DIpil Das

Introduction

What’s the Story?

The Coresight Research Playbook series provides recommendations for brands, retailers and marketplaces seeking to tap growth segments and emerging trends.

Coresight Research has identified the expanding metaverse as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the appendix of this report for more details).

Beauty, fashion and luxury brands and retailers worldwide have started turning to the metaverse (a digital reality that can include various elements, including virtual and augmented reality, NFTs and cryptocurrency payments) for consumer engagement opportunities and alternative revenue streams.

In this Playbook, we present four strategies for beauty brands and retailers who wish to begin participating in the metaverse. We also discuss recent examples of each strategy, other potential use cases and key considerations for those wishing to enter the metaverse.

Why It Matters

While it remains an emerging technology, the metaverse looks to become a mainstay of the Internet moving forward, supported by consumers' increased connectivity both to the Internet and each other via social media. For beauty industry participants, the metaverse is a new playground in which they can create, experiment and connect with consumers.

- Consumers are increasingly using the metaverse to shop online. In a Coresight Research survey of US consumers aged 13+, conducted in March 2022, 34% of respondents who use metaverse platforms reported that they are shopping on the metaverse and 16% are buying/trading non-fungible tokens (NFTs).

- Coresight Research estimates that metaverse retail sales will total around $2.3 billion by the end of 2022. We expect sales to more than double every year for the next five years to $89.2 billion in 2026, possibly growing to as much as $780 billion by 2030.

- The metaverse is more than a fad, given the intense interest of the next generation of beauty shoppers, who are currently in their teens. Shoptalk 2022 surveyed the audience regarding their expectations on the importance of new retail channels in North America in the next 12 months on a scale of one (low) to five (high): The average score for the metaverse came in at 2.6. Many notable retail companies, including Estée Lauder, Gucci and PacSun, have started increasing their metaverse offerings and experiences.

Beauty in the Metaverse: A Playbook

The beauty category is a natural fit for the metaverse. Beauty products transform how users feel and think about themselves . Similarly, the metaverse, with its virtual reality (VR) and augmented reality (AR) capabilities, allow users to present themselves however their heart desires. The metaverse also enables beauty brands to create virtual recreations of their products, meaning that consumers worldwide can test and interact with them from the comfort of their own homes.

In Figure 1, we showcase various metaverse projects undertaken by beauty brands worldwide since July 2020. We detail many of these projects further below in the report.

Figure 1. Select Beauty Brands’ Metaverse-Related Projects from the Past Two Years [wpdatatable id=2148 table_view=regular]

Source: Company reports/Coresight Research

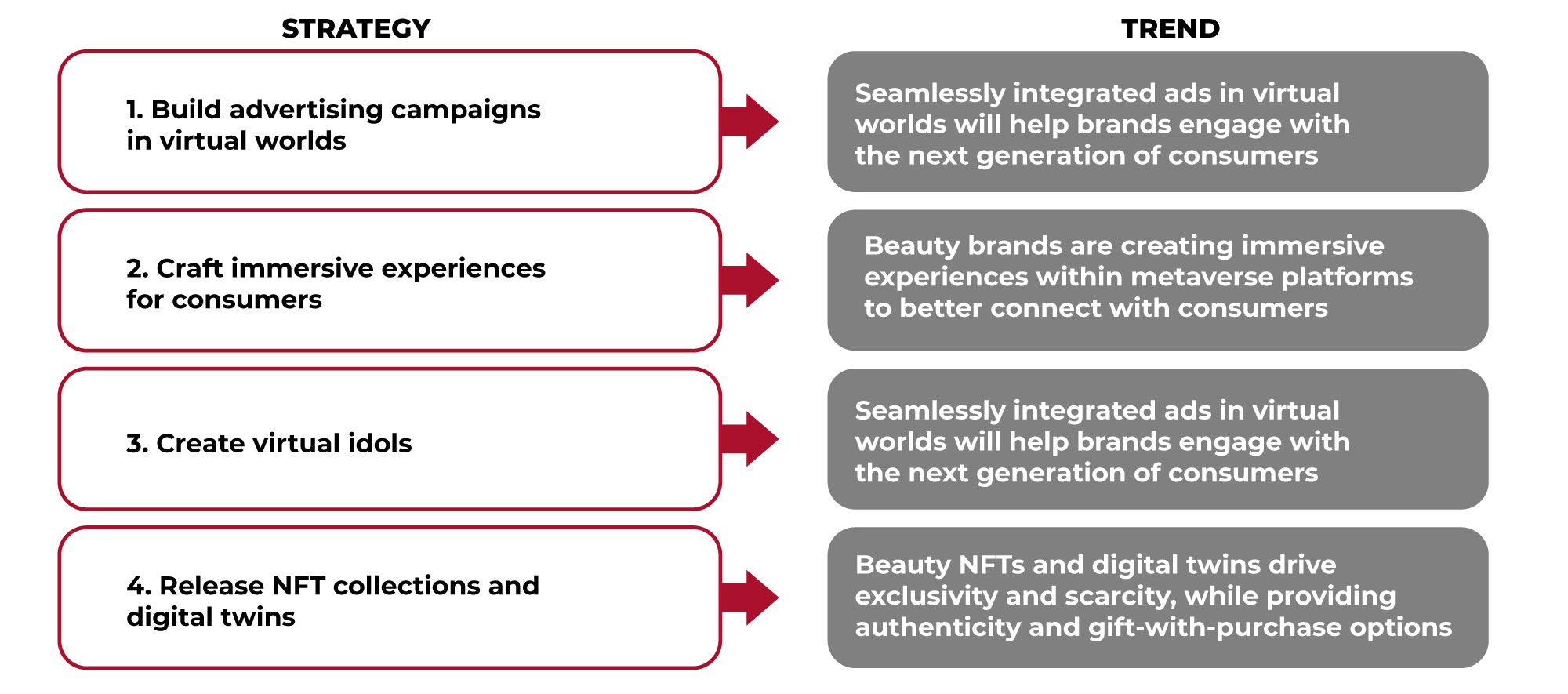

There are a variety of approaches a beauty can take to enter the metaverse. In Figure 2, we present four key strategies for beauty brands wishing to build a presence in the metaverse and reap the benefits such as improved reach, enhanced consumer engagement and increased sales opportunities. We explore each strategy in detail below, including successful examples of implementation and the benefits of adopting each strategy for beauty brands and retailers.

Figure 2. Four Key Strategies for Beauty Brands To Succeed in the Metaverse [caption id="attachment_152184" align="aligncenter" width="701"]

Source: Coresight Research[/caption]

1. Build Advertising Campaigns in Virtual Worlds

Source: Coresight Research[/caption]

1. Build Advertising Campaigns in Virtual Worlds

Advertising and marketing have always been essential to the beauty industry. However, adapting advertising campaigns to the metaverse is the key to attracting the next generation of shoppers. In the metaverse, advertisers can create entertaining and engaging content targeted at a particular community. As the technologies powering these advertisements strengthen, customers are much more likely to engage with—and even share—metaverse-based ads.

Online games and metaverse platforms have become popular avenues for beauty marketers as players often stay logged on for extended periods, giving marketers many opportunities to entice them. Beauty brands should not overlook the opportunities to target consumers—both men and women—through gaming. According to a survey of consumers aged 10+ from France, Germany, the UK and the US, conducted by games market data company NewZoo in August 2021, 53% of non-metaverse gamers are female and 41% of metaverse gamers (who had played Fortnite, Minecraft or Roblox) are female.

Many beauty brands have used gaming to connect with gamers of all ages.

- Givenchy Beauty partnered with Nintendo’s Animal Crossing in July 2020 to create new beauty looks for in-game avatars.

Promotional photo for Givenchy Beauty’s collection on Animal Crossing

Promotional photo for Givenchy Beauty’s collection on Animal Crossing Source: Company website [/caption]

- In August 2020, Estée Lauder launched ANRcade, a microsite featuring browser-based games, to support the launch of its Advanced Night Repair Synchronized Multi-Recovery Complex.

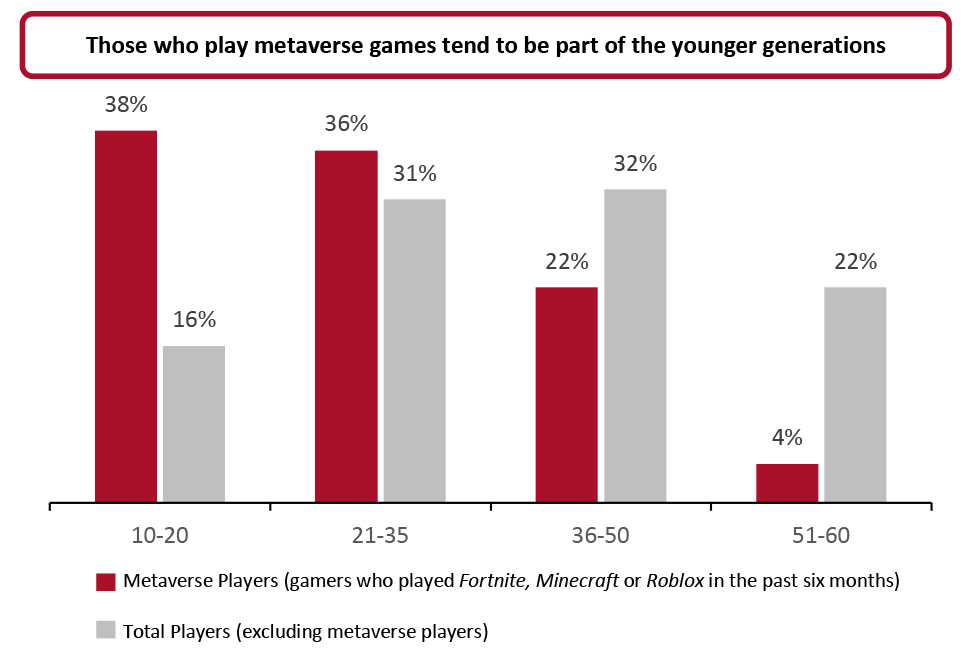

Companies should also dedicate resources to advertising on metaverse platforms, in addition to traditional video games. Given how active 10–20-year-olds are in metaverse gaming (see Figure 3), it presents a significant avenue for beauty brands to meet the next generation of buyers.

Figure 3. Average Age of Metaverse Players vs. Total Players [caption id="attachment_152185" align="aligncenter" width="701"]

Base: 2,358 metaverse game players age 10+ (for Metaverse players); 3,163 video game players age 10+, excluding metaverse players (for Total players)

Base: 2,358 metaverse game players age 10+ (for Metaverse players); 3,163 video game players age 10+, excluding metaverse players (for Total players) Source: Newzoo’s Trends to Watch in 2022 report [/caption]

Brands can partner with in-game and extended-reality (XR) advertising platforms to introduce virtual billboards and launch commercials onto metaverse platforms to target specific audiences. Beauty marketers could also take a more hands-on approach, creating limited-time events, immersive experiences (see next section) and usable digital objects to engage with online communities.

While these are great places to begin, the rapid advancement of technology will likely change what brands can do within the metaverse in the next two years. Brands should constantly increase their knowledge of the metaverse, as well as explore and test new marketing strategies to remain relevant.

2. Craft Immersive Experiences for ConsumersThe Covid-19 pandemic accelerated the beauty industry’s adoption of AR and VR technology as nonessential retail outlets closed and consumers needed a way to try cosmetic products online. Now, given the importance of the metaverse, many beauty companies are bringing these technologies to virtual worlds.

We expect that few, if any, beauty brands will have the extensive, in-house expertise required to create, maintain and advance metaverse content and characters. Instead, beauty brands should look to partner with tech companies that will help them craft online content that is both different and engaging, as well as marketing strategies utilizing emerging technologies.

- In March 2022, NYX Professional Makeup, a digital-first brand, launched MYAIA in March 2022, an AR-powered makeup artist that provides online makeup consultations. The brand also partnered with Snapchat to debut a metaverse beauty experience in December 2020. The Snapchat-powered AR store featured games, virtual try-ons and purchasable items. In the same month, NYX Professional Makeup hosted a virtual concert from pop star Bebe Rexha on Triller, a video-based social media site.

- As the official beauty partner of Decentraland’s Metaverse Fashion Week, Estée Lauder released 10,000 digitally wearable NFTs—which glitter around the user’s avatar when worn—inspired by its bestselling product, Advanced Night Repair, during the digital event. Users had to enter a massive digital recreation of the Night Repair bottle to receive the NFT.

A Decentraland avatar wearing the Estée Lauder Night Repair NFT

A Decentraland avatar wearing the Estée Lauder Night Repair NFT Source: Estée Lauder’s Twitter account [/caption]

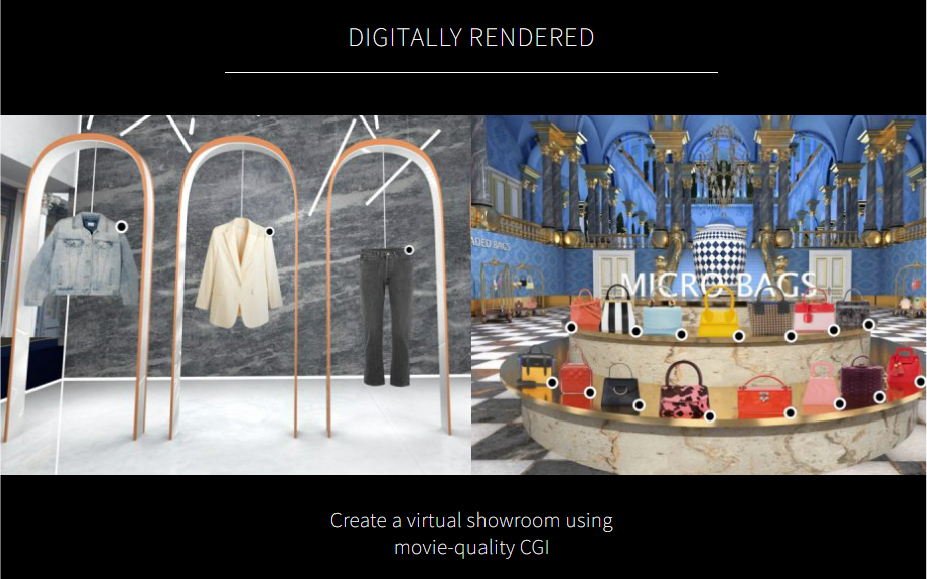

Beauty brands looking to create engaging, immersive experiences can also partner with virtual store platforms such as Obsess. Such companies work with brands to create virtual recreations of real-world stores, as well as digital storerooms and virtual experiences that are unattainable in the physical world. So far, Obsess has worked with various beauty companies, including Charlotte Tilbury, Dermalogica and Nars Cosmetics.

[caption id="attachment_152173" align="aligncenter" width="700"] Virtual showrooms created by Obsess

Virtual showrooms created by Obsess Source: Company website [/caption]

Beauty brands and retailers can also partner directly with virtual worlds and games, creating a mutually beneficial partnership based on shared revenue or commission. The developers behind metaverse platforms bring virtual land, as well as guidance and assistance in constructing and maintaining digital environments, while the beauty companies provide the creative power necessary to design unique experiences and an established customer base.

3. Create Virtual IdolsIn addition to digital adverts and experiences, beauty brands can also create virtual idols (computer-generated avatars) to promote their brands and products via adverts, interactions and videos on metaverse platforms and social media apps such as Instagram, Snapchat, TikTok and YouTube. Virtual idols present a unique opportunity for beauty companies, allowing them more control over their brand narrative and interaction with fans. Thanks to these company-controlled, virtual influencers, beauty brands are no longer beholden to the demands and schedules of real-world influencers.

- In May 2022, haircare brand Olaplex launched an artificial intelligence (AI)-driven, gender-neutral virtual team member, called Kai. According to the announcement post on Instagram, Kai was created to interact with both Olaplex’s professional stylists and consumers alike on social media, answering questions and giving haircare advice. According to the company, Kai is a synthesis of the personality and physical traits of more than 240 Olaplex team members and is designed to be a bias-free brand representative, reflecting the demands of Gen Z and Generation Alpha (those born after 2010).

- Italian luxury fashion brand Prada created virtual influencer Candy to promote the 2021 relaunch of its Candy fragrance collection (Prada Candy initially debuted in 2011). The “virtual muse” was part of Prada’s ReThink Reality marketing campaign, which spanned film, print and social media.

While the benefits of virtual influencers are clear, the costs of promoting and maintaining one can quickly add up, so beauty companies should carefully consider these costs before creating a virtual influencer for their brand or company. However, companies considering implementing a virtual idol also need to consider the influencers’ backstory and characterization (how they will interact with the brand’s audience). Of course, the virtual idol’s story and characterization should match the implanting brand’s story and the way it interacts with customers.

[caption id="attachment_152174" align="aligncenter" width="700"] Prada’s “virtual muse,” Candy

Prada’s “virtual muse,” Candy Source: Company website [/caption] 4. Release NFT Collections and Digital Twins

An NFT is a non-exchangeable unit of data stored on an indelible record of transactions (the blockchain). Many beauty brands have started to partner with NFT platforms to mint and sell customized collections, raising brand awareness, teaching users about available products and the company’s history, and driving exclusivity and scarcity.

- In February 2022, Kiehl’s, a cosmetics company owned by beauty giant L’Oréal, filed a patent to “[create] an online community for digital assets, non-fungible tokens, and metaverses and online worlds; [host] an online community website featuring digital assets, non-fungible tokens, and metaverses and online worlds.”

At this point in the evolution of digital products, NFTs and the metaverse, we find that brands often tie NFTs to a twin physical product. For instance, in January 2022, fashion brand Cult&Rain released NFTs of their latest sneaker line that also provided an identical pair of sneakers in the real world at no additional cost. Meanwhile, other brands have included tokens as a gift-with-purchase (GWP) option. Beauty brands should mirror these strategies with NFT collections for limited-edition products and packaging and by providing NFTs as GWPs to expand reach, keep consumers happy and have them returning for later NFT drops. These tokens should also be promoted as gift options for those who need to send a gift virtually or need something last minute. Beauty brands and retailers should consider digital twins and virtual GWP options to expand brand reach, creating interactions with consumers worldwide, virtually.

Beauty brands have also tied NFTs to charitable donations to showcase the causes they care about and connect with consumers who also care about them.

- In December 2021, L’Oréal commissioned five female artists to create NFTs in tandem with the marketing campaign for its new Colour Riche collection, Reds of Worth. The NFTs were available on the OpenSea marketplace for three days, during which time the artists received 100% of the proceeds from primary NFT sales. Afterward, until December 2022, 50% of all secondary market sales will be donated to L’Oréal Paris’ “signature philanthropic initiative,” Women of Worth, which finds and helps ordinary women who are trying to make a difference in their community.

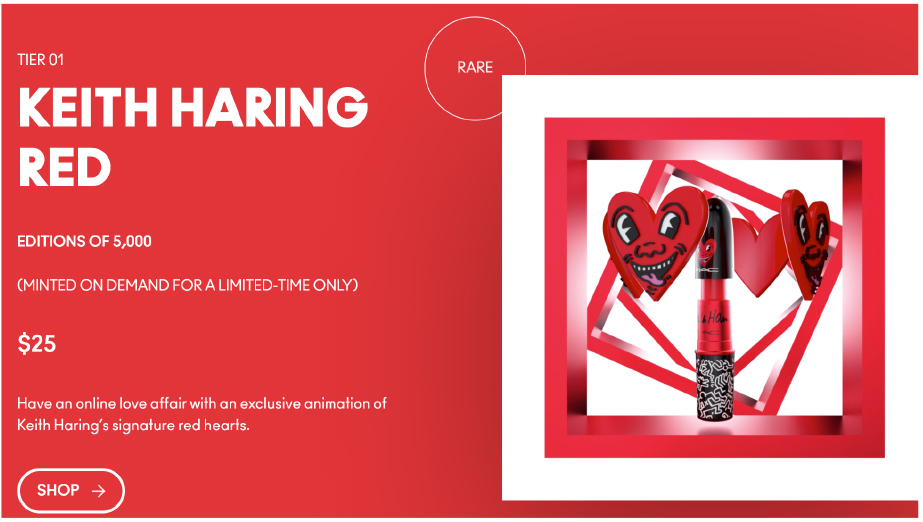

- In March 2022, MAC Cosmetics (owed by Estée Lauder) launched an NFT collection in collaboration with Keith Haring Foundation to support National Youth HIV/AIDS Awareness Day. The collection was available from mid-April until June 1 on OpenSea and could be purchased with either a credit card or cryptocurrency. MAC plans to donate all proceeds from primary sales of the collection to the MAC Viva Glam Fund, which supports young people impacted by HIV and AIDS. Afterward, 2.5% of all secondary sales will go to the Keith Haring Foundation, which supports HIV/AIDS education and research, through January 2023. The collection featured three tiers of rarity, and the tokens themselves showcased digital twins of MAC’s Keith Haring lipstick collection.

Advert for the Viva Glam x Keith Haring NFT collection

Advert for the Viva Glam x Keith Haring NFT collection Source: Company website [/caption]

- Maison Guerlain, a cosmetics company founded in 1828 and owned by luxury group LVMH, combined environmental sustainability and brand education with its latest NFT collection. The collection, which launched at the end of April 2022, comprises 1,828 tokens—a nod to the year the brand was founded—featuring the brand’s bee iconography. Proceeds from the sale of these “1828 Cryptobees” will help sponsor and maintain a parcel of land in the Vallée de la Millière, a biodiversity reserve in France that was created by environmentalist Yann Arthus-Bertrand in Millières. For the release, the company advertised the “Reaverse”—a combination of the words “real” and “metaverse”—highlighting the collection’s connection to the real world.

Advert for 1828 Cryptobees NFT collection

Advert for 1828 Cryptobees NFT collection Source: Company website [/caption]

Beauty brands and retailers already engaging with one or more charitable causes should consider how to bring their relationships with charities into the virtual world, which will likely bring new givers to brands’ selected causes. For companies not currently involved with charitable causes, we advise selecting a cause that both resonates with the younger, metaverse-using population and is brand-appropriate.

What We Think

Despite still being in its nascent stage, we think the metaverse presents opportunities for beauty brands to engage with new consumers, advertise in new mediums and sell both NFTs and physical products. We believe that digital advertising, immersive experiences, and NFT collections will all be essential components of a comprehensive brand strategy moving forward. As such, we highly encourage beauty brands and retailers to experiment and invest in the space.

Heritage brands can bring new relevancy to themselves by operating within gaming communities and metaverse platforms. They can also shine a light on the history of their brand and showcase the causes they care about the most via metaverse-based, charitable collaborations.

As soon as possible, beauty brands and retailers should begin to look for talent within their organization to lead the metaverse charge, as well as teach their organization about the rapidly evolving social e-commerce ecosystem and emerging Web 3.0 technologies. As technology develops, the metaverse will enjoy rapid consumer adoption. So, beauty companies should prepare now to ensure they do not fall behind.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.

RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework.

The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments.

Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

Appendix Figure 1. RESET Framework [caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]