DIpil Das

[caption id="attachment_96320" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

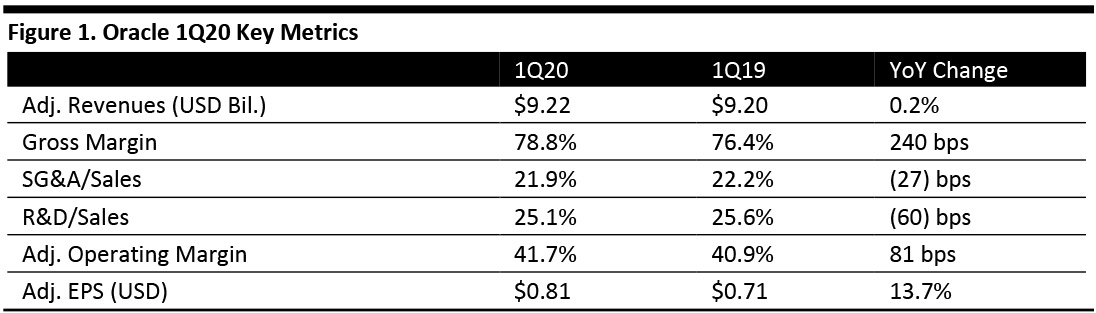

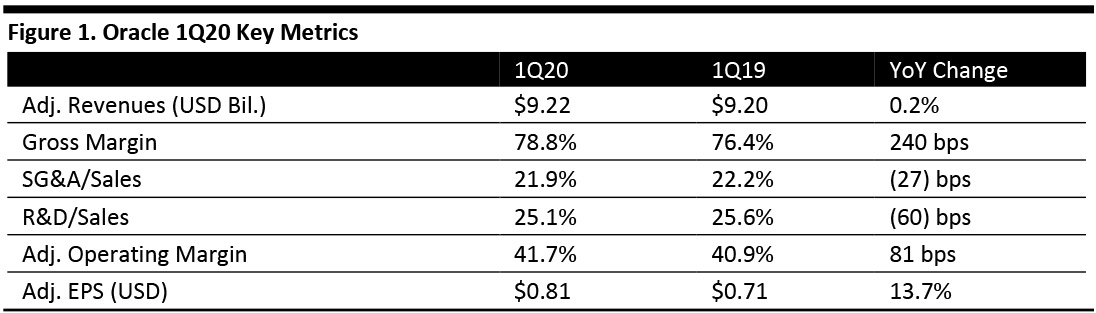

Oracle reported fiscal 1Q20 revenues of $9.22 billion, up 0.2% year over year and slightly below the consensus estimate of $9.29 billion. Revenues increased 2% at constant currency.

Adjusted EPS was $0.81, up 13.7% year over year and in line with the consensus estimate. GAAP EPS was $0.63, compared to $0.57 in the year-ago quarter. The difference was due to stock-based compensation, amortization of intangibles, acquisition-related expenses and restructuring expenses.

Management commented that Oracle’s low-margin hardware businesses continue to get smaller, while its higher-margin cloud business continues to get larger, which should raise operating margins, earnings per share and free cash flow.

Health-Related Leave for CEO Mark Hurd

Separately, the company announced that CEO Mark Hurd would take a leave of absence for health-related reasons and that Founder and Executive Chairman Larry Ellison and co-CEO Safra Catz would cover Hurd’s responsibilities.

Revenues by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

Oracle reported fiscal 1Q20 revenues of $9.22 billion, up 0.2% year over year and slightly below the consensus estimate of $9.29 billion. Revenues increased 2% at constant currency.

Adjusted EPS was $0.81, up 13.7% year over year and in line with the consensus estimate. GAAP EPS was $0.63, compared to $0.57 in the year-ago quarter. The difference was due to stock-based compensation, amortization of intangibles, acquisition-related expenses and restructuring expenses.

Management commented that Oracle’s low-margin hardware businesses continue to get smaller, while its higher-margin cloud business continues to get larger, which should raise operating margins, earnings per share and free cash flow.

Health-Related Leave for CEO Mark Hurd

Separately, the company announced that CEO Mark Hurd would take a leave of absence for health-related reasons and that Founder and Executive Chairman Larry Ellison and co-CEO Safra Catz would cover Hurd’s responsibilities.

Revenues by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

Oracle reported fiscal 1Q20 revenues of $9.22 billion, up 0.2% year over year and slightly below the consensus estimate of $9.29 billion. Revenues increased 2% at constant currency.

Adjusted EPS was $0.81, up 13.7% year over year and in line with the consensus estimate. GAAP EPS was $0.63, compared to $0.57 in the year-ago quarter. The difference was due to stock-based compensation, amortization of intangibles, acquisition-related expenses and restructuring expenses.

Management commented that Oracle’s low-margin hardware businesses continue to get smaller, while its higher-margin cloud business continues to get larger, which should raise operating margins, earnings per share and free cash flow.

Health-Related Leave for CEO Mark Hurd

Separately, the company announced that CEO Mark Hurd would take a leave of absence for health-related reasons and that Founder and Executive Chairman Larry Ellison and co-CEO Safra Catz would cover Hurd’s responsibilities.

Revenues by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

Oracle reported fiscal 1Q20 revenues of $9.22 billion, up 0.2% year over year and slightly below the consensus estimate of $9.29 billion. Revenues increased 2% at constant currency.

Adjusted EPS was $0.81, up 13.7% year over year and in line with the consensus estimate. GAAP EPS was $0.63, compared to $0.57 in the year-ago quarter. The difference was due to stock-based compensation, amortization of intangibles, acquisition-related expenses and restructuring expenses.

Management commented that Oracle’s low-margin hardware businesses continue to get smaller, while its higher-margin cloud business continues to get larger, which should raise operating margins, earnings per share and free cash flow.

Health-Related Leave for CEO Mark Hurd

Separately, the company announced that CEO Mark Hurd would take a leave of absence for health-related reasons and that Founder and Executive Chairman Larry Ellison and co-CEO Safra Catz would cover Hurd’s responsibilities.

Revenues by Segment

- Cloud services and license support revenues were $6.8 billion, up 3% year over year as reported and up 4% in constant currency. Most of this revenue is recurring.

- Applications revenues were $2.8 billion, up 2% year over year as reported and up 3% in constant currency. Oracle now has more than 6,500 Fusion ERP customers and more than 18,000 NetSuite ERP customers and claims to hold the global number-one position in cloud ERP and the number-one position in the North American applications business.

- Fusion app revenues were up nearly 40%.

- Fusion ERP revenues were up in the mid-40% range.

- Fusion HCM revenues were up in the low 30% range.

- NetSuite ERP revenues were up in the mid-20% range.

- Infrastructure revenues were $4.7 billion, also up 2% year over year as reported and up 3% in constant currency.

- Applications revenues were $2.8 billion, up 2% year over year as reported and up 3% in constant currency. Oracle now has more than 6,500 Fusion ERP customers and more than 18,000 NetSuite ERP customers and claims to hold the global number-one position in cloud ERP and the number-one position in the North American applications business.

- Cloud license and on‐premise license revenues were $812 million, down 6% year over year as reported and down 6% in constant currency. This figure follows 15% license growth in the previous quarter.

- Hardware revenues were $815 million, down 10% year over year as reported and down 9% in constant currency.

- Services revenues were $786 million, down 3% year over year as reported and down 2% in constant currency.

- Management cites autonomy as the defining attribute of a second-generation cloud. At the OpenWorld conference next week, the company plans to announce more autonomous cloud services to enhance the Oracle Autonomous Database, the most successful product in the company’s history. Oracle added more than 500 new Autonomous Database cloud customers in Q1 and expects to add more than twice that number in Q2.

- Back-office applications have been reporting strong growth for the past several quarters, and management outlined large opportunities in enterprise resource planning (ERP) and human capital management (HCM). There is a large base of these customers who can work in the cloud, however, more than half of the market includes customers who cannot upgrade to a software-as-a-service (SaaS) solution.

- Revenues to grow faster than FY19 in constant currency (greater than 3%).

- Double-digit adjusted EPS growth, compared to the consensus estimate of up 10%.

- Revenues up 1-3% year over year in constant currency and up 0-2% in US dollars, assuming a 1% currency headwind.

- Adjusted EPS of $0.87-0.89, up 9-11%, but below the $0.91 consensus estimate.