DIpil Das

What’s the Story?

In this report, we review data on sales in the US women’s plus-size apparel market. We look at the percentage of plus-size shoppers in the apparel market and average spending on plus-size apparel. We examine what retailers and brands are doing to better serve this market and the opportunities it presents.Why It Matters

According to the CDC, the average American woman wears a size 16–18. There is there is no industry-agreed starting size for plus-size apparel; it often varies according to brand and consumer perception. As a gauge, plus-size in the US fashion industry is identified as sizes 18 and over, or sizes 1X and up, according to PLUS Model magazine. Women’s plus-size clothing sales have been increasing faster than the total clothing market—until the coronavirus crisis hit apparel sales—and this market is now courted by designers, retailers and brands. A growing supply of inclusive apparel is addressing new consumer expectations—more brands and retailers are broadening their plus-size offerings to better serve this market and take advantage of the opportunity it presents.US Women’s Plus-Size Apparel Market Overview

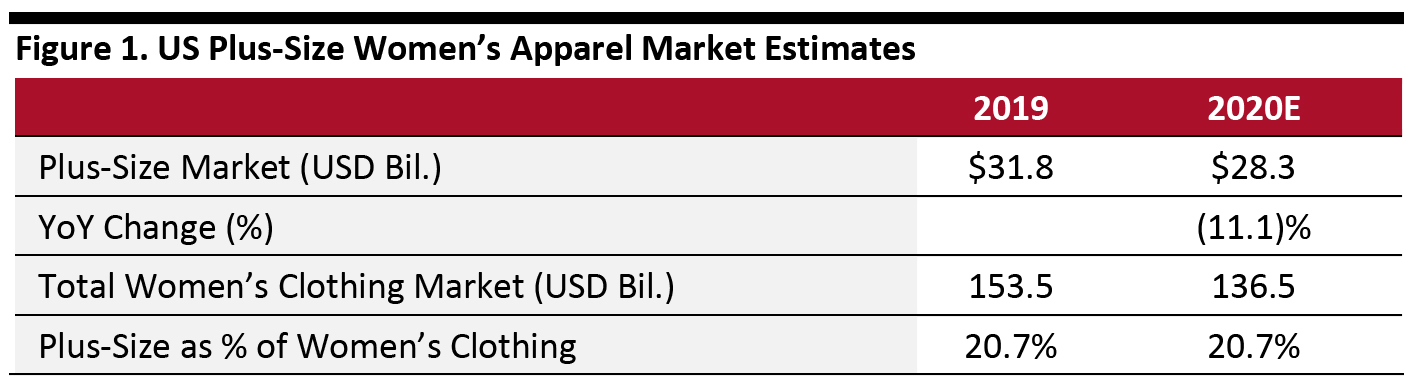

Market Value We estimate that the US women’s plus-size clothing market will be worth $28.3 billion in 2020—down by around 11% from $31.8 billion in 2019, as apparel spending is negatively impacted by the pandemic. Our market-size estimate factors in the proportion of women that browse plus-size clothing, estimated per capita spend, and the apparel market’s trajectory. We estimate that the total US clothing market will decline by around 12% in 2020—slightly faster than the plus-size market. [caption id="attachment_115908" align="aligncenter" width="700"] Source: BEA/Coresight Research[/caption]

Obesity Among Women in the US

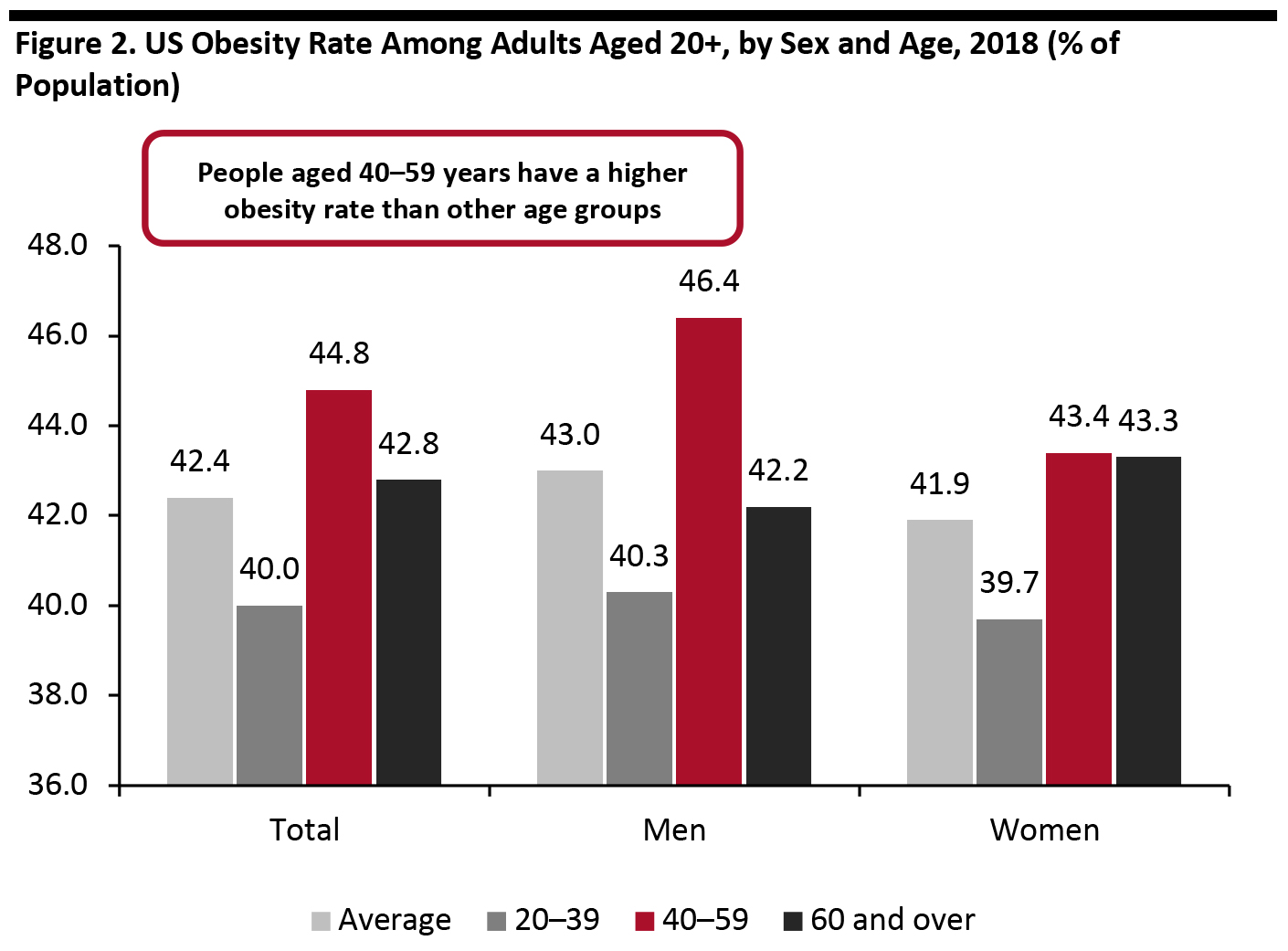

The increasing women’s obesity rate could be a factor in the development of the plus-size market in the US, but is not relevant to all plus-size shoppers. The rate of obesity among adult women (aged 20 and above) in the US is around 41.9%—approximately 52 million women—according to the Behavioral Risk Factor Surveillance System at the CDC. Figure 2 shows the increasing prevalence of obesity from 1999–2000 through 2017–2018 among adults, suggesting a change in plus-size apparel requirements for some shoppers.

Among women, obesity prevalence is linked to socioeconomic factors, with those from high-income groups displaying lower prevalence rates compared to middle- and low-income groups, according to the CDC’s “Morbidity and Mortality Weekly Report.”

[caption id="attachment_115909" align="aligncenter" width="700"]

Source: BEA/Coresight Research[/caption]

Obesity Among Women in the US

The increasing women’s obesity rate could be a factor in the development of the plus-size market in the US, but is not relevant to all plus-size shoppers. The rate of obesity among adult women (aged 20 and above) in the US is around 41.9%—approximately 52 million women—according to the Behavioral Risk Factor Surveillance System at the CDC. Figure 2 shows the increasing prevalence of obesity from 1999–2000 through 2017–2018 among adults, suggesting a change in plus-size apparel requirements for some shoppers.

Among women, obesity prevalence is linked to socioeconomic factors, with those from high-income groups displaying lower prevalence rates compared to middle- and low-income groups, according to the CDC’s “Morbidity and Mortality Weekly Report.”

[caption id="attachment_115909" align="aligncenter" width="700"] Source: CDC[/caption]

Source: CDC[/caption]

Sizing Inconsistencies in Plus-Size Apparel

Many retailers and brands have begun to answer the call of plus-size consumers by devoting more resources to this traditionally underserved market. However, we found that sizing is inconsistent across major brands and retailers, making it more difficult for consumers to choose the right size. For example, fashion label Chromat’s size 4X specifies a bust measurement of 54–57 inches, while department store chain Kohl’s defines 4X as including a bust measurement of 55.5–59.5 inches. Other retailers, including Macy’s, Old Navy and Target, each provide different measurements for the size 4X. Uncertainty around such sizing inconsistencies may be exacerbated by coronavirus-related store closures, as consumers have flocked to online shopping, a sales channel with limited options to try-on clothing. According to a July 2020 survey of 1,000 women sized 14 to 28, conducted by plus-size fashion brand Eloquii, finding clothes that fit correctly and comfortably is the top shopping priority for the majority of respondents. Brands such as Aerie have worked to break down barriers between plus-size options and the other apparel items. Aerie no longer keeps plus-size offerings as a separate or featured part of its offering but carries an extended range of sizes for all of its items. This indicates retailers’ intentions to ease the historic stigma surrounding bigger sizes and move this market into a mainstream offering.Figure 3. Selected US Apparel Brands and Retailers with Plus-Size Merchandise [wpdatatable id=435]

Source: Company reports and websites

New Plus-Size Offerings in Swimwear and Activewear in 2020

We have seen a spike in launches of plus-size swimwear and activewear collections among apparel brands in 2020.- On June 24, 2020, Good American launched its first size-inclusive swimwear line in 30 styles. The collection is available in sizes from 0 to 8 and XS to 5XL. Some styles are designed to facilitate varied body types—for example, a number of suits have wide straps and double drawstrings for added support, showing the brand’s active steps towards improving clothing fit.

- June 2020 also saw the launch of a new plus-size swim collection by US retailer Fashion To Figure, marketing for which featured model Tabria Majors (pictured below). The collection includes a swimsuit made from ultra-soft, four-way-stretch fabric that provides SPF/UPF 30+ protection and resists chlorine damage with quick-dry technology.

Fashion To Figure’s new plus-size swimwear collection, modeled by Tabria Majors

Fashion To Figure’s new plus-size swimwear collection, modeled by Tabria Majors Source: Fashion To Figure [/caption]

- In January 2020, Target launched its own line of size-inclusive activewear and sporting goods under the brand All in Motion. Products are available in sizes from XS–4X for women, S–3X for men and XS–XXL for kids. The line features sportwear items such as leggings and sports bras, and sporting gear such as hand weights and yoga mats.

- Stitch Fix Kids launched a new activewear line on July 29, 2020, with products available in sizes 2T–18 in playwear, outerwear and footwear categories.

- Department stores Kohl’s is expanding its assortment of inclusive sizes by adding plus-size ranges for brands such as Adidas, NIKE and Under Armour.

- Backpacks are now available in plus-size ranges. Outdoor gear brand Gregory announced in July 2020 that it is launching the industry’s first plus-size backpacks. The company is partnering with Jenny Bruso, the creator of popular Instagram account Unlikely Hikers, which promotes body liberation in the outdoors.

Gregory’s new plus-size backpack line with Jenny Bruso

Gregory’s new plus-size backpack line with Jenny Bruso Source: Gregory [/caption]

Store Closures amid Covid-19

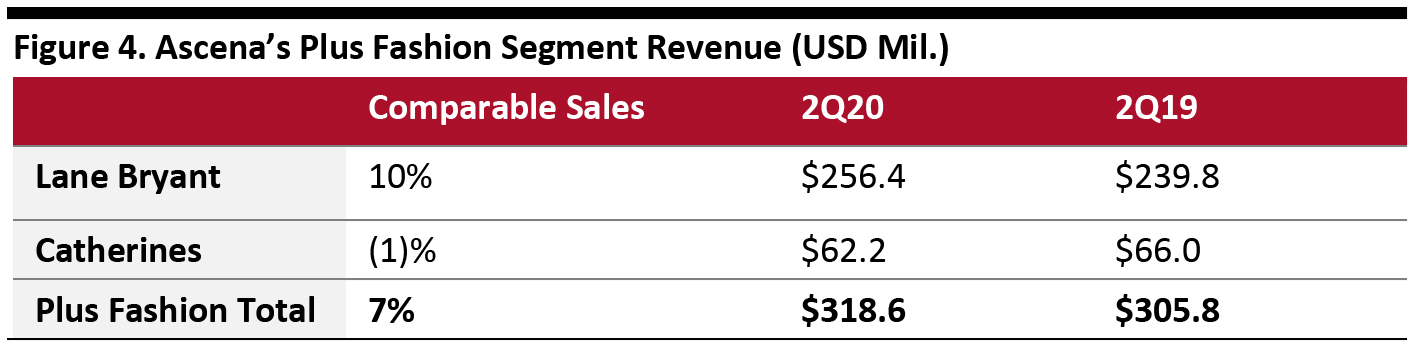

We are seeing a number of brands close business and exit the market due to the impacts of the coronavirus pandemic. Ascena Retail Group, the parent company of Lane Bryant and two other plus-size retailers, Catherines and Cacique, filed for bankruptcy on July 23, 2020. Ascena’s Plus Fashion business had been improving before the pandemic—in the three months ended February 1, 2020, it reported $318.6 million in revenue, up 4.2% compared to the year-ago quarter. The segment delivered 7% positive comparable growth while generating 90 basis points of gross-margin expansion. Although the company leveraged analytics and insights to ensure plus-size consumers received suitable product offerings and messages, the outbreak of Covid-19 forced Ascena to close all stores temporarily. In May, Ascena’s Interim Executive Chairman Carrie Teffner noted: “The pandemic has significantly reduced our earnings and cash flow, resulting in increased levels of debt and deferred liabilities.” All 264 Catherines stores will close permanently (the intellectual property assets have already been sold to Australian brand City Chic Collective). Among the total 688 stores, 157 Lane Bryant and Lane Bryant Outlet stores will close permanently. The reduced presence or closure of these banners will open up opportunities for major retailers such as Target and Walmart to gain market share. [caption id="attachment_115913" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

- Plus-size brand Grande Dame, a designer apparel boutique that has operated in Richmond, Virginia, for 28 years, is closing due to its inability to adsorb increased operating costs during the pandemic.

- Reitmans Limited, the parent company of plus-size brand Addition Elle, announced on May 19, 2020 that it would be permanently closing all 77 of the brand’s brick-and-mortar stores, as well as its e-commerce site. The company’s sales for the first quarter of 2021 decreased by $80.5 million, or 43.5%, to $104.7 million, primarily due to the impact of temporary coronavirus-related store closures.

Body Positivity in the Plus-Size Market

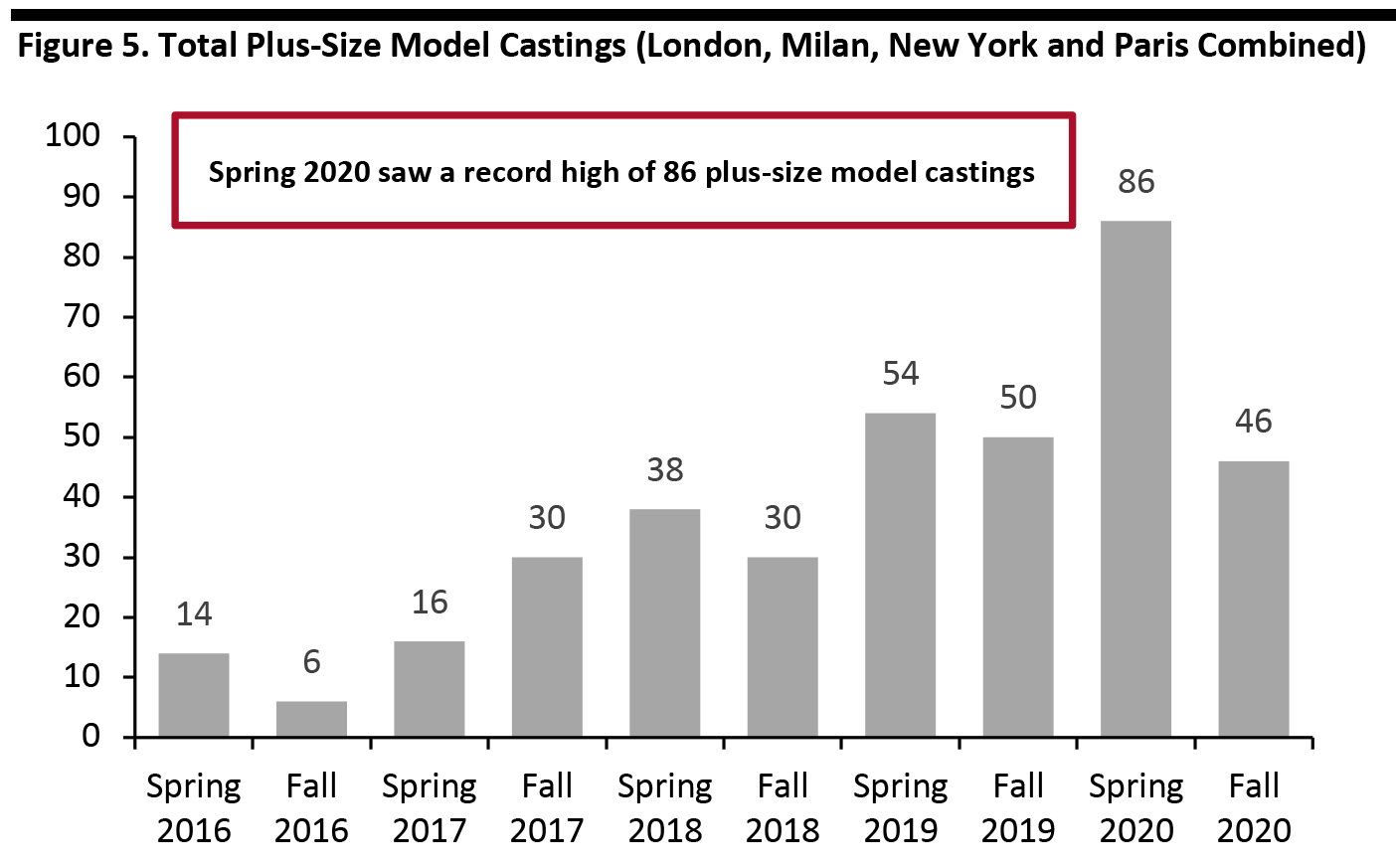

Plus-size models are seeing higher public exposure as they are increasingly being selected at catwalk castings. According to The Fashion Spot’s Diversity Report, plus-size castings for catwalks in London, Milan, New York and Paris increased from 14 for the spring 2016 season to 86 for spring 2020 (see Figure 5). Plus-size catwalk castings in these locations dropped to 46 for fall 2020, mainly because of the impacts of the pandemic on the fashion and retail industries. Based on the same report, New York was the source of most of the plus-size castings, followed by London. American fashion designer Christian Siriano has hired plus-size models including Candice Huffine, Chloé Véro, Ingrid Medeiro, Marquita Pring, Precious Lee, Sabina Karlsson, Seynabou Cissé and Solange van Doorn. [caption id="attachment_115914" align="aligncenter" width="700"] Source: The Fashion Spot[/caption]

Brands Launch Body Positivity Movements

Brands and retailers such as American Eagle Outfitters, Monki and NIKE are all participants in the shift towards body positivity in retail.

Source: The Fashion Spot[/caption]

Brands Launch Body Positivity Movements

Brands and retailers such as American Eagle Outfitters, Monki and NIKE are all participants in the shift towards body positivity in retail.

- American Eagle Outfitters is a leading retailer within the body positivity and inclusivity movement. It focuses on recruiting role models and ambassadors that reflect a wide range of women, as well as organizing #AerieREAL talks and events that express its recognition of plus-size fashion. During temporary brick-and-mortar store closures amid coronavirus lockdowns, American Eagle’s subsidiary brand Aerie went online to connect with consumers virtually. Aerie launched the #AerieREAL Positivity challenge on TikTok, which asked platform users to create a video sharing three things that they are grateful for in quarantine. Since the launch of the initiative on April 15, the videos created as a part of the challenge have accumulated over 2 billion impressions, and there has been an average increase of 855% in traffic to the Aerie website.

- NIKE introduced plus-size mannequins at its store on Oxford Street in London, UK, in June 2019 to emphasize its position on inclusivity and diversity in sport: The plus-size mannequins, both male and female, sport activewear. Since then, NIKE has partnered with various body-positive models and influencers, such as Chloe Elliot and Grace Victory, for collection collaborations.

- In June 2020, influencer and blogger Britney Vest launched WVVY—a size-inclusive activewear brand—with the Home Shopping Network. Vest explained that the collection marks a change from the usual plus-size apparel offerings, which are not necessarily fashion-forward. The collection is available in size XS to 3X and priced at under $100. The message behind the influencer’s personal brand is “positivity, body love and self-love.”

Plus-Size Business Models

· Fashion Rental New business models such as fashion rental are offering fashion-conscious plus-size shoppers greater choice online. In August 2020, Walmart-owned Eloquii launched its first clothing rental platform, Unlimited. With this subscription-based program, shoppers can pick and choose from Eloquii styles available in sizes 14 to 28, receiving a box of four items for $79 per month. In response to the coronavirus pandemic, the company partnered with CaaStle, a cloud-based third-party service provider, to employ health procedures that ensure the clothing is properly sanitized before being sent to customers. · Direct to Consumer (DTC) Plus-size brands are still embracing the DTC model for expansion, as the range of plus-size items carried by traditional retailers is often limited compared to the variety of standard ranges. For example, Macy’s has over 7,000 tops in standard sizes but only around 2,500 for its plus-size range, which starts at size 12, according to the company’s website. In December 2019, a new DTC plus-size brand, Hours, was launched by sisters-in-law Harroop Gulati Kaur and Naaz Gulati, with a mission of providing elevated, sustainable clothing options to shoppers. Every piece by Hours is made using upcycled fabrics to reduce waste, with plans to expand size offerings up to a size 40. [caption id="attachment_115915" align="aligncenter" width="700"] A model wearing Hours clothing

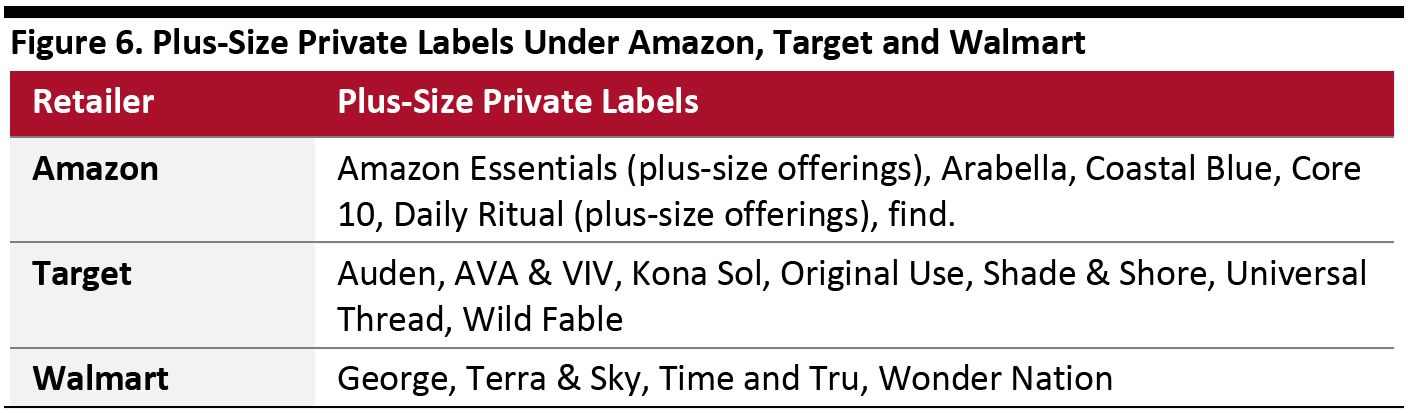

A model wearing Hours clothing Source: Hours [/caption] · Private Labels Plus-size apparel retailers often launch exclusive products and private-label lines. For example, 11 Honoré launched its own plus-size line in June 2020, which features quality clothes in sizes 12–26. Target launched its own line of size-inclusive activewear and sporting good brand All in Motion in the same month. We expect to see more retailers, especially major names such as Amazon, Target and Walmart, launch new lines in plus-size clothing. [caption id="attachment_115916" align="aligncenter" width="700"]

Source: Company websites[/caption]

· Social Commerce

Plus-size e-commerce platform Part & Parcel launched a new social commerce community for plus-size women in May 2019, facilitating customer-to-customer sales for plus-size apparel and offering affordable and versatile wardrobe essentials. The company also launched a plus-size talent agency in November 2019, which aims to increase representation for plus-size women.

Additionally, Part & Parcel is the first brand to create a dimensional sizing tool with extended options, such as “true fit” and “loose fit,” designed to offer the comfort of extra room in various areas such as bust, bicep, waist and calf. Dimensional sizing will be offered for a wide range of clothing options so users can customize fit to help them feel as comfortable as possible.

Part & Parcel’s social commerce model supports economic mobility in the retail sphere through its partner program, which allows plus-size women to connect in-person or online through an engaging shopping experience—when they become a brand “partner,” they earn commission when consumers purchase merchandise under them.

Source: Company websites[/caption]

· Social Commerce

Plus-size e-commerce platform Part & Parcel launched a new social commerce community for plus-size women in May 2019, facilitating customer-to-customer sales for plus-size apparel and offering affordable and versatile wardrobe essentials. The company also launched a plus-size talent agency in November 2019, which aims to increase representation for plus-size women.

Additionally, Part & Parcel is the first brand to create a dimensional sizing tool with extended options, such as “true fit” and “loose fit,” designed to offer the comfort of extra room in various areas such as bust, bicep, waist and calf. Dimensional sizing will be offered for a wide range of clothing options so users can customize fit to help them feel as comfortable as possible.

Part & Parcel’s social commerce model supports economic mobility in the retail sphere through its partner program, which allows plus-size women to connect in-person or online through an engaging shopping experience—when they become a brand “partner,” they earn commission when consumers purchase merchandise under them.

What We Think

Implications for Apparel Brands and Retailers- Social media influencers and the rise of the body positivity movement have contributed to changing attitudes toward those who wear plus sizes, and it is important for apparel retailers to respond to these historically underserved shoppers.

- Many retailers and brands are serving plus-size shoppers more proactively, offering them a wider range of fashionable choices in stores, online and through other options such as rental services.

- Consumers are expecting to find fashion and stylish apparel choices in plus-size assortments, and retailers and brands that respond to this demand are highly likely to succeed with plus-size customers.