albert Chan

Introduction

What’s the Story?

Our Playbook series provides recommendations for brands, retailers and marketplaces seeking to tap growth segments and emerging trends.

We have identified responsive product sourcing as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the end of the report for more details).

In this Playbook, we present five key strategies for global retail players to consider as they reframe their sourcing policies. Our coverage includes specific examples of the strategies and associated business models across multiple retail categories.

Why It Matters

Global markets continue to weather supply shocks, from the Russia-Ukraine war to China’s zero-tolerance Covid-19 policy, which has resulted in lockdowns across pockets of the country, disrupting supply and derailing freight processes. Retailers are overhauling their supply chain strategies to insulate them better against such shocks, making the reconsideration of sourcing a crucial exercise.

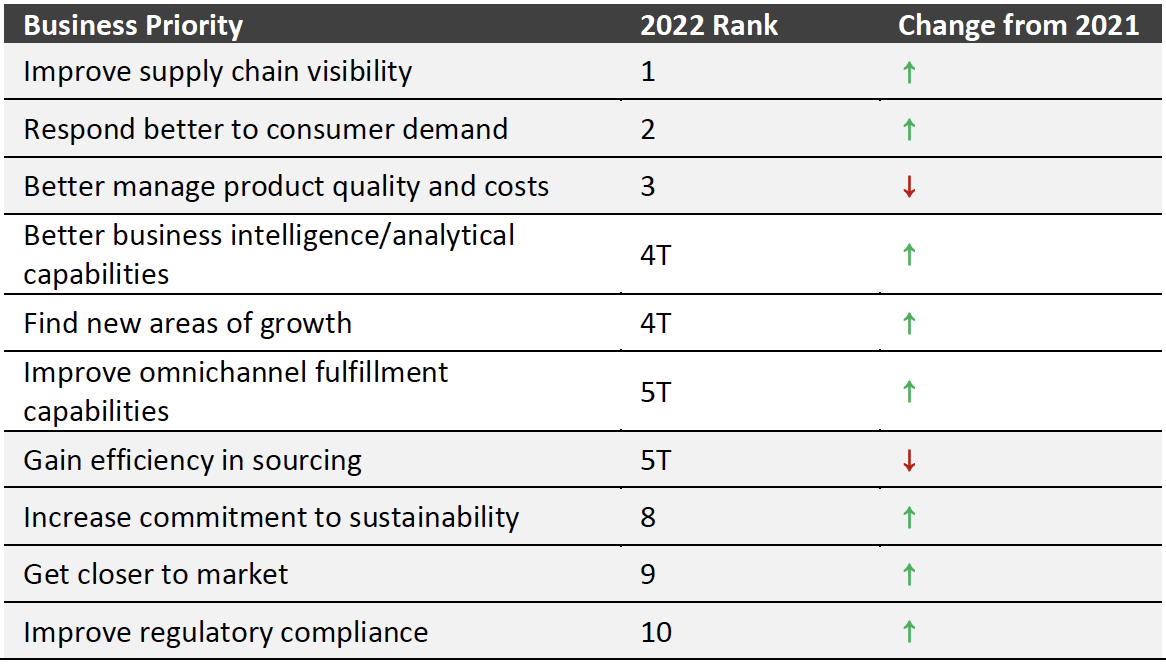

According to a 2022 survey by software services firm CGS, seven of the top 10 business priorities among global professionals from various retail sectors are directly related to sourcing (highlighted in Figure 1 below). Improving supply chain visibility became the most important priority—moving up one rank compared to the 2021 survey—while managing product quality and costs dropped from rank one to rank three.

Brands and retailers should review their sourcing processes with a critical eye, rethinking their supply chain strategy and re-rooting it in digitalization, if necessary.

Figure 1. Top 10 Business Priorities Ranked by Importance, 2022 [caption id="attachment_150881" align="aligncenter" width="700"]

Base: 160 retail professionals, surveyed in November and December 2021

Base: 160 retail professionals, surveyed in November and December 2021Source: CGS[/caption]

Digitalization for Faster, Closer and More Sustainable Sourcing: A Playbook

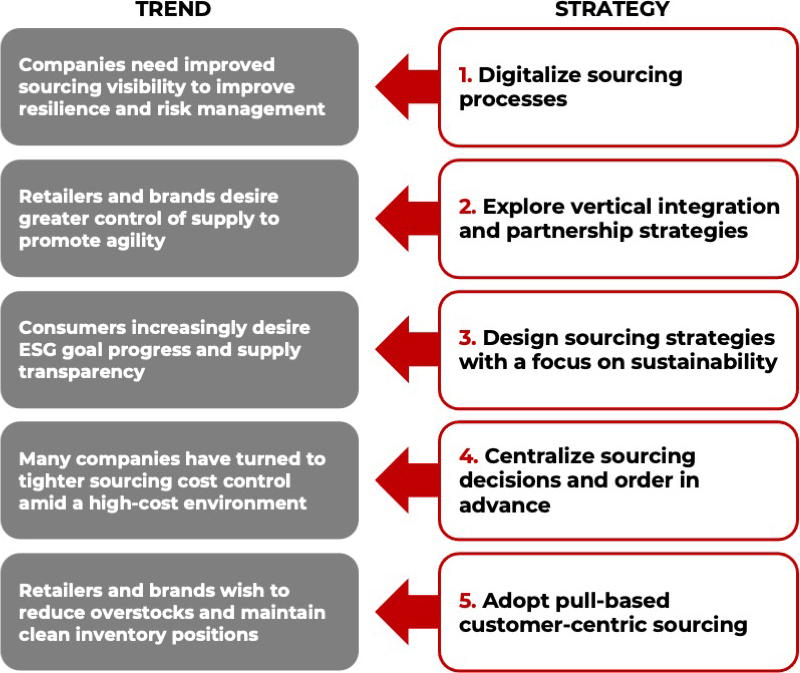

We define sourcing as activities involving supplier and vendor search; supplier evaluation; supplier selection and order placement; production monitoring; shipping to the retailers’ and brands’ destination markets; and the receipt of goods. In Figure 2, we identify five key trends in sourcing and summarize how retailers can adjust their strategies to cater to uncertainty in the supply chain. We explore each strategy in detail below.

Figure 2. Five Key Sourcing Trends and Strategies [caption id="attachment_150882" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

1. Digitalize Sourcing Processes

Source: Coresight Research[/caption]

1. Digitalize Sourcing Processes

Digitalization helps companies gather more data over time. Furthermore, as emerging technologies—such as artificial intelligence (AI)—evolve, the importance of data grows as it provides more accurate predictive capabilities. This became clear as pandemic-led supply chain disruptions grew, and companies needed to act quickly to tackle the problems and respond to shifting consumer demand. Retailers and brands needed the right information at the right time—i.e., complete supply chain visibility—to react quickly.

Product lifecycle management (PLM) software and process-specific technologies enable in-depth visibility, meaning that companies can see technical specifications, collaborate with suppliers on product innovation, detect errors and holdups in real time, and implement solutions. For example, 3D printing and 3D visualization can help speed up ideation, prototypes and approvals in earlier stages of product development and production. By shortening lead times, supply chains can become more resilient and less exposed to shocks before the product reaches market.

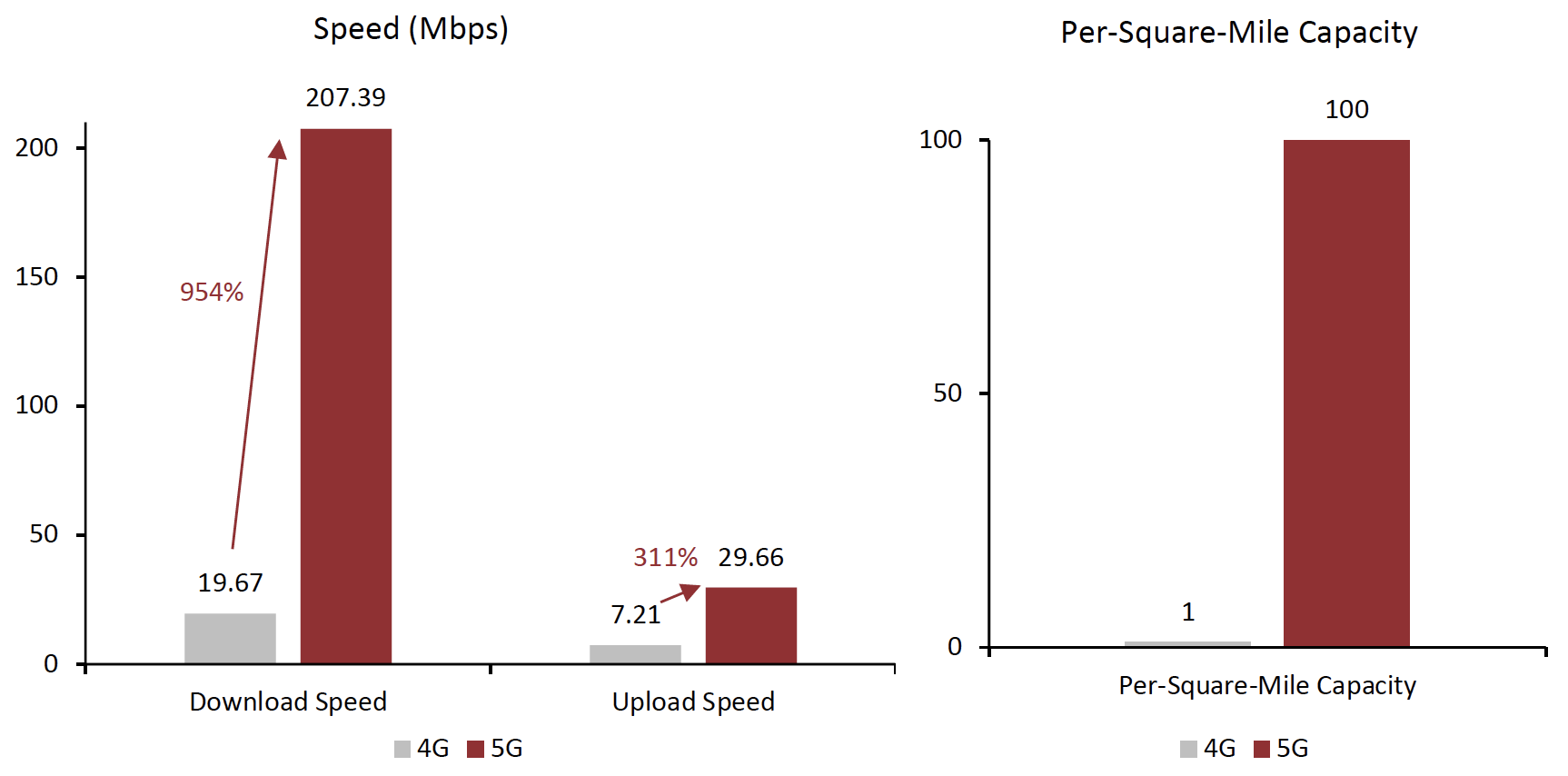

Furthermore, 5G wireless technology, when combined with other technologies such as Wi-Fi and Bluetooth, provides end-to-end supply chain coverage that is not possible with older technology. 4G technology can only handle 10,000 devices per square mile, while 5G can handle over 1 million devices per square mile, according to “Enhanced Logistics Security Techniques Using IoT and 5G,” a research paper published at the 2020 International Conference on Wireless Communications Signal Processing and Networking (WiSPNET).

5G is also much faster than 4G: in 2020, the worldwide median download speed for 5G was 954% faster than 4G, and the upload speed was 311% faster, according to the GSM Association (GSMA), a mobile network trade body.

Figure 3. 4G vs. 5G: Speed (Mbps) and Per-Square-Mile Capacity (Ratio of Devices)

[caption id="attachment_150883" align="aligncenter" width="700"] Source: GSMA/WiSPNET/Coresight Research[/caption]

Source: GSMA/WiSPNET/Coresight Research[/caption]

Companies should look to adopt emerging technologies across their supply chain and consider whether they need process-based software applications or PLM software based on their scale, budget and operating sectors.

Adidas, Levi’s and PVH Corp.—Pioneering 3D Design and Digital Sourcing

In 2021, Adidas unveiled a new growth strategy called “Own the Game.” As part of the strategy, which sets goals through 2025, Adidas will invest €1 billion ($1.2 billion) in digitalizing “core processes across the entire value chain,” including the product development process (which will use 3D design capabilities) and sourcing.

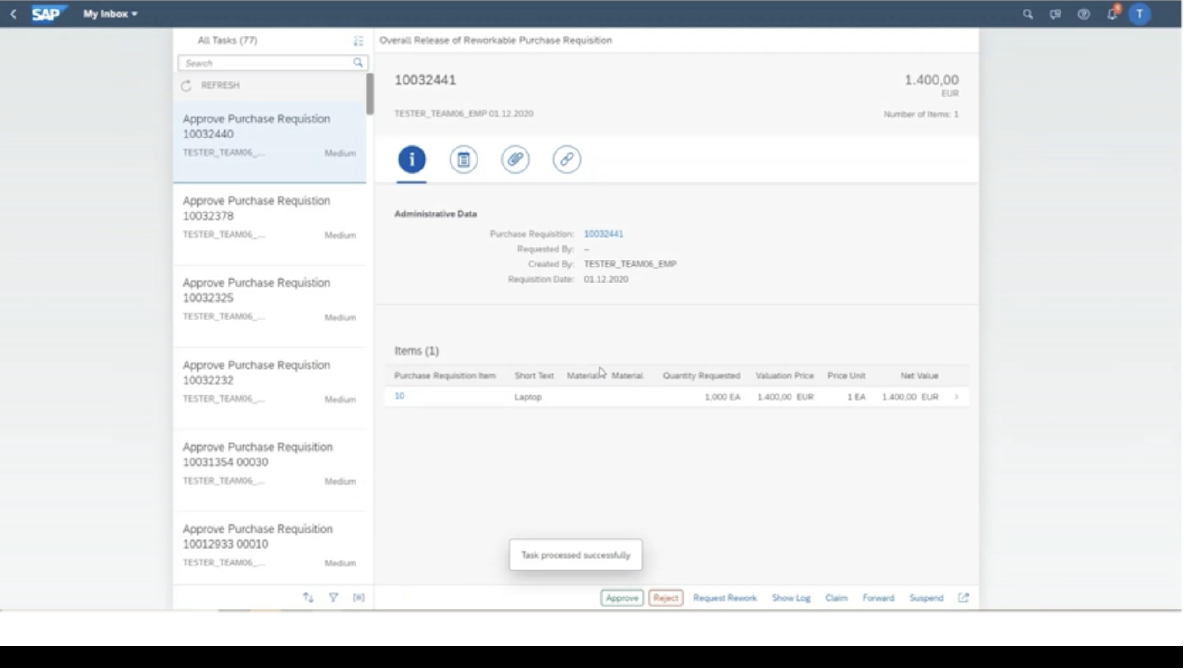

Shortly after the announcement of its growth strategy, Adidas hired more than 1,000 digital and tech personnel and deployed SAP’s S/4HANA, an enterprise resource planning (ERP) software. The ERP software uses AI to optimize processes and improve supply planning, such as by automating sourcing, providing contract management and centralizing sourcing processes.

[caption id="attachment_150884" align="aligncenter" width="550"] S/4HANA’s sourcing and procurement interface

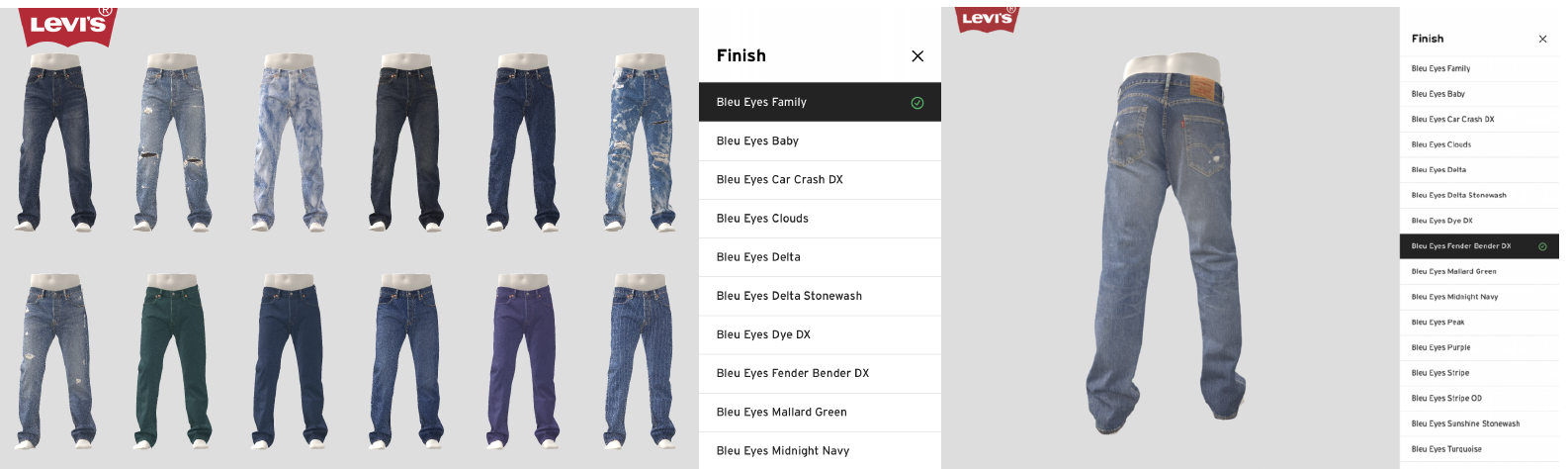

S/4HANA’s sourcing and procurement interfaceSource: Company website[/caption] Levi’s uses photorealistic digital 3D reproductions of denim and apparel samples to design and display new and classic finishes without having to develop or ship physical samples, thus saving resources and increasing speed to market. Levi’s says it shortens a process that usually takes months to just a few days, helping the brand adopt a make-to-order approach based on consumer demand, and reduce overall inventory. [caption id="attachment_150885" align="aligncenter" width="700"]

3D renderings of the Levi’s Bleu Eyes Denim Collection

3D renderings of the Levi’s Bleu Eyes Denim CollectionSource: Company website[/caption]

PVH Corp. has used 3D digital apparel design for several years. The company’s Tommy Hilfiger brand began experimenting with 3D design in 2017, developing proprietary tools and software, including digital fabrics, colors and assets. It then founded a tech incubator, Stitch, in the Netherlands in 2019 and began training its associates in 3D design and product development software through the Stitch Academy.

Most recently, during its Investor Day on April 13, 2022, PVH management said that it hopes to implement 3D design across 100% of its collections by 2025, helping the company improve speed to market and achieve its sustainability goals.

2. Explore Vertical Integration and Partnership Strategies

Retailers should vertically integrate processes by acquiring facilities at the end of the vertical value chain or collaborating with enablers that can reduce product cycle times and supply chain issues. Vertically integrated facilities enable retailers and brands to:

- Coordinate better, communicate faster and implement production changes quicker as decisions are made in-house

- Save on transaction and handling costs when buying goods from external vendors

- Reduce operational tasks involved with compliance and quality inspection at external facilities

- Benefit from economies of scale of buying raw materials in bulk, rather than losing on cost benefits distributed across multiple suppliers

- Maintain exclusivity over manufacturing processes and autonomy over design and development

- Deliver lower prices and maintain price competitiveness

At the pandemic’s peak, several retailers experienced stockouts when demand for essentials surged and consumers stockpiled products. Had retailers owned production facilities, they could have met demand quicker than those dependent on external facilities (provided they could source raw materials).

While vertical integration has numerous benefits, it may not be profitable for all companies or in all situations. For example, manufacturing and raw materials processing tend to be asset-heavy businesses and will require significant investments to develop vertical integration. Rigidity may also pose a hurdle, as some facilities may not be able to deliver specific product variations. Nonetheless, vertical integration provides control and visibility that businesses dependent on external suppliers lack.

Grocery and Luxury Companies Gaining Greater Control with Vertical Integration

Various grocery retailers, such as Albertsons and Kroger in the US and Morrisons in the UK, have a vertically integrated supply chain for some product lines, giving them greater control over the sourcing process. Albertsons and Kroger have dairy processing and milk bottling plants, while Morrisons owns abattoirs and sites for manufacturing and processing fresh food.

Costco announced the construction of a chicken-processing plant in Nebraska in 2017, and, in March 2021, the company stated the plant had reached full capacity. The plant fulfills about 25% of Costco’s chicken supply needs and helps the company maintain the $4.99 price of its signature Kirkland rotisserie chicken. Its centralized sourcing and manufacturing approach has been a disadvantage on some occasions, however. At the start of the pandemic, the company struggled to export US-manufactured products to its stores in Asia and Australia. Eventually, it found local suppliers to avoid such disruptions.

Walmart has vertically integrated several product supply chains, such as milk bottling and meatpacking. In 2016, Walmart opened a milk bottling plant in Indiana. It opened meat-processing facilities in Kansas and Georgina in 2019 and 2020, respectively, developing an end-to-end Angus beef supply chain.

Chanel acquired a majority stake in textile manufacturer Paima in August 2021, but it is not new to such investments. It has strategically acquired stakes in several different businesses over the years, including shoemaker Nillab Manifatture Italiane in October 2020 and tannery Conceria Samanta in July 2019. Chanel has also backed companies that use green chemistry and sustainable manufacturing methods, such as Evolved by Nature and P2 Science, which it backed in June 2019 and February 2020, respectively.

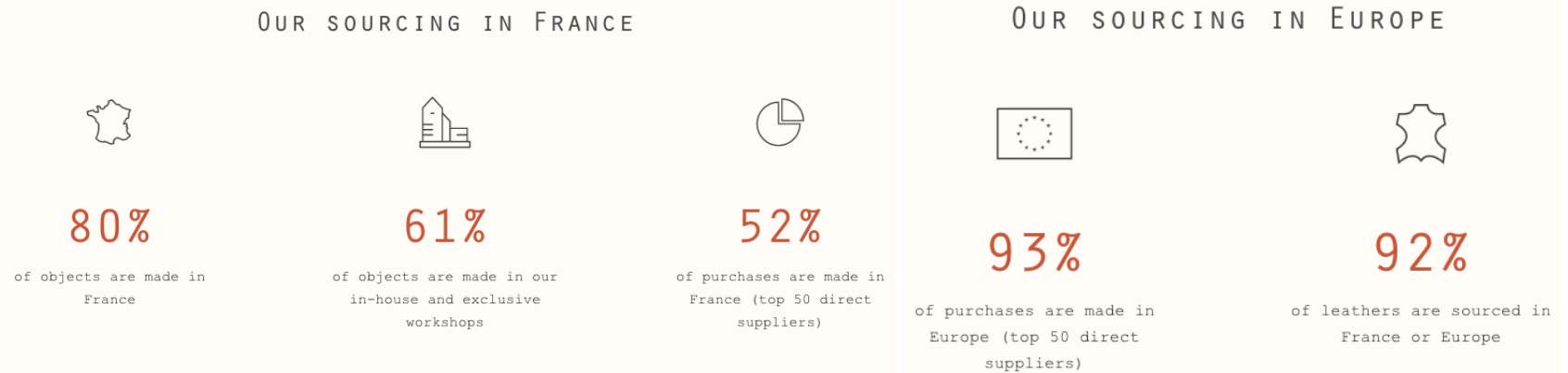

Hermès is one of the few luxury companies with a heavily vertically integrated supply chain, diligently protecting its raw materials and supply chain. The heritage luxury brand owns alligator and crocodile farms in the US and Australia, tanneries to tan and finish hides, and textile production sites.

[caption id="attachment_150886" align="aligncenter" width="700"] Sourcing information from Hermès

Sourcing information from HermèsSource: Company February 2021 earnings call presentation[/caption]

- In 2021, luxury fashion house Zegna partnered with Prada to acquire a stake in Italian cashmere supplier Filati Biagioli Modesto. Zegna also acquired a 60% stake in fine fabrics manufacturer Tessitura Ubertino, indicating that it is looking at multiple strategies, including integration and business expansion, to consolidate its position in a highly competitive market.

3. Design Sourcing Strategies with a Focus on Sustainability

Investors, employees and consumers are all increasingly calling for retailers and brands to focus on sustainability. They want to invest in, work for and buy from companies whose environmental and societal values align with their own.

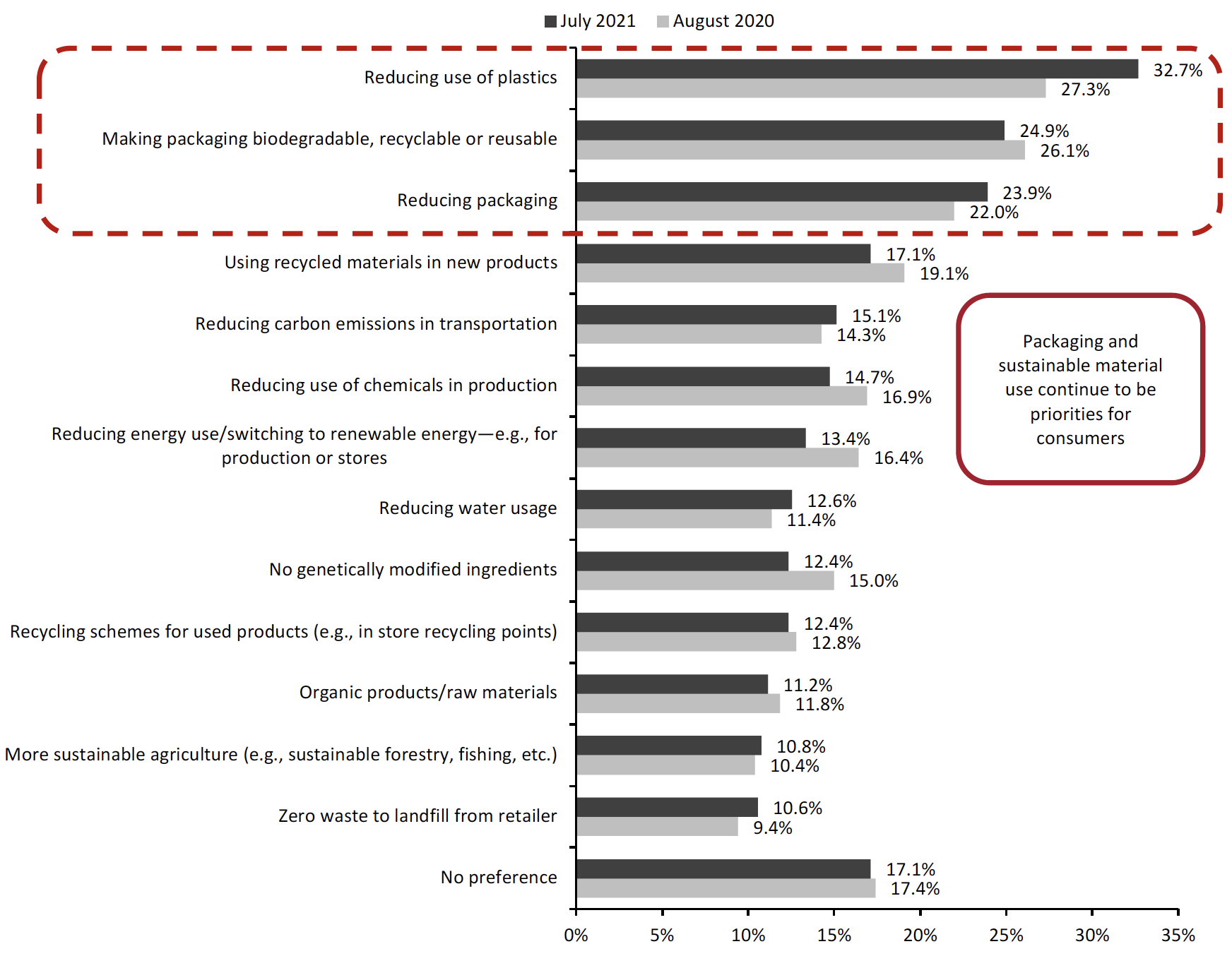

Specifically, reducing plastic use is the sustainability practice that consumers consider to be most important for retailers, according to a Coresight Research survey of US consumers conducted on July 26, 2021. Our survey results underscore the importance of sustainable packaging: consumers ranked making packaging more eco-friendly and reducing overall packaging as second- and third-most important, respectively (see Figure 4).

Figure 4. Which Types of Environmental Sustainability Consumers Consider To Be Most Important for Retailers (% of Respondents) [caption id="attachment_150887" align="aligncenter" width="700"]

Respondents could select up to three options or “No preference”

Respondents could select up to three options or “No preference”Base: US respondents aged 18+, surveyed in August 2020 and July 2021

Source: Coresight Research[/caption]

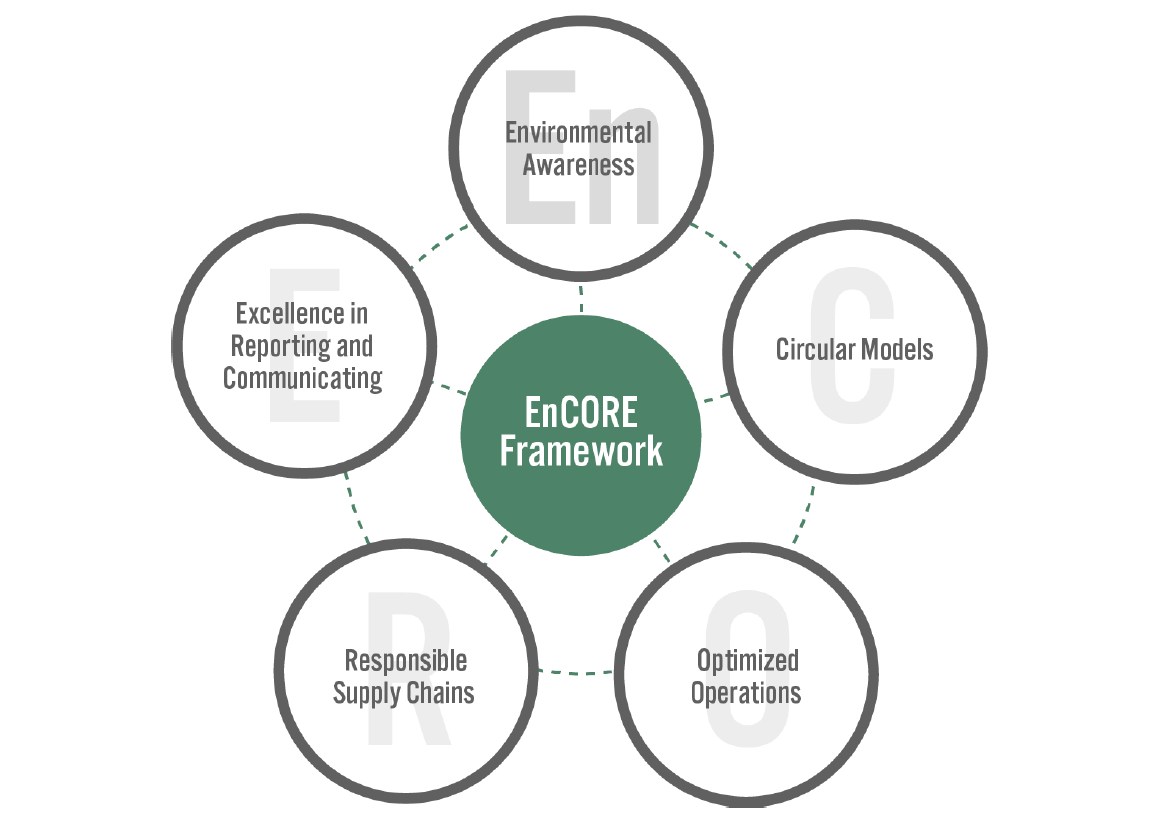

Coresight Research’s EnCORE framework for sustainability in retail comprises five components (see Figure 5), providing a model through which retailers can frame their approach to sourcing around sustainability, boosting profits and driving growth while also realizing environmental benefits.

- For more on our EnCORE framework and how it can impact various facets of retail business, read our separate report, The Time for Sustainability in Retail Is Now.

Figure 5. Coresight Research’s EnCORE Framework for Sustainability in Retail [caption id="attachment_125787" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

By implementing goals and actions that align with the EnCORE framework’s five components, retailers and brands can reduce their environmental impact—which should attract and retain new customers, employees and investors.

- Environmental engagement—The responsibility of a company’s environmental impact extends beyond its own footprint; external audits of first- and second-tier suppliers are crucial to ensuring adherence to sustainable practices within the sourcing process.

- Circular models—Efficient design and using alternative or repurposed materials while sourcing will reduce waste and returns, reducing excess and unsold inventory.

- Optimized operations—Lower energy, water and fuel consumption at all levels of production will contribute to a more sustainable supply chain.

- Responsible supply chains—An eco-friendly sourcing strategy should use sustainable materials and packaging, reduce landfill waste and support biodiversity preservation.

- Excellence in reporting—Companies need to communicate their enterprise-level sustainability goals and remain transparent on their progress, right from sourcing to the end-consumer, to all stakeholders, internal and external.

Companies Pursuing Sustainable Outcomes via Sourcing and Production

In 2015, Adidas introduced a footwear line created from reclaimed and recycled marine plastic waste turned into yarn and filaments. By 2019, it had produced more than 11 million pairs of shoes containing recycled ocean plastic. Now, by 2024, the company hopes only to use recycled polyester in all its products.

Capri Holdings aims to have 95% of suppliers and processing units fully assessed and all raw materials traceable and evaluated by 2025. It has also introduced a Factory Compliance Program, requiring all factories to adhere to its guidelines.

By 2050, Gap Inc. plans to eliminate its use of wood-derived fibers sourced from ancient and endangered forests. As of the latest update (2019), the company is on track to complete the goal, with 86% of its cellulosic fiber no longer coming from said forests. Gap has another 2025 goal: sustainably source 100% of the cotton it uses. As of the first quarter of 2020, the company sustainably sources 57% of its cotton.

Kering implemented its “Kering Standards” in 2018, which apply to its internal operations. Kering measures its reporting scope and sustainability progress across every tier of its supply chain:

- Tier 5—Production and extraction of raw materials

- Tier 4—Raw material processing

- Tier 3—Manufacturing and preparation of subcomponents

- Tier 2—Final product manufacturing and assembly

- Tier 1—Store, office and warehouse operations

As of 2020, the group is 68% aligned with the goals put forth in the Kering Standards and plans to achieve 100% alignment by 2025.

In September 2021, the company took another step toward total alignment when it announced it would stop using fur in all products by fall 2022. Later, in May 2022, it backed biotech startup VitroLabs, which develops lab-grown, animal-free leather.

In April 2022, LVMH, along with Fendi, Imperial College and Central Saint Martins, announced a two-year research initiative to develop lab-grown fur for luxury fashion.

While NIKE still has sustainability goals it wants to achieve, it already has several product lines using recycled materials. The company uses recycled leather fibers, polyester, cotton and nylon in many of its products, as well as recycled plastic from bottles for shoe uppers, generating 60% less waste than in traditional footwear upper production, according to NIKE.

4. Centralize Sourcing Decisions

When production facilities shut down during the pandemic, it led to port congestion and a serious pileup of unshipped inventory. This started a domino effect leading to higher input costs—such as freight prices—and out-of-stocks, among other hurdles. Although there was some recovery in early 2022, the Russia-Ukraine war and Covid-19 lockdowns in China thwarted the recovery, pushing input and raw material costs even higher.

Companies can curb high costs by implementing a centralized sourcing strategy and creating a more systematic and coordinated approach toward procurement. Apart from the cost benefits of sourcing at scale that a centralized approach offers, there are various ways companies can benefit from centralization:

- A standardized process helps sourcing teams avoid costly errors or oversights.

- Centralizing sourcing activities through a platform that company teams can access allows others to remain aware of the products being sourced and benefit from a shared knowledge repository.

- Reducing the number of vendors and intermediaries can cut down transaction costs and indirect costs incurred from operational tasks involving a large number of stakeholders.

- Companies can cut down on fees paid to agents and, instead, have in-house personnel carry out various sourcing activities, such as quality inspections and compliance monitoring.

When companies implement a centralized sourcing strategy, they must define specific instances when the teams can bypass the standardized protocol and have autonomy over decisions.

Kohl’s and Macy’s—Realizing Gross Margin Efficiencies with Unified Sourcing

Kohl’s is looking to drive its gross margin to approximately 36% by 2023 from 35.7% in 2019, according to its earnings call on March 2, 2021. One of the drivers it is implementing is a reduction in sourcing costs; specifically, it plans to reduce its private-label costs by $125 million by the end of 2022 by enabling centralized sourcing, carrying out direct factory negotiations and relying on third-party agents less.

Macy’s discovered that its previous, brand-based sourcing approach led to higher transport and supply costs, as each brand worked individually. It has now transitioned to a category-based sourcing approach that relies on strategic data on relationships, according to its earnings call on February 25, 2022. The company also noted it was previously “informal” with its fabric decisions, leading to 12,000 fabrics with a low adoption rate. Macy’s now plans to use fabrics that cut across genders and brands.

5. Adopt Pull-Based Sourcing Approach

Consumer buying trends are increasingly fleeting, and the pandemic amplified fluctuations in demand. Manufacturing and sourcing on demand—rather than sourcing for cost savings—could help drive inventory efficiency in discretionary sectors where input costs are high.

Data-driven analytics enable retailers to track shifts in consumer demand and quickly signal sourcing teams to procure or produce goods accordingly. For pull-based manufacturing to run smoothly, retailers and brands must have:

- Digitalized sourcing decisions and processes that enable fast data flow

- Identified close-to-market suppliers and vendors to promptly deliver products or finish assembly

- Vertically integrated processes for better control and faster production

Companies Using On-Demand Manufacturing To Reduce Costs and Inventory

In September 2022, Alibaba unveiled a new facility, the Xunxi Digital Factory, that uses cloud computing and the Internet of Things (IoT) to drive on-demand manufacturing. Xunxi is piloting apparel production, which has historically been characterized by long production cycles and high inventory levels. The facility uses new technologies such as real-time resourcing and cost planning, automated in-house logistics and a proprietary manufacturing operating system to produce smaller lots at lower costs with quicker delivery times. Alibaba says this increases average manufacturing efficiency from 25% to 55%.

Xunxi’s trend and sales forecast model, along with its AI-powered integrated product design platform, provides manufacturers insights into consumer trends. This rich flow of information cuts down research and development costs and helps businesses to tap opportunities for consumer personalization.

[caption id="attachment_150889" align="aligncenter" width="550"] Alibaba’s Xunxi Digital Factory

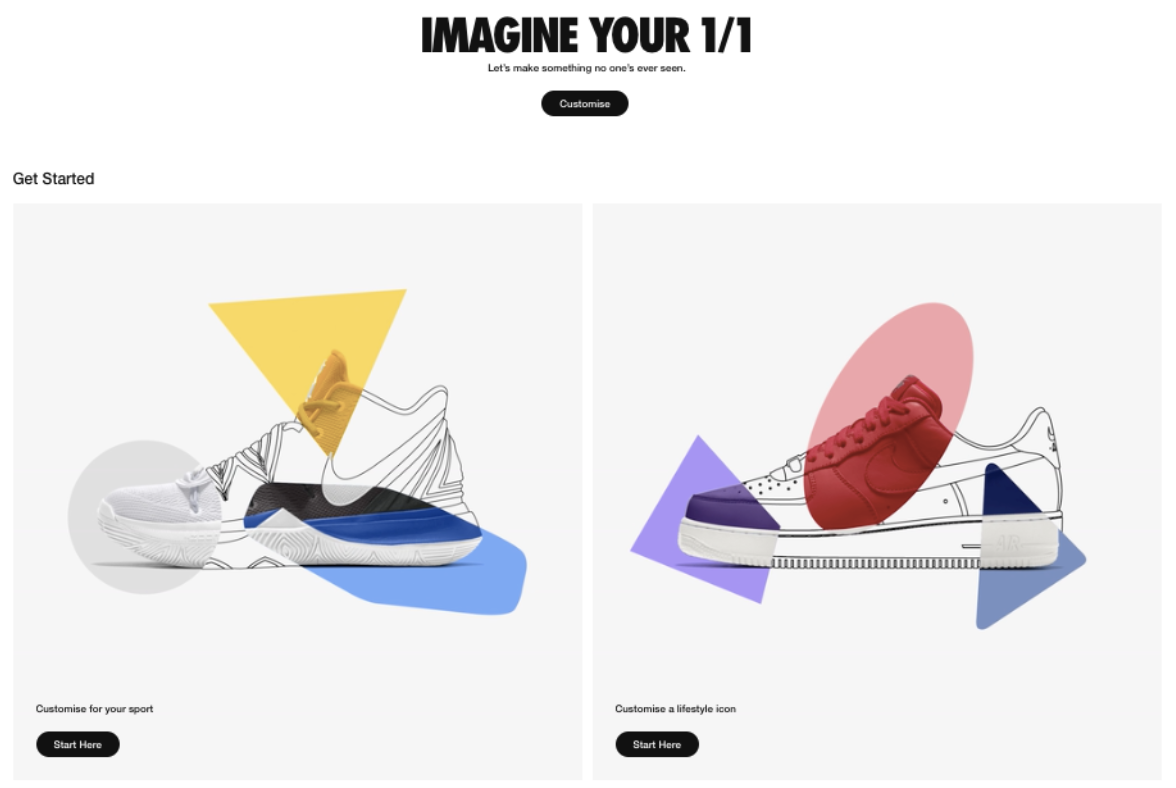

Alibaba’s Xunxi Digital FactorySource: Company website[/caption] NIKE allows shoppers to customize sneakers on its website and in its stores. NIKE’s By You platform provides a host of customization options, categorized into “sport” and “lifestyle” icons. Customers can also choose the underlay and overlay materials, heel clips, outsoles, midsoles and laces, and receive the finished product in two to five weeks. [caption id="attachment_150890" align="aligncenter" width="550"]

NIKE’s By You customization platform

NIKE’s By You customization platformSource: Company website[/caption]

What We Think

Retailers and brands need to rethink their sourcing strategies due to the hurdles presented by the pandemic, political conflicts, economic disruptions and climate change. Given the amount of supply chain characteristics a company can improve, it may seem hard to know where to begin. However, as sourcing is the start of the product journey and is initiated by the company itself, businesses are well positioned to gain control and drive positive outcomes for themselves and consumers with stronger sourcing strategies.

Implications for Brands/Retailers

- Businesses must leverage technology at each stage of the supply chain so processes can function cohesively, rather than in isolated siloes.

- Retailers and brands should digitalize their sourcing processes to increase data flow and drive informed decisions moving forward.

- Companies should explore acquisitions, partnerships or collaborations that enable vertical integration or close-to-market product assembly, cutting down on production time and external shock exposure.

- As conscious shoppers demand transparency in their purchases and investors desire concentrate environmental goals, retailers and brands should design sourcing strategies with a sustainability focus and outline clear, achievable goals.

- For companies looking to achieve tighter cost control in sourcing and production, centralizing sourcing will help contain expenses by cutting down on intermediaries.

- With an uncertain consumer demand environment, retailers and brands should shift toward a pull-based, make-to-order model and away from a push-based, make-to-stock approach.

Implications for Technology Vendors

- Firms with scale may be able to easily deploy end-to-end solutions, but smaller companies may have lower investments allocated to technology.

- Process-specific technology providers can cater to retailers and brands that operate at a smaller scale but are looking to drive efficiencies across their cost-heavy processes.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.

RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework.

The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments.

Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

Appendix Figure 1. RESET Framework

[caption id="attachment_143517" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]