DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

1H19 Results

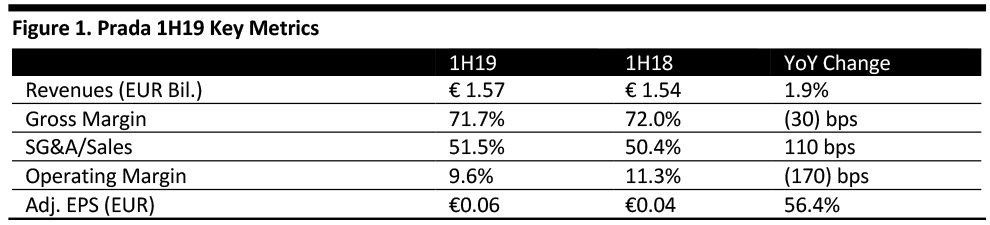

Prada reported net revenue of €1.57 billion in the first half of 2019, up 1.9% year over year at constant currency. The company ended seasonal markdowns in January 2019, which resulted in a positive €60 million impact. Sales in the retail channel declined 3% to €1.23 billion, impacted by the reduction in seasonal markdowns. Sales in the wholesale channel were up 14% to €314 million at constant currency, driven by growth from European online retailers.

Led by strong performance in the latest collections in both men and women, sales at Prada rose 4% to €1.28 billion, sales at Miu Miu dropped 6% to €221 million while Church’s sales also increased 4% to €33 million.

By category, clothing sales rose 8% to €339 million driven by strong momentum in both men’s and women’s ready-to-wear. Sales from leather goods saw stable growth at 1% to €868 million. Footwear sales inched up to €309 million from €308 million.

By region, sales in Europe rose 6% to €598 million, led by wholesale; sales in the Americas increased 6% to €216 million; sales rose 5% in Japan; affected by recent political unrest in Hong Kong, sales in greater China declined 2% to €337 million; and in the Middle East, sales rose 3% to €51 million.

Operating profit, or earnings before interest and tax, saw a year-over-year decrease of 13.2% to €150.4 million, resulting in an operating margin of 9.6%. Operating expenses increased 5% to €975 million. The increase was led by ongoing brand investment activities such as a premier project launch, Prada Re-Nylon. Advertising and promotional expenses increased 8.6% to €101 million.

Total inventory increased 8.5% to €685.3 million on a year-over-year basis.

Outlook

The company did not provide quantitative guidance but does anticipate a progressive return to volume and margin growth as a result of its business transformation strategy.

Prada intends to take more control of its wholesale market. By spring/summer in 2020, the company will cut the budget for wholesale sales channels 50%. Moreover, Prada will terminate relationships with partners that don't comply with its price and positioning policies. These activities are expected to curb buyers’ access to products on the parallel market, enabling Prada to better maintain consistency between retail and digital channels.

In 2H19 and early 2020, Prada will focus on relocating, refurbishing and expanding floor space in existing stores rather than opening new ones. Prada will continue investing in technologies that support pricing, CRM, communications and e-commerce. It will also focus on creating innovative materials that meet consumer demand for sustainable products.