DIpil Das

Introduction

What’s the Story? Returns represent a growing and complex post-purchase issue for retailers, and the issue will only grow over time as online and offline retail sales grow. Retailers’ return policies can determine whether the customer buys the product, and how a return is handled can determine whether the customer comes back. In this report, we analyze the size of the returns challenge in the US and discuss the causes of returns, how consumers view returns policies and the impacts on sales and loyalty, and how retailers and resellers can best handle and prevent returns. This report is sponsored by SAP, a global leader in enterprise application software that offers end-to-end solutions in enterprise resource planning, digital supply chain, employee and consumer experience management, and spending management, as well as a collaborative business network and Industry Cloud. Why It Matters The costs associated with returns can be high, increasing with growing returns volumes, and they can easily exceed any potential margin when considering the cost of incremental labor, transportation and refurbishment, in addition to any necessary discounting. There are also other issues at stake: Many consumers take returns policies into consideration when choosing a retailer—and the ease of making a return and the quality of service received when doing so has a major influence on whether that consumer comes back to make another purchase. In addition, consumers are increasingly taking sustainability into account when shopping, and this extends to the returns process. Retailers can use intelligent platforms to mitigate returns during the shopping process, as well as during the return process—protecting margins, minimizing the impact on the environment, and maintaining customer satisfaction and loyalty by giving the consumer choices and visibility during the returns process. Enormous Scope of the Returns Problem Returns amounted to $761 billion in the US in 2021, the equivalent of 16.6% of total US retail sales, according to a report by the National Retail Federation (NRF) and Appriss Retail. The returns rate increased markedly from the 10.6% rate recorded in 2020, likely due to the increase in e-commerce penetration and the unwillingness of consumers to enter physical stores to inspect merchandise and try on apparel. In dollar terms, returns increased by 78% in 2021 from the prior year. The returns challenge is even greater in e-commerce, with returns of online orders totaling $218 billion, or 20.8% of total US e-commerce retail sales in 2021. The online returns challenge will only get larger as e-commerce penetration increases: Coresight Research forecasts that US e-commerce penetration will increase from 18.2% of total retail in 2020 to 19.7% in 2022, an increase of 1.5 percentage points in two years. The pandemic drove a jump in e-commerce penetration above the prior trend line, and e-commerce penetration is likely to continue to increase further as consumers embrace the convenience of online shopping. At the present time, consumers are highly concerned about their safety and are avoiding physical stores, which is likely resulting in even-greater online returns of apparel and footwear due to sizing issues.Solving the Eternal Returns Challenge in Retail: Coresight Research x SAP Analysis

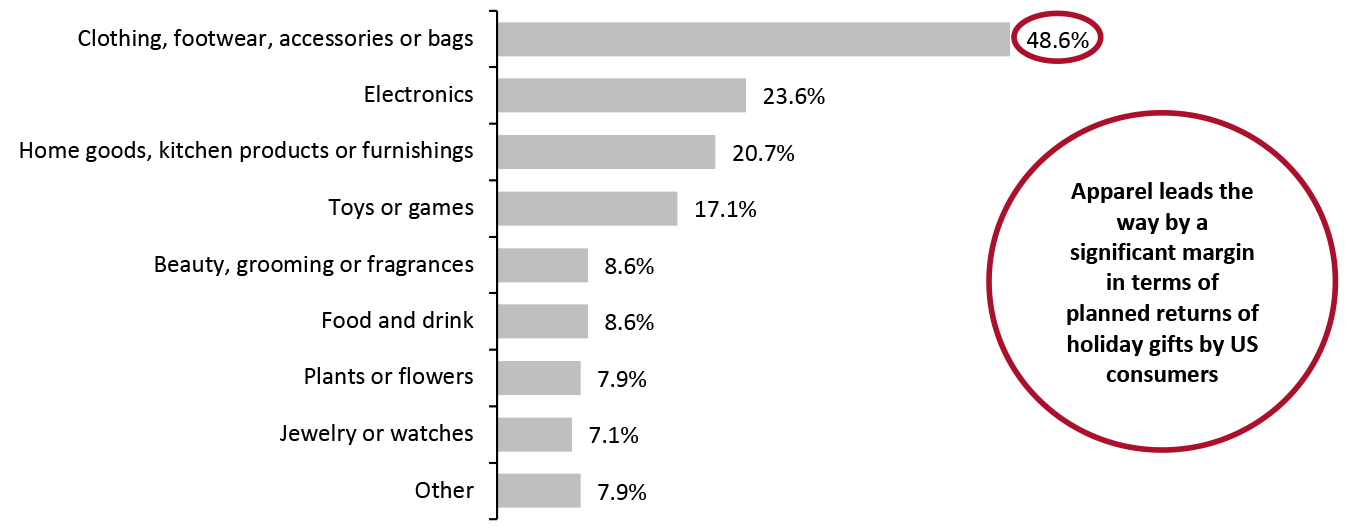

Holiday Returns Rates Alongside a seasonal peak in retail sales, returns are logically higher during the end-of-year holiday season. According to a Coresight Research survey of US consumers conducted on January 24, 2022, one-third of respondents intended to or already did return holiday gifts to retailers. Among those who intended to or already did return a gift, nearly half expected to return three or more items; clothing, footwear and accessories comprised the dominant product category for returns; and incorrect sizing was the primaryreason for making a return—findings that we discuss further below. Returns rates vary widely by type of product. Our survey found that clothing was the most-returned category by far, with a returns rate of more than double that of the next two categories—electronics and home goods (see Figure 1).Figure 1. Holiday Gift Returns, by Product Category (% of Respondents) [caption id="attachment_140832" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: 140 US consumers aged 18+ who returned, or planned to return, holiday gifts, surveyed on January 24, 2022

Source: Coresight Research [/caption] There are many reasons for returning a product, such as shipment errors, damage during shipping and various forms of fraud, including “wardrobing” (purchasing a piece of apparel to wear once and then returning it). Many of these issues are manageable or controllable by the retailer. The top reason for US consumers returning holiday gifts, according to our proprietary survey, was incorrect sizing—which follows logically from apparel being the most-returned category. We present our findings in Figure 2.

Figure 2. Reasons for Holiday Gift Returns (% of Respondents) [wpdatatable id=1696 table_view=regular]

Respondents could select multiple options Base: 140 US consumers aged 18+ who returned, or planned to return, holiday gifts, surveyed on January 24, 2022 Source: Coresight Research Shopper Behavior and Loyalty Retailers’ policies and their handling of returns have a major effect on consumer shopping behavior and loyalty. In fact, many consumers research a retailer’s returns policies before deciding to make a purchase. Consumer views on returns changed markedly during the pandemic. In a November 2020 survey conducted by Coresight Research, 42.6% of US consumers said they preferred to make returns by mail during the preceding 12 months, yet 26.4% of all respondents said that they expected to make post-holiday returns by mail. Similarly, 25.4% of US consumers that returned items during the preceding 12 months preferred to make returns in store, yet only 17.9% of all respondents expected to make post-holiday returns in-store. In the same survey, nearly four in 10 respondents said that a retailer’s returns policies influences where they shop, and 41.7% of consumers thought that retailers should offer a longer returns window during the 2020 holiday season due to the pandemic. Retailers can also modify their returns policies to increase loyalty, which we have seen through retailer membership programs such as Amazon Prime, Best Buy’s loyalty program and Walmart+. Retailers can bend returns rules or waive them entirely for large customers or elite program members. For example, higher Best Buy membership levels offer successively longer returns periods, with Elite Plus members being allocated more than 45 days to make a return compared to the standard 15 days for a regular member. Typical retail returns periods span 15–30 days but can run as long as 90 days. Another common practice for retailers is to offer store credit over a cash refund rather than accepting a product for return, providing a strong incentive for the consumer to make another purchase and potentially bringing the consumer back into the store, which could lead to additional purchases. Sustainability Implications The steps in the transportation and ultimate disposal of returned items have numerous implications for sustainability. In Figure 3, we illustrate the sustainability impacts of the returns process, which we discuss in detail below.

- For more on the broader topic of sustainability in retail, Coresight Research’s EnCORE framework provides a model through which retailers can begin to internalize a sustainability strategy.

Figure 3. Retail Returns: Sustainability Consequences for Returns [wpdatatable id=1697 table_view=regular]

Source: Coresight Research Repackage Item(s) If the original product packaging is still available and has not been discarded or recycled, then it can be used to repackage the item, assuming that it is a cardboard box or other reusable packaging. If the packaging is not reusable or available, then the consumer must acquire new packaging that will likely be disposed of at the returns facility. Packaging using non-biodegradable materials such as plastics will ultimately generate their own waste and emissions when deposited in a landfill. Ship Item(s) Consumers have several options for physically returning an item: They can return it to a physical store, drop it off at a designated pickup location or schedule a pickup from a carrier. Each of these options creates carbon emissions from the vehicles that transport the item. Resell/Destroy/Dispose of Item(s) Once the retailer or distribution center receives the item, there are several options for its next step, which each carry their own implications for sustainability:

- Prepare for sale—To be suitable for sale, items could require cleaning, which uses cleaning solvents, and repackaging, which consumes packaging material, or other materials for refurbishment.

- Render unusable—Brands often destroy unsaleable or returned items in order to protect the value and exclusivity of their brands, to prevent them from discounting or being sold in non-premium channels, and several well-known global luxury brands have admitted to or have been caught destroying products. The items are typically shredded or burned—and burning generates smoke and pollution. These destroyed items are subsequently deposited into landfills, which creates the same or greater environmental issues as just discarding them.

- Send for disposal—Once an item is deposited in a landfill, it starts to decompose and can release chemicals that interact with local water supplies; decomposing materials can emit gases (off-gassing), which cause pollution or take the form of greenhouse gases.

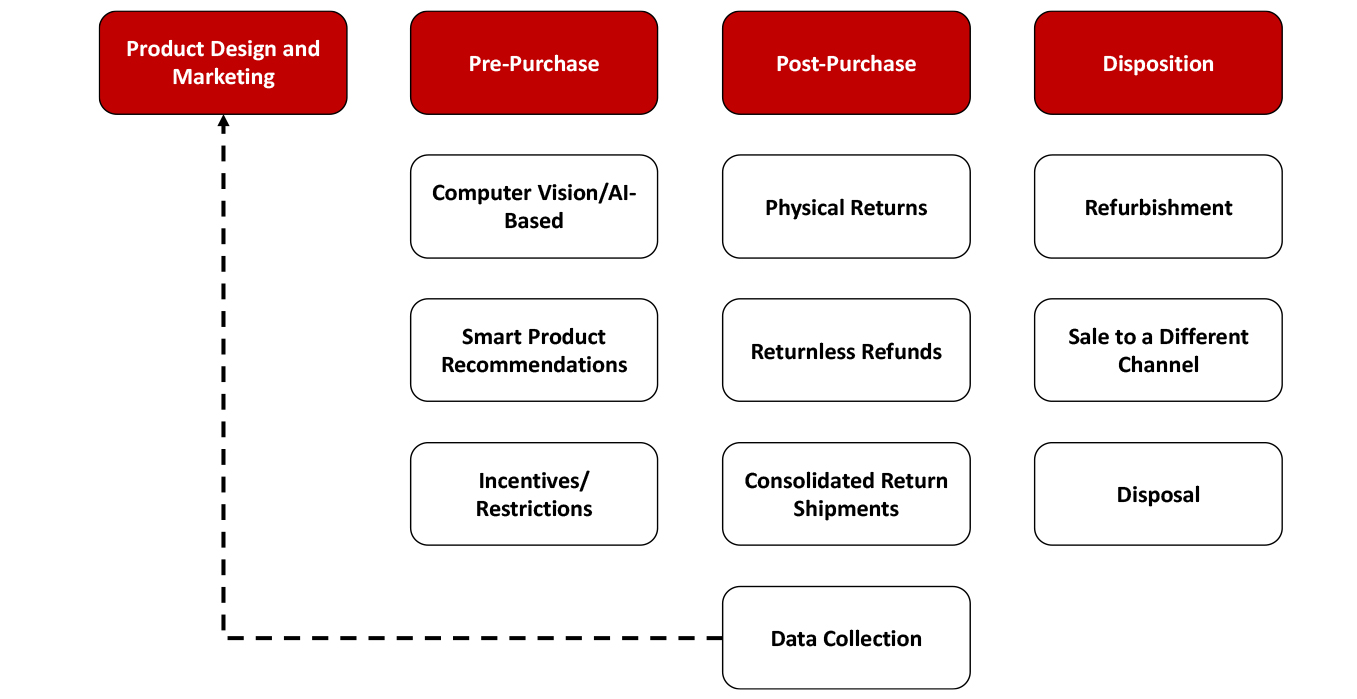

Figure 4. Retailer Options for Minimizing the Impact of Returns [caption id="attachment_140833" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Preventing Returns (Pre-Purchase Activities)

The best way to avoid and minimize returns and their financial and environmental impacts is to prevent them in the first place. Data from returns can be fed back into product design or manufacturing or marketing to reduce returns: for example, if the majority of returns of a garment deriving from a specific size could indicate a manufacturing issue, or if the majority of returns are for a specific style or color, then the product could be redesigned or fewer quantities ordered. Technology such as AI (artificial intelligence) helps retailers understand consumer preferences and make smart product recommendations that are more likely to please the customer and lead to fewer returns.

Sizing is one of the most frequent reasons for apparel and footwear returns, and a lack of clarity on sizing—where sizes can vary across brands or even within a single brand—leads many consumers to purchase the same item in a variety of sizes and return all but the one item that fits, exacerbating the returns problem. There are several technologies that retailers can implement to help ensure that shoppers are confident in only buying items that will fit. AI can help determine a customer’s body type and their preferences in terms of a normal, tight or loose fit, and can make recommendations on sizes. Moreover, mobile apps can leverage built-in smartphone cameras to scan the consumer’s body to create a complete 3D body map, which can be coordinated with information from the manufacturer to help improve fit.

Retailers can also offer incentives to prevent returns entirely. Jet.com (acquired and absorbed by Walmart) offered modest discounts to consumers on items when they waived their return privileges. Retailers’ handling of returns varies widely, ranging from automatically offering refunds to categorically refusing all returns.

Mitigating Returns (Post-Purchase Activities)

Once the consumer has committed to making a return, there are measures that a retailer can take to minimize the environmental and financial impacts of how it receives returns—for example, by consolidating return shipments. Returns platforms can determine the optimal means and location of return, and whether it makes better financial sense to accept an item for return at all.

If the shipping, repackaging and restocking costs exceed the sale price of an item, then the retailer can issue a return-less refund to the consumer, and it is left to the consumer as to how to dispose of the item.

If the retailer does elect to take the item back, then there are several options regarding the location and means of the return. If a retailer offers pickup, then it may have to provide an additional shipping box for repackaging the return.

If the consumer is willing or is required to drop off the item, they may do so at one of the retailer’s physical stores (BORIS—buy online, return in store), at a drop-off location such as a UPS or FedEx location, or even at the mall (BORIM—buy online, return in mall). US department store retailer Kohl’s has an innovative agreement with e-commerce giant Amazon, whereby consumers can drop off returns of Amazon orders at Kohl’s stores, which drives traffic for the store. (Amazon also accepts returns at its own stores, including bookstores, Whole Foods Markets and even certain Amazon distribution centers.)

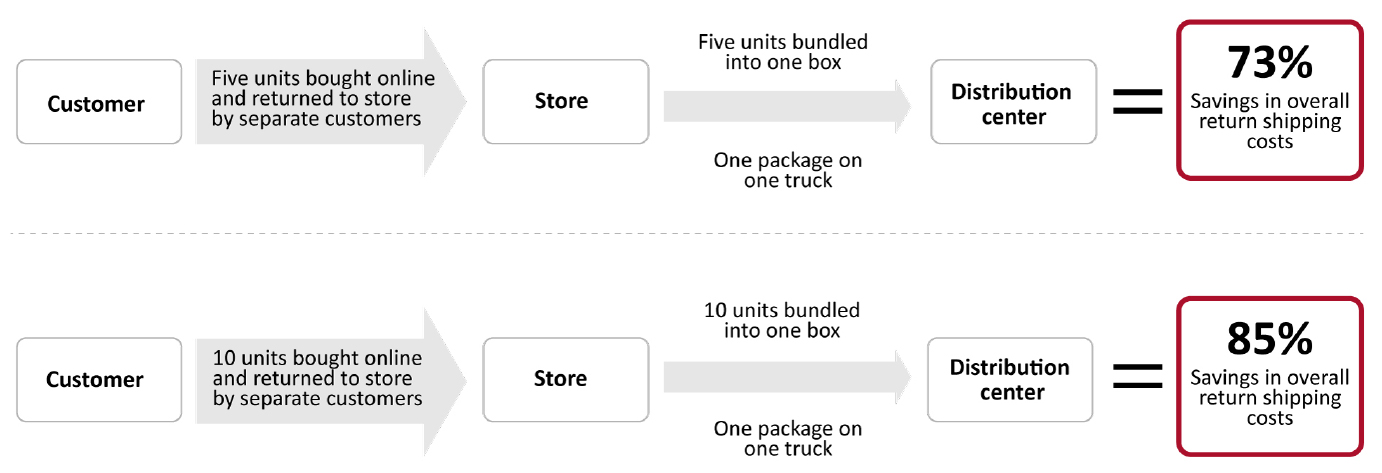

BORIS offers potentially large savings as items are bundled together for shipment to the returns facility, rather than having a large number of one-off shipments. A study by real estate investment trust Simon Property Group in 2021 found a 73% reduction in overall return shipping costs when bundling five units in one box, and the saving rises to 85% for 10 items, as illustrated in Figure 5.

Source: Coresight Research[/caption]

Preventing Returns (Pre-Purchase Activities)

The best way to avoid and minimize returns and their financial and environmental impacts is to prevent them in the first place. Data from returns can be fed back into product design or manufacturing or marketing to reduce returns: for example, if the majority of returns of a garment deriving from a specific size could indicate a manufacturing issue, or if the majority of returns are for a specific style or color, then the product could be redesigned or fewer quantities ordered. Technology such as AI (artificial intelligence) helps retailers understand consumer preferences and make smart product recommendations that are more likely to please the customer and lead to fewer returns.

Sizing is one of the most frequent reasons for apparel and footwear returns, and a lack of clarity on sizing—where sizes can vary across brands or even within a single brand—leads many consumers to purchase the same item in a variety of sizes and return all but the one item that fits, exacerbating the returns problem. There are several technologies that retailers can implement to help ensure that shoppers are confident in only buying items that will fit. AI can help determine a customer’s body type and their preferences in terms of a normal, tight or loose fit, and can make recommendations on sizes. Moreover, mobile apps can leverage built-in smartphone cameras to scan the consumer’s body to create a complete 3D body map, which can be coordinated with information from the manufacturer to help improve fit.

Retailers can also offer incentives to prevent returns entirely. Jet.com (acquired and absorbed by Walmart) offered modest discounts to consumers on items when they waived their return privileges. Retailers’ handling of returns varies widely, ranging from automatically offering refunds to categorically refusing all returns.

Mitigating Returns (Post-Purchase Activities)

Once the consumer has committed to making a return, there are measures that a retailer can take to minimize the environmental and financial impacts of how it receives returns—for example, by consolidating return shipments. Returns platforms can determine the optimal means and location of return, and whether it makes better financial sense to accept an item for return at all.

If the shipping, repackaging and restocking costs exceed the sale price of an item, then the retailer can issue a return-less refund to the consumer, and it is left to the consumer as to how to dispose of the item.

If the retailer does elect to take the item back, then there are several options regarding the location and means of the return. If a retailer offers pickup, then it may have to provide an additional shipping box for repackaging the return.

If the consumer is willing or is required to drop off the item, they may do so at one of the retailer’s physical stores (BORIS—buy online, return in store), at a drop-off location such as a UPS or FedEx location, or even at the mall (BORIM—buy online, return in mall). US department store retailer Kohl’s has an innovative agreement with e-commerce giant Amazon, whereby consumers can drop off returns of Amazon orders at Kohl’s stores, which drives traffic for the store. (Amazon also accepts returns at its own stores, including bookstores, Whole Foods Markets and even certain Amazon distribution centers.)

BORIS offers potentially large savings as items are bundled together for shipment to the returns facility, rather than having a large number of one-off shipments. A study by real estate investment trust Simon Property Group in 2021 found a 73% reduction in overall return shipping costs when bundling five units in one box, and the saving rises to 85% for 10 items, as illustrated in Figure 5.

Figure 5. BORIS: Savings in Overall Return Shipping Costs [caption id="attachment_140834" align="aligncenter" width="700"]

Source: Simon Property Group[/caption]

Analyzing returns data is another element in preventing and reducing returns. Retailers can use analytics and AI to review returns data and product reviews to find patterns in returns that can help them eliminate or reduce returns. For example, if a customer returned an item but then purchased the same item in another size and did not make a return, this could indicate a sizing issue; a large number of returns plus negative consumer reviews could indicate a product quality issue, which could be fed back into designing the next generation of product.

Reporting Returns for Retailers and Rental/Resale Companies

There is an opportunity for retailers to disclose how they minimize returns, particularly how they manage them, particularly with regard to sustainability. Although reporting returns is uncomfortable for retailers and could possibly offer intelligence to competitors, reports of success in this area would be welcomed by green-minded consumers and ESG (environment, social and governance)-focused investors. Consumers purchasing sustainable products, or products whose provenance has been documented feel like they are benefiting the environment when making a purchase, and retailers taking on the disclosure and handling of returns could be viewed as leaders within their industry.

There is an additional opportunity for resale and rental companies to measure and report on their sustainability activities, for example, their energy and water usage or carbon output.

Source: Simon Property Group[/caption]

Analyzing returns data is another element in preventing and reducing returns. Retailers can use analytics and AI to review returns data and product reviews to find patterns in returns that can help them eliminate or reduce returns. For example, if a customer returned an item but then purchased the same item in another size and did not make a return, this could indicate a sizing issue; a large number of returns plus negative consumer reviews could indicate a product quality issue, which could be fed back into designing the next generation of product.

Reporting Returns for Retailers and Rental/Resale Companies

There is an opportunity for retailers to disclose how they minimize returns, particularly how they manage them, particularly with regard to sustainability. Although reporting returns is uncomfortable for retailers and could possibly offer intelligence to competitors, reports of success in this area would be welcomed by green-minded consumers and ESG (environment, social and governance)-focused investors. Consumers purchasing sustainable products, or products whose provenance has been documented feel like they are benefiting the environment when making a purchase, and retailers taking on the disclosure and handling of returns could be viewed as leaders within their industry.

There is an additional opportunity for resale and rental companies to measure and report on their sustainability activities, for example, their energy and water usage or carbon output.

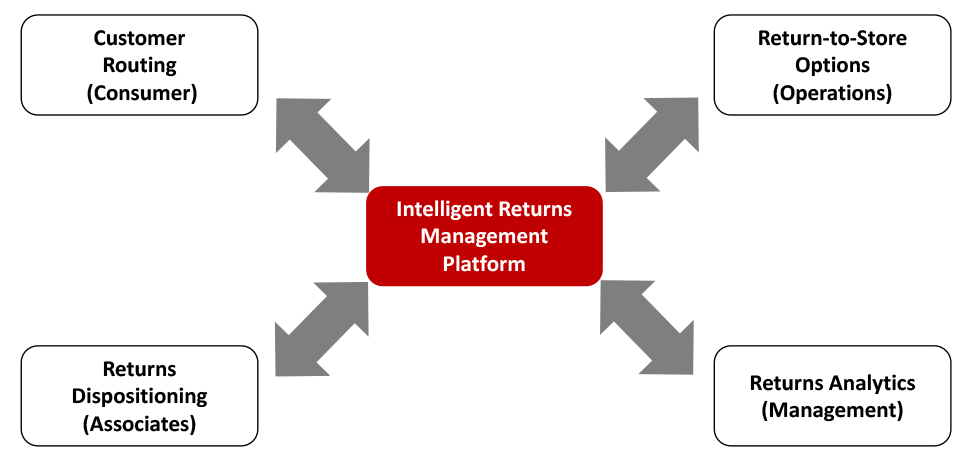

SAP Intelligent Returns Management Platform

In September 2021, SAP launched its Intelligent Returns Management Platform, which forms a key pillar of the company’s retail portfolio. The solution aims to guide products across the entire journey, from customers’ hands to the steps of their final disposition, maximizing the customer experience and margins throughout the entire journey. The entry of an established global technology provider such as SAP into the returns-management segment is likely to reassure retailers who might be reluctant to risk their business on the solution of a startup or less-established company. The platform uses data to recommend returns options for consumers that optimize the customer experience while minimizing value leakage for retailers, providing end-to-end visibility into the returns process, according to SAP. The platform operates at the intersection of the retailer’s ERP platform and SAP’s Industry Cloud and offers benefits for brands and fashion retailers. SAP’s platform builds on other sustainability solutions and software, including reporting, climate change, circular economy and social responsibility. For example, the company demonstrated an ordering platform in partnership with automaker Porsche in which the consumer was able to select delivery and interior materials based on their estimated carbon footprint. In contrast to other companies’ offerings of return solutions primarily focused on the consumer experience, SAP’s solution integrates seamlessly with its inventory and finance platforms with a major focus on sustainability. Platform Overview SAP’s platform aims to offer three main categories of benefits to users:- Guiding customers through a smooth and transparent return experience, offering an intuitive, fluid experience that keeps the customer updated throughout the entire process to improve customer retention and maintain a strong connection with the retailer

- Offering the optimal disposition for returned products, such as carbon-friendly returns options, and minimizing the amount of product that is disposed of in landfills

- Understanding the root causes of returns and determining corrective actions to reduce returns, such as optimizing assortments and pricing

Figure 6. SAP Intelligent Returns Management Platform: Key Features and Where They Apply [caption id="attachment_140835" align="aligncenter" width="700"]

Source: Company reports[/caption]

Customer Routing

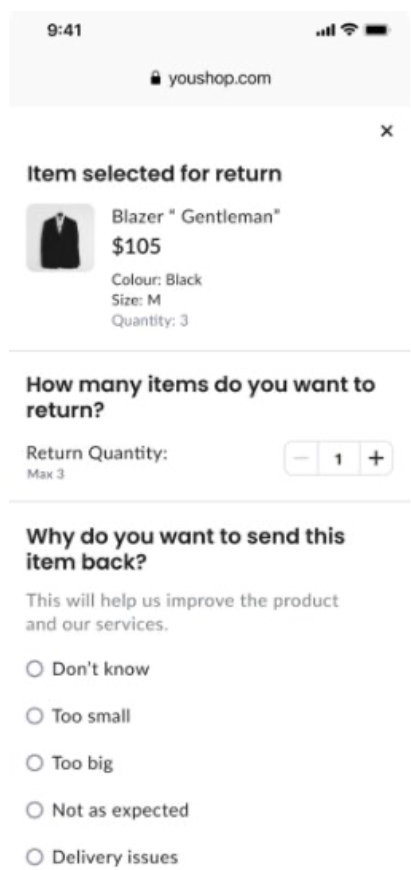

The platform offers a smooth returns process to improve customer retention and connection with the brand. It can offer suggestions for the return method, such as pickup, drop-off at a shipper or physical store to offer the optimal performance in terms of margin impact and sustainability. The image below shows a customer-friendly returns page, which collects data on the reason for return, which can be used in product design or marketing. For example, frequent returns of an item not caused by sizing could indicate an issue with its presentation on a retailer’s ecommerce site.

[caption id="attachment_140836" align="aligncenter" width="227"]

Source: Company reports[/caption]

Customer Routing

The platform offers a smooth returns process to improve customer retention and connection with the brand. It can offer suggestions for the return method, such as pickup, drop-off at a shipper or physical store to offer the optimal performance in terms of margin impact and sustainability. The image below shows a customer-friendly returns page, which collects data on the reason for return, which can be used in product design or marketing. For example, frequent returns of an item not caused by sizing could indicate an issue with its presentation on a retailer’s ecommerce site.

[caption id="attachment_140836" align="aligncenter" width="227"] Sample consumer return page

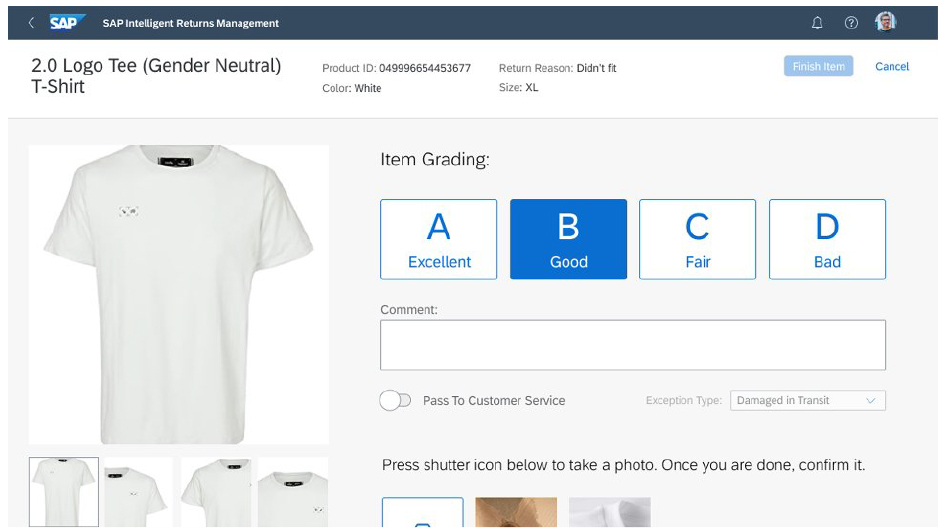

Sample consumer return page Source: Company reports [/caption] Return-to-store options The platform initiates processes to capture returns, confirming and initiating the optimal routing flow, while also driving incentives for creating new sales opportunities. Returns dispositioning The platform enables warehouse associates to manage returned goods in real time to enhance productivity and consistency, while optimizing dispositioning to limit value leakage. Returns analytics The platform’s built-in analytics engine provides visibility into the returns process, tracks key performance indicators and informs the sales funnel about emerging returns trends. The image below shows an example dashboard on the platform to process a returned item. [caption id="attachment_140837" align="aligncenter" width="700"]

Sample consumer return page

Sample consumer return page Source: Company reports [/caption] SAP: Company Overview SAP SE, founded in 1972, is a leading global provider of enterprise software, with market leadership in enterprise application software, including enterprise resource planning (ERP), supply chain management, data integration and quality, as well as master data management. The company aims to promote digital transformation in omnichannel retail through enabling commerce everywhere, improving convenience, boosting personalization and enhancing sustainability. SAP’s retail-specific products manage retail marketing and customer experience, merchandising, sourcing and procurement, supply chain and omnichannel and store operations.

What We Think

The combination of steadily increasing e-commerce penetration combined with higher returns rates for e-commerce escalates the importance of returns for retailers. Moreover, retailers must increasingly need to importance on sustainability to meet consumer demand for environmental consideration and transparency; returns pose a critical sustainability challenge. Returns affect nearly all aspects of a retailer’s operations, from product design to supply chain processes to customer satisfaction and loyalty. The broad scope and complexity of the returns issue requires a comprehensive solution that connects the manufacturing, supply chain and customer data functions for a retailer; AI-based solutions excel at automatically finding relationships among data in these functions to generate actionable insights. Implications for Brands/Retailers- Brands and retailers would be well served to find a platform to help mitigate the cost and frequency of returns, which are only likely to increase over time as e-commerce penetration grows.

- The issue of returns management is more pressing for apparel brands and retailers, which can address high returns rates through AI-based tools and smartphone apps that manage sizing, for example.

- Brands and retailers need to consider the effects of returns policies on customer acquisition and retention; they can offer membership program benefits related to returns (such as free returns) to enhance loyalty.

- Consumers’ increasing demands for sustainability adds urgency to managing returns and their environmental impacts. Retailers can demonstrate their leadership in pursuing responsible business practices through disclosing returns sustainability and handling data, and these KPIs can become industry standards for reporting sustainability.