albert Chan

Introduction

What’s the Story?

Organized retail crime (ORC) is defined as theft or fraudulent activity conducted with the intent to convert illegally obtained merchandise, cargo, cash or cash equivalent into financial gain where the following elements are present: the theft or fraud is committed over multiple occurrences and/or in multiple stores, by two or more persons, or an individual acting in dual roles (known as a “booster” and “fence”), according to the Washington Organized Retail Crime Association.

ORC has been in the spotlight due to an increasing number of thefts involving high-profile retailers including Best Buy, Burberry, Bloomingdale's, CVS, Louis Vuitton, Macy’s, Nordstrom, Ulta Beauty and Walgreens. It is increasing due to a multitude of factors, including the pandemic, changes to sentencing guidelines and the growth of online marketplaces. In this report, we discuss the challenges and costs of ORC in the US and how retailers can combat the issue.

Why It Matters

According to the National Retail Federation’s (NRF) 2021 Retail Security Survey, 69% of US retailers said they had seen an increase in ORC activity from 2019 to 2020. Since this survey, ORC activity has further accelerated.

Nearly every retailer may encounter ORC as some of the top retail product categories stolen by crime rings span designer apparel, handbags, appliances and consumer packaged goods including infant formula, pain relievers, deodorants and energy drinks.

All retail channels may be impacted by ORC as it can occur at any point in the supply chain and through online and physical retail channels. Retailers need to protect against ORC as it is not only costly but sometimes violent.

Organized Retail Crime: Coresight Research Analysis

1. An Insidious Form of Shrink

ORC groups seek in-demand products and resell them through online marketplaces or by fronting as legitimate businesses. The thefts are detrimental to both businesses and the overall economy as they pose both societal and health risks to the community, according to a report by the Department of Homeland Security. Merchandise is being “cleaned” and resold through other channels. While this is costly in monetary terms for retailers, it can also pose health risks in terms of the resale of products such as medicine or infant formula.

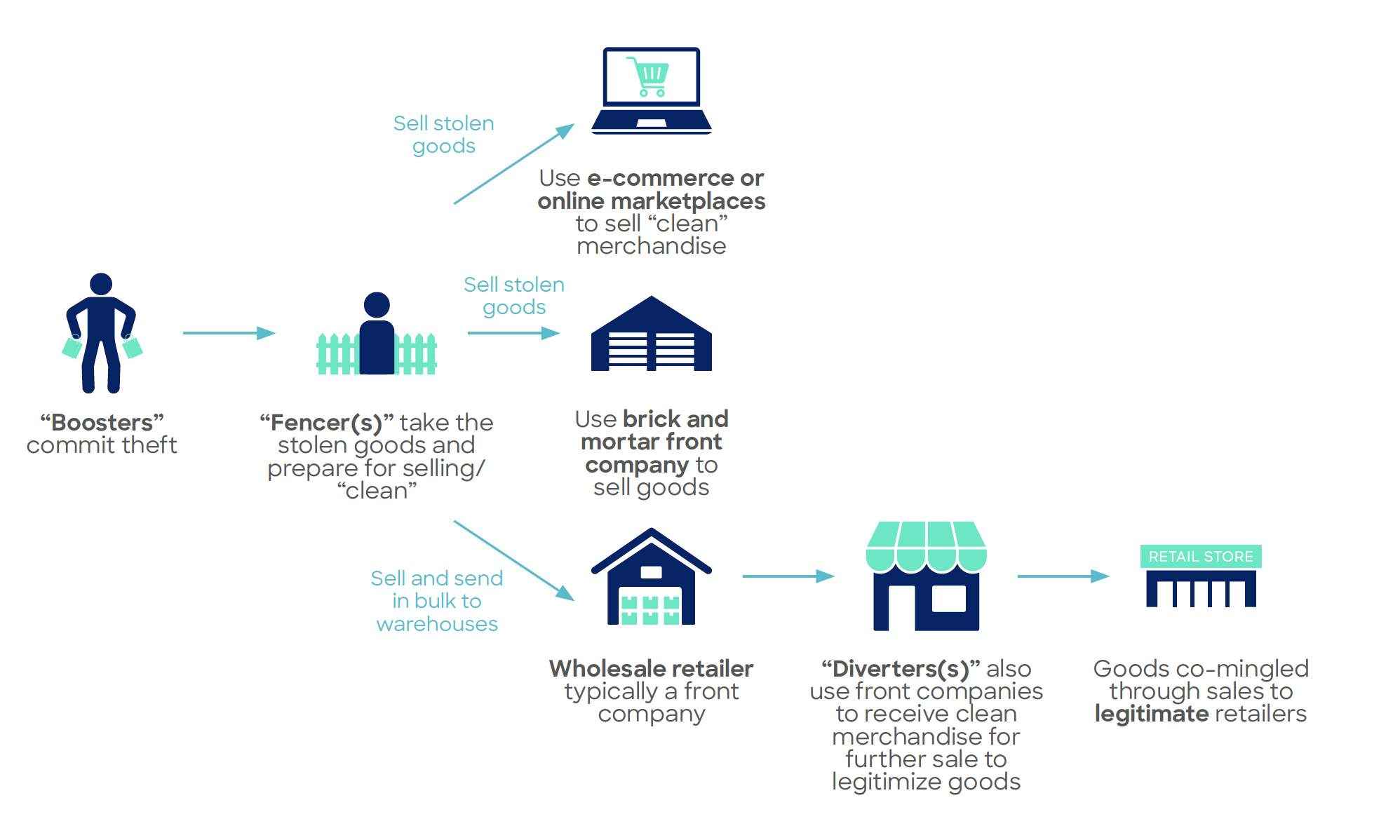

While organized theft groups can vary, according to the Department of Homeland Security, they include the following roles: a “booster,” the individual who steals the merchandise; and a “fence,” the individual who prepares the merchandise for selling on alternative channels including online marketplaces, a brick-and-mortar store or a wholesale retailer.

The image below depicts the ORC flow.

[caption id="attachment_153548" align="aligncenter" width="700"] The ORC flow

The ORC flowSource: “Detecting and Reporting the Illicit Financial Flows Tied to Organized Theft Groups (OTG) and Organized Retail Crime (ORC),” published in June 2022 by Associated Anti-Money Laundering Specialist (ACAMS) and Homeland Security Investigations[/caption]

Jason Brewer, Senior EVP of Communications and Marketing at the Retail Industry Leaders Association (RILA), explained on the podcast “RILA’s Team Explains the Value of the INFORM Act” in February 2022 that selling stolen goods online was an area where RILA’s members have seen a huge increase over the past several years. During the pandemic, the problem got exponentially worse. Brewer said that RILA created the Buy Safe America Coalition, a diverse group of retailers, consumer groups, manufacturers, intellectual property advocates and law enforcement officials who support efforts at all levels of government to protect consumers and communities from the sale of counterfeit and stolen goods. The coalition highlights the problem and helps policymakers understand the issue, with a specific focus on the need for more transparency online.

2. Felony Thresholds, Online Marketplaces and Covid-19 Pandemic Accelerate ORC

Each state in the US establishes its own rules regarding what differentiates felony theft from a misdemeanor. Since 2000, at least 37 states have raised their felony theft thresholds or the value of stolen money or goods above which prosecutors may charge theft offenses as felonies, rather than misdemeanors, according to the Pew Research Center. Many states raised their minimum from $500 to $1,000, which in turn allows individuals to steal more items without the fear of stronger penalties. According to the NRF’s Organized Retail Crime Survey in 2020, 64% of retailers reported that they saw an increase in the average organized retail case value in states that had increased the felony threshold, up from 51% in 2019.

The proliferation of online marketplaces is another contributing factor, according to Ben Dugan, CFI, Director of ORC and Corporate Investigations at CVS Health and President of the Coalition of Law Enforcement and Retail. In a report published by Loss Prevention Magazine, Dugan said that ORC has grown exponentially since 2017 with the rise of online marketplaces. He explained that the Covid-19 pandemic was an accelerant as thieves were emboldened since courts were closed, and law enforcement was not responding to nonviolent property crimes. According to the NRF’s 2021 Retail Security Survey, 65% of retailers believe that retail gangs are now more aggressive and more violent than in the past, while 37% said ORC gangs are much more aggressive than in the past.

We expect that inflation may create an accelerant for ORC, as consumers may increasingly shop for products online at discounted prices, particularly everyday commodities, since prices have escalated and wallets are being squeezed. This will create even greater challenges for pharmacies and big-box retailers—the two biggest targets for ORC.

The Scope and Cost of ORC for the Industry

An estimated $68.9 billion worth of products were stolen from US retailers in 2019, representing approximately 1.5% of total retail sales, according to a report by RILA. ORC also results in an estimated $15 billion in lost federal and state tax revenue per year, according to the report.

According to the NRF, ORC cost US retailers an average of over $719,548 per $1 billion of sales in 2020, up 59% from 2015. In order to combat retail crime, retailers are hiring extra security at an added cost. They are also taking more security measures in their stores, including locking up higher-value or highly sought-after products, which can range from higher-priced items to everyday items such as infant formula and medicine. This also adds costs for retailers as it may require additional staff to unlock merchandise and may also result in lost sales due to more friction in the shopping experience for consumers who do not wish to call an associate to unlock general merchandise.

Finally, retailers often have to absorb some costs of ORC, according to the Department of Homeland Security. While retailers are insured, the base value of an individual theft that is required in order to file a claim far exceeds the amount of each theft on its own. Retailers are left to absorb this loss as operating costs or to pass on the impact of increased prices, lower wages and fewer staff.

The Most Targeted Retailers and Stolen Products

The top 10 US retail targets for ORC, according to the Coalition of Law Enforcement and Retail, are as follows:

- Pharmacies

- Big-box retail

- Home improvement

- Grocery

- Softlines

- Electronics

- Luxury

- Specialty

- Dollar stores

- Cellphone stores

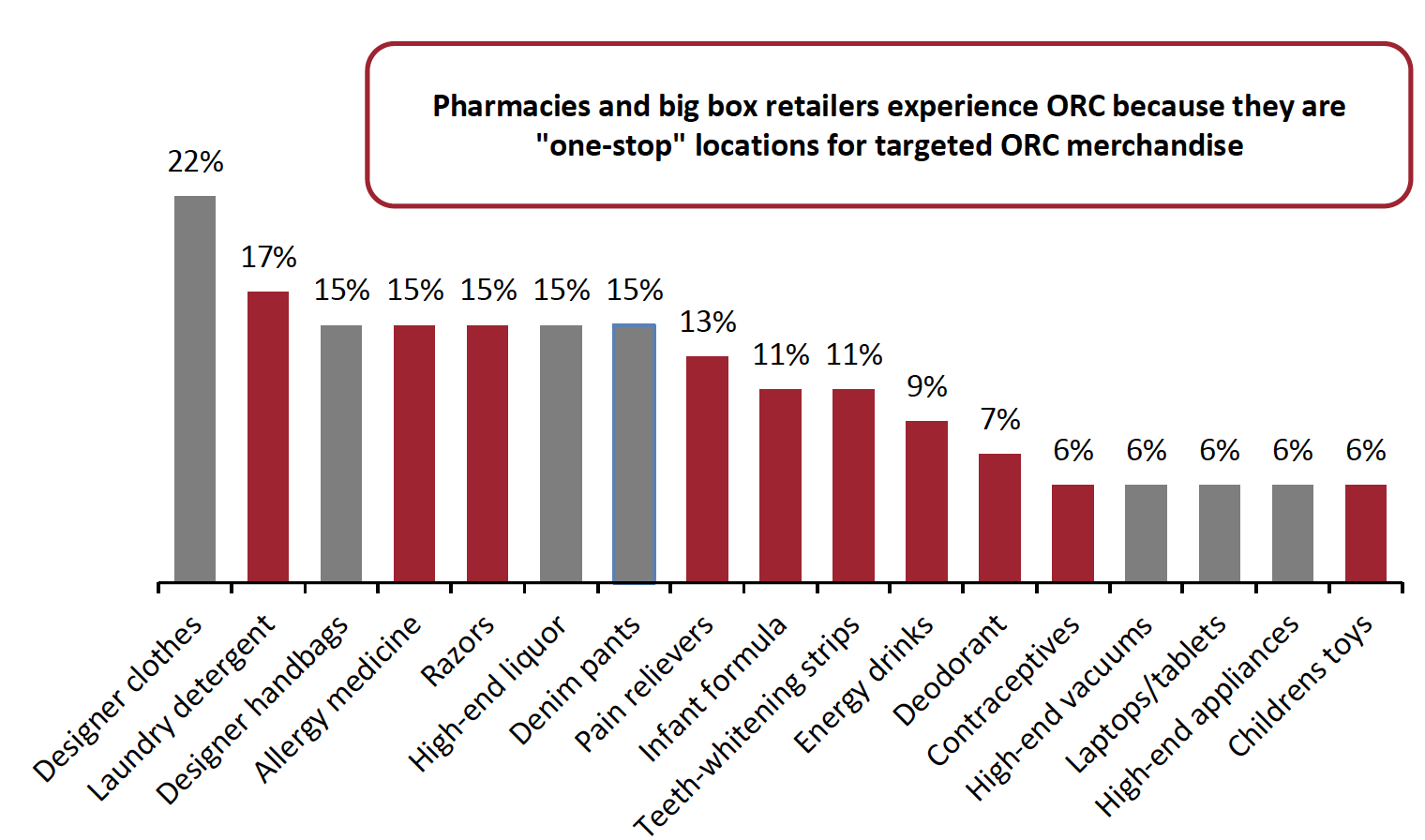

According to the NRF’s 2021 Retail Security Survey, designer clothing was the most targeted item for ORC, cited by 22% of retailers. However, in terms of other ORC-targeted products, retailers reported that out of the 17 most frequently targeted items in Figure 1, 10 could be found at a pharmacy or big-box retailer (represented by the red bars in the figure). This makes these retailers high-risk targets, as many items could be stolen in one location.

Figure 1. Top Merchandise Items Stolen by ORC (% of Respondents)

[caption id="attachment_153549" align="aligncenter" width="700"] Base: 41 retail industry loss prevention and asset protection professionals

Base: 41 retail industry loss prevention and asset protection professionalsSource: 2021 Retail Security Survey, NRF[/caption]

Dr. Cory Lowe, a research scientist at the Loss Prevention Research Council (LPRC) reported in a Loss Prevention Magazine article that items that are more likely to be targeted items of retail theft follow a “CRAVED model: concealable, removable, enjoyable and/or disposable.” He added that many retailers are forced to lock up items in high-theft areas; the LPRC researched locked merchandise and discovered that the friction of the shopping experience is driving consumers to purchase these items elsewhere.

3. Retailers Are Allocating More Resources To Combat Retail Crime

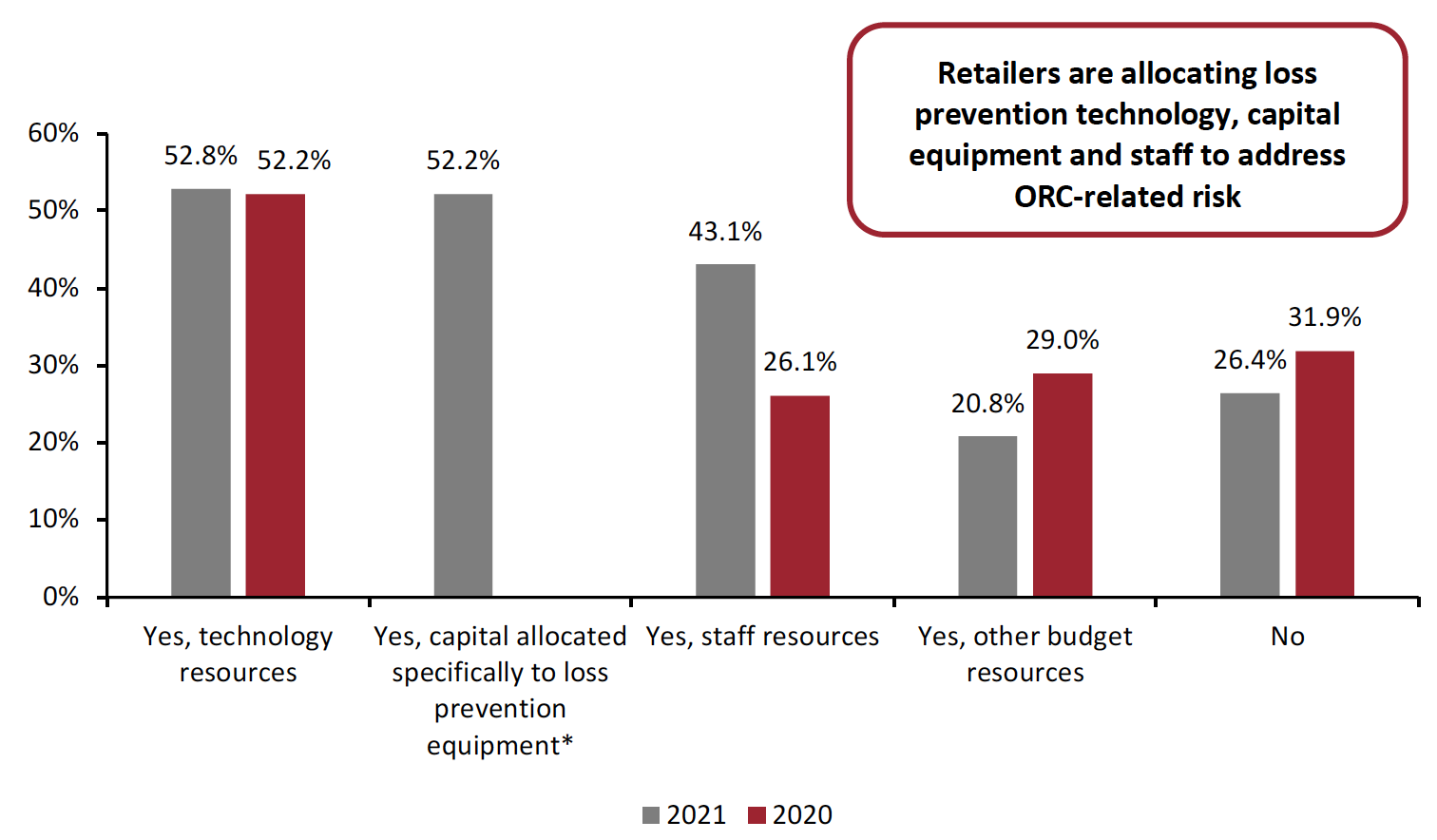

As ORC becomes an increasing threat, retailers are allocating more resources to combat crime, which includes technology, capital for loss prevention equipment, and staff. According to the NRF’s 2021 Retail Security Survey, the proportion of retailers allocating additional staff resources to address ORC-related risks increased from 26.1% in 2020 to 43.1% in 2021. While the category “capital allocated specifically to loss prevention equipment” was not surveyed in 2020, over half of retailers are allocating their budgets to this category in 2021.

Figure 2. Whether Retail Companies Are Allocating Additional Resources To Address ORC-Related Risks (% of Respondents)

[caption id="attachment_153550" align="aligncenter" width="700"] *Not included in the 2020 survey

*Not included in the 2020 surveyBase: 41 retail industry loss prevention and asset protection professionals

Source: 2021 Retail Security Survey, NRF[/caption]

Retailers Should Join Forces To Combat ORC

In order to combat ORC, retailers should not try to operate alone. The NRF advocates for companies to be engaged with each other. Below, we discuss three leading organizations for retailers to consider as avenues for participation:

- The NRF has a Loss Prevention Council (LP Council) for senior loss prevention executives from NRF member companies with the goal of collaborating on issues of loss prevention and asset protection challenges facing the retail industry. The LP Council has over 70 representatives from US companies.

- The LPRC is an organization comprising researchers, retailers, solution partners (security and technology companies) and law enforcement professionals with a mission to provide research, development opportunities and collaborative spaces for members to enable the innovation of loss- and crime-control solutions. As shown below, the LPRC has retail members and partners spanning the industry.

LPRC members and partners

LPRC members and partnersSource: Lpresearch.org[/caption]

- RILA’s Buy Safe America Coalition (as mentioned earlier) is a diverse group of retailers, consumer groups, manufacturers, intellectual property advocates and law enforcement officials who support efforts at all levels of government to protect consumers and communities from the sale of counterfeit and stolen goods. The Buy Safe America Coalition has almost 60 companies, associations and others who have joined because legislation not only helps to stop ORC, but it also helps to mitigate the sale of counterfeit goods.

These organizations are educating policymakers on the impact of ORC and helping to push legislation forward. Michael Hanson, Senior EVP of Public Affairs at RILA, said on the podcast “RILA’s Team Explains the Value of the INFORM Act” in February 2022 that conversations with Congress focused on stopping ORC and centered on creating more transparency and accountability online, which led to the introduction of the INFORM Consumers Act on February 10, 2022. This bill requires online marketplaces to collect and verify third-party sellers’ government ID, tax ID, bank account information and contact information. It requires high-volume sellers to disclose contact information to consumers. Hanson credited success at the federal level to the direct engagement of retailers, brands, law enforcement and trade associations.

What We Think

ORC has been increasing since the Covid-19 pandemic, becoming more violent. ORC is impacting different sectors from mass retail to luxury, as the target goods and target retailers span the entire retail industry. It impacts worker safety and is a malicious form of brand manipulation, which not only causes loss of the stolen goods, but can affect brand image, price and consumer confidence.

Implications for Brands/Retailers

- We expect retailers and brands to invest in loss prevention technology, tools and resources, as ORC is an increasing threat to all retailers.

- We advise that retailers collaborate through associations that include the National Retail Federation’s Loss Prevention Council, the Loss Prevention Research Council, RILA’s Buy Safe America Coalition and others to share loss prevention learnings, best practices, collaborate on solutions, and help to advance legislation to prevent ORC.