albert Chan

Source: Company reports/Coresight Research[/caption]

1Q19 Results

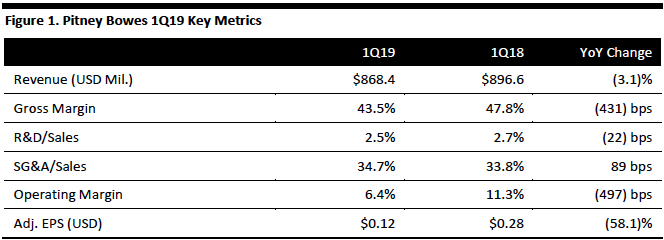

Pitney Bowes reported 1Q19 revenue of $868.4 million, down 3.1% from the prior year, beating the consensus estimate of $866.0 million. Revenues were down 2% at constant exchange rates and down 1% excluding currency and the previously announced small and medium-sized business market exits in six European markets. The company had previously announced exits from direct operations in six smaller European markets.

Gross margin declined 431 bps year over year, largely due to the impact of changes in the business mix and a $9 million charge to replace SendPro C tablets due a battery issue. The tablet replacement hurt gross margin by one percentage point. The upgraded tablet promises to offer the latest technology and an improved user experience.

Adjusted EPS was $0.12, below the consensus estimate of $0.21. GAAP EPS was $(0.01), compared to $0.32 in the year-ago quarter. The tablet upgrade issue hurt EPS by $0.03 per share.

Management commented that, while revenues were in line with expectations, profitability fell short. Still, management remains confident that its actions will improve profitability and position it for long-term growth, and the company continues to adjust its portfolio to make progress towards its long-term objectives.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Pitney Bowes reported 1Q19 revenue of $868.4 million, down 3.1% from the prior year, beating the consensus estimate of $866.0 million. Revenues were down 2% at constant exchange rates and down 1% excluding currency and the previously announced small and medium-sized business market exits in six European markets. The company had previously announced exits from direct operations in six smaller European markets.

Gross margin declined 431 bps year over year, largely due to the impact of changes in the business mix and a $9 million charge to replace SendPro C tablets due a battery issue. The tablet replacement hurt gross margin by one percentage point. The upgraded tablet promises to offer the latest technology and an improved user experience.

Adjusted EPS was $0.12, below the consensus estimate of $0.21. GAAP EPS was $(0.01), compared to $0.32 in the year-ago quarter. The tablet upgrade issue hurt EPS by $0.03 per share.

Management commented that, while revenues were in line with expectations, profitability fell short. Still, management remains confident that its actions will improve profitability and position it for long-term growth, and the company continues to adjust its portfolio to make progress towards its long-term objectives.

Performance by Segment

- Commerce services revenues were $401 million, up 5.2% (up 6% currency neutral). Within the segment:

o Global e-commerce revenues were $266 million, up 7.7% (9% currency neutral). Growth in domestic parcel and shipping solutions volumes partially offset lower cross-border volumes. Margins were hurt by a shift in service mix, investments in future growth opportunities and a delay in the approval of an agreement with the US Postal Service, which has subsequently been approved. This segment includes different capabilities, such as cross-border, fulfillment, returns and APIs, which each carry different margin structures.

o Presort services revenues were $135 million, up 0.7%, driven by higher volumes of premium services processed, offsetting lower revenue per piece owing to the client mix shifting towards larger clients.

- Small and medium business (SMB) solutions revenues were $394 million, down 10.3% (9% currency neutral). Excluding the impact of currency and market exits, SMB solutions revenue declined 7% and international mailing revenue decreased 6%. Within the segment:

o North America mailing revenues were $315, million, down 7.6%, due to lower equipment sales and a decline in recurring revenue streams.

o International mailing revenues were $79 million, down 19.4%. Growth in equipment sales in the UK and Japan partially offset weak sales in Germany and France.

- Software Solutions revenues were $73 million, down 3.9% and down 2% currency neutral. Lower license revenue was partially offset by higher revenue from data updates and software as a service SaaS). In addition, the year-ago quarter benefited from a $7 million location-intelligence deal.

- Management discussed execution issues in the presort business in the quarter, which remains under pressure from transportation and labor markets. The company has hired consultants to solve issues such as higher volume and lower revenue per piece of mail.

- Despite the issues surrounding the SendPro C tablet, the company has placed 85,000 units and has scheduled several international launches over the next several quarters. During the quarter, the Pitney Bowes Bank launched Wheeler Financial, which will help clients purchase critical equipment. Management considers financing a natural, adjacent area.

- Management commented that commerce services is now the company’s largest segment, and revenue ramped throughout the quarter, exiting the quarter at a strong pace expected to continue during Q2. The company added two differentiated capabilities in the quarter:

o A pilot program for 2-3-day guaranteed delivery.

o A branded experience for clients to track shipments.

Implications for Retail Pitney Bowes continues to be a beneficiary of global e-commerce, as the company expands its domestic parcel and fulfillment business, growth in domestic shipping solutions, and opportunities from cross-border e-commerce. Outlook The company updated its outlook for 2019:- Revenue growth of 1-3% at constant foreign exchange rates (down from 1-4% previously).

- Adjusted EPS from continuing operations in the range of $0.90 to $1.05.

- Free cash flow of $200-250 million, which includes the funding of third-party financing initiatives.