Source: Company reports/Fung Global Retail & Technology

FY16 Results

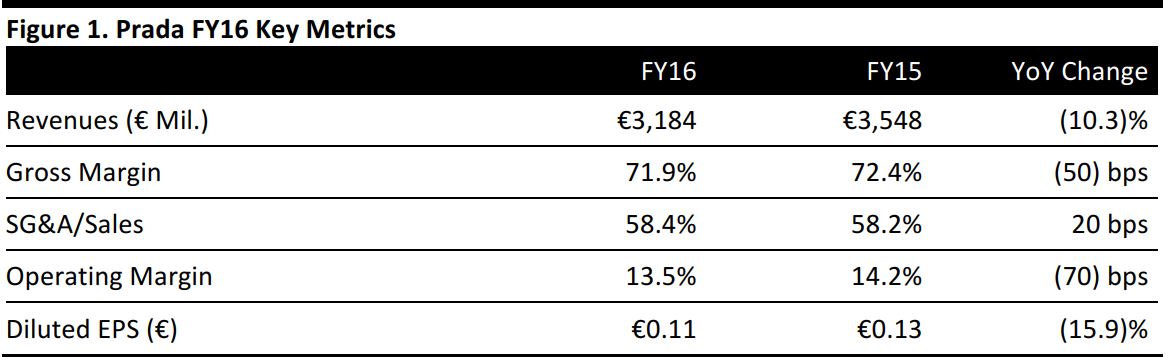

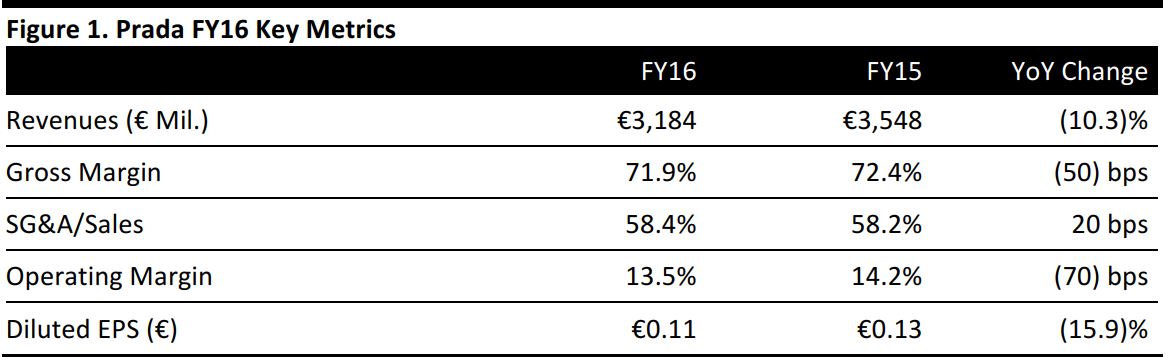

Prada reported revenue of €3,184 million for FY16, down 10.3% year over year and slightly higher than the consensus estimate of €3,182 million. The decline in headline revenue was mainly driven by the weak retail segment, where revenue fell by 13.1% year over year at constant exchange rates. The retail segment comprised almost 84% of total revenues.Sales in the wholesale channel were up by 14.6% at constant currencies and growth in the channel was due primarily to new partnerships with leading global e-tailers.

Reported EPS was €0.11 for the period, down almost 16% and below the consensus estimate of €0.12. Gross margin contracted by 50 basis points year over year in FY16, to 71.9%. SG&A expenses as a percentage of sales increased by 20 basis points year over year and operating margin contracted by 70 basis points, to 13.5%.

The figures below refer only to the sales of stores directly operated by Prada Group, and do not include sales to independent customers or sales made through franchises. They also do not include income from royalties.

Sales Breakdown by Geographic Segment

Revenues declined year over year for all geographic segments. We highlight the performance of the top-three geographic segments below.

- Europe: Revenues declined by 5.2% year over year at constant exchange rates, mainly due to reduced tourist spending following terrorist attacks in the region, particularly in France. Europe was the largest geographical segment, with 37.9% revenue share.

- Asia-Pacific region: Revenues declined by 12.1% year over year at constant exchange rates. The Asia-Pacific region was the second-largest geographical segment, with 31.6% revenue share.

- Americas: Revenues declined by 12% at constant exchange rates and the region comprised 14.6% of total revenues. Sales in the US were down in both the retail and wholesale channels, while Brazil and Mexico reported growth in the second half, as did Canada.

Sales Breakdown by Brand

The Prada brand, the largest segment, comprised 80.5% of revenues in FY16 and saw sales fall by 10.3% at constant exchange rates. MiuMiu, which contributed 16.4% of revenues, saw sales decline by 8.3% at constant exchange rates.

Sales Breakdown by Product Line

Sales declined across all product lines in FY16:

- Leather goods, the largest segment, accounted for 57.5% of revenues and saw sales slide by 14% year over year at constant exchange rates.

- Footwear declined by 4.5% year over year at constant exchange rates and comprised 21.6% of sales.

- Clothing sales declined by 0.8% year over year at constant exchange rates and comprised 19.1% of sales.

Outlook

Management stated that FY16 was a challenging year for the company and provided no specific numerical guidance for FY17.

The consensus estimates call for FY17 revenue of €3,313 million, which represents an increase of 4% year over year, and for EPS of €0.14, up 27.3% year over year.