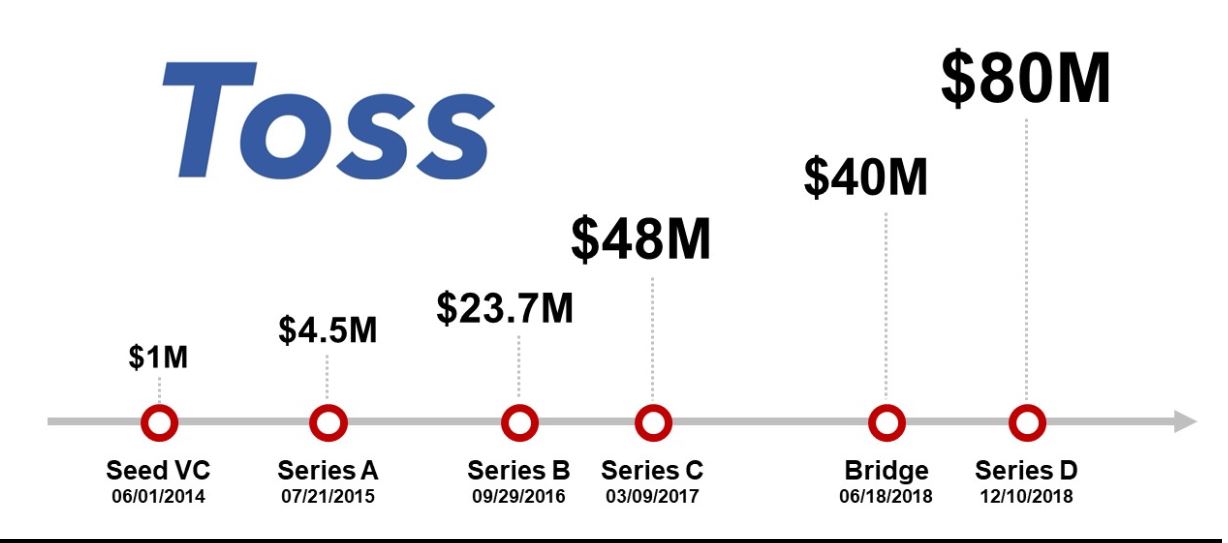

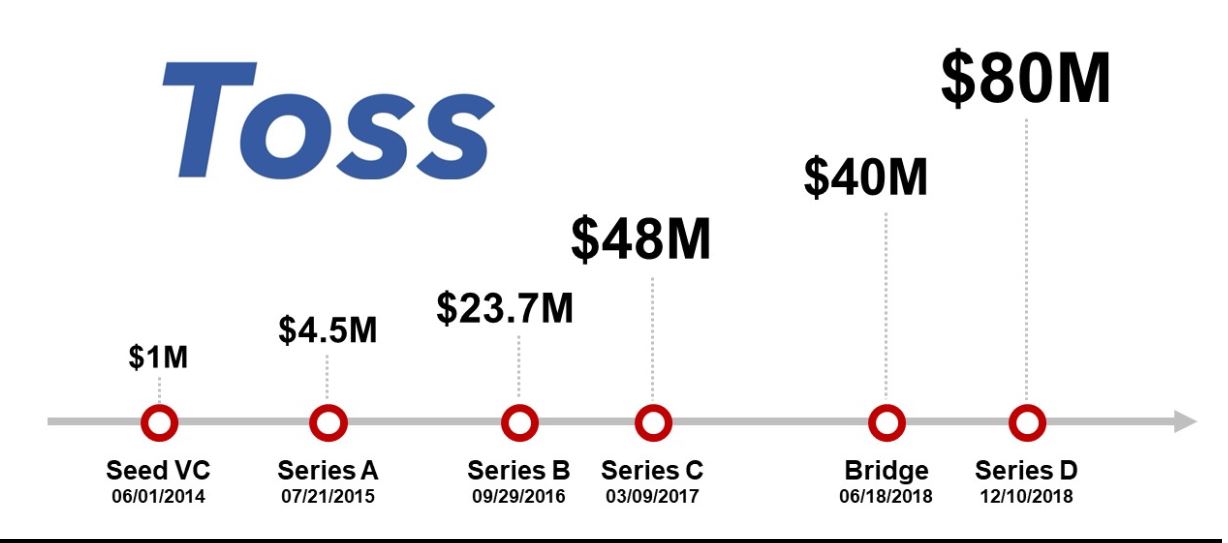

On December 10, Toss became the fifth Korean unicorn startup, after its parent company, Viva Republica, announced that it raised an additional $80 million in funding, bringing total funding to $200 million and valuing the company at $1.2 billion. The new funding round was led by Silicon Valley-based venture capital firms Kleiner Perkins and Ribbit Capital. Previous funding came from PayPal, Sequoia and the Singapore Sovereign Wealth Fund Government Investment Corporation.

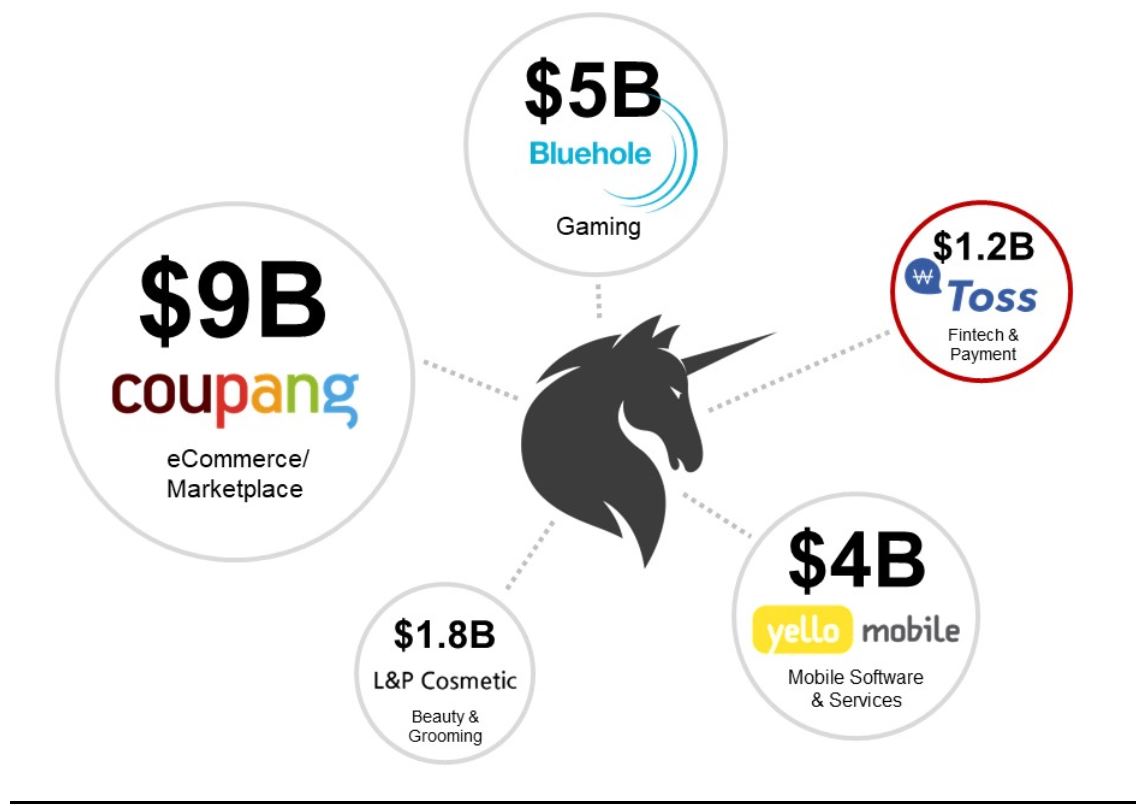

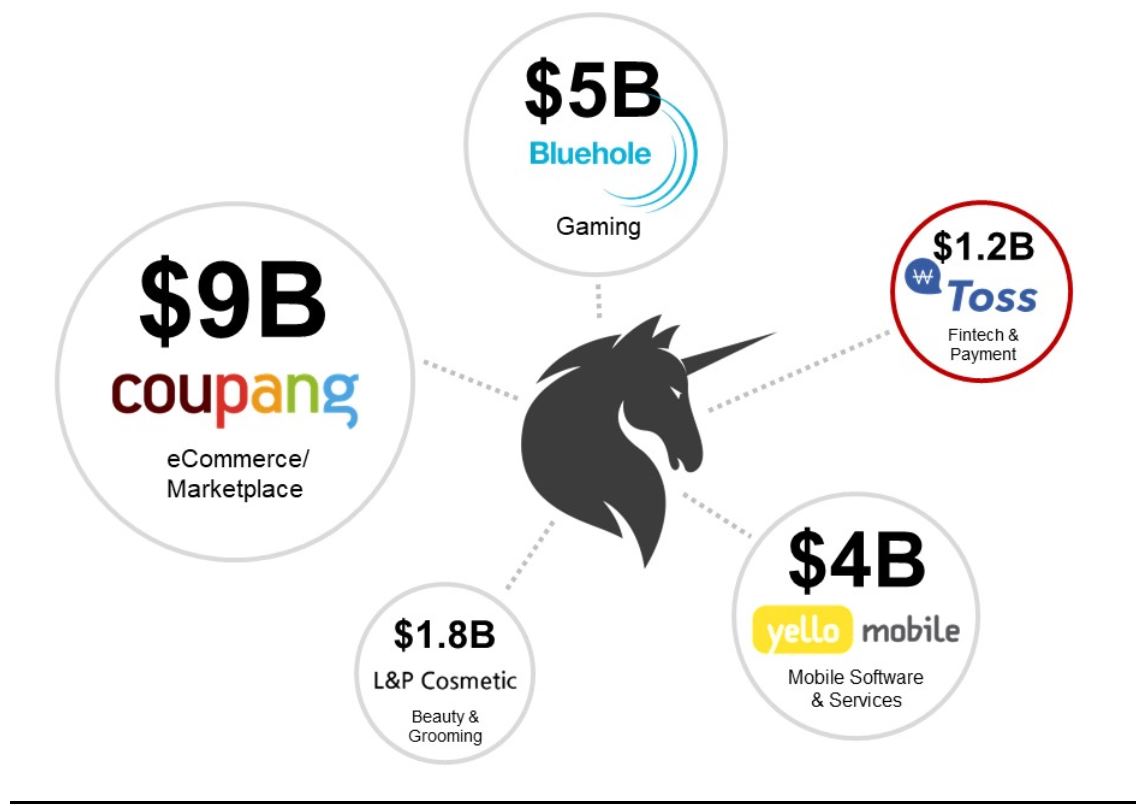

Toss is the first fintech unicorn in Korea. Before Toss joined the Korean unicorn club, there were four existing members:

- Coupang (e-commerce/marketplace)

- Bluehole (gaming)

- Yello Mobile (mobile software and services)

- L&P Cosmetics (beauty and grooming)

Tight financial regulations have constrained Korea’s fintech sector. Toss grew out of an effort to solve some of those problems, and is helping to reshape the domestic payments market in the process.

Korean Unicorn Club, based on company valuations.

Source: CB Insights/Coresight Research

Korean Unicorn Club, based on company valuations.

Source: CB Insights/Coresight Research

Growing from a Venmo-Like Company into a Financial Powerhouse

“Before Toss, users required five passwords and around 37 clicks to transfer $10. with Toss, users need just one password and three steps to transfer up to

₩500,000 (around $430),” says Lee Seung-gun, the former dentist who founded Toss. Viva Republica says Toss now has 10 million registered users, almost 20% of Korea’s total population.

Toss was born as a Venmo-like peer-to peer (P2P) service in 2015 to ease the complex process of transferring money online. Toss lets users transfer money without financial authentication certificates or security cards.Korea has the highest smartphone penetration rates in the world: 94% according to Pew Research, compared to 77% in the US, so Toss sees enormous market potential. Toss grew dramatically in the past three years and now offers25 different services, including credit score management, customized insurance plans, investments and loans. Lee said he created Toss to “help people save and spend money smartly,” similar to Credit Karma and Mint in the US.

Funding timeline of Toss

Source: CB Insights/Coresight Research

Funding timeline of Toss

Source: CB Insights/Coresight Research

Expanding the Business

Toss will use part of the funding to expand its services into new areas such as securities and brokerage services, and also to expand overseas. Since raising Series C funding 18 months ago, Toss is eyeing Southeast Asia markets in Indonesia, the Philippines, Vietnam, Thailand, Myanmar and Malaysia. Lee says Toss will launch country by country, starting with Vietnam in 2019.

Toss is Building Connections with Tech Giants from China

China’s tech giants Alibaba and Tencentare already competing globally with their mobile solutions—although markets in Asia are emerging as the main battlefield. Alipay (Alibaba) and WeChat Pay (Tencent) started life similar to Toss:Alipay and WeChat Paybegan as mobile payment solutions, then added more services. Once established in their home market, both companies began expanding into other parts of Asia, then to the world.

Toss is considering partnerships with these tech giants in an effort to beat other domestic Korean players. KakaoPay, one of Toss’s major competitors in Korea, has already built a strong connection with Tencent and Alibaba’s Ant Financial. KakaoPayis backed by Tencent and recently secured $200 million in funding from Ant Financial. Toss’s Lee explained that his company has a “good relationship” with Tencent, but has no specific plans to work together.

With its expansion strategy and potential partnership with Tencent, Toss expects to grow further in 2019.

Korean Unicorn Club, based on company valuations.

Source: CB Insights/Coresight Research

Korean Unicorn Club, based on company valuations.

Source: CB Insights/Coresight Research Funding timeline of Toss

Source: CB Insights/Coresight Research

Funding timeline of Toss

Source: CB Insights/Coresight Research