Introduction

India reported its first case of the coronavirus on January 30, 2020. The virus appears to have subsequently spread more slowly in India than in other countries. Shortly after the World Health Organization (WHO) classified the Covid-19 outbreak as a pandemic, India implemented a full nationwide lockdown on March 25, when about 530 cases had been reported.

The Indian government put a number of travel and other restrictions in place in the weeks leading up to the lockdown; read about these in our earlier report

here.

The lockdown, which was initially set to be lifted on April 14, was extended to May 3 in light of the increasing spread of the coronavirus in India—albeit at a slower pace compared to other countries, such as Italy and the US. It was further extended to May 17 but with relaxations in some parts of India that reported fewer cases.

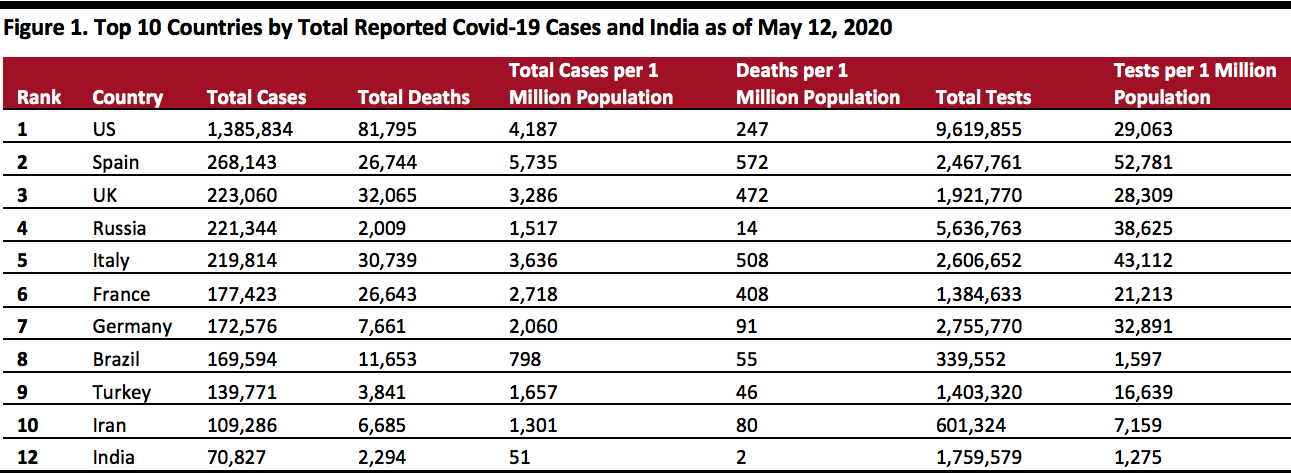

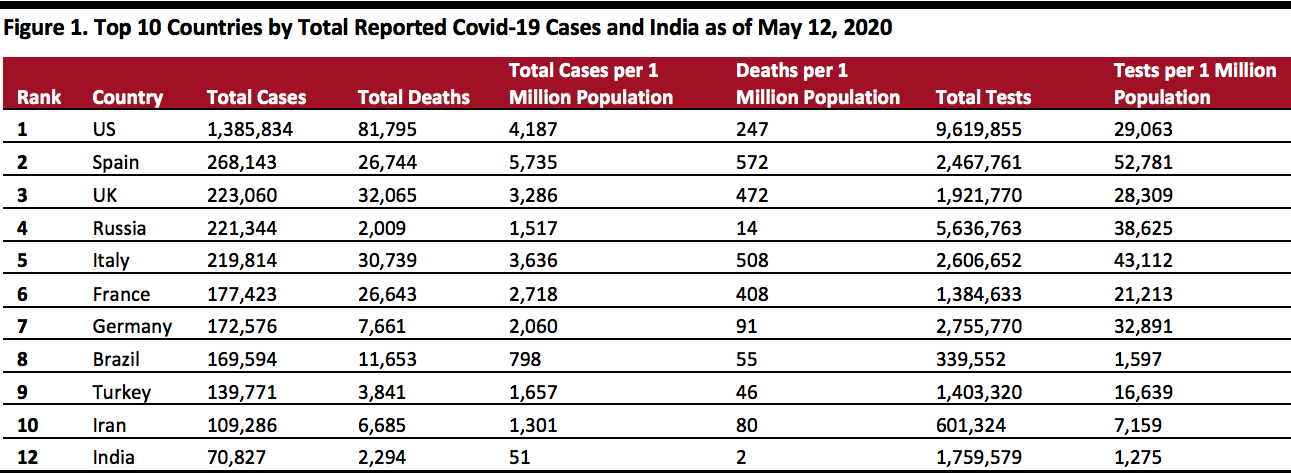

As of May 12, the country had seen 70,827 total cases and 2,294 deaths, according to the Ministry of Health and Family Welfare (shown in Figure 1).

[caption id="attachment_109532" align="aligncenter" width="700"]

Source: Ministry of Health and Family Welfare, Government of India/Worldometer

Source: Ministry of Health and Family Welfare, Government of India/Worldometer[/caption]

The slower spread of the coronavirus in India can be partially attributed to the restrictive measures that the Indian government imposed, which include the following:

- A ban on people leaving their homes, except for buying groceries or accessing essential services at certain times during the day.

- A ban on all social and religious gatherings in public.

- A ban on the movement of all vehicles, including goods transport vehicles and vehicles for other services such as food delivery. The government relaxed this measure for certain industries after a few days of imposing the lockdown, allowing the movement of some goods vehicles and food and grocery delivery personnel.

- The closure of all nonessential businesses, such as apparel stores, malls, cinemas, gyms and restaurants.

- Requirements for offices to enforce a work-from-home policy.

On April 15, the government set out further guidelines for the extended lockdown period. While it relaxed some measures—such as allowing interstate movement of goods vehicles and allowing some industries to function—the country largely remains on lockdown as of May 12, and this will have wide-ranging impacts on sectors within India, including retail.

The Crisis in Context: The Retail Sector’s Share of GDP and Employment in India

The Indian retail sector accounts for approximately 10% of national GDP, as per the latest figures from the Ministry of Statistics and Programme Implementation, released in January 2020. In gross value-added terms, this translates to around $2.7 trillion. Some 8% of India’s workforce is employed in the retail sector, according to the India Brand Equity Foundation, which is equivalent to around 40–50 million people, according to data from the Retailers Association of India (RAI).

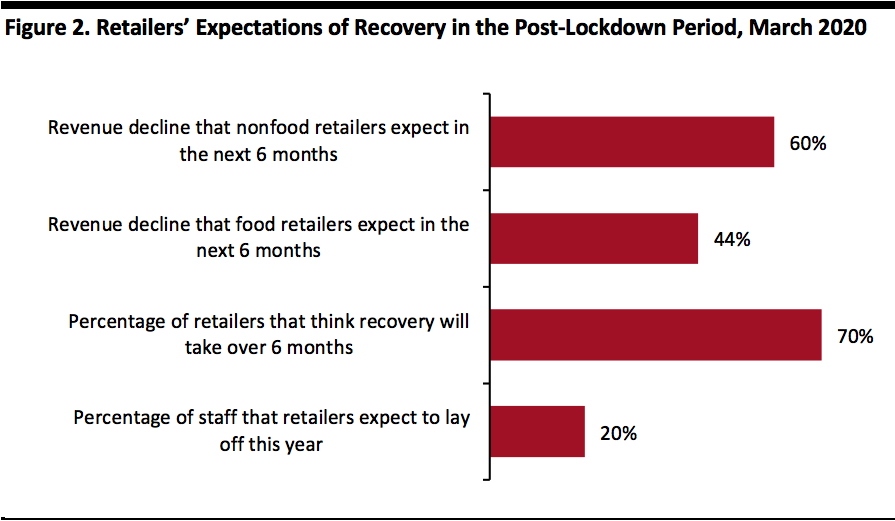

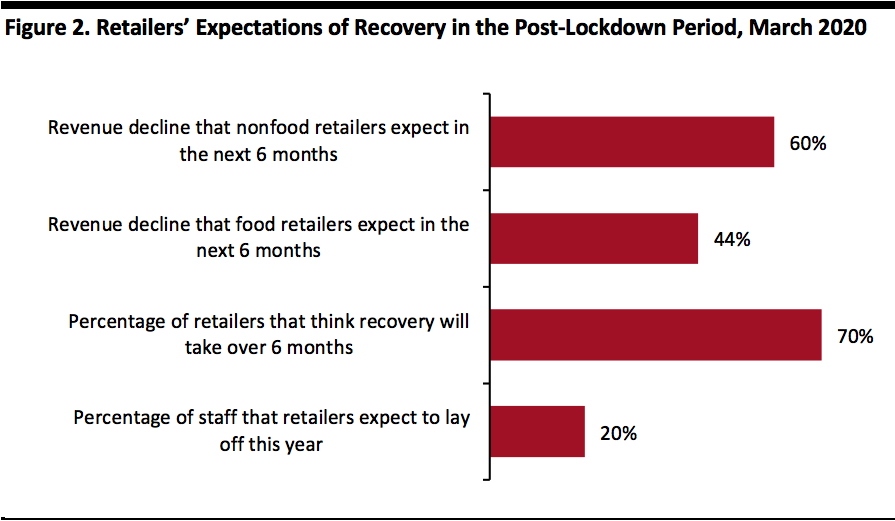

In late March 2020, RAI conducted a survey of 768 retailers of all sizes that sell essential and nonessential items, to measure the impact of the coronavirus on the retail sector and the expectations for recovery. We outline some of the key findings below:

- Nonfood retailers expect their revenues to fall by 60% compared to last year, while food retailers expect their revenues to fall by 44% as they also run some nonfood stores and sell nonfood items as part of their assortment.

- Around 70% of retailers surveyed expect their businesses to recover after six months, but around 20% of retailers are more pessimistic, expecting recovery to take over a year. Overall, 80% said they do not expect to earn any profits until August this year.

- On average, retailers expect to lay off at least 20% of their workforce in order to cope with the disruption brought on by the coronavirus lockdown—although the range sees large retailers expecting to lay off 5% while small retailers expect to lay off up to 30% of their workforce.

[caption id="attachment_109533" align="aligncenter" width="580"]

Source: RAI

Source: RAI[/caption]

As a significant proportion of business costs in retail are fixed, retailers in India have requested stimulus measures and concessions from the government, such as:

- A waiver in rents.

- Support to pay employee wages and salaries.

- A waiver in utility charges and fees.

- Relief on tax and loan payments.

So far, the government has offered several concessions to businesses in India, including extensions in deadlines to file taxes, deferment in loan interest payments and an extension in furnishing compliance documents for businesses.

While these measures provide limited relief to businesses, the Indian commerce industry awaits further stimulus from the government to help it battle the growing financial strain.

In the meantime, retail businesses across India have adapted to the situation in various ways.

How India’s Retail Sector Has Responded to the Lockdown

Grocery retail in India is a high-growth sector, but food retailers have had to pivot quickly to serve the market during the coronavirus crisis. While nonfood retailers have been forced to temporarily shut down, they have explored ways to keep their customers engaged. We outline below the different ways in which the retail sector has responded to lockdown measures.

Innovative Channels and Partnerships Underline Food Retailers’ Response

Stores that sell essential items have been allowed to remain open, and the government has encouraged consumers to use retailers’ home-delivery services in order to uphold social-distancing measures.

- Taking orders by phone: Brick-and-mortar grocery retailer Big Bazaar is one of the largest grocery chains in India. It began selling products online in late April 2020 (on mobile devices only). Before the lockdown, the retailer had partnered with Amazon to sell on its marketplace platform and offer two-hour delivery through Amazon Prime Now in four metro cities. To reach more customers through the lockdown period, Big Bazaar began taking orders by phone for doorstep delivery across several cities. Customers place orders by calling or WhatsApp messaging their local Big Bazaar stores and make payment on delivery.

- Partnering with ride-sharing firms and food aggregators: The vehicle fleets and drivers of Uber, bike-sharing provider Rapido, and food aggregators Swiggy and Zomato had been idle since the lockdown began. Grocery retailers—such as Bigbasket, Big Bazaar and Spencer’s Retail—needed the additional last-mile delivery capacity due to surging online orders. Partnerships were therefore formed that allowed the retailers to reach more customers by leveraging the fleets of ride-sharing firms and food aggregators.

- Hiring workers from other industries: Online grocery retailer Grofers reported in a blog post on April 7, 2020 that it was seeing increased demand—with daily traffic of 1.5 million people on its app—but it was able to serve only 12.5% of customers due to an insufficient workforce. In order to rapidly increase capacity, Grofers began hiring workers laid off from the textiles and manufacturing industries.

- Leveraging retailers’ own transportation: The grocery supply chain was disrupted during lockdown, with FMCG companies unable to deliver goods to warehouses on time. Grofers therefore sent its own trucks to the FMCG warehouses to transport goods to its warehouses, in order to meet demand.

- Enabling contactless delivery: Cash on delivery is a popular payment method for orders placed online in India. However, many home-delivery providers have removed this option to restrict services to contactless delivery, requiring customers to prepay for their orders online.

- Partnering with Resident Welfare Associations (RWAs): Grofers and Spencer’s Retail each partnered with RWAs to enable the delivery of orders in bulk to gated communities and housing complexes. This strategy increases delivery capacity, which is particularly beneficial as a lower number of individual delivery persons are operating, due to the government’s restrictions.

Nonfood Retailers Look To Keep Customers Connected with Creative Engagement Strategies

Retailers of nonessential items, such as apparel retailers and department stores, have been making efforts to remain engaged with their customers through digital channels, as their physical stores remain shut.

- Games and videos: Myntra, an online fashion platform, is keeping customers engaged with in-app games and video content, featuring celebrity stylists. The website also features a digital reality show that identifies fashion influencers, called Myntra Fashion Superstar, which is hosted by Indian actor Sonakshi Sinha.

- Pivot to selling or highlighting essential items: Online beauty retailer Nykaa has highlighted its assortment of daily-use personal care essentials (such as shampoos, body washes, hand washes and sanitizers) and began selling face masks through the lockdown period. Myntra pivoted to selling protective face masks and highlighting its personal care and skincare items as these are categorized as essential items.

- Buy now, receive later: Several retailers—including Lifestyle, Peachmode, Shoppers Stop and Tjori—are accepting online orders that are prepaid with the caveat that they will deliver only once lockdown restrictions are lifted, in a push to drive revenue during store shutdowns.

Despite implementing these measures to keep consumers engaged, nonessential retailers will still experience a significant drop in revenues as they have had to suspend business for several weeks.

Recovery May Take Longer Than Expected and May Not Be Smooth

We expect the retail sector in India to see an overall significant drop in revenues due to the coronavirus crisis, and there are several challenges that may need to be overcome on its path to recovery.

- The supply chain may not work as efficiently as before: Manufacturing businesses across industries have been closed since March 25, although a phased relaxation on restrictions for some businesses came into effect from April 15. In the recovery period, manufacturers may not be able to provide buyers with the same capacity as before the lockdown, and with some smaller businesses unlikely to survive the downturn, supply could be severely impacted.

- Workers that returned home may need to travel back to work: Large numbers of workers that migrate to cities and towns for work returned home during the lockdown. Until public transport returns to normal, these workers may not be able to travel to resume their roles, impacting the capacity of retailers.

- Impacted ancillary businesses may be inundated with backlogs: Once restrictions are eased, ancillary businesses such as logistics and warehousing services providers will need to clear the backlog of deliveries that were suspended during the lockdown before serving new business.

- Shoppers may want to spend on staples rather than discretionary items: As many jobs were suspended or lost due to the coronavirus crisis, consumer and household incomes may have been hit hard. Shoppers may therefore reduce their outgoings and choose to allocate more of their spending to staple items rather than discretionary products in the initial months after the lockdown is lifted.

- Shoppers will be wary of shopping at stores and malls: Until the threat of the virus is reduced, shoppers will be wary of shopping at physical retail stores and malls as this will put them in close proximity to people. With lower footfall, retailers that heavily rely on in-store touchpoints for conversions may experience a slower recovery than other retailers.

What Retailers Can Do To Tide Them Over during the Recovery Period and Emerge Stronger

Retailers continue to be burdened by sustained store closures and lack of revenues. This situation means that it is important for retailers to examine several cost areas, cut those that are giving little return on investment and redirect resources to areas that look profitable.

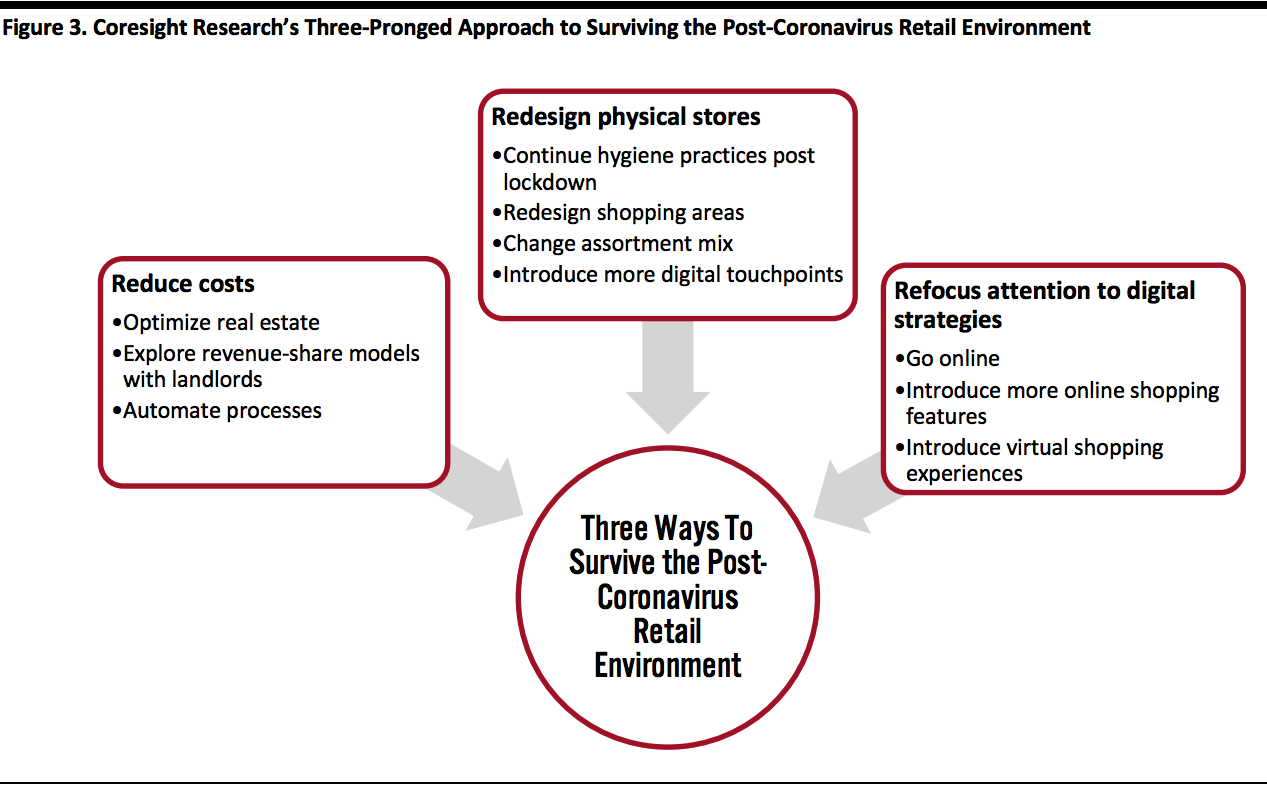

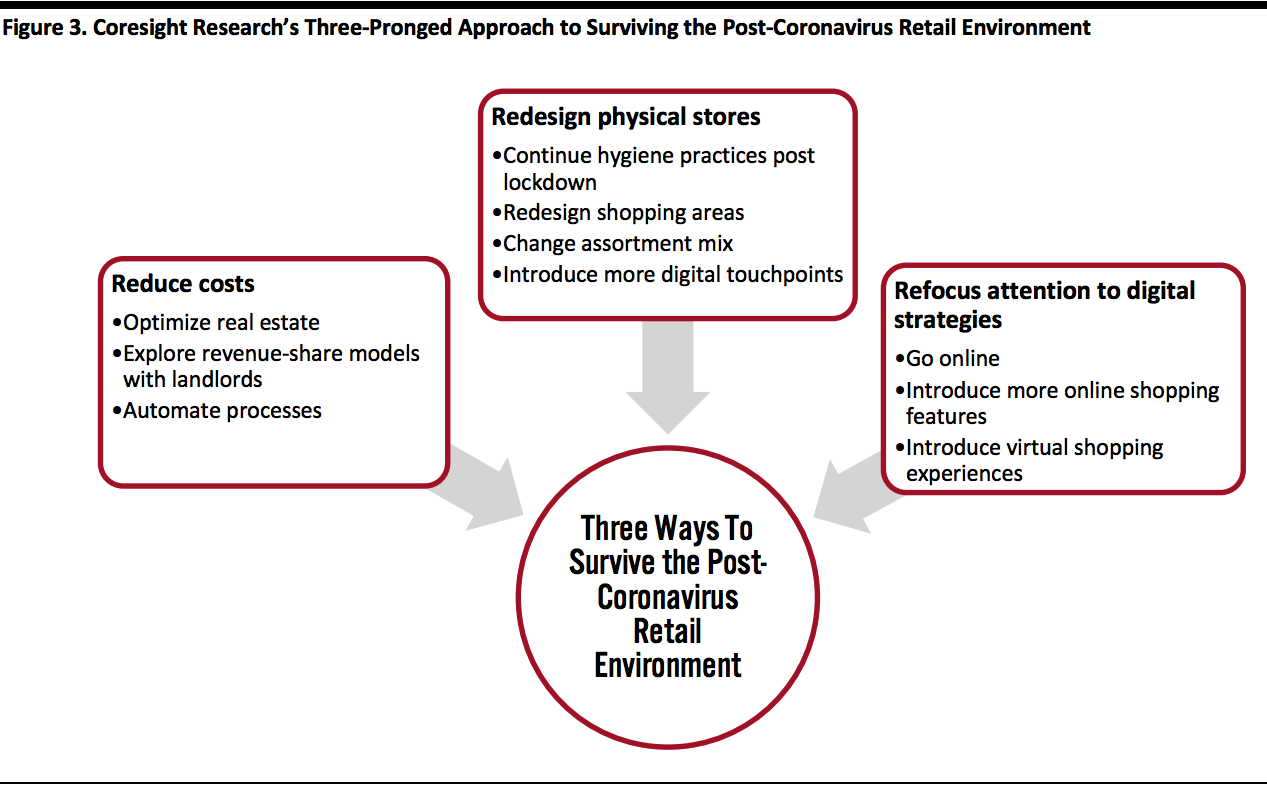

We present a three-pronged approach for retailers to prepare for the new normal post Covid-19, which comprises three actions: reducing costs, redesigning physical stores and refocusing attention to digital strategies.

[caption id="attachment_109534" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

1. Reduce Costs

Optimize real estate: As stores may not see traffic return to pre-lockdown levels immediately or even for several months, retailers must examine their store portfolio and identify stores that are burning the most cash with little return. Closing these stores will automatically cut out some fixed costs, such as rent and salaries, and help retailers to save cash that they can redirect to other critical areas.

Explore revenue-share models with landlords: Retailers could consider a revenue-share model with their landlords as a solution to manage the recurring rental costs. As stores will take time to return to profitability, this could be a way for retailers to subjugate disproportionate costs.

Automate processes: Retailers could look to automate some processes, which could save on recurring expenses. For example, self-checkout technology, which is popular in grocery retail stores in the West, is available at only a handful of stores in India. Similarly, very few retailers use real-time on-shelf monitoring to restock inventory and tend to rely instead on human personnel to ensure timely restocking. Although requiring initial investment, adopting these new technologies should help retailers to cut down on some recurring expenses over the medium and long term.

2. Redesign physical stores

Continue safety and hygiene practices post-lockdown: To allay consumers’ safety concerns in the shopping environment, retailers must continue with the hygiene practices they adopted during the Covid-19 outbreak. Equipping staff with protective material, encouraging social distancing among employees and customers, and keeping shelves and other areas sanitized will re-instill shoppers’ faith in the safety of the shopping environment.

Redesign shopping areas to be more spacious: Retailers could widen aisles to enable social distancing. They could also change the way in which products are displayed to use less space-consuming layouts—for example, displaying items against walls in apparel stores rather than using the center of the store.

Change the assortment mix: As many consumers may have experienced job losses or otherwise reduced incomes due to the lockdown, they may be inclined to spend more on staple items and less on discretionary items. This will likely determine how they shop for discretionary items, leading shoppers to seek lower- or mid-priced options when they previously sought higher-priced options. Retailers could offer more affordable items up front or in high-traffic areas to drive conversion.

Introduce more digital touchpoints: Retailers could install more digital touchpoints within stores, such as endless aisle screens, self-checkout stations and contactless payments options so that customers are less reliant on store staff for information or assistance. However, retailers would need to sanitize the screens, touchpads and buttons regularly to ensure hygiene and safety.

3. Refocus attention to digital strategies

Go online or revamp e-commerce sites: Retailers that do not yet sell online will need to pivot to e-commerce to be able to survive, either by launching their own sites or by selling on marketplace platforms. Retailers that already have an online presence may need to revamp their sites to handle more traffic, reduce friction through the shopping journey or increase mobile friendliness.

Introduce more online shopping features: Retailers will need to make online shopping more attractive or convenient to encourage return business. They could do this by introducing more delivery or pickup choices, greater shipping options, extended returns windows and pickup-from-home options, as well as by offering discounts or offers for digital customers.

Introduce virtual stores: Retailers can introduce virtual stores or create engaging augmented reality (AR) experiences to simulate the experience of shopping at physical stores. Burberry and H&M have each introduced an AR experience whereby shoppers can picture the retailers’ products within their own environment or on themselves using their smartphone cameras. Some Indian retailers, such as toys retailer Varnam and home décor retailers Fab Home and Deco Villa, already have virtual stores. More retailers could look to adopt this tehnology to connect with a wider shopper base.

What We Think

The Indian government has taken several drastic measures in its fight against the Covid-19 outbreak, and these seem to have paid off, as India has so far remained out of the top-10 list of countries with the most reported cases.

While these measures may have helped slow the spread of the coronavirus and limit the burden on India’s already strained healthcare system, the crisis has brought the economy to a standstill, resulting in millions of job losses and the widespread closure of several sectors. With the lockdown remaining in place for now, the business environment is uncertain, as the government is yet to clarify the measures that will be relaxed.

Retailers are already constrained by the loss of business they have suffered since the lockdown began and will need to brace for further declines brought about by changing consumer behavior. Retailers will also need to rely on other parties in their supply chain that are also affected by the lockdown and may not be able to return to “business as usual” immediately.

To prepare for the recovery period, retailers will need to re-examine their businesses and look closely at their cost structure and the channels they use to reach customers. They can look to our three-pronged approach to help trim costs, redesign their stores and enhance their digital experience in order to redirect resources and overcome this crisis.

Source: Ministry of Health and Family Welfare, Government of India/Worldometer[/caption]

The slower spread of the coronavirus in India can be partially attributed to the restrictive measures that the Indian government imposed, which include the following:

Source: Ministry of Health and Family Welfare, Government of India/Worldometer[/caption]

The slower spread of the coronavirus in India can be partially attributed to the restrictive measures that the Indian government imposed, which include the following:

Source: RAI[/caption]

As a significant proportion of business costs in retail are fixed, retailers in India have requested stimulus measures and concessions from the government, such as:

Source: RAI[/caption]

As a significant proportion of business costs in retail are fixed, retailers in India have requested stimulus measures and concessions from the government, such as:

Source: Coresight Research[/caption]

1. Reduce Costs

Optimize real estate: As stores may not see traffic return to pre-lockdown levels immediately or even for several months, retailers must examine their store portfolio and identify stores that are burning the most cash with little return. Closing these stores will automatically cut out some fixed costs, such as rent and salaries, and help retailers to save cash that they can redirect to other critical areas.

Explore revenue-share models with landlords: Retailers could consider a revenue-share model with their landlords as a solution to manage the recurring rental costs. As stores will take time to return to profitability, this could be a way for retailers to subjugate disproportionate costs.

Automate processes: Retailers could look to automate some processes, which could save on recurring expenses. For example, self-checkout technology, which is popular in grocery retail stores in the West, is available at only a handful of stores in India. Similarly, very few retailers use real-time on-shelf monitoring to restock inventory and tend to rely instead on human personnel to ensure timely restocking. Although requiring initial investment, adopting these new technologies should help retailers to cut down on some recurring expenses over the medium and long term.

2. Redesign physical stores

Continue safety and hygiene practices post-lockdown: To allay consumers’ safety concerns in the shopping environment, retailers must continue with the hygiene practices they adopted during the Covid-19 outbreak. Equipping staff with protective material, encouraging social distancing among employees and customers, and keeping shelves and other areas sanitized will re-instill shoppers’ faith in the safety of the shopping environment.

Redesign shopping areas to be more spacious: Retailers could widen aisles to enable social distancing. They could also change the way in which products are displayed to use less space-consuming layouts—for example, displaying items against walls in apparel stores rather than using the center of the store.

Change the assortment mix: As many consumers may have experienced job losses or otherwise reduced incomes due to the lockdown, they may be inclined to spend more on staple items and less on discretionary items. This will likely determine how they shop for discretionary items, leading shoppers to seek lower- or mid-priced options when they previously sought higher-priced options. Retailers could offer more affordable items up front or in high-traffic areas to drive conversion.

Introduce more digital touchpoints: Retailers could install more digital touchpoints within stores, such as endless aisle screens, self-checkout stations and contactless payments options so that customers are less reliant on store staff for information or assistance. However, retailers would need to sanitize the screens, touchpads and buttons regularly to ensure hygiene and safety.

3. Refocus attention to digital strategies

Go online or revamp e-commerce sites: Retailers that do not yet sell online will need to pivot to e-commerce to be able to survive, either by launching their own sites or by selling on marketplace platforms. Retailers that already have an online presence may need to revamp their sites to handle more traffic, reduce friction through the shopping journey or increase mobile friendliness.

Introduce more online shopping features: Retailers will need to make online shopping more attractive or convenient to encourage return business. They could do this by introducing more delivery or pickup choices, greater shipping options, extended returns windows and pickup-from-home options, as well as by offering discounts or offers for digital customers.

Introduce virtual stores: Retailers can introduce virtual stores or create engaging augmented reality (AR) experiences to simulate the experience of shopping at physical stores. Burberry and H&M have each introduced an AR experience whereby shoppers can picture the retailers’ products within their own environment or on themselves using their smartphone cameras. Some Indian retailers, such as toys retailer Varnam and home décor retailers Fab Home and Deco Villa, already have virtual stores. More retailers could look to adopt this tehnology to connect with a wider shopper base.

Source: Coresight Research[/caption]

1. Reduce Costs

Optimize real estate: As stores may not see traffic return to pre-lockdown levels immediately or even for several months, retailers must examine their store portfolio and identify stores that are burning the most cash with little return. Closing these stores will automatically cut out some fixed costs, such as rent and salaries, and help retailers to save cash that they can redirect to other critical areas.

Explore revenue-share models with landlords: Retailers could consider a revenue-share model with their landlords as a solution to manage the recurring rental costs. As stores will take time to return to profitability, this could be a way for retailers to subjugate disproportionate costs.

Automate processes: Retailers could look to automate some processes, which could save on recurring expenses. For example, self-checkout technology, which is popular in grocery retail stores in the West, is available at only a handful of stores in India. Similarly, very few retailers use real-time on-shelf monitoring to restock inventory and tend to rely instead on human personnel to ensure timely restocking. Although requiring initial investment, adopting these new technologies should help retailers to cut down on some recurring expenses over the medium and long term.

2. Redesign physical stores

Continue safety and hygiene practices post-lockdown: To allay consumers’ safety concerns in the shopping environment, retailers must continue with the hygiene practices they adopted during the Covid-19 outbreak. Equipping staff with protective material, encouraging social distancing among employees and customers, and keeping shelves and other areas sanitized will re-instill shoppers’ faith in the safety of the shopping environment.

Redesign shopping areas to be more spacious: Retailers could widen aisles to enable social distancing. They could also change the way in which products are displayed to use less space-consuming layouts—for example, displaying items against walls in apparel stores rather than using the center of the store.

Change the assortment mix: As many consumers may have experienced job losses or otherwise reduced incomes due to the lockdown, they may be inclined to spend more on staple items and less on discretionary items. This will likely determine how they shop for discretionary items, leading shoppers to seek lower- or mid-priced options when they previously sought higher-priced options. Retailers could offer more affordable items up front or in high-traffic areas to drive conversion.

Introduce more digital touchpoints: Retailers could install more digital touchpoints within stores, such as endless aisle screens, self-checkout stations and contactless payments options so that customers are less reliant on store staff for information or assistance. However, retailers would need to sanitize the screens, touchpads and buttons regularly to ensure hygiene and safety.

3. Refocus attention to digital strategies

Go online or revamp e-commerce sites: Retailers that do not yet sell online will need to pivot to e-commerce to be able to survive, either by launching their own sites or by selling on marketplace platforms. Retailers that already have an online presence may need to revamp their sites to handle more traffic, reduce friction through the shopping journey or increase mobile friendliness.

Introduce more online shopping features: Retailers will need to make online shopping more attractive or convenient to encourage return business. They could do this by introducing more delivery or pickup choices, greater shipping options, extended returns windows and pickup-from-home options, as well as by offering discounts or offers for digital customers.

Introduce virtual stores: Retailers can introduce virtual stores or create engaging augmented reality (AR) experiences to simulate the experience of shopping at physical stores. Burberry and H&M have each introduced an AR experience whereby shoppers can picture the retailers’ products within their own environment or on themselves using their smartphone cameras. Some Indian retailers, such as toys retailer Varnam and home décor retailers Fab Home and Deco Villa, already have virtual stores. More retailers could look to adopt this tehnology to connect with a wider shopper base.