Plenti is a new coalition-based loyalty rewards program for shoppers, created by American Express, partnering with cross-industry companies that include AT&T, ExxonMobil, Hulu, Macy’s, Nationwide and, Rite Aid. It is one of the first of its kind to be launched in the US.

For consumers, Plenti maximizes their opportunities to earn meaningful reward points across vendors while giving them the option of redeeming those points at any one of the vendors. Rewards points aren’t tied to any particular type of payment, as they are with, say, a Macy’s credit card, which allows buyers to accumulate points only when they purchase items with that card at a Macy’s physical or online store. Although this is an American Express initiative, consumers can use their Visa or MasterCard, or even cash, to make purchases at any of the Plenti partners and earn Plenti points.

Corporations will pay a one-time flat fee to join the Plenti initiative, and additional fees based on the program’s performance. For this, Plenti offers the exponential value added of the ability to access the multiple consumer bases of a broad network of companies within a range of industries, and leverage multiple marketing budgets.

Customer benefits:

- Plenti is free to join

- Not tied to a credit card

- Accepts all payment options including MasterCard, Visa and cash

Corporate benefits:

- Ability to reach multiple consumer bases

- Leverage of marketing strategies and budgets of other companies

- Decreased loyalty program costs through shared administrative costs

COLLECTIVE PROMOTIONS

Plenti promotes the concept that the whole is greater than the sum of its parts, a strategy that has worked well with similar loyalty programs such as AIR MILES in Canada and Coalition Rewards in Europe. Additionally, American Express has seen success in its PAYBACK loyalty program, which was launched outside the US, in Germany, India, Italy, Mexico and Poland.

Plenti will be integrated into each individual brand’s marketing strategy. Macy’s plans to feature in-store and storefront Plenti signage, and make a big splash with its TV, print and digital advertising. Meanwhile, all of Nationwide’s advertising efforts will highlight a Plenti “tag” and tie into its overall advertising offers. Rite Aid is already actively pairing Plenti with its current rewards program, wellness+, and shifting that program’s budget toward pushing enrollment in Plenti.

WILL IT WORK?

While coalition loyalty initiatives have existed in Europe for years, the US market has been slower to embrace the idea, mainly because of barriers such as high geographic fragmentation among US companies, especially among grocers and gas stations. Additionally, larger companies have traditionally protected their data, particularly those companies with long-standing loyalty programs singular to their product, as that data is both proprietary and mature.

Consumer adoption of the program will depend partly on the mix of companies involved—as of now, Plenti does not have a grocery partner. But consumers can gain rewards points more quickly by utilizing Plenti for multiple purchases than they can through the slower build of siloed rewards offers. Being able to amass points more quickly obviously means being able to redeem them more quickly, and if the rewards are meaningful and the marketing is right, this can create a competitive demand cycle. Generally, the more simplistic the rewards system—such as dollar for point—the more actively the consumer works to build points. And, the more products and purchases a corporation includes in the program, the more that corporation can benefit.

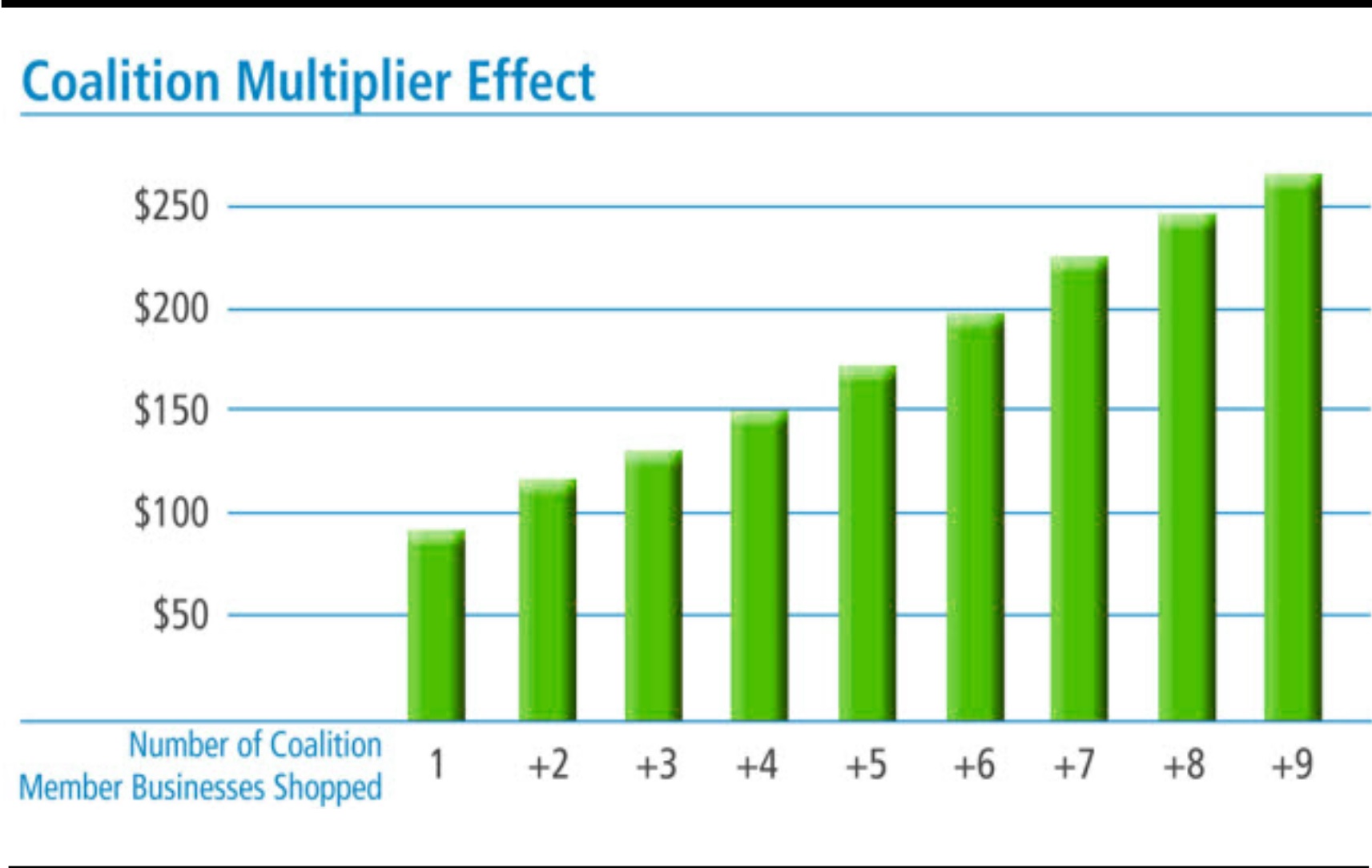

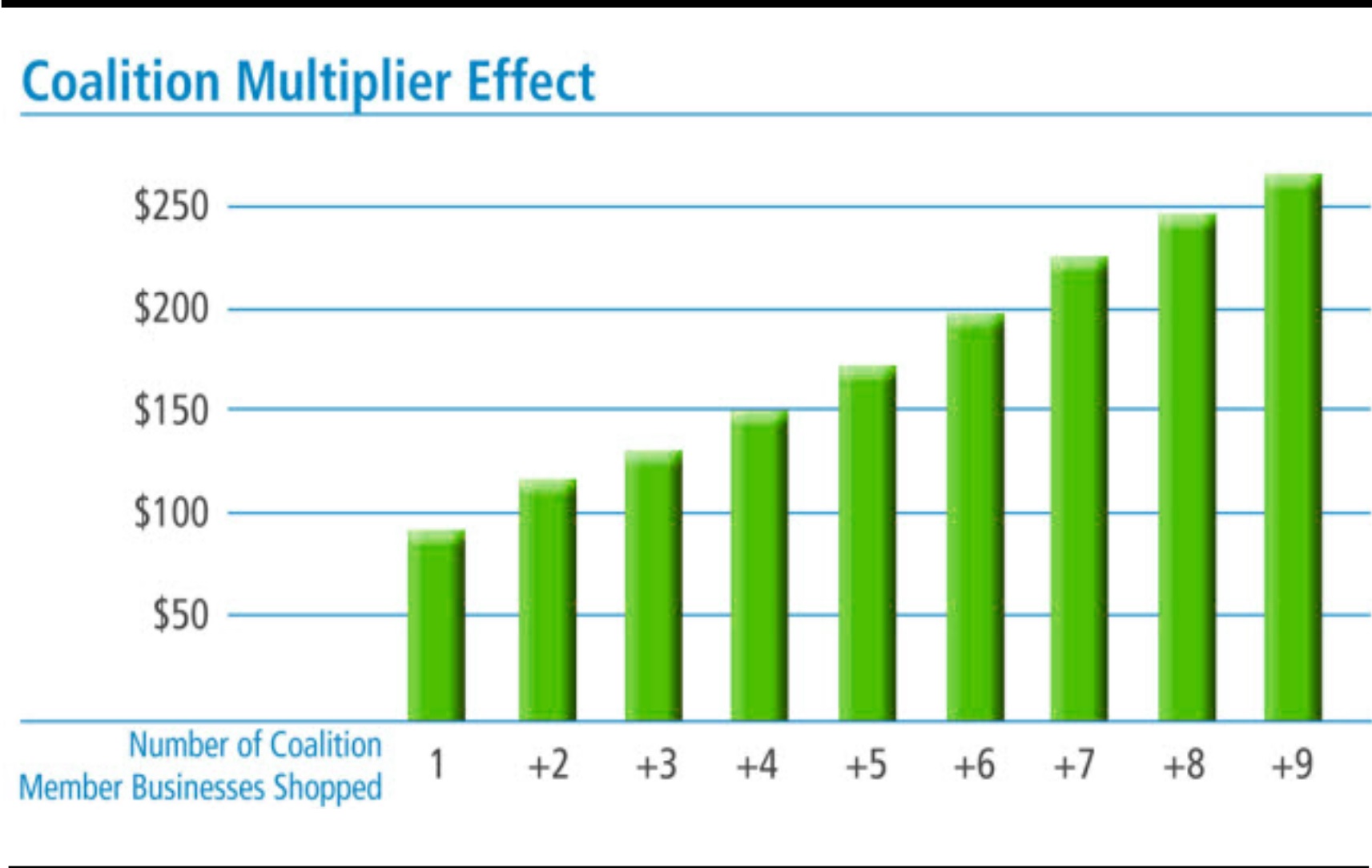

Data shows that the more companies within a coalition partnership a consumer shops at, the more money that consumer will spend at the company that first brought him or her into the program.

DATA AND LOYALTY PARTICIPATION

While retailers will of course have access to their own product and customer data through Plenti, they’ll also be able to use the broader Plenti network to offer their brand promotions, rather than being limited to their individual marketing efforts. However, item-level transactional data will not be shared collectively.

For some companies, such as Nationwide, this is their first foray into the rewards loyalty program space. Others, such as Rite Aid, have a long history and mature loyalty program consumer base. However, loyalty program membership doesn’t mean active participation. While membership registration is sometimes incentivized by an instant, first-purchase offer, the proliferation of rewards programs frequently leads to a lazy rewards customer. A 2014 COLLOQUY study found that only 9.5% of US loyalty program members are active.

WHAT’S NEXT?

The rollout of Plenti gives the consumer multiple shopping rewards options. However, its sole department store partner is Macy’s and its sole drugstore is Rite Aid. Will shoppers who frequent Macy’s but prefer CVS over Rite Aid actively change their purchase decision to increase their Plenti rewards? The answer to that question could partly depend on how aggressively each brand promotes the new program, as well as how quickly rewards can be accumulated and what type of rewards are offered. Additionally, the type of complementary companies that are added to the Plenti roster will influence the broader reach of the program.

Considering that US consumers are making more savvy purchasing decisions and are still acutely aware of the need for savings, this program launch could be coming at the perfect time.

Plenti is a new coalition-based loyalty rewards program for shoppers, created by American Express, partnering with cross-industry companies that include AT&T, ExxonMobil, Hulu, Macy’s, Nationwide and, Rite Aid. It is one of the first of its kind to be launched in the US.

For consumers, Plenti maximizes their opportunities to earn meaningful reward points across vendors while giving them the option of redeeming those points at any one of the vendors. Rewards points aren’t tied to any particular type of payment, as they are with, say, a Macy’s credit card, which allows buyers to accumulate points only when they purchase items with that card at a Macy’s physical or online store. Although this is an American Express initiative, consumers can use their Visa or MasterCard, or even cash, to make purchases at any of the Plenti partners and earn Plenti points.

Corporations will pay a one-time flat fee to join the Plenti initiative, and additional fees based on the program’s performance. For this, Plenti offers the exponential value added of the ability to access the multiple consumer bases of a broad network of companies within a range of industries, and leverage multiple marketing budgets.

Customer benefits:

Plenti is a new coalition-based loyalty rewards program for shoppers, created by American Express, partnering with cross-industry companies that include AT&T, ExxonMobil, Hulu, Macy’s, Nationwide and, Rite Aid. It is one of the first of its kind to be launched in the US.

For consumers, Plenti maximizes their opportunities to earn meaningful reward points across vendors while giving them the option of redeeming those points at any one of the vendors. Rewards points aren’t tied to any particular type of payment, as they are with, say, a Macy’s credit card, which allows buyers to accumulate points only when they purchase items with that card at a Macy’s physical or online store. Although this is an American Express initiative, consumers can use their Visa or MasterCard, or even cash, to make purchases at any of the Plenti partners and earn Plenti points.

Corporations will pay a one-time flat fee to join the Plenti initiative, and additional fees based on the program’s performance. For this, Plenti offers the exponential value added of the ability to access the multiple consumer bases of a broad network of companies within a range of industries, and leverage multiple marketing budgets.

Customer benefits:

Plenti promotes the concept that the whole is greater than the sum of its parts, a strategy that has worked well with similar loyalty programs such as AIR MILES in Canada and Coalition Rewards in Europe. Additionally, American Express has seen success in its PAYBACK loyalty program, which was launched outside the US, in Germany, India, Italy, Mexico and Poland.

Plenti will be integrated into each individual brand’s marketing strategy. Macy’s plans to feature in-store and storefront Plenti signage, and make a big splash with its TV, print and digital advertising. Meanwhile, all of Nationwide’s advertising efforts will highlight a Plenti “tag” and tie into its overall advertising offers. Rite Aid is already actively pairing Plenti with its current rewards program, wellness+, and shifting that program’s budget toward pushing enrollment in Plenti.

Plenti promotes the concept that the whole is greater than the sum of its parts, a strategy that has worked well with similar loyalty programs such as AIR MILES in Canada and Coalition Rewards in Europe. Additionally, American Express has seen success in its PAYBACK loyalty program, which was launched outside the US, in Germany, India, Italy, Mexico and Poland.

Plenti will be integrated into each individual brand’s marketing strategy. Macy’s plans to feature in-store and storefront Plenti signage, and make a big splash with its TV, print and digital advertising. Meanwhile, all of Nationwide’s advertising efforts will highlight a Plenti “tag” and tie into its overall advertising offers. Rite Aid is already actively pairing Plenti with its current rewards program, wellness+, and shifting that program’s budget toward pushing enrollment in Plenti.

The rollout of Plenti gives the consumer multiple shopping rewards options. However, its sole department store partner is Macy’s and its sole drugstore is Rite Aid. Will shoppers who frequent Macy’s but prefer CVS over Rite Aid actively change their purchase decision to increase their Plenti rewards? The answer to that question could partly depend on how aggressively each brand promotes the new program, as well as how quickly rewards can be accumulated and what type of rewards are offered. Additionally, the type of complementary companies that are added to the Plenti roster will influence the broader reach of the program.

Considering that US consumers are making more savvy purchasing decisions and are still acutely aware of the need for savings, this program launch could be coming at the perfect time.

The rollout of Plenti gives the consumer multiple shopping rewards options. However, its sole department store partner is Macy’s and its sole drugstore is Rite Aid. Will shoppers who frequent Macy’s but prefer CVS over Rite Aid actively change their purchase decision to increase their Plenti rewards? The answer to that question could partly depend on how aggressively each brand promotes the new program, as well as how quickly rewards can be accumulated and what type of rewards are offered. Additionally, the type of complementary companies that are added to the Plenti roster will influence the broader reach of the program.

Considering that US consumers are making more savvy purchasing decisions and are still acutely aware of the need for savings, this program launch could be coming at the perfect time.