Fiscal years ended January 31.

Source: Company reports

FY16 RESULTS

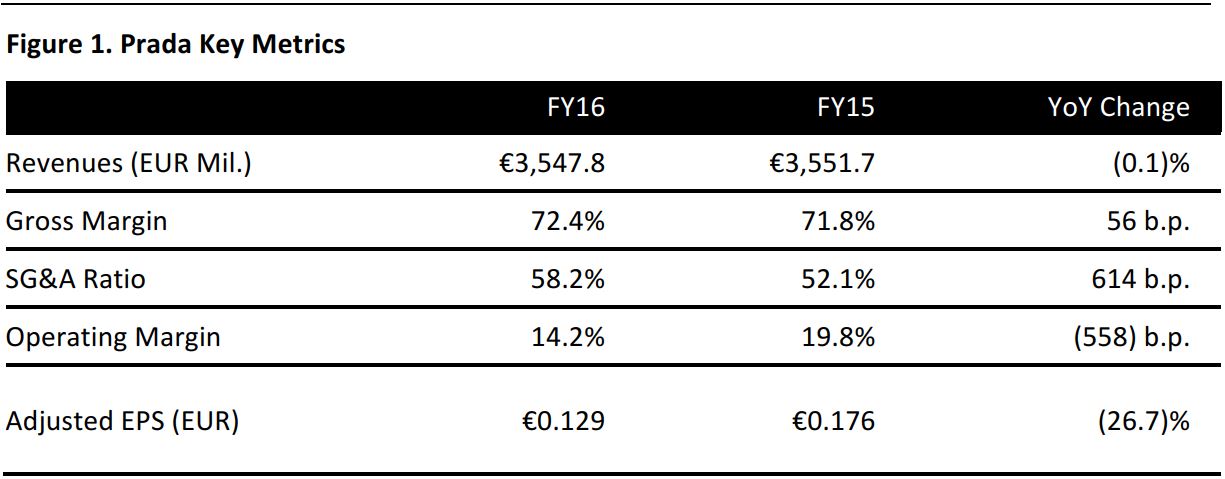

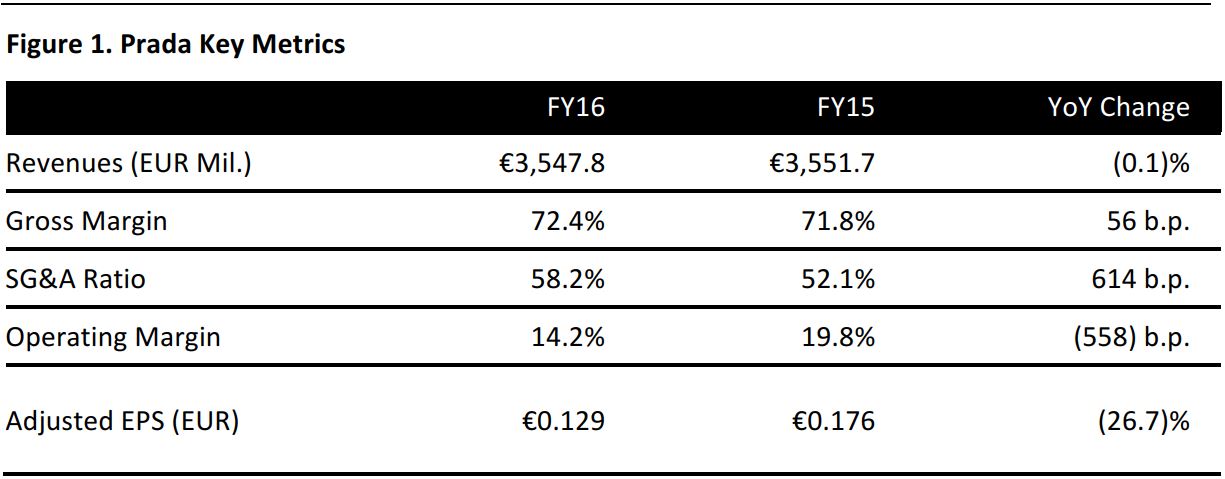

Italian luxury brand owner Prada reported net revenue of €3,548 million in FY16, down 0.1% from €3,552 million in FY15 and missing the consensus estimate of €3,550 million. The marginal fall in revenue translated to a more substantial drop in profits.

Net income for the year fell by 27.4%, to €333.3 million, from €459.2 million in FY15. The reported EPS was €0.129, down 26.7% from €0.176 in FY15 and below the consensus of €0.14. The company blamed the downturn in the international luxury goods market, particularly in Asia, for the steep fall. It also pointed to strong headwinds from foreign exchange fluctuations, as a weaker euro would have given the company a competitive advantage in selling to its Asian customers.

The gross margin increased from 71.8% in FY15 to 72.4% in FY16, due to the impact of industrial efficiencies. The SG&A ratio rose from 52.1% in FY15 to 58.2% in FY16, despite being subject to cost containment measures. The company noted that nonrecurring expenses such as indemnities and heavy leases, and increased investments in promoting the brand and digital channel, led to the rise in SG&A costs.

Prada’s operating margin dropped from 19.8% in FY15 to 14.2% in FY16, as the company’s expansion of its retail network was not justified by sales growth. The retail expansion incurred increases in several fixed costs, including labor and rent, Prada said.

The breakdown figures below refer only to the sales of stores directly operated by the Prada group, and do not include sales to independent customers or sales through franchises. They also do not include income from royalties. Sales are calculated in the reported currency. The rise and fall in revenues mentioned are year over year.

SALES BREAKDOWN BY GEOGRAPHIC SEGMENT

- The Asia-Pacific region contributed 35.3% of the directly operated stores segment’s revenues and saw sales drop by 4.4%, to €1,080 million.

- The Middle East markets, source of 3.4% of the segment’s revenues, saw revenues jump 11.5%, to €103.5 million.

- Japan and Italy contributed 13.2% and 12.8% of the segment’s revenues, respectively, and both showed a notable increase of 10.7% in regional sales; Japan’s sales totaled €403.7 million and Italy’s €392.8 million.

- The Americas contributed 13.4% of the segment’s revenues and saw sales increase by 5.0%, to €410.8 million.

- Europe (excluding Italy), source of 21.8% of the segment’s revenues, saw sales increase by a mere 3.3%, to €665.8 million.

- Other countries contributed 0.1% of the segment’s sales and saw sales rise by 41.4%, to €3.1 million.

SALES BREAKDOWN BY BRAND

- The Prada brand contributed a significant, 81.3% share of the directly operated stores segment’s sales and saw sales rise by 1.0%, to €2,487.6 million.

- Sales of Church’s contributed 1.8% of the segment’s revenues and rose by 14.7%.

- MiuMiu accounted for 16.4% of the segment’s sales and saw sales increase by 10.3%.

- Other brands, which constituted 0.5% of the segment’s total revenue, saw sales rise by 3.8%, to €14.3 million.

SALES BREAKDOWN BY PRODUCT LINE

- Leather goods accounted for a sizeable, 62.7% of segment revenues; sales of these goods fell by 2.3%, to €1,919.9 million.

- Clothing contributed 17.7% of the segment’s revenues and the category’s sales rose by 5.7%, to €541.6 million.

- Footwear accounted for 17.6% of the segment’s revenues; footwear sales rose by 19.8%, to €537.5 million.

- Other products contributed 2.0% of the segment’s revenues; sales of these rose by 11.9%, to €60.7 million.

Net sales to independent customers and franchisees fell by 16.5% year over year, from €532.5 million in FY15 to €444.6 million in FY16. The company attributed this “mainly [to] the ongoing selective strategy in Italy and Europe.”

GUIDANCE

The company noted that results were heavily impacted by the volatility in both the international economic environment and luxury goods market, and by increased political tensions around the world. It expects these macro factors to further influence its performance through the current fiscal year.

Prada stated that, in light of these factors, it has implemented several measures to ensure “satisfactory profit levels.” These include thorough reviews of operational processes and exploring new methods of increasing engagement between its brands and customers.

The company did not explicitly state its guidance range for the forthcoming year. The consensus estimate for the company’s revenues is €3,599 million and consensus is for EPS is €0.14.