DIpil Das

Introduction

What’s the Story?

Our Playbook series provides recommendations for brands, retailers and marketplaces seeking to tap growth segments and emerging trends.

Product returns have always been a part of retail, but recent e-commerce growth has magnified their importance. In this Playbook, we present four strategies that retailers can implement to improve the online returns logistics process.

- For more on online returns, read our separate reports, Opportunities in Retail Returns and Retail-Tech Landscape: Returns Management.

Why It Matters

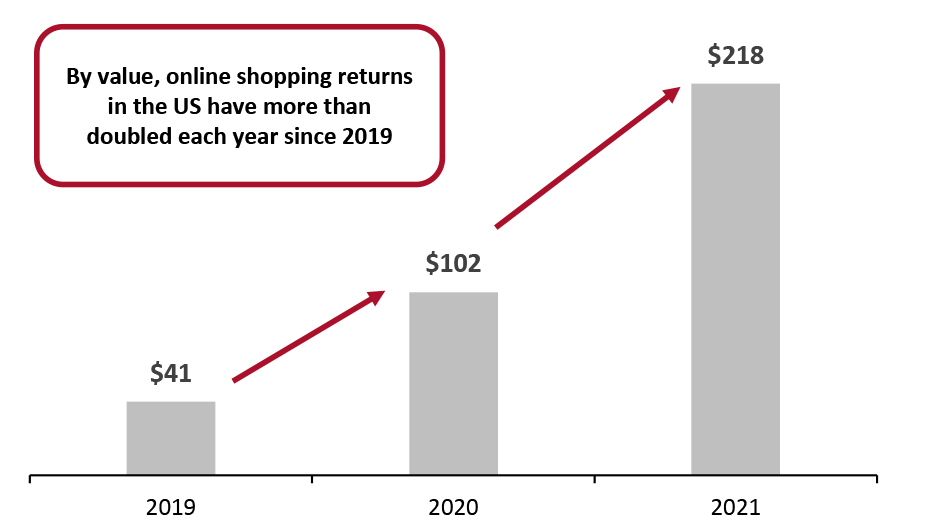

As e-commerce gains a greater share of the retail market, return rates have also ballooned, adding significant pressure to retailers’ bottom lines. According to the National Retail Federation (NRF), total returns amounted to $761 billion in the US in 2021, equivalent to 16.6% of total US retail sales. By comparison, return rates are higher in e-commerce; returns equated to around one-fifth (20.8%) of online US retail sales in 2021.

Figure 1. US Online Shopping Returns (USD Bil.) [caption id="attachment_151542" align="aligncenter" width="700"]

Source: NRF/Coresight Research[/caption]

Source: NRF/Coresight Research[/caption]

There are also other issues at stake. Many consumers take returns policies into consideration when choosing which retailers to shop with—and the ease of making a return and the quality of service are major factors in customers’ shopping choices. In addition, consumers are increasingly taking sustainability into account when shopping, and this extends to the returns process.

Efficiently managing and processing returns is fast becoming a differentiator and key competitive advantage for retailers, which should explore ways to enhance their returns logistics capabilities to better cater to consumers’ needs, while driving down costs and reducing the environmental impact of their returns process.

Mastering Online Returns Logistics: A Playbook

We present four strategies that retailers should implement to manage the returns process.

Figure 2. Strategies To Improve Reverse Logistics [caption id="attachment_151544" align="aligncenter" width="700"]

Source: Coresight Research [/caption]

1. Offer Multiple Channels for Customers to Make Returns

Source: Coresight Research [/caption]

1. Offer Multiple Channels for Customers to Make Returns

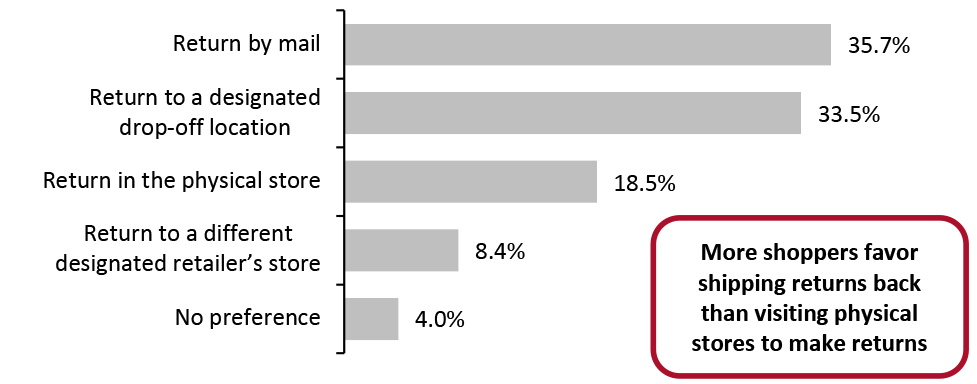

Retailers should offer multiple channels for customers to return items, to accommodate the differing preferences of consumers—particularly when it comes to online purchases. A Coresight Research survey of US consumers conducted on April 11, 2022, found that among online shoppers who had returned an online purchase in the past 12 months, mail and drop-off locations were the most preferred channels (see Figure 3).

Figure 3. Channel Preference To Return Online Purchases (% of Respondents) [caption id="attachment_151546" align="aligncenter" width="700"]

Base: 227 US-based shoppers aged 18+ who had returned an online purchase in the last 12 months

Base: 227 US-based shoppers aged 18+ who had returned an online purchase in the last 12 months Source: Coresight Research [/caption]

By Postal Mail

Mail is the most popular choice for shoppers to return their online purchases, our survey found. Retailers should look to enhance the convenience of this process so it is simple for consumers, such as by providing a returns label with every online shipment, containing the returns address. This can save time and effort for the retailer as well as the customer, as the customer should not need to contact the retailer before making a return.

Alternate Drop-off Locations

Almost one-third of shoppers who returned products in the last 12 months prefer to return to a designated drop-off location, according to our survey. Omnichannel retailers and online pure plays, or retailers without large brick-and-mortar networks, should look to install parcel lockers or partner with third-party returns specialists that accept returns at physical drop-off points. An expansive shared network allows for a more accessible and convenient process for customers to return items, while driving down costs through consolidated shipments.

Retailers can partner with reverse logistics technology companies such as Fillogic, Narvar and Optoro to simplify the returns process. These platforms have partnered with retailers and Real Estate Investment Trusts to act as the point of collection for returns.

- Narvar has teamed up with retailers Nordstrom, Simon Property Group and Walgreens, and parcel carriers FedEx and UPS, to offer boxless returns across 200,000 carrier and retail locations in the US.

- Optoro provides customers with return drop-offs at more than 1,000 locations. Optoro manages returns for Bed Bath & Beyond, Best Buy, IKEA, Staples, Target, Under Armour and many smaller online retailers.

- Logistics-as-a-service provider Fillogic—which has partnered with major malls including Brookefield Retail, Simon Property Group and Tanger—cuts the 15-day average return time in half using its micro-distribution hubs, according to the company.

Return to the Store

Buy online, return in-store (BORIS) and buy online, return at curbside (BORAC) are alternative options for customers to drop off returns at one of the retailer’s physical locations. Retailers have the option to send these items to a distribution center for subsequent online purchases or add them to the store’s inventory. This option can be a powerful tool for retailers with large store networks.

Although less than one-fifth of US consumers prefer to return online orders to physical stores (according to our survey), retailers should nudge customers to use this channel more as it facilitates faster returns and offers upselling opportunities. Additionally, items returned to the store by different customers can be processed and bundled in-store prior to a return shipment to the distribution center, lowering overall shipping costs.

Retailers can use the following steps to pursue an in-store or curbside returns strategy:

Communication

- Actively encourage store-based returns by highlighting their benefits for customers, such as saving money and time and reducing environmental impacts.

- Promote the in-store returns option in after-sales and returns-related communication materials.

- Remind shoppers of the proximity of their nearest stores by providing the distances on return slips and other return-related communications.

Implementation

- BORIS—Creating a dedicated returns area will ensure that customers do not need to wait in a checkout queue to make a return. Retailers can also install in-store parcel lockers to help alleviate congestion and reduce wait times for returns.

- BORAC—Implementing a geofencing functionality that sends timely customer arrival notifications means store staff can be ready to collect items from customers promptly.

Retailers can build a dedicated workspace for sorting, processing and inspecting inventory once it is returned to the distribution center or warehouse. The returned items should be kept separate from regular merchandise or other incoming shipments.

Another way to optimize the returns logistics process is by building a dedicated centralized returns facility. Most traditional distribution centers are geared toward outbound shipments rather than processing returns. These are mostly inefficient when handling goods flowing both up and down the supply chain, likely because forward logistics is prioritized. By dealing exclusively with the flow of products back up the supply chain, centralized returns facilities can streamline operations and speed up the process. Dedicated facilities can also better implement automation, such as automated storage and retrieval systems, to speed up processing times and maximize the assets’ value recovery, while reducing cycle times and labor costs.

Anisa Kumar, Chief Customer Officer at Narvar, told Coresight Research that the most cost-effective solution must be assessed case by case, since it depends on the size of the retailer, volume of returns, amount of inventory, speed of return, customer locations and the condition that products are returned in. For example, for a beauty brand that has to destroy most returns for health and safety reasons, it may be more cost-effective to have a separate returns facility. On the other hand, a luxury brand that is receiving the majority of its returns in resaleable condition will find it beneficial to co-locate and integrate returns processing with an outbound shipping facility.

3. Evaluate Channels for Returned ItemsEvaluating options to reinvest or dispose of returned merchandise is a critical decision point in returns logistics. While the first choice of retailers would be to resell returns at full price, Coresight Research estimates that only 40–50% of returned merchandise can sell at full price due to time lags between the purchase, decision to return, return and restocking—which necessitate markdowns. The challenge of disposal is especially prominent in cross-border returns, because of the high cost of reverse logistics and the increased complexity of managing those returns.

There are four primary channels for returned items:

- Resale—Items that are returned in new conditions should be immediately restocked and resold, either at a full retail price or a discounted price. Retailers should establish clear and rigorous inspection standards and employees involved at this stage should be highly trained and knowledgeable about the products as well as repair or refurbishment processes. Directing online return packages to a store location with appropriate inventory also provides a greater chance to resell at a full price.

- Refurbishment or repair—Retailers should deploy internal or third-party refurbishment programs for disposing of gently used or out-of-package returns and relist them at a discounted price or resell them at a secondary market

- Return to vendor—Retailers should look to return defective products or items that are returned at a higher frequency back to the original manufacturer or vendor. This will allow them to recoup some of the returned item’s cost and eliminate the need to find another distribution channel.

- Recycling—Retailers should look for ways to sustainably recycle heavily damaged and unusable items and avoid sending them to landfill to reduce the impact on the environment.

Retailers can also partner with third-party companies that specialize in disposing of returned items:

- Optoro uses AI (artificial intelligence) and proprietary algorithms to determine which channel will yield the highest value for a product, by considering the predicted selling price and shipping costs for the item to reach the proposed destination. It then helps to divert returned items to the channel that will recoup the greatest value for retailers. Options include reselling directly to consumers, reselling to wholesalers, returning to vendors for repair, charitable donation or recycling. According to Optoro, its clients were able to keep more than 96% of their returned and excess inventory out of landfill on average in 2020.

- FloorFound offers an end-to-end recommerce platform that deals with the return of oversized items. It manages the entire return process, including pickup and intake, inspection in regionalized warehouses and reselling via the optimal sales channel using data-driven pricing.

- ZigZag helps retailers to manage their returns domestically and globally. Its platform integrates over 30 leading e-commerce marketplaces, enabling retailers to access its reverse logistics network, which comprises over 450 carrier services and 220 warehouses in 130 countries. It uses AI and predictive analytics to grade the returned products and select the most cost-effective and energy-efficient route for returned products to either go back to the retailer via consolidation or be locally distributed, recycled or resold internationally.

High volumes of returns can burden companies’ logistics networks and add complexity to their supply chains. Therefore, for certain items, retailers can opt to refund shoppers for their online purchases without requiring them to return the merchandise, leaving the consumer to dispose of the item.

E-commerce giant Amazon and mass merchandisers such as Target and Walmart employ a returnless refund strategy in some cases—using AI-powered analysis to identify when the option is preferential. According to our proprietary survey data, a substantial 57.3% of respondents said they had been offered a refund for an item that they were planning to return in the past 12 months and were told not to send it back.

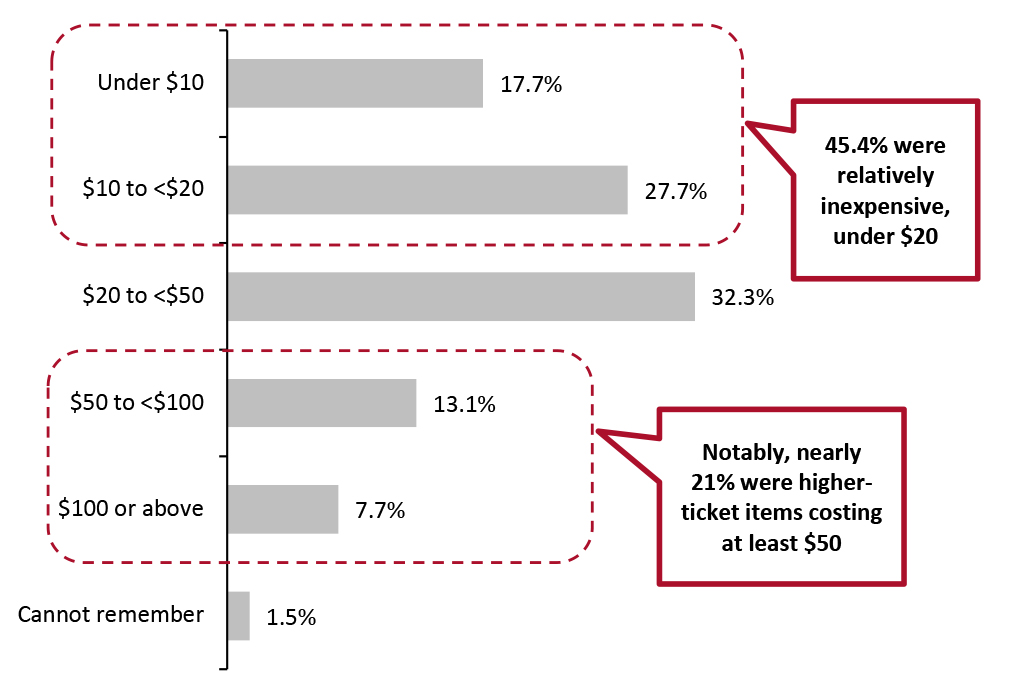

Returnless refunds benefit retailers in cases where returns processing costs more than the returned item’s resale value. Supporting this, our survey found that items costing less than $20 accounted for 45.4% of returnless refunds, while items costing at least $50 accounted for only 20.8% (see Figure 4).

Figure 4. Shoppers Who Were Offered a Returnless Refund: Approximate Price of Product (% of Respondents) [caption id="attachment_151547" align="aligncenter" width="701"]

Base: 130 US based shoppers aged 18+ who were offered a returnless refund in the past 12 months

Base: 130 US based shoppers aged 18+ who were offered a returnless refund in the past 12 months Source: Coresight Research [/caption]

Returnless refunds have three major advantages, which we discuss in detail below.

Cost-Effectiveness

Returnless refunds can be a less costly option for retailers—avoiding the time and cost drains of managing return shipping and processing, especially for items that would be hard to resell. According to B-Stock, an online marketplace for returned merchandise, processing certain returned items costs twice as much as their sales price. Hence, it is more cost-effective for retailers to let customers keep the items, especially when the price and margin is very low.

Avoiding Negative Refund Experiences

Consumers may face significant delays in receiving refunds since payment is only processed once an item purchased online arrives back at the distribution center. While having funds tied up with a retailer for an extensive time period will likely frustrate customers, a returnless refund releases the refund almost instantly, thus eliminating any negative refund experience, encouraging customers to shop with the retailer again.

Reduced Friction for Customers

Returnless refunds remove the hassle of the returns process for customers, which can include printing out a shipping label, packing the product and then taking it to a drop-off location or post office to send it back. Navjit Bhasin, Founder and CEO of Newmine, an AI-driven returns management platform, told Coresight Research that consumers feel positively about returnless refunds in the majority of cases and appreciate that retailers are saving their time and effort by letting them keep the return.

Retailers should use AI-powered analysis to judge when to employ a returnless refund strategy. The technology assesses factors including a customer’s purchase history (to flag potential fraudsters), the cost of processing the return and the price of the product, to identify instances where the strategy can save retailers money.

What We Think

With returns becoming a significant expense, retailers should take a closer look at their returns logistics and find opportunities to recover more money on returned items. Additionally, rising return rates make it vital for retailers to figure out a more cost-effective solution to handle product returns. Evaluating reverse logistics processes to identify inefficiencies and addressing those shortcomings can boost the bottom line, while increasing customer loyalty and elevating brand reputation.

Implications for Retailers

- Returns management often operates within disjointed functions. Retailers should look to integrate reverse logistics, forward logistics, and inventory management systems to increase the end-to-end visibility and collaboration throughout the returns process and make the complexity of reverse logistics more efficient and manageable.

- We believe returnless refunds policies will yield better results when targeted toward repeat customers and loyalty program members, which can promote a mutual feeling of trust and a higher likelihood of advocacy. Retailers using a returnless refund strategy should prioritize ways to communicate the reasoning behind the policy, along with guidance that customers can use to dispose of the merchandise if they do not want to keep it.

- Managing reverse logistics is not a core competency of retailers. Retailers can seek the assistance of third-party platforms that specialize in the collection, storage, handling and distribution of returns. Companies must consider the costs and benefits of running a returns operation in the same facility that processes outbound orders versus a using a dedicated returns center or outsourcing to a third party.

Implications for Technology Vendors

- Technology vendors can offer a comprehensive solution that streamlines retailer’s end-to-end returns process, ensuring that key functions, such as supplier collaboration, transportation and warehousing, are fully aligned with the reverse logistics strategy.

- Technology vendors should offer AI-based solutions to analyze the returns data and find patterns in returns that can help retailers uncover opportunities to eliminate or reduce returns while increasing profits, efficiencies and customer satisfaction.