DIpil Das

Introduction

What’s the Story? China has long been an important sourcing destination, earning itself the moniker of “the world’s factory.” Pandemic-led lockdowns and ensuing factory shutdowns, widely documented port congestion and sky-rocketing inflation, however, have revived the debate around sourcing diversification across nonfood categories, favoring the onshoring of sourcing and manufacturing to the US. In this report, we examine onshoring as a sourcing strategy for US brands and retailers and what it would take to bring sourcing to the US for categories such as apparel and footwear, furniture and furnishings, and other general-merchandise products. We also discuss nearshoring as an alternative approach. Why It Matters Businesses have long strived for sources with optimal competitive advantages and economies of scale—and sometimes an exclusive supply. The pandemic, however, highlighted that US businesses’ dependence on overseas suppliers is extremely risky and can lead to inventory delays and very high costs. Reconsidering a sourcing mix is not straightforward and requires thorough examination of myriad factors.- The US has historically been a net importer for several decades—pandemic-led disruptions have imposed tremendous costs on the nation, locking away supplier countries and congesting ports.

- Some 90.2% of US retailers faced disruptions to their supply chain—a greater share than businesses in other sectors, according to a September 2021 survey of US businesses conducted by the Federal Reserve Bank of Richmond. The high share means that US retail’s international supply network is deeply embedded and intertwined with sources in other nations—making it more challenging to bring manufacturing back to the US.

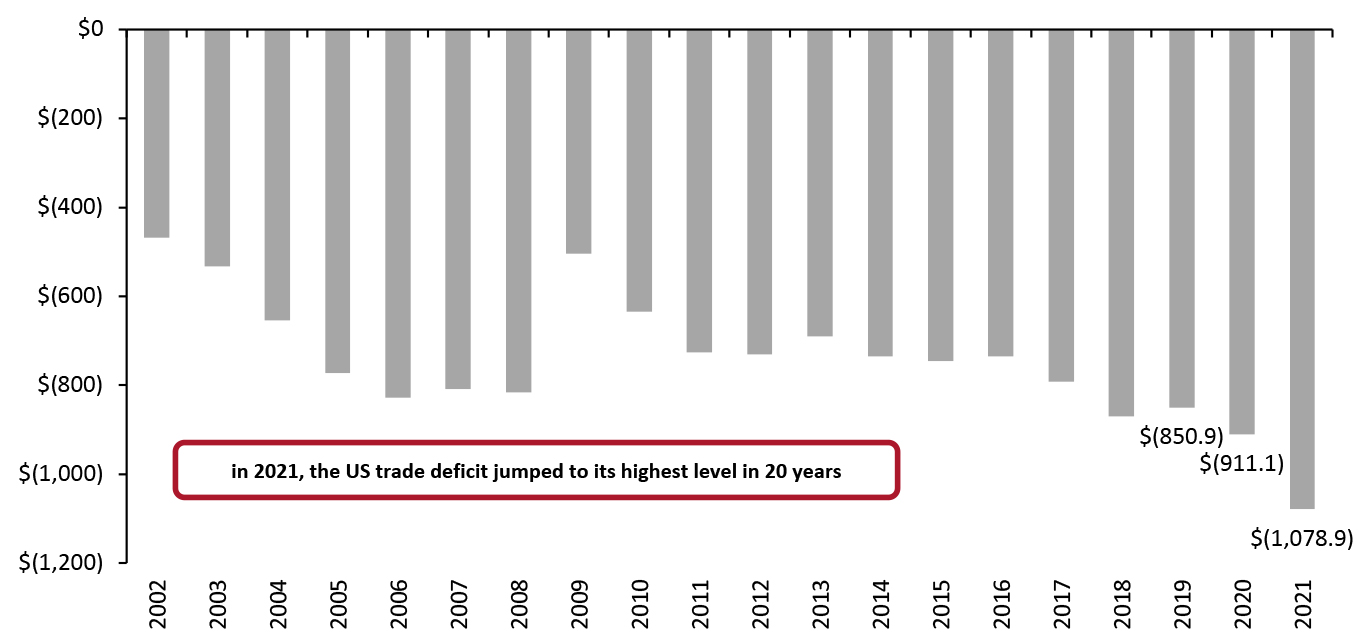

- US prospects on growing manufacturing quickly look bleak: its goods-trade balance (the difference between its goods imports and exports) has consistently been in deficit, exceeding $400 billion since 2002. It surpassed $1.0 trillion in 2021—the highest level in the last two decades, according to the US Census Bureau, as shown in Figure 1.

Figure 1. US Goods Trade Deficit (USD Bil.) [caption id="attachment_144784" align="aligncenter" width="700"]

Source: Census Bureau/Coresight Research[/caption]

Source: Census Bureau/Coresight Research[/caption]

Onshoring Retail Sourcing in the US: Coresight Research Analysis

Most brands and retailers use a combination of the three primary sourcing strategies: onshoring, nearshoring and regionalization. Onshoring sourcing in the US will allow brands and retailers to procure goods for sale from domestic manufacturers or set up in-country manufacturing units. Nearshoring comprises sourcing from markets close to the US, including Canada, Mexico and countries in Central America. Regionalization involves sourcing from countries close to the consumer market; for the US, this would look similar to nearshoring in practice. For US retailers selling outside the country, regionalization would mean sourcing closer to the markets where they sell. In this report, we focus on onshoring and nearshoring. 1. Onshoring Sourcing: Advantages While sourcing from China and other Far East locations presents several cost advantages—the major driver for brands and retailers using these sourcing destinations—supply chain disruptions over the past two years have led to price rises across the board. This may well offset some of the pricing disadvantages of manufacturing onshore, particularly when considered alongside the advantages of onshoring retail sourcing to the US, which we present below.- Reduced logistics costs

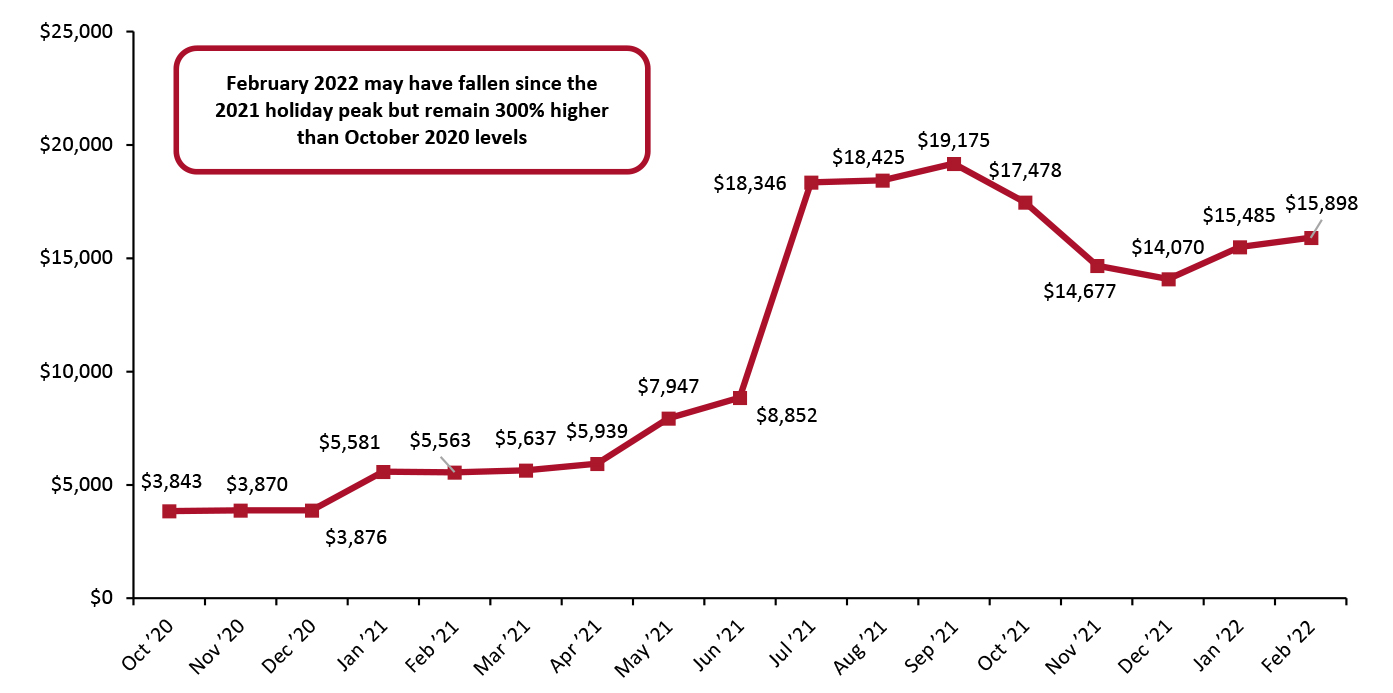

Figure 2. China/Eastern Asia to US West Coast: Average Weekly Freight Rate per Forty-Foot Container [caption id="attachment_144751" align="aligncenter" width="700"]

Source: FBX.com[/caption]

Source: FBX.com[/caption]

- Reduced lead to market times

- Reduced travel for quality control

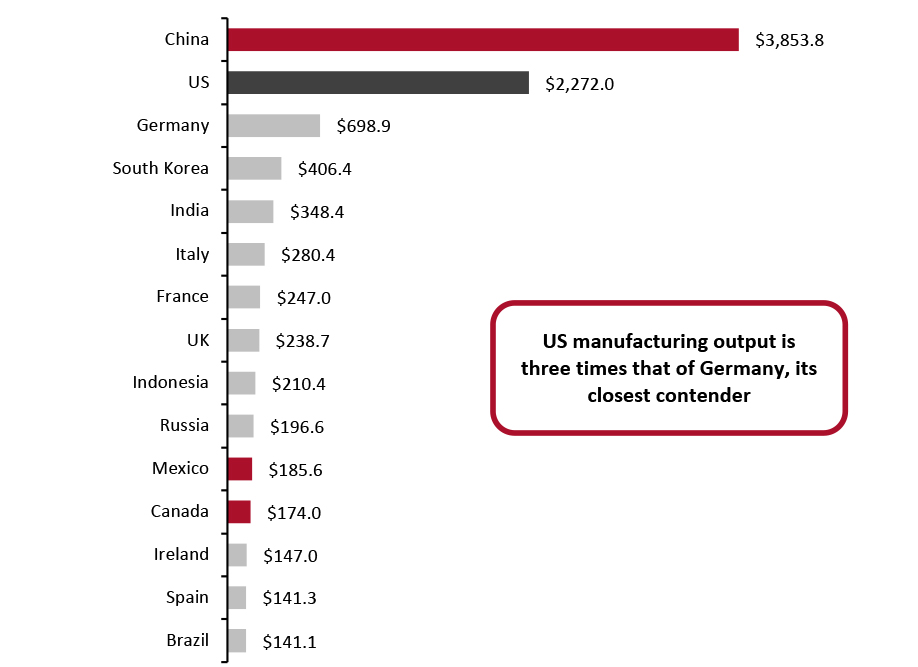

- Manufacturing output in the US is second only to China—the global manufacturing leader, with an output of $3.9 trillion in 2020. The US comes in second at $2.7 trillion. Other nations pale in comparison to these two countries in terms of manufacturing output, meaning the US is in a stronger position than many other countries looking to onshore or scale domestic manufacturing.

Figure 3. Top 15 Countries Globally: Manufacturing Output (2020; USD Bil.) [caption id="attachment_144752" align="aligncenter" width="700"]

Source: World Bank/Bureau of Economic Analysis/Government of Canada[/caption]

Source: World Bank/Bureau of Economic Analysis/Government of Canada[/caption]

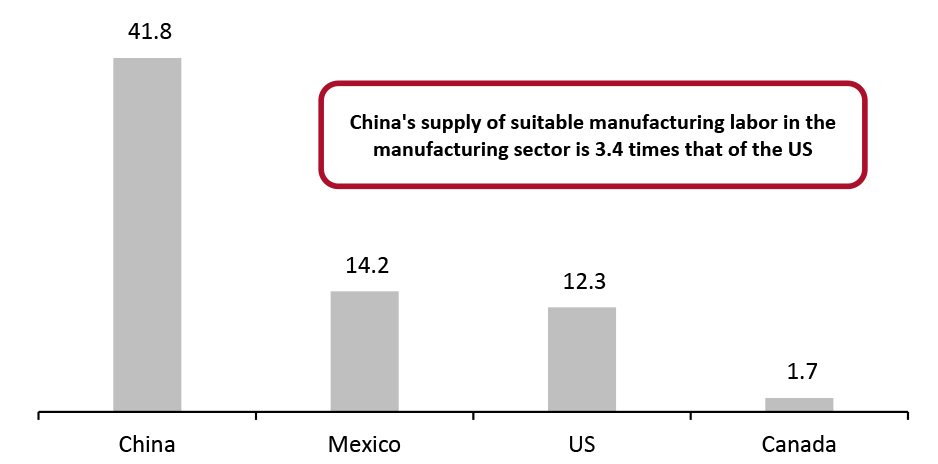

- China’s supply of suitable labor far exceeds other countries—perhaps unsurprisingly given the scale of China’s manufacturing capabilities. As of 2018 (latest data) China has 41.7 million people working in the manufacturing sector, according to the National Bureau of Statistics (NBS). Interestingly, Mexico ranked second among our comparison group, with 14.2 million workers in industry as of 2019 (data specifically for manufacturing is not available), according to the International Labor Organization (ILO), surpassing the US and Canada, which have 12.3 million and 1.7 million manufacturing workers, per latest government data as of 2021.

Figure 4. US and Top Three Trading Partners: Employees Working in Manufacturing (Mil.) [caption id="attachment_144753" align="aligncenter" width="700"]

Data are latest available: China (2018), Mexico (2019), Canada (2021), US (2021)

Data are latest available: China (2018), Mexico (2019), Canada (2021), US (2021) Source: NBS/ILO/BLS/StatCan/Coresight Research [/caption]

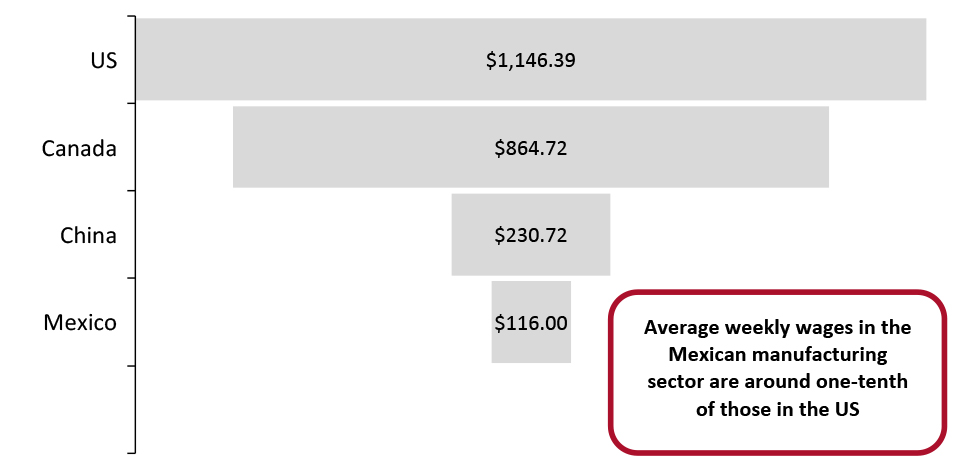

- Labor cost in China and Mexico is a fraction of that in the US. Along with a surplus labor supply, China and Mexico trump the US in terms of labor costs. As of 2021, average manufacturing weekly wages in Mexico are $116, we calculate, based on average hourly wage data from the National Institute of Statistics and Geography (INEGI). Average manufacturing weekly wages in China are $230.70, as of 2020, according to NBS while those in Canada and the US were multiple times higher, based on 2020 government data.

Figure 5. US and Top Three Trading Partners: Average Manufacturing Weekly Wages [caption id="attachment_144754" align="aligncenter" width="700"]

Source: NBS/INEGI/BLS/StatCan/Coresight Research[/caption]

Source: NBS/INEGI/BLS/StatCan/Coresight Research[/caption]

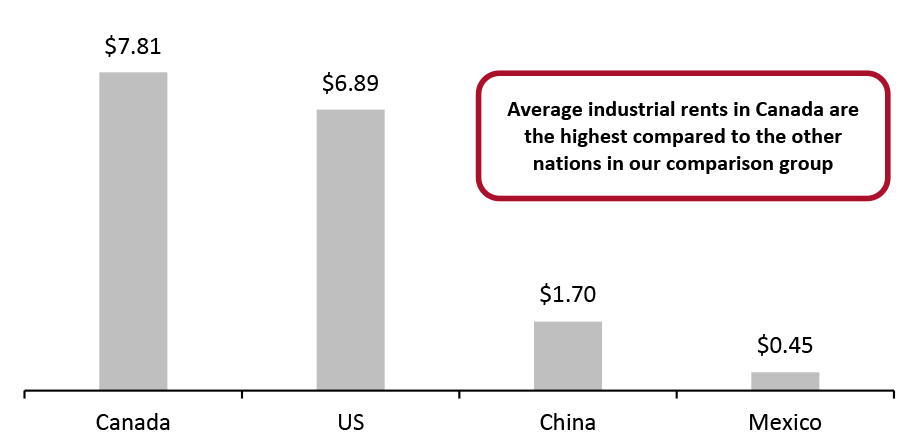

- Factory rents in Mexico and China are cheaper than in the US. As well as wages, rent and utility payments are a substantial component of operating expenses and businesses endeavor to keep these costs low. Industrial rents in Canada are higher than those in the US by at least $1.00 based on the latest data from real estate companies JLL and CBRE, making it unviable to set up a large-scale unit for many companies. In reality, rates vary based on the location of the facility in each country.

Figure 6. Quarterly Rent per Square Foot US Manufacturing Sector and Its Top Three Trading Partners [caption id="attachment_144755" align="aligncenter" width="700"]

For Canada, the US and Mexico, rent is as of the fourth quarter of 2021. For China, rent is as of the first quarter of 2020.

For Canada, the US and Mexico, rent is as of the fourth quarter of 2021. For China, rent is as of the first quarter of 2020. Source: NAI Mexico/Knight Frank/JLL/CBRE/Coresight Research [/caption]

- The US ranks top in the World Bank’s “ease of doing business” rating among our comparison group. On a global scale, the US ranks sixth followed by Canada at 23, China at 32 and Mexico at 60, among 190 ranked countries. The ranking considers numerous factors, including opening a business in the country, employing workers, dealing with construction permits, getting electricity, registering property, paying taxes, enforcing contracts and other processes typically involved in incorporating a business.

- Securing supply chains, reviving domestic manufacturing capacity and creating jobs

- New investment in research, innovation, training and university partnerships

- Work on shielding the economy from potential shortages of critical imported products and components, such as semiconductors, minerals and materials, pharmaceuticals and their ingredients, and advanced batteries such as those used in electric vehicles

- A long-term review of six sectors of the economy to identify policy recommendations to fortify the supply chain

- A freight information exchange system called Freight Logistics Optimization Works (FLOW), which consolidates data from private businesses, warehouses, logistics firms, ports and other stakeholders, to help improve the movement of goods and ease congestion

- Senate and House approval to fund the CHIPS for America Act to build semiconductor production capacity in the US

What We Think

Disruptions brought about by the pandemic and the Russia-Ukraine war have underscored the need for diversification in supply chains. For many brands and retailers in the US, this has shone a spotlight on the importance of reducing reliance on foreign imports through onshoring. Despite several factors that set the US at a cost disadvantage for sourcing it appears that there is no better time for US businesses to incrementally begin reshoring sourcing and manufacturing. The US already ranks highly for the ease of doing business in the country among its global counterparts, which means incorporating a new firm is relatively smoother than the process in other countries. The US government is also implementing several initiatives to ensure the nation’s supply chain is insulated against global shocks, including helping businesses reshore successfully. Implications for Brands/Retailers- Companies must look to revamp their sourcing mixes and use this time to negotiate favorable contracts with local suppliers in the US who are looking to grow their business.

- Honing supplier relationships takes time. Brands and retailers must invest to build long-term relationships that are mutually beneficial.

- Brands and retailers should look to invest in domestic manufacturing facilities as a way of integrating their supply chains and helping local suppliers scale their manufacturing.

- Industrial real estate providers should provide help to businesses looking to onshore manufacturing. Businesses will already have significant upfront investment in terms of facilities, technology and labor, so real estate providers could seek pay outs over a longer period to help ease some initial cost burdens.

- Supply chain technology vendors that have a specific focus on suppliers in the US can help brands and retailers identify vendors they can work with.

- Technology solutions that can provide local supplier equivalents with typical overseas suppliers can help expedite the onshoring process.