Nitheesh NH

What’s the Story?

In the coming years, retailers face an uphill task of adapting to the new shopper’s changed preferences and shopping habits in the post-Covid era. With e-commerce penetration in overall retail having accelerated amid the pandemic, we expect the online channel to remain a key focus for investment moving forward. However, retailers must also focus on their physical stores as shoppers make a gradual return to in-store shopping, to make their retail spaces stand out from the competition and ensure that the in-store experience drives customer retention and loyalty. This is particularly important in today’s fast-changing retail environment amid volatility in consumer preferences and receding brand loyalty. It is therefore essential for retailers to take action to achieve effective merchandising execution—i.e., the way they present products across shelves and aisles within their stores to shoppers. In this report, we explore the importance of agility in merchandising—in other words, the ability to respond to changing market trends and consumer behavior—leveraging the findings of an October 2021 Coresight Research survey of 173 global retail respondents in Germany, the UK and the US who are involved in strategic retail merchandising decision-making in grocery and drugstore retail. Our analysis covers the use of software/digital platforms for space management and planning, merchandising areas/processes that retailers believe need a technology upgrade, and the future-proofing of merchandising capabilities. This report is sponsored by One Door, an artificial intelligence (AI)-powered cloud-based retail merchandising execution platform.Why It Matters

We identify two key factors contributing to the importance of effective merchandising execution:- Merchandising is investment-intensive: Getting merchandising right across the entire store fleet is only possible by effectively leveraging advanced technologies. Incorporating modern planning tools and technologies such as AI costs retailers a significant proportion of their overall technology budget. These investments can translate to sunk investments if they are not proportionally spanned across merchandising processes and are not objective-oriented.

- Merchandising execution involves multiple moving parts: Effective merchandising execution is a confluence of many independent processes, which must be leveraged together to enhance both efficiency and efficacy in merchandising execution. We summarize these processes in Figure 1.

Figure 1. Selected Processes Leading to Effective Merchandising Execution [caption id="attachment_137324" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

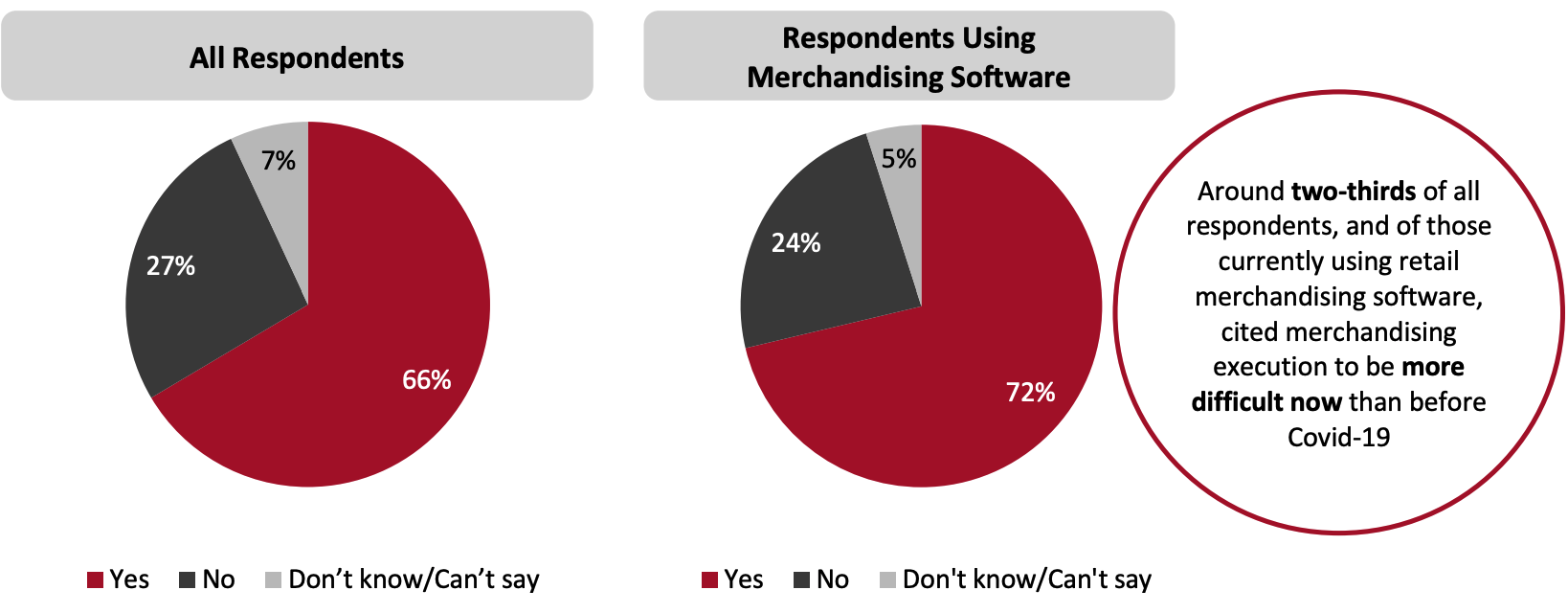

Pathway to Agility in Merchandising Execution: Three Actions That Retailers Must Take in 2022

Our analysis of the survey data sheds light on three key actions that retailers must take to achieve agility in merchandising execution. We present these in Figure 2 and discuss each below, before exploring the supporting survey findings in detail in the later sections of this report.Figure 2. Pathway to Merchandising Agility: Three Key Actions Retailers Must Take in 2022 [caption id="attachment_137325" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Leverage AI effectively for customer-centric merchandising

Customer-centricity in merchandising enables brands and retailers to showcase the right products to the right customers at the right time. Technology is paramount in determining success in today’s fast-changing retail landscape. In fact, our survey data reveal that over the past 12 months, around two-thirds of all respondents have either increased or invested the same amount on in-store merchandising technology than they did previously.

Retailers must focus not only on investing in the latest AI technologies but on facilitating the integration of planning processes. A continuous feedback loop can support retailers in moving toward more nimble operations, which can help them achieve customer-centric merchandising.

2. Achieve integration maturity across merchandising processes and store fleets

Efficiency in merchandising execution is meaningful only when it is highly scalable. Ensuring compliance across the entire store fleet can help retailers achieve their objective of localization of assortment while ensuring consistency in how shoppers perceive their stores. We believe this can only be possible through the integration of merchandising processes across stores and departments—and only around two in 10 respondents cited having integration maturity in merchandising processes across departments and stores, according to our survey data.

With retailers already revamping investments, the focus should be on investing in technologies that can plug into existing systems and so offer fast implementation.

3. Focus on objective-led investments in merchandising processes

Retailers must identify areas within their organization that require a technology upgrade, and they should make investments in purpose-built solutions. Our survey data reveal monetary constraints—specifically, implementation cost and an inability to demonstrate a return on investment (ROI)—to be the biggest challenges facing retailers that plan to introduce a merchandising software tool soon (cited by 69% and 57% of this subset, respectively).

We believe that by tracking investment initiatives, retailers can better monitor and analyze results and ROI. Inability to track investment initiatives and returns attached to them can negatively impact retailers’ ability to scale technology adoption across the entire organization.

Source: Coresight Research[/caption]

1. Leverage AI effectively for customer-centric merchandising

Customer-centricity in merchandising enables brands and retailers to showcase the right products to the right customers at the right time. Technology is paramount in determining success in today’s fast-changing retail landscape. In fact, our survey data reveal that over the past 12 months, around two-thirds of all respondents have either increased or invested the same amount on in-store merchandising technology than they did previously.

Retailers must focus not only on investing in the latest AI technologies but on facilitating the integration of planning processes. A continuous feedback loop can support retailers in moving toward more nimble operations, which can help them achieve customer-centric merchandising.

2. Achieve integration maturity across merchandising processes and store fleets

Efficiency in merchandising execution is meaningful only when it is highly scalable. Ensuring compliance across the entire store fleet can help retailers achieve their objective of localization of assortment while ensuring consistency in how shoppers perceive their stores. We believe this can only be possible through the integration of merchandising processes across stores and departments—and only around two in 10 respondents cited having integration maturity in merchandising processes across departments and stores, according to our survey data.

With retailers already revamping investments, the focus should be on investing in technologies that can plug into existing systems and so offer fast implementation.

3. Focus on objective-led investments in merchandising processes

Retailers must identify areas within their organization that require a technology upgrade, and they should make investments in purpose-built solutions. Our survey data reveal monetary constraints—specifically, implementation cost and an inability to demonstrate a return on investment (ROI)—to be the biggest challenges facing retailers that plan to introduce a merchandising software tool soon (cited by 69% and 57% of this subset, respectively).

We believe that by tracking investment initiatives, retailers can better monitor and analyze results and ROI. Inability to track investment initiatives and returns attached to them can negatively impact retailers’ ability to scale technology adoption across the entire organization.

State of Retail Merchandising and Way Forward: Key Survey Findings

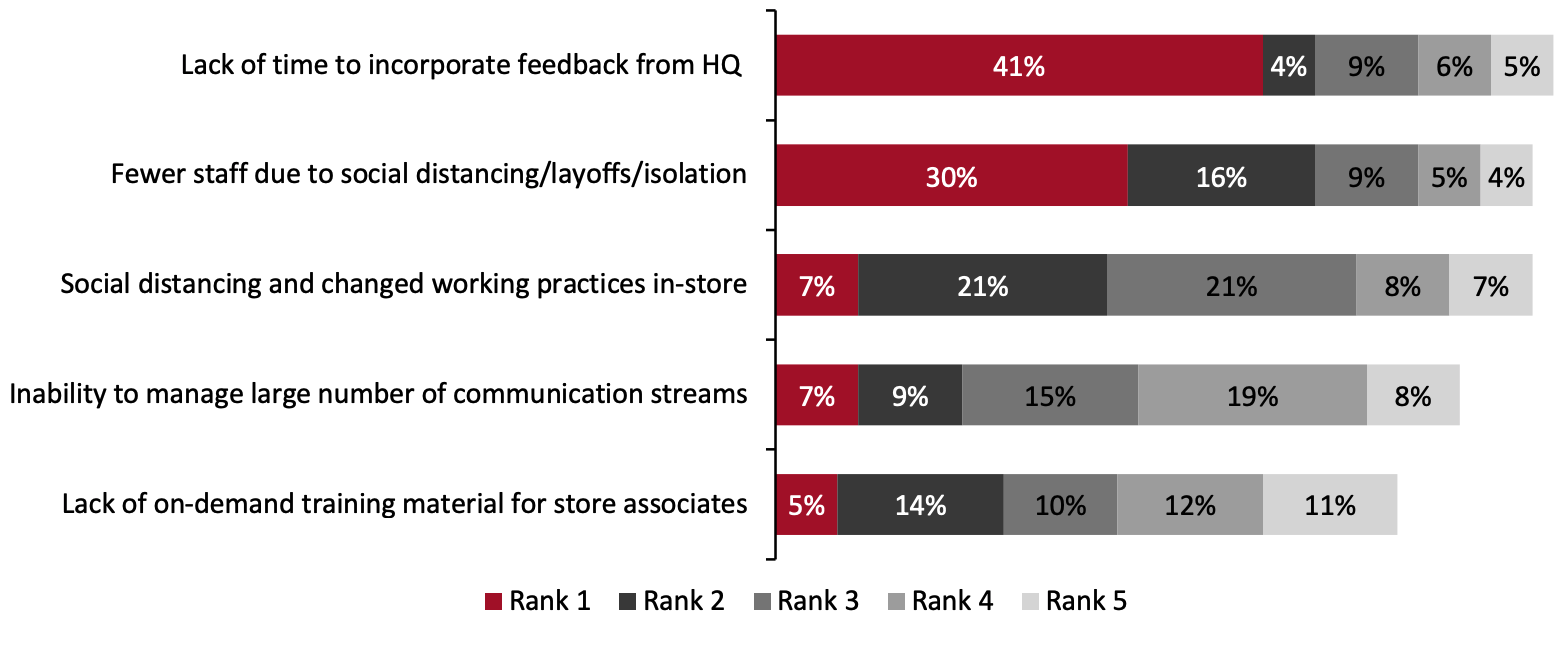

Merchandising Execution Is More Difficult Now Than Ever Covid-19 has prompted not only changes in shopper behavior, but also a holistic change in the overall retail sector. E-commerce has accelerated and omnichannel retail has become more important than ever to retailers to reach consumers across multiple touchpoints. We expect more shoppers to return to stores as the environment improves, so retailers must refocus on their stores moving forward; each store must tell the brand story while ensuring effective localization and a relevant promotional calendar, among other things. However, merchandising, which was already difficult, presents an extra layer of challenges to retailers today due to volatile store staffing levels and more frequent requirements for planogram resets amid fast-changing consumer preferences. Reflecting this, the majority of retail executives we surveyed reported that managing merchandising execution is more difficult now than before Covid-19 (cited by 66% of respondents). Surprisingly, among the respondents currently using merchandising software (59% of all respondents), some 72% cited merchandising execution as more challenging than before Covid-19—six percentage points more than the proportion of all respondents that reported the same (see Figure 3). This underlines the importance of using technology effectively, as simply having technology in place does not guarantee success in addressing the growing complexity of retail processes.Figure 3. Whether Managing Merchandising Execution Is More Difficult Than Before Covid-19 (% of Respondents) [caption id="attachment_137326" align="aligncenter" width="700"]

Base: 173 global retail merchandising decision-makers (left); 102 global retail merchandising decision-makers whose organizations are currently using merchandising software (right)

Base: 173 global retail merchandising decision-makers (left); 102 global retail merchandising decision-makers whose organizations are currently using merchandising software (right)Source: Coresight Research[/caption] Existing challenges in effective merchandising execution include communicating multiple instructions across the entire store fleet and ensuring compliance in real time. Today, with remote-working arrangements and more frequent planogram resets, the end-to-end merchandising process is further strained. We asked respondents who believe managing merchandising execution is more difficult than before Covid-19 about the key factors contributing to increased difficulties in managing merchandising execution:

- We found a lack of time to incorporate feedback from HQ (headquarters) to be the most significant factor, cited by 41% of respondents as the topmost contributor to increased difficulties in merchandising execution and by 65% as one of the top five contributors. Volatile market conditions and evolving shopper preferences around shopping channels and brands have led to a greater need for store and planogram resets, which adds to the pressure of real-time compliance for store associates.

- Fewer staff emerged as the second biggest contributor, cited by 30% of respondents as the most significant and tying with changed working practices in-store for the proportion of respondents reporting it as one of the top five contributing factors (64%).

Figure 4. Top Five Factors Contributing to Increased Difficulties in Managing Merchandising Execution (% of Respondents) [caption id="attachment_137328" align="aligncenter" width="700"]

Respondents were asked to select the top five factors contributing to increased difficulties in merchandising execution, and rank them from most important (“Rank 1”) to least important (“Rank 5”); responses are ordered based on weighted average of ranks where “Rank 1” carries the highest weight

Respondents were asked to select the top five factors contributing to increased difficulties in merchandising execution, and rank them from most important (“Rank 1”) to least important (“Rank 5”); responses are ordered based on weighted average of ranks where “Rank 1” carries the highest weightBase: 115 global retail merchandising decision-makers who cited merchandising execution is more difficult now than before Covid-19

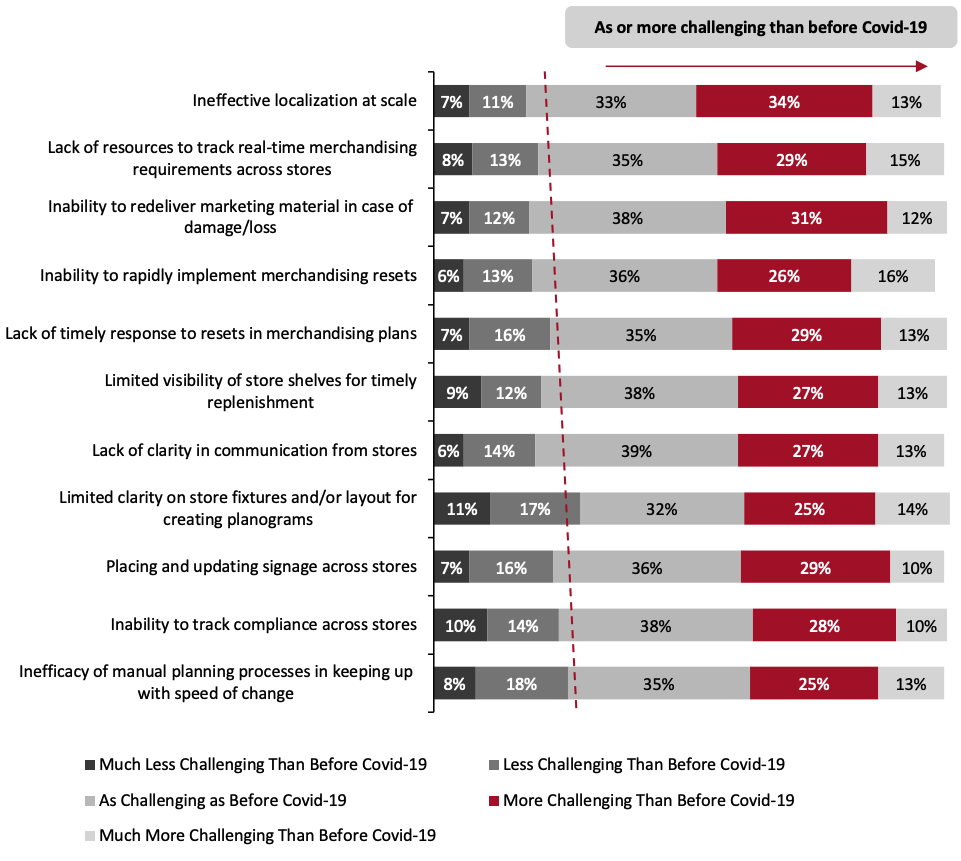

Source: Coresight Research[/caption] Furthermore, our survey data reveal that Covid-19 has made almost all existing merchandising challenges more challenging:

- An overwhelming majority of respondents—around 70%–80%—believe that each merchandising execution challenge has become more challenging since the start of the Covid-19 outbreak.

- Nearly half of respondents (47%)—the highest proportion among all challenges—reported that localization at scale has become either “more” or “much more” challenging than before Covid-19.

Figure 5. Whether Existing Merchandising Execution Challenges Are More or Less Challenging Than Before Covid-19 (% of Respondents) [caption id="attachment_137332" align="aligncenter" width="700"]

Responses are ordered in descending order of the sum of respondents who cited each of the challenges to be “more” or “much more” challenging than before Covid-19. Totals do not sum to 100% as we have not included respondents that cited “don’t know”

Responses are ordered in descending order of the sum of respondents who cited each of the challenges to be “more” or “much more” challenging than before Covid-19. Totals do not sum to 100% as we have not included respondents that cited “don’t know”Base: 173 global retail merchandising decision-makers

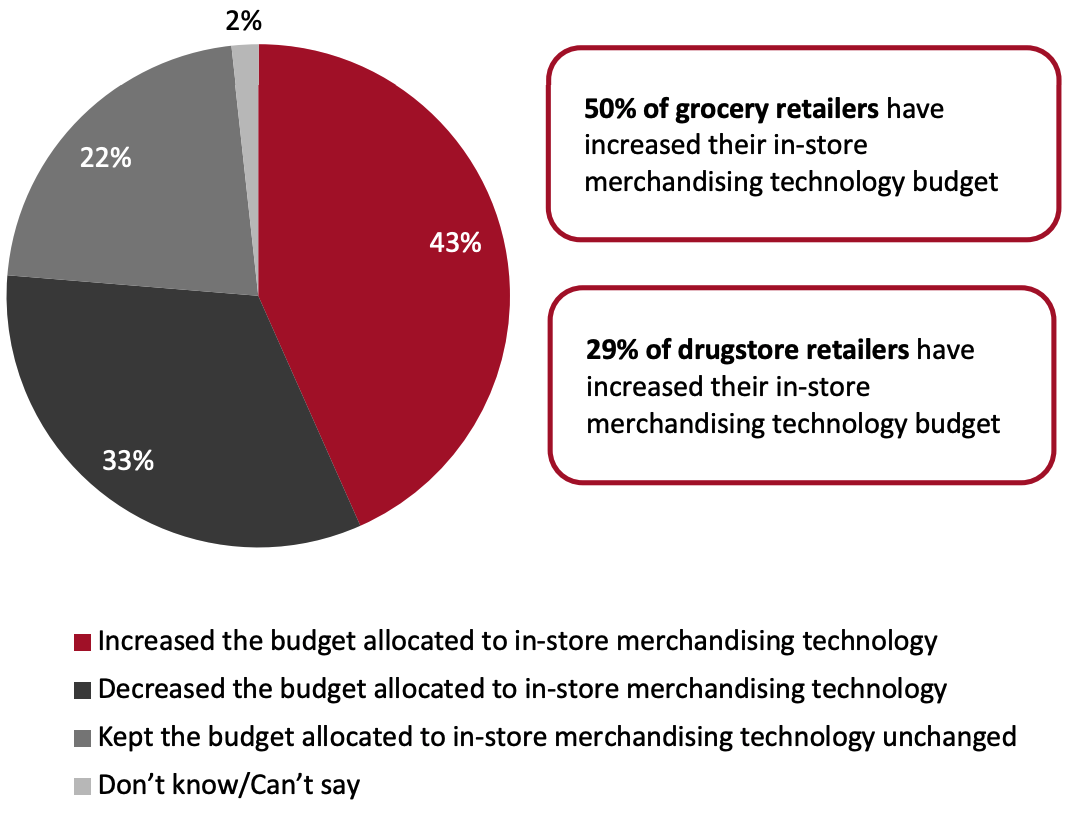

Source: Coresight Research[/caption] In-Store Merchandising Technology Increased Investment The more challenging nature of merchandising execution has led to retailers increasing their investment into in-store merchandising technology: More than four in 10 respondents reported that they had done so over the past 12 months (see Figure 6). The high proportion of retailers that have increased the budget allocated to technology was largely driven by respondents from the grocery sector: Over half of this subset reported increasing their technology budget, compared to only 29% of drugstore retail respondents. This can be attributed to the rapid acceleration of e-commerce in the grocery sector; increased investment in in-store merchandising could represent grocers’ efforts to incentivize shoppers to return to stores, ensuring that they provide an enjoyable shopping experience. The nature of grocery retail—a diverse mix of low-value products, a high risk of markdowns, and multiple store formats and fulfillment options—also drives retailers’ requirements for in-store merchandising technology.

Figure 6. Whether Retailers Have Changed the Budget Allocated To Merchandising Technology Over the Past 12 Months (% of Respondents) [caption id="attachment_137334" align="aligncenter" width="580"]

Base: 173 global retail merchandising decision-makers

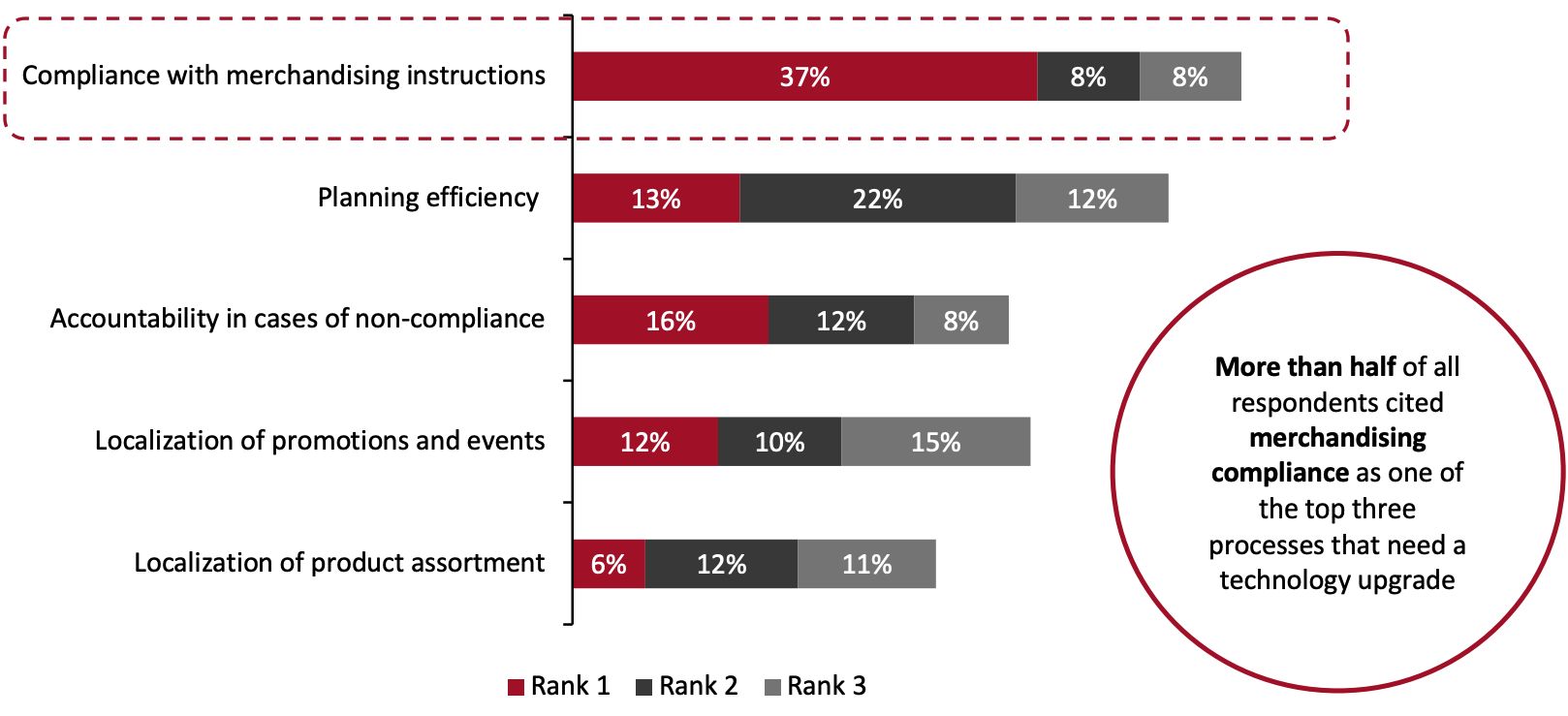

Base: 173 global retail merchandising decision-makersSource: Coresight Research[/caption] Upgrade Requirements We asked our survey respondents about the processes they believe need technology upgrades:

- Compliance—meaning that stores effectively implement instructions from HQ—is an essential component of merchandising execution. More than half of respondents (53%) cited compliance with merchandising instructions as among the top three areas needing a technology upgrade—and the highest proportion (37%) ranked it as being the process most in need.

- Planning efficiency emerged at the second process most in need of a technology upgrade, cited by 47% of respondents as among the top three.

Figure 7. Top Five Processes That Retailers Believe Need a Technology Upgrade (% of Respondents) [caption id="attachment_137335" align="aligncenter" width="700"]

Respondents were asked to select the top three processes that need a technology upgrade and rank them according to most in need (“Rank 1”) to least in need (“Rank 3”); the ranking of responses is based on the weighted average of ranks, where “Rank 1” carries the highest weight.

Respondents were asked to select the top three processes that need a technology upgrade and rank them according to most in need (“Rank 1”) to least in need (“Rank 3”); the ranking of responses is based on the weighted average of ranks, where “Rank 1” carries the highest weight. Base: 173 global retail merchandising decision-makers

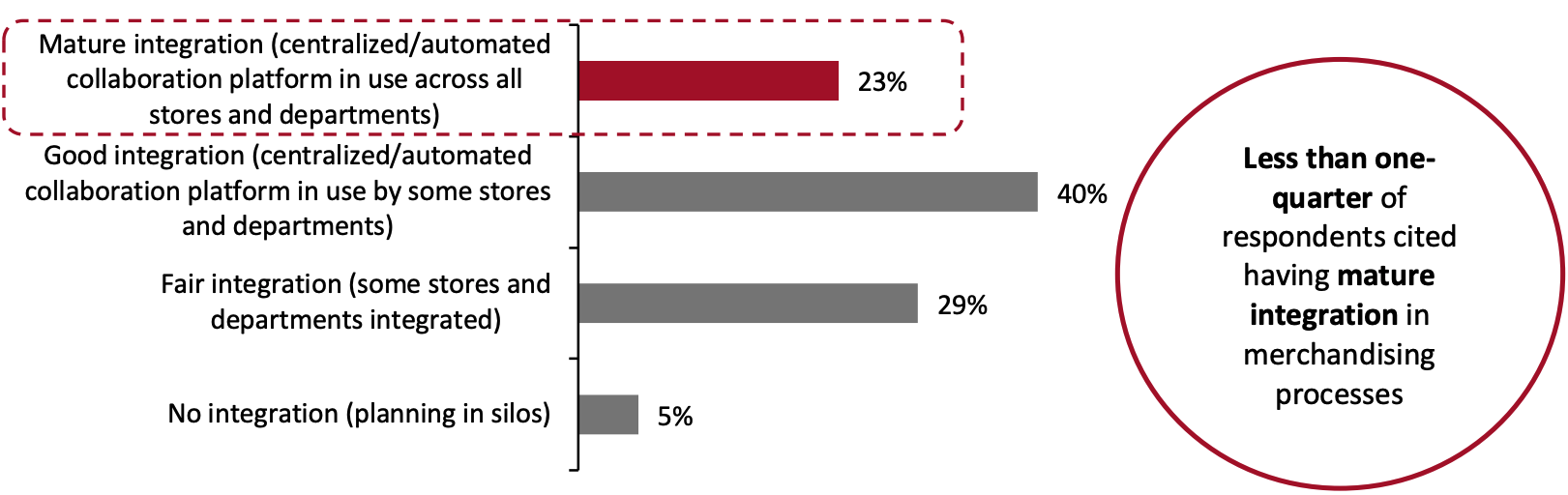

Source: Coresight Research[/caption] Integration of Merchandising Processes Effective merchandising execution can be achieved through the seamless integration of a wide range of merchandising processes such as pricing and inventory management. If retailers can flatten any disparities across processes such as inventory management, planogram generation and promotion management, they can significantly improve the merchandising execution outcome. This eventually translates to shopper-centric and effective localization at scale as retailers can make changes to their merchandising strategy in a uniform manner. Our survey data reveal that integration of merchandising processes is still far from mature—only 23% of respondents cited “mature” integration in merchandising processes across stores and departments. We believe that the pathway to achieving efficacy in merchandising execution involves the gradual integration of various merchandising processes. Retailers understand this and are working toward higher levels of integration across merchandising processes and departments. For example, big-box retailer Walmart combined its in-store and online buying teams in early 2020. Walmart’s Senior Director of Global Communications Kevin Gardner said, “Our customers see one Walmart, and they expect the same low prices and seamless experience no matter how they choose to shop with us. Today we are making changes that put the customer at the center of how we buy and sell merchandise.”

Figure 8. Level of Integration of Merchandising Processes Across Stores and Departments (% of Respondents) [caption id="attachment_137336" align="aligncenter" width="700"]

Base: 173 global retail merchandising decision-makers

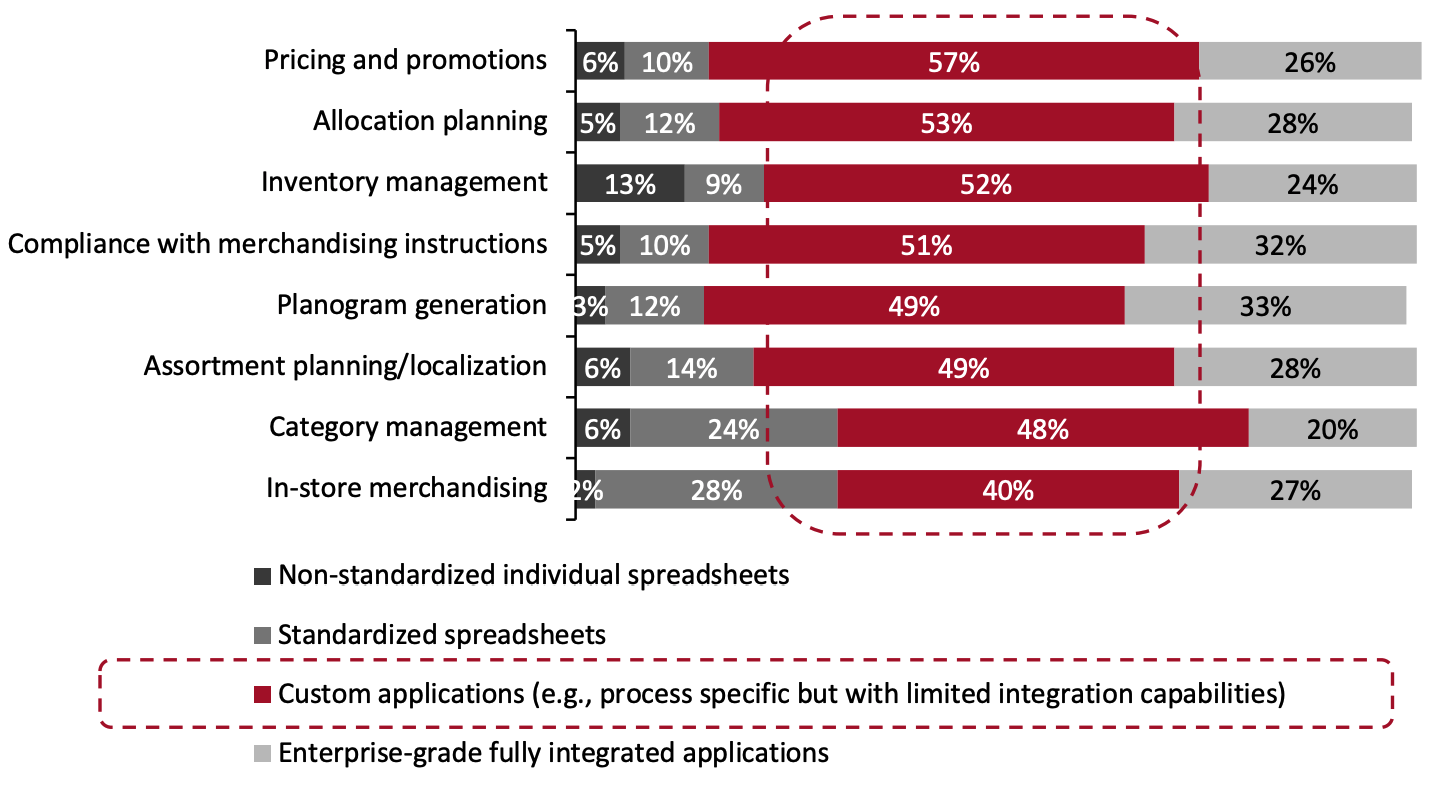

Base: 173 global retail merchandising decision-makersSource: Coresight Research[/caption] Leveraging advanced planning tools—enterprise-grade and fully integrated applications—can help retailers achieve integration across merchandising processes. We asked respondents what planning tools they currently use to handle selected retail processes:

- Custom applications—process-specific, but with limited integration capabilities—are the most prominently used planning tool across processes. For example, 57% of respondents cited using a custom application for planning pricing and promotions. High dependence on custom applications partially explains very low levels of maturity in integration of merchandising processes across stores and departments discussed directly above.

- Around 28% of respondents cited using standardized spreadsheets for handling in-store merchandising—the highest among all processes, which implies a very low level of integration of in-store merchandising with other retail operations and processes.

Figure 9. Planning Tools in Use for Handling Selected Retail Operations/Processes (% of Respondents) [caption id="attachment_137337" align="aligncenter" width="700"]

Totals do not sum to 100 as we have not included respondents citing “don’t know”

Totals do not sum to 100 as we have not included respondents citing “don’t know”Base: 173 global retail merchandising decision-makers

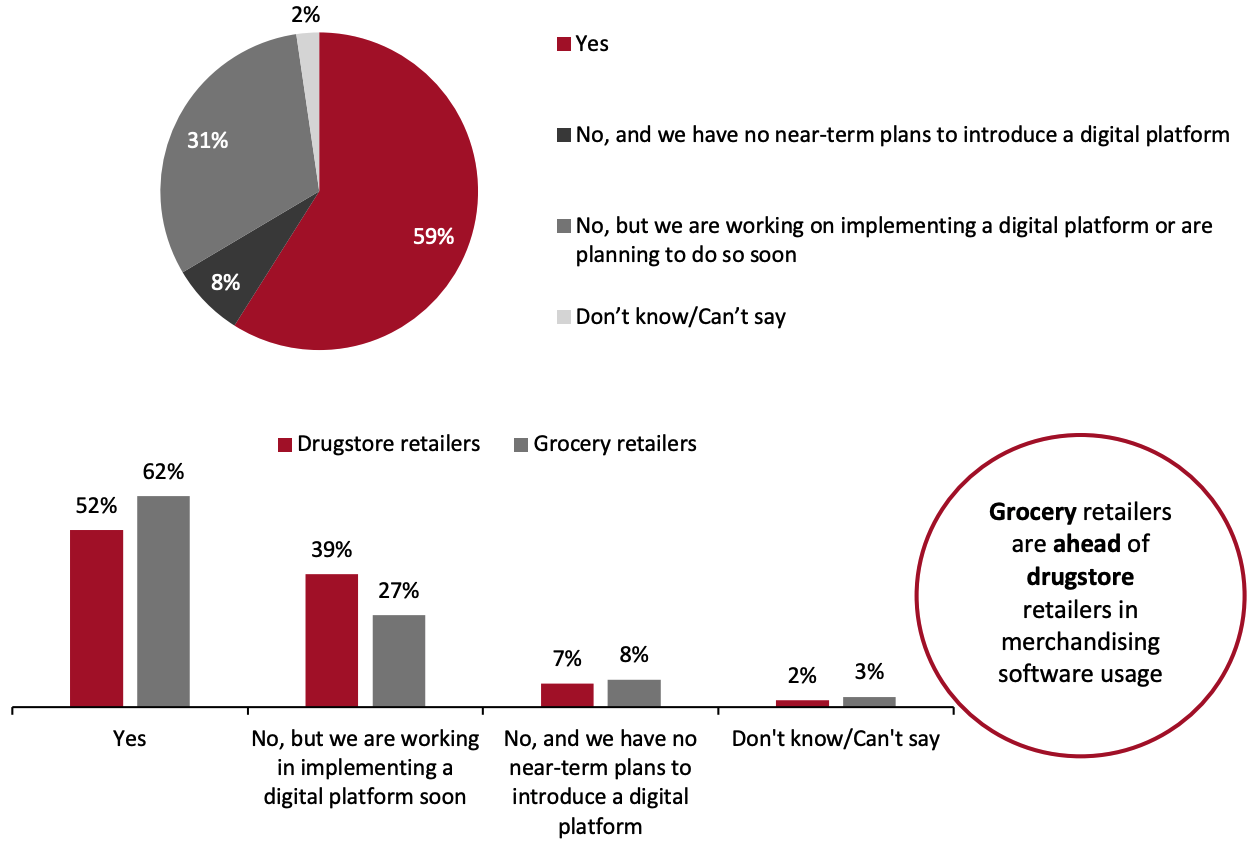

Source: Coresight Research[/caption] Most Retailers Are Using Merchandising Software Making optimal use of store square footage is crucial for retailers. Shoppers are more likely to find what they are looking for and make a purchase in a well-organized store where products are strategically displayed. In fact, according to our August 2020 report entitled Bridging the Retail Merchandising Execution Gap, around seven in 10 retailers use merchandising software for some, or all, of their merchandising processes. Our recent survey respondents whether they are using a merchandising software for space management and planning and found around 59% of retailers are currently using a digital platform/software tool. Furthermore, some 31% cited plans to introduce a digital platform in the short run. When looking at retail segments individually, we found that grocery retailers (62%) are ahead of drugstore retailers (52%) in merchandising software usage for space management and planning. However, almost four in 10 drugstore retailers plan to introduce merchandising software for space management and planning.

Figure 10. Whether Respondents Are Using Merchandising Software: All Respondents (Top) and a Breakdown by Retail Sector (Bottom) (% of Respondents) [caption id="attachment_137338" align="aligncenter" width="700"]

Base: 173 global retail merchandising decision-makers

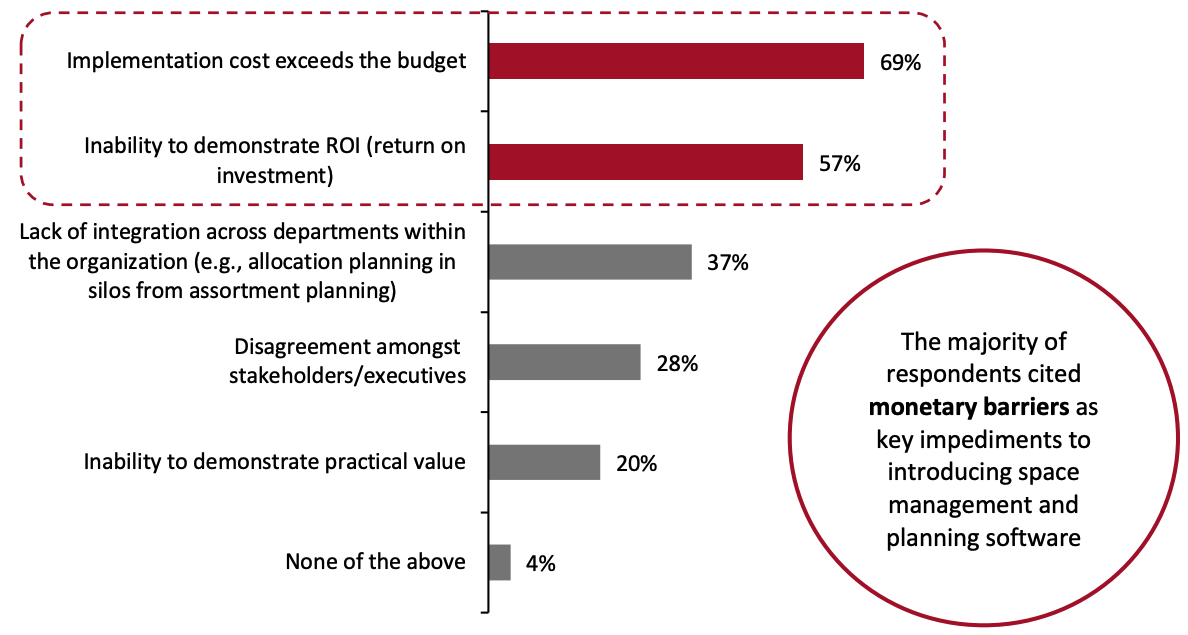

Base: 173 global retail merchandising decision-makersSource: Coresight Research[/caption] The implementation process, however, is not straightforward, and there are multiple challenges involved. We asked respondents who are working toward introducing a space management and planning software to identify the key challenges they face in implementing such tools:

- With many brands and retailers not having the same budget as they had pre-pandemic, implementation cost exceeding the budget is the topmost challenge in introducing space management and planning software, cited by almost seven in 10 respondents in the subset.

- An inability to demonstrate ROI emerged as the second top challenge, cited by 57% of respondents in the subset. We believe that retailers can better justify investment into in-store merchandising by shifting their focus to measurable and actionable metrics, such as compliance with merchandising instructions and the impact of promotions on sales.

Figure 11. Challenges in Introducing Space Management and Planning Software (% of Respondents) [caption id="attachment_137339" align="aligncenter" width="700"]

Base: 54 global retail merchandising decision-makers who are working toward introducing space management and planning software

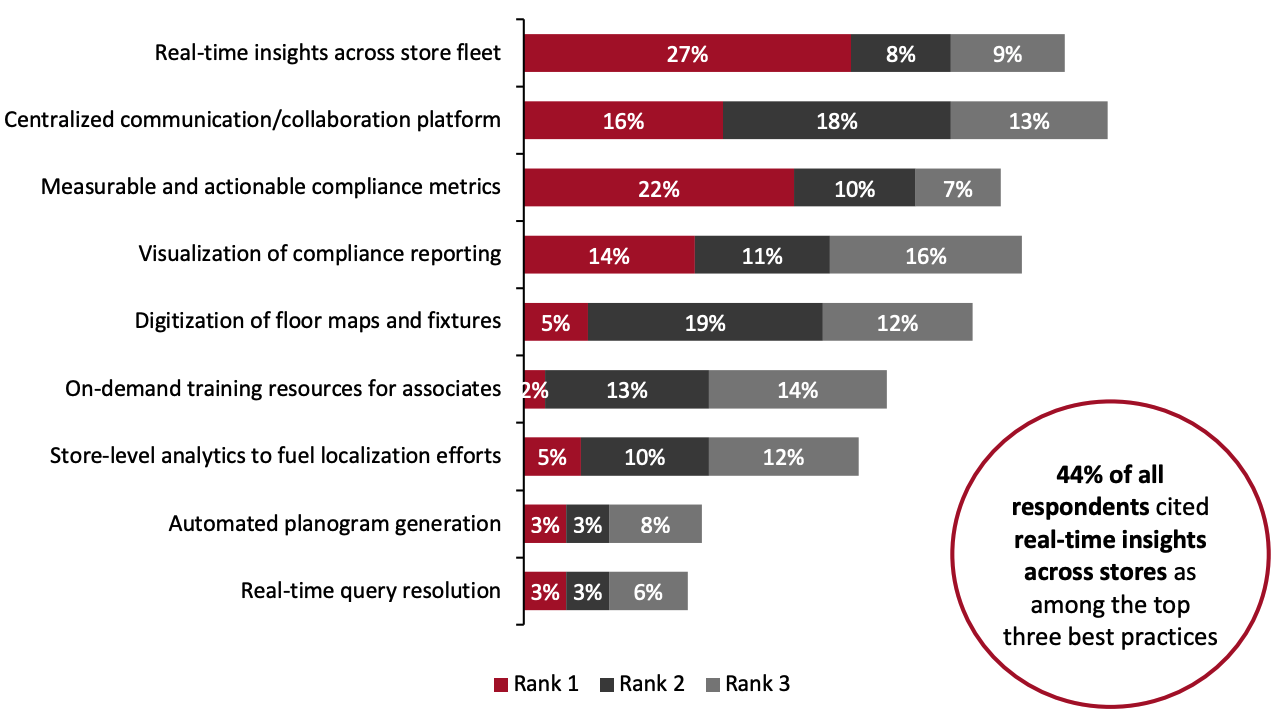

Base: 54 global retail merchandising decision-makers who are working toward introducing space management and planning softwareSource: Coresight Research[/caption] Future-Proofing Merchandising Execution The next few years will be crucial in determining success in omnichannel retail. Succeeding with investment initiatives—compliance management and planning efficiency being the top two, according to our survey data—will require retailers to better manage communication and insights. We asked retailers about the best practices they must put in place to future-proof merchandising execution:

- Real-time insights across the store fleet emerged as the topmost best practice to future-proof merchandising execution, cited by 44% of respondents as among the top three and ranked first by 27%.

- Having a centralized communication platform emerged as the second most important best practice, with 47% of respondents citing it among the top three best practices.

Figure 12. Best Practices to Future-Proof Merchandising Execution (% of Respondents) [caption id="attachment_137340" align="aligncenter" width="700"]

Respondents were asked to select the top three best practices to future-proof merchandising execution, and rank them according to most importance (“Rank 1”) to least important (“Rank 3”); responses are ordered based on weighted average of ranks where “Rank 1” carries the highest weight.

Respondents were asked to select the top three best practices to future-proof merchandising execution, and rank them according to most importance (“Rank 1”) to least important (“Rank 3”); responses are ordered based on weighted average of ranks where “Rank 1” carries the highest weight.Base: 173 global retail merchandising decision-makers

Source: Coresight Research[/caption]

Moving Faster Toward Agility in Merchandising

One Door’s retail merchandising platform Merchandising Cloud leverages advanced technologies such as AI and computer vision to help retailers better plan, communicate, execute and analyze their end-to-end merchandising efforts. Below, we list key benefits of One Door’s AI-powered merchandising platform in achieving merchandising agility, according to the company.- Planning efficiency: One Door’s Merchandising Cloud helps retailers consolidate key merchandising data into a single platform and provides automation capabilities that enable HQ teams to create and localize their merchandising plans around five to eight times faster than conventional methods, according to the company.

- Improved execution: One Door’s Merchandising Cloud includes a mobile-optimized merchandising assistant that simplifies and guides store associates through each plan, step-by-step, for rapid, accurate placement of products and point of purchase (POP).

- Improved compliance: Merchandising Cloud enables both HQ and store teams to communicate and resolve issues in real time. In addition, store associates can act upon more frequent resets and reorder merchandise and POP with evidence of work completion through photographic proof. The photographs are confirmed by AI technology, which enables retailers to take corrective actions quickly. This allows HQ teams to identify when store teams have not engaged with communications or compliance photos and retailers can intervene when necessary.

What We Think

Winning in merchandising execution requires brands and retailers to make changes in real time. Responsiveness to market changes paves the way for agility in merchandising, which can help retailers stay ahead of the competition. Our survey findings indicate the increasingly difficult nature of merchandising processes and their execution, which has translated to an increase in budget allocated to in-store merchandising. We believe that retailers must focus on the integration of merchandising processes and invest in innovative technology that can be implemented across stores. Having a performance- and result-oriented approach to investment can help retailers scale their merchandising solutions in a time when competition is abundant but time to action is scarce.Methodology

This study is based on the analysis of data from an online survey of 173 global retailers conducted by Coresight Research between October 11 and 25, 2021. The survey respondents fit the following criteria:- Based in Germany, the UK and the US (around 50 respondents from Germany and 60 each from the UK and the US)

- Employed in either grocery or drugstore retail

- Position focus on both brick-and-mortar and e-commerce

- Holding senior positions (owners, C-suite, VP/EVP, directors, senior managers)

- Responsible for category management, merchandising, retail marketing, customer insights and analytics, space management or store operations

- Holding roles with significant strategic decision-making responsibilities