Nitheesh NH

Introduction

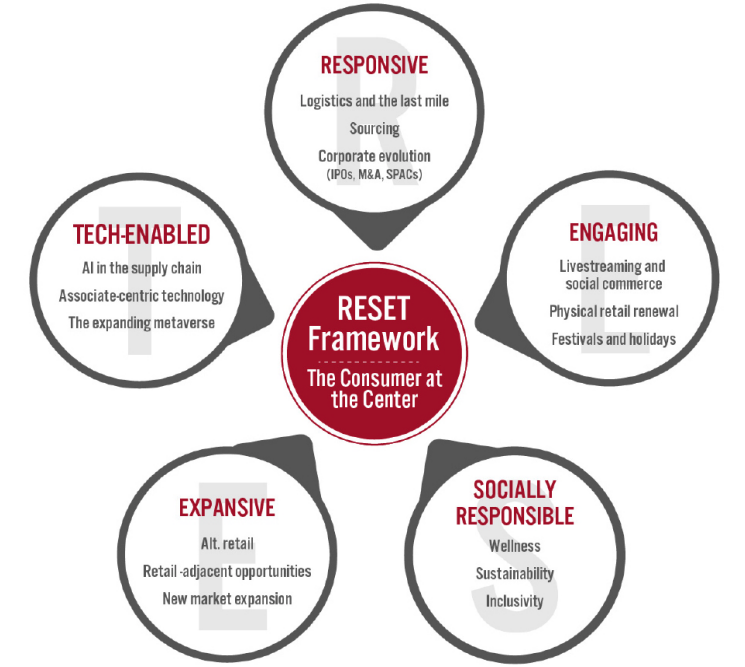

What’s the Story? The Coresight Research Playbook series provides recommendations for brands, retailers and marketplaces seeking to tap growth segments and emerging trends. Coresight Research has identified corporate evolution, which includes initial public offerings (IPOs) as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the end of this report for more details). In this Playbook, we present four key strategies and a four-stage action plan for retail players to capitalize on growth opportunities in IPOs. We discuss examples of the strategies across multiple retail categories, with a focus on the US and the UK markets. We also present two approaches for retailers to counter key challenges. Why It Matters To devise effective IPO strategies, brands and retailers should keep in mind the current trends prevailing in the global retail and retail-tech landscapes. Outlining a structured approach that breaks down complex IPO activity into defined phases, steps and deliverables can ensure efficiency, consistency and standardization in IPO outcomes. Below, we summarize recent IPO activity in the US and the UK. The US In 2021, the rate of IPOs transactions in US retail massively accelerated: 52 retail-focused IPOs debuted on US stock exchanges, raising $20.0 billion, compared to 19 IPO debuts in 2020, raising $10.6 billion, according to Coresight Research analysis of S&P Capital IQ data. We expect this trend to remain strong in 2022 despite high inflation and the potential increase in interest rates: as of March 10, 2022, 11 retail-focused IPOs were listed on the US stock exchange and raised $1.1 billion versus five IPO debuts which raised $3.3 billion in the same period last year. The current trend suggests that there could be a greater number of IPOs at lower valuations in 2022 (versus 2021). Some of the most anticipated IPOs of 2022 include grocery delivery service provider Instacart, Walmart-owned e-commerce company Flipkart and beauty company Savage X Fenty. The IPO transactions in 2021 and year-to-date 2022 included companies in the consumer discretionary and consumer staples sectors, such as Internet and direct marketing retailers, apparel and footwear specialty stores, food retailers, home-goods retailers, packaged foods manufacturers, personal care products manufacturers, consumer durable and electronics stores, automotive retail and specialized consumer services providers, including payment platforms, among others. While the US retail-focused IPO market is diverse, Internet and direct marketing retailers are listing the highest number of retail and consumer goods IPOs, comprising about 23% of the total 52 transactions in 2021. Apparel and footwear retailers, which saw strong recoveries in 2021, listed the second-largest number of IPO transactions, comprising 12% of total transactions. The UK Unlike in the US, the retail-focused IPO market is small in the UK. 2021 was an extraordinary year for retail-focused IPOs in the UK: 22 IPOs were listed on UK stock exchanges, raising $4.1 billion, versus three IPOs in 2020, raising only $161 million, according to our analysis of S&P Capital IQ data. The spectacular rise in retail-focused IPOs has been mainly driven by the public listings of the Internet and direct marketing retailers, which comprise e-commerce firms, payment platforms and other tech-enabled companies. However, in contrast to the US, we have not seen any key retail-focused completed IPO transaction in the UK in 2022 (as of March 10, 2022) versus five transactions in the same period last year. This suggests that the UK retail-focused IPO activity could slow down in 2022. Nevertheless, we still expect the number of IPOs in the UK retail and consumer goods sector in 2022 to be considerable. Some of the most anticipated IPOs of 2022 include plant-based food manufacturer Huel and THG Beauty, the beauty division of e-commerce company THG.- Read our separate report for more on noteworthy IPO completed transactions.

IPOs in Retail: A Playbook

Four Key Strategies To Adapt to Recent Trends in IPOs We present four key strategies that brand owners and retailers globally can adopt in response to recent IPO trends. We summarize these trends and strategies in Figure 1 and discuss each in detail below, with examples.Figure 1. Four Key Strategies for Retailers to Adapt to Trends in IPO [caption id="attachment_145543" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Choose the Type of IPO Based on Suitability and Requirements

The traditional definition of IPO is broadening rapidly to include alternative methods, such as special purpose acquisition companies (SPACs) and direct listings. This is because the economic impact of the pandemic has forced companies to consider other options rather than just the traditional IPO. As compared to traditional IPOs, SPAC transactions require a shorter timeline—generally three to four months to enter the public market, compared to six to nine months with traditional IPO. Furthermore, by fixing stock prices with SPACs as part of their merger deals, retailers can shield their stock value from market uncertainties.

In December 2021, Italy-based luxury apparel brand Zegna, owned by luxury group Ermenegildo Zegna, went public and started trading on New York Stock Exchange (NYSE) after completing a merger deal with US SPAC Investindustrial Acquisition Corp. The SPAC deal valued the combined company at $3.1 billion. The deal is one of the biggest global SPAC transactions in the apparel/luxury space to date.

Under the terms of the SPAC agreement, Zegna retained a 66% stake in the combined company—with a market capitalization of $2.4 billion. Zegna stated that the deal provided $761 million in cash proceeds, which will support its expansion plans in the US and China.

In July 2021, commenting on the SPAC merger announcement, Zegna’s CEO Gildo Zegna said, “We could have remained private for another 100 years, but the timing was perfect and luxury has become very challenging.” He also stated that the Zegna family “will remain at the company’s helm following the transaction’s completion, and will continue to invest in creativity, innovation, talent, and technology in order to sustain Zegna’s leadership position in the global luxury market.”

With apparel brands and retailers experiencing a robust recovery amid a trend of consolidation taking place globally in the industry, we expect to see more SPACs targeting this sector in 2022 and beyond.

For instance, in November 2021, Bleuacacia (also referred to as Acacia Blue), a SPAC formed by former Coach Inc.’s CEO Lew Frankfort and former Tapestry CEO Jide Zeitlin, started trading on the Nasdaq Global Market. The SPAC, intended primarily for acquiring apparel companies targeting millennials and Gen Z, is seeking to raise $240 million through an IPO. In its registration statement with the SEC in June 2021, Bleuacacia stated:

Source: Coresight Research[/caption]

1. Choose the Type of IPO Based on Suitability and Requirements

The traditional definition of IPO is broadening rapidly to include alternative methods, such as special purpose acquisition companies (SPACs) and direct listings. This is because the economic impact of the pandemic has forced companies to consider other options rather than just the traditional IPO. As compared to traditional IPOs, SPAC transactions require a shorter timeline—generally three to four months to enter the public market, compared to six to nine months with traditional IPO. Furthermore, by fixing stock prices with SPACs as part of their merger deals, retailers can shield their stock value from market uncertainties.

In December 2021, Italy-based luxury apparel brand Zegna, owned by luxury group Ermenegildo Zegna, went public and started trading on New York Stock Exchange (NYSE) after completing a merger deal with US SPAC Investindustrial Acquisition Corp. The SPAC deal valued the combined company at $3.1 billion. The deal is one of the biggest global SPAC transactions in the apparel/luxury space to date.

Under the terms of the SPAC agreement, Zegna retained a 66% stake in the combined company—with a market capitalization of $2.4 billion. Zegna stated that the deal provided $761 million in cash proceeds, which will support its expansion plans in the US and China.

In July 2021, commenting on the SPAC merger announcement, Zegna’s CEO Gildo Zegna said, “We could have remained private for another 100 years, but the timing was perfect and luxury has become very challenging.” He also stated that the Zegna family “will remain at the company’s helm following the transaction’s completion, and will continue to invest in creativity, innovation, talent, and technology in order to sustain Zegna’s leadership position in the global luxury market.”

With apparel brands and retailers experiencing a robust recovery amid a trend of consolidation taking place globally in the industry, we expect to see more SPACs targeting this sector in 2022 and beyond.

For instance, in November 2021, Bleuacacia (also referred to as Acacia Blue), a SPAC formed by former Coach Inc.’s CEO Lew Frankfort and former Tapestry CEO Jide Zeitlin, started trading on the Nasdaq Global Market. The SPAC, intended primarily for acquiring apparel companies targeting millennials and Gen Z, is seeking to raise $240 million through an IPO. In its registration statement with the SEC in June 2021, Bleuacacia stated:

Well managed brands can realize tremendous growth over the next decade. As such, this is an exciting time to pursue acquisitions of globally relevant, premium and consumer-facing brands that have a powerful emotional engagement with millennial and Gen Z consumers.

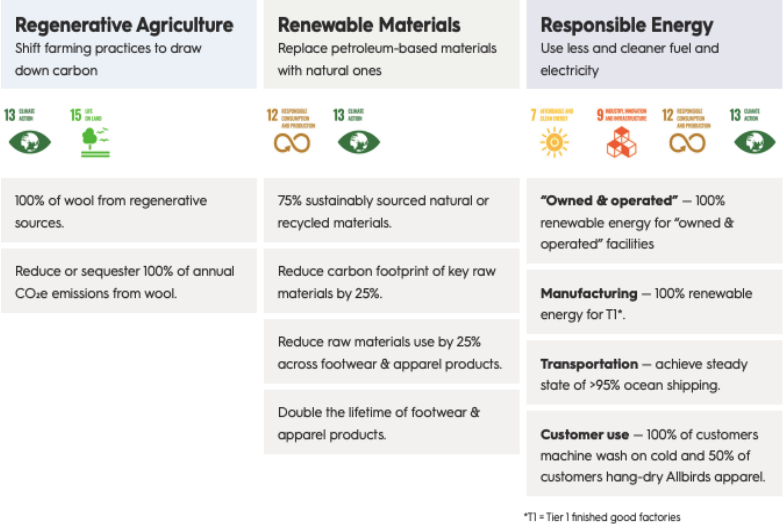

Some retailers are going public via direct listings. For example, in September 2021, Warby Parker, a digitally native eyewear retailer, went public via a direct listing. The company benefitted from the listing—as the price point for direct listing was higher than its final private-market valuation. 2. Decide the Right Market Timing and Pricing for Launching an IPO The Covid-19 pandemic and the volatile economic environment have created profound change and uncertainty. Brands and retailers need to be ready to adapt their IPO plans as situations change, including economic predictions, local and global trends, domestic and international political events, interest rates and inflation, among others. Recently, fast-fashion retailer Shein put its plan to debut NYSE via an IPO on hold, citing growing volatility in capital markets amid Russia-Ukraine war tensions, as quoted by Reuters on February 25, 2022. Earlier, in January 2022, Reuters reported that Shein revived its plan to debut on the NYSE via an IPO in 2022, and the company has reportedly hired Bank of America, Goldman Sachs and JP Morgan as investment bankers for floating its shares. This is the second time the company has put its IPO plans on hold. Shein planned for the US IPO about two years ago, but the company took a U-turn amid the rising trade tensions between the US and China. (Read our separate report for more on Shein.) While it is not clear whether the company will revive its listing plan again in 2022, recent developments, such as Shein making the Singaporean firm Roadget Business Pte its de factor holding company, changing its headquarters to Singapore and Shein’s founder changing his citizenship to Singaporean to dodge China’s strict rules on overseas listings, are in line with the online retailer’s potential public listing plans. Last year, most of the retailers and brands that came to raise capital and list on the US stock exchanges found comfort in the fact that the timing was right—buoyed by a liquidity-led bull market. However, timing alone is not enough, and the IPO pricing will also need to be right. Retailers should be flexible in accepting different valuations and offering sizes different from initially planned to capitalize on the opportunity. The final IPO pricing typically occurs one or two days before the filing of the final prospectus. The price range of shares could change due to changes in market conditions and levels of interest in the company over time. For instance, in November 2021, Allbirds, known for its eco-friendly shoes and sneakers, priced its IPO at $15 a share, higher than its expected range of $12–$14 a share. The company also increased the number of shares offered to 20.1 million, from 19.2 million set previously. Overall, retailers and brands looking to enter public markets via an IPO in 2022 should deploy a strategy that is resilient, flexible and more adaptable to fast-changing market conditions. 3. Communicate ESG Impact to Potential Shareholders as Part of Equity Story and IPO Diligence Environmental, social and governance (ESG) will continue to be a key theme in 2022 and beyond for IPO candidates and investors alike. Brands and retailers must incorporate ESG considerations into their equity story as investors see ESG as a key element to build a more sustainable business, which can adapt well to potential market shifts. Below we list out some of the recent key IPOs with sustainability-focused or mission-driven components.- Allbirds

Allbirds’ high-priority goals that it aims to achieve by the end of 2025

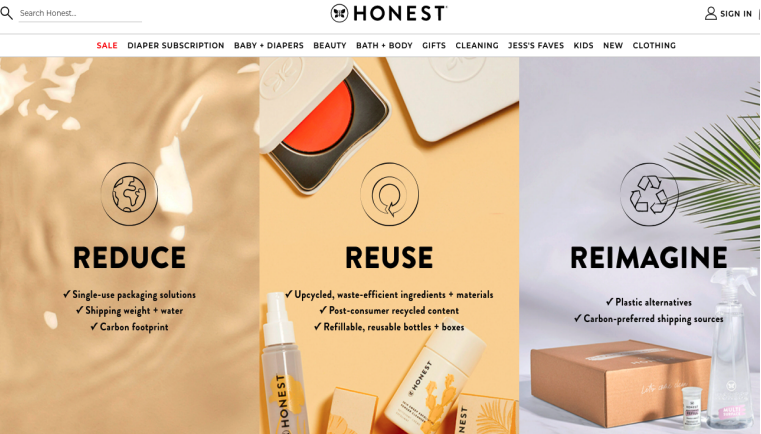

Allbirds’ high-priority goals that it aims to achieve by the end of 2025Source: Allbirds[/caption] The Honest Company The Honest Company—a beauty and personal care brand founded by American celebrity and businesswoman Jessica Alba—highlighted its ESG measures in its IPO filing with SEC in April 2021. The Honest Company noted that it helps the consumer make clean and conscious choices when it comes to purchasing beauty and cleaning products, and many of the company’s products are part of the “Climate Pledge Friendly” program, which aims to reduce greenhouse gas emissions. As part of the program, the company aims to be carbon neutral across its online order shipments by the end of 2022 by using plastic alternatives, recycled boxes and single-use packaging solutions, among others. The Honest Company also highlighted its inclusive and diverse initiatives—stating that women represent 68% of its workforce and people of color comprise nearly half of its workforce. [caption id="attachment_145545" align="aligncenter" width="700"]

The Honest Company’s key sustainability strategy

The Honest Company’s key sustainability strategySource: The Honest Company[/caption] 4. High-Growth Retail-Tech Startups Can Prioritize IPO Exit Strategies In 2022, we expect technology to continue to dominate IPO activity globally. For instance, Perfect Corp., a beauty software-as-service (SaaS) startup, is mulling an IPO via a merger with SPAC Provident Acquisition Corp in 2022, as cited by Bloomberg on March 3, 2022. The deal could provide the beauty startup with a valuation of about $1 billion. Earlier, in November 2021, we saw real-time data-savvy fast-fashion company Lulu’s Fashion Lounge and online clothing subscription-based e-commerce company Kidpik entering the US public market via IPOs—raising $92 million and $18 million, respectively. A strong growth opportunity and robust business models make e-commerce and retail-tech firms an investor favorite irrespective of profitability. E-commerce firms and retail-tech startups with a track record of strong sales growth and an experienced management team can capitalize on the opportunity and maximize the valuation by choosing IPO as an exit strategy instead of a trade sale. A Four-Step Action Plan for Retailers Seeking To Go Public via IPO We identify four steps that retailers and brands can take when seeking to go public via an IPO. We summarize this action plan in Figure 2 and discuss each step in detail below.

Figure 2. Four-Step Action Plan for Retailers Seeking to Go Public via IPO [caption id="attachment_145546" align="aligncenter" width="700"]

Source: Coresight Research [/caption]

1. Select the Right Investment Banks or Underwriters

Picking the right underwriters or investment banks is critical to the successful execution of a company’s IPO. Underwriters will be responsible for assisting the company in the IPO registration statement, conducting the due diligence, coordinating the efforts of the underwriting syndicate and leading the marketing and selling efforts, among others.

Retailers should conduct ample due diligence when selecting investment banks or underwriters. Some of the key considerations include:

Source: Coresight Research [/caption]

1. Select the Right Investment Banks or Underwriters

Picking the right underwriters or investment banks is critical to the successful execution of a company’s IPO. Underwriters will be responsible for assisting the company in the IPO registration statement, conducting the due diligence, coordinating the efforts of the underwriting syndicate and leading the marketing and selling efforts, among others.

Retailers should conduct ample due diligence when selecting investment banks or underwriters. Some of the key considerations include:

- Past Track Record and Network Base

- Vision Alignment and Cultural Fit

- Sector Specialization

- Total Addressable Market (TAM), Competitive Advantage and Key Growth Drivers

- Stress-Test of the Business Plan

- ESG Initiatives

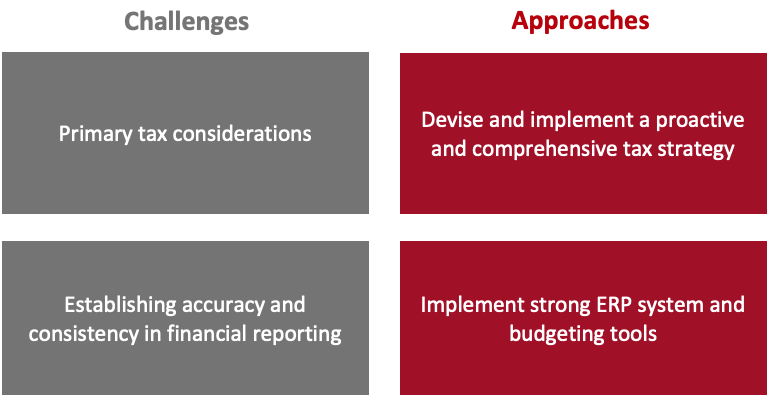

Figure 3. Two Approaches for Retailers to Counter Key Challenges in Becoming a Public Company [caption id="attachment_145547" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Devise and Implement a Proactive and Comprehensive Tax Strategy

Tax considerations remain a critical issue for an IPO. Retailers and brands can effectively address the tax implications of an IPO by devising a proactive and comprehensive tax strategy that includes the impacts of legal and regulatory changes and incorporates value-added models.

Below, we present some of the key aspects of tax planning that brands and retailers should consider when entering the public market via IPO:

Source: Coresight Research[/caption]

1. Devise and Implement a Proactive and Comprehensive Tax Strategy

Tax considerations remain a critical issue for an IPO. Retailers and brands can effectively address the tax implications of an IPO by devising a proactive and comprehensive tax strategy that includes the impacts of legal and regulatory changes and incorporates value-added models.

Below, we present some of the key aspects of tax planning that brands and retailers should consider when entering the public market via IPO:

- Develop an Independent Tax Team In-House

- Ensure Tax Documentation Is Streamlined and Up to Date

- Scale Up the Existing Tax Policies

- Keep Track of Potential Tax Legislation

What We Think

The successful transformation from a private company to a public company has always been challenging, even with the presence of several legal arrangements (including due diligence) and the availability of various valuation and forecasting methods (such as budgeting models). As discussed in this Playbook, developing a structured approach and action plan can ensure efficiency, consistency and standardization in IPO outcomes. Retailers and brands should remain cognizant of the current trends prevailing in the global retail and retail-tech landscapes when devising their IPO strategies. In addition, developing a well-defined and comprehensive IPO tax strategy for each function and geography across the entire enterprise will be helpful to retailers to identify the overall values and ensures compliance. While all executives and directors are typically involved in IPO in some way, successful transformation requires dedicated oversight throughout the entire IPO process. Empowering a dedicated IPO team with prior experience and sound knowledge of the business strategy, current operations and objectives can be helpful in managing all stakeholders and their competing priorities. Implications for Brands and Retailers- As the world of IPO is evolving, retailers and brand owners should keep pace with new trends and opportunities. Sound strategic planning in response to emerging trends will help retail companies to enhance the value for all stakeholders—including owners, investors, consumers and employees.

- An efficient and structured action plan can help retailers maximize IPO benefits—such as enhanced customer base and expansion of market opportunity—while minimizing risks, including legal, financial and tax compliance.

- Retailers and brand owners should structure due diligence plans to align with the value drivers of going public. Retailers’ IPO readiness can stir more confidence from investors and underwriters, which will increase the likelihood of a smooth IPO process.

- Given that SPAC IPOs require public disclosure of forward-looking projections, private retailers and brands entering SPAC transactions should look to capitalize on the opportunity to tell a more in-depth story in terms of the investment thesis.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes. RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework. The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments. Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.Appendix Figure 1. RESET Framework [caption id="attachment_145548" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]