Nitheesh NH

Introduction

What’s the Story? An enormous amount of food goes to waste in the US and around the world while millions of people suffer food insecurity. There are several sources of food waste: homes (accounting for 37% of total food waste in the US, according to national nonprofit ReFED); restaurants, food retail (12%); farms (21%) and manufacturers (14%). In this report, we focus on food waste occurring at grocery retailers, as highlighted in Figure 1. Edible food waste reduces grocery retailers’ profitability and negatively impacts the environment, occupying space in landfills and generating carbon and greenhouse gas emissions. However, much of this waste can be avoided through the use of technology. We explore the scope of the food-waste issue for grocery retailers and discuss how technology can be used to manage and reduce waste. Our analysis is based on proprietary survey findings and exclusive interviews with leading grocery retailers.Figure 1. Sources of Food Waste and Share of Total [caption id="attachment_150021" align="aligncenter" width="700"]

Source: ReFED/Coresight Research[/caption]

Why It Matters

Food waste has wide-ranging economic, social and environmental consequences on a global basis. The United Nations’ Environment Programme estimated that global food waste amounted to 931 million tons in 2021, and a 2011 study (latest available data) by the UN Food and Agriculture Organization estimated that food waste caused a $750 billion economic impact (excluding fish and seafood) and generating 3.3 billion metric tons of CO2e (carbon dioxide equivalents) into the air, and the current figure is likely much higher.

The magnitude of food waste has likely become even more acute than previous estimates in the current pandemic-impacted environment, with consumers having increased the share of food they purchase from grocery stores (as opposed to at restaurants) while sheltering and working from home. This larger volume of food passing through grocery retailers likely results in an even greater amount of food waste, particularly as retailers are experiencing supply chain shortages and finding demand forecasting even more challenging amid rapidly shifting consumer buying patterns.

Focusing on the US, we outline the costs of food waste in Figure 2 and discuss each in further detail below.

Source: ReFED/Coresight Research[/caption]

Why It Matters

Food waste has wide-ranging economic, social and environmental consequences on a global basis. The United Nations’ Environment Programme estimated that global food waste amounted to 931 million tons in 2021, and a 2011 study (latest available data) by the UN Food and Agriculture Organization estimated that food waste caused a $750 billion economic impact (excluding fish and seafood) and generating 3.3 billion metric tons of CO2e (carbon dioxide equivalents) into the air, and the current figure is likely much higher.

The magnitude of food waste has likely become even more acute than previous estimates in the current pandemic-impacted environment, with consumers having increased the share of food they purchase from grocery stores (as opposed to at restaurants) while sheltering and working from home. This larger volume of food passing through grocery retailers likely results in an even greater amount of food waste, particularly as retailers are experiencing supply chain shortages and finding demand forecasting even more challenging amid rapidly shifting consumer buying patterns.

Focusing on the US, we outline the costs of food waste in Figure 2 and discuss each in further detail below.

- While the calculation below sizes the lost revenues arising from food waste, if grocery food waste fell to zero, retail revenues would remain the same, though grocers would be freed from the cost burden of unsold food and its disposal costs.

Figure 2. US: Selected Costs of Food Waste [wpdatatable id=2053]

Financial estimates based on 2021 data *Coresight Research’s gross estimate of food waste based on a 30% loss figure; does not account for food that is donated, sold to a liquidator or reused Source: Environmental Research & Education Foundation/Feeding America/Morningstar/ReFED/US Bureau of Economic Analysis/US Department of Agriculture/US Environmental Protection Agency/ Coresight Research

Economic Impact Kroger, the US’s largest pure-play grocer, reported a 22% gross margin and a 20% tax rate in fiscal 2021. Applying these figures to our estimate of $482 billion in food waste, we calculate that grocery retailers could increase their net income by $16 billion, which is meaningful in an industry that we estimate generated about $25 billion in net income in 2021. Grocery retailers face additional costs related to collecting wasted food and paying for its hauling and disposal in landfills. Investor Impact As highlighted in Figure 2, ESG stocks outperformed stocks in the broader US market by 8% in 2021, according to data from financial services firm Morningstar. Interest in ESG stocks is likely to increase over time, leading investors to increase allocations in the category to capture future outperformance, which would then lead to lower allocations of non-ESG stocks, causing their performance gap to widen. These relative changes in performance will put pressure on management teams to increase their ESG compliance and disclosure, with noncompliant or underperforming management teams at increasing risk of being replaced. Public companies are also likely to come under pressure from investors to make climate-related disclosures. In March 2022, the US SEC (Securities and Exchange Commission) issued a rule for public comment that would require companies to include a climate-related disclosure section in their annual reports and registration statements, disclose their greenhouse gas emissions and add a note with climate-related metrics to their financial statements. Environmental Impact Surplus food has several environmental consequences. According to ReFED, uneaten food consumes- 24% of landfill inputs

- 18% of US cropland use

- 14% of fresh water use

- 4% of US greenhouse gas emissions

Overcoming the Food-Waste Challenge: Coresight Research Analysis

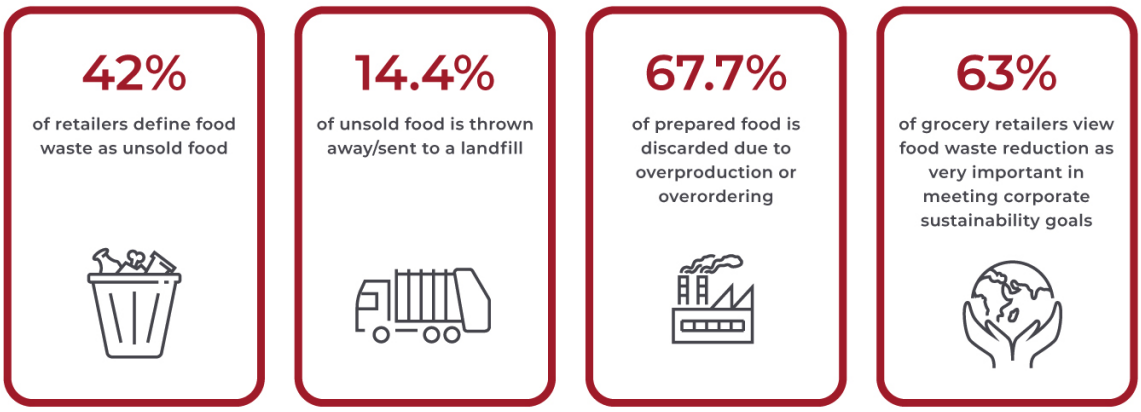

Coresight Research conducted a survey of more than 200 large grocery retailers in North America in October 2021, asking them about their definitions, activities, challenges and plans for reducing food waste. We present key findings in Figure 3 and dive deeper into the results in this report.Figure 3. Key Insights from Food-Waste Survey [caption id="attachment_149362" align="aligncenter" width="700"]

Base: 219 grocery retailers based in North America

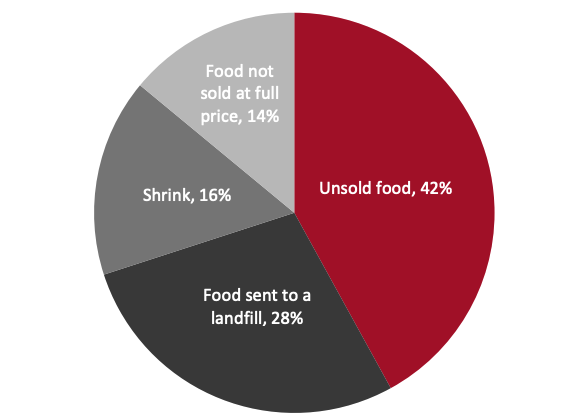

Base: 219 grocery retailers based in North AmericaSource: Coresight Research[/caption] The Definition of “Food Waste” Coresight Research’s survey of grocery retailers in North America found that retailers use a variety of definitions for food waste, as shown in Figure 3. Finding an industry-wide solution to food waste is more challenging due to the inconsistent views held by grocers. Subsequent questions in the survey defined food waste as part of “shrink” (inventory lost due to spoilage and expiration, theft, inaccurate shipments and miscounting) as it is an industry-standard term.

Figure 4. Definitions of Food Waste Used by Grocery Retailers (% of Respondents) [caption id="attachment_149363" align="aligncenter" width="480"]

Base: 219 grocery retailers based in North America

Base: 219 grocery retailers based in North AmericaSource: Coresight Research[/caption]

Call to action: The grocery retailer industry needs to adopt common metrics for food waste to bring attention to the issue and enable comparison across companies.

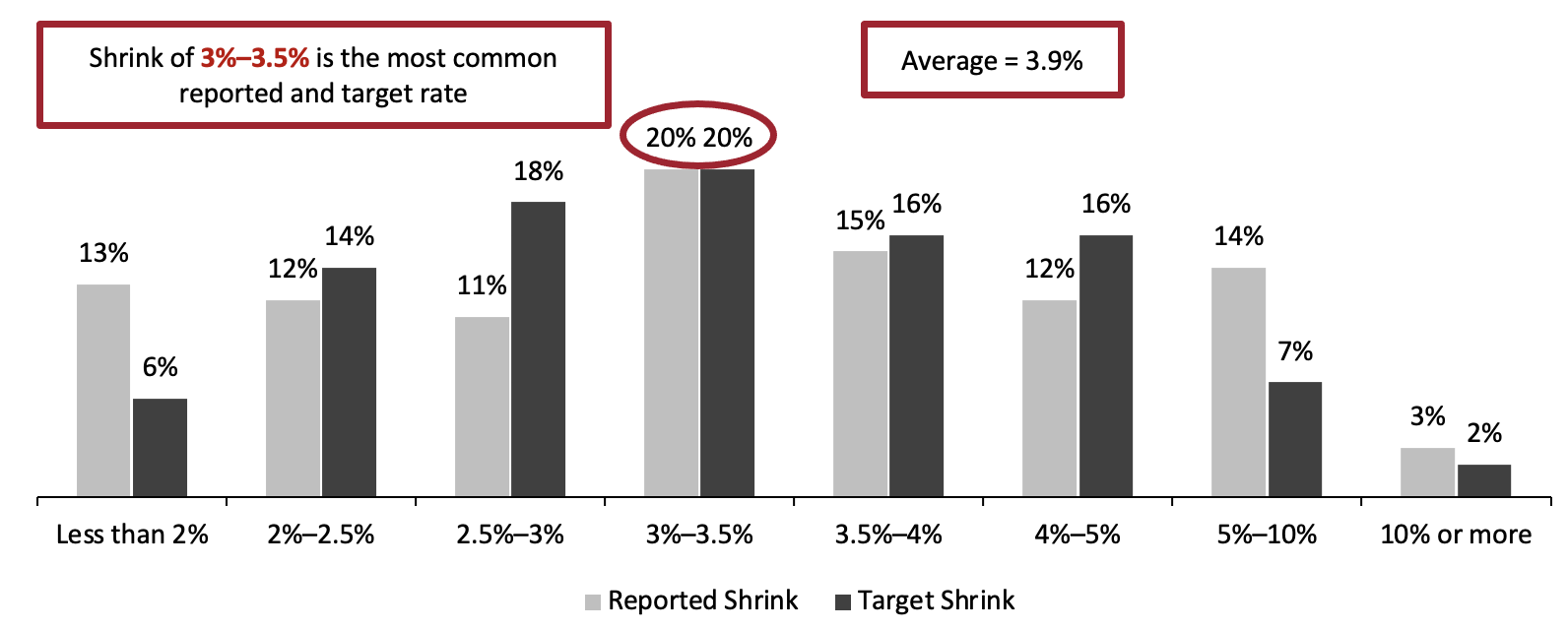

The Size of the Food-Waste Problem for Grocery Retailers Survey respondents reported average shrink of 3.9% (as shown in Figure 5), and industry experts we interviewed defined the lowest reasonably achievable shrink as slightly above 2% of revenues.Figure 5. Shrink as a Proportion of Total Annual Revenue in the Most Recent Financial Year vs. Annual Target for Food Shrink (% of Respondents) [caption id="attachment_150011" align="aligncenter" width="700"]

May not sum to 100 due to rounding

May not sum to 100 due to roundingBase: 219 grocery retailers based in North America

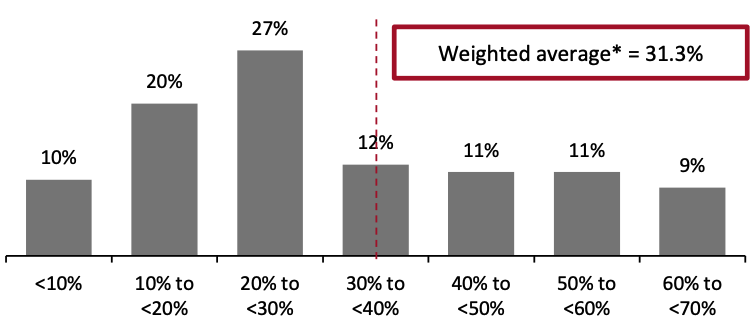

Source: Coresight Research[/caption] Interestingly, respondents reported that food damage, waste, expiration or spoilage only accounts for slightly less than one-third of overall shrink (see Figure 6 below).

Figure 6. Food Damage, Waste, Expiration or Spoilage as a Proportion of Shrink (% of Respondents) [caption id="attachment_149370" align="aligncenter" width="560"]

*Based on a midpoints of the ranges

*Based on a midpoints of the rangesBase: 219 grocery retailers

Source: Coresight Research[/caption]

Call to action: Food waste, expiration and spoilage are sources of shrink that can be measured and reduced.

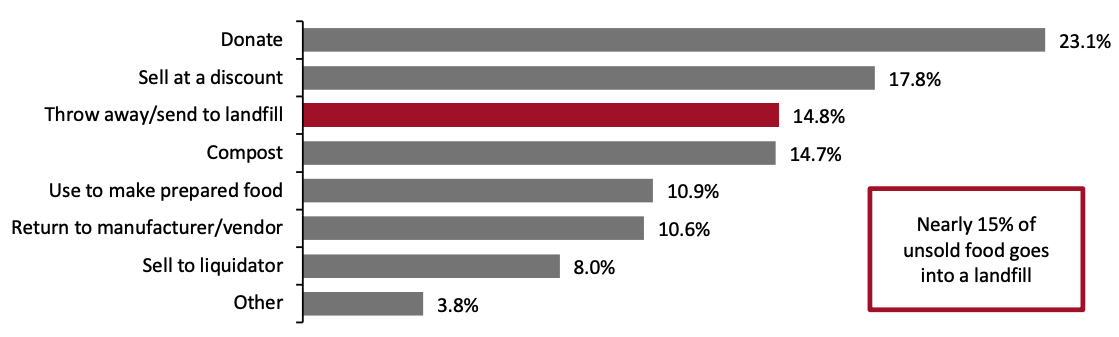

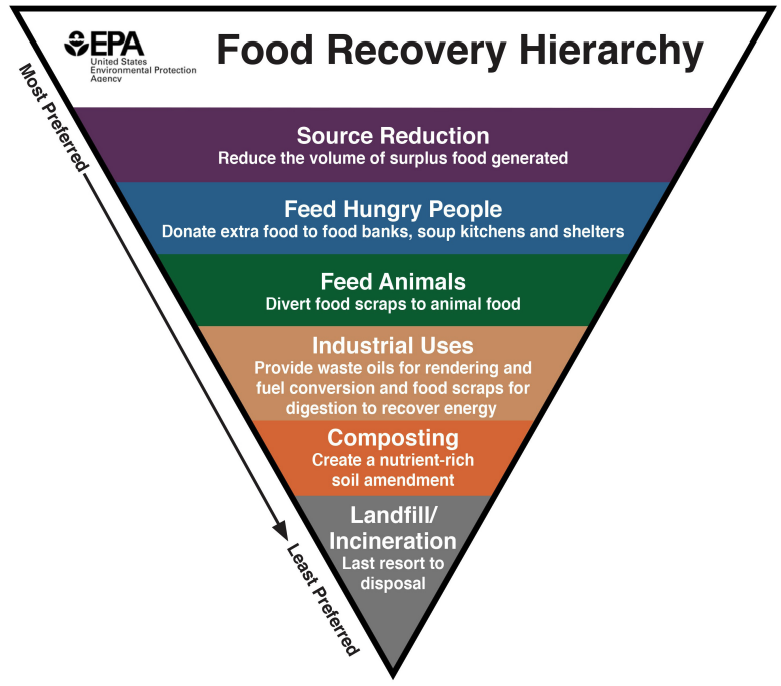

Grocery retailers reported that, on average, just 14.4% of unsold food is thrown away, with the remaining 85.6% being donated, sold at a discount or to a liquidator, composted, used to make prepared food, or used for other purposes. However, ultimately, grocery retailers have little visibility or control of how much donated, discounted or returned food is actually eaten or disposed of in a landfill—although they clearly can select the most effective food pantries, for example.Figure 7. How Organizations Manage Unsold Food (% of Total Unsold Food) [caption id="attachment_149371" align="aligncenter" width="700"]

Charted proportions are the calculated averages for each option

Charted proportions are the calculated averages for each optionBase: 219 grocery retailers

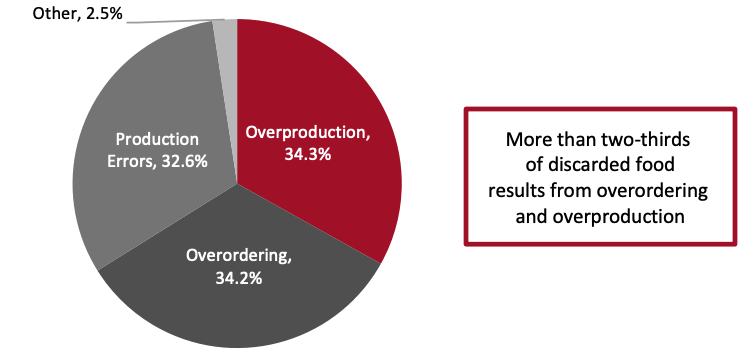

Source: Coresight Research[/caption] In terms of the causes of food waste, respondents reported a fairly even split, on average, among overproduction, overordering and production errors (see Figure 8). Overproduction and overordering can be mitigated by better demand forecasting, which we will discuss later in this report.

Figure 8. Proportion of Prepared Food That Grocery Retailers Discard Due to Selected Reasons (% of Total Discarded Food) [caption id="attachment_149372" align="aligncenter" width="550"]

Charted proportions are the calculated averages for each option

Charted proportions are the calculated averages for each optionBase: 219 grocery retailers

Source: Coresight Research[/caption]

Call to action: Overproduction and overordering are situations that can be mitigated with more accurate demand forecasting.

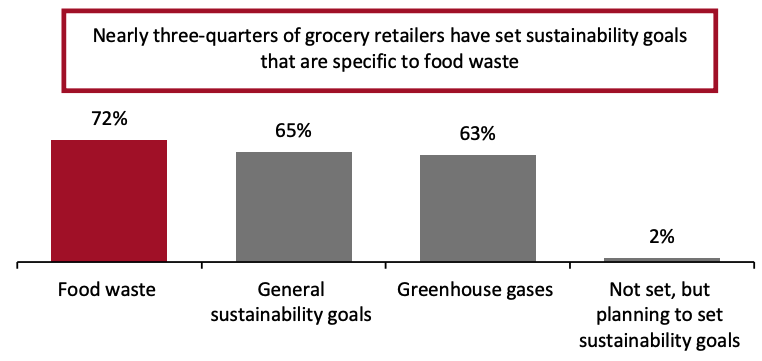

Sustainability Goals The majority (98%) of grocery retailers we surveyed have set some type of sustainability goal, and managing food waste ranks as the top response, reported by nearly three-quarters of respondents.Figure 9. Sustainability Goals That Have Been Set by Grocery Retailers (% of Respondents) [caption id="attachment_149373" align="aligncenter" width="550"]

Respondents could select more than one option

Respondents could select more than one optionBase: 219 grocery retailers

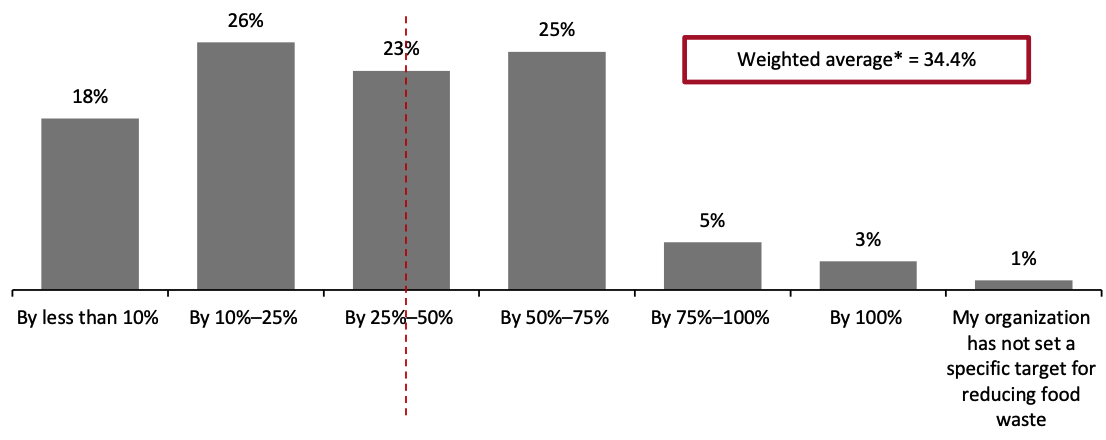

Source: Coresight Research[/caption] In accordance with these goals, nearly half of grocery retailers said that they plan to reduce food waste by 25%–75% by 2030.

Figure 10. Grocery Retailers’ Targets for Reducing Food Waste by 2030 (% of Respondents) [caption id="attachment_149374" align="aligncenter" width="700"]

*Based on the midpoints of the ranges

*Based on the midpoints of the rangesBase: 158 grocery retailers that have set sustainability goals for food waste

Source: Coresight Research[/caption] Leading Grocery Retailers’ Food-Waste Goals Several large US grocers have publicly released their goals for reducing food waste. We present notable examples below.

- Albertsons committed in 2019 to reduce food waste by 50% in its Pacific Coast divisions by 2030. The company also donates edible fresh and packaged food products that are close to the “use by” date to local food banks. It donated more than $226 million worth of products to food banks, food pantries and other hunger-relief agencies in 2018. Albertsons also has partnerships with local farms to donate animal feed, and in the Pacific Northwest, the company sends food waste to a biodigester that creates biogas and soil nutrients for a local organic farm.

- Kroger’s “Zero Hunger | Zero Waste” program aims to end hunger in the communities it operates and end food waste by 2025 through innovation, increasing food donation, increasing nutrition and advocating for changes in public policy to address hunger and divert food from landfills. Kroger reported that it achieved its prior goal of becoming a zero-waste company by 2020 and is targeting zero food waste in all of its stores and across the country by 2025. The company donated 1 billion meals in 2020 and aims to donate 3 billion meals by 2025.

- Walmart has set a goal to eliminate food waste in the US, Canada, Japan and the UK by 2025 as part of its general goal of moving to zero waste in the US and Canada by the same year. This program supplements the company’s existing initiatives, such as “10x20x30,” which was launched in 2019 and aims to engage 10 of the largest grocery retailers with 20 of their priority suppliers, to halve food loss and waste by 2030. The company disclosed that in 2020, it sold more than 256 million food units through discount programs, and in 2019, it had wasted 57 million fewer food units in its fresh departments than in the prior year.

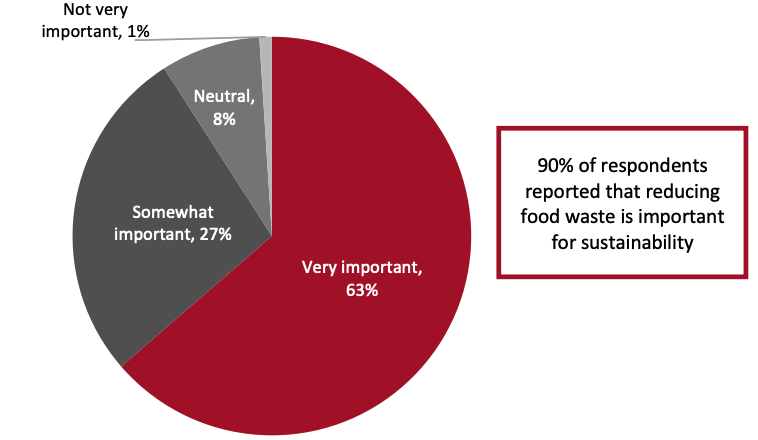

Figure 11. The Importance of Food-Waste Reduction in Meeting Corporate Sustainability Goals (% of Respondents) [caption id="attachment_149375" align="aligncenter" width="550"]

Base: 219 grocery retailers

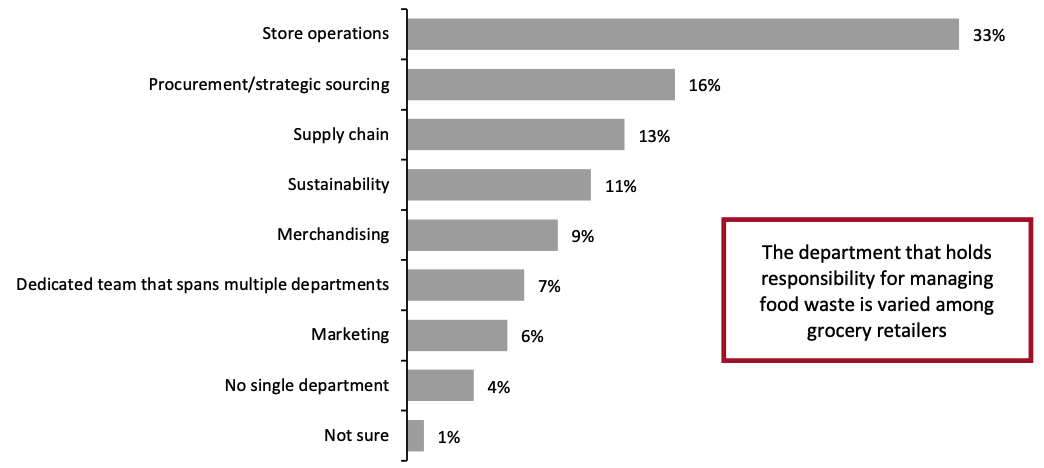

Base: 219 grocery retailersSource: Coresight Research[/caption] However, the execution of food-waste reduction among grocery retailers is fragmented, with the responsibility lying with varied departments (see Figure 12).

Figure 12. Departments That Hold the Primary Responsibility for Food-Waste Reduction (% of Respondents) [caption id="attachment_149376" align="aligncenter" width="700"]

Base: 219 grocery retailers

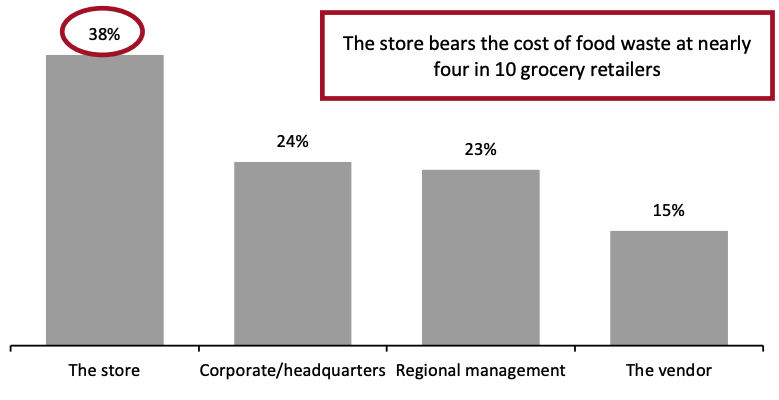

Base: 219 grocery retailersSource: Coresight Research[/caption] Although the responsibility for food waste is spread among multiple departments in grocery retail, the cost of food waste falls primarily upon the individual store, as shown in Figure 13.

Figure 13. Parties That Bear the Cost of Food Waste or Surplus Food (% of Respondents) [caption id="attachment_149377" align="aligncenter" width="550"]

Base: 219 grocery retailers

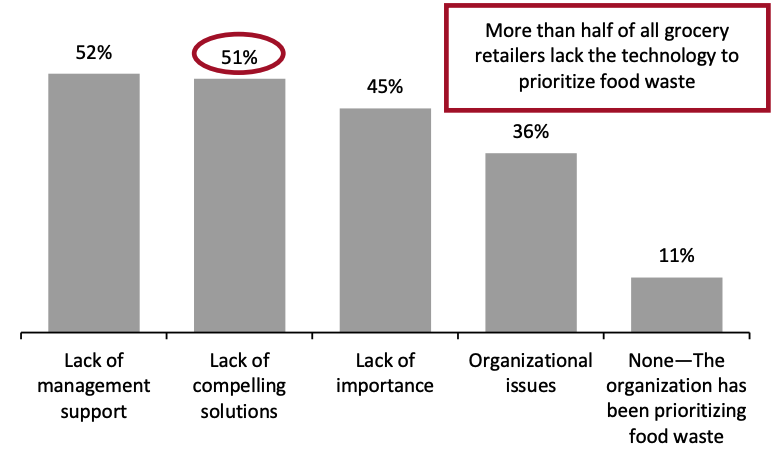

Base: 219 grocery retailersSource: Coresight Research[/caption] Food waste continues to be a serious challenge despite a majority of grocery retailers responding that they view sustainability and food-waste goals as important, leading to the question of what is holding up progress in these areas. A lack of management support and lack of a compelling solution topped the list of hindrances for grocery retailers in prioritizing the management of food waste (see Figure 14). Despite nine in 10 respondents citing food-waste reduction as important to meeting sustainability goals, it is troubling that nearly half of all respondents cited a lack of importance as a hindrance for grocery retailers in prioritizing food-waste management.

Figure 14. Hindrances in Prioritizing the Management of Food Waste (% of Respondents) [caption id="attachment_149378" align="aligncenter" width="550"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 219 grocery retailers

Source: Coresight Research[/caption]

Call to action: Grocery retailers need to empower an individual with responsibility and the power to manage food waste across the entire organization and make the organization changes necessary to achieve their food-waste goals.

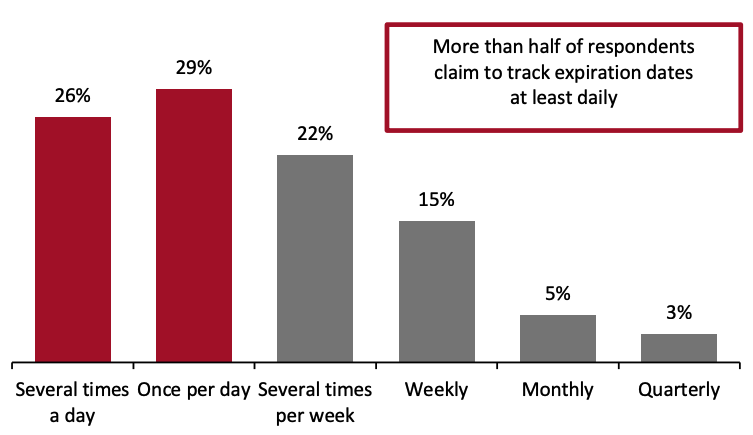

Areas of Opportunity To Manage Food Waste More than half of our survey respondents reported that they check food freshness or sell-by dates at least once per day, as indicated in Figure 15. However, this could apply primarily to prepared food or fresh produce; our interviews turned up anecdotes of retailers keeping long-expired cans of food on the shelves.Figure 15. Frequency That Grocery Retailers Check Freshness or Sell-By Dates of Food (% of Respondents) [caption id="attachment_149379" align="aligncenter" width="550"]

Base: 219 grocery retailers

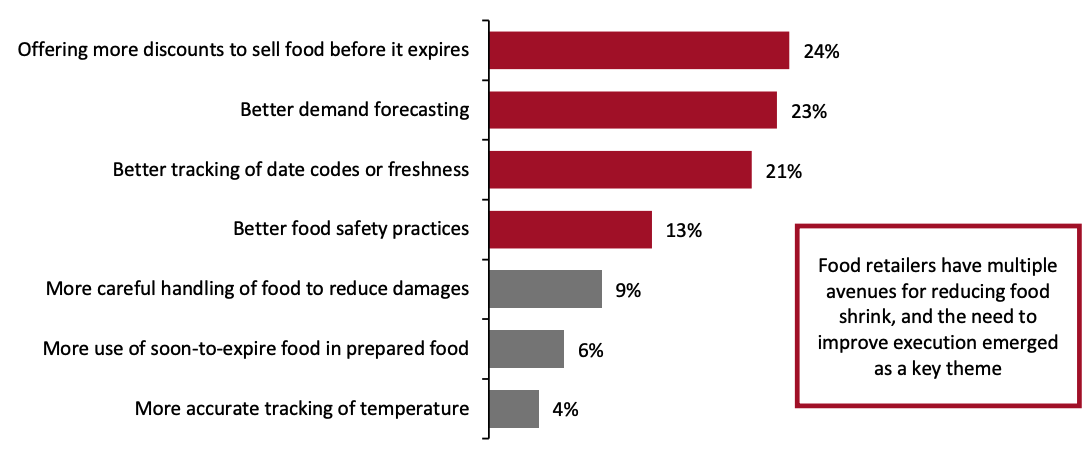

Base: 219 grocery retailersSource: Coresight Research[/caption] Better tracking of freshness ranked third in the top areas of opportunity for grocery retailers to reduce shrink from unsold food, according to our survey. The top four areas of opportunity are primarily related to retailers’ need to improve execution, as shown in Figure 16.

Figure 16. Top Areas of Opportunity To Reduce Shrink from Unsold Food (% of Responses) [caption id="attachment_149380" align="aligncenter" width="700"]

Respondents were asked to select three areas of opportunity

Respondents were asked to select three areas of opportunityBase: 219 grocery retailers

Source: Coresight Research[/caption]

Call to action: Grocery retailers’ top opportunities to reduce shrink from unsold food include freshness tracking and discounting, which go hand in hand.

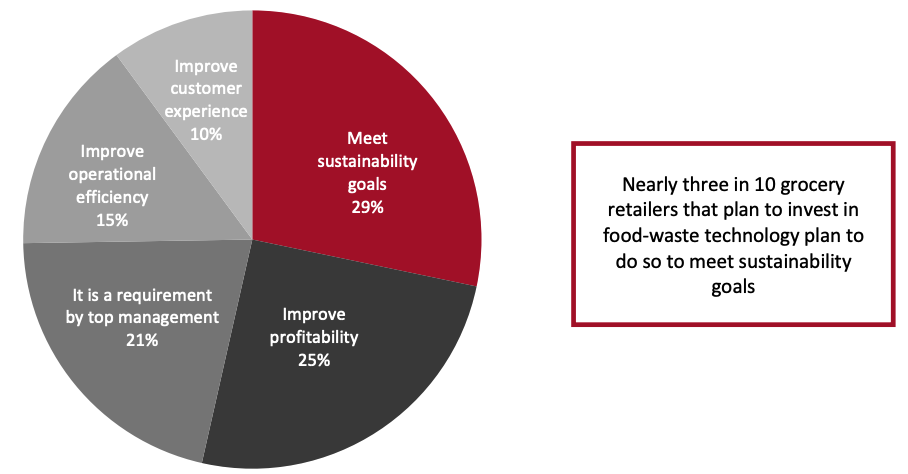

Technology-Driven Strategies for Reducing Food Waste Our survey found that 84% of respondents plan to invest in technology over the next two years to manage food waste. Grocery retailers have diverse reasons for investing in food-waste technology, with meeting sustainability goals being the top response. Despite the strong motivation to increase profitability and efficiency, these goals ranked second and fourth, respectively, as shown in Figure 17.Figure 17. Grocery Retailers’ Most Important Reason for Investing in Food-Waste Technology (% of Respondents) [caption id="attachment_149381" align="aligncenter" width="550"]

Base: 183 grocery retailers who plan to invest in technology over the next two years to manage food waste

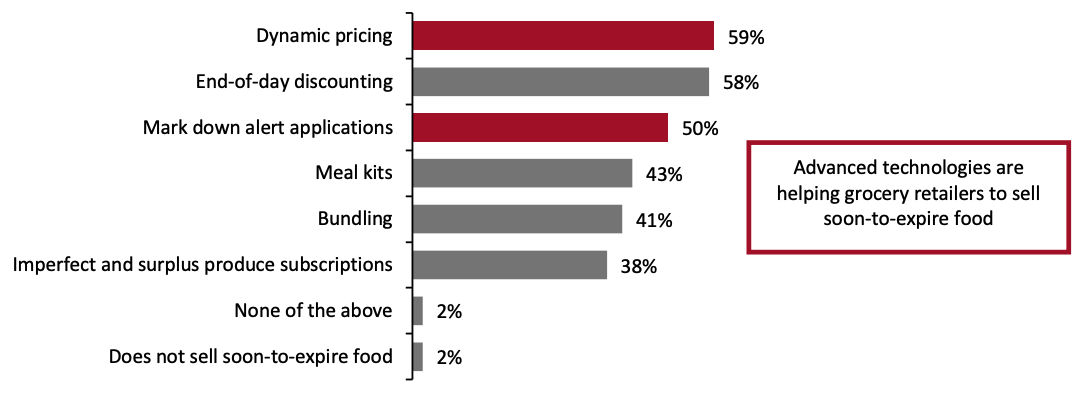

Base: 183 grocery retailers who plan to invest in technology over the next two years to manage food wasteSource: Coresight Research[/caption] Investments in technology will build on current strategies for selling soon-to-expire food for many grocery retailers. In the store, more than half of the respondents in our survey reported that they use dynamic pricing (whereby pricing changes during the day based on expiration date), end-of-day discounting and markdown alert applications to close out food inventory, as shown in Figure 18.

Figure 18. Methods Employed by Grocery Retailers To Sell Soon-To-Expire Food (% of Respondents) [caption id="attachment_149382" align="aligncenter" width="700"]

Base: 219 grocery retailers

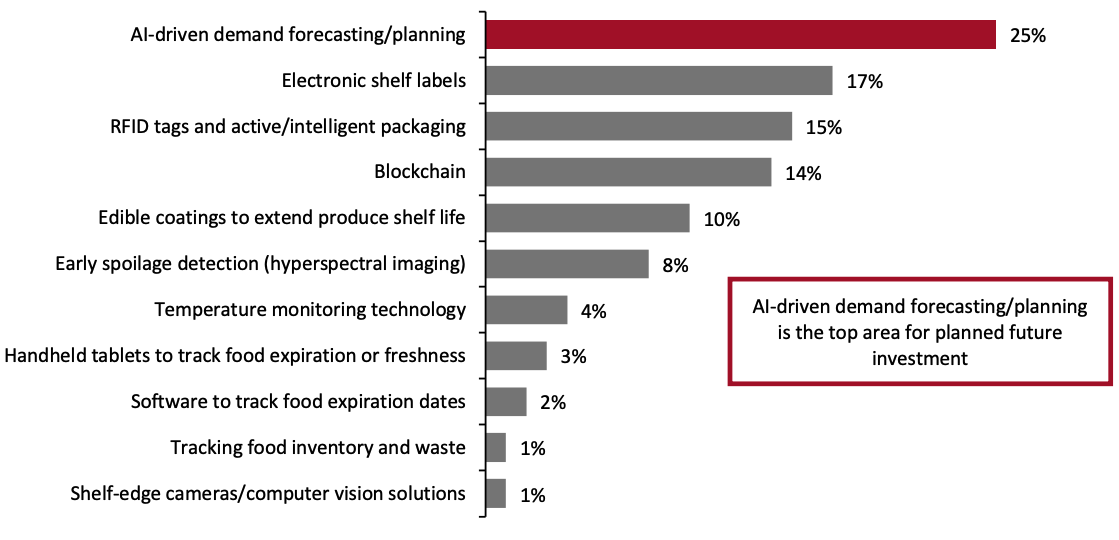

Base: 219 grocery retailersSource: Coresight Research[/caption] Our interviews with grocery retailers largely linked food waste to over-receiving, overordering and overproduction of prepared food. Many of these issues could be reduced through accurate demand forecasting. In fact, AI-driven demand forecasting emerged as the top technology that grocery retailers in our survey plan to invest in to reduce food waste, followed by electronic shelf labels and blockchain, as shown in Figure 19. Although RFID (radio-frequency identification) tags and intelligent packaging only ranked third among respondents, the use of RFID in food tracking has been cited as a major opportunity by vendors, and it works in concert with many of the other technologies.

- Please refer to the appendix of this report for descriptions of the technologies charted in Figure 19.

Figure 19. Technologies That Grocery Retailers Plan To Invest In Over the Next Two Years To Track and Manage Food Waste (% of Responses) [caption id="attachment_149383" align="aligncenter" width="700"]

Respondents were asked to select three responses

Respondents were asked to select three responsesBase: 183 grocery retailers who plan to invest in technology over the next two years to manage food waste

Source: Coresight Research[/caption]

Call to action: Accurate demand forecasting can align supply with demand and help prevent overordering and reduce food expiration.

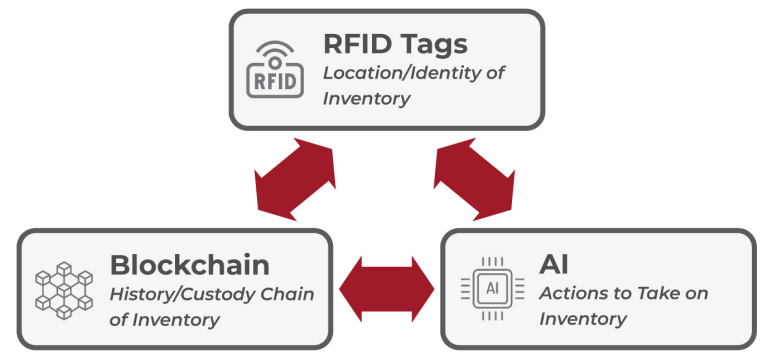

Low-Cost Technology and Government Solutions Available Today Solving the food-waste problem will likely take a combination of technology, government support and pressure from investors or environmental activists to pressure grocery retailers to meet their sustainability goals. Areas of Focus- Data Enablement

- Demand Forecasting

- Inventory Management

- Availability—Retailers and consumers gain visibility into whether items, and not substitutes, are available as advertised.

- Quality and freshness—Having accurate expiry data means that items maintain the maximum in-storage times and are rotated on a timely basis to ensure their use.

- Safety—Accurate expiry information helps avoid safety-related product recalls.

- Brand identity—Consumers increasingly prefer brands that they consider to be good stewards of the environment and whose owners make business decisions that reduce waste and support sustainability.

Figure 20. Interaction Between Basic Technologies for Inventory Management [caption id="attachment_149384" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

- RFID Tags

- Blockchain

- AI

- Shelf-Life Extension

- Upcycling

- Dynamic Pricing

Source: US Environmental Protection Agency[/caption]

There are several pieces of recent and proposed legislation in the US that aim to alleviate issues surrounding food waste, including the following:

Source: US Environmental Protection Agency[/caption]

There are several pieces of recent and proposed legislation in the US that aim to alleviate issues surrounding food waste, including the following:

- The Food Date Labelling Act, introduced in December 2021, aims to standardize food labelling to include both a quality-date indicator and a discard-date indicator.

- The proposed amendment to the Bill Emerson Good Samaritan Food Donation Act, introduced in November 2021, aims to reduce limitations on the quantity of food that can be donated, improve visibility of available food for donation and clarify food-labeling standards for the purpose of donation. The original act, signed in 1996, aimed to protect consumers who donated food to non-profit organization, standardize donor liability and set a floor for intentional misconduct in food donations.

- The Food Donation Improvement Act, introduced in November 2021, aims to extend liability protections to food donors when food is given to persons in need or sold at a deeply reduced cost.

- The Fresh Produce Procurement Reform Act, introduced in September 2021, aims to improve the USDA’s procurement of fruits and vegetables, requiring producers to partner with organizations such as schools, food pantries and youth organizations.

- The School Food Recovery Act, introduced in September 2021, aims to offer grants to enable food waste measurement and reporting, prevention and education in schools.

- The Zero Food Waste Act and the Cultivating Organic Matter through the Promotion Of Sustainable Techniques (COMPOST) Act, introduced in tandem in July 2021, aim to support the expansion of food waste reduction and management across the US.

- The FDA Food Safety Modernization Act, signed in 2011, granted the FDA new powers, including mandatory recall, as part of regulation on how food is grown, harvested and processed, in response to several foodborne illnesses.

What We Think

Food waste represents a huge, largely avoidable drag on grocery retailers’ revenues and margins, in addition to posing additional burdens on the environment. Transporting food waste emits carbon; the waste occupies space in landfills; and additional chemical reactions take place there—such as the emission of large quantities of methane—from the food as well as from its packaging. Just as important is the social cost: The existence of avoidable food waste is shameful given the number of people facing food insecurity in the US and around the world. Moreover, companies without clear and adequate ESG programs will pay a penalty in their stock prices, possibly leading to the replacement of management teams. Interviews with large grocery retailers, in addition to the survey discussed, indicate that many of the causes of food waste are organizational and bureaucratic. Grocery retailers generally support and have goals for reducing food waste, yet there is a disconnect in which part of their organizations are responsible (organizationally and financially) for reducing food waste, although there are clear financial and efficiency benefits. Grocery retailers interviewed largely cited overordering, inflexibility in shipping quantities, and overproduction of prepared food as the greatest causes of food waste. Better linkage of demand versus supply can alleviate these problems, whether through AI-based demand forecasting software or tightening up operations. For example, more accurate demand forecasting would increase inventory turns, which would keep produce looking fresh and reduce the need for buffer inventory to make shelves look full. We are hopeful that many of the sustainability and waste-reduction goals espoused for 2025 will force grocery retailers to improve operations, and there is also the threat of heightened competition from quick-commerce vendors and a shift to online ordering during the pandemic that could prompt grocery retailers to become more efficient.Methodology

This study is based on the analysis of data from an online survey of 219 large grocery retailers conducted by Coresight Research in October 2021. Respondents in the survey satisfied the following criteria:- Based in the US and Canada

- Annual revenues of at least $100 million

- Selling in the grocery retail, convenience store, drugstore, mass merchant and other food retail segments

- Products sold include produce, fresh meat and seafood, dairy and eggs, breads and bakery, dry grocery, frozen food, prepared foods, meal kits and ready-to-drink beverages

- Titles include C-suite, president, senior vice president, vice president, senior director, director and manager

- Has primary responsibility or involved in efforts to reduce/manage food waste

This report is sponsored by Avery Dennison Corp., a global materials science company specializing in the design and manufacturing of a wide variety of labels, functional materials and digital ID technologies.

Appendix

The function and use of the technologies illustrated in Figure 19 are as follows:- AI-driven demand forecasting/planning—These platforms use the forecasting and analytical capabilities of AI/ML to combine internal data (such as historical sales) with external data (such as the season and local events) to create highly accurate demand forecasts, free of human bias or error.

- Blockchain—This is a low-cost technology that provides an immutable ledger, providing trust, security and traceability. Its applications include documenting the provenance or history of an item—for example, recording a series of temperature measurements for frozen food to ensure preservation of the cold chain.

- Early spoilage detection (hyperspectral imaging)—Hyperspectral imaging uses a wide spectrum of wavelengths of light, and it can non-invasively determine freshness, microbial spoilage, the moistness/dryness of produce, as well as the presence of foreign matter.

- Edible coatings to extend product life—Edible coatings can replace disposable plastic packaging and extend the life of certain food items such as produce.

- Electronic shelf labels—Active displays show pricing, and other information below the product on the shelf can receive updates wirelessly. Electronic shelf labels can be used to implement dynamic pricing, display promotions or supplemental product information, and provide wayfinding guidance for store associates for stocking shelves or filling online orders.

- Handheld tablets to track food expiration or freshness—Arming store associates with mobile devices enables them to collect data, access product information and receive direction as they pass through the store.

- RFID tags and active and intelligent packaging—RFID tags contain a unique product ID that can be read by handheld or fixed scanners in a store. Retailers can use them to track the number of items of a specific type as well as their location, getting a precise view of their inventory. Other applications include loss prevention.

- Shelf-edge cameras/computer vision solutions—Shelf-edge cameras use computer vision to track the amount of inventory on the shelves, verify price tags, and monitor planogram compliance, and they can issue directives to store associates when inventory is moved or runs low.

- Software to track food expiration dates—Tailored software platforms monitor food expiration dates and instruct associates when to rotate, discount and discard expiring items.

- Temperature monitoring technology—Thermal sensors and cameras can monitor the temperature of food and coolers in real time, alerting store associates in the event of a malfunction or power outage.

- Tracking food inventory and waste—Platforms and weighing systems can track the amount of inventory on the shelves as well as the quantity of food that is discarded.