Nitheesh NH

What’s the Story?

The Coresight Research Playbook series provides recommendations for brands, retailers and marketplaces seeking to tap growth segments and emerging trends. Coresight Research has identified inclusivity as one of the key trends to watch in 2021. Inclusivity—providing equal access for people who might otherwise be excluded or marginalized—has accelerated in the light of the racial justice movement in the US helping to inspire a global conversation on diversity and representation. It is a thread that touches every part of an organization, both internally and externally. In this Playbook, we present five strategies for brands and retailers to align inclusivity goals across their products and operations.Why It Matters

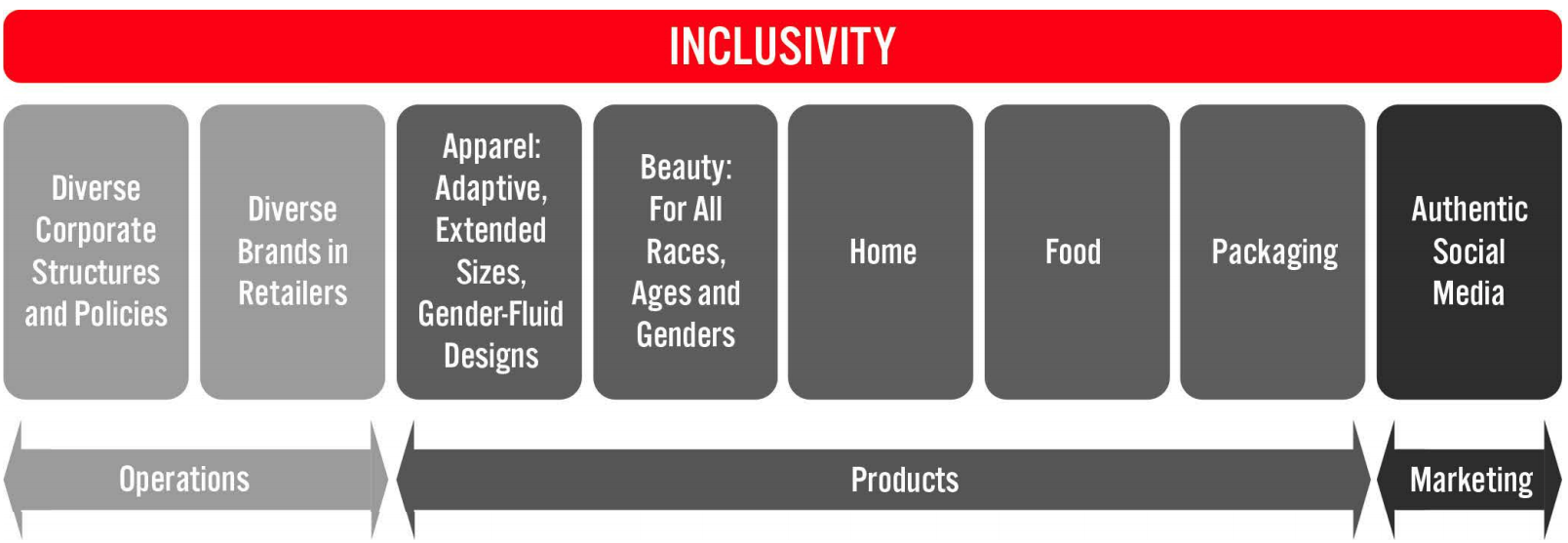

Inclusivity is not just a trend but a movement that is influencing meaningful long-term change within retail organizations as they reassess their teams and goals, corporate structures and policies, brand representation on shelves, and the content that they are posting on social media. Conversations around inclusivity are also helping brands and retailers to identify opportunities for growth in product categories that serve underrepresented individuals—spanning apparel, footwear, beauty, home, and fast-moving consumer goods (FMCG). Packaging is a significant opportunity too, particularly in the FMCG sector. By enacting inclusivity throughout the supply chain, brands and retailers become more socially responsible and can tap growth opportunities. Furthermore, inclusive marketing approaches that appeal to today’s shoppers enable brands and retailers to boost consumer spending: Consumers spend more with brands that represent more diverse demographics in ads, according to a Facebook Study conducted in conjunction with Geena Davis Institute on Gender in Media in October 2020. Inclusivity Touches All Aspects of Organizations Inclusivity is a thread that touches every part of an organization, both internally and externally. It is guided by an organization’s strategic goals and mission. Internally, it covers operations, employees, corporate policies and procedures, and brand partnerships. Inclusivity also spans the types of products that organizations produce. Externally, inclusivity includes how organizations and products are branded, marketed and targeted, as well as represented on social media.Figure 1. Inclusivity Spans Operations, Products and Marketing [caption id="attachment_129865" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Inclusivity in Retail: A Playbook

Coresight Research has identified five strategies for brands and retailers to align inclusivity across their organization internally and across their product portfolio. We summarize these strategies in Figure 2 and explore each in detail below.Figure 2. Five Strategies for Organizations To Align Inclusivity Across Operations, Products and Marketing [caption id="attachment_129866" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Determine Strategic Inclusivity Goals

The first step provides a roadmap for the organization; subsequent decisions and tasks should fall in line with the company’s strategic goals. There are opportunities for brands and retailers to incorporate inclusivity into products, grow their customer base to include underrepresented segments, better represent consumers on social media and have more diverse corporate structures and policies.

Brands should assess how inclusivity fits into the brand ethos and where inclusivity is a priority. Brands should consider a number of questions around the company’s vision, customers and internal operations as they undertake this exercise—the answers to which will help them determine the areas of focus and opportunity. We offer examples below:

Source: Coresight Research[/caption]

1. Determine Strategic Inclusivity Goals

The first step provides a roadmap for the organization; subsequent decisions and tasks should fall in line with the company’s strategic goals. There are opportunities for brands and retailers to incorporate inclusivity into products, grow their customer base to include underrepresented segments, better represent consumers on social media and have more diverse corporate structures and policies.

Brands should assess how inclusivity fits into the brand ethos and where inclusivity is a priority. Brands should consider a number of questions around the company’s vision, customers and internal operations as they undertake this exercise—the answers to which will help them determine the areas of focus and opportunity. We offer examples below:

- How is the brand perceived today?

- Is inclusivity being incorporated into the company’s corporate policies, procedures and management structure today?

- Is inclusivity part of the brand’s product strategy?

- How can diversity and inclusion fit into the brand’s strategic vision?

- Who is the customer today, and who is the target consumer for the future?

- How does the target consumer fit in with the brand's position?

Nike Go FlyEase hands-free shoe

Nike Go FlyEase hands-free shoeSource: NIKE[/caption] 2. Align Strategic Inclusivity Goals to the Organizational Structure and Through the Supply Chain Over the past year, brands and retailers have focused on increasing inclusivity organizationally through hiring and retention initiatives, updating policies and procedures, and mentoring. It is important for retail companies to align their strategic goals to specific actions and outcomes in terms of organizational structure, policies, procedures, and hiring and retention strategies. Retailers should also assess their brand and product portfolios to identify opportunities to improve diversity and inclusivity across vendor relationships and product placement. Social media also plays a role in how retail companies are responding to consumer awareness of, and demand for, brand authenticity and inclusivity. In June 2020, there was a #putuporshutup challenge on Instagram that was launched in light of the Black Lives Matter movement, challenging big beauty companies to reveal their true diversity on social media; this challenge was created on the premise that companies were promoting messages on social media that did not truly reflect their internal organizational structures. We further discuss social media later in this report, but this is one example of how changes in consumer awareness are influencing brands and retailers to be more transparent about their internal team structures and implement positive changes to incorporate diversity across ethnicity and gender, for example. Some organizations have been increasing diversity throughout the supply chain and through their brand portfolios. Specifically, we have seen a number of retailers—including Macy’s, Sephora, Ulta Beauty and West Elm—make pledges to increase shelf space for Black, Indigenous and People of Color (BIPOC)-owned brands. Other retailers, including Kroger, have committed to diversify their suppliers. In Figure 3, we highlight recent actions and announcements from selected brands and retailers globally whose strategic goals focus on increasing inclusivity and diversity through their internal structures or product and brand portfolios.

Figure 3. Inclusivity Developments from Selected Brands and Retailers

| Brand or Retailer | Date | Announcement |

| Changes to Organizational Structures | ||

| Macy’s | March 2021 | Macy’s releases its first Human Capital Report, which details its goals to increase representation at the senior director level and above to 25% ethnic diversity in 2021 and to 30% by 2025. |

| Best Buy | December 2020 | Best Buy’s five-year plan focuses on hiring BOPIC (Black, Indigenous and People of Color) and women. |

| Target | September 2020 | Target announces plans to increase representation of Black employees in its workforce by 20% over the next three years by “sharpening its focus on advancement, retention and hiring.” |

| Under Armour | July 2020 | Under Armour adds to its existing commitment of 30% of director positions being filled by BIPOC by announcing that it aims for 12% to be filled by Black talent by 2023. |

| Adidas | June 2020 | Adidas announces plans to increase the number of Black employees, with a minimum of 30% of all new positions in the US at Adidas and Reebok to be filled with Black and Latinx people. |

| Intel | May 2020 | In its Corporate Responsibility Report, Intel reveals plans to increase the number of women in technical roles to 40% and to double the number of women and underrepresented minorities in senior roles by 2030. |

| Changes to Brand and Product Portfolios | ||

| Ulta Beauty | February 2021 | Ulta Beauty pledges to double the number of Black-owned brands it carries in 2021 and invest $4 million in marketing support for these brands. |

| Macy’s | November 2020 | Macy’s allocates 15% of its shelf space to products made by Black-owned companies. |

| Kroger | October 2020 | As part of its Framework of Action Plan, Kroger pledges to increase spending from diverse suppliers from $3.4 billion in 2019 to $10 billion by 2030. The company’s supplier inclusion program includes partnerships BIPOC entrepreneurs, women- and veteran-owned brands and services, and businesses operated by the LGBTQ community and people with disabilities. |

| Lowe’s | September 2020 | Lowe’s invites entrepreneurs from underrepresented communities to pitch their products to Lowe's executives, for a chance to be sold online and in stores. |

| West Elm | July 2020 | West Elm allocates 15% of its shelf space to products made by Black-owned companies. |

| Sephora | June 2020 | Sephora allocates 15% of its shelf space to products made by Black-owned companies. |

- Coresight Research estimates that the US extended-size women’s clothing market will reach $32.3 billion in 2021, representing approximately 20.7% of the total women’s apparel market. According to the Centers for Disease Control and Prevention, 73.6% of all US adults over the age of 20 are overweight, which presents an opportunity for brands and retailers to tap into plus-size fashion.

- We expect spending in the US adaptive apparel and footwear market to total approximately $1.3 billion in 2021, with a total addressable market of $64.3 billion. In 2019, 41.1 million individuals reported disabilities in the US, according to the US Census Bureau—representing 12.7% of the US population. (Read our Think Tank on the purpose and promise of the US adaptive apparel market.)

- Inclusive beauty is an opportunity to reach consumers outside of traditional beauty parameters to include individuals of all races, skin tones and ages, as well as men, and non-binary and transgender individuals. We estimate that the inclusive beauty market will grow at nearly twice the CAGR of traditional beauty over the next five years in three primary areas: innovation and inclusion in beauty products for non-Caucasian women; male beauty products, going beyond grooming products to include light concealers and cosmetics; and products geared to baby boomers. These categories highlight that there are opportunities to expand offerings with an inclusive mindset; for example, male consumers are generally not thought of as underrepresented, but color makeup for men is somewhat new and requires a progressive and inclusive view.

- Unisex and gender-fluid designs are an opportunity to reach a broader consumer base as traditional concepts of masculinity and femininity evolve and push fashion boundaries. Gender-fluid fashion is being legitimized by celebrities such as British singer Harry Styles, who was featured on Vogue’s December 2020 cover wearing a Gucci dress and a Chopova Lowena belted skirt. American singer Billie Eilish modeled for leather luxury goods brand MCM Worldwide as part of its gender-fluid campaign launch. Gucci’s brand ambassador, Jared Leto, is also known to his 10.1 million Instagram followers for his boundary-pushing styles—such as metallic heeled boots. (Read our separate report on gender-fluid design.)

- The home category is present further opportunity for inclusive design options to better accommodate consumer needs. Strategic design and innovation consulting firm Smart Design developed its OXO Good Grips utensil line for individuals who have arthritis, making the product easier to hold by featuring rubberized material, ridged surfaces and side indentations. In April 2019, Target launched 20 sensory-friendly home products under its Pillowfort private label. The retailer reported that it designed the collection based on parents’ and kids’ feedback on their needs. The assortment includes sensory-friendly cushions, a foam-filled crash pad (as parents reported that their children liked to jump and roll), an indoor sensory tent and weighted blankets.

OXO Good Grips peeler

OXO Good Grips peelerSource: Smart Design[/caption]

- Inclusive packaging can use voice-activated codes for the visually impaired, as well as easy-open functionality and sensory-enhanced packaging. There are significant packaging opportunities in the FMCG sector. In October 2020, UK-based cereal company Kellogg’s produced a trial box design aimed to help blind and partially sighted people. The box that features a unique on-pack code that customers can scan with their smartphones to hear ingredients, allergen and recycling information read aloud to them. The innovation follows research from the Royal National Institute of Blind People, which found that 90% of blind and partially sighted individuals found information on food packaging difficult or impossible to read.

- Brand Extension—Target launched its Cat & Jack kids' and baby apparel and accessory private label in 2016. In the summer of 2017, Target expanded the label to include an adaptive line of 40 sensory pieces, featuring soft knits, flat seams and no tags. The technical scale of Target’s adaptive range is commensurate with the company’s value orientation and the scale of its operations; by choosing seamless and tagless solutions (relatively simple designs), the company is still able to serve a new consumer base while maintaining its value proposition.

Cat & Jack’s adaptive designs feature snap buttons for easier dressing and tagless construction for a smooth and comfy fit. Some products have openings for convenient abdominal access.

Cat & Jack’s adaptive designs feature snap buttons for easier dressing and tagless construction for a smooth and comfy fit. Some products have openings for convenient abdominal access.Source: Target[/caption]

- Product-Line Launches—Apparel brand Ministry of Supply was founded by MIT engineers in 2010 and has won awards for its technical innovations. The company’s ethos is at the intersection of fashion and function. Ministry of Supply launched its Kinetic Adaptive Pant for men and women in wheelchairs in October 2020 after extensive design and testing with Paralympians. Its pants can be made to order, with adjustments for catheter access and other features available depending on the customer’s individual needs.

- Category Creation—Tommy Hilfiger created an adaptive collection for children in 2016. The brand has grown over the past five years and now offers one of the largest selections of contemporary adaptive apparel designs for men, women and children with mobility and sensory challenges. The brand’s mid-range price points are accessible with a mid-range technical level, including magnetic closures.