DIpil Das

[caption id="attachment_95138" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

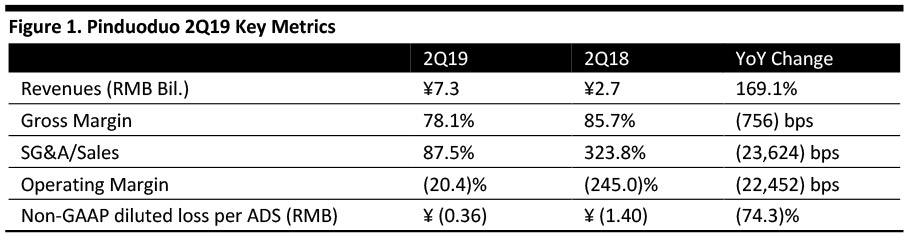

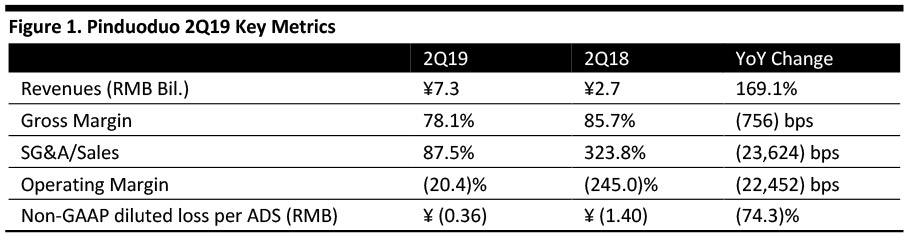

2Q19 Results

Pinduoduo reported revenues of ¥7.3 billion ($1.1 billion) for the second quarter ended June 30, 2019, beating the consensus estimate of ¥6.2 billion ($878.8 million) and up 169% year over year. Revenue growth was primarily driven by online marketing services, an increase in active buyer base and higher spending per active buyer.

The company attributed the strong performance to its user-first engagement strategy and more consumers from China’s upper tier cities ordering on Pinduoduo. The GMV from tier 1 and tier 2 cities as a percentage of total GMV increased from 37% in January to 48% in June. Average incomes and discretionary spending are higher in tier 1 cities.

2Q19 revenues were broken down as follows:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Pinduoduo reported revenues of ¥7.3 billion ($1.1 billion) for the second quarter ended June 30, 2019, beating the consensus estimate of ¥6.2 billion ($878.8 million) and up 169% year over year. Revenue growth was primarily driven by online marketing services, an increase in active buyer base and higher spending per active buyer.

The company attributed the strong performance to its user-first engagement strategy and more consumers from China’s upper tier cities ordering on Pinduoduo. The GMV from tier 1 and tier 2 cities as a percentage of total GMV increased from 37% in January to 48% in June. Average incomes and discretionary spending are higher in tier 1 cities.

2Q19 revenues were broken down as follows:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Pinduoduo reported revenues of ¥7.3 billion ($1.1 billion) for the second quarter ended June 30, 2019, beating the consensus estimate of ¥6.2 billion ($878.8 million) and up 169% year over year. Revenue growth was primarily driven by online marketing services, an increase in active buyer base and higher spending per active buyer.

The company attributed the strong performance to its user-first engagement strategy and more consumers from China’s upper tier cities ordering on Pinduoduo. The GMV from tier 1 and tier 2 cities as a percentage of total GMV increased from 37% in January to 48% in June. Average incomes and discretionary spending are higher in tier 1 cities.

2Q19 revenues were broken down as follows:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Pinduoduo reported revenues of ¥7.3 billion ($1.1 billion) for the second quarter ended June 30, 2019, beating the consensus estimate of ¥6.2 billion ($878.8 million) and up 169% year over year. Revenue growth was primarily driven by online marketing services, an increase in active buyer base and higher spending per active buyer.

The company attributed the strong performance to its user-first engagement strategy and more consumers from China’s upper tier cities ordering on Pinduoduo. The GMV from tier 1 and tier 2 cities as a percentage of total GMV increased from 37% in January to 48% in June. Average incomes and discretionary spending are higher in tier 1 cities.

2Q19 revenues were broken down as follows:

- Online marketing services were ¥6.5 billion, up 173% year over year.

- Transaction services were ¥822.9 million, up 143% year over year.

- Sales and marketing expenses were ¥6.1 billion, up 105% year over year due to an increase in online and offline advertisement and promotions.

- General and administrative expenses were ¥278.3 million, down 95% year over year, mainly due to a one-time share-based compensation expense recorded in April 2018.

- Research and development expenses were ¥803.7million, up 332% year over year.

- GMV for the 12 months ended June 30, 2019 was ¥709.1 billion, up 171% year over year.

- Active buyers for the 12 months ended June 30, 2019 were 483.2 million, up 41% year over year.

- Annual spending per active buyer for the 12 months ended June 30, 2019 was ¥1,467.50, up 92% year over year.

- Average monthly active users in the quarter were 366.0 million, up 88% year over year.