Nitheesh NH

Introduction: The Fastest-Growing E-Commerce Platform in China

Pinduoduo launched in 2015 but has quickly become the fastest-growing major e-commerce platform in China. It is now the fifth-largest Internet company in terms of market capitalization in China after Alibaba, Tencent, Meituan and JD.com, passing Baidu as of November 29, 2019. (“Internet company” refers to any business that relies on the Internet, including e-commerce platforms and cloud service providers. Pinduoduo uses a group-buying model, inviting users to form groups to shop in bulk for lower prices—as much as 90% off certain products. In this report, we profile Pinduoduo’s meteoric growth, its partnership with WeChat and details of how it offers products at low prices. Gamification is also an important tool to engage with consumers in a fun way.A Closer Look at Pinduoduo’s Growth

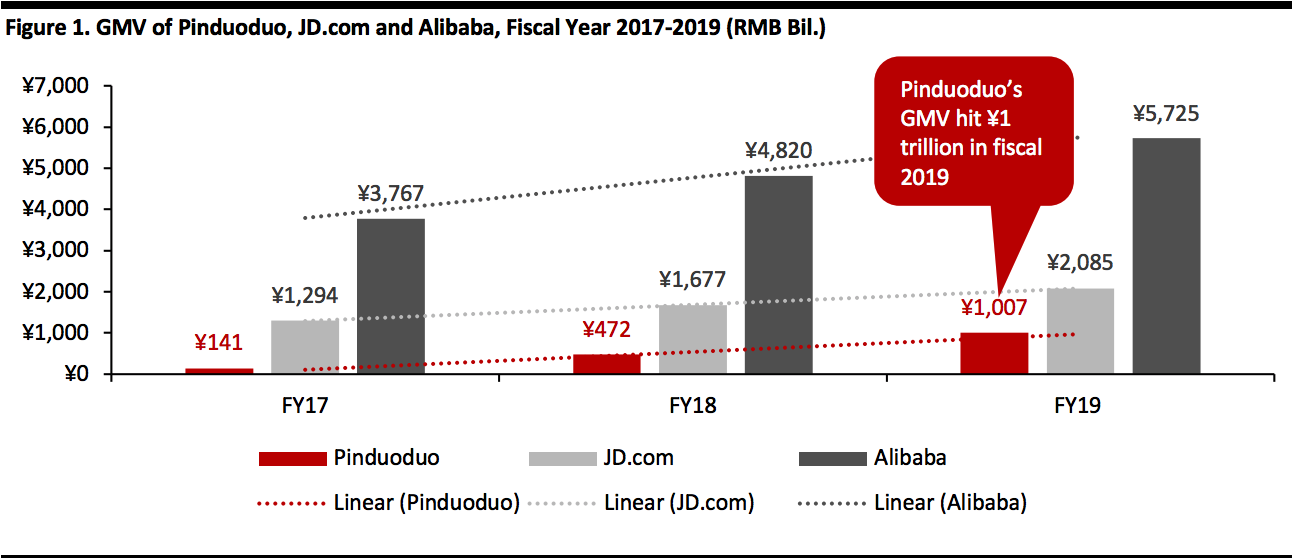

Pinduoduo enjoyed steady growth in GMV and number of annual active users from 2017 to 2019, and we expect that growth to continue into 2020. Pinduoduo’s GMV surged 620% from ¥141 billion (around $20 billion) in 2017 to ¥1 trillion (around $144 billion) in fiscal year 2019. This compares to still-robust 52% growth on Alibaba’s Tmall and Taobao platforms and JD.com’s 61% growth during the same time period. [caption id="attachment_106915" align="aligncenter" width="700"] Source: Company reports[/caption]

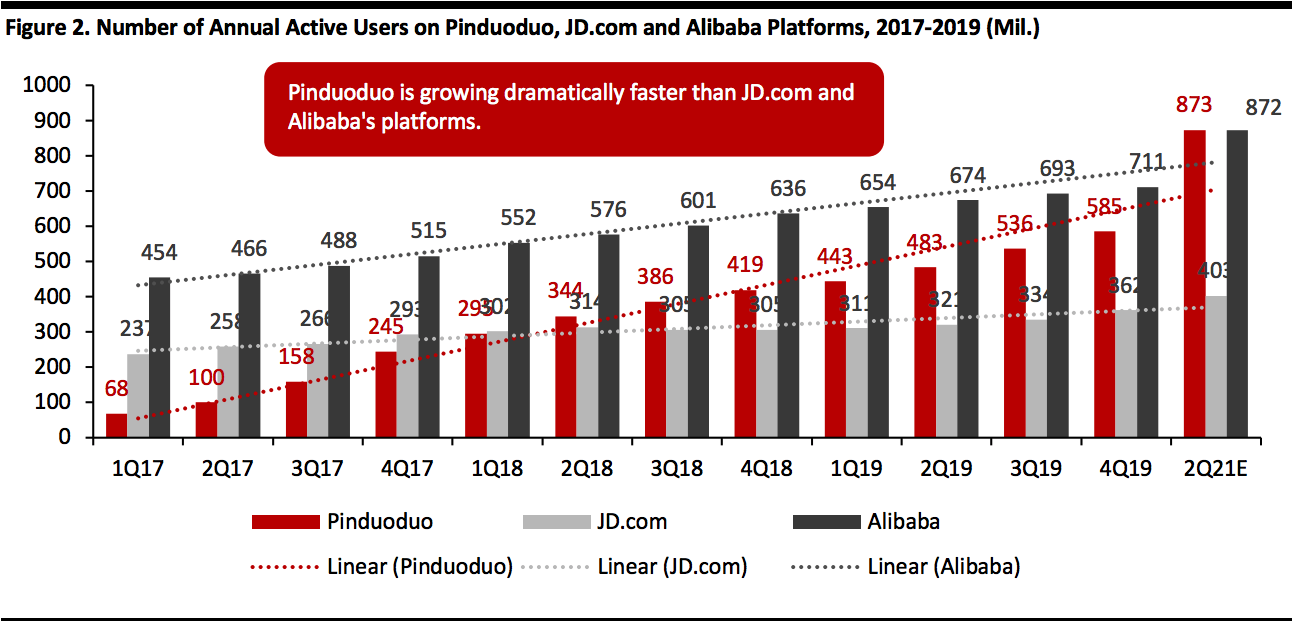

Pinduoduo’s annual active user base grew faster than that of Tmall, Taobao and JD.com, jumping some 760% from 68 million in the first quarter of 2017 to 585 million as of fourth quarter 2019. This is compares to 57% growth on both Alibaba platforms (Tmall and Taobao) and JD.com’s 53% growth over the same period.

If its growth trajectory continues, Pinduoduo is on track to overtake Alibaba on annual active users by the second quarter of 2021, with 873 million annual active users compared to a projected 872 million on Alibaba’s platforms.

[caption id="attachment_106916" align="aligncenter" width="700"]

Source: Company reports[/caption]

Pinduoduo’s annual active user base grew faster than that of Tmall, Taobao and JD.com, jumping some 760% from 68 million in the first quarter of 2017 to 585 million as of fourth quarter 2019. This is compares to 57% growth on both Alibaba platforms (Tmall and Taobao) and JD.com’s 53% growth over the same period.

If its growth trajectory continues, Pinduoduo is on track to overtake Alibaba on annual active users by the second quarter of 2021, with 873 million annual active users compared to a projected 872 million on Alibaba’s platforms.

[caption id="attachment_106916" align="aligncenter" width="700"] Source: Company reports[/caption]

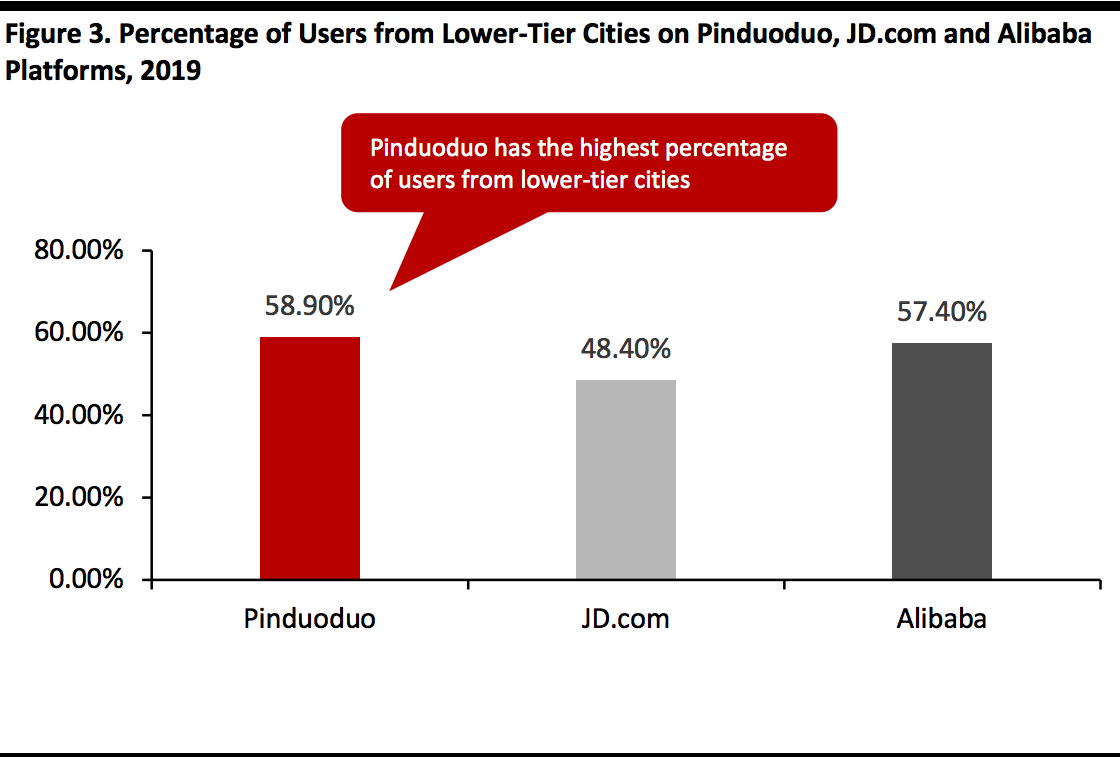

Pinduoduo has a higher percentage of users from lower-tier cities than either Alibaba or JD.com: Around 58.9% of Pinduoduo users were from lower-tier cities in 2019, compared to JD.com’s 48.4% and Alibaba’s 57.4%, according to data firm QuestMobile and GeTui. This group offers great opportunity for growth.

In the Coresight Research report The Opportunities in Chinas $1.3 trillion Lower Tier Markets, we outline how online retail sales of physical goods in lower-tier markets will account for an estimated 45% of total online retail sales in China, worth some ¥8.1 trillion (around $1.25 trillion) in 2025. This would represent a compound annual growth rate (CAGR) of 18.3% from 2018 to 2025.

[caption id="attachment_106918" align="aligncenter" width="520"]

Source: Company reports[/caption]

Pinduoduo has a higher percentage of users from lower-tier cities than either Alibaba or JD.com: Around 58.9% of Pinduoduo users were from lower-tier cities in 2019, compared to JD.com’s 48.4% and Alibaba’s 57.4%, according to data firm QuestMobile and GeTui. This group offers great opportunity for growth.

In the Coresight Research report The Opportunities in Chinas $1.3 trillion Lower Tier Markets, we outline how online retail sales of physical goods in lower-tier markets will account for an estimated 45% of total online retail sales in China, worth some ¥8.1 trillion (around $1.25 trillion) in 2025. This would represent a compound annual growth rate (CAGR) of 18.3% from 2018 to 2025.

[caption id="attachment_106918" align="aligncenter" width="520"] Source: QuestMobile and GeTui[/caption]

Source: QuestMobile and GeTui[/caption]

Partnership with WeChat

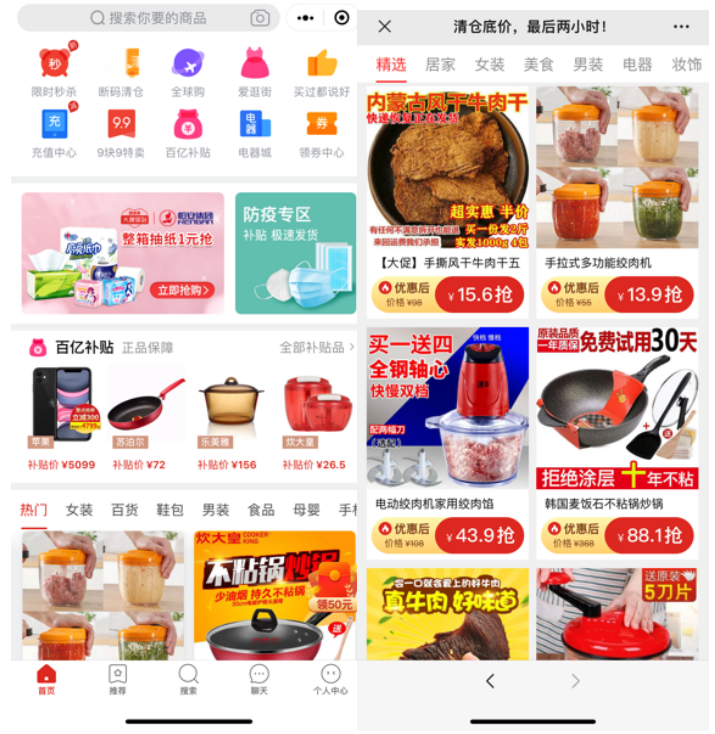

Pinduoduo’s rapid ascent has been bolstered by its partnership with WeChat and the all-in-one app’s 1.13 billion monthly active users as of June 2019—nearly equal to the entire adult population. Users spend an average of 21% of their daily mobile time—210 minutes—on WeChat (around 44 minutes) as we discuss in the Coresight Research report The Landscape of China’s New Digital Economy. Users can undertake a wide range of activities through the app—pay bills, hail taxis, find restaurants, order food, make doctors’ appointments, find parking spots and even pay traffic tickets. State-run media and government agencies also have official WeChat accounts to communicate to the general public. The partnership is also strengthened by Tencent’s 18.5% stake in Pinduoduo, making Tencent the second-largest shareholder after Pinduoduo’s Founder and Chief Executive Officer Huang Zheng with a 50.7% stake, according to the company’s prospectus. Driving Traffic from WeChat Pinduoduo’s partnership adds extra power to its WeChat mini program and official account. The company’s official account is a service account which allows the company to sell products, and around 15% of traffic came from the WeChat mini program in March 2019, according to data firm QuestMobile. By comparison, Alibaba’s Alipay also developed mini programs to get users to spend more time on the app, but that effort drove just 9% of Taobao’s traffic during the period. [caption id="attachment_106922" align="aligncenter" width="420"] Pinduoduo mini program (left) and official account (right)

Pinduoduo mini program (left) and official account (right)Source: WeChat[/caption] WeChat also promotes Pinduoduo on the front page of WeChat Pay—prime virtual real estate that WeChat does not offer up easily. Services listed on the front page are carefully selected as it attracts considerable attention and drives traffic as users constantly pass the WeChat Pay page for a variety of functions including ride hailing, buying train tickets, movie tickets and other transactions. [caption id="attachment_106923" align="aligncenter" width="420"]

Pinduoduo on WeChat Pay

Pinduoduo on WeChat PaySource: WeChat[/caption] WeChat users have multiple entry points to shop on Pinduoduo, delivering meaningful reductions in the cost of customer acquisition: In the June quarter of 2019, Pinduoduo spent around ¥153 ($22) per acquired customer, compared to JD.com’s ¥520 (around $74.80) and Alibaba’s ¥535 (around $76.90). (This period represented the second quarter of 2020 for Pinduoduo and JD.com, and for the first quarter of fiscal 2020 for Alibaba.) And, WeChat blocks Alibaba-owned Taobao and Tmall, removing a major competitor from one of the country’s most widely used social media platforms.

Strategic Differences

Pinduoduo’s proposition remains offering products at low prices, leveraging initiatives such as a consumer-to-manufacturer (C2M) model and partnering with small and medium-sized merchants. As outlined in the Coresight Research report New Retail Models in E-commerce: Opportunities To Accelerate Growth, Pinduoduo collaborates with manufacturers to sell directly to consumers, enabling it to offer more competitive prices. Pinduoduo gathers huge quantities of consumer data and gives manufacturers insights into consumer purchasing behavior, helping them more effectively target customers. Pinduoduo helps manufacturers create customer profiles, forecast consumption and plan production. One example of how well this model can work is umbrella maker Paradise Umbrella: The company said it sold more than 80,000 umbrellas on Pinduoduo in just two days using the C2M model. On Pinduoduo the umbrella sells for around ¥35 ($5)—but on Tmall it’s ¥57 ($8). [caption id="attachment_106926" align="aligncenter" width="240"] The Paradise Umbrella model that sold 80,000 units in two days

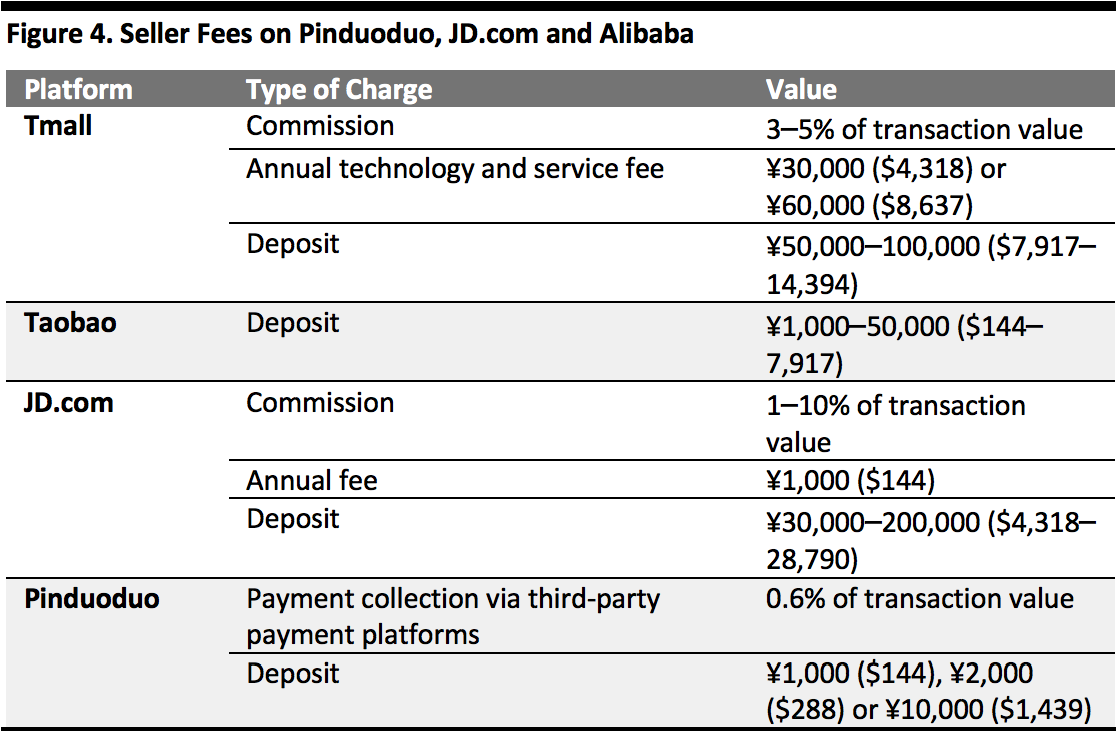

The Paradise Umbrella model that sold 80,000 units in two daysSource: Pinduoduo[/caption] The C2M model is a huge trend in China: The market was worth an estimated ¥17.5 billion ($2.5 billion) in 2018 and is expected to more than double to ¥42 billion ($6 billion) in 2022, a CAGR of 24.4%, according to iResearch. That’s just 0.4% of total e-commerce sales in China in 2018 and 0.6% in 2022 (as estimated by Statista), but still a substantial figure in nominal terms. Working with Small- and Medium-Sized Businesses Pinduoduo also works with small- and medium-sized businesses, focusing on value pricing while Alibaba and JD.com have been leaning towards brand names and bigger businesses to focus on higher end products. Merchants also pay more to sell on Alibaba and JD.com platforms than they do on Pinduoduo: Tmall and JD.com charge a commission of anywhere from 3% to 10% of the transaction value, whereas Pinduoduo charges just 0.6%. Tmall, Taobao and JD.com also require bigger deposits than Pinduoduo. These e-commerce platforms require merchants to make a one-time deposit as collateral used in the event the merchant violates terms and causes harm to the platform, such as selling non-genuine products. A deposit for a flagship store on Tmall may run to ¥100,000 ($14,394), whereas for a franchise store it would be ¥50,000 ($7,917). [caption id="attachment_106927" align="aligncenter" width="520"]

Source: CITIC Securities[/caption]

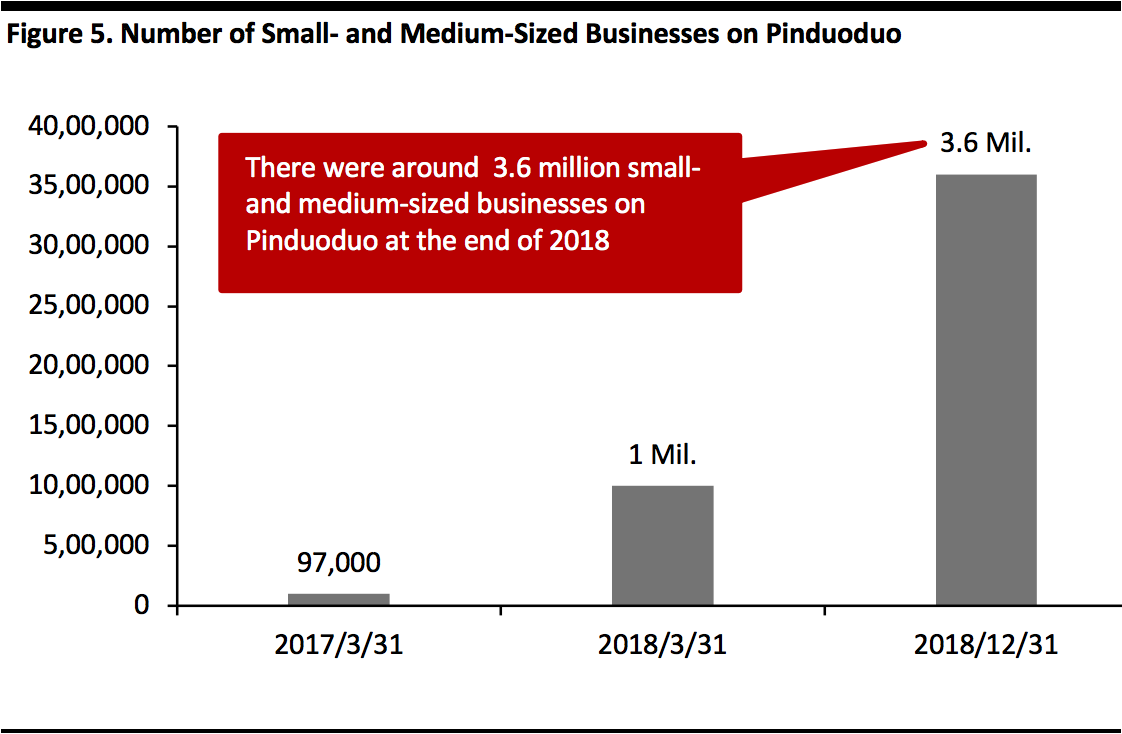

Pinduoduo’s fee structure is designed to be more attractive to small- and medium-sized business, helping ensure the platform has an adequate supplier base for its customers. The number of small- and medium-sized companies on Pinduoduo jumped to 3.6 million at the end of 2018 from just 97,000 in March 2017, according to financial firm Zhongtai.

[caption id="attachment_106928" align="aligncenter" width="520"]

Source: CITIC Securities[/caption]

Pinduoduo’s fee structure is designed to be more attractive to small- and medium-sized business, helping ensure the platform has an adequate supplier base for its customers. The number of small- and medium-sized companies on Pinduoduo jumped to 3.6 million at the end of 2018 from just 97,000 in March 2017, according to financial firm Zhongtai.

[caption id="attachment_106928" align="aligncenter" width="520"] Source: Zhongtai Securities[/caption]

Source: Zhongtai Securities[/caption]

Adding New Features to Gamify the Shopping Process

In late 2019 Pinduoduo added features to upgrade its 2018 gaming feature called Duoduoguoyuan (translated as “Duoduo Garden”). For example, the company asked users to log into the app for seven consecutive seven days to carry out various gardening tasks such as watering plants. At the end of the week, consumers who completed all tasks get a chance to win one kilo of fruit. [caption id="attachment_106930" align="aligncenter" width="240"] Duoduo Garden

Duoduo GardenSource: Company website[/caption] Gamification not only draws consumers to the app and keeps them there longer when they visit, but also introduces an element of fun that can drive greater consumer engagement. Pinduoduo says daily active users on Duoduo Garden increased by 11 million between January and March 2019 to 50 million. At its peak, around two million “trees” were being planted every day. Pinduoduo gave out 500,000 kilograms of fruit in the first quarter of 2019—helping also boost agricultural product sales on Pinduoduo, which more than doubled from ¥65.3 billion (around $9.4 billion) in 2018 to ¥136.4 billion (around $19.6 billion) in 2019.