DIpil Das

[caption id="attachment_91363" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

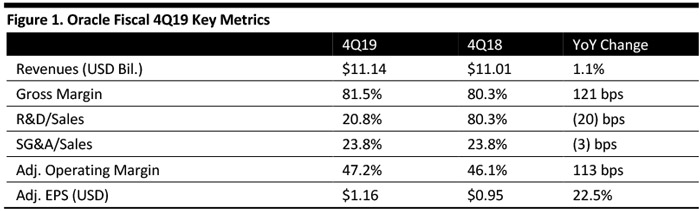

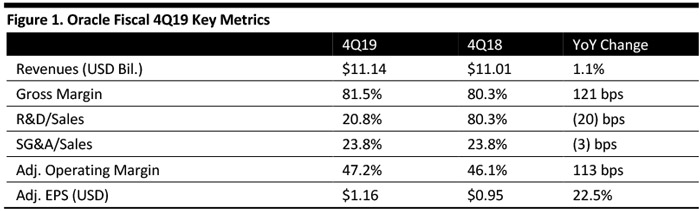

Oracle reported fiscal 4Q19 revenues of $11.14 billion, up 1.1% year over year, ahead of the $10.93 billion consensus estimate. Revenues increased 4% in constant currency.

Adjusted EPS was $1.16, up 22.5% year over year and above the consensus estimate of $1.07. GAAP EPS was $1.16, compared to $0.79 in the year-ago quarter. The change in year over year was primarily due to a much lower provision for income taxes.

Management commented that the high-margin Fusion and NetSuite cloud applications businesses are growing rapidly, while the company is downsizing its low-margin legacy hardware business, which drove operating margins to a five-year record high.

Fiscal 2019 Results

Oracle reported fiscal 2019 revenues of $39.5 billion, up 0.3% year over year. Revenues increased 3% in constant currency.

Adjusted EPS was $3.52, up 22.5% year over year. GAAP EPS was $2.97, compared to $0.85 in the prior year.

Management commented that Fusion enterprise resource planning (ERP) and human capital management (HCM) cloud applications suite revenues grew 32% in FY19. The company’s NetSuite ERP cloud application revenues also grew 32% this year. The company believes these results extend Oracle’s lead in worldwide Cloud ERP and that its cloud applications businesses are growing faster than its competitors, citing IDC’s latest study that found Oracle gained the most market share globally of all enterprise application software as a service (SaaS) vendors in CY16, CY17 and CY18.

Revenues by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Oracle reported fiscal 4Q19 revenues of $11.14 billion, up 1.1% year over year, ahead of the $10.93 billion consensus estimate. Revenues increased 4% in constant currency.

Adjusted EPS was $1.16, up 22.5% year over year and above the consensus estimate of $1.07. GAAP EPS was $1.16, compared to $0.79 in the year-ago quarter. The change in year over year was primarily due to a much lower provision for income taxes.

Management commented that the high-margin Fusion and NetSuite cloud applications businesses are growing rapidly, while the company is downsizing its low-margin legacy hardware business, which drove operating margins to a five-year record high.

Fiscal 2019 Results

Oracle reported fiscal 2019 revenues of $39.5 billion, up 0.3% year over year. Revenues increased 3% in constant currency.

Adjusted EPS was $3.52, up 22.5% year over year. GAAP EPS was $2.97, compared to $0.85 in the prior year.

Management commented that Fusion enterprise resource planning (ERP) and human capital management (HCM) cloud applications suite revenues grew 32% in FY19. The company’s NetSuite ERP cloud application revenues also grew 32% this year. The company believes these results extend Oracle’s lead in worldwide Cloud ERP and that its cloud applications businesses are growing faster than its competitors, citing IDC’s latest study that found Oracle gained the most market share globally of all enterprise application software as a service (SaaS) vendors in CY16, CY17 and CY18.

Revenues by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Oracle reported fiscal 4Q19 revenues of $11.14 billion, up 1.1% year over year, ahead of the $10.93 billion consensus estimate. Revenues increased 4% in constant currency.

Adjusted EPS was $1.16, up 22.5% year over year and above the consensus estimate of $1.07. GAAP EPS was $1.16, compared to $0.79 in the year-ago quarter. The change in year over year was primarily due to a much lower provision for income taxes.

Management commented that the high-margin Fusion and NetSuite cloud applications businesses are growing rapidly, while the company is downsizing its low-margin legacy hardware business, which drove operating margins to a five-year record high.

Fiscal 2019 Results

Oracle reported fiscal 2019 revenues of $39.5 billion, up 0.3% year over year. Revenues increased 3% in constant currency.

Adjusted EPS was $3.52, up 22.5% year over year. GAAP EPS was $2.97, compared to $0.85 in the prior year.

Management commented that Fusion enterprise resource planning (ERP) and human capital management (HCM) cloud applications suite revenues grew 32% in FY19. The company’s NetSuite ERP cloud application revenues also grew 32% this year. The company believes these results extend Oracle’s lead in worldwide Cloud ERP and that its cloud applications businesses are growing faster than its competitors, citing IDC’s latest study that found Oracle gained the most market share globally of all enterprise application software as a service (SaaS) vendors in CY16, CY17 and CY18.

Revenues by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Oracle reported fiscal 4Q19 revenues of $11.14 billion, up 1.1% year over year, ahead of the $10.93 billion consensus estimate. Revenues increased 4% in constant currency.

Adjusted EPS was $1.16, up 22.5% year over year and above the consensus estimate of $1.07. GAAP EPS was $1.16, compared to $0.79 in the year-ago quarter. The change in year over year was primarily due to a much lower provision for income taxes.

Management commented that the high-margin Fusion and NetSuite cloud applications businesses are growing rapidly, while the company is downsizing its low-margin legacy hardware business, which drove operating margins to a five-year record high.

Fiscal 2019 Results

Oracle reported fiscal 2019 revenues of $39.5 billion, up 0.3% year over year. Revenues increased 3% in constant currency.

Adjusted EPS was $3.52, up 22.5% year over year. GAAP EPS was $2.97, compared to $0.85 in the prior year.

Management commented that Fusion enterprise resource planning (ERP) and human capital management (HCM) cloud applications suite revenues grew 32% in FY19. The company’s NetSuite ERP cloud application revenues also grew 32% this year. The company believes these results extend Oracle’s lead in worldwide Cloud ERP and that its cloud applications businesses are growing faster than its competitors, citing IDC’s latest study that found Oracle gained the most market share globally of all enterprise application software as a service (SaaS) vendors in CY16, CY17 and CY18.

Revenues by Segment

- Cloud services and license support revenues were $6.8 billion, up 0.5% year over year as reported and up 3% in constant currency.

- Cloud license and on‐premise license revenues were $2.5 billion, up 12.1% year over year as reported and up 15% in constant currency.

- Hardware revenues were $994 million, down 10.9% year over year as reported and down 8% in constant currency.

- Services revenues were $823 million, down 6.8% year over year as reported and down 4% in constant currency.

- Oracle stated it launched more than five thousand new autonomous database trials in the quarter. Management believes its new Gen2 Cloud Infrastructure offers those customers a compelling array of including a self-driving database that automatically encrypts all the customer’s data, backs itself up, tunes itself, upgrades itself, and patches itself when a security threat is detected. This happens autonomously, without the need for human intervention or downtime.

- Technology license revenue was up 19% year over year, demonstrating customer support of the Oracle platform. The key database options necessary to run the Oracle autonomous database service grew 21%.

- With the popular bring your own license (BYOL) model, customers can use their licenses on-premise, in the cloud or via hybrid environment and leverage security, performance or scalability and, in the Oracle cloud, autonomous capabilities.

- Management expects the interconnection of Microsoft Azure and the Oracle Cloud (announced June 5) to accelerate the transition from on-premise databases to Oracle’s autonomous database service.

- Overall annualized revenue from ERP and HCM is now nearly $3 billion, growing in the high 20% range, including the following:

- Fusion app revenue was up 36% in the quarter and up 32% for the full year.

- Fusion HCM revenue was up 25% in the quarter.

- Fusion ERP revenue was up 44% in the quarter and up 44% for the full year.

- NetSuite ERP revenue was up 28% in the quarter, with 30% bookings growth.

- Revenue in the company’s vertical markets increased 19% in the quarter and 32% in the year.

- In a retail example, Oracle mentioned tailoring its NetSuite cloud ERP business management suite as a solution for university campus bookstores, combining the software with consulting services.

- Revenues to grow faster than FY19 in constant currency (greater than 3%).

- Double-digit EPS growth, compared to the consensus estimate of up 10%.

- Revenues up 1-3% year over year in constant currency and up 2% in US dollars.

- Adjusted EPS of $0.80-0.82, up 14-16%, above the $0.80 consensus estimate.