Nitheesh NH

[caption id="attachment_80754" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

2018 Results

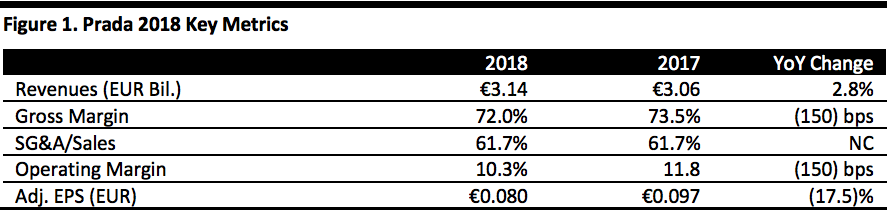

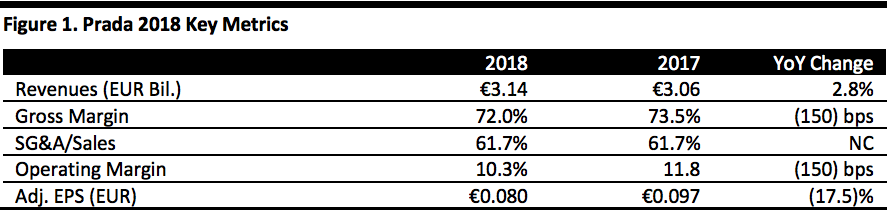

Prada reported net revenues of €3.14 billion for 2018, up 2.8% with currency penalizing growth 300 bps. Net sales rose €90 million to €3.10 billion and royalty revenues declined 8.5% to €44.1 million. Net retail sales rose 7% on a constant-currency basis to €2.53 billion and the company reported strong double-digit sales growth in its digital channels.

Sales at the Prada brand rose 3.9% to €2.56 billion and represented 82.6% of net sales, while sales at Miu Miu declined 1.3% to €453.5 million and Church’s sales dropped 2.7% to €69.1 million.

By category, clothing sales rose 6.8% to €666.2 million with a noted strong performance in men’s ready-to-wear; leather goods sales rose 3.1% to €1.76 billion; and footwear sales declined 1.3% to €616.3 million. By region, sales in Asia-Pacific grew at a 6.4% pace to €1.04 billion; sales rose 1.6% in Europe, to €1.19 billion; in the Americas, sales declined 1.3% to €426.2 million; in Japan, sales rose 4% to €350.3 million; and in the Middle East, sales rose 0.8% to €93.7 million.

The operating margin declined 150 bps to 10.3% in tandem with a 150-bps gross-margin contraction, to 72.0% related to the adverse impact of foreign currency and FX hedging. The SG&A expense ratio was flat at 61.7% of sales, with an 80-bps reduction in selling costs, to 45.0% of sales offset by a 60-bps lift in advertising costs, to 6.6% of sales, as the company spent on a communications campaign highlighting iconic nylon handbags. Product design and development costs represented 4.0% of sales and G&A expenses, 6.1%.

The strategic decision to preserve exclusivity of the brand portfolio entailed revising promotional activity. Full-price selling increased during 2018 and discounted sales declined; however, unfavorable FX rates erased the benefits related to the increase in full-price selling.

Inventories increased by €61.9 million, or 10.9%, to €631.8 million on a year-over-year basis.

Outlook

The company did not provide quantitative guidance but does anticipate a progressive return to volume and margin growth as a result of its business transformation strategy.

Source: Company reports/Coresight Research[/caption]

2018 Results

Prada reported net revenues of €3.14 billion for 2018, up 2.8% with currency penalizing growth 300 bps. Net sales rose €90 million to €3.10 billion and royalty revenues declined 8.5% to €44.1 million. Net retail sales rose 7% on a constant-currency basis to €2.53 billion and the company reported strong double-digit sales growth in its digital channels.

Sales at the Prada brand rose 3.9% to €2.56 billion and represented 82.6% of net sales, while sales at Miu Miu declined 1.3% to €453.5 million and Church’s sales dropped 2.7% to €69.1 million.

By category, clothing sales rose 6.8% to €666.2 million with a noted strong performance in men’s ready-to-wear; leather goods sales rose 3.1% to €1.76 billion; and footwear sales declined 1.3% to €616.3 million. By region, sales in Asia-Pacific grew at a 6.4% pace to €1.04 billion; sales rose 1.6% in Europe, to €1.19 billion; in the Americas, sales declined 1.3% to €426.2 million; in Japan, sales rose 4% to €350.3 million; and in the Middle East, sales rose 0.8% to €93.7 million.

The operating margin declined 150 bps to 10.3% in tandem with a 150-bps gross-margin contraction, to 72.0% related to the adverse impact of foreign currency and FX hedging. The SG&A expense ratio was flat at 61.7% of sales, with an 80-bps reduction in selling costs, to 45.0% of sales offset by a 60-bps lift in advertising costs, to 6.6% of sales, as the company spent on a communications campaign highlighting iconic nylon handbags. Product design and development costs represented 4.0% of sales and G&A expenses, 6.1%.

The strategic decision to preserve exclusivity of the brand portfolio entailed revising promotional activity. Full-price selling increased during 2018 and discounted sales declined; however, unfavorable FX rates erased the benefits related to the increase in full-price selling.

Inventories increased by €61.9 million, or 10.9%, to €631.8 million on a year-over-year basis.

Outlook

The company did not provide quantitative guidance but does anticipate a progressive return to volume and margin growth as a result of its business transformation strategy.

Source: Company reports/Coresight Research[/caption]

2018 Results

Prada reported net revenues of €3.14 billion for 2018, up 2.8% with currency penalizing growth 300 bps. Net sales rose €90 million to €3.10 billion and royalty revenues declined 8.5% to €44.1 million. Net retail sales rose 7% on a constant-currency basis to €2.53 billion and the company reported strong double-digit sales growth in its digital channels.

Sales at the Prada brand rose 3.9% to €2.56 billion and represented 82.6% of net sales, while sales at Miu Miu declined 1.3% to €453.5 million and Church’s sales dropped 2.7% to €69.1 million.

By category, clothing sales rose 6.8% to €666.2 million with a noted strong performance in men’s ready-to-wear; leather goods sales rose 3.1% to €1.76 billion; and footwear sales declined 1.3% to €616.3 million. By region, sales in Asia-Pacific grew at a 6.4% pace to €1.04 billion; sales rose 1.6% in Europe, to €1.19 billion; in the Americas, sales declined 1.3% to €426.2 million; in Japan, sales rose 4% to €350.3 million; and in the Middle East, sales rose 0.8% to €93.7 million.

The operating margin declined 150 bps to 10.3% in tandem with a 150-bps gross-margin contraction, to 72.0% related to the adverse impact of foreign currency and FX hedging. The SG&A expense ratio was flat at 61.7% of sales, with an 80-bps reduction in selling costs, to 45.0% of sales offset by a 60-bps lift in advertising costs, to 6.6% of sales, as the company spent on a communications campaign highlighting iconic nylon handbags. Product design and development costs represented 4.0% of sales and G&A expenses, 6.1%.

The strategic decision to preserve exclusivity of the brand portfolio entailed revising promotional activity. Full-price selling increased during 2018 and discounted sales declined; however, unfavorable FX rates erased the benefits related to the increase in full-price selling.

Inventories increased by €61.9 million, or 10.9%, to €631.8 million on a year-over-year basis.

Outlook

The company did not provide quantitative guidance but does anticipate a progressive return to volume and margin growth as a result of its business transformation strategy.

Source: Company reports/Coresight Research[/caption]

2018 Results

Prada reported net revenues of €3.14 billion for 2018, up 2.8% with currency penalizing growth 300 bps. Net sales rose €90 million to €3.10 billion and royalty revenues declined 8.5% to €44.1 million. Net retail sales rose 7% on a constant-currency basis to €2.53 billion and the company reported strong double-digit sales growth in its digital channels.

Sales at the Prada brand rose 3.9% to €2.56 billion and represented 82.6% of net sales, while sales at Miu Miu declined 1.3% to €453.5 million and Church’s sales dropped 2.7% to €69.1 million.

By category, clothing sales rose 6.8% to €666.2 million with a noted strong performance in men’s ready-to-wear; leather goods sales rose 3.1% to €1.76 billion; and footwear sales declined 1.3% to €616.3 million. By region, sales in Asia-Pacific grew at a 6.4% pace to €1.04 billion; sales rose 1.6% in Europe, to €1.19 billion; in the Americas, sales declined 1.3% to €426.2 million; in Japan, sales rose 4% to €350.3 million; and in the Middle East, sales rose 0.8% to €93.7 million.

The operating margin declined 150 bps to 10.3% in tandem with a 150-bps gross-margin contraction, to 72.0% related to the adverse impact of foreign currency and FX hedging. The SG&A expense ratio was flat at 61.7% of sales, with an 80-bps reduction in selling costs, to 45.0% of sales offset by a 60-bps lift in advertising costs, to 6.6% of sales, as the company spent on a communications campaign highlighting iconic nylon handbags. Product design and development costs represented 4.0% of sales and G&A expenses, 6.1%.

The strategic decision to preserve exclusivity of the brand portfolio entailed revising promotional activity. Full-price selling increased during 2018 and discounted sales declined; however, unfavorable FX rates erased the benefits related to the increase in full-price selling.

Inventories increased by €61.9 million, or 10.9%, to €631.8 million on a year-over-year basis.

Outlook

The company did not provide quantitative guidance but does anticipate a progressive return to volume and margin growth as a result of its business transformation strategy.

- Prada is in the middle of a multiyear business transformation announced in 2017. In 2018 the company reduced markdowns and promotional activity in its direct-to-consumer channel by approximately 30% and for 2019 intends to eliminate promotional pricing completely. This is slowing top-line growth but improving merchandise margins.

- This year, continued investments in technology, marketing, communications, logistics, workforce and refreshed iconic as well as new product with a focus on digital marketing and selling should drive increased brand relevancy.