DIpil Das

What’s the Story?

The Coresight Research Playbook series provides recommendations for brands, retailers and marketplaces seeking to tap growth segments and emerging trends. In this Playbook, we present six key strategies for retail players to compete against traditional retailers by capitalizing on gradually maturing alternative models in retail: collaboration, DTC (direct to consumer), rental, resale and subscription. We discuss examples of the strategies and models across multiple categories, with a focus on the US market.Why It Matters

Coresight Research has covered resale, rental and subscription, and brand collaboration in previous reports. Although these models are not brand new, we expect them to reach a turning point in 2021 as brands, retailers and marketplaces look to better compete against traditional retail models amid significant shifts in consumer shopping behaviors, driven by the Covid-19 pandemic.Alternative Models in Retail: A Playbook

Brands, retailers and marketplaces are increasingly looking to adjust their strategies to effectively cater to consumer demand and maintain competitive positioning in the evolving retail landscape. As part of this, they can turn to alternative models in retail. We summarize six key strategies in Figure 1 and discuss each in detail below.Figure 1. Six Key Strategies To Compete Against Traditional Retailers, Leveraging Alternative Models in Retail [caption id="attachment_124947" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

1. Use Differentiated Operational Models To Drive Growth in Target Markets

From marketplaces and retailers with resale, rental and subscription services, to DTC brands and retailers, it is important for retail players to clearly define market segmentation and determine the most appropriate approach to best serve consumer demand and shopping preferences.

Geographic Considerations

Geography has long been an important consideration in adapting retail strategies in traditional retail, and this remains true for alternative retail models such as DTC and resale.

Resale company The RealReal reported in its earnings call on February 22, 2021 that it is seeing store consignment drop-offs as still important for key markets in the US, as resale consigners that live in populated cities such as New York City find it convenient to drop off or pick up products. The company is therefore testing store formats in selected geographies The RealReal opened a “mini store” in Palo Alto, California in late 2020. The new store format has a very small footprint of 2,000–3,000 square feet, carrying only 400–500 SKUs (stock-keeping units) in the front with luxury consignment offices in the back. The company plans to open two more mini stores in California this year. The RealReal also has plans to open 10 more “neighborhood stores” (bigger than mini stores but smaller than normal stores) by the end of 2021.

VF Corporation, a retailer that is increasingly adopting a DTC model, saw strong sales momentum in China last year—even amid the pandemic—and announced in January 2021 that it plans to move the center of its brand operations from Hong Kong to Shanghai for long-term development.

Integrated Subscription Models

Within the subscription e-commerce industry, we have seen a few retail players recently adjust their business models to accommodate changes in consumer shopping preferences and leverage further opportunities for growth.

Stitch Fix, an apparel subscription-based company, launched a “direct buy” option in late 2019, which allows sales of individual items to subscribed members. In June 2020, the company announced that non-members could also buy individual items without committing to a subscription plan, as part of Stitch Fix’s new growth strategy. The “direct buy” option has helped Stitch Fix accelerate top-line and client growth even during the pandemic, the company reported in December 2020.

Similarly, Dollar Shave Club, which delivers razors and other personal grooming products to subscribers on a monthly basis, enables one-off purchases without a subscription (although customers are required to create a member account with the company).

In the next three to five years, we expect more subscription e-commerce companies to adopt an integrated model—offering both subscription-based services and non-subscription-based shopping. An integrated model could present more growth opportunities because it attracts customers who may want to try out products from a brand that they are not familiar with, without the financial commitment of a long-term repeat service.

Targeting Younger Consumers

Demographically, younger consumers are typically more digitally adept and are therefore more inclined to engage with retail companies online and through mobile devices. As with other e-commerce and omnichannel retailers, brands and retailers that operate alternative models should therefore look to increase consumer engagement through digital channels.

The RealReal has invested in paid advertising on social media platforms such as Instagram and TikTok, as well as referral programs to boost loyalty among younger consumers. The company has also invested in methods of discovery such as press exposure and brand partnerships with Burberry and Stella McCartney to drive consumer engagement.

As a DTC player, global apparel retailer PVH Corp. engaged with shoppers in China through Chinese messaging and social media app WeChat. The company uses the platform to showcase its brand offerings and connect with consumers.

VF Corporation has adopted geographic-specific marketing practices, such as offering livestreaming on Alibaba’s Tmall platform based on Chinese consumers’ high digital engagement with this channel.

[caption id="attachment_124938" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

1. Use Differentiated Operational Models To Drive Growth in Target Markets

From marketplaces and retailers with resale, rental and subscription services, to DTC brands and retailers, it is important for retail players to clearly define market segmentation and determine the most appropriate approach to best serve consumer demand and shopping preferences.

Geographic Considerations

Geography has long been an important consideration in adapting retail strategies in traditional retail, and this remains true for alternative retail models such as DTC and resale.

Resale company The RealReal reported in its earnings call on February 22, 2021 that it is seeing store consignment drop-offs as still important for key markets in the US, as resale consigners that live in populated cities such as New York City find it convenient to drop off or pick up products. The company is therefore testing store formats in selected geographies The RealReal opened a “mini store” in Palo Alto, California in late 2020. The new store format has a very small footprint of 2,000–3,000 square feet, carrying only 400–500 SKUs (stock-keeping units) in the front with luxury consignment offices in the back. The company plans to open two more mini stores in California this year. The RealReal also has plans to open 10 more “neighborhood stores” (bigger than mini stores but smaller than normal stores) by the end of 2021.

VF Corporation, a retailer that is increasingly adopting a DTC model, saw strong sales momentum in China last year—even amid the pandemic—and announced in January 2021 that it plans to move the center of its brand operations from Hong Kong to Shanghai for long-term development.

Integrated Subscription Models

Within the subscription e-commerce industry, we have seen a few retail players recently adjust their business models to accommodate changes in consumer shopping preferences and leverage further opportunities for growth.

Stitch Fix, an apparel subscription-based company, launched a “direct buy” option in late 2019, which allows sales of individual items to subscribed members. In June 2020, the company announced that non-members could also buy individual items without committing to a subscription plan, as part of Stitch Fix’s new growth strategy. The “direct buy” option has helped Stitch Fix accelerate top-line and client growth even during the pandemic, the company reported in December 2020.

Similarly, Dollar Shave Club, which delivers razors and other personal grooming products to subscribers on a monthly basis, enables one-off purchases without a subscription (although customers are required to create a member account with the company).

In the next three to five years, we expect more subscription e-commerce companies to adopt an integrated model—offering both subscription-based services and non-subscription-based shopping. An integrated model could present more growth opportunities because it attracts customers who may want to try out products from a brand that they are not familiar with, without the financial commitment of a long-term repeat service.

Targeting Younger Consumers

Demographically, younger consumers are typically more digitally adept and are therefore more inclined to engage with retail companies online and through mobile devices. As with other e-commerce and omnichannel retailers, brands and retailers that operate alternative models should therefore look to increase consumer engagement through digital channels.

The RealReal has invested in paid advertising on social media platforms such as Instagram and TikTok, as well as referral programs to boost loyalty among younger consumers. The company has also invested in methods of discovery such as press exposure and brand partnerships with Burberry and Stella McCartney to drive consumer engagement.

As a DTC player, global apparel retailer PVH Corp. engaged with shoppers in China through Chinese messaging and social media app WeChat. The company uses the platform to showcase its brand offerings and connect with consumers.

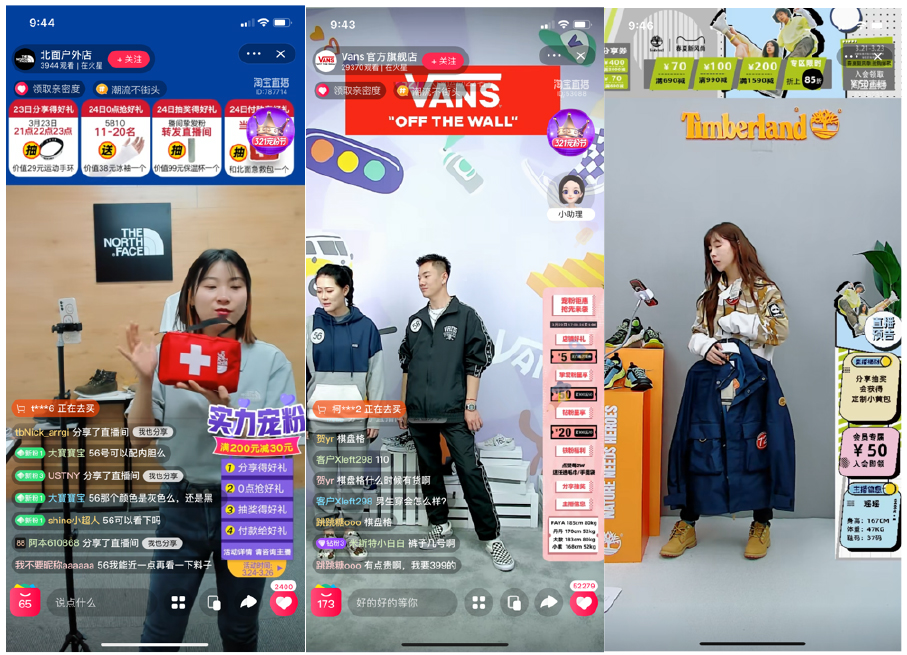

VF Corporation has adopted geographic-specific marketing practices, such as offering livestreaming on Alibaba’s Tmall platform based on Chinese consumers’ high digital engagement with this channel.

[caption id="attachment_124938" align="aligncenter" width="725"] VF Corporation-owned brands The North Face, Timberland and Vans hosted livestreaming sessions on Tmall on March 23, 2021

VF Corporation-owned brands The North Face, Timberland and Vans hosted livestreaming sessions on Tmall on March 23, 2021 Source: Tmall [/caption] 2. Deploy Technology To Improve Operational Efficiency Across the Supply Chain and in Pricing and Customer Service Technology is a key enabler of alternative retail models, particularly with regard to operational efficiency. Brands, retailers and marketplaces can deploy technology to optimize pricing and drive sales in theresale model. For consignment-based resale platforms, merchandise is first sent from consignors to platforms, before being authenticated and integrated into a platform’s inventory with the right SKU number, enabling products to be sold to customers at appropriate prices. It is therefore important that resale marketplaces have a seamless product acceptance process, pricing and inventory management system. As a data-driven resale platform, The RealReal has adopted what it calls “a single-SKU inventory management system,” which uses automation techniques to optimize inbound processes, such as product authentication, copywriting, photography and photo editing. The company is also increasingly using artificial intelligence (AI) to automate pricing for goods sold through its online marketplace. Online consignment and thrift store ThredUP has adopted Vue.ai’s automated image-recognition technology starting August 2019 to process over 35,000 brands and close to 100 million unique products. The technology enables automated visual tagging and assigns attributions based on the necklines of clothing, patterns, label name, color, fashion edginess and more. This means that ThredUP can review products’ attributes more easily and assign resale value at scale for each of its millions of products. Technologies powered by AI could also be advantageous to luxury resale platforms in efficiently identifyingauthentic and counterfeit goods. While most luxury resale platforms still use brand experts or art curators to inspect thousands of items each day, The RealReal is working with the University of Arizona to develop proprietary technology to inspect luxury goods faster and more accurately. In addition to supply chain operations, AI technology supports advances in customer service. We have seenmore retail companies implement chatbots recently to deal with increased levels of digital interaction withcustomers, given the surge in e-commerce amid the pandemic. Chatbots can access customer data to interpret contextual information, enabling intelligent, interactive conversations and faster responses. 3. Leverage Data To Generate Hyper-Personalized Recommendations and Offer Personalized Shopping Experiences Leading brand owners and retailers are embracing innovative technologies to give consumers a personalized experience, and we believe that it is important for companies with alternative models to do this too, in order to remain competitive. For example, for a styling-based subscription model, personalization is a key advantage because customers rely on sellers to choose and curate products for them. Data collection and analysis is critical in helping retail companies to formulate their personalization strategy.

- Chewy, a pet food and pet-related products supplier, reported that it outperformed expectations for traffic, conversion, orders and customer retention in the quarter ended November 30, 2020, partly driven by innovative product and service launches such as personalized pet gifts and personalized mugs, puzzles and picture frames.

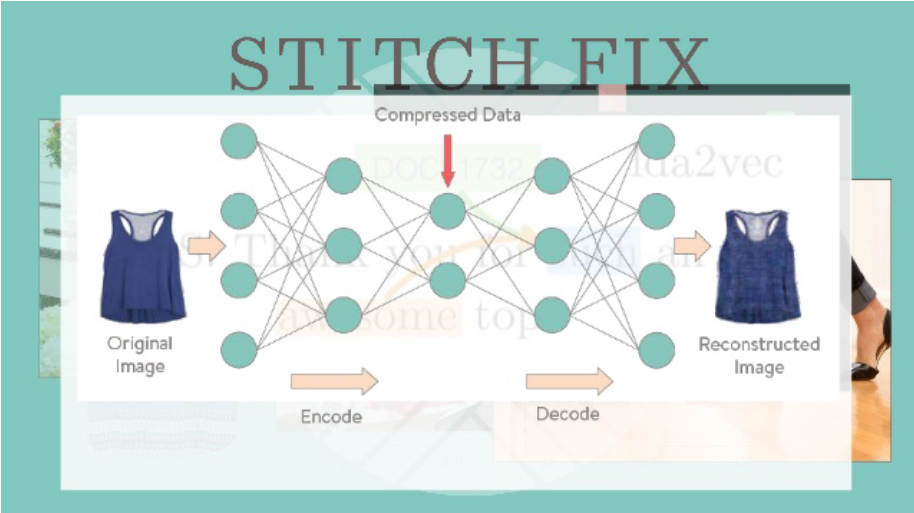

- Stitch Fix uses recommendation algorithms to personalize clothing items based on size, budget and style. The companyreported in the fourth quarter of 2020, ended August 1, 2020, that its adoption of an algorithmic recommendation engine exclusively for “direct buy” customers helped the company acquire more customers who also bought products with higher average prices and converted at higher rates. The system uses customers’ direct-buy data to capture their interactions and preferences and create a highly personalized shopping feed.

Stitch Fix offers a personalized apparel shopping experience, leveraging data about customer preferences

Stitch Fix offers a personalized apparel shopping experience, leveraging data about customer preferences Source: Stitch Fix [/caption] 4. Adjust Product and Service Assortment To Serve Elevated Demand in Certain Categories Brands, retailers and marketplaces that deploy alternative business models should ensure that they monitor and adapt to changes in demand—something that has become critical in the pandemic-impacted retail environment. Below, we present a few examples of resale, rental and subscription companies that adjusted their product assortments to market needs amid the pandemic.

- In October 2020, meal-kit service Blue Apron began offering customers the option to order multiple boxes per week to have more flexibility and customize select components of recipes to have more personalized choices. Interest in at-home cooking and dining has likely been boosted by consumers spending more time at home and with restaurants and other food-service businesses seeing temporary closures. According to Blue Apron, the company is seeing more customers want different styles of home cooking. Blue Apron also expanded its “Two-Person Signature Menu” to allow home cooks to get up to four recipes per box.

- Chewy launched a telehealth service for pets on October 28, 2020. The company mentioned on its earnings call on December 8, 2020 that the telehealth service is still in the early stages, and the company has a lot to learn. However, Chewy emphasized that it is important to build a telehealth platform that can evolve and expand over time, aligning with the company’s culture of innovation.

- Beauty subscription service IPSY launched personal care brand Refreshments in January 2021, which offers clean, cruelty-free and vegan products. Coresight Research estimates that the US beauty wellness market—covering clean beauty, self-care, mental health, sleep care and beauty supplements—is set to grow significantly over the next few years, driven by consumer emphasis on health amid the pandemic.

- In Stitch Fix’s fourth quarter of 2020 (ended August 1, 2020), the company broadened the product categories of women’s and men’s activewear and added kids’ categories. In women’s, the company has grown its athleisure assortment as a percent of women's inventory by over 150% compared to pre-Covid levels, helping the company to serve elevated demand for these products as working from home accelerates the casualization trend. In addition, while we estimate that traditional plus-size apparel spending was negatively impacted by the pandemic in 2020, Stitch Fix reported momentum in the plus-size category and added inventories in plus-size to support further acceleration.

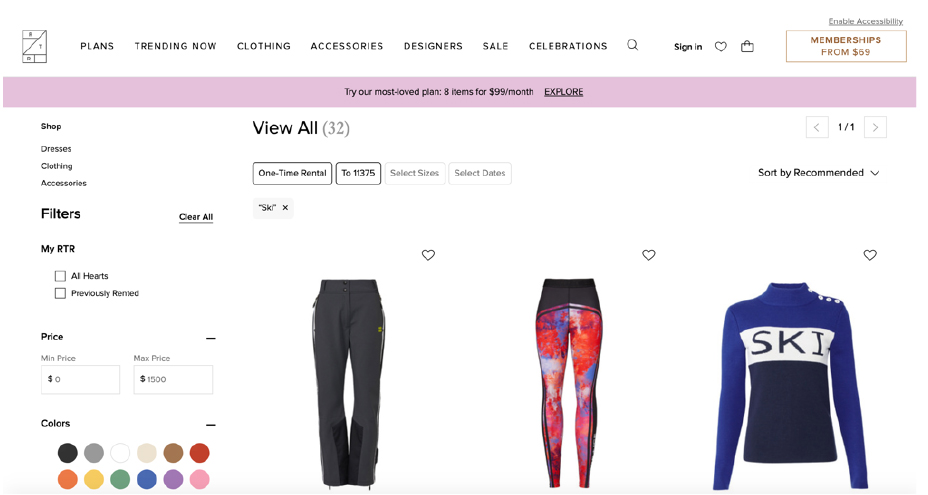

- Subscription fashion service Rent the Runway announced in March 2020 that it will expand its categories of workout clothes and ski clothes based on customer’s outdoor activity needs, while also offering categories such as home goods.

Ski fashion offerings on Rent the Runway

Ski fashion offerings on Rent the Runway Source: Rent the Runway [/caption] The pandemic has resulted in consumers spending more time at home and showing greater enthusiasm for home cooking and interest in home goods. Alongside this, there has been increasing demand for comfortable casualwear and home-friendly games and activities. With gyms suffering closures, consumers have turned to home fitness and outdoor activities. We have therefore seen brands and retailers adjust their product assortments to align with these trends, such as by adding more casual apparel and home goods offerings to attract customers and unlock new growth opportunities. Although vaccines are now being rolled out, we expect consumer interest in these activities to remain at elevated levels through 2021. This year will therefore present opportunities for brands and retailers to continue to adjust their assortments to respond to shifting consumer trends, while also giving them time to prepare for a future in which some changed behaviors will revert to pre-pandemic norms. 5. Communicate DTC Brand Stories to Consumers; Improve Pricing and Delivery This section will be solely focused on the DTC model. Brands and retailers are increasingly turning to DTC channels while reducing their wholesale exposure. However, there are risks in pricing inconsistencies, inventory management issues and shipping speed, and it is important that DTC players look to communicate effectively with consumers to drive traffic and retain business. Below, we offer specific actions that retailers can take to operate successful DTC services, as well as industry examples.

- Engage directly with consumers with more interesting brand content or unique experiences. It is important for companies with DTC businesses to tell their own brand stories. Under Armour is sold through marketplaces including Amazon, Walmart and the company’s own e-commerce website. To better communicate with customers more directly, the brand has been focusing enhancing its marketing campaigns (with a focus on performance and purpose), shifting toward running categories and offering fitness courses. Under Armour leaned heavier into brand and product marketing in 2020 to support the successful launch of its Project Rock collection, Meridian Pant and Infinity Bra. The company also strengthened its collaborations with basketball player Stephen Curry to launch the Curry brand in December 2020.

- Offer consistent pricing across channels. Consumers are approaching more touchpoints for research before making the decision to buy a product, which means that they may utilize a larger variety of channels to browse and buy, making it more critical for retailers to offer consistent pricing across all channels to reduce the risk of consumers delaying making a purchase as they are comparing prices.

- Improve shipping efficiency. Most wholesale channels, such as department stores and mass merchants, are increasingly offering faster shipping options. To remain competitive with these retailers, as well as e-commerce marketplaces such as Amazon, DTC brands and retailers need to speed up delivery services or utilize stores for fulfillment to take control of the last mile.

- Adidas partnered with Stella McCartney to debut a new sustainable collection called “Futureplayground” in February 2021.

- eBay teamed up with “Female Athlete T-shirt” brand Playa Society to celebrate Women’s History Month.

- H&M and Lee launched a sustainable and size-inclusive denim collection in January 2021.

The “Futureplayground” collection was launched in February 2021

The “Futureplayground” collection was launched in February 2021 Source: Adidas/Stella McCartney [/caption] Read our separate Retail Reimagined report, which further explores how brands and retailers can innovate their product offerings through collaboration in a pandemic-impacted retail environment.

What We Think

Implications for Platforms/Retailers Operating Alternative Retail Models- It is important for brands, retailers and marketplaces with resale, rental, subscription, DTC and collaboration models to clearly define market segmentation and determine the most appropriate approach to best serve consumer demand.

- Technology is a key enabler of alternative models in retail, as companies need to build out capabilities to support business expansion.Resale platforms should look to deploy technology to optimize pricing and more efficiently identify authentic and counterfeit luxury goods using AI. AI is also beneficial in enhancing the customer experience, such as via chatbots.

- Companies should look to data analysis to drive personalization. This is most obviously relevant for subscription services seeking to anticipate preferences in product selection but can be applied to all retail-alternative models to surface relevant product amid an abundance of choice.

- Companies should adjust product offerings to respond to changing consumer demand. With traditional brands and retailers extending their product offerings into trending categories such as athleisure and home goods, resale, rental and subscription business players should seek to adapt their assortment in a similar manner to capitalize on current trends. However, companies should look to plan ahead by considering the changed consumer behaviors that may not stick post 2021.

- Retailers with DTC models should look to communicate effectively with consumers to drive traffic and retain business, focusing on telling their brand stories. They should also focus on pricing consistency across channels to drive conversion, as well as offering competitive delivery timeframes.

- With collaborations enabling retail players to reach new consumers, create market buzz and drive sales, brands and retailers should align the collaboration with the overall brand image and formulate strategies to deliver interesting concepts and products with seemingly disparate brands—thus boosting consumer interest.