DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

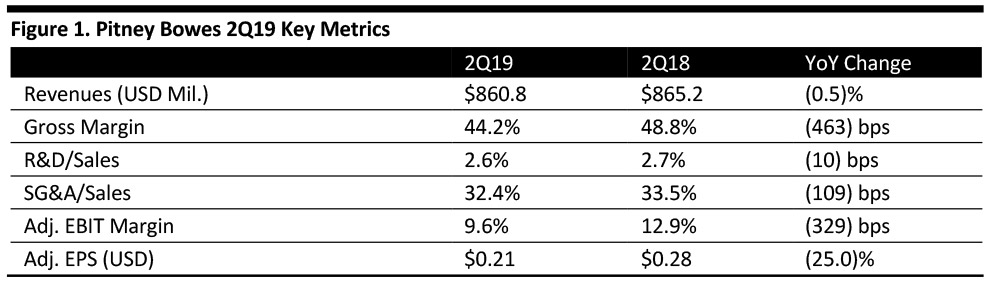

Pitney Bowes reported 2Q19 revenue of $860.8 million, down 0.5% year over year and below the $861.7 million consensus estimate. Revenues were flat when adjusted for currency exchange rates and up 2% when adjusted for currency and market exits.

Gross margin declined 463 basis points (bps) year over year, largely due to the impact of changes in business mix.

SG&A expense declined both in dollar terms and as a percentage of revenue versus the prior year.

Adjusted EPS was $0.21, beating the consensus estimate of $0.17. GAAP EPS from continuing operations was $0.17, compared to $0.27 in the year-ago quarter. Discontinued operations earned $0.04 per share and restructuring charges and transaction costs amounted to $0.04 per share.

Performance by Group Commerce Services: The group includes two segments: Global e-commerce, which facilitates global cross-border e-commerce, domestic retail and domestic e-commerce shipping, including fulfillment and returns, and presort services, which provides sorting services to qualify large volumes of mail for postal workshare discounts. Revenues were $410 million, up 13.4%.- Global e-commerce’s revenues were $282 million, up 18.1%, driven by growth in domestic parcel and shipping solutions volume. Margins declined year over year due to a shift in the mix to faster growing, lower-margin services, as well as from investments in market growth opportunities and operational excellence initiatives.

- Presort services revenues were $128 million, up 4.4%, driven by volume growth across all mail classes, along with higher revenue per piece. Volume drivers were higher quantities of marketing mail and flats processed. Margins increased year over year and sequentially primarily due to higher revenue per piece plus lower labor costs.

- North America mailing revenues were $303 million, down 4.9% year over year, driven by lower equipment sales and recurring revenue. The decline in recurring revenue was driven by lower support services, supplies and financing revenue partially offset by higher business services. Margins were relatively flat to the prior year, driven by lower revenue and higher tariff costs partially offset by lower expenses.

- International mailing revenues were $75 million, down 19.5% year over year, driven by previously announced market exits. Excluding the effect of currency and market exits, the revenue decline was driven by lower services and supplies revenue partially offset by higher rental revenue, in particular . The revenue decline was driven by weakness in the UK and Germany, partially offset by growth in France. Margins improved year over year, driven by lower expenses.

Details from the Quarter

- Management commented that parcel volumes through the domestic network represent an important metric and grew 42% in the quarter. The company continues to make progress against its strategic objective of moving the business portfolio towards growth areas in the market.

- The company expects its revenue growth rate, which was 2% excluding currency and the exit of direct operations in six smaller European markets, to remain positive and continue to improve.

- Shipping accounted for 35% of revenue in the quarter. Commerce services accounted for 48% of total revenues, compared to less than 30% of revenues two years ago. The company’s long-term goal is for commerce services to contribute 60% of revenues.

- The commerce services group is a $1 billion business, growing at close to 30% and EBITDA positive. Management commented a volume growth rate of 25% puts the business on track to reach optimal scale. Management commented that the reported domestic physical volume growth of 42% in the quarter is unlikely to be sustained.

- The company stabilized its legacy SMB portfolio and continued to grow its shipping capabilities and third-party financing to achieve its goal of flat or improved EBITDA by 2021.

Implications for Retail

Pitney Bowes continues to transform its business mix towards higher-growth segments, such as providing products and services to enable global e-commerce. In that segment, the company offers global products for cross-border e-commerce, domestic retail and domestic e-commerce shipping, including fulfillment and returns.

Outlook

The company reiterated its outlook for 2019:

- Revenue growth of 1-3% at constant foreign exchange rates (down from 1%-4% previously).

- Adjusted EPS from continuing operations in the range of $0.90 to $1.05.

- Free cash flow of $200-250 million, which includes the funding of third-party financing initiatives.

Management commented that the company remains positioned to meet its financial goals for the year and for the long term.