albert Chan

What’s the Story?

The Coresight Research Playbook series provides recommendations for brands, retailers and marketplaces seeking to tap growth segments and emerging trends.

Coresight Research has identified the evolution of last-mile delivery as one of the key trends to watch in 2021. In this Playbook, we present four best practices for US retailers to develop winning strategies for enhancing the last mile—i.e., the delivery process of getting the product into the hands, or onto the doorstep, of the consumer.

Why It Matters

Retailers will have to enhance their last-mile delivery capabilities moving forward in order to capitalize on the pandemic-driven shifts in consumer spending behavior that are likely to sustain in the long term.

The most impactful of these is the surge in e-commerce: Coresight Research estimates that US online retail sales surged 33.5% year over year in 2020 and will grow by a further 2.6% to total $766.2 billion in 2021.

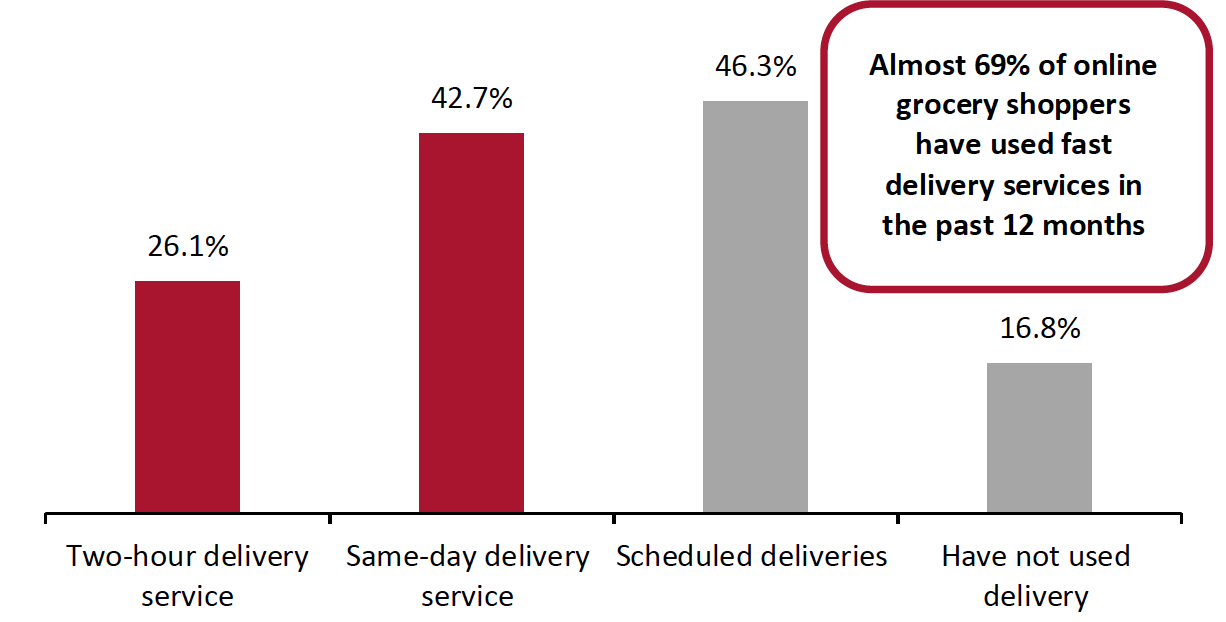

Alongside the consumer shift to the online channel is increasing demand for convenience and speedy delivery. A January 2021 survey of US consumers conducted by Coresight Research and Blue Yonder found that 22.3% of respondents cited fast online delivery as a top priority when purchasing apparel. In addition, according to a Coresight Research survey conducted in April 2021, over two-thirds of US consumers who had shopped online in the past 12 months had used same-day delivery services (see Figure 1).

Figure 1. Online Grocery Shoppers: Delivery Service They Had Used in the Past 12 Months (% of Respondents)

[caption id="attachment_128219" align="aligncenter" width="550"] Base: 975 US Internet users aged 18+ who had purchased groceries online in the past 12 months

Base: 975 US Internet users aged 18+ who had purchased groceries online in the past 12 monthsSource: Coresight Research[/caption]

However, offering fast and convenient fulfillment is costly to retailers and has significant impacts on the environment, causing increased emissions and traffic congestion. According to a study released by the World Economic Forum in January 2020, urban last-mile delivery emissions are set to rise by 32%, and congestion by over 21%, in 100 cities by 2030.

Retailers therefore need to balance their efforts in last-mile fulfillment to meet consumer demand while reducing costs and implementing effective sustainability initiatives that minimize their impact on the environment—not an easy feat.

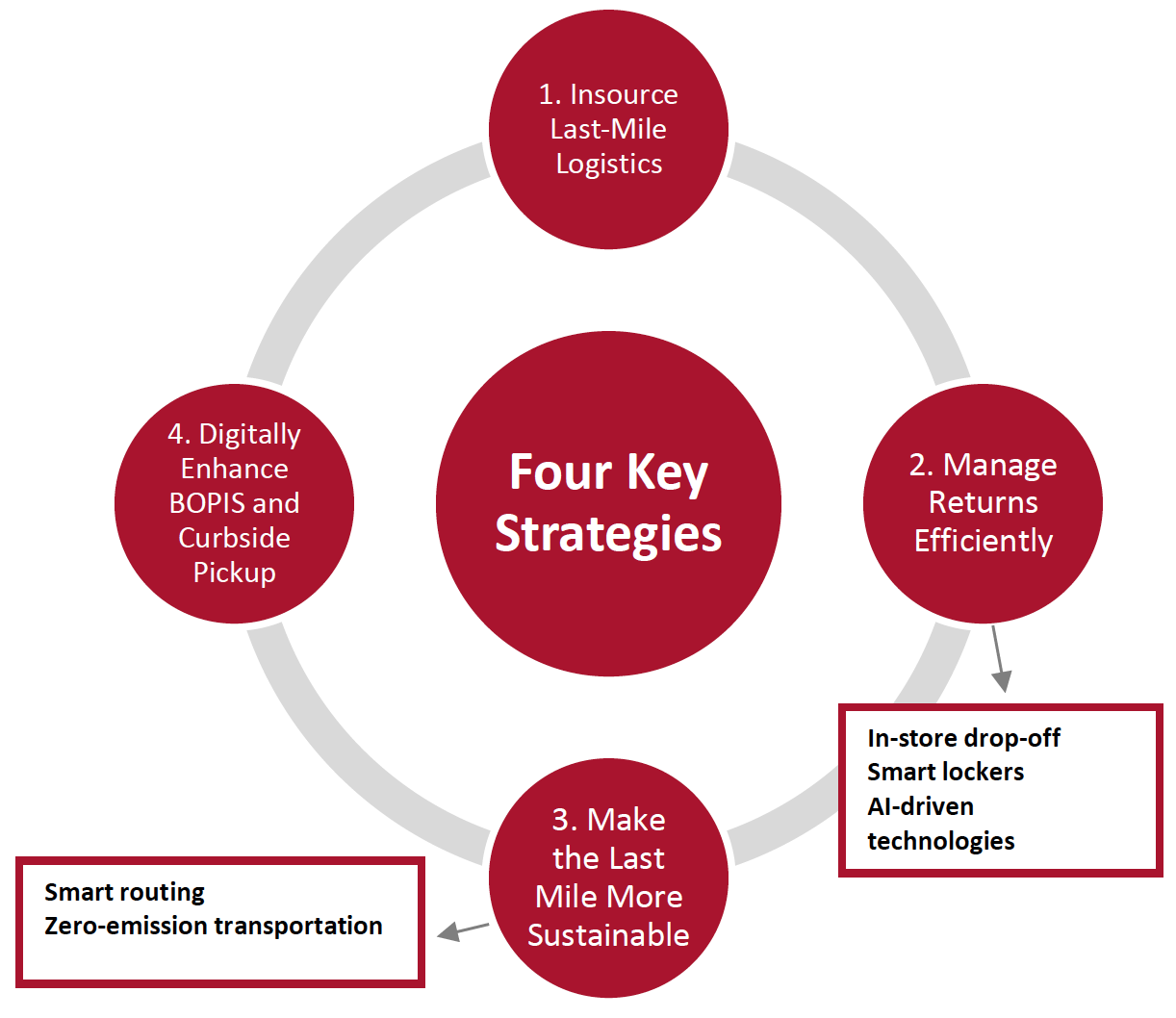

Evolving the Last Mile Playbook: In Detail

We present four key strategies that retailers can adopt in their last-mile ecosystem to gain a competitive advantage. We summarize the strategies in Figure 2 and discuss each in detail below, offering recommendations for retailers to enhance the last mile.

Figure 2. Four Key Strategies To Gain a Competitive Advantage in the Last Mile

[caption id="attachment_128220" align="aligncenter" width="550"] Source: Coresight Research[/caption]

1. Insource Last-Mile Logistics

Source: Coresight Research[/caption]

1. Insource Last-Mile Logistics

Retailers that have strategically invested in bringing last-mile delivery in-house are poised to have a big advantage compared to those who rely on courier services.

In 2020, the surge in online shopping strained the capacity of last-mile delivery partners during peak periods. On December 2, 2020, UPS placed shipping restrictions on six retailers due to space allocation: Gap, Hot Topic, L.L.Bean, Macy’s, Newegg and NIKE. Additionally, FedEx, UPS and USPS tend to levy holiday shipping surcharges for residential deliveries, spanning the period from mid-October to mid-January.

Building an in-house logistics infrastructure enables companies to control costs, build positive customer experiences, expand their delivery windows, branch out to more products and redirect orders in real time.

US retailers are at various stages of bringing their logistics infrastructure in-house. We explore some notable examples below.

Amazon

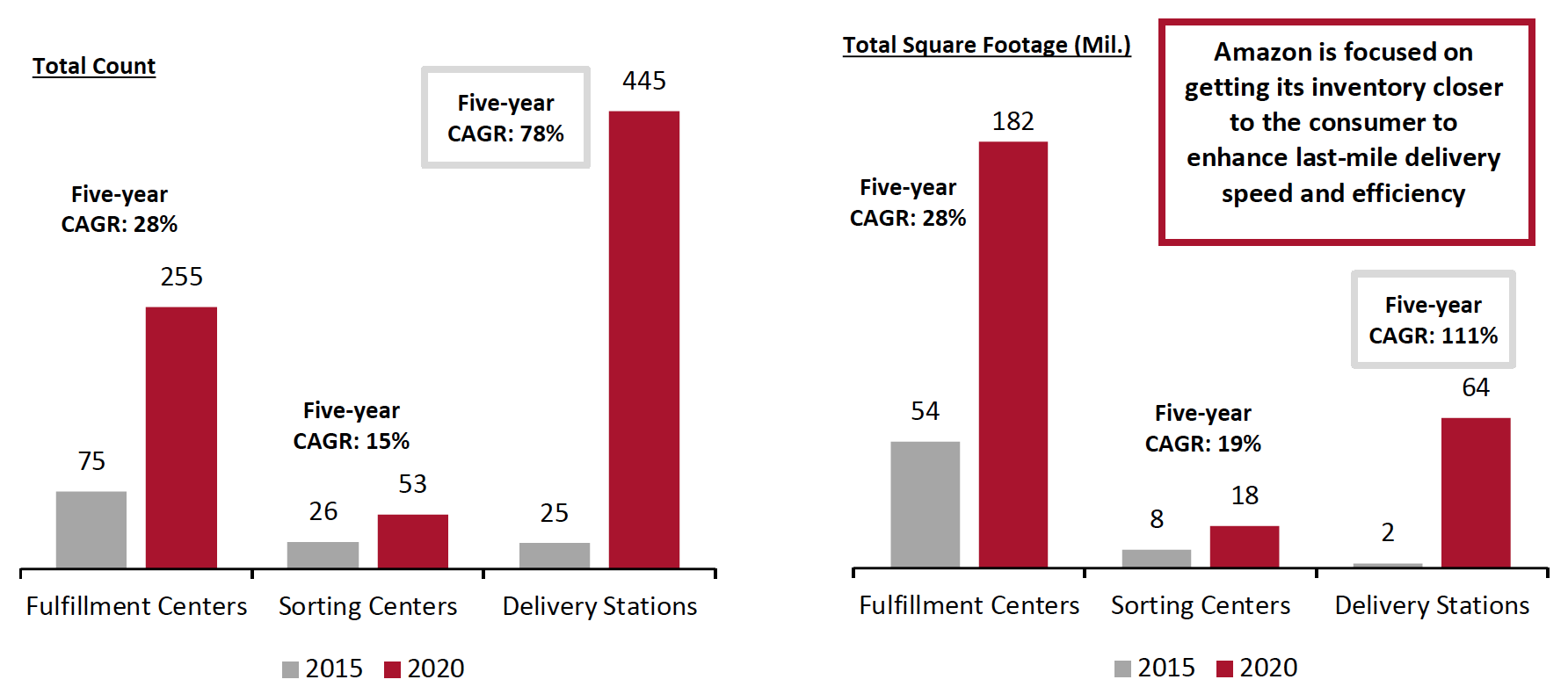

The e-commerce giant has been expanding its delivery operations in recent years and has surged ahead without many shipping troubles as it relies heavily on its own delivery service and drivers to accommodate its slew of shipments. In its earnings call for the fiscal year ended December 31, 2020, Amazon said that it boosted its fulfillment capacity—the collection of warehouses, delivery stations and drivers it uses to get packages to customers—by 50% in 2020, contributing to the company’s total capital expenditure of $45 billion.

According to supply chain consultancy MWPVL, Amazon’s delivery stations, the facilities closest to consumers, are seeing the highest growth as the company builds out is logistics footprint. This emphasis on delivery stations suggests that Amazon is focused on getting its inventory dramatically closer to the consumer to enhance its last-mile delivery speed and efficiency.

Figure 3. Amazon Logistics Infrastructure Growth

[caption id="attachment_128221" align="aligncenter" width="700"] Source: MWPVL[/caption]

Source: MWPVL[/caption]

By controlling all aspects of shipping and delivery, Amazon builds a high level of customer service by offering faster delivery even on low-ticket items, in flexible delivery windows. This drives growth in Prime subscription revenues as more customers sign up to take advantage of convenient, same-day delivery options. Expansion and vertical integration of Amazon’s delivery network also enables the company to reduce per-unit delivery/shipment costs over the long term and reduces its reliance on courier services.

Costco

In March 2020, Costco acquired third-party delivery and installation company Innovel (now called Costco Logistics) for $1 billion from Transform Holdco, the holding company for Kmart and Sears. Innovel has 11 distribution centers and more than 100 delivery centers nationwide.

H-E-B

In February 2018, supermarket chain H-E-B acquired Favor, an on-demand delivery company, to scale its own e-commerce operations. In April 2020, H-E-B expanded its online grocery options with the launch of the Favor Express two-hour delivery service.

Kroger

Kroger is building its own fulfillment centers and delivery infrastructure with technology provider Ocado, the first of which went live in April 2021. On Kroger’s Investor Day held on March 31, 2021, the company said that it expects the fulfillment centers to reach the unit-level breakeven point in the third year, and by the fourth year, it expects the centers to reach parity with store operating profit rates. Over the long term, Kroger expects the profitability of these facilities to be higher than its stores.

Target

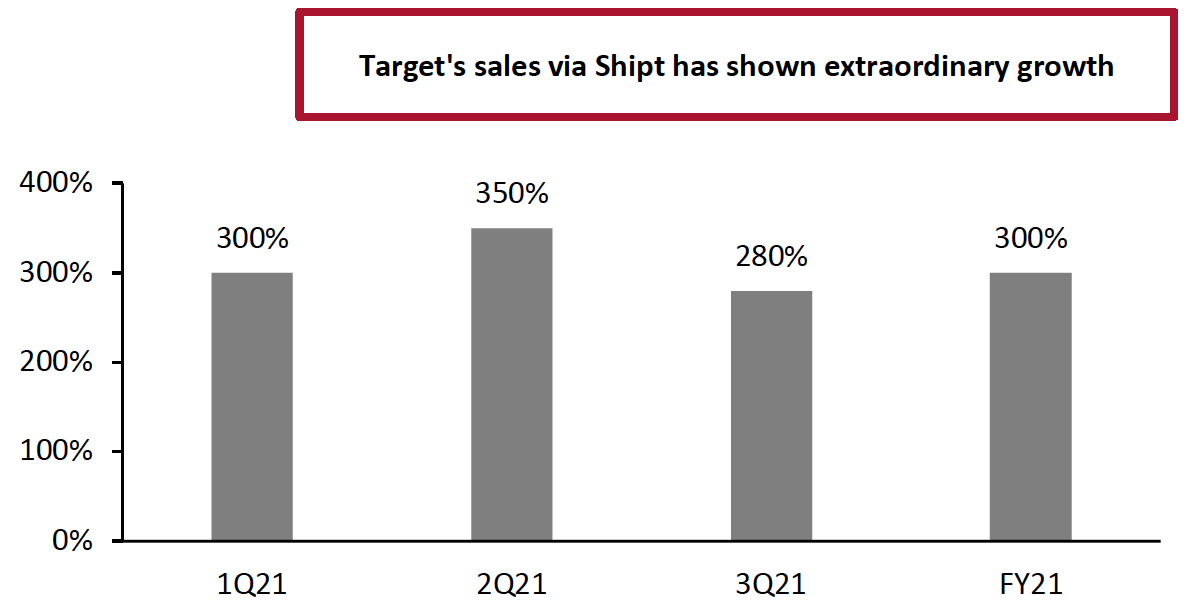

Target has invested heavily in developing its own last-mile logistics over the last few years, including its $550 million acquisition of delivery service Shipt in 2017 and its acquisition of transportation technology firm Grand Junction in the same year, as well as the acquisition of technology assets from last-mile technology company Deliv in May 2020.

These efforts to ramp up investment in in-house logistics operations are paying off for the retailer. In its fiscal year ended January 30, 2021, Target noted that sales on Shipt for the full year increased by nearly 300% and memberships grew 130%. The company added that it would continue to invest in broadening Shipt’s reach by entering new markets while expanding existing ones.

Figure 4. Target Sales Fulfilled by Shipt (YoY % Change) [caption id="attachment_128222" align="aligncenter" width="550"]

Target’s fiscal 2021 ended on January 30, 2021

Target’s fiscal 2021 ended on January 30, 2021Source: Coresight Research[/caption]

Walmart

Walmart has been building its own micro-fulfillment centers and growing its digital offerings, including its Express Delivery service, launched in April 2020, which it plans to roll out to more than 2,000 stores. Walmart’s team of 74,000 personal shoppers will pick online orders from stores and deliver them to customers.

Coresight Research recommendation: Retailers should make strategic and gradual moves to own the fulfillment process by investing in technology such as automated fulfillment centers and building an in-house logistics infrastructure to increase last-mile efficiency. Retailers with a more dispersed store footprint and operations could settle for a hybrid approach: their own solutions for high route-density and third-party delivery providers for smaller cities where they cannot achieve the required scale for order density.

2. Manage Returns EfficientlyReturns are a double-edged sword for retailers: Attractive returns options—including transparent policies—drive customer retention and loyalty but also add costs and complexity. As e-commerce gains a greater share of the retail market, the overall returns rate will continue to climb, adding significant pressure to retailers’ bottom lines. According to the National Retail Federation, around $101 billion worth of goods were returned during the 2020 holiday period in the US, and over $428 billion in merchandise were returned in 2020 overall, representing 10.6% of total US retail sales.

The “2020 Impact Report” published by returns solutions provider Optoro states that an estimated 16 million metric tons of carbon dioxide were emitted from the transportation of returns in the US last year. The report also claims that e-commerce returns can produce 14% more landfill waste than brick-and-mortar returns, thanks to inefficiencies in traditional reverse logistics. Furthermore, according to Olive (a delivery consolidation service that bundles e-commerce orders into a single, weekly shipment delivered in a reusable “shipper”), 75% of e-commerce’s carbon emissions come from single-use packaging and last-mile delivery—and when retailers offer doorstep pickup of returns, it creates a first-mile return journey that potentially doubles carbon emissions.

- Read more about the hidden costs of retail returns in our separate report.

Despite the high cost of lenient online returns policies, retailers cannot simply make their policies more stringent—according to a Coresight Research survey of US consumers conducted in November 2020, 39.1% of respondents reported that retailers’ returns policies influence where they shop. Additionally, the UPS Pulse of the Online Shopper 2019 study found that the returns experience affects the likelihood of online consumers buying from a retailer again, with 73% of consumers globally reporting this.

Coresight Research recommendation: There are three actions that retailers could take to make their reverse logistics process smoother and more efficient, which would foster customer loyalty and attract new customers. We discuss these actions in detail below.

Facilitate E-Commerce Returns via the Store or Alternative Drop-Off Locations

Omnichannel retailers should encourage buyers to make online returns at their physical locations—rather than by mail—as this facilitates faster returns, lowers the costs for the retailer and shortens the order lifecycle. Coresight Research survey findings from March 2021 reveal that 38.8% of the US consumers that had returned products in the past year reported that they prefer to return online purchases in physical stores. This is encouraging for retailers, as it transfers the last-mile return trip cost to the consumer, while creating opportunities for in-store exchanges (again saving the last-mile cost for the retailer) and add-on purchases.

Retailers could work with various innovators and startups to more efficiently manage and process returns in-store. For example, logistics and asset-tracking company Position Imaging’s iPickup platform solution provides a quick and easy way for shoppers to buy online and return items in stores without having to wait in line. It also allows shoppers to exchange online purchases in-store, optimizing the exchange process so that the item to be exchanged is ready within 15 seconds of a customer dropping off the original item at the store, according to the company.

Online pure plays, which do not have a brick-and-mortar presence, could partner with third-party returns specialists to accept returns at physical drop-off points. Happy Returns provides “Return Bars,” physical locations where shoppers can return items for an immediate refund. The products are shipped in bulk back to the retailers, decreasing overall shipping costs. Happy Returns has a network of over 500 locations nationwide, including in malls, campus bookstores and office buildings. In October 2020, the company partnered with FedEx to add Return Bars to more than 2,000 FedEx locations. Happy Returns claims to provide 10% guaranteed savings on reverse logistics costs to retailers in the first year of business.

Similarly, post-purchase specialist platform Narvar teamed up with Simon Property Group in November 2020 to enable easy drop-off returns for in-mall retailers at participating locations. In November 2020, Narvar also partnered with UPS to enable no-label and boxless returns at nearly 5,000 The UPS Store locations.

In April 2021, real estate investment trust Tanger Outlets partnered with logistics service provider Fillogic to open a micro-distribution hub at a Tanger property in Deer Park, Long Island. The company picks up merchandise that has been ordered online from the inventory of tenant stores and then aggregates orders for consolidated delivery and pickup. The tech-enabled facility also allows customers to make online returns on-site.

Invest in Smart Lockers To Simplify Returns

In-store smart lockers offer an alternative method of order fulfillment, but they can also be used for returns, helping alleviate congestion and eliminating wait times at the customer service desk. Smart lockers can also be installed at outdoor locations—including residential areas, high-traffic commuting stations and shopping centers—to increase convenience for customers. A single associate can collect any number of waiting returns at smart lockers, creating bulk returns, which significantly lowers costs for the retailer.

[caption id="attachment_128223" align="aligncenter" width="550"] Lowe’s smart lockers for order pickup and returns

Lowe’s smart lockers for order pickup and returnsSource: Lowe’s[/caption]

Invest in AI-Driven Technologies To Reduce Returns Rates

Retailers should determine the primary reasons behind product returns to inform their strategies. The relevant data lives in disparate systems, can range over a long period of time, is voluminous and ever-changing. AI platforms can identify the root cause of returns and give retailers timely, in-season recommendations to curb negative trends.

Technology innovators such as Newmine focus on proactively reducing future returns. Newmine’s Chief Returns Officer platform provides a 360-degree view of returns data through powerful AI elements such as anomaly detection and natural language processing, to understand the primary reasons for returns in real time. The platform then identifies corrective actions that retailers can take to reduce future returns, thus improving their bottom line.

- Read more about innovators that are disrupting the e-commerce fulfillment and returns space in our separate Retail-Tech Landscape.

The growing appetite for quicker same-day delivery is adding pressure on the last-mile elements of the supply chain, leading to sub-optimal resource utilization. Consumers are also becoming more conscious of sustainability: 65.6% of US consumers in Coresight Research and Blue Yonder’s survey said that a retailer’s or brand’s environmental sustainability initiatives were “somewhat” or “very” important to them when choosing where to purchase clothing or footwear. In addition, 59.4% of consumers said that a retailer’s or brand’s social impact was important to them.

- Read more Coresight Research coverage of sustainability in retail.

Coresight Research recommendation: With increasing expectations for speedier delivery alongside rising consumer awareness of the impacts of their shopping decisions on the environment, retailers need to adopt affordable logistics delivery solutions that make the last-mile more eco-friendly. Below, we highlight two actions that retailers can take to make the last mile more sustainable and reduce overall operating costs.

Invest in Smart Routing To Optimize Delivery Routes

Route optimization is an important step toward creating eco-friendly delivery operations. With effective route planning, drivers can make more stops per trip while covering fewer miles, compared to a sub-optimal route. This reduces mileage, fuel emissions and costs, and has positive impacts for road congestion.

Retailers could invest in AI-aided route optimization software that uses sophisticated algorithms for route planning. Routing platforms leverage machine learning and analytics to re-route in real time based on constantly changing parameters such as traffic congestion, weather conditions and road restrictions. For example, UPS uses the AI-based On-Road Integrated Optimization and Navigation (ORION) system to create the most efficient routes for its fleet. Routes can be changed in real time depending on road conditions and other factors. UPS estimates that ORION route optimization reduces its delivery miles by 100 million and results in annual cost savings of around $50 million.

Use Zero-Emission Transportation

Retailers can look to electrify their fleet to reduce carbon emissions and save costs.

Amazon, which is committed to achieving net-zero carbon by 2040 as part of The Climate Pledge, announced in October 2020 that it would start using new custom Rivian electric vehicles (EVs) to deliver packages to customers from 2021, with the goal of having over 10,000 EVs on the road globally as early as 2022 and total fleet of 100,000 by 2030. Amazon plans to add 1,800 EVs from Mercedes-Benz in its European delivery fleet this year and incorporate 10,000 EVs in India by 2025.

Furthermore, EVs are beginning to be adopted by major global logistics players. For example, UPS plans to add 10,000 EVs manufactured by UK-based EV manufacturer Arrival to its North American and European delivery fleet, beginning this year.

In the future, autonomous delivery services have the potential to significantly reduce the carbon emissions caused by traditional online fulfillment. Although the initial cost of an EV is more than gas- and diesel-operated vehicles, its superior efficiency, the moderate price of electricity compared to fossil fuels and the high utilization of fleet vehicles allow companies to quickly recoup the upfront cost and achieve a lower total cost of ownership. Switching to EVs can also bring significant incentives for fleet operators, such as purchasing rebates, tax benefits and tax credits, as well as additional perks including waivers on fees such as parking and tolls.

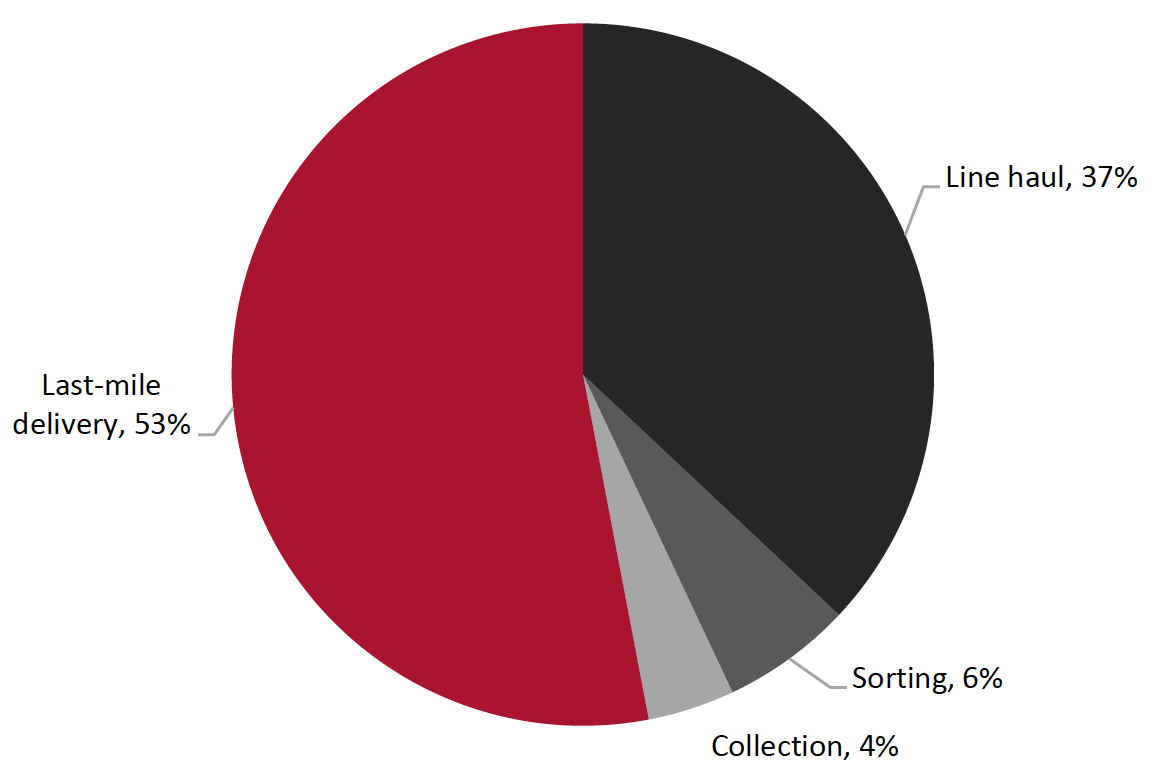

Adopting autonomous vehicles can slash the cost of last-mile deliveries from $1.60 per delivery via human drivers to $0.06 per delivery through autonomous robots, according to Robotics Business Review. This would help to dramatically reduce the overall cost of the last mile, which automation solutions provider Honeywell estimates to account for 53% of total shipping costs (see Figure 5).

Figure 5. Breakdown of Average Logistics Costs of a Shipment [caption id="attachment_128224" align="aligncenter" width="550"]

Source: Honeywell[/caption]

Source: Honeywell[/caption]

According to the “Consumer Mobility Report” released by driverless technology company Motional in September 2020, 62% of the US consumers believe that self-driving vehicles are the way of the future, and enthusiasm for those vehicles has grown since the onset of the pandemic.

Many retailers revved up their autonomous delivery programs during the pandemic:

- In June 2020, Amazon rolled out its Scout delivery robot service to two new locations in Atlanta, Georgia and Franklin, Tennessee to help meet high demand in the test areas.

- Kroger and Walmart tested Nuro’s second-generation R2 delivery robot.

- Walgreens, which began a trial drone service with Alphabet’s Wing in September 2019, saw drone deliveries increase five times in April over the levels of February 2020. The company expanded the eligible list of drone deliveries to approximately 100–155 items.

Retailers must assess the cost savings that autonomous robots could provide in last-mile delivery and conduct trials to determine consumers’ acceptance of robotic deliveries and which SKUs (stock-keeping units) are most suitable for this shipping method.

4. Digitally Enhance BOPIS and Curbside PickupPickup is fast becoming a preferred delivery mode for customers who order online. Retailers of all types have ramped up their BOPIS (buy online, pick up in-store) and curbside-pickup services as a safe and convenient alternative to in-store shopping in the age of social distancing. These services are less margin-erosive than delivery for retailers. According to Target, it costs 90% less for the company to fulfill online orders by BOPIS and curbside pickup than traditional online fulfillment.

However, BOPIS and curbside-pickup services are not without flaws, including long wait times, vague pickup instructions and poorly timed rendezvous plans to connect with customers and staff. We have seen US retailers implement technology solutions to address these issues and enhance their fulfillment services:

- American Eagle Outfitters launched BOPIS and curbside-pickup options in May 2020 as part of its store-reopening strategy following pandemic-led lockdowns. However, the retailer faced several operational challenges, including customers having difficulty finding curbside-pickup locations and depending on associates to provide parking directions and pickup instructions. The retailer partnered with locations technology provider Radar in September 2020, which provided flexible geofencing functionality to support trip tracking for curbside pickup.

- Lululemon launched virtual waitlist technology in September 2020 that notifies consumers via text when it is their turn to enter the store or perform pickup, returns and exchanges outside the store. Customers can also use the waitlist service to schedule shopping appointments that can be scheduled even before or after the store’s normal operating hours.

- Target and Walmart have been using location-based technology for a while, paving the way for others to follow suit. In September 2020, Giant Eagle partnered with Radius Network to use its FlyBuy Pickup location technology to optimize curbside and in-store pickup. The FlyBuy platform is directly integrated into the Giant Eagle mobile application; it predicts a customer’s estimated time of arrival in the parking lot and sends live alerts to the store, enabling the store associate to properly prioritize order fulfillment. Similarly, Lowe’s Foods, SpartanNash and Albertsons-owned United Supermarkets implemented Radius Network’s FlyBy system in 2020 to reduce the time it takes to fulfill orders.

- Ulta Beauty, which launched curbside pickup in April 2020, has implemented a curbside notification system integrated with GPS and geofencing technology. It automatically alerts the store associate when a customer is on the way to the store, allowing them to deliver the orders as soon as the customer arrives at the pickup zone.

Coresight Research recommendation: We expect consumer demand for alternative fulfillment options to remain elevated post pandemic, due to the convenience and efficiency they provide. According to a survey conducted by e-commerce technology provider CommerceHub in August 2020, 67% of US consumers said they are likely to continue using in-store and curbside-pickup services even when the pandemic subsides. To remain competitive in this space, retailers should leverage technology, with the goal of refining their approaches to BOPIS and curbside pickup to further enhance the customer experience—such as by solving queuing and overcrowding issues and decreasing wait times.

What We Think

The last-mile ecosystem has been evolving for several years. With the onset of the pandemic, its steady expansion gave way to a sudden explosion in growth. With retailers scrambling for quick fixes to meet surging online demand, the initial pandemic response has mostly run its course. Retailers must now revisit their last-mile strategies and incorporate modern tools to focus on the long-term growth of their e-commerce business.

Implications for Retailers

- Retailers can diversify out of traditional shipping carriers and gradually take greater ownership of last-mile logistics. In an e-commerce ecosystem, last-mile delivery is the only stage where a brand physically meets the customer. Therefore, building a positive customer experience through last-mile delivery has become critical, and mismanagement at this stage can severely hurt the brand’s reputation and prompt shoppers to migrate to competitors.

- Efficiently managing and processing returns is fast becoming a differentiator and key competitive advantage for retailers and e-commerce companies, which should explore ways to drive down returns rates and handle returns more efficiently over the long term. Innovators and service providers can provide support to this end, with solutions ranging from software-as-a-service returns-optimization platforms to returns-handling firms that consolidate and process returns to real-world returns drop-off points.

- Environmentally conscious consumers may look to shop with retailers that offer delivery options which do not involve large carbon dioxide emissions. Incorporating electric vehicles and autonomous delivery vehicles in their fleet would allow a retailer to promote itself as a firm committed to sustainability while simultaneously expanding their delivery capacity.

Implications for Technology Vendors

- Technology vendors can capitalize on retailers’ efforts to leverage innovation and technology in their last-mile logistics ecosystem to keep up with pandemic-induced trends, improve their margins and retain customer loyalty.

- Technology vendors must provide holistic solutions that integrate retailers’ disparate logistics functions onto a single platform to enable seamless management of inventory, last-mile execution and delivery to the end-customer.