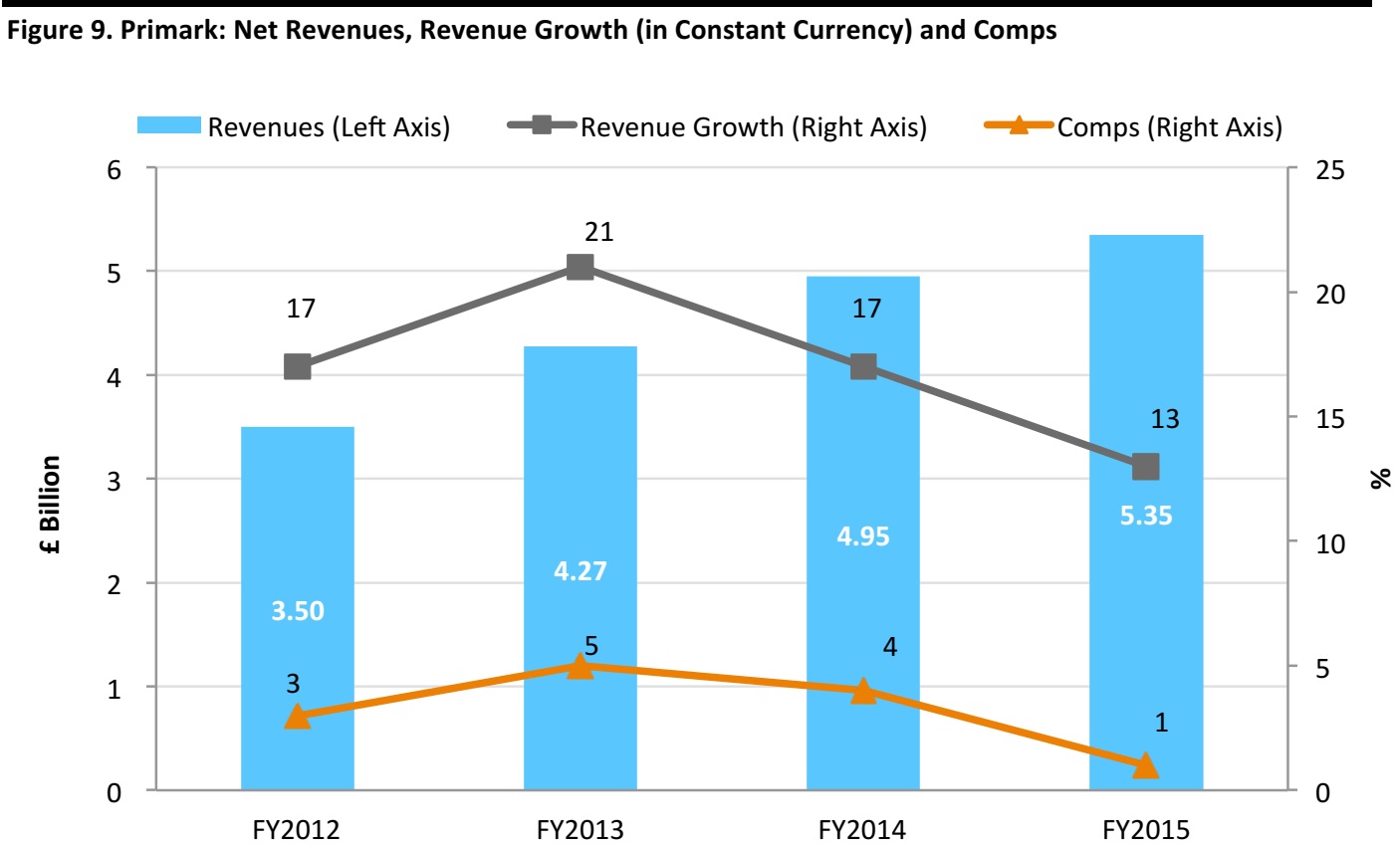

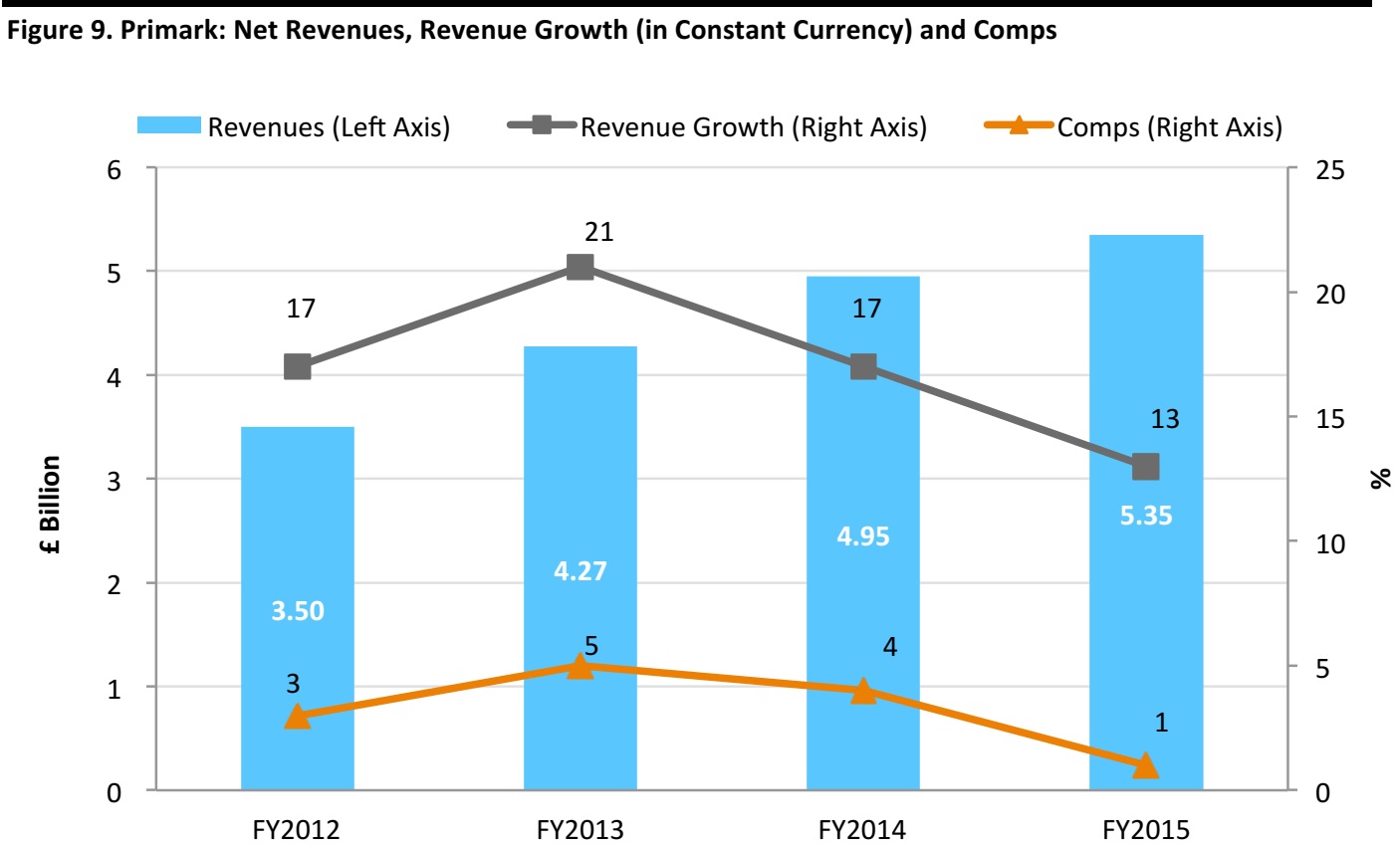

Sales Have Powered Ahead, but Growth Is Slowing

The company turned over £5.35 billion (US$8.28 billion) in the year ending September 12, 2015. Net revenues almost doubled in the five years through fiscal year 2015. Total sales growth remains strong, but comps are now near-zero: in fiscal year 2015, comps were hit by unseasonal weather in autumn 2014 and spring 2015. Cannibalization was a further problem, with newly opened stores in Germany and the Netherlands taking sales from established stores in those countries.

Primark’s top-line figures remained impressive in fiscal year 2015, but greatly helped by a 9% boost in selling space over the year.

Source: S&P Capital IQ/company reports/FBIC Global Retail & Technology

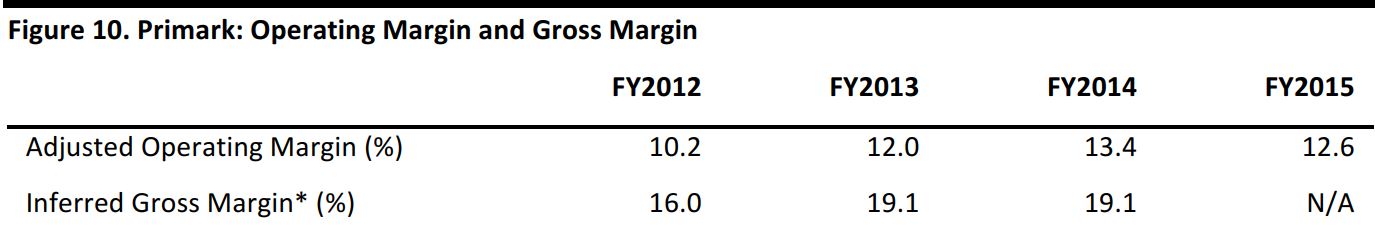

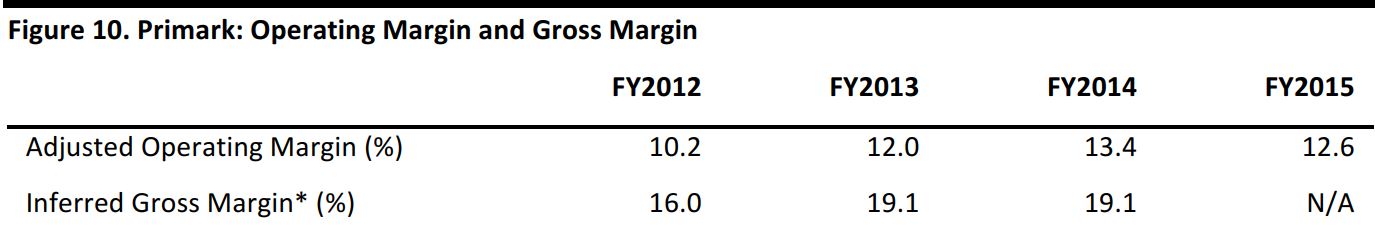

Operating margins had been improving until they were hit in fiscal year 2015 by a return to “more normal levels” of markdowns as well as by the strength of the US dollar (Primark sources much of its merchandise in dollars).

Our gross margin data below were calculated from Primark’s accounts filed in the UK. Parent company ABF does not report gross profit for Primark as a whole. Subsidiary accounts should always be treated with a degree of caution, however. These data imply Primark is a low-gross-profit business, which in turn suggests that low operating costs, such as due to an absence of advertising, are key to profitability.

*Gross margin of Primark Stores Ltd., the UK subsidiary of Primark, which in 2014 accounted for 56% of total Primark sales. Latest data for Primark Stores Ltd. are from 2014.

Source: S&P Capital IQ/company reports/FBIC Global Retail & Technology

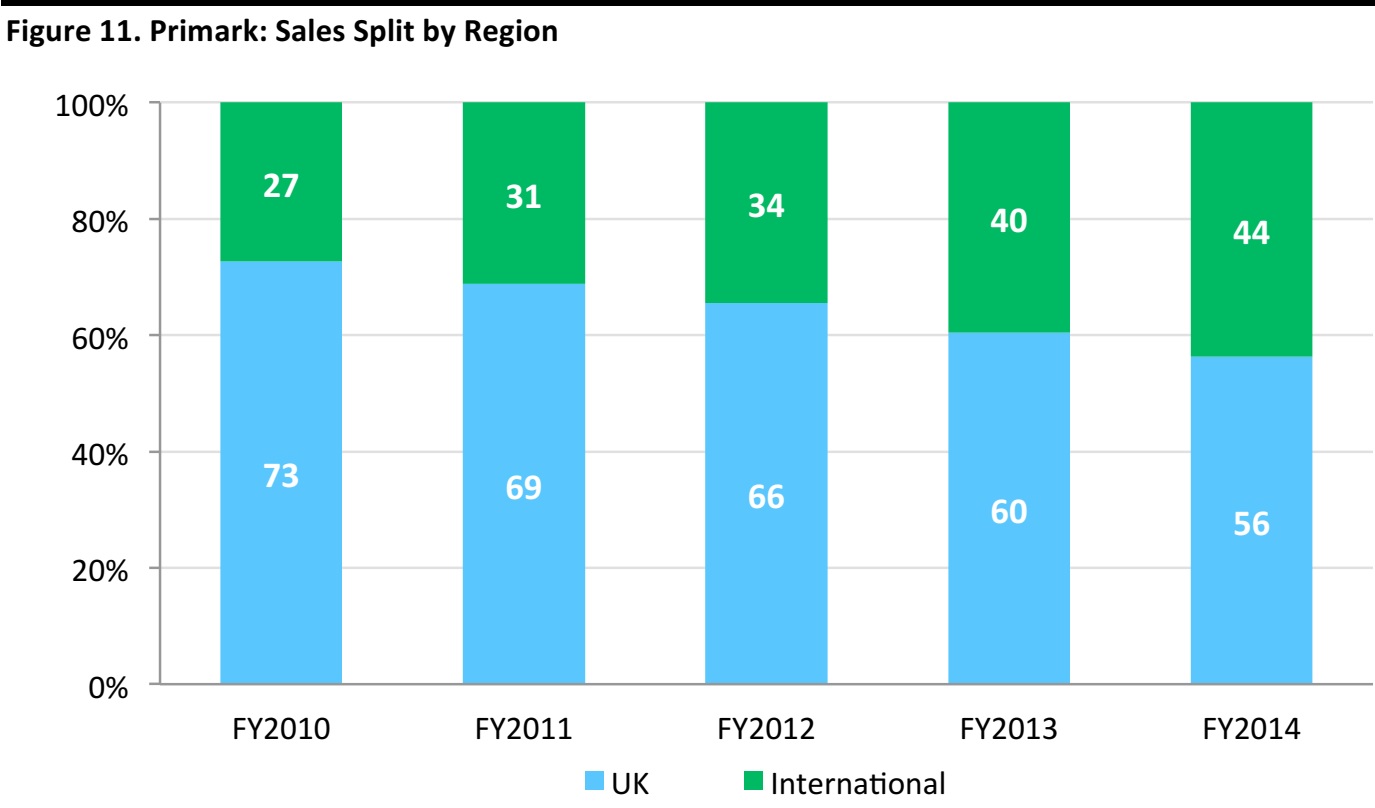

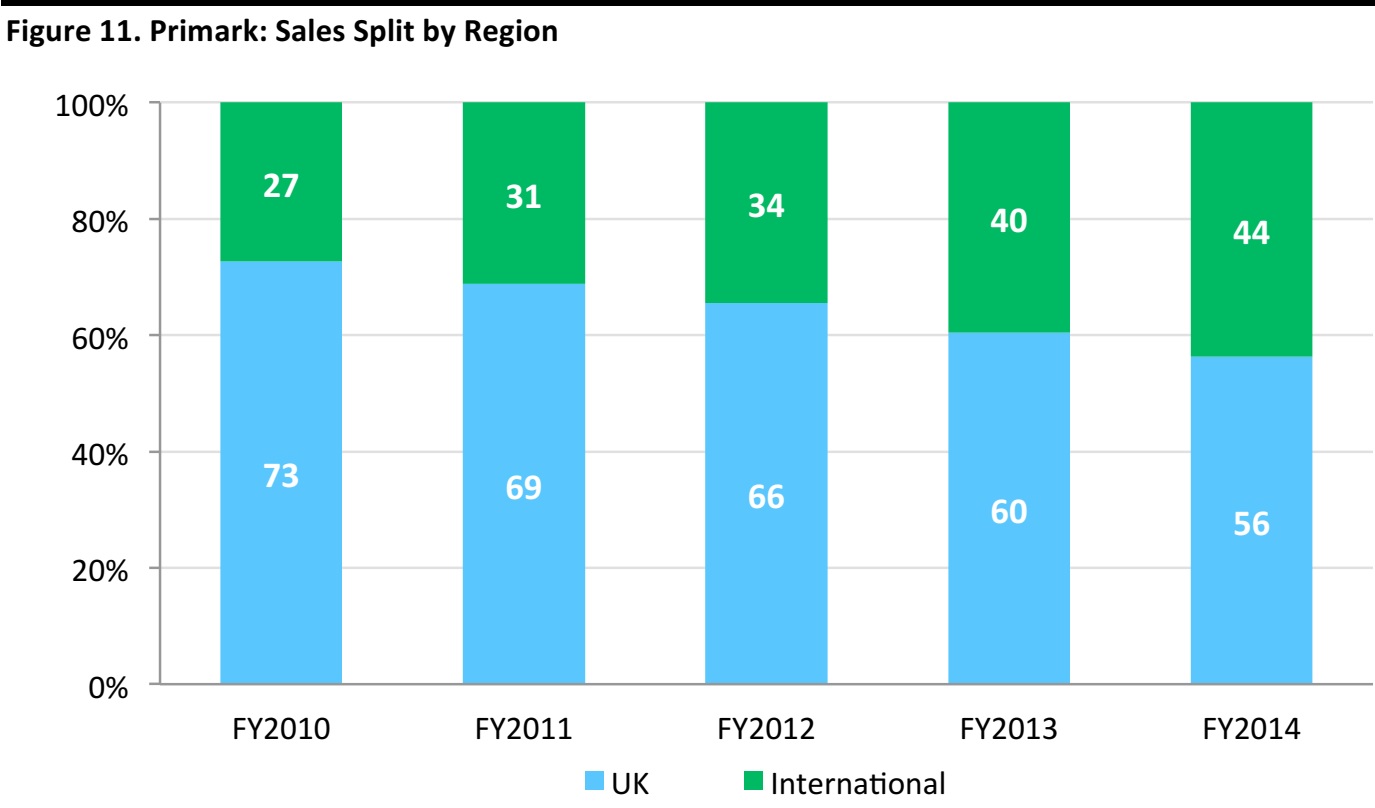

International Growing in Importance

International expansion has been a big success for Primark, with stores in France, Germany, and Spain performing strongly. Sales outside the UK are likely to be contributing almost half of all sales at the time of this writing. As of September 2015, non-UK shops made up 44% of the store estate—which suggests that the big flagship stores in Continental European cities are seeing higher average sales per store than longer-standing UK stores are.

Regarding fiscal year 2015, the company commented that:

- Spain, Portugal, and Ireland performed very well throughout the fiscal year.

- French stores saw very high sales densities, and France was the most successful new market entry to date.

- New stores impacted negatively on sales at some existing stores in the Netherlands and Germany.

- Comps were positive in the UK.

Calculated on the assumption that UK accounts for Primark Stores Ltd. are for the entirety of UK sales and exclude all non-UK sales.

Source: S&P Capital IQ/company reports/FBIC Global Retail & Technology

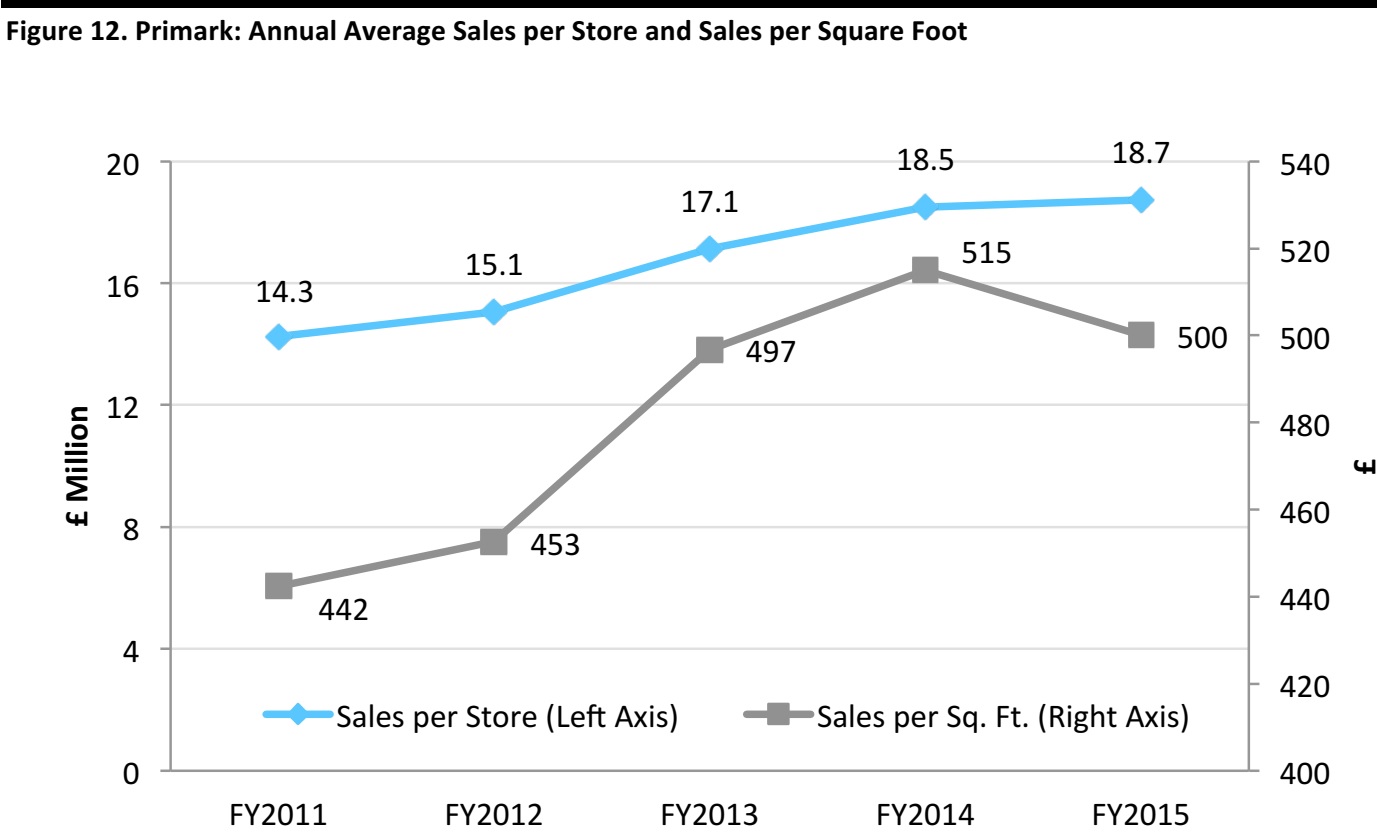

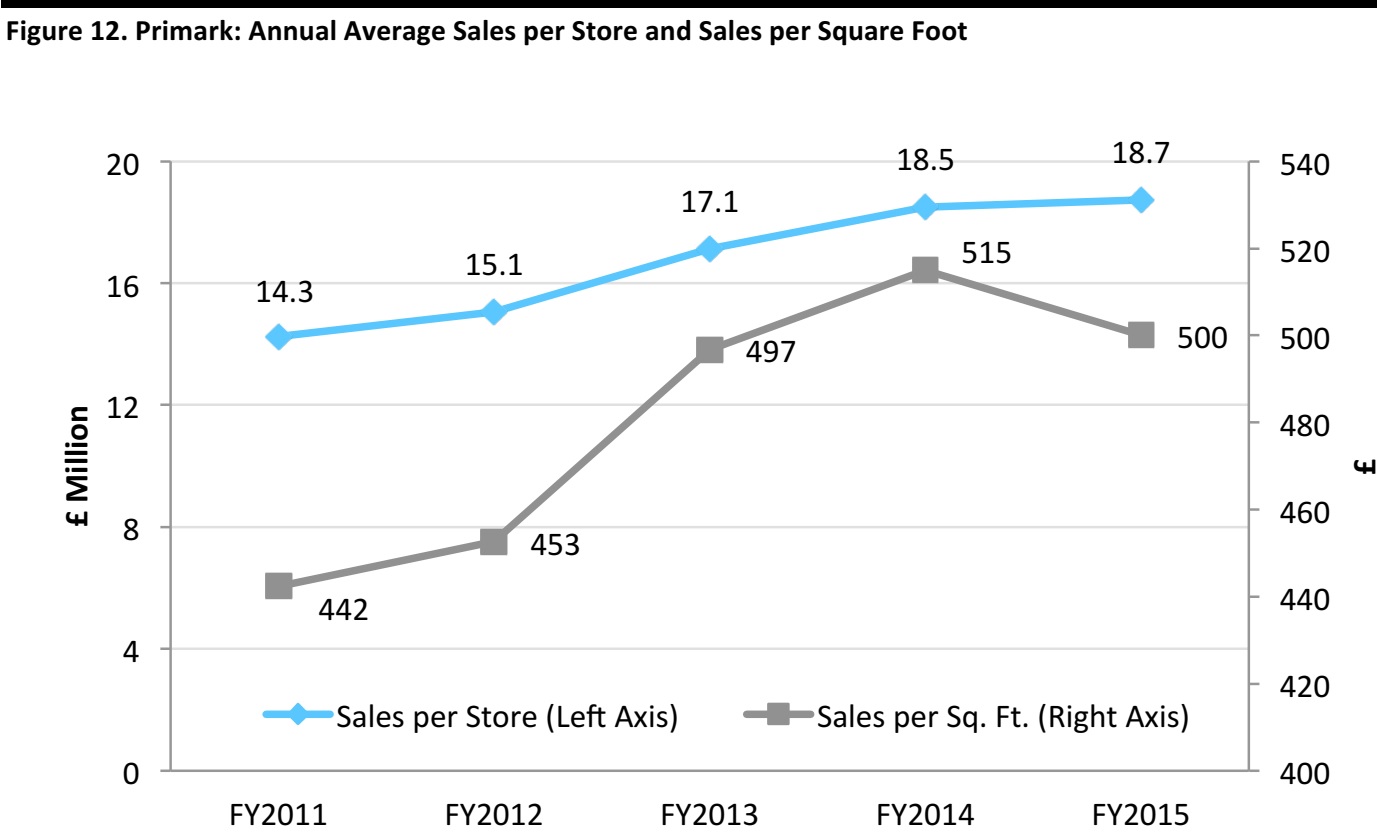

Sales per store continued to rise, albeit at a slower rate, in fiscal year 2015. The opening of bigger stores has helped this metric. To put the figures below in some context, UK apparel stalwart Marks & Spencer was turning in nonfood sales per store of £11.5 million in fiscal year 2015 (down £1 million per store since fiscal year 2011).

Sales per square foot disappointed in the latest fiscal year, in part due to the currency effects that depressed top-line growth from 13% at constant foreign-exchange rates to 8% at actual rates. At constant rates, sales per square foot would have continued their upward trajectory, albeit at slower rates, as we saw with sales per store.

As we noted earlier, we estimate that non-UK stores typically see higher average annual sales than the group total, and fiscal year 2015 sales per store are estimated to come in at £20.9 million outside the UK. This is because Primark UK has a substantial number of smaller, legacy stores in provincial towns, while, internationally, it has opened large flagship outlets.

Sales per store and sales per square footwere calculated using average annual store numbers and sales area, respectively.

Source: Company reports/FBIC Global Retail & Technology

KEY TAKEAWAYS

- Primark’s prices are compelling, but the retailer offers much more than simply ultralow price points: it delivers value for money in the broader sense. It has a fast-fashion element in its apparel offering, and its newer flagship stores are impressive retail destinations.

- We have few doubts that Primark will make waves in the US—we estimate it could become a billion-dollar retailer in the next four years if it maintains a steady, but ultimately modest, store-opening plan. We think the retailer will resonate with US shoppers who are wary of spending big on fashion, but who still want to look great. We think lower-midmarket and budget fashion specialty stores are most likely to lose out to this retailer in the States.

- We have less certainty about Italy, where Primark is set to debut in 2016. Italians typically are demanding fashion shoppers and they are willing to spend on apparel. Primark’s value positioning will help it consolidate the lower end of the apparel market in Italy, and gain share at the expense of traditional markets. We think it will be less easy for Primark to win midmarket shoppers in Italy than in many other countries—but if it can succeed there, it can succeed almost anywhere.

Primark opened its first US store on September 10, 2015, and has so far announced plans to open up to 10 stores in the country, with eight of these confirmed so far. We are bullish on Primark’s prospects in the American market. Its mix of low prices, fast fashion and core staples is likely to resonate with US consumers who have shown consistent unwillingness to grow their spending on apparel.

This could result in Primark generating around $1 billion in annual sales by the end of its fourth full year in the US, we estimate. We believe the underlying assumptions for our calculations err toward the conservative, although the average number of stores that will be opened each year is a major uncertainty.

We explain our calculations and assumptions in more detail below, but, in summary, our projections assume an average of 7.5 stores opened per year and a short lag before US stores ramp up to Primark’s average sales per international store.

Primark opened its first US store on September 10, 2015, and has so far announced plans to open up to 10 stores in the country, with eight of these confirmed so far. We are bullish on Primark’s prospects in the American market. Its mix of low prices, fast fashion and core staples is likely to resonate with US consumers who have shown consistent unwillingness to grow their spending on apparel.

This could result in Primark generating around $1 billion in annual sales by the end of its fourth full year in the US, we estimate. We believe the underlying assumptions for our calculations err toward the conservative, although the average number of stores that will be opened each year is a major uncertainty.

We explain our calculations and assumptions in more detail below, but, in summary, our projections assume an average of 7.5 stores opened per year and a short lag before US stores ramp up to Primark’s average sales per international store.

Primark stores are typically big, multi-floor spaces—and they have been getting bigger in recent years, in part as a result of the strategy to put flagships in major European cities. The average Primark store offered a little over 37,000 square feet of net selling space in the first half of 2015, we calculate, up from just under 32,000 square feet at year-end 2010.

Moreover, the glossy, feature-heavy appearance of these stores shows that Primark does not neglect the in-store experience, despite its low-price positioning. For shoppers, such environments only amplify the feeling of getting more for their money.

Primark’s new US stores will be even bigger than the already substantial average. Seven of its first stores in the US will be sublet from existing Sears department stores, and the average size of these will be nearly 57,000 square feet, we estimate. We expect the biggest, at King of Prussia Mall, to come in at 75,000 square feet of net selling space.

Primark stores are typically big, multi-floor spaces—and they have been getting bigger in recent years, in part as a result of the strategy to put flagships in major European cities. The average Primark store offered a little over 37,000 square feet of net selling space in the first half of 2015, we calculate, up from just under 32,000 square feet at year-end 2010.

Moreover, the glossy, feature-heavy appearance of these stores shows that Primark does not neglect the in-store experience, despite its low-price positioning. For shoppers, such environments only amplify the feeling of getting more for their money.

Primark’s new US stores will be even bigger than the already substantial average. Seven of its first stores in the US will be sublet from existing Sears department stores, and the average size of these will be nearly 57,000 square feet, we estimate. We expect the biggest, at King of Prussia Mall, to come in at 75,000 square feet of net selling space.

Primark focuses on semi-disposable fashion, but its product offering spans for malwear (suits, shirts and ties), lingerie, beauty products, costume jewelry, shoes, accessories (handbags are prominent), travel luggage and housewares (soft furnishings and decorative items).

Based on store visits, we estimate that Primark’s typical space mix breaks down approximately as follows:

Primark focuses on semi-disposable fashion, but its product offering spans for malwear (suits, shirts and ties), lingerie, beauty products, costume jewelry, shoes, accessories (handbags are prominent), travel luggage and housewares (soft furnishings and decorative items).

Based on store visits, we estimate that Primark’s typical space mix breaks down approximately as follows:

Our flash price survey of a handful of items suggests that Forever 21 is about35% more expensive than Primark and that H&M charges 102% more in the US. We caution that this is based on a limited sample of items (see table below for details). Our H&M finding, however, is in the same ballpark as the 107% price difference that Morgan Stanley found, as noted above.

The price difference versus Walmart is much narrower, but Primark’s fashion credentials will be a key advantage against superstore players such as Walmart.

Our flash price survey of a handful of items suggests that Forever 21 is about35% more expensive than Primark and that H&M charges 102% more in the US. We caution that this is based on a limited sample of items (see table below for details). Our H&M finding, however, is in the same ballpark as the 107% price difference that Morgan Stanley found, as noted above.

The price difference versus Walmart is much narrower, but Primark’s fashion credentials will be a key advantage against superstore players such as Walmart.