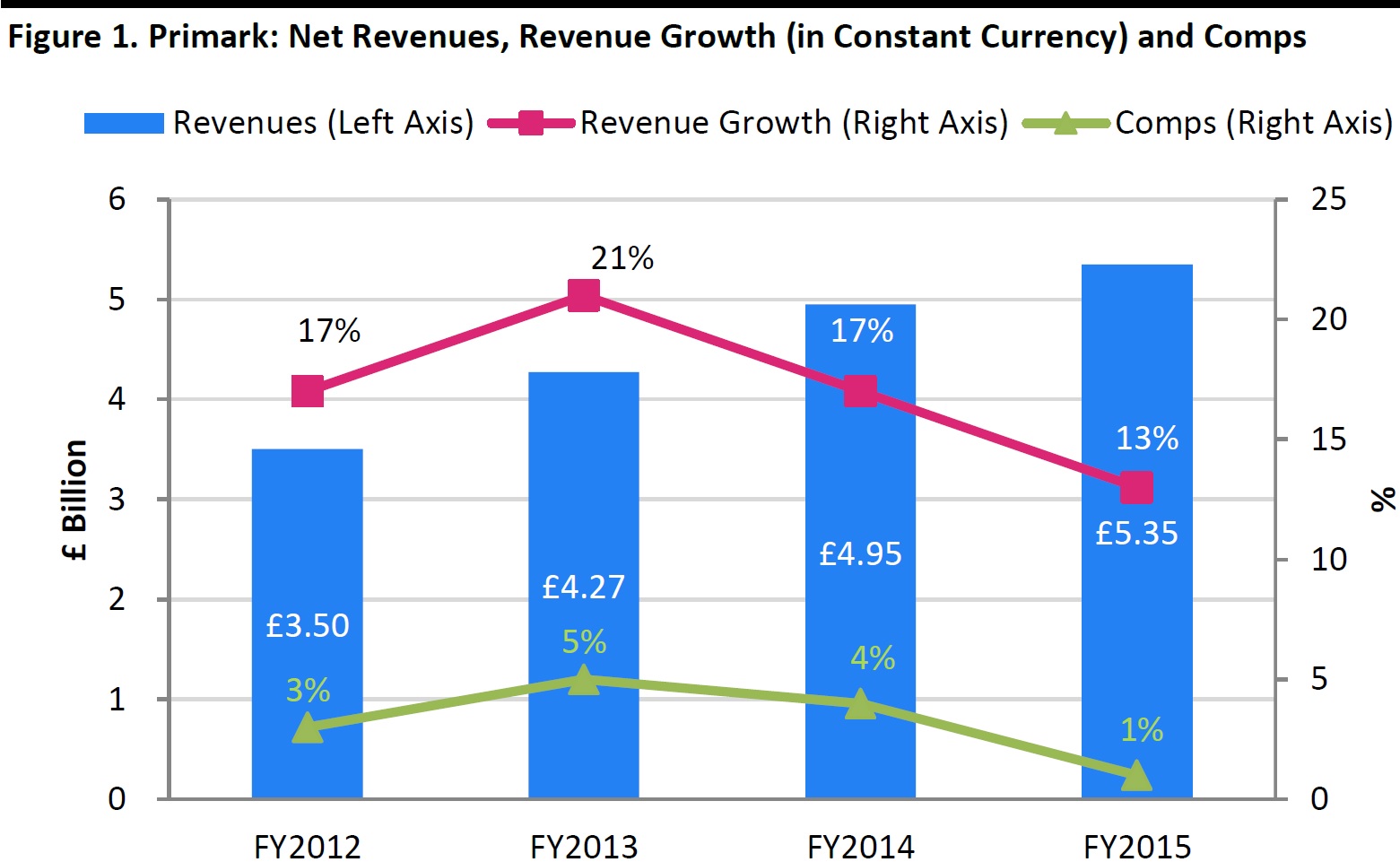

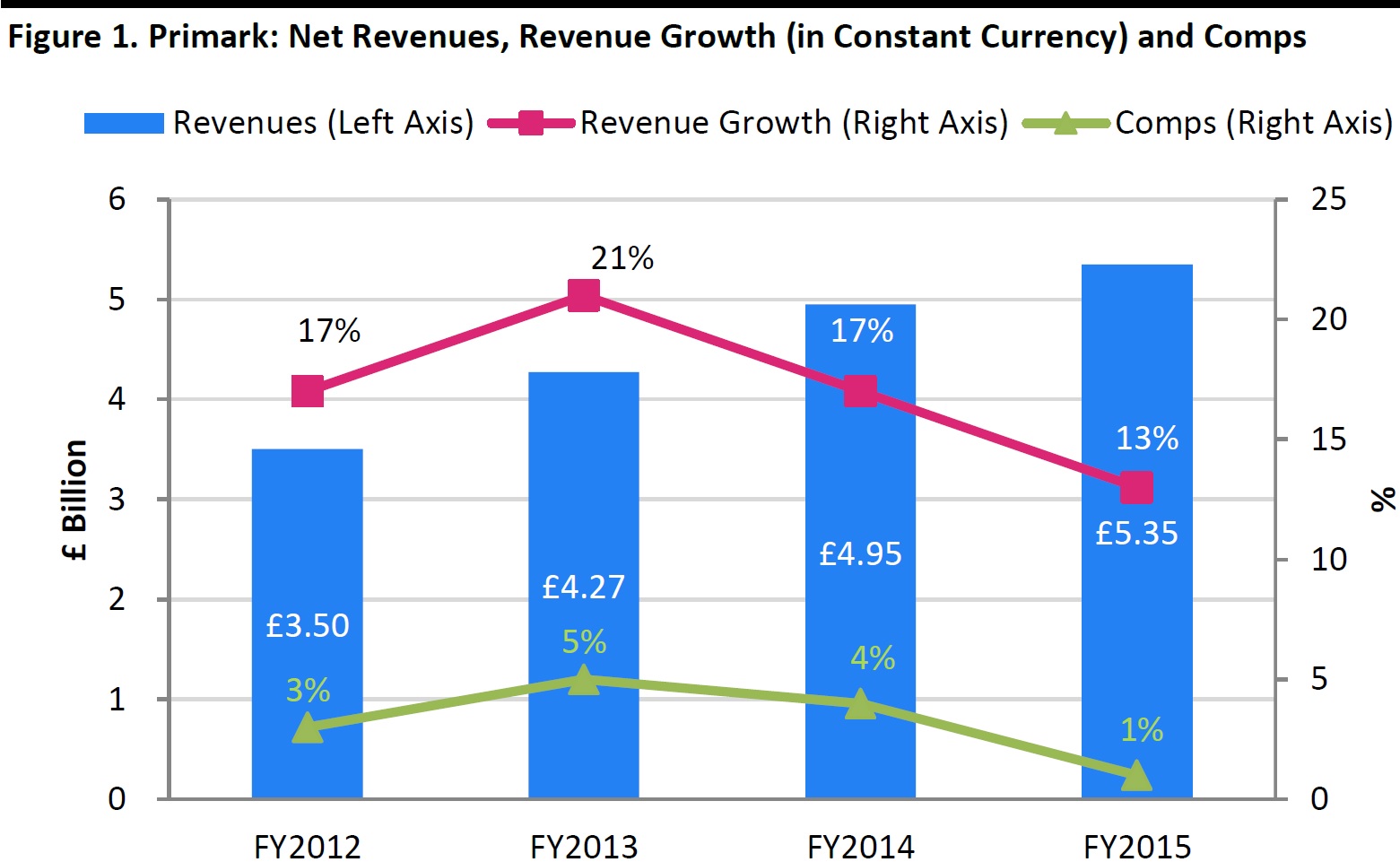

Slow Underlying Sales Growth

Primark’s top-line figures were impressive, but greatly helped by a 9% boost in selling space over the year ending September 12. The company eked out comparable sales growth of only 1% in the year, noting that warm autumn weather in 2014 and cool weather in spring 2015 negatively impacted results, but that those weaker periods were balanced by a strong final quarter. Cannibalization was a further problem, with newly opened stores in Germany and the Netherlands taking sales from established stores in those countries.

Full-year growth continued to slow, following a trend that began in fiscal year 2013. The trend suggests that Primark will need to take action to boost underlying demand in fiscal year 2016 in order to prevent comps from turning negative.

Source: S&P Capital IQ/company reports/FBIC Global Retail & Technology

Operating profit growth lagged revenue growth substantially, and was impacted by a return to “more normal levels” of markdowns as well as by the strength of the US dollar (Primark sources much of its merchandise in dollars).

A net total of 15 new stores were added in the year: six in Germany, four in the Netherlands, one in Portugal, one in Austria, three in Belgium and one in the US; Irish store numbers fell by a net one. The new stores averaged approximately 62,000 square feet, versus 38,000 square feet for total group stores, reflecting the company’s strategy of opening big, destination stores in major cities (NB, we have not adjusted for store relocations in the total added space due to absence of data). In fiscal year 2016, the company plans to add some 1.5 million square feet, including seven more stores in the US, totaling 0.4 million square feet.

Primark gave no indication of early performance at its first US store—but that was unsurprising, as the store was opened in Boston just a couple of days before the company’s fiscal year ended.

The Boston Primark entrance ahead of the grand opening