DIpil Das

[caption id="attachment_88792" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

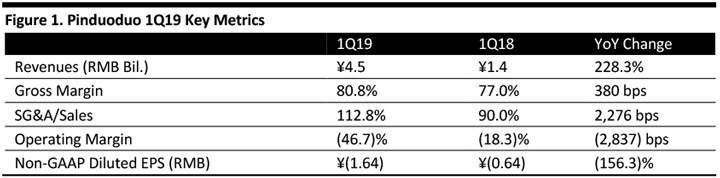

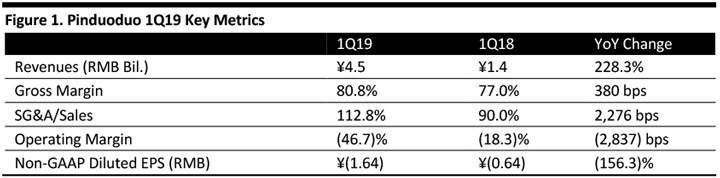

Pinduoduo reported revenues of ¥4.5 billion for the first quarter, ended March 31, 2019, beating the consensus estimate of ¥4.1 billion and up 228% year over year. Revenue growth was primarily driven by online marketing services as merchants increased marketing spend on the platforms.

1Q19 revenues were broken down as follows:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Pinduoduo reported revenues of ¥4.5 billion for the first quarter, ended March 31, 2019, beating the consensus estimate of ¥4.1 billion and up 228% year over year. Revenue growth was primarily driven by online marketing services as merchants increased marketing spend on the platforms.

1Q19 revenues were broken down as follows:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Pinduoduo reported revenues of ¥4.5 billion for the first quarter, ended March 31, 2019, beating the consensus estimate of ¥4.1 billion and up 228% year over year. Revenue growth was primarily driven by online marketing services as merchants increased marketing spend on the platforms.

1Q19 revenues were broken down as follows:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Pinduoduo reported revenues of ¥4.5 billion for the first quarter, ended March 31, 2019, beating the consensus estimate of ¥4.1 billion and up 228% year over year. Revenue growth was primarily driven by online marketing services as merchants increased marketing spend on the platforms.

1Q19 revenues were broken down as follows:

- Online marketing services were ¥3.9 billion, up 256% year over year.

- Transaction services were ¥596.8 million, up 116% year over year.

- Sales and marketing expenses were ¥4.9 billion, up 302% year over year due to higher spending on advertising, promotions and branding campaigns.

- General and administrative expenses were ¥236.1 million, up 720% year over year due to increased expenses in headcount and share-based compensation.

- Research and development expenses were ¥667.1 million, up 816% year over year due to increased spending on recruitment of R&D personnel and R&D-related cloud services.

- GMV for the 12 months ended March 31, 2019 was ¥557.4 billion, up 181% year over year.

- Active buyers for the 12 months ended March 31, 2019 were 443.3 million, up 50% year over year.

- Annual spending per active buyer for the 12 months ended March 31, 2019 was ¥1,257.3, up 87% year over year.

- Average monthly active users in the quarter were 289.7 million, up 74% year over year.