albert Chan

Introduction

What’s the Story?

The Coresight Research Playbook series provides recommendations for brands, retailers and marketplaces seeking to tap growth segments and emerging trends.

Coresight Research has identified alternative retail as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see end of the report for more details).

We expect alternative retail models to continue to grow in 2022 as brands, retailers and marketplaces look to increase sales amid significant shifts in consumer shopping behaviors, driven by the Covid-19 pandemic.

In this Playbook, we present six key strategies for retail players that are already using or plan to capitalize on resale, subscription or rental as alternative models. Our coverage of the rental and resale models focuses on the fashion category, and our coverage of the subscription model includes the fashion, grocery, beauty and pet categories, with a focus on the US market.

· For more on other alternative retail models, read our coverage of direct-to-consumer and digitally native sales models for apparel, beauty, food and beverage, and home retail.

Why It Matters

In total, alternative retail models such as resale, subscription and rental present multibillion-dollar markets. Moreover, category segments within these models typically growing more quickly than the comparable category segments in conventional retail. We therefore see meaningful opportunities for companies to generate incremental revenues via market entry or market share gains. Yet, companies can find alternative models to be profit-challenged and they face operational complexity in fast-evolving markets—meaning companies must understand the nuances that can help drive growth in the top and bottom lines.

Alternative Models in Retail—Resale, Subscription and Rental: A Playbook

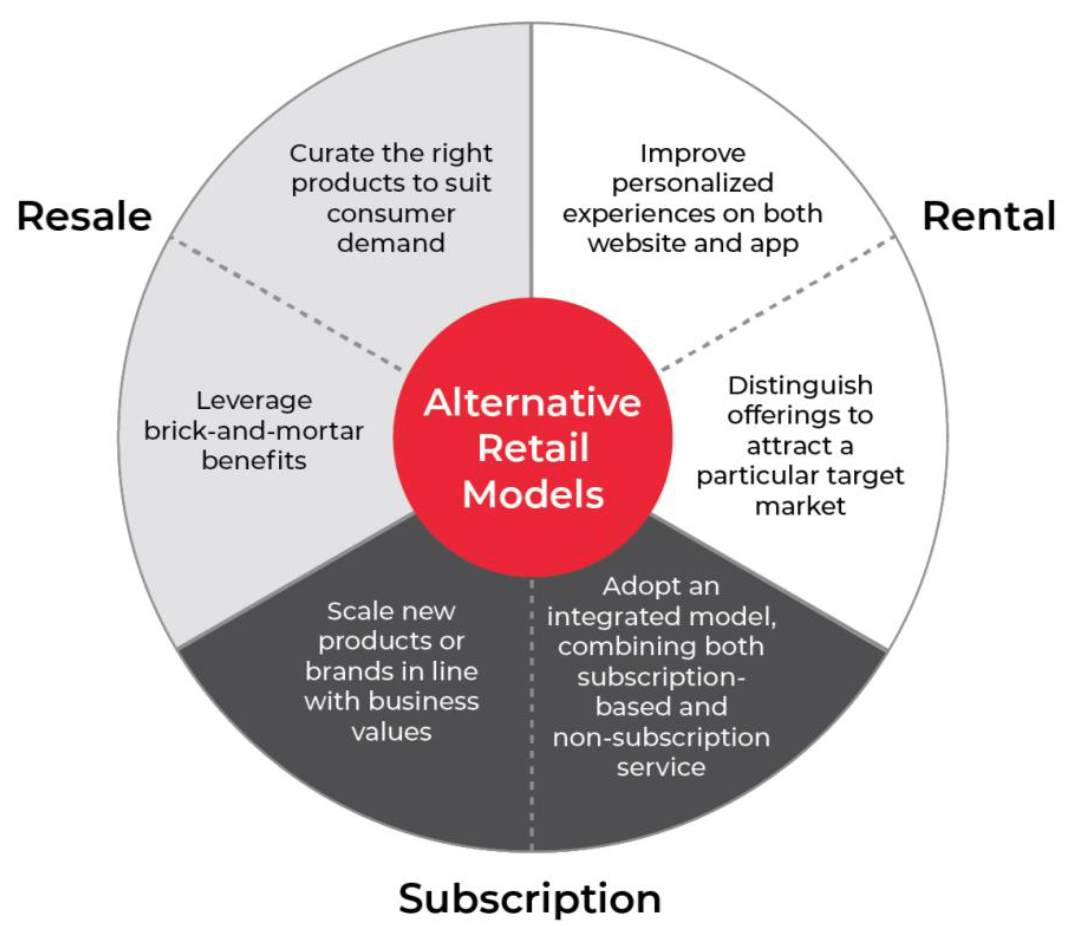

Brands, retailers and marketplaces are increasingly looking to adjust their strategies to cater effectively to consumer demand and maintain competitive positionings in the evolving retail landscape. To unlock new opportunities, they can turn to resale, subscription and rental as alternative resale models. We summarize six key strategies in Figure 1 (two for each retail model) and discuss each in detail below.

Figure 1. Six Key Strategies To Leverage Alternative Models in Retail [caption id="attachment_148634" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Resale

The US fashion resale market has evolved from a single-billion-dollar market in 2008 to a $22.3 billion market in 2021. We expect the market to reach $25.9 billion and $29.7 billion in 2022 and 2023, equating to 16.0% and 15.0% growth, respectively. The market comprises a range of players, from traditional e-commerce companies such as eBay to relatively new consignment-based marketplaces such as ThredUP and The RealReal and social commerce platforms such as Facebook Marketplace and Poshmark, as well as retailers such as NIKE. In addition, offline-based fashion resale players, mostly thrift stores such as Buffalo Exchange, continue to operate in the market.

To capitalize on the $26 billion US fashion resale market, we see opportunities for brands and retailers to launch resale services or work with resale platforms. Below, we present two strategies for companies that are already operating in the fashion resale space and those who want to enter the space.

1. Curate The Right Products To Suit Consumer Demand

We identify value offerings, pre-owned luxury items, vintage products and occasion wear as four categories that resale consumers are looking to buy in 2022. For companies that currently use the resale model or are aiming to enter the resale space, it is essential to curate products that suit consumer demand.

We believe that the most important driving force in the fashion resale space is consumers’ intention to seek value and save money. Our proprietary consumer survey from November 2021 indicates that over 60% of US consumers have used fashion resale services for the purpose of saving money and seeking value.

We are also seeing outperformance in apparel and footwear become increasingly polarized at the high and low ends. As such, we expect to see continued strong demand in discount and luxury women’s apparel and footwear. Selected companies in the space, from platforms such as ThredUP to retailers such as Nuuly, are already highlighting value offerings on their websites’ front pages to attract consumers.

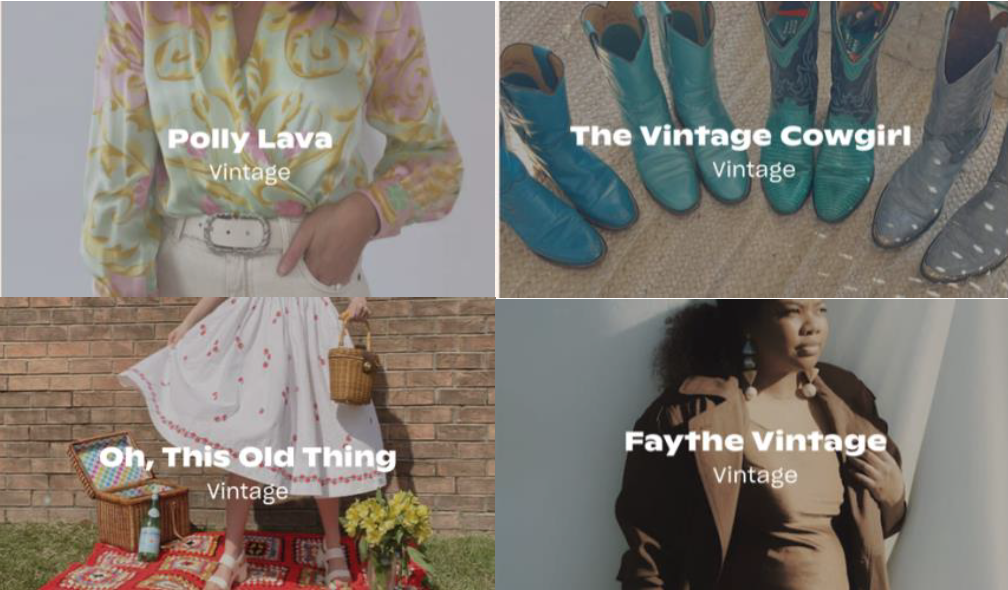

A third popular product category we are seeing in the market is vintage. Our proprietary consumer survey from November 2021 indicates that 30% of US consumers used fashion resale services for the purpose of buying vintage products. In fact, four of Nuuly Thrift’s top five sellers focus on vintage products, as of May 31, 2022, reflecting this demand. Brands and retailers in the space or that hope to enter the space can leverage the popularity of vintage products to attract customers.

The fourth product category that we expect to drive hype in 2022 is occasion wear. We are seeing consumers shifting away from categories that were popular during the pandemic, including casual and activewear, into occasion-based and dress apparel for special occasions, weddings, social gatherings and parties. We expect demand for blazers, blouses, dresses, skirts, leather shoes, shirts and suits in these categories to grow substantially in 2022.

[caption id="attachment_148635" align="aligncenter" width="550"] Among Nuuly Thrift’s top five sellers as of May 31, 2022, four of them focus on vintage products

Among Nuuly Thrift’s top five sellers as of May 31, 2022, four of them focus on vintage productsSource: Nuuly Thrift[/caption]

2. Leverage Brick-and-Mortar Benefits

Brands, retailers and platforms that use the resale model or plan to enter the space can leverage the benefit of brick-and-mortar by opening stores, pop-up shops or shop-in-shop locations in department stores and specialty retailers to attract customers.

Brick-and-mortar has been an important business driver for The RealReal, according to the company’s presentation at the 2nd Annual New Retail Ecosystem CEO Summit on Innovation and Digitalization in May 2021. Management stated that the company’s 10 physical stores have been one of the main engines of discovery, with more than 30% of new consignors in the second quarter of fiscal 2021 being introduced to The RealReal through a physical location. The company’s next focus will be letting its existing store spaces mature.

The RealReal’s neighborhood stores, which have a small footprint, are performing well–with many achieving profitability quickly, according to the company’s earnings call on February 23, 2022. In 2022, The RealReal opened a new retail location in Brentwood, Los Angeles. As of May 2, 2022, The RealReal has 19 luxury consignment offices across the US, 16 of which are in its retail stores.

[caption id="attachment_148636" align="aligncenter" width="550"] The RealReal’s store in Brentwood, Los Angeles

The RealReal’s store in Brentwood, Los AngelesSource: The RealReal[/caption] In September 2021, ThredUP and Madewell launched a Brooklyn pop-up shop stocked with secondhand clothes. In addition to shopping, visitors can bring their own clothes to be repaired by experts. The store also offers tailoring for any clothes purchased there. ThredUP stated in its earnings call on November 30, 2021, that the partnership with Madewell was very successful. The company expects department stores and specialty retail will serve as powerful partners for secondhand product businesses over the next 10 years, as stated on its earnings call on March 9, 2022. [caption id="attachment_148637" align="aligncenter" width="550"]

Madewell’s pop-up shop with ThredUP

Madewell’s pop-up shop with ThredUPSource: ThredUP/Madewell[/caption]

Subscription

We estimate that the total US subscription e-commerce market reached $14.7 billion in 2021. We expect it to grow at a high single-digit rate in 2022, presenting opportunities for new or existing players.

With the e-commerce industry booming across discretionary categories, we believe that online shopping as a sustained consumer habit will be the key growth driver for the subscription e-commerce market in 2022. Moreover, we expect consumers to continue to spend more time working and socializing at home in 2022 as pandemic-related habits stick, making them more likely to sign up for repeat delivery of products and services.

Subscription e-commerce companies or companies that plan to enter the space must look to retain customer loyalty amid strong competition to reduce churn rates (the rate at which customers discontinue their subscriptions within a given time period). We present the two strategies for brands, retailers and marketplaces to consider.

1. Scale New Products or Brands in Line with Business Values

Businesses that are using or plan to use the subscription model need to ensure that they monitor and adapt to changes in demand. Offering subscribers a wider product or brand range improves customer retention and boosts spending. We expect product or brand portfolio expansion to be a key driver and strategy in the subscription e-commerce market in 2022.

Selected subscription e-commerce businesses have expanded the products or brands in their portfolios. For example, Hello Fresh, a meal-kit subscription company, made a push into the ready-to-eat segment in 2021. The company acquired Factor75 in November 2020, a company that sells fully prepared meals for plant-based diets. Along with Australian health food brand Youfoodz, the companies comprise the company’s new ready-to-eat segment. According to Hello Fresh’s March 1, 2022, earnings call, the company expects the segment to become a $1 billion business line in the near future.

Blue Apron, a meal-kit subscription company, added breakfast to its menu portfolio in March 2022. The decision was informed by its survey insights, which revealed demand for breakfast recipes from Blue Apron among 35% of respondents. This follows several product portfolio innovations by the company in recent years. In September 2021, introduced Heat & Eat, its first single-serving meals ready in five minutes or less, designed to give customers additional flexibility. On its earnings call in February 2022, the company stated that the Heat & Eat product launch had been successful, with a steady uptick in volume and unique customer trials. Based on the company’s analysis, customers who are adding Heat & Eat to their boxes appear to be doing so on top of their standard recipes, which in turn helps drive average order value (AOV).

Blue Apron plans to continue expanding its recipe options as it learns more about customer tastes and preferences. On its 2021 third-quarter earnings call, the company stated that product innovations provided the company a nearly 19% year-over-year lift in average order value (AOV) before promotions, credits and refunds. We recommend that meal-kit subscription companies launch similar strategies to provide customers with more options for their boxes to drive sales.

BarkBox, a dog toy subscription box, is expanding its portfolio by tapping into food and health products. The company believes that dog food is a huge opportunity and its management is confident that this category will become a meaningful driver of BarkBox’s business, according to the company’s earnings call on February 10, 2022.

Harry’s, a men’s personal care subscription company, raised $155 million from series E funding in April 2021. It plans to primarily use the capital to add more brands to its portfolio, which consists of men’s personal care brand Harry's, women's razor and body care brand Flamingo, pet brand Cat Person and haircare brand Headquarters.

Birchbox, a beauty subscription box company, is also expanding its brand portfolio. The company launched refillable beauty brand Re.fil in June 2021, capitalizing on trends in the sustainability space. The first product in the line, a lip and multi-purpose beauty balm, is sold in a refillable case made from post-consumer recycled plastic.

2. Adopt an Integrated Model (Subscriptions and Non-Subscription Services)

Compared to conventional retail, subscription e-commerce businesses lack flexibility. We recommend that companies using subscription models work to prevent consumers from gravitating back to conventional retail by complementing their recurring services with flexible purchasing options. We are seeing more subscription e-commerce companies adopting an integrated model, combining both subscription-based and non-subscription services, and this approach has been effective.

Stitch Fix opened up its direct-buy option named Freestyle to the public in September 2021, enabling consumers to buy individual pieces of clothing or shoes from its website. The company disclosed that Freestyle revenue grew nearly 30% year over year in the second quarter of fiscal 2022, ended January 29, 2022. Although the company launched the service publicly in September 2021, it had been testing the service with existing clients from late 2019. Management stated on its earnings call on March 8, 2022, that Freestyle will help drive improved client conversion from flexible purchases to subscription services. The company’s subscription business, Fix, is steadily improving, with over 32% of women's Fix clients purchasing via Freestyle, according to the company, showing the positive impact of flexible purchase options on subscription business performance.

As well as delivering razors on a monthly recurring basis to subscribers, Dollar Shave Club also offers home-delivery on additional grooming products to non-subscribers. We expect to see more subscription businesses adopt a hybrid model, aiming to capture more active clients.

Rental

We estimate that the total US apparel rental market was worth $1.2 billion in 2021 and expect it to grow to $1.6 billion in 2022, driven by the in-person events boom, which presents opportunities for existing and new apparel rental players. The apparel rental model can provide consumers with an option to wear apparel in a cost-effective and novel way.

We are seeing apparel brands and retailers jump onto the bandwagon and launch rental services. Below, we present two strategies for revenue growth in the apparel rental area.

1. Improve Personalized Experiences on Both Website and App

Online apparel rental businesses must enable customers to easily find products they like and be inspired by relevant recommendations. From Ralph Lauren’s Style Guide (which provides customers with recommendations on apparel for different occasions) to Nuuly’s Trending Right Now (which offers popular style recommendations), it is vital for apparel rental businesses to offer inspirational styling ideas.

Beyond these standard styling recommendations, we expect to see more data-based, personalized styling recommendation services. Rent the Runway stated on its earnings call in April 2022 that it will continue to make important investments in customer experiences to make it faster and easier for customers to find clothing they love by improving search and product discovery. The company believes that it can make annual progress to increase customer discovery, acquisition and retention through these efforts.

In addition to style recommendations, personalized sizing recommendations will also fuel the success of rental businesses. Rent the Runway is investing in sizing recommendations. The company plans to enhance tools to improve fit confidence and success, which in turn can drive conversion. Rent the Runway introduced a proprietary fit algorithm in 2021 that recommends sizes that are most likely to fit customers. This has already resulted in a 40% reduction in fit issues, higher customer satisfaction and fewer customer service calls among customers who take the recommendations, according to the company’s April 2022 earnings call. We view personalization as a critical part of the apparel rental business and expect to see more investment into product discovery and fit solutions.

2. Distinguish Offerings To Attract a Particular Target Market

While most veteran apparel rental companies are expanding their product assortments and brand mix or improving their customer services, we believe brand positioning through focused offerings is a key strategy that will help new or traditional rental players to stand out.

For example, we are seeing companies bet on inclusive sizing needs or turning to the less saturated men’s and children’s rental market to seek out opportunity. Seasons, an apparel rental player that entered the market in 2020, focuses on menswear and streetwear, for example. The startup enables customers to rent pieces from curated high-end designers, including Acne Studios, Fear of God and Dries Van Noten.

Scotch & Soda, an apparel retailer, launched apparel rental service Scotch Select in 2019, offering gender-neutral clothing. Moreover, apparel retailer Eloquii launched a rental service segment named Eloquii Unlimited in 2020, focusing on plus-size rental fashion.

What We Think

Implications for Brands/Retailers/Platforms Operating or Aiming to Leverage Alternative Retail Models

- We recommend that brands, retailers and marketplaces that are using the resale model or plan to enter the space curate products to suit consumer demand.

- Brick-and-mortar is important for the resale model, as it can drive customer traffic and offer more convenience for shoppers to send in secondhand products while allowing shoppers to browse what they like in person. Department stores and specialty retail will serve as powerful partners for secondhand product businesses.

- Companies should look to scale new products or brands that are in line with their values. This is most relevant for subscription services seeking to suit changing consumer preferences and generate recurring revenues.

- Companies using or looking to use subscription models should seek to prevent consumers from gravitating back to conventional retail by complementing their recurring services with flexible purchasing options.

- Most rental fashion industry players are already expanding product assortments or brand mix; we view brand positioning as an area that will help players stand out. In addition, we view personalization as a critical part of the fashion rental business and expect to see more investment into product discovery and fit solutions.

Implications for Technology Vendors

- Opportunities exist for technology vendors to offer analytics solutions that can help brands and retailers drive customer personalization.

Implications for Commercial Real Estate Owners

- We encourage commercial real estate owners to work with resale brands and retailers and come up with innovative solutions to attract customers.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution.

To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.

RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework.

The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments.

Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

Appendix Figure 1. RESET Framework

[caption id="attachment_143517" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]