Web Developers

The biggest story in mass-market fashion retail in the US right now is the imminent market entry of UK budget apparel chain Primark. The retailer’s ultralow price points and fast-fashion ethos have won it legions of fans and rewarded it with substantial market-share growth in Europe.

Here, for the particular benefit of our American readers, we look at Primark’s positioning, key financial metrics, stores and products.

Primark is set to open its first US store in Boston this fall, followed shortly by another seven locations, including the largest mall in the US, King of Prussia Mall in Pennsylvania.

TJX Companies CEO Carol Meyrowitz is among those welcoming the new competition, stating on the company’s May 19 conference call, “We love being next to Primark and fast fashion because it really just drives the traffic along with the other off-pricers, so it just creates a mecca for us.” No doubt Sears will be hoping for the same effect, given that it has signed to sublet mall space to Primark.

But FBIC Global Retail & Technology believes that many retailers are more than a little nervous. And they should be!

Primark is set to open its first US store in Boston this fall, followed shortly by another seven locations, including the largest mall in the US, King of Prussia Mall in Pennsylvania.

TJX Companies CEO Carol Meyrowitz is among those welcoming the new competition, stating on the company’s May 19 conference call, “We love being next to Primark and fast fashion because it really just drives the traffic along with the other off-pricers, so it just creates a mecca for us.” No doubt Sears will be hoping for the same effect, given that it has signed to sublet mall space to Primark.

But FBIC Global Retail & Technology believes that many retailers are more than a little nervous. And they should be!

Primark is primed to capture the value apparel shopper when it lands on US shores this fall, posing a threat to budget fashion rivals such as Forever 21, JCPenney and mass merchandisers.

A recent study by Morgan Stanley, for instance, showed a substantial price difference between Primark and H&M, with the latter 107% more expensive on average across 100 items and three European cities. We think it would be wrong to view Primark and H&M as interchangeable rivals (H&M is distinctly closer to the midmarket), but these figures underline just how cheap Primark is.

While prices are low, judging from the shoppers we see in London (and our own personal experience), Primark makes up for that in units sold.

Anecdotally, this shopper was not unique; consumers are hard pressed to limit their purchases, so they heap another item to the pile. Shoppers walk away happy: they bought a lot and they saved more.

Primark is primed to capture the value apparel shopper when it lands on US shores this fall, posing a threat to budget fashion rivals such as Forever 21, JCPenney and mass merchandisers.

A recent study by Morgan Stanley, for instance, showed a substantial price difference between Primark and H&M, with the latter 107% more expensive on average across 100 items and three European cities. We think it would be wrong to view Primark and H&M as interchangeable rivals (H&M is distinctly closer to the midmarket), but these figures underline just how cheap Primark is.

While prices are low, judging from the shoppers we see in London (and our own personal experience), Primark makes up for that in units sold.

Anecdotally, this shopper was not unique; consumers are hard pressed to limit their purchases, so they heap another item to the pile. Shoppers walk away happy: they bought a lot and they saved more.

Far from needing to take time for new space to mature, Primark consistently reports higher sales densities in its newest stores. In its most recent update, for 1H 2015, the company said it had seen “very strong trading” in stores opened within the past year, and that some of these “now regularly feature in Primark’s top 20 stores by annualized sales.”

The quality and size of new stores may be one factor, but a much bigger one is that Primark is in many cases expanding into areas where shoppers have not yet had access to its stores. This is not about a mature retailer tapping small infill catchments—it is about introducing the brand to a new customer, including in big European cities like Lisbon, Berlin, Cologne and Vienna.

This bodes well for Primark’s move into the US. We think it will likely see a similar pattern of avid shoppers flocking to get their hands on the merchandise.

Far from needing to take time for new space to mature, Primark consistently reports higher sales densities in its newest stores. In its most recent update, for 1H 2015, the company said it had seen “very strong trading” in stores opened within the past year, and that some of these “now regularly feature in Primark’s top 20 stores by annualized sales.”

The quality and size of new stores may be one factor, but a much bigger one is that Primark is in many cases expanding into areas where shoppers have not yet had access to its stores. This is not about a mature retailer tapping small infill catchments—it is about introducing the brand to a new customer, including in big European cities like Lisbon, Berlin, Cologne and Vienna.

This bodes well for Primark’s move into the US. We think it will likely see a similar pattern of avid shoppers flocking to get their hands on the merchandise.

Primark focuses on semidisposable fashion, but its product offer spans formalwear (suits, shirts, ties), lingerie, beauty products, costume jewelry, shoes, accessories (handbags are prominent), travel luggage and housewares (soft furnishings and decorative items).

Based on store visits, we estimate Primark’s typical space mix is approximately:

Primark focuses on semidisposable fashion, but its product offer spans formalwear (suits, shirts, ties), lingerie, beauty products, costume jewelry, shoes, accessories (handbags are prominent), travel luggage and housewares (soft furnishings and decorative items).

Based on store visits, we estimate Primark’s typical space mix is approximately:

As we noted earlier, Primark has been pushing more toward larger, flagship stores in major European cities. In London, this resulted in a second Primark store opening on Oxford Street in September 2012; the retailer now bookends the legendary shopping street.

As we noted earlier, Primark has been pushing more toward larger, flagship stores in major European cities. In London, this resulted in a second Primark store opening on Oxford Street in September 2012; the retailer now bookends the legendary shopping street.

Here, we tour Primark’s newest Oxford Street store, on the corner of Tottenham Court Road. It is a big, multifloor outlet, and its glossy, feature-heavy appearance illustrates how Primark does not neglect the in-store experience despite its price positioning. Striking store features such as its central atrium and great in-store signage put many of its midmarket rivals to shame.

Here, we tour Primark’s newest Oxford Street store, on the corner of Tottenham Court Road. It is a big, multifloor outlet, and its glossy, feature-heavy appearance illustrates how Primark does not neglect the in-store experience despite its price positioning. Striking store features such as its central atrium and great in-store signage put many of its midmarket rivals to shame.

The store doesn’t go for a uniform look throughout. Some areas are bright and minimalist, others are darker and rely on lightboxes to brighten up the space.

The Tottenham Court Road store works with its unconventional shape—for instance, lightboxes are used to enhance its narrow side entrance.

The store doesn’t go for a uniform look throughout. Some areas are bright and minimalist, others are darker and rely on lightboxes to brighten up the space.

The Tottenham Court Road store works with its unconventional shape—for instance, lightboxes are used to enhance its narrow side entrance.

Cross-selling is a prominent feature, with footwear, bags and other accessories showcased alongside garments.

Product is showcased attractively on mannequins and pedestals. Although this is a budget store, in-store merchandising remains strong.

Cross-selling is a prominent feature, with footwear, bags and other accessories showcased alongside garments.

Product is showcased attractively on mannequins and pedestals. Although this is a budget store, in-store merchandising remains strong.

Although Primark’s product offer includes formalwear, shoes, accessories and housewares, casualwear is at its heart.

Jeans (from £8) and chinos (from £10), for instance, are core to menswear.

Although Primark’s product offer includes formalwear, shoes, accessories and housewares, casualwear is at its heart.

Jeans (from £8) and chinos (from £10), for instance, are core to menswear.

Our store tour took place in early summer, when light tops (from £4) and dresses (from £5) were core to the womenswear offer.

Our store tour took place in early summer, when light tops (from £4) and dresses (from £5) were core to the womenswear offer.

Sportswear (from £3.50) is offered across menswear and womenswear.

Sportswear (from £3.50) is offered across menswear and womenswear.

Women’s footwear spans ballerinas (from £5) to heels (from £12).

Women’s footwear spans ballerinas (from £5) to heels (from £12).

Housewares include home textiles such as bedding (from £1.80) and small decorative items such as candles (from £1.50) and wall art (from £3). (Not everything features a Union Jack flag.)

Housewares include home textiles such as bedding (from £1.80) and small decorative items such as candles (from £1.50) and wall art (from £3). (Not everything features a Union Jack flag.)

THE STORY

Set to Pile on the Pressure

Primark is set to open its first US store in Boston this fall, followed shortly by another seven locations, including the largest mall in the US, King of Prussia Mall in Pennsylvania.

TJX Companies CEO Carol Meyrowitz is among those welcoming the new competition, stating on the company’s May 19 conference call, “We love being next to Primark and fast fashion because it really just drives the traffic along with the other off-pricers, so it just creates a mecca for us.” No doubt Sears will be hoping for the same effect, given that it has signed to sublet mall space to Primark.

But FBIC Global Retail & Technology believes that many retailers are more than a little nervous. And they should be!

Primark is set to open its first US store in Boston this fall, followed shortly by another seven locations, including the largest mall in the US, King of Prussia Mall in Pennsylvania.

TJX Companies CEO Carol Meyrowitz is among those welcoming the new competition, stating on the company’s May 19 conference call, “We love being next to Primark and fast fashion because it really just drives the traffic along with the other off-pricers, so it just creates a mecca for us.” No doubt Sears will be hoping for the same effect, given that it has signed to sublet mall space to Primark.

But FBIC Global Retail & Technology believes that many retailers are more than a little nervous. And they should be!

Volume Is the Key

Primark is primed to capture the value apparel shopper when it lands on US shores this fall, posing a threat to budget fashion rivals such as Forever 21, JCPenney and mass merchandisers.

A recent study by Morgan Stanley, for instance, showed a substantial price difference between Primark and H&M, with the latter 107% more expensive on average across 100 items and three European cities. We think it would be wrong to view Primark and H&M as interchangeable rivals (H&M is distinctly closer to the midmarket), but these figures underline just how cheap Primark is.

While prices are low, judging from the shoppers we see in London (and our own personal experience), Primark makes up for that in units sold.

Anecdotally, this shopper was not unique; consumers are hard pressed to limit their purchases, so they heap another item to the pile. Shoppers walk away happy: they bought a lot and they saved more.

Primark is primed to capture the value apparel shopper when it lands on US shores this fall, posing a threat to budget fashion rivals such as Forever 21, JCPenney and mass merchandisers.

A recent study by Morgan Stanley, for instance, showed a substantial price difference between Primark and H&M, with the latter 107% more expensive on average across 100 items and three European cities. We think it would be wrong to view Primark and H&M as interchangeable rivals (H&M is distinctly closer to the midmarket), but these figures underline just how cheap Primark is.

While prices are low, judging from the shoppers we see in London (and our own personal experience), Primark makes up for that in units sold.

Anecdotally, this shopper was not unique; consumers are hard pressed to limit their purchases, so they heap another item to the pile. Shoppers walk away happy: they bought a lot and they saved more.

The Appeal Is Not Just Price

It would be a mistake for those unfamiliar with Primark to think its attraction is simply ultralow prices. Primark’s strengths are that it mixes compelling prices with a fast-fashion outlook, bringing new ranges to store frequently and offering on-trend product that young shoppers want to buy. A strong range of basics sits alongside this fast-changing selection. This is not about cheap, supermarket-style clothing. It is about semidisposable clothing with a convincing fashion edge.The Last-Standing Monochannel Retailer

The ultralow price points are why Primark stands alone in the UK market in not selling online, as the costs of fulfilling orders would wipe out margins. We also think that impulse buys made as shoppers browse the ranges would be lost online—there would be no digital equivalent of piling baskets to overflowing as shoppers walk the aisles. A short-lived experiment to sell Primark products through ASOS was abandoned in 2013, and there has been no sign of movement toward a multichannel proposition since. The company’s focus appears to be on building its presence in new regions—including new international markets. It is working well, and we do not see e-commerce being a near-term priority.Bigger, Better Stores

Primark stores are typically big, multifloor spaces—and they’ve been getting bigger in recent years, in part a result of the strategy to put flagships in major European cities. At 1H 2015, the average Primark store offered a little over 37,000 sq. ft. of net selling space, we calculate, up from just under 32,000 sq. ft. at year-end 2010. But for our US readers, we want to be clear: these are not department stores—at least not in the European sense. Primark is an apparel specialist, albeit with a modest housewares section tacked on.The US Stores Will Be Even Bigger!

Primark’s new US stores look set to be even bigger than the already-substantial average. Among Primark’s first North American locations will be seven stores sublet from existing Sears department stores, and the average size of these stores will be nearly 57,000 sq. ft., FBIC Global Retail & Technology estimates. We expect the biggest, at King of Prussia Mall, to come in at 75,000 sq. ft. of net selling space.New Stores See Higher Densities

Far from needing to take time for new space to mature, Primark consistently reports higher sales densities in its newest stores. In its most recent update, for 1H 2015, the company said it had seen “very strong trading” in stores opened within the past year, and that some of these “now regularly feature in Primark’s top 20 stores by annualized sales.”

The quality and size of new stores may be one factor, but a much bigger one is that Primark is in many cases expanding into areas where shoppers have not yet had access to its stores. This is not about a mature retailer tapping small infill catchments—it is about introducing the brand to a new customer, including in big European cities like Lisbon, Berlin, Cologne and Vienna.

This bodes well for Primark’s move into the US. We think it will likely see a similar pattern of avid shoppers flocking to get their hands on the merchandise.

Far from needing to take time for new space to mature, Primark consistently reports higher sales densities in its newest stores. In its most recent update, for 1H 2015, the company said it had seen “very strong trading” in stores opened within the past year, and that some of these “now regularly feature in Primark’s top 20 stores by annualized sales.”

The quality and size of new stores may be one factor, but a much bigger one is that Primark is in many cases expanding into areas where shoppers have not yet had access to its stores. This is not about a mature retailer tapping small infill catchments—it is about introducing the brand to a new customer, including in big European cities like Lisbon, Berlin, Cologne and Vienna.

This bodes well for Primark’s move into the US. We think it will likely see a similar pattern of avid shoppers flocking to get their hands on the merchandise.

The Product Offer

Primark focuses on semidisposable fashion, but its product offer spans formalwear (suits, shirts, ties), lingerie, beauty products, costume jewelry, shoes, accessories (handbags are prominent), travel luggage and housewares (soft furnishings and decorative items).

Based on store visits, we estimate Primark’s typical space mix is approximately:

Primark focuses on semidisposable fashion, but its product offer spans formalwear (suits, shirts, ties), lingerie, beauty products, costume jewelry, shoes, accessories (handbags are prominent), travel luggage and housewares (soft furnishings and decorative items).

Based on store visits, we estimate Primark’s typical space mix is approximately:

- Womenswear (including beauty and jewelry): 60% of store space

- Menswear: 20 to 25%

- Childrenswear: 10%

- Housewares and luggage: 5 to 10%

THE NUMBERS

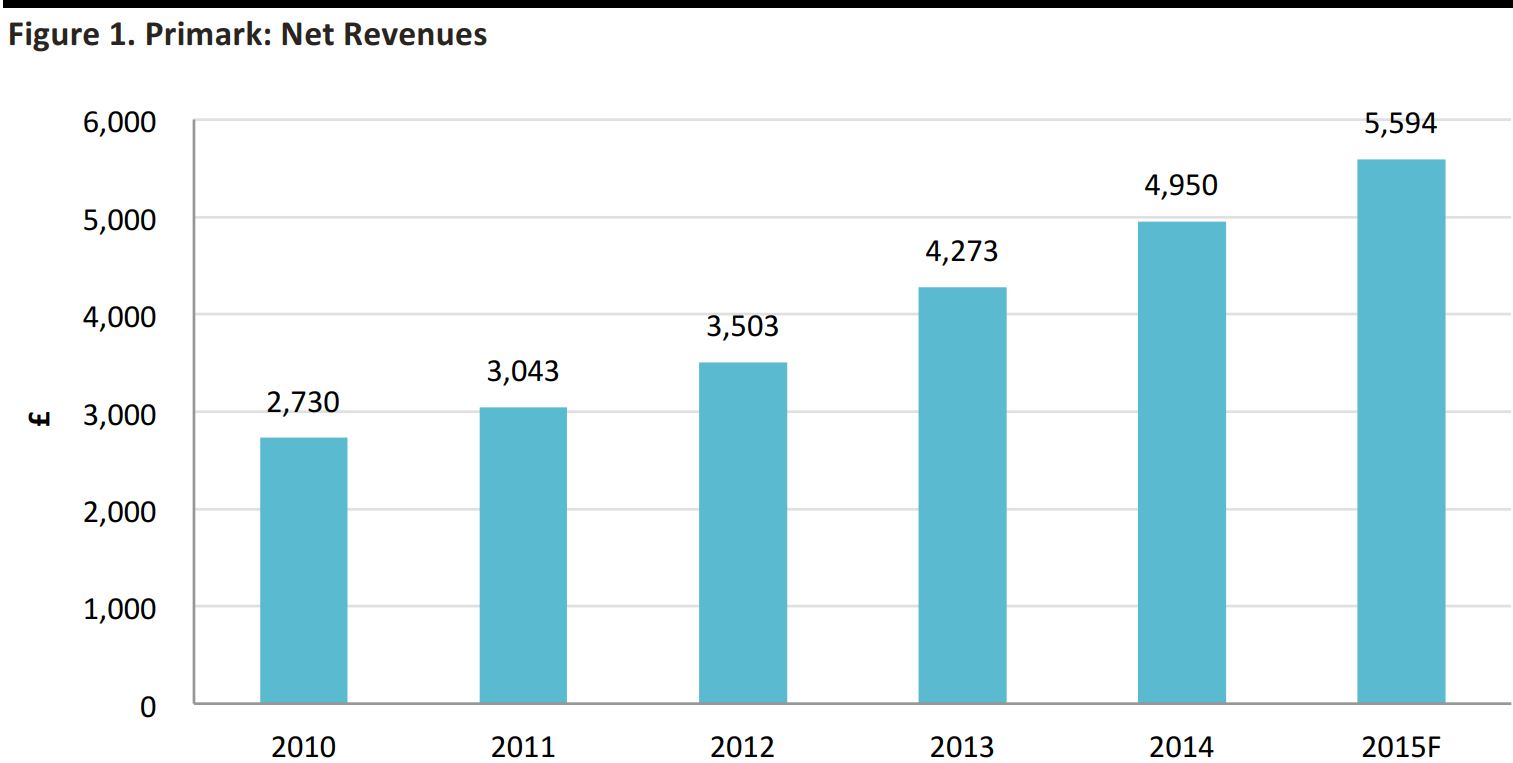

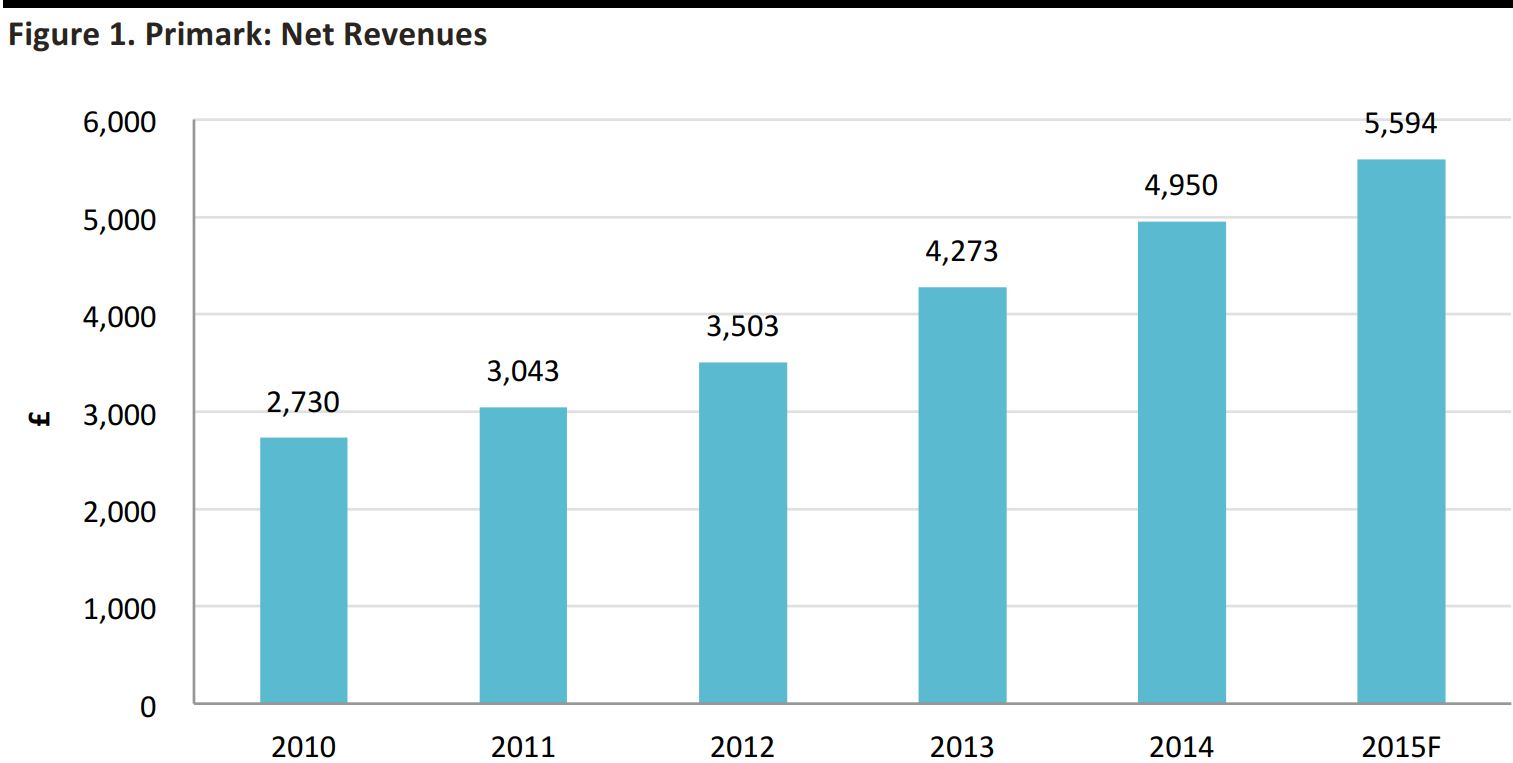

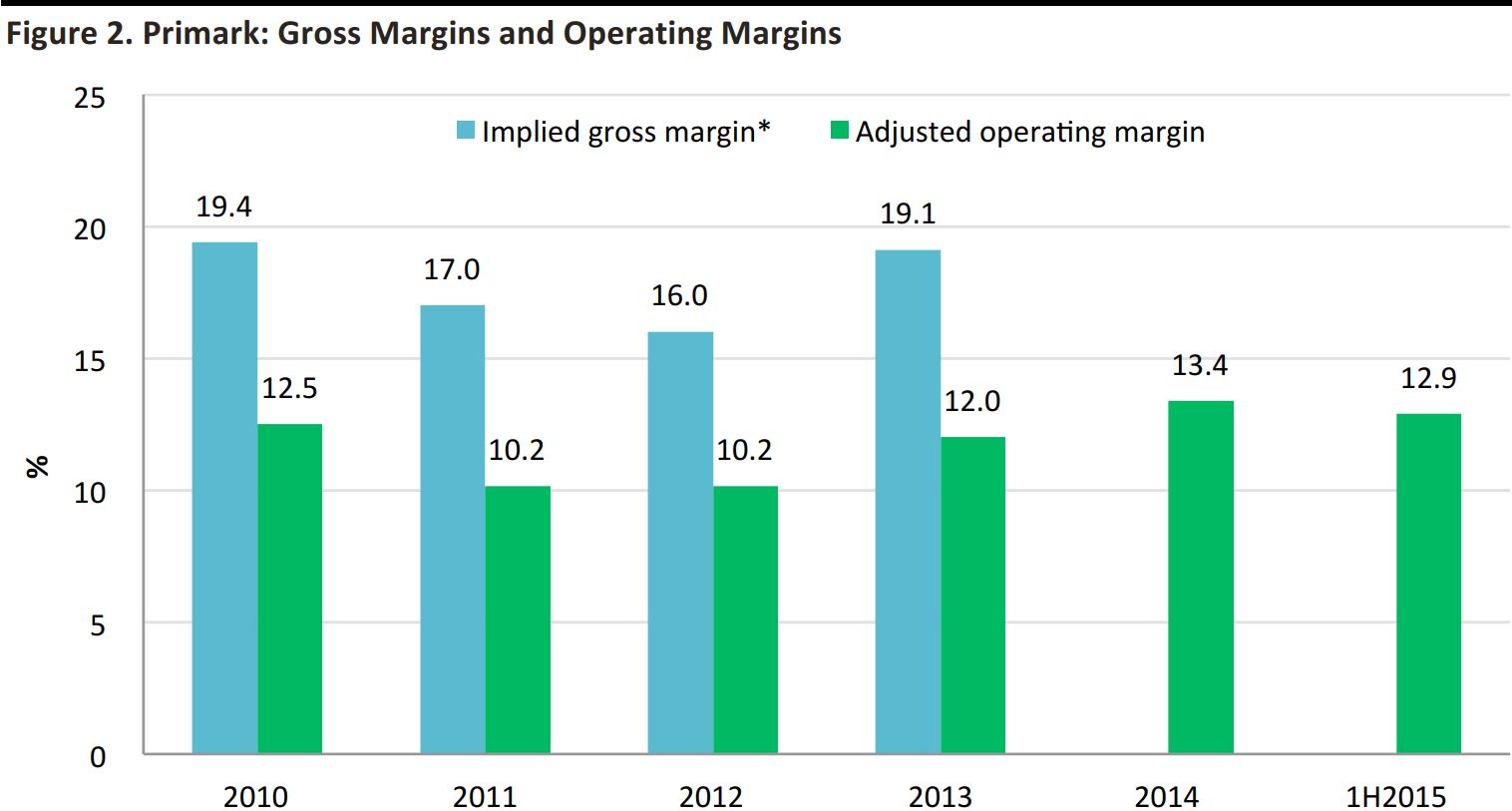

Impressive financial metrics have been the reward for this near-unique proposition. As we show in this section, revenues have surged and operating margins have tended to trend upward while sales per store and sales per sq. ft. have also been on the rise.Sales Powering Ahead, Progress on Margins

Strong sales growth is the headline story at Primark. Net revenues will have doubled in the five years to FY2015, we forecast. We expect FY2015 sales growth to come in at around 13%, following a slightly disappointing 1H, when currency effects and the unusually warm European autumn depressed growth in GBP to “just” 12%. Openings of new stores, including big flagships, and positive same-store sales have underpinned long-term performance.

Source: S&P Capital IQ/Company reports/FBIC Global Retail & Technology

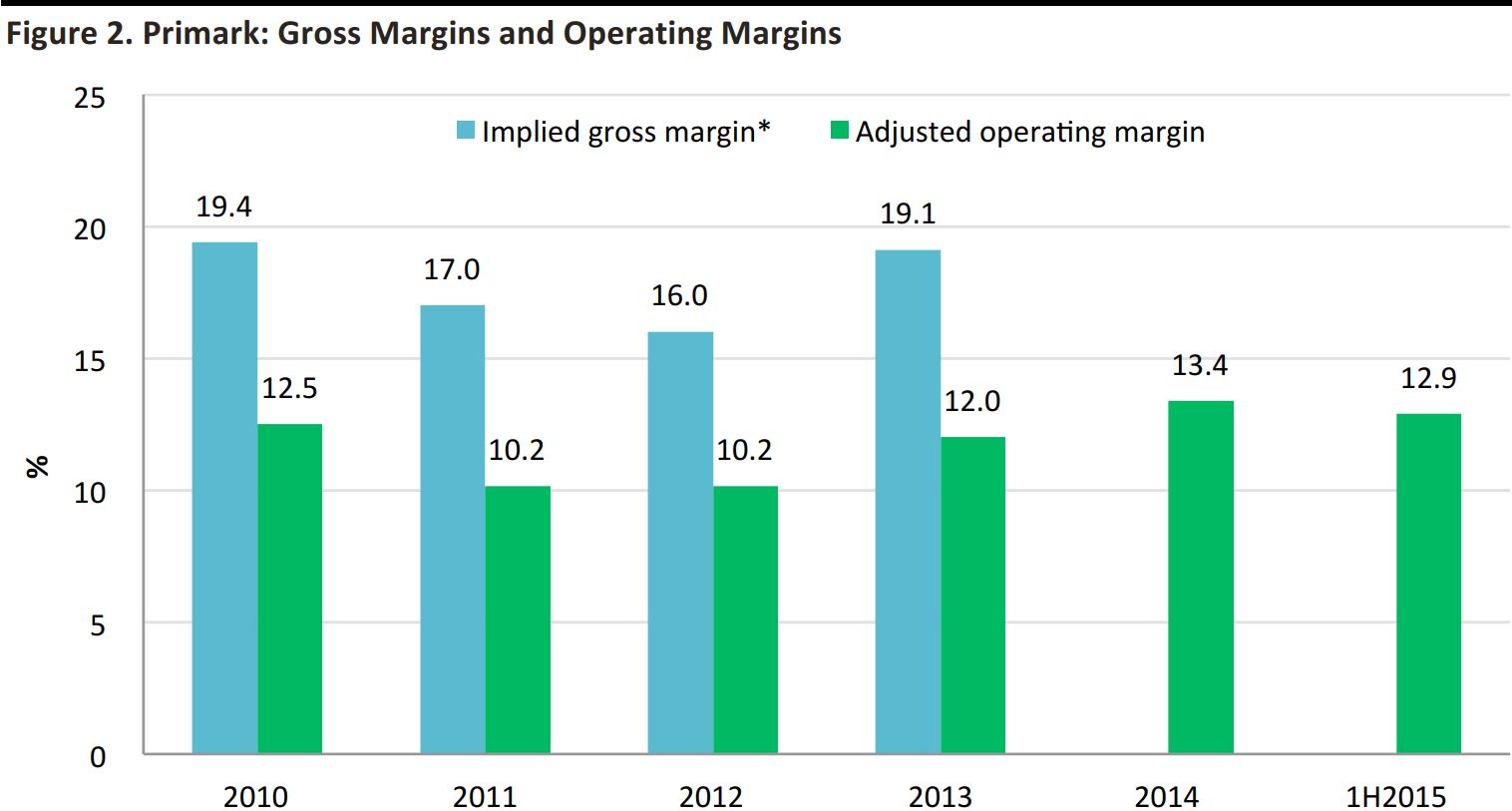

Operating margins had been improving until they were hit in 1H 2015 by unseasonably warm autumn 2014 weather in Europe, which discouraged shoppers from buying A/W ranges. The strong dollar also played a part, given that Primark sources some of its products in dollars.

* Gross margin of Primark Stores, the UK subsidiary of Primark, which in 2013 accounted for 60% of total Primark sales. Latest data for Primark Stores is from 2013. Source: S&P Capital IQ/Company reports/FBIC Global Retail & Technology

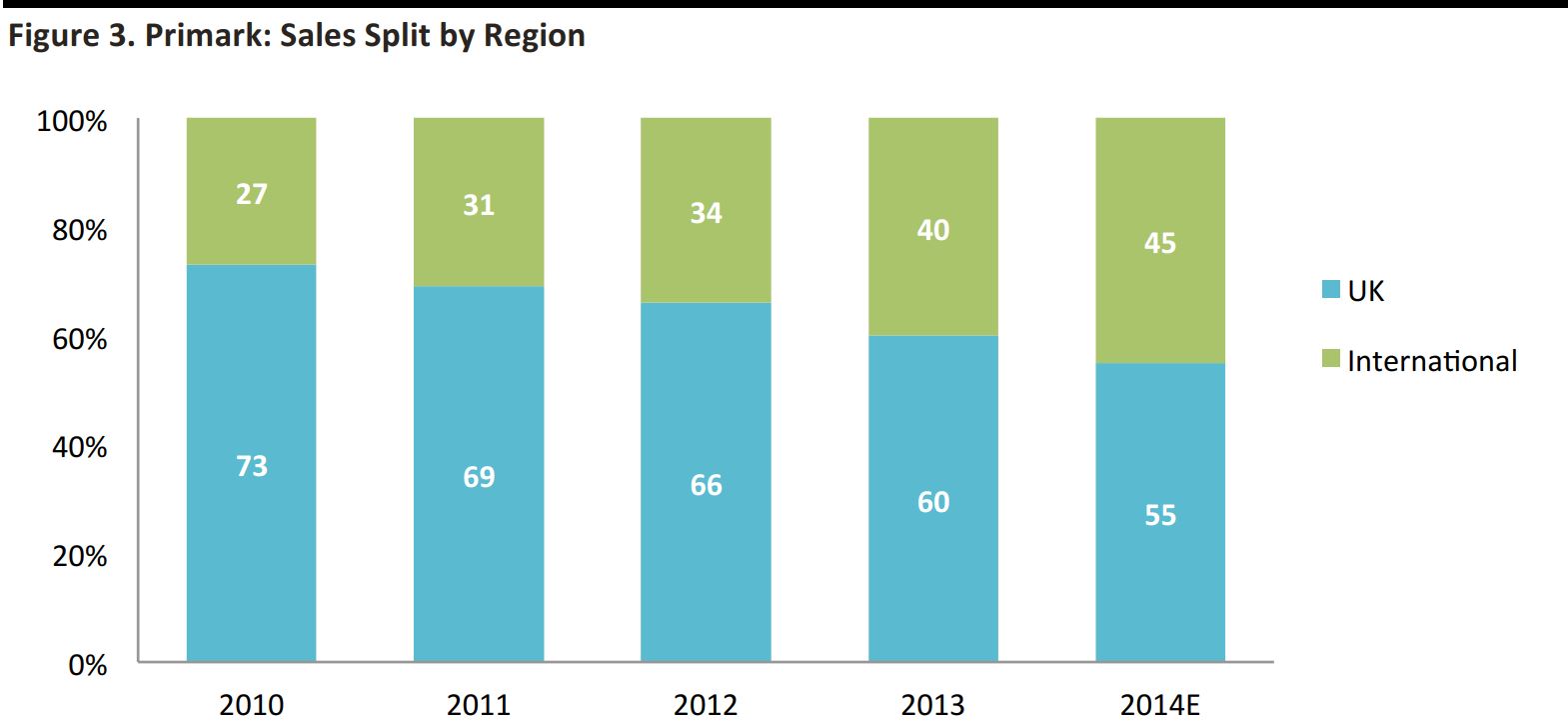

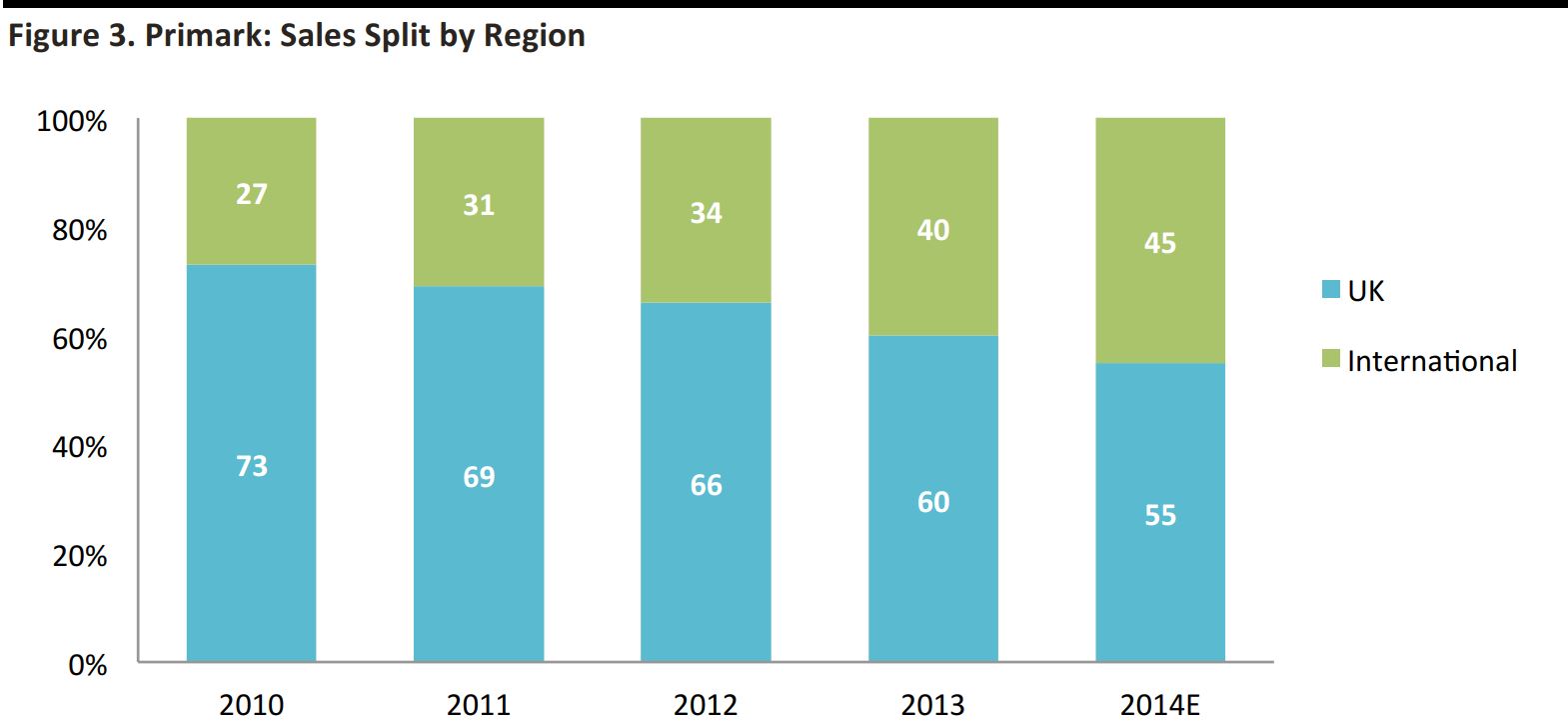

International Growing in Importance

International expansion has been a big success for Primark, with strong performance reported in France, Germany and Spain. Sales outside the UK are likely to be contributing around half of all sales at the time of writing. At June 2015, non-UK shops made up only 43% of the store estate, we estimate—which suggests that the big flagship stores in continental European cities are seeing higher average sales per store than longer-standing UK stores.

Calculated on the assumption that UK accounts for Primark Stores are for the entirety of UK sales and exclude all non-UK sales. Source: S&P Capital IQ/Company reports/FBIC Global Retail & Technology

Continental Europe Driving Portfolio Growth

The company is powering ahead with expansion. In its recent 1H 2015 update, the company said it has “an extensive pipeline of new stores to be opened over the next few years,” with 1.5 million sq. ft. scheduled to open in the next financial year.

Data provided by the company has been approximate in recent years. ** At June 3, 2015. Source: Company reports/FBIC Global Retail & Technology

Primark began trading in France in December 2013, and the company recently said that “sales across all five stores have been exceptional.” Spain has been a strong market, with hard-pressed shoppers flocking to Primark. For FY 2014, the company said that comps in its Spanish stores were “particularly strong.” * Excluding Canary Islands.

Source: Company reports/FBIC Global Retail & Technology

* Excluding Canary Islands.

Source: Company reports/FBIC Global Retail & Technology

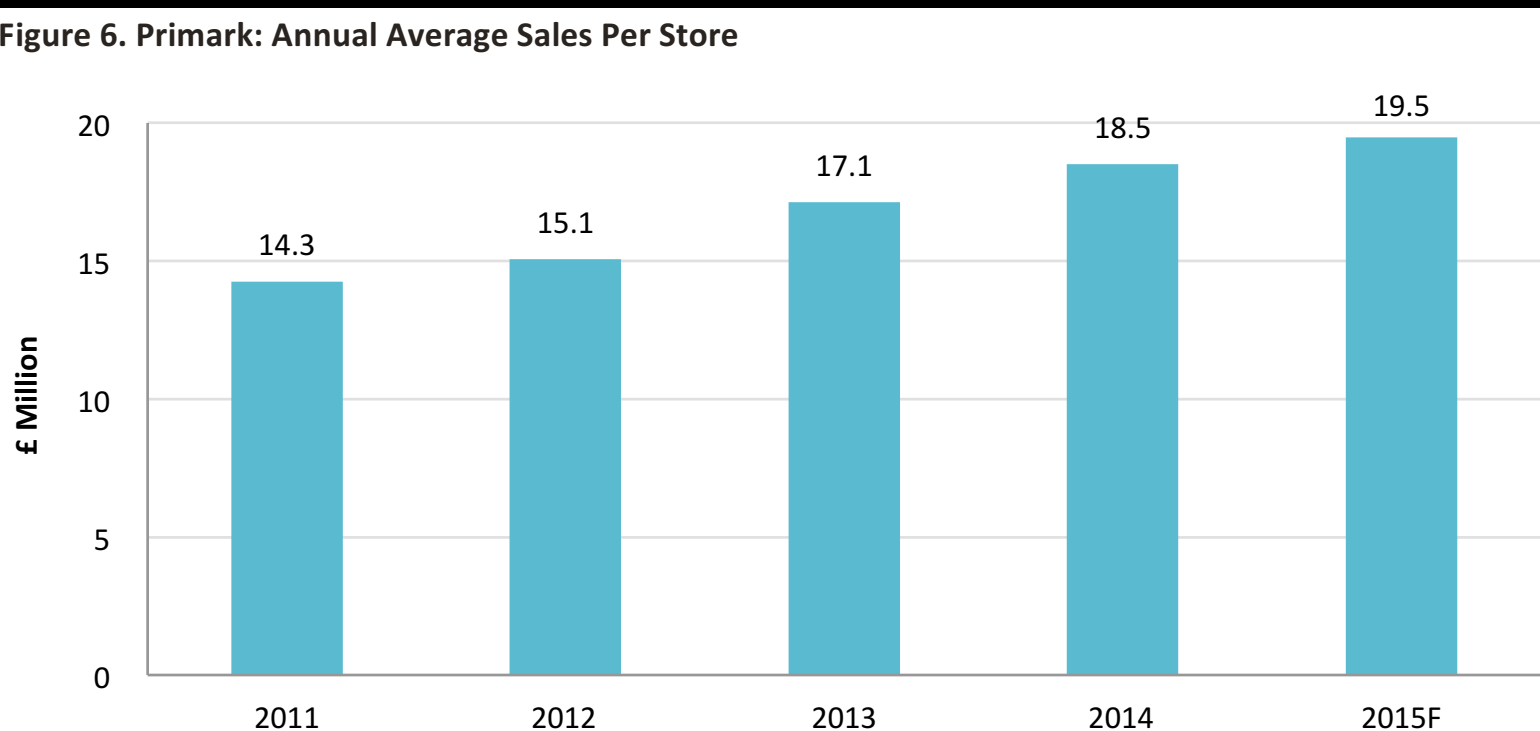

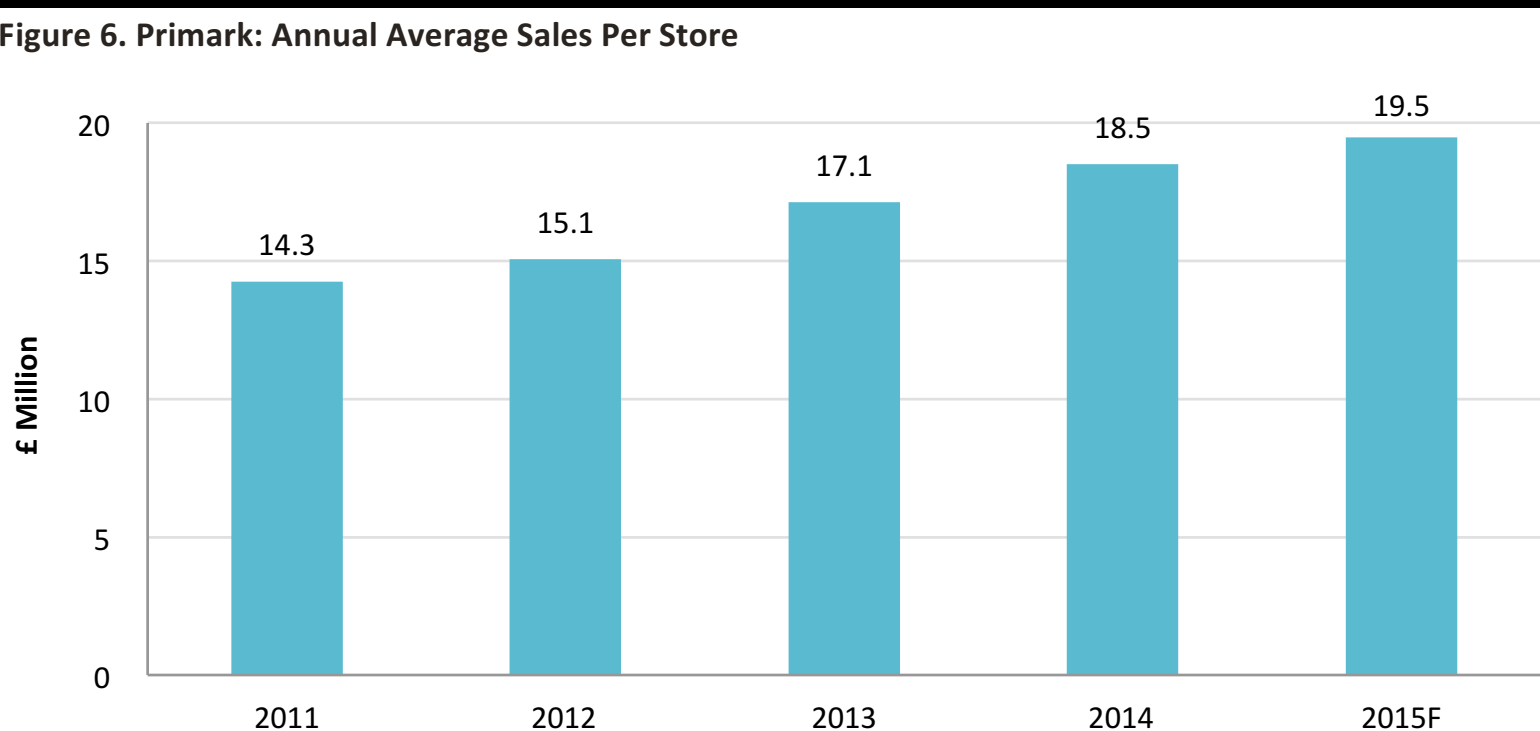

Sales Per Store Growing Solidly

Helped by the opening of bigger stores, average sales per store have risen steadily in recent years. To put the figures below in some context, UK apparel stalwart Marks & Spencer was turning in non-food sales per store of £11.5 million in FY 2015 (down £1 million per store since FY 2011).

Sales per store calculated using average annual store numbers. 2015 data calculated using half-year store numbers. Source: Company reports/FBIC Global Retail & Technology

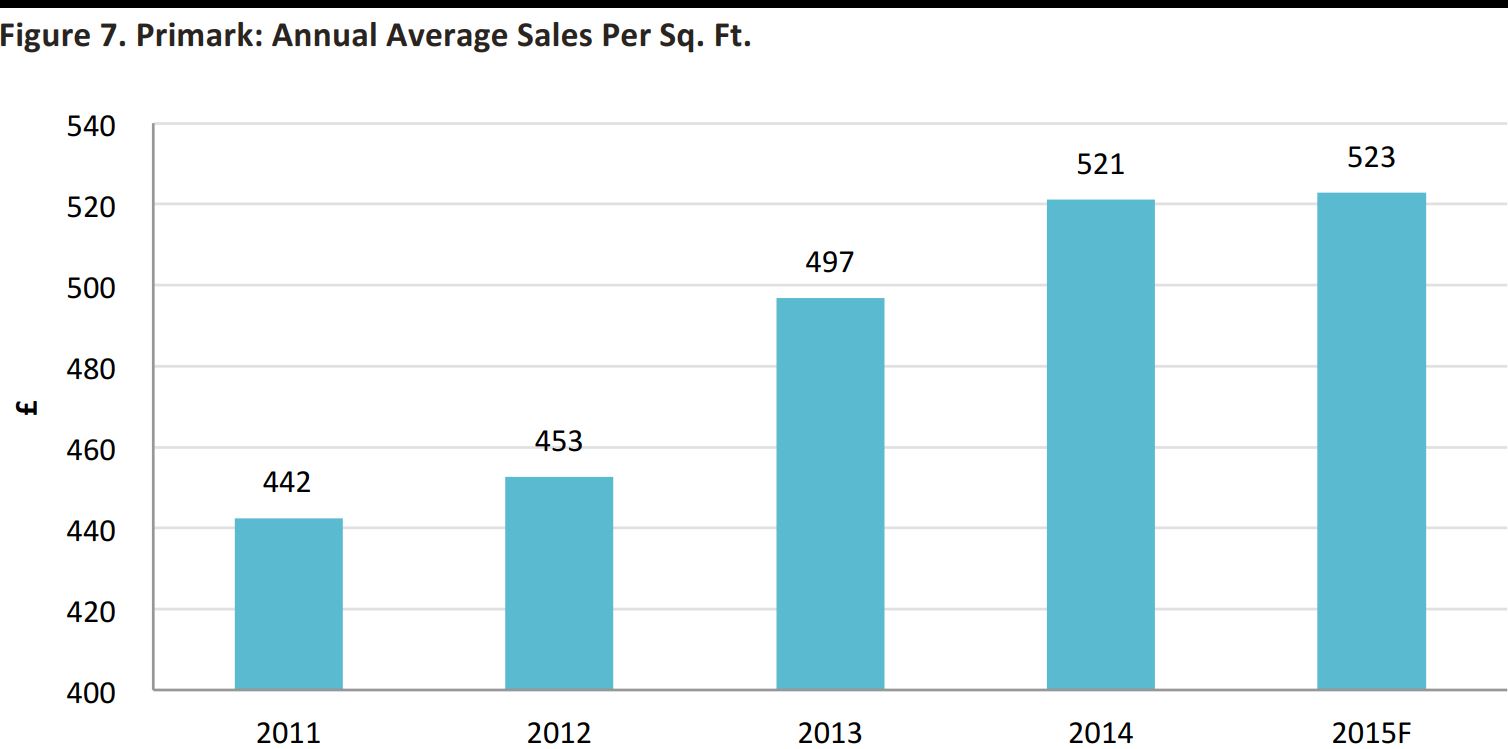

Sales Densities Falter

A similar upward trend has been seen in sales per sq. ft. However, we expect growth to slow substantially for FY2015, because currency effects and the warm autumn of 2014 affected reported 1H revenue growth. Sales per sq. ft. calculated using average annual store numbers. 2015 data calculated using half-year sales.

Source: Company reports/FBIC Global Retail & Technology

Sales per sq. ft. calculated using average annual store numbers. 2015 data calculated using half-year sales.

Source: Company reports/FBIC Global Retail & Technology

THE STORES

As we noted earlier, Primark has been pushing more toward larger, flagship stores in major European cities. In London, this resulted in a second Primark store opening on Oxford Street in September 2012; the retailer now bookends the legendary shopping street.

As we noted earlier, Primark has been pushing more toward larger, flagship stores in major European cities. In London, this resulted in a second Primark store opening on Oxford Street in September 2012; the retailer now bookends the legendary shopping street.

Here, we tour Primark’s newest Oxford Street store, on the corner of Tottenham Court Road. It is a big, multifloor outlet, and its glossy, feature-heavy appearance illustrates how Primark does not neglect the in-store experience despite its price positioning. Striking store features such as its central atrium and great in-store signage put many of its midmarket rivals to shame.

Here, we tour Primark’s newest Oxford Street store, on the corner of Tottenham Court Road. It is a big, multifloor outlet, and its glossy, feature-heavy appearance illustrates how Primark does not neglect the in-store experience despite its price positioning. Striking store features such as its central atrium and great in-store signage put many of its midmarket rivals to shame.

The store doesn’t go for a uniform look throughout. Some areas are bright and minimalist, others are darker and rely on lightboxes to brighten up the space.

The Tottenham Court Road store works with its unconventional shape—for instance, lightboxes are used to enhance its narrow side entrance.

The store doesn’t go for a uniform look throughout. Some areas are bright and minimalist, others are darker and rely on lightboxes to brighten up the space.

The Tottenham Court Road store works with its unconventional shape—for instance, lightboxes are used to enhance its narrow side entrance.

Cross-selling is a prominent feature, with footwear, bags and other accessories showcased alongside garments.

Product is showcased attractively on mannequins and pedestals. Although this is a budget store, in-store merchandising remains strong.

Cross-selling is a prominent feature, with footwear, bags and other accessories showcased alongside garments.

Product is showcased attractively on mannequins and pedestals. Although this is a budget store, in-store merchandising remains strong.

THE PRODUCT

Although Primark’s product offer includes formalwear, shoes, accessories and housewares, casualwear is at its heart.

Jeans (from £8) and chinos (from £10), for instance, are core to menswear.

Although Primark’s product offer includes formalwear, shoes, accessories and housewares, casualwear is at its heart.

Jeans (from £8) and chinos (from £10), for instance, are core to menswear.

Our store tour took place in early summer, when light tops (from £4) and dresses (from £5) were core to the womenswear offer.

Our store tour took place in early summer, when light tops (from £4) and dresses (from £5) were core to the womenswear offer.

Sportswear (from £3.50) is offered across menswear and womenswear.

Sportswear (from £3.50) is offered across menswear and womenswear.

Women’s footwear spans ballerinas (from £5) to heels (from £12).

Women’s footwear spans ballerinas (from £5) to heels (from £12).

Housewares include home textiles such as bedding (from £1.80) and small decorative items such as candles (from £1.50) and wall art (from £3). (Not everything features a Union Jack flag.)

Housewares include home textiles such as bedding (from £1.80) and small decorative items such as candles (from £1.50) and wall art (from £3). (Not everything features a Union Jack flag.)

KEY TAKEAWAYS: FBIC’S VIEW

- Primark is about much more than price; it delivers value for money in the broader sense. It has a fast-fashion element in its apparel offer, and its newer flagship stores are impressive retail destinations.

- This proposition has yielded impressive metrics—sales per store, margins and sales densities have tended to head in the right direction, barring short-term hits.

- We have little doubt that Primark will make waves in the US. We think the retailer will resonate with US shoppers who are wary of spending big on fashion but who still want to look great.

- E-commerce looks to be off the agenda, but international expansion is generating rewards. Shoppers are flocking to big stores in city locations, and the stores are getting bigger.

- Swaths of Europe—and the US—remain untapped. There is major scope for further growth.