albert Chan

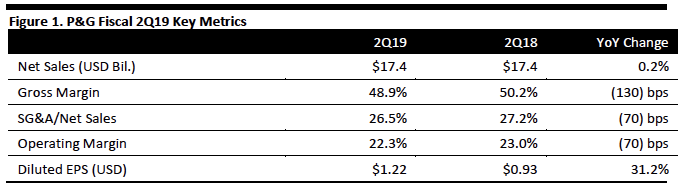

[caption id="attachment_67126" align="aligncenter" width="680"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

P&G reported net sales of $17.4 billion for the three months ended December 31, 2018, up 0.2% year over year. Operating income came in at $3.9 billion, down 0.6% year over year. Gross margin on net sales decreased 130 basis points to 48.9% and operating margin fell 70 basis points to 22.3%. Due to income tax charges caused by a transitional impact of the US Tax Act, diluted earnings per share were $1.22, an increase of 31.2% compared to the previous year. Management said the strong result was driven by the company’s focus on product superiority, productivity and improving its organization and culture.

Segment Review

The company’s strategy of raising prices amid higher commodity and transportation costs is paying off. P&G’s strong results were driven by its beauty, healthcare, and fabric and home care segments.

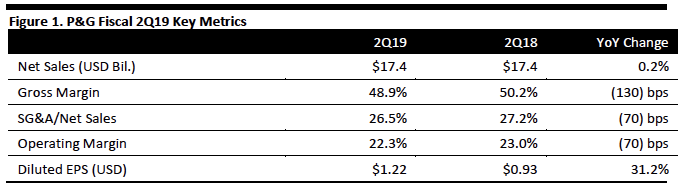

Source: Company reports/Coresight Research[/caption]

2Q19 Results

P&G reported net sales of $17.4 billion for the three months ended December 31, 2018, up 0.2% year over year. Operating income came in at $3.9 billion, down 0.6% year over year. Gross margin on net sales decreased 130 basis points to 48.9% and operating margin fell 70 basis points to 22.3%. Due to income tax charges caused by a transitional impact of the US Tax Act, diluted earnings per share were $1.22, an increase of 31.2% compared to the previous year. Management said the strong result was driven by the company’s focus on product superiority, productivity and improving its organization and culture.

Segment Review

The company’s strategy of raising prices amid higher commodity and transportation costs is paying off. P&G’s strong results were driven by its beauty, healthcare, and fabric and home care segments.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

P&G reported net sales of $17.4 billion for the three months ended December 31, 2018, up 0.2% year over year. Operating income came in at $3.9 billion, down 0.6% year over year. Gross margin on net sales decreased 130 basis points to 48.9% and operating margin fell 70 basis points to 22.3%. Due to income tax charges caused by a transitional impact of the US Tax Act, diluted earnings per share were $1.22, an increase of 31.2% compared to the previous year. Management said the strong result was driven by the company’s focus on product superiority, productivity and improving its organization and culture.

Segment Review

The company’s strategy of raising prices amid higher commodity and transportation costs is paying off. P&G’s strong results were driven by its beauty, healthcare, and fabric and home care segments.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

P&G reported net sales of $17.4 billion for the three months ended December 31, 2018, up 0.2% year over year. Operating income came in at $3.9 billion, down 0.6% year over year. Gross margin on net sales decreased 130 basis points to 48.9% and operating margin fell 70 basis points to 22.3%. Due to income tax charges caused by a transitional impact of the US Tax Act, diluted earnings per share were $1.22, an increase of 31.2% compared to the previous year. Management said the strong result was driven by the company’s focus on product superiority, productivity and improving its organization and culture.

Segment Review

The company’s strategy of raising prices amid higher commodity and transportation costs is paying off. P&G’s strong results were driven by its beauty, healthcare, and fabric and home care segments.

- Beauty Segment: The Beauty segment recorded net sales of $3.4 billion, up 3.8% year over year. Organic sales increased 8% over last year due to premium innovation, China Olay Skin and SK-II driving Skin and Personal Care organic sales, and increased pricing in Hair Care.

- Grooming Segment: The Grooming segment recorded net sales of $1.6 billion, down 9.0% year over year. Organic sales decreased 3% over last year due to volume declines driven by price increase, volatility in merchandising events and heightened competition.

- Health Care Segment: The Health Care segment recorded net sales of $2.2 billion, up 0.4% year over year. Organic sales increased 5% as premium innovation drove increased organic sales in oral care.

- Fabric and Home Care Segment: The Fabric and Home Care segment recorded net sales of $5.6 billion, up 2.3% year over year. Organic sales increased 6% due to innovation and increased pricing.

- Baby, Feminine and Family Care Segment: The Baby, Feminine and Family Care segment recorded net sales of $4.6 billion, down 1.2% year over year. Organic sales increased 3% due to innovation and growth in premium products, increased distribution and price increases.

- Moving forward, P&G will continue to drive sales through by additional hiring to supplement talent development, superiority in product performance and packaging, and adopting lean innovation process to shorten the product launch cycle.

- P&G will continue to innovate its Fabric Care segment by introducing new products next quarter, including Studio Delicates by Tide and Tide Antibacterial Spray.

- Growth in China will remain strong.

- P&G sees headwinds from competitors and uncertainty from global issues such as Brexit and the consumer confidence crisis in France.