DIpil Das

Introduction

What’s the Story? The Coresight Research Playbook series provides recommendations for brands, retailers and marketplaces seeking to tap growth segments and emerging trends. Coresight Research has identified corporate evolution, which includes venture capital (VC) funding, as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the end of this report for more details). In this Playbook, we present four key strategies and a four-stage action plan for retail players to capitalize on growth opportunities in VC funding. We discuss examples of the strategies across multiple retail categories, with a focus on the US market. We also present four approaches for retailers to counter key challenges. Why It Matters To devise effective VC financing strategies, brands and retailers should keep in mind the current trends prevailing in the global retail and retail-tech landscapes. Outlining a structured approach that breaks down complex VC funding activity into defined phases, steps and deliverables can ensure efficiency, consistency and standardization in VC financing outcomes. In 2021, the overall value of VC funding transactions in the US retail and consumer goods industry more than doubled from 2020, despite a slight reduction in the number of transactions: A total of 339 VC financing transactions were completed in the retail and consumer goods industry, valued at $6.5 billion, versus 373 in 2020, valued at $3.0 billion, according to Coresight Research analysis of S&P Capital IQ Pro data. We expect the strong VC financing trends, in terms of value, to continue in 2022 despite high inflation and the increase in interest rates: as of May 15, 2022, 115 VC financing transactions were completed year-to-date, raising $2.4 billion versus 139 VC investments raising $1.8 billion in the equivalent period last year. However, we also see the growing risks and fears of recession in the US, which could impact VC funding activities as economic contraction could affect retail startups’ access to equity capital and debt costs. VC financing transactions included companies in the consumer discretionary and consumer staples sectors, such as apparel and footwear stores, automotive retailers, breweries, consumer electronics manufacturers, food retailers, furniture and home-furnishing retailers, Internet and direct marketing retailers, packaged foods manufacturers, personal care products manufacturers, restaurants, sporting goods retailers and software retailers, among others.- Read our separate Think Tank report for more on VC funding—process, key benefits and challenges and noteworthy completed transactions.

Venture Capital Funding in Retail: A Playbook

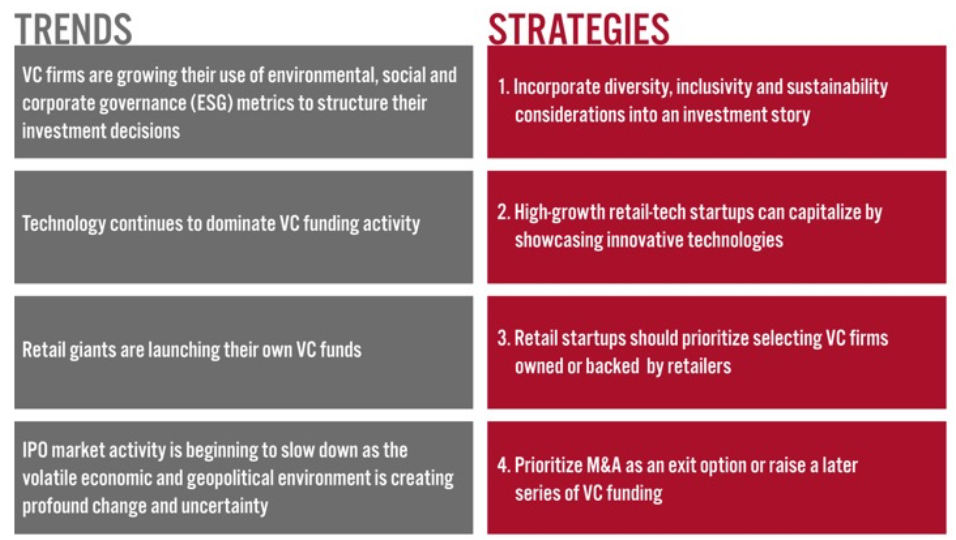

Four Key Strategies to Adopt to Recent Trends in VC Funding We present four key strategies that brand owners and retailers globally can adopt in response to recent VC funding trends. We summarize these trends and strategies in Figure 1 and discuss each in detail below, with examples.Figure 1. Four Key Strategies for Retailers to Adapt to Trends in VC Funding [caption id="attachment_150336" align="aligncenter" width="699"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

1. Incorporate Diversity, Inclusivity and Sustainability Considerations into the Investment Story

Diversity, inclusivity and sustainability will continue to be key themes in 2022 and beyond as retail companies and VC firms look at their environmental and social footprints and consider acquiring, rationalizing or divesting assets.

Brands and retailers should incorporate diversity, inclusivity and sustainability considerations into their investment story as VC investors see ESG as a key element to building a more sustainable business that can adapt well to potential market shifts—and many VC firms are specifically launching funds that invest in startups fully focused on sustainable and inclusive initiatives. For instance, in May 2022, UK-based private equity (PE) firm General Investment Management announced a $1.7 billion growth equity fund, which the company plans to invest in startups that promote sustainability, financial inclusion and people’s health.

Below we provide case examples of two retail startups with sustainability-focused or inclusivity-driven components that recently raised VC financing.

- Wildtype

In February 2022, Wildtype, a cell-cultivated seafood startup, raised $100 million in Series B funding—the largest ever for a cell-cultivated seafood startup. The funding was led by PE firm L Catterton and included a number of high-profile investors, such as Jeff Bezos, Leonardo DiCaprio and Robert Downey Jr. Wildtype provides a renewable and sustainable source of seafood through innovation across product development, process design and research and development—for instance, the company process involves isolating cells from salmon, which are grown in cultivators and free of antibiotics, mercury, microplastics and other contaminants.

At the time of raising VC funding, Wildtype’s Co-Founder Aryé Elfenbein said

This capital raise will allow us to deliver on the promise of cultivated seafood: protection of our oceans with a truly sustainable, nutritious, and contaminant-free source of seafood. Wildtype’s scaled-up production systems will also enable us to bring an unprecedented level of transparency and traceability to the salmon supply chain. We couldn’t be more excited to expand our existing partnerships and offer healthful seafood that is free of harm to both people and the planet.

In addition, American celebrity and environmentalist Leonardo DiCaprio commentedWildtype is the clear leader in cultivated seafood, which will give us the chance to protect our oceans while creating the cleanest seafood on the planet. Wildtype will surely transform our food system with its incredible salmon.

- Skims

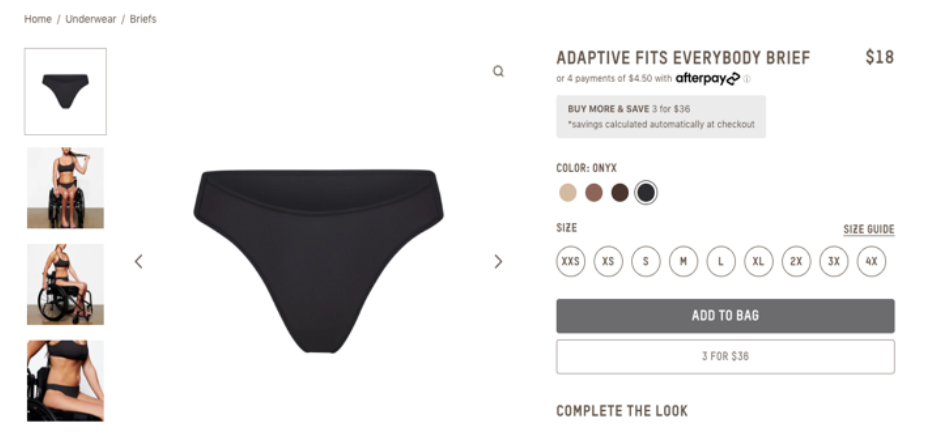

In January 2022, Skims, the US-based apparel brand co-founded by Kim Kardashian and Jens Grede, raised $240 million in VC funding. Skims’ key competitive advantage lies in its inclusive value proposition—for instance, its marketing campaigns focus on body positivity with unretouched images of women with disabilities and different body types, medical needs and racial backgrounds.

The company continues to expand its inclusive initiatives. For instance, in May 2022, Skims launched an adaptive collection, which contains bras and underwear specially designed for consumers with mobility impairments. Unlike other adaptive lines that feature magnets, Velcro and zippers, Skim’s adaptive underwear features hook and eye closures, which provide added accessibility—making it comfortable for consumers with disabilities.

[caption id="attachment_150340" align="aligncenter" width="699"] Skims’ adaptive bras and underwear

Skims’ adaptive bras and underwear Source: Skims [/caption]

2. High-Growth Retail-Tech Startups Can Capitalize by Showcasing Innovative Technologies

In 2022, we expect technology to continue to dominate VC financing activity: Year-to-date (as of May 15, 2022), Internet and direct marketing retailers raised the highest funding from VC firms among all retail sectors in the US—accounting for 30% of the total $2.4 billion raised during the period, according to Coresight Research analysis of S&P Capital IQ Pro data.

A strong growth opportunity and robust business models make e-commerce and retail-tech firms a VC investor favorite irrespective of profitability. E-commerce firms and retail-tech startups with a track record of strong sales growth and an experienced management team can capitalize on the opportunity and maximize the valuation in the exit phase. Retail-tech firms can add leverage by showcasing innovative technologies, including artificial intelligence (AI), augmented and virtual reality, 3D modelling, automated checkout and delivery technology, data analytics and machine learning, and internet of Things (IOTs)—when presenting competitive advantage in their investment stories.

Below we describe two fast-growing retail tech startups that recently raised VC funding in the US.

- Wasoko

In March 2022, African business-to-business (B2B) retail and e-commerce platform and payment service provider Wasoko (earlier known as Sokowatch) raised $125 million in Series B VC funding, valuing the company at $625 million. The investment was led by the US-based venture capitalists Tiger Global and Avenir Growth Capital. Wasoko plans to utilize the funding to enhance its product offerings and expand into new geographies.

Since its founding in 2016, Wasoko has witnessed strong growth: Between 2016 and 2021, the company has delivered 2.5 million orders from suppliers to over 50,000 active retailers in the company’s network. In 2021, Wasoko’s revenues increased by 500% year over year.

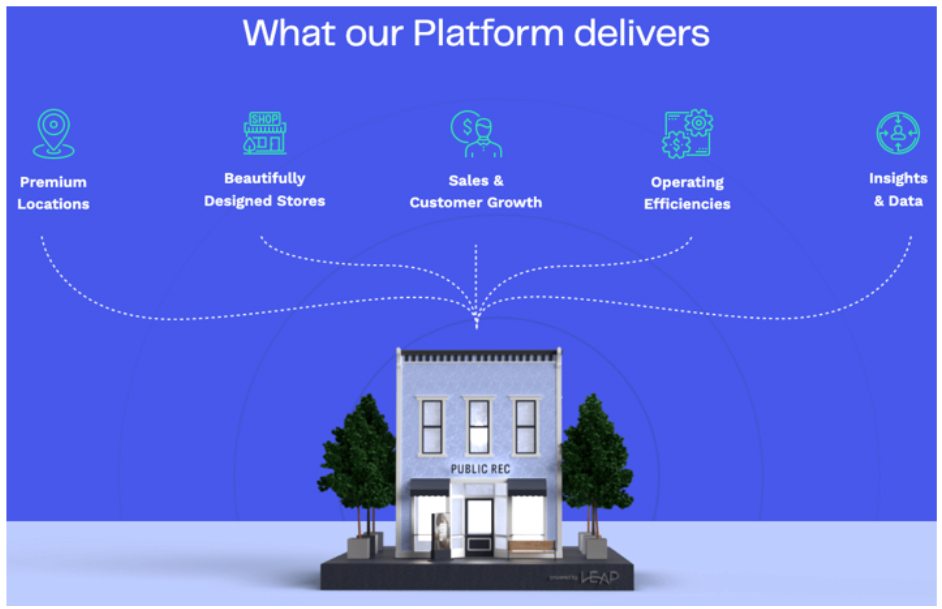

- Leap

In January 2022, retail-as-a-service platform Leap raised $50 million in Series B financing. Leap plans to utilize the new round of funds to fast-track growth through significant investments in its platform and store location network. Leap’s sales have quadrupled in 2021, according to the company.

As of January 2022, over 500 brands have registered with the company, and the Leap platform has enabled over 30 brands, including digitally-native apparel and footwear companies Birdies, Something Navy and ThirdLove, to deploy physical stores equipped with omnichannel technology and sales teams versus the traditional approach of doing it all in-house. It has helped brands to overcome growing costs in their digital marketing channels and supply chain and to create sales synergies. Brands can determine brick-and-mortar locations, merchandising and operations by capitalizing on Leap’s proprietary algorithms and millions of data points. In addition to brands, Leap works with mall landlords to build shopping centers armed with digital technologies.

[caption id="attachment_150344" align="aligncenter" width="701"] Leap’s retail-as-a-service platform offerings

Leap’s retail-as-a-service platform offerings Source: Leap [/caption]

3. Retail Startups Should Prioritize VC Firms Owned or Backed by Retailers

Retail startups should prioritize VC firms owned or backed by leading retailers and brands that have relevant domains of expertise in the startups’ respective retail industries to ensure vision alignment and efficiency while increasing the chance of success.

Retail giants across the globe have started launching their own VC firms to fund companies in emerging retail and sustainable technologies. For instance, in May 2022, home-improvement retailer Home Depot launched a $150 million venture capital fund, known as “Home Depot Ventures,” to support mainly early-stage and growth-stage companies that can bolster Home Depot’s ability to develop innovative and differentiated capabilities and offer a seamless interconnected consumer shopping experience.

At the time of the launch of the venture capital fund, the company noted that Home Depot Ventures is built on its successful history of investments in retail-tech startups, such as Internet of Things (IoT) platform Afero, freight technology company Loadsmart, digitally native home renovation platform Made Renovation and delivery platform Roadie, that have delivered strong business partnerships and consistent returns on investments (ROI).

In May 2022, French beauty conglomerate L'Oréal launched a new program under its venture capital fund BOLD (Business Opportunities for L'Oréal Development)—known as BOLD Female Founders. BOLD Female Founders will make investments in female-led startups to promote gender equality. At the time of the launch of BOLD Female Founders, L'Oréal’s CEO Nicolas Hieronimus said, “Today, 30% of the startups of our BOLD venture capital fund are led by women. With BOLD Female Founders, we want to accelerate our venture capital investment to support female entrepreneurship.”

With an initial allocation of €25.0 million ($26.7 million), BOLD Female Founders will invest globally across the wider beauty ecosystem, including beauty brands, beauty-tech and green science.

[caption id="attachment_150346" align="aligncenter" width="700"] In May 2022, L'Oréal launched its BOLD Female Founders program to invest in female-led startups

In May 2022, L'Oréal launched its BOLD Female Founders program to invest in female-led startups Source: L'Oréal [/caption]

Similarly, Amazon recently launched a series of corporate venture funds. In April 2022, Amazon launched a $1 billion venture capital fund, known as the Amazon Industrial Innovation Fund, to invest in companies working in the field of artificial intelligence (AI), customer fulfillment, logistics, robotics and supply chain innovation. The company noted that the first round of investments of the newly launched fund will focus on wearable technology.

Earlier in April 2021, Amazon launched the $250 million Amazon SMBHAV Venture Fund to invest in Indian retail-tech startups that focus on the digitization of small and medium-sized retail businesses in the key overseas market. Previously, in June 2020, Amazon launched the $2 billion Climate Pledge Fund, which focuses on clean, green and sustainable retail technologies. As of October 2021, Climate Pledge Fund has invested in 11 companies, including Resilient Power, a US-based electric vehicle (EV) charging infrastructure provider, and CMC, an Italy-based designer and manufacturer of technology for e-commerce, graphic arts, logistics and mailing.

4. Prioritize M&A as an Exit Option or Raise a Later Series of VC Financing

Initial public offering (IPO) is one of the key exit options for VC-backed retail startups. However, IPO market activity in the retail sector is beginning to slow down: As of May 15, 2022, 13 retail-focused IPOs were listed on the US stock exchange year-to-date, raising $1.1 billion versus 17 IPO debuts raising $10.4 billion in the same period last year, according to Coresight Research analysis of S&P Capital IQ data. The current trend suggests that there could be lower IPO listings (both in terms of count and valuations) in the US retail sector in 2022 (versus 2021), due to a slew of headwinds, such as high inflation, rising interest rates and geopolitical uncertainty.

In addition, in the first quarter of 2022, only 28 VC-backed companies (across all sectors, not specific to retail) chose IPO as an exit option in the US, while 224 VC-backed companies pursued M&A as an exit option, according to US-based financial data and technology provider Pitchbook. This suggests that a large number of VC-backed companies (across all sectors, not specific to retail) are prioritizing M&A as an exit option over IPOs in the current scenario of extremely volatile and uncertain public markets across the globe.

We advise VC-funded retail startups looking for exits to evaluate various M&A offers and choose the most appealing ones. When a VC firm receives an attractive offer from a major player to buy the integrated company, it can sell off the investment, generating profits for each of the investors and the business founder.

Alternatively, VC-backed retail startups can go for a later series of VC funding, such as Series D and even Series E rounds (Series A, B and C are the most common rounds of VC financing), if they have not achieved stated goals during the last round of funding or if they are looking for a final push before an IPO.

A Four-Step Action Plan for Retailers Seeking to Raise Funds Via VC Financing We identify four steps that brands and retailers can take when seeking to raise funds via VC financing. We summarize this action plan in Figure 2 and discuss each step in detail below.Figure 2. Four-Step Action Plan for Retailers Seeking to Raise Fund via VC Financing [caption id="attachment_150349" align="aligncenter" width="699"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

1. Develop a Powerful Investment Story

A powerful investment story is a key to enticing VC firms. This is because VC investors view the retail startups seeking funds as the financial instruments with certain distinct features, including in terms of profitability and liquidity prospects.

We believe that brands’ and retailers’ investment stories should be fascinating in order to attract VC investments. We suggest the inclusion of the following three key components in an investment story to make the retail startup look appealing to VC investors.

- Business Model, Total Addressable Market (TAM) and Competitive Positioning

Retail startups should include their business models in detail in their investment stories. A proven business model is highly attractive, particularly for Series A investment. Relatedly, brands and retailers should ensure that their story includes their total addressable market (TAM)—market size and target audience—and major competitors in the market and the company’s advantage against them.

Retailers should also highlight any differentiator—that is, how their products or solutions are different from what is currently available in the target market. Additionally, startups that exhibit domain expertise can foster confidence among VC investors to invest.

- Financial Metrics and Business Valuation

Financial metrics help VC firms to understand the overall financial health of the retail startups. Some of the most common financial growth metrics VC firms look at while financing startups are revenues CAGR, cost of goods sold, customer acquisition costs, gross and operating margins, return on investment (ROI) and operating cash flows.

In addition, presenting business valuation in the investment story appeals to VC investors. The most common methods for determining the business valuation of startups include discounted cash flow methods (projecting future cash flows of the company and discounting it at an interest rate to determine the present intrinsic value of the business) and profit multiples, such as enterprise value (EV) to EBITDA ratio—the lower this ratio, the more VC firms find the retail startups attractive.

- Diverse, Inclusive and Sustainable Initiatives

As we mentioned earlier, brands and retailers should emphasize their sustainable, diverse and inclusive initiatives in their investment stories to entice VC investors in a dynamic retail landscape.

2. Build a Dedicated Fundraising Team Comprising Core Members and Advisors

To successfully manage the VC investment pathway, brands and retailers should build a dedicated fundraising team comprising core members—such as key company executives—and advisors. Dedicated core members with committed time, capital, and relevant background and experiences can bolster VC firms’ confidence to invest. This core team can also help with articulating the next steps toward the company’s vision. VC investors typically place a huge weight on their perception of the company’s management abilities.

In addition, retailers should include advisors with relevant experience in raising capital via VC financing in their fundraising teams. These advisors usually comprise accountants, attorneys, industry executives and professional investors.

3. Select the Right VC Investors

Like any other major financing transaction, VC funding involves complex processes, and retailers should conduct ample checks when selecting a VC firm. Some of the key considerations include:

- VC Firm’s Network Base and Sector Specialization

Retail startups should look to collaborate with a VC firm that has solid networks and can introduce them to future funding options. Looking deep into the VC firm’s operational structure, funding history and management experience can provide a fair idea of the VC firm’s network base.

In addition, retailers should search for VC firms that have a specialization in their respective retail industries. Startups will have a higher chance of success if they collaborate with VC firms that have relevant domains of expertise—as VC firms can support them with advice and talent, along with money.

- VC Firm’s Past Financial Track Record

Retailers must substantiate the past financial successes of VC-backed projects in terms of return and risk. The key metrics to evaluate a VC firm performance are total value to paid-in capital (TVPI) and internal rate of return (IRR).

- TVPI is calculated as the total value of the VC fund’s holdings (realized and unrealized) divided by the amount of money the limited partner has paid into the fund. The higher this ratio, the more startups find the VC fund attractive.

- IRR is the approximate annual rate of growth an investment is expected to generate over a certain period. The IRR calculation involves trial and error using the net present value (NPV) method—which equates the present value of future cash flows with the initial investments made.

- Vision Alignment and Flexibility in Deal Structuring

Retail startups should ensure that the VC firm’s vision is aligned with the company’s vision to generate robust values across key functions, including product development, promotions and sales. Many VC firms can be more shortsighted than startup founders. A short-term focus on ROI could impact the survival of a promising startup. Therefore, retailers and VC firms should develop a clear understanding with regards to exit aspiration, whether it is IPO or M&A.

Additionally, retailers should seek out flexibility in VC funds according to the developmental phase of the company: seed, startup and expansion. For instance, during the expansion stage, the retail startup should raise a Series B round of funding through VC firms that specialize in the later stages of funding.

4. Efficiently Prepare and Manage the Capitalization Table

Early-stage retail startups should prepare a detailed capitalization table, listing ownership and pricing of common stocks, preferred stocks and stock warrants, among other securities. Retailers and brands should administer the capitalization table efficiently as the recording of capital transactions (with accuracy and timeliness) could become complicated after a few rounds of funding and with exits, such as IPO and M&A. In addition to recording of various capital transactions, the capitalization table should include several financial and legal documents, such as those related to the issue of right or bonus securities and dividend, stock ownership transfers and dilution, and conversion of debt to equity.

The capitalization table can be used by retail startups for numerous purposes in VC financing, such as raising a new round of VC funding, hiring new company executives, allocating employee stock options (ESOP), meeting regulation and tax compliances related to raising capital and pursuing exit valuations, such as in the case of IPO and M&A.

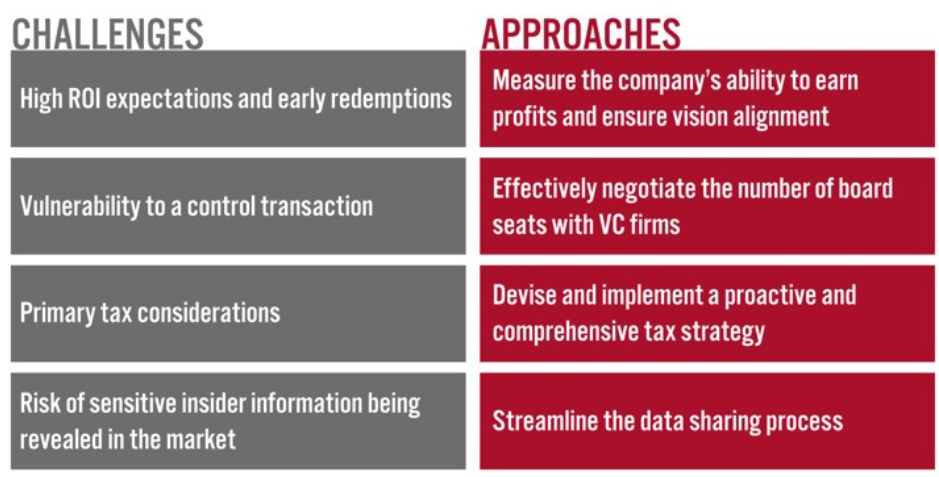

Four Approaches for Retailers to Counter Key Challenges We identify four approaches that retailers and brand owners can deploy to address key challenges relating to VC financing. We summarize these four approaches in Figure 3 and discuss each in detail below.Figure 3. Four Approaches for Retailers to Counter Key Challenges in VC Financing [caption id="attachment_150350" align="aligncenter" width="701"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

1. Measure the Company’s Ability to Earn Profits and Ensure Vision Alignment

Some VC firms may choose to redeem their total investments within three to five years and require a high ROI in the medium term itself, which can often elevate the already high pressure that the startups’ founders experience, particularly if the owner’s business plan will take a longer time to provide liquidity. In addition, VC firms’ stringent and over-ambitious conditions of attaining higher returns can be challenging—particularly amid the current volatile economic environment and geopolitical uncertainty.

We advise brands and retailers to evaluate their abilities to meet VC investors’ expectations of returns before entering into a VC transaction and also ensure that the VC firms’ medium-to-long-term vision aligns with the company’s vision. We suggest retailers implement strong budgeting tools, including robust financial models, to ensure accuracy in their financial metrics forecasts. Retailers can choose either independent budgeting tools or ones that are built in their enterprise resource planning (ERP) system based on their suitability and requirements.

2. Effectively Negotiate the Number of Board Seats with VC Firms

Another major issue is the potential loss of the company’s control and autonomy. The controlling shareholders’ equity interest and voting interest in the company are usually lowered post-VC funding, which could make the retailer vulnerable to a control transaction.

To tackle this issue, retail startups can efficiently negotiate the number of board seats with VC investors. The lower proportion of seats the VC investors have, the lesser control they will have for key issues that require the company’s board approval—such as the sale of the company in the exit phase or raising future rounds of financing.

3. Devise and Implement a Proactive and Comprehensive Tax Strategy Tax considerations remain a key issue for VC-funded retail startups. Brands and retailers can address the tax implications by devising a proactive and comprehensive tax strategy that includes the impacts of legal and regulatory changes and incorporates value-added models. Below, we present some of the key aspects of tax planning that retailers should consider when entering the VC financing transactions:- Build an Independent Tax Team In-House

Retailers and brands should build an independent in-house tax team that can develop a tax structure with proper tax controls, and suitable financial procedures and reporting environment. While retail startups with limited resources benefit from outsourcing tax teams, some startups make an early decision to invest in comprehensive tax technology to bring the tax team in-house from the very start. Retailers can analyze both outsourcing and in-house options to decide what works best for the company.

- Streamline Tax Documentation

VC-funded retail startups looking for exit options, such as IPO and M&A, should streamline the tax component in advance by collecting and summarizing the tax-related information that would be required for due diligence procedures. Additionally, a company should ensure that all provided tax-related information is up to date and verifiable. As a lot of tax-related data has legal consequences, it is essential that all parties involved, including the startup and legal advisors, dig deep within the tax documentation to identify and fix any potential tax issues.

- Keep Track of Potential Tax Legislation

Retail startups should take into account potential changes in tax legislation. For instance, in March 2022, the Democrats in the US House of Representatives proposed an increase in the corporate tax rate to 28.0% from 21%.

4. Streamline the Data Sharing Process

Another key challenge in VC funding is the investor’s access to sensitive insider information from retailers raising funds. Any leak of such information can pull down the success rate of the company, as well as hurt the branding and reputation of the retailer.

To tackle this challenge, brands and retailers can streamline the data sharing process by taking various measures, such as building an online data room and maintaining a data tracking system. Retail startups can create an online data room for providing access and sharing files and documents with VC investors in a structured manner. Additionally, the retailer should maintain their own data tracking system to track when and what data has been shared with VC investors. This way, the retail startup can track access and return of any sensitive information from VC firm. The data tracking system can also be supportive in speeding-up the overall VC financing process.

What We Think

While we expect the strong VC financing trends in retail, in terms of value, to continue throughout this year, we also see the growing risks of a US recession, which can lead to the abandonment of considerable potential VC financing deals in 2022. An overall uptick in the value of retail-focused VC financing activity could well intensify the competition for investment, placing greater focus on preparing early for VC funding. However, navigating the VC investments pathway is an immense undertaking, and retailers should evaluate the resource and time commitment required, as well as weigh the pros and cons of VC financing. As discussed in this Playbook, developing a structured approach and action plan can ensure efficiency and standardization in VC financing outcomes. Getting acquainted with the current trends prevalent in the global retail and retail-tech landscapes, as well as IPO and M&A markets, can help retailers devise efficient strategies, both for entering into VC financing transactions and for exits. Likewise, empowering a dedicated fundraising team, comprising core company executives and legal and financial advisors—with prior relevant experience and sound knowledge of the business strategy, current operations and objectives—can be helpful in the successful transformation of the VC-funded business.Implications for Brands and Retailers

- Retail startups should keep pace with new trends and opportunities. Sound strategic planning in response to emerging trends will help retail companies successfully navigate the VC investments pathway.

- Devising and implementing an efficient and structured action plan can help retailers maximize VC financing benefits—such as an expansion of market opportunity—while minimizing risks, including legal and tax compliance.

- As the VC funding process is only the beginning of a retailer’s journey to the capital market, retailers should consider the long-term consequences, and devise approaches to resolve the key challenges arising out of the transactions, such as high ROI expectations, early redemptions from VC firms and loss of autonomy.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.

RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework.

The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments.

Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

Appendix Figure 1. RESET Framework [caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]