Nitheesh NH

The Coresight Research team attended the NRF Big Show in January, participating in panel discussions, meeting with retailers and brands, and touring the booths of retail tech companies. The major theme we observed was computer vision, which was used for applications in unstaffed stores, inventory tracking, customer tracking and even for effecting payment. Eliminating the checkout and payment steps is a key part of unstaffed stores’ offering of speed and convenience.

Payments at the 2020 NRF Big Show

We saw a number of automated store technologies on display at the show, most of which incorporate their own version of payment technology.

Automated Stores

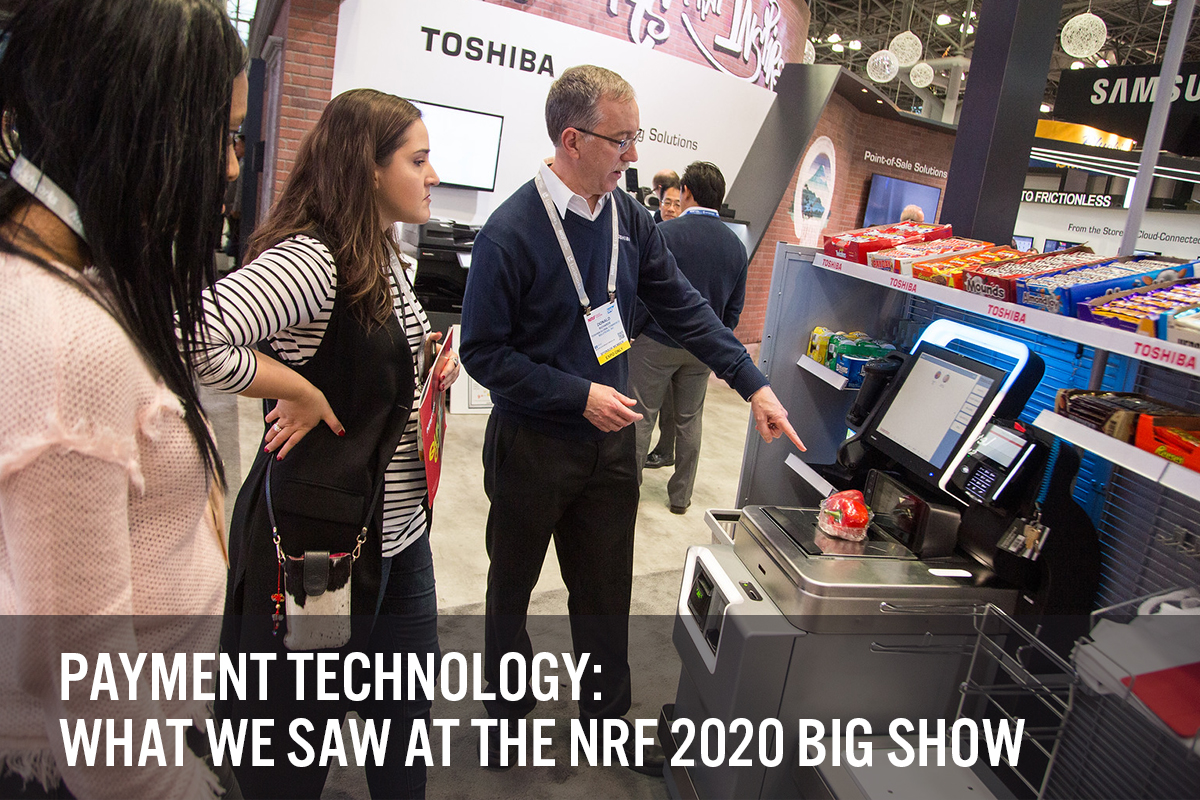

Coresight Research saw technology from Intel, Toshiba, Sensormatic and Hisense.

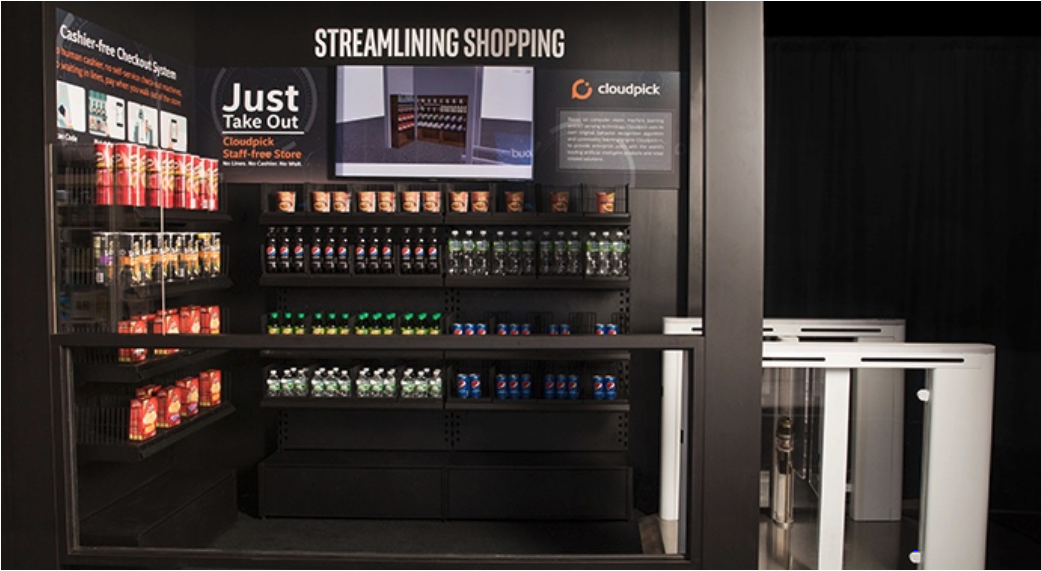

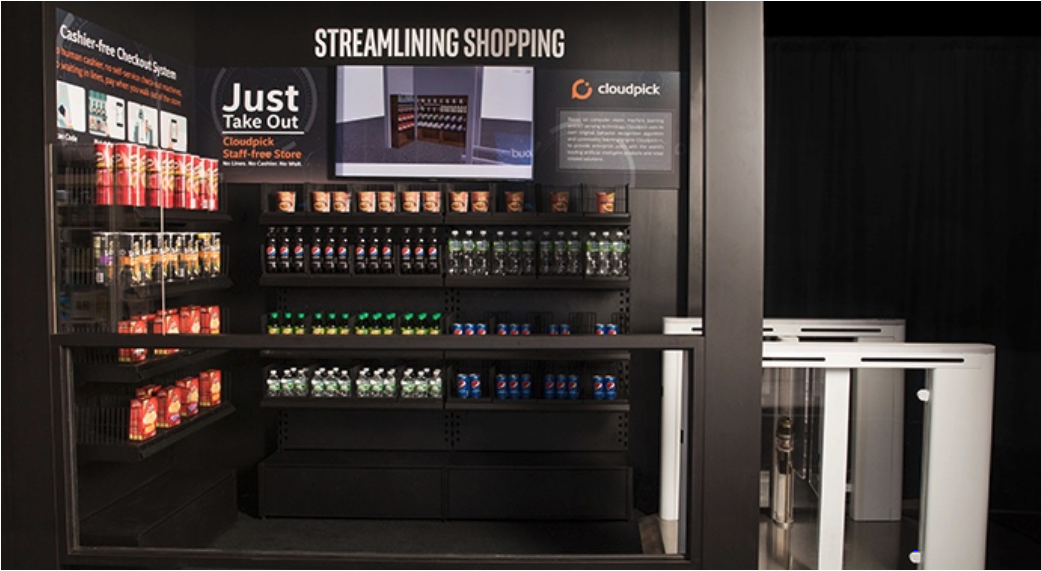

Intel’s booth featured unstaffed store technology from Cloudpick, which operates unstaffed stores in China. The technology operates in a similar fashion to Amazon Go stores: The customer scans a barcode to gain entry, computer vision monitors when customers remove products from shelves and the customer simply leaves the store when done. Representatives from grocer Ahold Delhaize USA and system integrator Retail Business Services (RBS) were also on hand to discuss two tests of the technology in RBS offices in Quincy, Massachusetts, and at a Giant Food Stores distribution center in Carlisle, Pennsylvania.

[caption id="attachment_102902" align="aligncenter" width="700"] Unstaffed store

Unstaffed store

Source: Company[/caption] Toshiba demonstrated frictionless store technology that works with existing store layouts. It uses computer vision to identify products, and the platform generates a pop-up window asking the customer to confirm shopping cart contents when crossing a threshold within the store. After confirming the cart’s contents, the customer can then leave the store. [caption id="attachment_102903" align="aligncenter" width="700"] Toshiba frictionless store

Toshiba frictionless store

Source: Company[/caption] Sensormatic demonstrated a store platform that uses RFID to track goods (it used apparel in the demonstration), using an example of a trusted VIP customer who can just pick up items, scan an NFC sensor on an exit gate (located on the left rail, see image below) to just walk out. Items will be billed to the customer’s account. [caption id="attachment_102904" align="aligncenter" width="520"] Sensormatic automated exit gate

Sensormatic automated exit gate

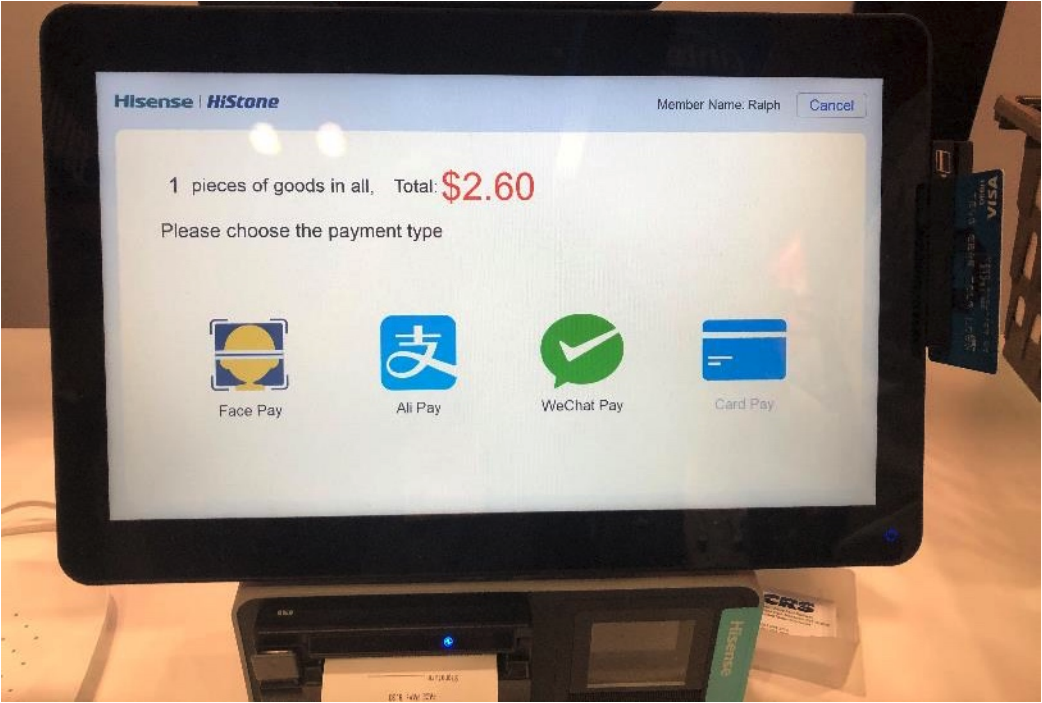

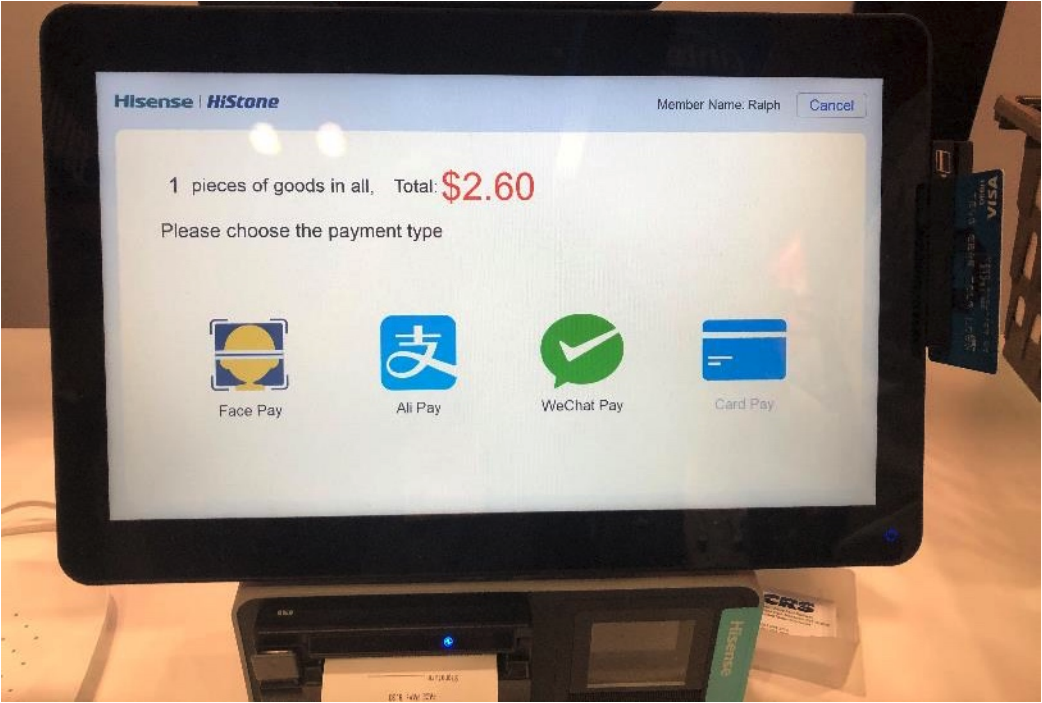

Source: Company[/caption] Hisense demonstrated a modular POS system that can scan barcodes or use computer vision to identify items. The surprise feature was facial recognition, in addition to accepting WeChat Pay and Alipay. [caption id="attachment_102905" align="aligncenter" width="700"] Hisense payment terminal

Hisense payment terminal

Source: Coresight Research[/caption] The Backlash Against Cashless Stores While retailers and technology companies have been busy developing new technologies to support cashless stores, public opinion has been growing against it. One example is recent New York City Council legislation (passed on January 23) which bans restaurants and other retail establishments from refusing to accept cash, with the bill expected to become law in nine months. New York City will join Philadelphia and San Francisco in banning cashless restaurants. The rationale is that refusing to accept cash discriminates against people without bank accounts and credit cards, as well as minors. New York City Councilman Ritchie Torres claimed that 25% of New Yorkers are unbanked or underbanked and would be excluded by cashless establishments. New York City Joining the Tap-and-Go Club for Transit At the same time New York City’s city council was passing a no-cashless store law, its Metropolitan Transit Authority (MTA) was making plans to expand tap-and-go payment terminals called One Metro New York (OMNY). The MTA tested the new terminals in selected subway and bus lines in May 2019 and is currently installing them in more stations, with the goal of covering all subway and bus lines by the end of 2020. In 2021, the MTA will expand it to commuter lines, specifically the Long Island Rail Road and the Long Island Rail Road. As of January 6, 2020, OMNY had recorded 5 million tap payments. The system will replace the current prepaid MetroCard, launched in 1993, which uses a magnetic stripe and replaced the previous iconic metal tokens. OMNY riders can pay with contactless cards, reloadable prepaid cards and digital wallets (including NFC-equipped smartphones). The current card does not have a contactless feature, but the company that provides the service plans to test a commuter debit card in early 2020. MTA officials assured riders there will always be a cash option. [caption id="attachment_102906" align="aligncenter" width="480"] OMNY payment terminal

OMNY payment terminal

Source: Coresight Research[/caption] Secure Remote Commerce Is Here Secure Remote Commerce (SRC) is a new payment platform that promises to create the foundation for a consistent consumer checkout experience while increasing simplicity and security. The platform was developed jointly by Eurocard, Mastercard and Visa, but has also been embraced by American Express. To checkout with SRC, the consumer uses a login and receives a code via second-factor identification, such as e-mail, freeing consumers from having to enter a credit card number and security information to complete a transaction. The platform works online as well as on mobile devices and will replace current platforms such as VISA Checkout, Masterpass and American Express Checkout. Visa announced that starting January 21, merchants will transition to the new platform. SRC is also compatible with tokenization and future technologies, such as the 3-D Secure specification. The first merchants to adopt SRC include BassPro, JoAnn Fabric and Crafts, Papa John’s, Saks Fifth Avenue, SHOP.com and Tickets.com. The checkout button below shows the SRC logo at the left, along with logos of supporting credit-card companies. [caption id="attachment_102907" align="aligncenter" width="480"] Secure remote commerce checkout button

Secure remote commerce checkout button

Source: Company press release[/caption] Other Coresight Research Reports For more information on new developments in retail technology and how it impacts the industry and the consumer experience, please see our related reports: New Retail Briefing: Alipay Now Available to Visitors to China Insights from China: Alipay and WeChat Pay Go International The Future of Payments

Unstaffed store

Unstaffed storeSource: Company[/caption] Toshiba demonstrated frictionless store technology that works with existing store layouts. It uses computer vision to identify products, and the platform generates a pop-up window asking the customer to confirm shopping cart contents when crossing a threshold within the store. After confirming the cart’s contents, the customer can then leave the store. [caption id="attachment_102903" align="aligncenter" width="700"]

Toshiba frictionless store

Toshiba frictionless storeSource: Company[/caption] Sensormatic demonstrated a store platform that uses RFID to track goods (it used apparel in the demonstration), using an example of a trusted VIP customer who can just pick up items, scan an NFC sensor on an exit gate (located on the left rail, see image below) to just walk out. Items will be billed to the customer’s account. [caption id="attachment_102904" align="aligncenter" width="520"]

Sensormatic automated exit gate

Sensormatic automated exit gateSource: Company[/caption] Hisense demonstrated a modular POS system that can scan barcodes or use computer vision to identify items. The surprise feature was facial recognition, in addition to accepting WeChat Pay and Alipay. [caption id="attachment_102905" align="aligncenter" width="700"]

Hisense payment terminal

Hisense payment terminalSource: Coresight Research[/caption] The Backlash Against Cashless Stores While retailers and technology companies have been busy developing new technologies to support cashless stores, public opinion has been growing against it. One example is recent New York City Council legislation (passed on January 23) which bans restaurants and other retail establishments from refusing to accept cash, with the bill expected to become law in nine months. New York City will join Philadelphia and San Francisco in banning cashless restaurants. The rationale is that refusing to accept cash discriminates against people without bank accounts and credit cards, as well as minors. New York City Councilman Ritchie Torres claimed that 25% of New Yorkers are unbanked or underbanked and would be excluded by cashless establishments. New York City Joining the Tap-and-Go Club for Transit At the same time New York City’s city council was passing a no-cashless store law, its Metropolitan Transit Authority (MTA) was making plans to expand tap-and-go payment terminals called One Metro New York (OMNY). The MTA tested the new terminals in selected subway and bus lines in May 2019 and is currently installing them in more stations, with the goal of covering all subway and bus lines by the end of 2020. In 2021, the MTA will expand it to commuter lines, specifically the Long Island Rail Road and the Long Island Rail Road. As of January 6, 2020, OMNY had recorded 5 million tap payments. The system will replace the current prepaid MetroCard, launched in 1993, which uses a magnetic stripe and replaced the previous iconic metal tokens. OMNY riders can pay with contactless cards, reloadable prepaid cards and digital wallets (including NFC-equipped smartphones). The current card does not have a contactless feature, but the company that provides the service plans to test a commuter debit card in early 2020. MTA officials assured riders there will always be a cash option. [caption id="attachment_102906" align="aligncenter" width="480"]

OMNY payment terminal

OMNY payment terminalSource: Coresight Research[/caption] Secure Remote Commerce Is Here Secure Remote Commerce (SRC) is a new payment platform that promises to create the foundation for a consistent consumer checkout experience while increasing simplicity and security. The platform was developed jointly by Eurocard, Mastercard and Visa, but has also been embraced by American Express. To checkout with SRC, the consumer uses a login and receives a code via second-factor identification, such as e-mail, freeing consumers from having to enter a credit card number and security information to complete a transaction. The platform works online as well as on mobile devices and will replace current platforms such as VISA Checkout, Masterpass and American Express Checkout. Visa announced that starting January 21, merchants will transition to the new platform. SRC is also compatible with tokenization and future technologies, such as the 3-D Secure specification. The first merchants to adopt SRC include BassPro, JoAnn Fabric and Crafts, Papa John’s, Saks Fifth Avenue, SHOP.com and Tickets.com. The checkout button below shows the SRC logo at the left, along with logos of supporting credit-card companies. [caption id="attachment_102907" align="aligncenter" width="480"]

Secure remote commerce checkout button

Secure remote commerce checkout buttonSource: Company press release[/caption] Other Coresight Research Reports For more information on new developments in retail technology and how it impacts the industry and the consumer experience, please see our related reports: New Retail Briefing: Alipay Now Available to Visitors to China Insights from China: Alipay and WeChat Pay Go International The Future of Payments