albert Chan

Pinduoduo

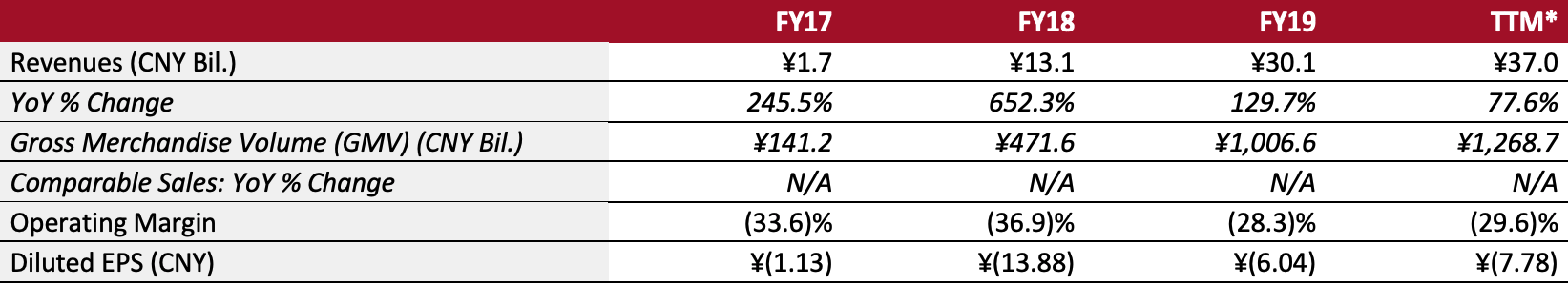

Sector: E-commerce Country of operation: China Key product categories: Apparel, food and household necessities Annual Metrics [caption id="attachment_124196" align="aligncenter" width="720"] Fiscal year ends on December 31

Fiscal year ends on December 31*Trailing 12 months ended June 30, 2020; FY20 results are not yet available[/caption] Summary Founded in 2015 and headquartered in Shanghai, Pinduoduo operates as an e-commerce platform in China, offering a range of merchandise. The platform uses a group-buying model, inviting users to form groups to shop in bulk and access lower prices, which can reach discounts of up to 90%. Pinduoduo was listed on NASDAQ in July 2018. Company Analysis Coresight Research insight: Pinduoduo has quickly become the fastest-growing e-commerce platforms in China since its launch in 2015. It is the third-largest e-commerce platform in terms of market capitalization in China after Alibaba and JD.com, as of October 16, 2020. The company continues to upgrade its platform to attract and engage with users, such as offering entertainment through e-commerce gamification. Pinduoduo’s expansion is likely to be supported by its strategy of targeting Tier 2 and Tier 3 markets, as we expect the fastest retail growth in China to come from the lower-tier cities that are currently catching up economically with the country’s bigger metropolises.

| Tailwinds | Headwinds |

|

|

a. Collaborate with manufacturers to sell directly to consumers, enabling the company to offer more competitive prices

b. Gather consumer data and give manufacturers insights into consumer purchasing behavior, helping them to target customers more effectively

c. Assist manufacturers in creating customer profiles, forecasting consumption and planning production

2. Increase Depth and Breadth of Product Categoriesa. Historically, Pinduoduo focused on promoting high quantities of a smaller range of stock-keeping units (SKUs) compared to Alibaba and JD.com, as Pinduoduo required merchants to sell a large quantity of a few items at a low price. However, the firm is expanding in household essentials categories with more SKUs, such as fast-moving consumer goods (FMCGs), as they have a higher purchase frequency than electronics, for instance. In its mid-year 6.18 campaign, the platform added more FMCG products to meet consumer demand.

b. Use C2M initiatives to improve the quality and range of products offered

3. Work with Small- and Medium-Sized Businessesa. Partner with small and medium-sized businesses, focusing on value pricing. This contrasts with competitors Alibaba and JD.com, which have been leaning towards brand names and bigger businesses. To attract small businesses, Pinduoduo offers much lower fees for small and medium-sized businesses to sell on its platform than Alibaba and JD.com.

4. Continue to Invest in Fooda. Aim to become China’s top online platform for food products

b. Leverage consumer insights to help farmers make more informed decisions, including what to plant and when to harvest

c. Continue to invest in technology and operations in the agriculture value chain, such as drip irrigation, and robotics. Pinduoduo will also continue to provide farming knowledge and business training to farmers.

d. Optimize logistics for agriculture produce, such as delivery routes, and coordinate delivery schedules

5. Improve Product Recommendations and Livestreaminga. Use algorithms to introduce consumers to the most relevant products at suitable price points to increase conversion

b. Encourage merchants on the platform to adopt livestreaming to increase engagement with consumers

Company Developments| Date | Development |

| February 18, 2021 | Pinduoduo provides uninterrupted grocery services and delivery during the Chinese New Year holiday from February 11 to 17). |

| December 21, 2020 | Pinduoduo announces a $500 million private share placement to a global institutional investor, to pursues its strategic priority of raising farm productivity and improving food security and quality. |

| November 18, 2020 | Pinduoduo announces the pricing of its offerings of convertible notes and equity, set to raise $6.1 billion including over-allotment. |

| October 12, 2020 | Pinduoduo partners with Henan Provincial Department of Agriculture and Rural Affairs to help promote and sell agricultural products from Henan province online |

| September 22, 2020 | Pinduoduo teams up with Yili, the largest dairy company in China, to livestream the production process in its formula factory, to gain consumer trust in its products. |

| August 25, 2020 | Luckin Coffee opens a digital store on Pinduoduo. |

| August 19, 2020 | Founder Huang Zheng and CEO Chen Lei withdraw from the company’s Board of Directors. Zhu Jianchong joins the Board. |

| April 20, 2020 | Pinduoduo invests $200 million of convertible bonds in electronics/appliance retailer GOME. |

| April 1, 2020 | Pinduoduo raises $1.1 billion in a private share placement from a range of investors. |

| November 25, 2019 | Amazon opens a pop-up store on Pinduoduo, open for the remainder of 2019. The pop-up storefront features a selection of 1,000 products from overseas, ranging from apparel and cosmetics to electronics and personal-care products. |

| February 26, 2019 | Pinduoduo launches a cross-border e-commerce channel to attract high-end shoppers. |

| December 13, 2018 | Pinduoduo launches a “New Brand Plan” to help 1,000 factory brands in China promote their products and brands to a wider consumer base . |

| October 31, 2018 | Pinduoduo launches a new health channel on its platform to sell birth control, Chinese traditional medicines and contact lenses, joining the increasingly crowded pharmaceutical e-commerce space in China. |

- Huang, Zheng—Founder and Chairperson

- Chen, Lei—CEO and Director

- Ma, Jing—Vice President of Finance

- Xiao, Junyun—Senior Vice President of Operation

- Shu, Nick—Director of Corporate Development & Investor Relations

Source: Company reports/S&P Capital IQ/Coresight Research