Nitheesh NH

What’s the Story?

The Coresight Research Playbook series provides recommendations for brands, retailers and marketplaces seeking to tap growth segments and emerging trends. In this Playbook, we present four key strategies and a four-stage action plan for retail players to capitalize on growth opportunities in traditional M&A (mergers and acquisitions) and SPACs (special purpose acquisitions companies). We discuss examples of the strategies across multiple retail categories, with a focus on the US market. We also present two approaches for retailers to counter key challenges.Why It Matters

Outlining a structured approach that breaks down a complex M&A integration activity into defined phases, steps and deliverables can ensure efficiency, consistency and standardization in M&A outcomes. To devise effective M&A and SPAC strategies, brands and retailers should keep in mind the current trends prevailing in the global retail and retail-tech landscapes. Below, we summarize recent M&A and SPAC activity in the US.- Read our separate reports for more on noteworthy M&A completed transactions and opportunities in SPACs.

M&A

The rate of traditional M&A transactions in US retail has massively accelerated in 2021. As of September 20, 2021, 196 retail and consumer goods M&A transactions have been completed in the US, raising $80.6 billion—higher than the 96 M&A completed transactions in the equivalent period last year, valued at just $44.5 billion, according to Coresight Research analysis of S&P Capital IQ data. We expect this trend to further accelerate moving into 2022. The M&A transactions in 2020 and year-to-date 2021 included companies in the consumer discretionary and consumer staples sectors, such as apparel and footwear specialty stores, automotive retailers, breweries, consumer electronics manufacturers, food retailers, furniture, home-furnishing and garden supply retailers, Internet and direct marketing retailers, packaged foods manufacturers, personal care products manufacturers, restaurants, sporting goods retailers, and software retailers, among others. SPACs The SPACs trend has also gained traction in 2021. As of August 18, 2021, 484 SPACs have been listed for IPO (initial public offering) in the US, raising $125 billion—more than 50% higher than the full-year tally for 2020—according to S&P Capital IQ Pro. Most of the SPAC growth acceleration this year was in the first calendar quarter, which saw 320 SPAC IPOs raise $88 billion. The second quarter of calendar 2021, saw an 82% quarter-over-quarter decrease in the SPAC issuance—only 110 SPAC IPO transactions took place, raising a total of $16 billion. The retail and consumer goods sector remains an attractive target for SPACs in the US. From August 1, 2020, to September 4, 2021, we saw 24 completed SPAC merger transactions (accounting for about 16% of the total completed SPAC mergers during the period) in consumer discretionary and consumer staples sectors.M&A and SPACs in Retail: A Playbook

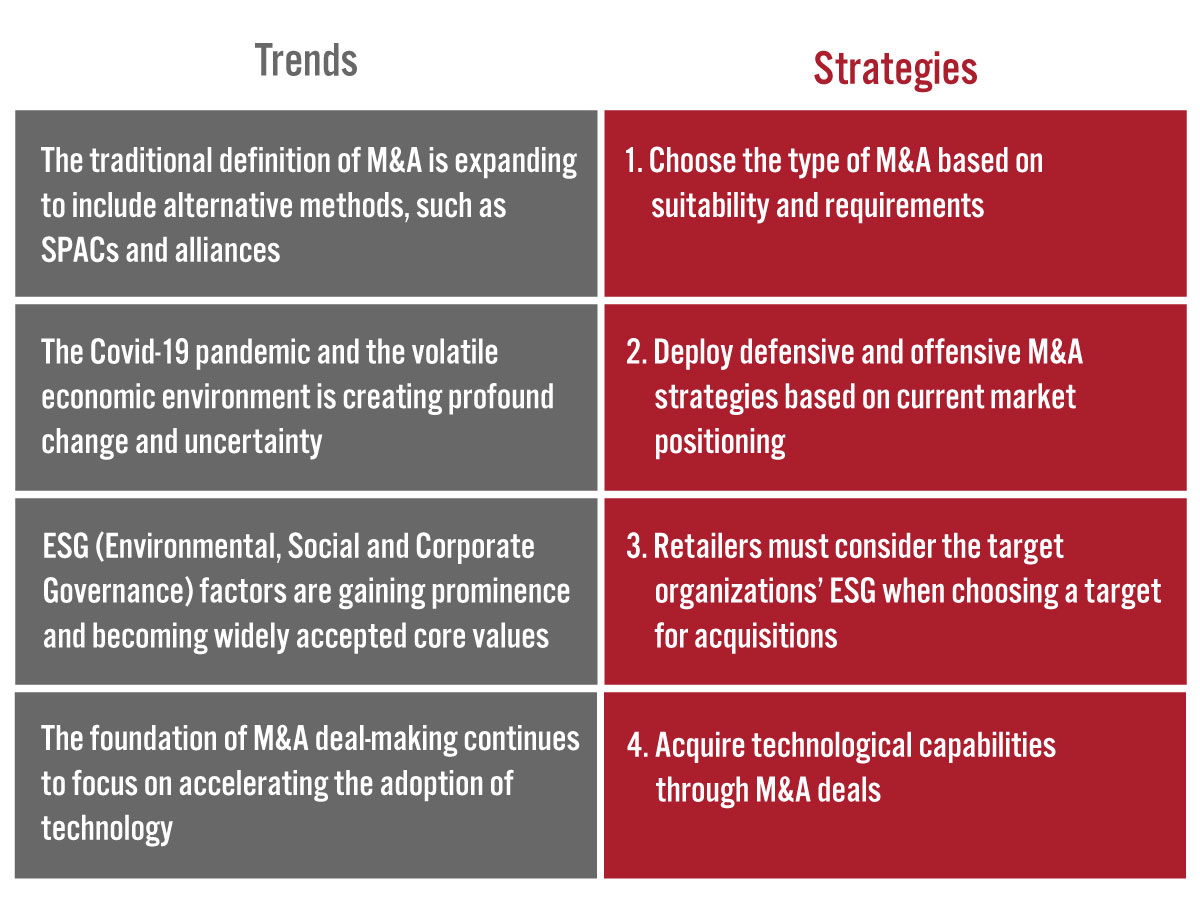

Four Key Strategies To Adapt to Recent Trends in M&A We present four key strategies that retailers and brand owners globally can adopt in response to recent M&A trends. We summarize these trends and strategies in Figure 1 and discuss each in detail below, with examples.Figure 1. Four Key Strategies for Retailers To Adapt to Trends in M&A [caption id="attachment_136581" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Choose the Type of M&A Based on Suitability and Requirements

The traditional definition of M&A is broadening rapidly to include alternative methods, such as SPACs and joint ventures. This is because the economic impact of the pandemic has forced companies to consider every option rather than just buy-side and sell-side in the traditional M&A. For instance, many retailers and brand owners are going public and merging with other companies via SPAC transactions.

Source: Coresight Research[/caption]

1. Choose the Type of M&A Based on Suitability and Requirements

The traditional definition of M&A is broadening rapidly to include alternative methods, such as SPACs and joint ventures. This is because the economic impact of the pandemic has forced companies to consider every option rather than just buy-side and sell-side in the traditional M&A. For instance, many retailers and brand owners are going public and merging with other companies via SPAC transactions.

- In June 2021, Germany-based online sporting goods retailer Signa Sports entered into a business combination agreement with the US SPAC Yucaipa Acquisition Corporation to enter the US public market. The deal valued the combined company at $3.2 billion and is set to complete by the end of fiscal 2021. Furthermore, as part of the agreement, Signa Sports will acquire its UK-based online rival Wiggle (financial terms have not been disclosed). For fiscal 2021, ended September 30, 2021, Signa Sports and Wiggle expect to generate a combined $1.6 billion in net revenues. Signa stated that it expects the deal to provide around $645 million in gross proceeds, including $345 million in cash and private investment in public equity of about $300 million, for the company to bolster product line growth and boost international expansion. Signa Sports’ CEO Stephan Zoll said in the merger announcement, “Becoming a listed company allows us to continue capturing market share in Europe and to accelerate our US and international expansion while scaling our platform solutions.”

- Beauty giant Estée Lauder entered into an agreement in February 2021 to increase its stake from 29% to 79% in the Canada-based, vertically integrated, multibrand beauty company DECIEM Beauty Group for $1.0 billion—reflecting a total enterprise value of about $2.2 billion for the first phase, according to Estée Lauder. The transaction closed in DECIEM’s second quarter, ended June 30, 2021. Estée Lauder’s management said that it expects to have a non-cash gain on its initial investment in the first phase. Excluding this non-cash gain, DECIEM’s revenues and EPS had a negligible impact on Estée Lauder’s fiscal 2021 (ended June 30, 2021) results. Estée Lauder will purchase the remaining stake in DECIEM after a three-year period.

- UK-based sportswear and footwear retailer JD Sports Fashion’s acquired US-based athletic apparel and footwear retailer DTLR Villa for $495 million in March 2021. As of February 1, 2021, DTLR owned and operated 247 stores across 19 states, mainly in the eastern and northern US.

- In December 2020, JD Sports acquired US-based footwear retailer Shoe Palace for $325 million, providing the British retailer a robust geographical footprint in the western US through a network of 167 stores. JD Sports’ push into the US market commenced in 2018 through the $558 million acquisition of athletic apparel and footwear retailer Finish Line.

- LVMH-owned beauty company Sephora entered into an agreement in July 2021 to acquire UK-based prestige beauty e-commerce player Feelunique. With this acquisition, Sephora will take on Feelunique’s 1.3 million active customers and 35,000-product cosmetic and fragrance portfolio. The acquisition is set to complete between March and July next year, according to Sephora. Martin Brok, CEO and President of Sephora, said, “The transaction is a key step in Sephora’s European growth strategy and marks a first step for Sephora’s presence in the UK. UK consumers have a strong appetite for a carefully curated prestige beauty offer that is tailored to their needs and provided through a consumer-centric, seamless experience.”

- In June 2021, Sephora partnered with Germany-based apparel e-commerce company Zalando to create a “new, innovative online prestige beauty experience for millions of Zalando customers,” according to the companies.

- In February 2020, Beiersdorf, a Germany-based manufacturer and retailer of personal care products, acquired clean cosmetics company “Stop The Water While Using Me!” and noted the target company’s sustainable nature as one of the reasons behind the deal. In the acquisition statement, Iain Holding, General Manager of Beiersdorf Germany/Switzerland, said, “Sustainability is a top priority at Beiersdorf. That is why we are thrilled that Beiersdorf is partnering with this strong, purpose-driven brand... We will bring together our combined expertise, beliefs and talents in increasing our sustainable contribution for our consumers and the environment.”

- Also, in February 2020, e.l.f. Beauty acquired cruelty-free beauty brand W3LL People for $27 million. e.l.f. Beauty’s CEO Tarang Amin stated, “Clean beauty is a strategically important segment given consumer sentiment and strong growth rates.”

- Dot Foods, one of the largest foodservice redistribution companies in the US, acquired ShopHero, a US-based grocery-focused e-commerce technology company, in June 2021. ShopHero provides a customized e-commerce platform enabling hundreds of retailers across the US and Canada to establish affordable online shopping experiences and further build their brands. In the acquisition statement, Dot Foods’ CEO said, “We love the ShopHero business model. At Dot, we are always looking for innovative solutions, and that is exactly what ShopHero delivers every day. They are experts in retail grocery e-commerce solutions and help their customers compete in an evolving, more digital retail environment.”

- E-commerce giant Amazon entered the autonomous vehicle market through the acquisition of US-based autonomous vehicle company Zoox for $1.3 billion in June 2020. Amazon had previously invested in self-driving vehicle startups, including Aurora and Rivian; however, this is the retailer’s first acquisition in the space. Although Amazon already has an internal automation team, Zoox’s acquisition provides an instant lift in operational efficiencies, scale and sophistication. Zoox’s acquisition will likely increase automation in Amazon’s distribution network, mainly its last-mile delivery system—complementing the company’s existing initiatives, including its Amazon Air drone delivery system.

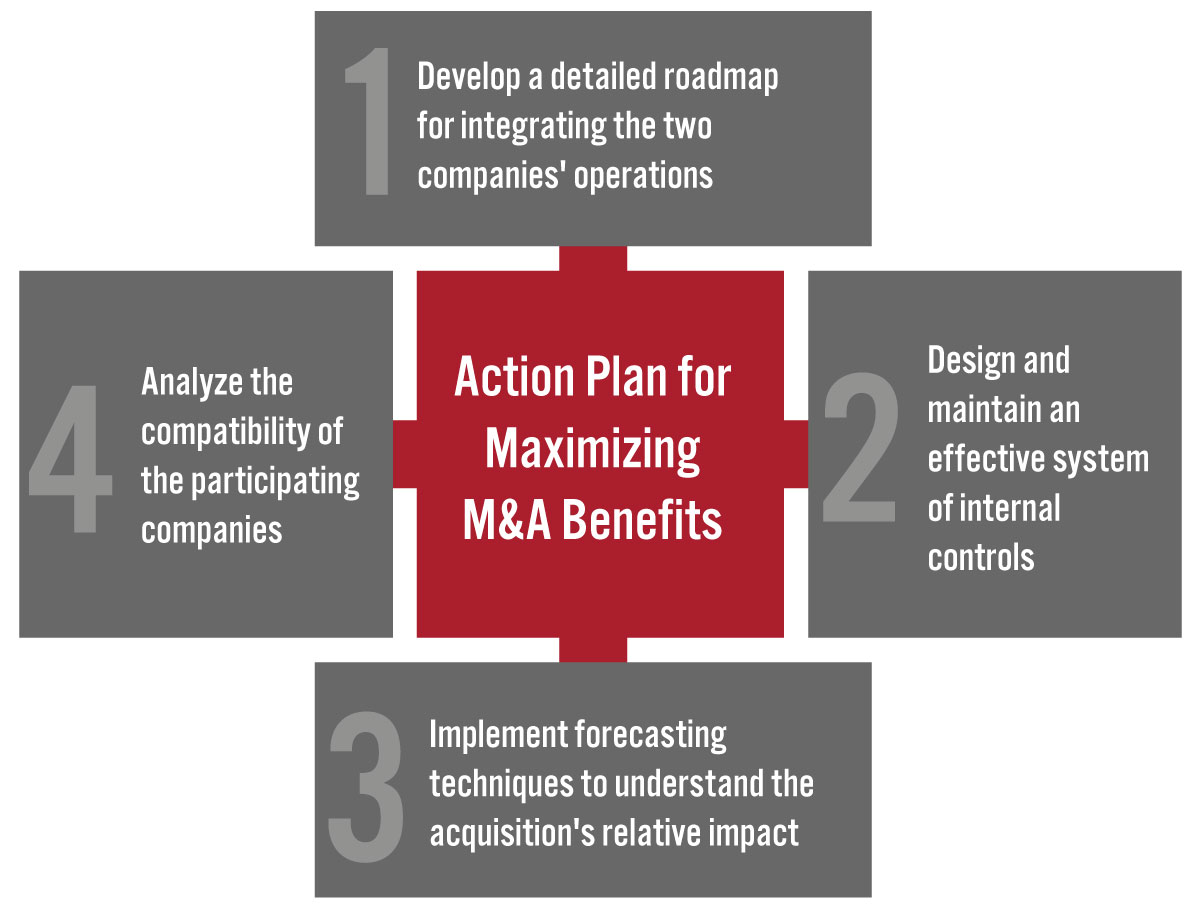

Figure 2. Four-Step Action Plan for Retailers To Maximize Benefits from M&A Deals [caption id="attachment_136582" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Develop a Detailed Roadmap for Integrating the Two Companies’ Operations

While post-merger integration plans vary in structure, retailers need to take early steps, prior to the deal’s close, to avoid disarray and disruptions in operations and ensure a smooth transition. Managing the complexities of post-merger integration requires a disciplined and systematic process governed by a detailed roadmap.

We suggest the inclusion of five key components in an M&A integration roadmap, which we detail below.

Source: Coresight Research[/caption]

1. Develop a Detailed Roadmap for Integrating the Two Companies’ Operations

While post-merger integration plans vary in structure, retailers need to take early steps, prior to the deal’s close, to avoid disarray and disruptions in operations and ensure a smooth transition. Managing the complexities of post-merger integration requires a disciplined and systematic process governed by a detailed roadmap.

We suggest the inclusion of five key components in an M&A integration roadmap, which we detail below.

- Selection of a team of experienced leaders and advisors

- Formulation of the purpose and direction of newly merged entity

- Establishment of a framework for the functioning of the newly merged entity

- Establishment of objectives for key functional areas

- Establishment of time and sequence for execution and monitoring

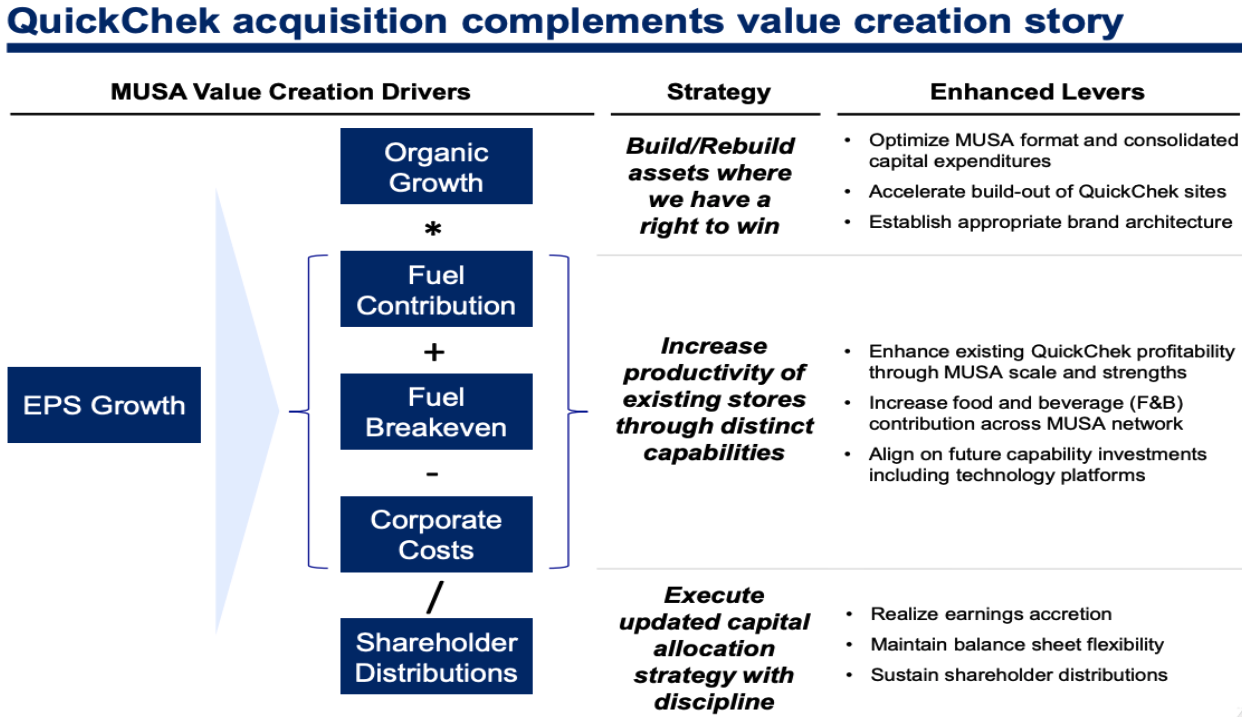

- Gas station and convenience store chain Murphy USA acquired convenience store chain QuickChek for $645 million in February 2021. Through the acquisition, Murphy USA added 157 stores in the Northeast region, increasing its total store count to over 1,650. Murphy USA’s CEO Andrew Clyde has stated that the acquisition of QuickChek enabled the company “to obtain the capabilities we needed immediately and accelerate by turning up the learning curve while leveraging a unique and distinctive brand in a new geography with a similar culture and aligned aspirations for future growth.” Clyde noted that the M&A integration will be a mutually inclusive process, where Murphy USA will capitalize its gasoline supply and retail pricing expertise to optimize QuickChek’s operations while benefiting from the latter’s food and beverage offerings. Murphy USA is ramping up its foodservice program and has a multi-year pipeline of stores under contract for both Murphy USA and QuickChek. Murphy USA expects the acquisition to generate a synergy of $28 million within three years of integration, the company reported.

QuickChek’s acquisition complements Murphy USA’s existing value creation story

QuickChek’s acquisition complements Murphy USA’s existing value creation storySource: Murphy USA[/caption] Two Approaches for Retailers To Counter Key Challenges We identify two approaches that retailers and brand owners can deploy to address key challenges in M&A/SPACs. We summarize these two approaches in Figure 3 and discuss each in detail below.

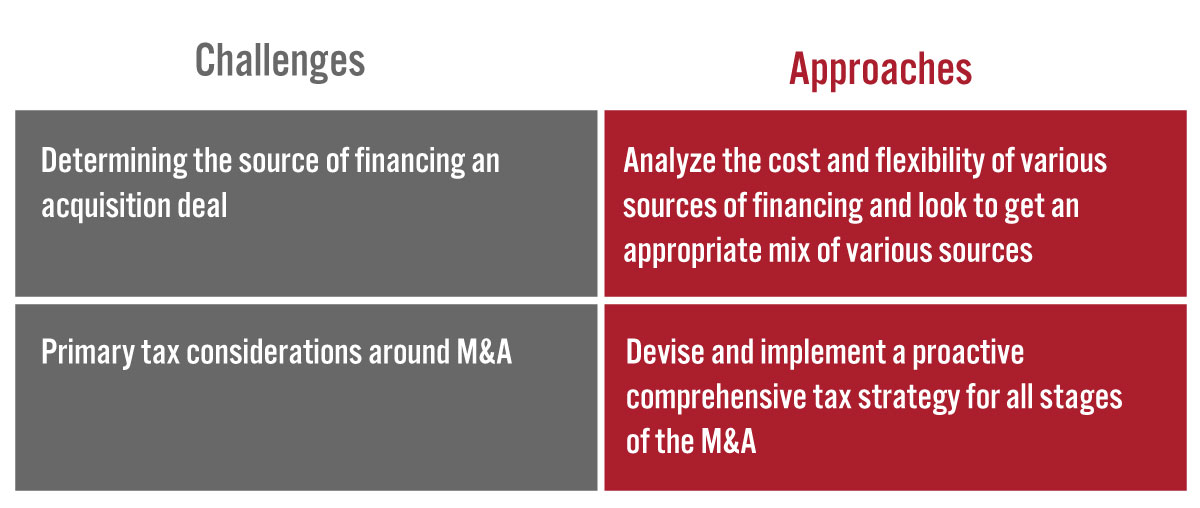

Figure 3. Two Approaches for Retailers To Counter Key Challenges in M&A/SPACs [caption id="attachment_136587" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Analyze the Cost and Flexibility of Various Sources of Financing

An acquisition can be financed through various sources, including cash, debt, equity, stock swaps, leveraged buyout and seller’s financing. However, complexities arise in determining optimal acquisition financing and its alignment with the nature and purpose of the deal.

The acquisition finance structure should offer sufficient flexibility so that it can be altered to fit different contexts, such as SPACs or alliances. One way to achieve flexibility is by incorporating the cash-flow generating capacity of participating retailers and the strength of their asset base in the acquisition financing structure. While debt financing is substantially cheaper than equity financing, the interest component on debt constrains the flexibility of the acquiring company. We believe that established and mature retailers with stable cash flow and lesser capital expenditures can better capitalize on low-cost debt financing, while equity financing is more appropriate for fast-growing companies that compete in volatile markets and need huge amounts of capital to fund their future growth.

Nevertheless, acquisition financing is complex, often involving multiple sources, particularly for larger acquisitions. The finance structures usually require many combinations and variations. With several alternatives available to finance an acquisition, retailers and brand owners should look to establish the appropriate mix of financing, which offers the lowest cost of capital while providing financial and operational flexibility. One way to do this is to build an enterprise valuation model, which evaluates the estimated future returns and the cost of the M&A (using the various sources of financing, including cash, equity and debt, among others) and selects a financial means that provides maximum benefits relative to costs.

Devise and Implement a Proactive and Comprehensive Tax Strategy

Tax considerations remain a critical issue, both in traditional M&A and SPACs. Retailers and brand owners can effectively address the tax implications of M&A by devising a proactive and comprehensive tax strategy that includes the impacts of regulatory changes and incorporates value-added models.

Below, we present some of the key aspects of tax planning that brand owners and retailers may consider when entering into an M&A transaction:

Source: Coresight Research[/caption]

Analyze the Cost and Flexibility of Various Sources of Financing

An acquisition can be financed through various sources, including cash, debt, equity, stock swaps, leveraged buyout and seller’s financing. However, complexities arise in determining optimal acquisition financing and its alignment with the nature and purpose of the deal.

The acquisition finance structure should offer sufficient flexibility so that it can be altered to fit different contexts, such as SPACs or alliances. One way to achieve flexibility is by incorporating the cash-flow generating capacity of participating retailers and the strength of their asset base in the acquisition financing structure. While debt financing is substantially cheaper than equity financing, the interest component on debt constrains the flexibility of the acquiring company. We believe that established and mature retailers with stable cash flow and lesser capital expenditures can better capitalize on low-cost debt financing, while equity financing is more appropriate for fast-growing companies that compete in volatile markets and need huge amounts of capital to fund their future growth.

Nevertheless, acquisition financing is complex, often involving multiple sources, particularly for larger acquisitions. The finance structures usually require many combinations and variations. With several alternatives available to finance an acquisition, retailers and brand owners should look to establish the appropriate mix of financing, which offers the lowest cost of capital while providing financial and operational flexibility. One way to do this is to build an enterprise valuation model, which evaluates the estimated future returns and the cost of the M&A (using the various sources of financing, including cash, equity and debt, among others) and selects a financial means that provides maximum benefits relative to costs.

Devise and Implement a Proactive and Comprehensive Tax Strategy

Tax considerations remain a critical issue, both in traditional M&A and SPACs. Retailers and brand owners can effectively address the tax implications of M&A by devising a proactive and comprehensive tax strategy that includes the impacts of regulatory changes and incorporates value-added models.

Below, we present some of the key aspects of tax planning that brand owners and retailers may consider when entering into an M&A transaction:

- Choose traditional M&A or alternatives based on after-tax net returns

- Streamline tax part of the M&A process

- Identify potential tax issues and tax-specific value drivers early

- Understand and estimate the value of tax attributes

- Keep track of potential tax legislation

What We Think

Successful M&A integration has always been challenging, even with the presence of several legal arrangements (including due diligence) and the availability of various valuation and forecasting methods (such as financial and tax models). As discussed in this Playbook, outlining a structured approach that breaks down a complex M&A integration activity into defined phases, steps and deliverables can ensure efficiency, consistency and standardization in M&A outcomes. Retailers and brand owners should remain cognizant of the current trends prevailing in the global retail and retail-tech landscapes when devising their M&A strategies. In addition, developing a well-defined and comprehensive M&A tax strategy for each function and geography across the entire enterprise will be helpful to retailers to identify the overall deal’s cash and non-cash values. While all staff in the company—from top executives to frontline workers—are typically involved in M&A integration in some way, successful integration requires dedicated oversight throughout the entire process. Empowering a dedicated M&A integration leader with sound knowledge of the operating model, business strategy, current operations and deal objectives can be helpful in managing all stakeholders and their competing priorities. Implications for Brands and Retailers- As the world of M&A is evolving, retailers and brand owners should keep pace with new trends and opportunities. Sound strategic planning in response to emerging trends will help retail companies to enhance the value of an M&A for all stakeholders—including owners, investors, consumers and employees.

- An efficient and structured action plan can help retailers maximize M&A benefits—such as revenue and cost synergies, enhanced customer base and expansion of market share—while minimizing risks, including diseconomies of scale.

- Retailers and brand owners should structure due diligence and integration plans to align with the value drivers of the M&A deal.

- During the merger, the management of both companies should aim to address people and culture issues speedily to avoid delays and loss of value.

- Given that SPACs require public disclosure of forward-looking projections, private retailers and brand owners entering SPAC transactions should look to capitalize on the opportunity to tell a more in-depth story in terms of the investment thesis.