Source: Company reports/Fung Global Retail & Technology

1H16 RESULTS

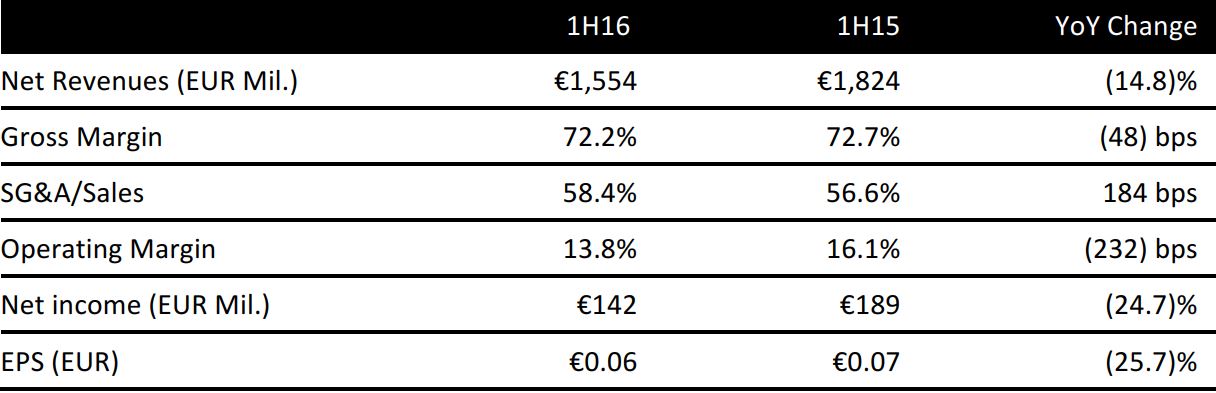

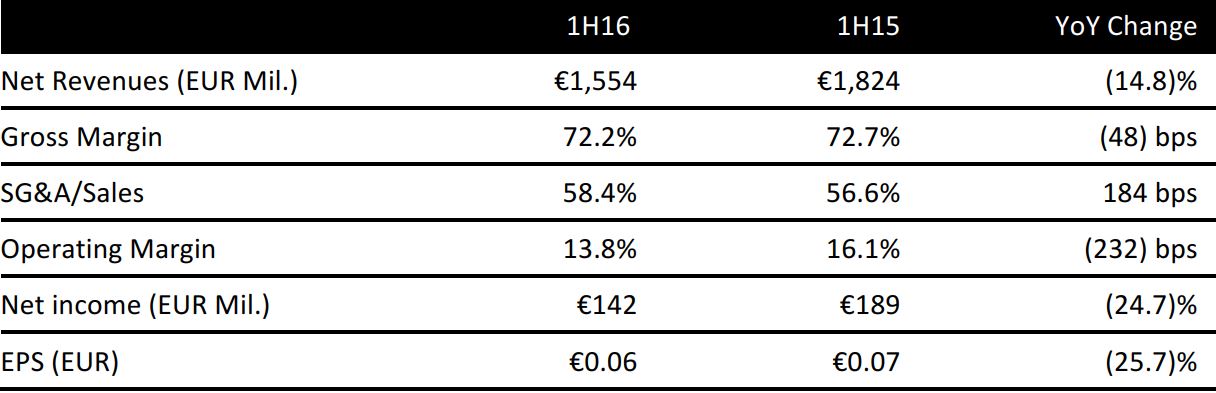

Italian luxury brand Prada reported net revenues of €1,554 million in 1H16, down nearly 15% year over year and below the consensus estimate of €1,642 million. The decline in headline revenue was mainly driven by the weak retail segment, where revenue fell by almost 18% year over year. The retail segment comprised 82% of total revenues.

Net income fell by 25%, to €142 million, in 1H16. Reported EPS was €0.06, down from €0.07 in 1H15. The year-over-year earnings decline was due to the negative impact of macroeconomic uncertainties on luxury sales and sharp sales declines in the leather goods category and in the Asia-Pacific region. These declines were partially offset by positive signs in the UK, where sales benefited from the weak pound.

Gross margin decreased to 72.2% in 1H16, from 72.7% in 1H15, despite the group’s efforts to contain costs. SG&A expenses as a percentage of sales rose by 184 basis points, as product design and development costs and selling costs fell less than revenues.

The operating margin declined to 13.8% in 1H16 from 16.1% in the year-ago period, despite initiatives introduced in 2015 that aimed to limit the pressure of the sales decline on operating margins.

The below figures refer only to the sales of stores directly operated by the Prada group, and do not include sales to independent customers or sales through franchises. They also do not include income from royalties. Sales are calculated in the reported currency. The rise and fall in revenues mentioned are year over year.

SALES BREAKDOWN BY GEOGRAPHIC SEGMENT

Revenues declined year over year for all geographic segments. We highlight the performance of the top three geographic segments below:

- Asia-Pacific region: Revenues were down 22% year over year (down 18% at constant exchange rates), as Hong Kong and Macau continued to weigh heavily on results. Mainland China underperformed, and revenues for the Greater China region were down 24% (down 21% at constant exchange rates). The Asia-Pacific region was the largest geographical segment, with 34% revenue share.

- Europe: Revenues declined by 21% (down 16% at constant exchange rates) from the year-ago period, to €281 million, mainly due to reduced tourist spending on the back of terrorist attacks in the region. Europe was the second-largest geographical segment, with 21% revenue share.

- Japan: Revenues declined by 2% (down 9% at constant exchange rates) and comprised 15% of total revenues.

SALES BREAKDOWN BY BRAND

The Prada brand, the largest segment, comprised 81% of revenues and saw sales fall by 19% (down 17% at constant exchange rates) during the period. MiuMiu, which contributed 17% of revenues, saw sales decline by 16% (down 14% at constant exchange rates).

SALES BREAKDOWN BY PRODUCT LINE

Sales from all product lines saw a broad-based decline:

- Leather goods, the largest segment, accounted for 61% of revenues and saw sales slide by 22% (down 21% at constant exchange rates).

- Clothing sales declined by 10% year over year (down 8% at constant exchange rates) and comprised 18% of sales.

- Footwear declined by 9% year over year (down 6% at constant exchange rates) and comprised 19% of sales.

GUIDANCE

Management sees 2016 as a turning point, and expects the group to return to growth in 2017. Prada will achieve the objective by redefining its business and marketing strategies, such as pricing strategically and engaging customers by digital communications. The group is rationalizing its retail network and rolling out its new store concept to cater to international travelers.

The consensus estimates call for FY16 revenue of €3,412 million, which represents a decline of 3% year over year, and EPS of €0.13, down 28% year over year.