Nitheesh NH

Introduction

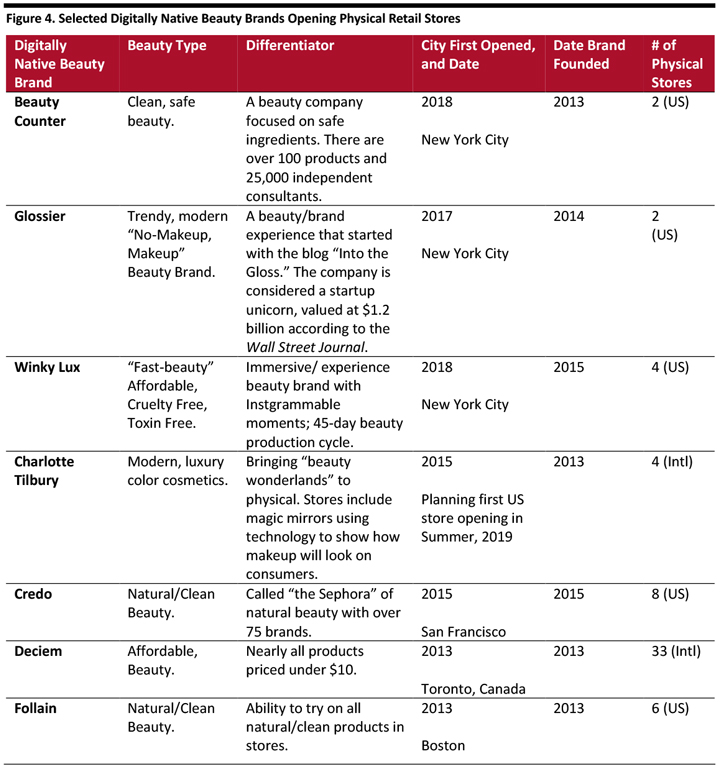

The beauty market has an abundance of digitally native brands – yet while consumers discover beauty online, they still buy in stores. So, many digitally native brands are making the move offline. Some, such as Credo, Follain and Deciem, have opened shops, while WinkyLux, a “fast-beauty” brand, opened a storefront in Macerich’s new Brandbox retail popup in Tysons Corner Mall. Here, we look at digitally native brands that are successfully moving into the physical space.The Beauty and Personal Care Market: Online Brands Moving Offline

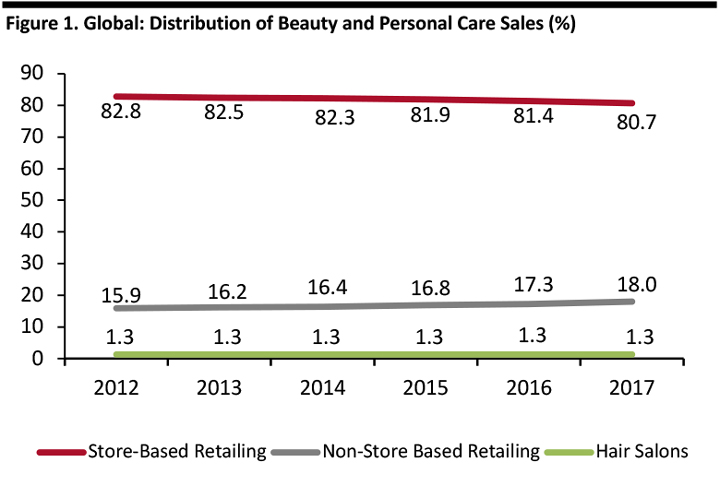

Many Digitally Native Beauty Brands were Launched Based on Needs and Ties to the Digital Community There is an abundance of digitally native, independent, beauty brands. Today, many successful beauty brands have digital roots. The Internet provides a platform which allows everyone to share opinions, become influencers and bloggers, and even launch brands. There are strong links between the digital beauty community and digitally native beauty brands. For example, some beauty brands, such as ColourPop and Glossier, started as blogs that built products around the beauty community and its feedback. Other brands, including Drunk Elephant, Credo and Briogeo, were created to solve unique customer needs around skincare and haircare. For example, Tiffany Masterson, founder of Drunk Elephant, said that she created her clean-beauty brand because her skin was sensitive to the chemicals in the products she was using, so she formulated a brand that eliminated “the suspicious six” (essential oils, drying alcohols, silicones, chemical screens, fragrances/dyes and sodium lauryl sulfate) ingredients to create a product that she says is nontoxic and free from synthetic ingredients. As digitally native brands gain momentum, they are increasingly adding a physical presence offline into specialty retail, drugstores and pop-ups, and some are even launching their own stores. Some 80.7% of Beauty and Personal Care Purchases are Still Made In-Store The global beauty and personal care market was valued at $464.9 billion in 2017, according to Euromonitor International, with 80.7% of all those sales made in stores. Of all beauty selling channels, Internet retailing is the fastest growing. Internet retailing grew from 4.2% of the global beauty market in 2012 to 7.8% in 2017. Non-store retailing, which includes Internet retailing, direct selling, homeshopping and vending, grew from 15.9% to 18.0% over the same period. [caption id="attachment_83344" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

The new breed of direct-to-consumer beauty brands that operate online only are contributing to the rise of Internet retailing, but even successful digitally native brands are seeking physical locations to complement their online presence.

Consumers Use Social Media to Discover Beauty and Determine Which Brands to Buy

Beauty is one of the most-posted categories on social media. In 2018, there were over 169 billion content views on YouTube of beauty content, including tutorials, DIY videos, product reviews and haul videos (a video where a consumer discusses items that they purchased, sometimes going into detail about their experiences during the purchase and the cost of the items they bought), according to Pixability, a video advertising and software insight company. This was an increase of 62.5% from 2017, when there were 104 billion content views. From November 2015 to April 2017, “beauty” was the most popular category on Instagram, with over 3,325 million mentions, according to Socialbakers, an AI company measuring social media.

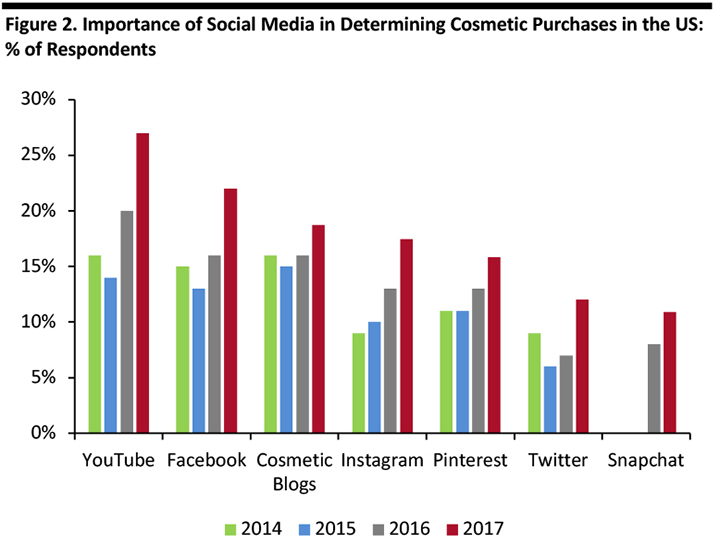

The beauty consumer is discovering beauty products on social media through product reviews, blogs, YouTube videos, friend recommendations, Instagram posts and Pinterest images. Each year, social media becomes more important in helping consumers determine which beauty brands to buy.

In 2017, YouTube was the most influential social media channel for beauty, with 26.7% of US consumers relying on it to make a beauty purchase, according to an October 2017 TABS Analytics survey.

[caption id="attachment_83334" align="aligncenter" width="720"]

Source: Euromonitor International[/caption]

The new breed of direct-to-consumer beauty brands that operate online only are contributing to the rise of Internet retailing, but even successful digitally native brands are seeking physical locations to complement their online presence.

Consumers Use Social Media to Discover Beauty and Determine Which Brands to Buy

Beauty is one of the most-posted categories on social media. In 2018, there were over 169 billion content views on YouTube of beauty content, including tutorials, DIY videos, product reviews and haul videos (a video where a consumer discusses items that they purchased, sometimes going into detail about their experiences during the purchase and the cost of the items they bought), according to Pixability, a video advertising and software insight company. This was an increase of 62.5% from 2017, when there were 104 billion content views. From November 2015 to April 2017, “beauty” was the most popular category on Instagram, with over 3,325 million mentions, according to Socialbakers, an AI company measuring social media.

The beauty consumer is discovering beauty products on social media through product reviews, blogs, YouTube videos, friend recommendations, Instagram posts and Pinterest images. Each year, social media becomes more important in helping consumers determine which beauty brands to buy.

In 2017, YouTube was the most influential social media channel for beauty, with 26.7% of US consumers relying on it to make a beauty purchase, according to an October 2017 TABS Analytics survey.

[caption id="attachment_83334" align="aligncenter" width="720"] Base: 864 respondents aged 18-75, surveyed in October 2017 Source: TABS Analytics [/caption]

Online Beauty Bloggers and Influencers Have Launched Some of the Most Successful, Million Dollar Brands

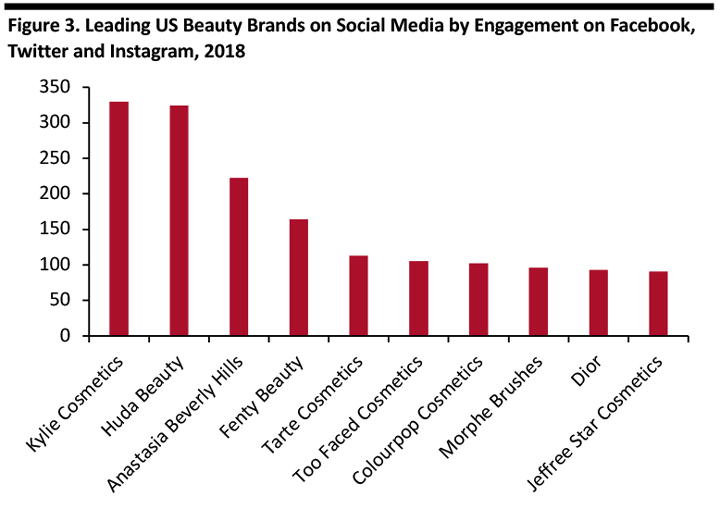

Of the top 10 beauty brands on social media, only one, Dior, is a traditional retail brand. Two of the 10 brands are celebrity brands — Kylie Jenner and Rihanna (Fenty) — and the remaining seven are all digitally native brands that are now sold in physical retail locations.

[caption id="attachment_83335" align="aligncenter" width="720"]

Base: 864 respondents aged 18-75, surveyed in October 2017 Source: TABS Analytics [/caption]

Online Beauty Bloggers and Influencers Have Launched Some of the Most Successful, Million Dollar Brands

Of the top 10 beauty brands on social media, only one, Dior, is a traditional retail brand. Two of the 10 brands are celebrity brands — Kylie Jenner and Rihanna (Fenty) — and the remaining seven are all digitally native brands that are now sold in physical retail locations.

[caption id="attachment_83335" align="aligncenter" width="720"] Source: Shareablee[/caption]

Source: Shareablee[/caption]

- Digitally native influencer: Kylie Jenner, the number one beauty brand on social media, launched Kylie Cosmetics’ Exclusive partnership with Ulta in November 2018. Jenner’s Lip Kit sold out within one day of the initial launch in 2016. The lip kits were sold online and in store.

- Digitally native blogger: Huda Beauty, the number two brand on social media in 2018, was launched by Huda Kattan in 2013 after a successful beauty blog and how-to videos in 2010. Kattan launched her own synthetic and mink eyelash collection after she could not find products that she liked; the lashes sold out on the first day of the launch. Mink eyelashes are false eyelashes that have gained popularity because they are very light and fluffy, and therefore comfortable for the user. Today, Huda Beauty has 34.5 million followers on Instagram and over 2 million followers on YouTube. Huda Beauty is sold in physical stores through Sephora, Macy’s and JC Penney.

Source: Company websites/Coresight Research[/caption]

Specialty Retailer Ulta Reports Significant Growth from Digitally Native Brands and Key to its Growth Strategy

Digitally native beauty brands are finding homes in specialty retailers. Ulta reported it is focused on bringing independent brands in-store. Ulta CEO Mary Dillon said Ulta is gaining share across all categories with digitally native brands. Dillon attributed Ulta’s partnership with digitally native brands as key to its strategy and commented that approximately 6-7% of its merchandise is exclusive, meaning brands have selected Ulta as their only offline selling channel. The company reported fourth quarter net sales rose 9.7% with comparable sales rising 8.1% for the year.

At Ulta’s company’s Investor Day in November, 2018, Tara Simon, SVP of Merchandising for Prestige Beauty, reported the company is seeing significant growth in brands it has introduced, including ColourPop, Dose of Colors, Juvia’s Place and Morphe.

[caption id="attachment_83337" align="aligncenter" width="720"]

Source: Company websites/Coresight Research[/caption]

Specialty Retailer Ulta Reports Significant Growth from Digitally Native Brands and Key to its Growth Strategy

Digitally native beauty brands are finding homes in specialty retailers. Ulta reported it is focused on bringing independent brands in-store. Ulta CEO Mary Dillon said Ulta is gaining share across all categories with digitally native brands. Dillon attributed Ulta’s partnership with digitally native brands as key to its strategy and commented that approximately 6-7% of its merchandise is exclusive, meaning brands have selected Ulta as their only offline selling channel. The company reported fourth quarter net sales rose 9.7% with comparable sales rising 8.1% for the year.

At Ulta’s company’s Investor Day in November, 2018, Tara Simon, SVP of Merchandising for Prestige Beauty, reported the company is seeing significant growth in brands it has introduced, including ColourPop, Dose of Colors, Juvia’s Place and Morphe.

[caption id="attachment_83337" align="aligncenter" width="720"] Source: Company reports[/caption]

Ulta has an “Emerging Brands Team” dedicated to identifying and on-boarding selected brands. The company has created processes to on-board and incubate small, emerging brands across all of its merchandising categories to help to ensure successful product launches.

Drugstore Walgreens Teamed up with Birchbox to Introduce Consumers to Prestige Independent Brands

Digitally native brand Birchbox is bringing its concept to physical retail with a build your own box (BYOB) at 11 Walgreens and Duane Reade locations. The in-store experience allows consumers to select five sample and full-sized skincare, haircare and makeup brands from over 40 prestige beauty brands, some of which are also digitally native including RMS Beauty, Winky Lux and Wander Beauty. The Birchbox stations are interactive, encouraging customers to test and try on beauty products.

[caption id="attachment_83338" align="aligncenter" width="720"]

Source: Company reports[/caption]

Ulta has an “Emerging Brands Team” dedicated to identifying and on-boarding selected brands. The company has created processes to on-board and incubate small, emerging brands across all of its merchandising categories to help to ensure successful product launches.

Drugstore Walgreens Teamed up with Birchbox to Introduce Consumers to Prestige Independent Brands

Digitally native brand Birchbox is bringing its concept to physical retail with a build your own box (BYOB) at 11 Walgreens and Duane Reade locations. The in-store experience allows consumers to select five sample and full-sized skincare, haircare and makeup brands from over 40 prestige beauty brands, some of which are also digitally native including RMS Beauty, Winky Lux and Wander Beauty. The Birchbox stations are interactive, encouraging customers to test and try on beauty products.

[caption id="attachment_83338" align="aligncenter" width="720"] Source: Walgreens[/caption]

Winky Lux, a Digitally Native Brand, Opened BrandBox, a Short-Term Flexible Leasing Pop-up Solution

Digitally native brands are exploring temporary, flexible physical locations to test new markets. Some mall operators and department stores are responding by providing pop-up spaces in their locations. For example, in November 2018, mall operator Macerich launched BrandBox, a pop-up solution with short-term leases ranging from six months to a year for spaces ranging from 500 square feet to 2,500 square feet. BrandBox stores include services and support for teams, including design, staffing, technology and retail analytics dashboards to monitor offline sales. Digitally native beauty brand Winky Lux was one of the six brands to debut its BrandBox store in November 2018.

Kevin McKenzie, Macerich’s EVP and Chief Digital Officer, said his team spent over a year on research and development, interviewing 50 founders from digitally native brands. The interview process revealed that digitally native brands had an overwhelming desire to open physical stores because it was becoming more difficult to reach new customers through only one channel, and online only was reaching an “exhaustion point.”

[caption id="attachment_83339" align="aligncenter" width="720"]

Source: Walgreens[/caption]

Winky Lux, a Digitally Native Brand, Opened BrandBox, a Short-Term Flexible Leasing Pop-up Solution

Digitally native brands are exploring temporary, flexible physical locations to test new markets. Some mall operators and department stores are responding by providing pop-up spaces in their locations. For example, in November 2018, mall operator Macerich launched BrandBox, a pop-up solution with short-term leases ranging from six months to a year for spaces ranging from 500 square feet to 2,500 square feet. BrandBox stores include services and support for teams, including design, staffing, technology and retail analytics dashboards to monitor offline sales. Digitally native beauty brand Winky Lux was one of the six brands to debut its BrandBox store in November 2018.

Kevin McKenzie, Macerich’s EVP and Chief Digital Officer, said his team spent over a year on research and development, interviewing 50 founders from digitally native brands. The interview process revealed that digitally native brands had an overwhelming desire to open physical stores because it was becoming more difficult to reach new customers through only one channel, and online only was reaching an “exhaustion point.”

[caption id="attachment_83339" align="aligncenter" width="720"] BrandBox Storefronts, Tysons Corner

BrandBox Storefronts, Tysons Corner Source: David Madison for Macerich [/caption]

Key Insights

Digitally native beauty brands are continuing to grow and move from online to offline.- As the independent beauty market becomes more crowded online, beauty brands are differentiating by opening physical stores and seek to stand out from the competition through immersive events, experiences and solving the modern beauty consumer’s needs.

- Physical retail is still relevant – especially for beauty – as consumers want to try on and experience beauty products: Although the beauty consumer’s beauty product discovery process begins online with YouTube as the preferred channel, some 80.7% of beauty and personal care purchases are still made in store.

- Opening a physical retail store increases online traffic for emerging brands by 45%, according to an ICSC survey. The survey found that a new physical store increases brand awareness and perception, as well as the consumer’s willingness to recommend a brand to a friend.

- Digitally native brands are seeking to open physical stores because it offers them another channel to reach consumers. After one year of research with over 50 digitally native brand founders, mall operator Macerich said brand owners reported an overwhelming desire to open physical stores because it was becoming more difficult to reach new customers through only one channel, and online only was reaching an “exhaustion point.”

- Digitally native beauty brands are collaborating with specialty retail and drugstores. Specialty retailer Ulta has reported significant growth from digitally native brands and said they are key to its growth strategy. The company has a team devoted to discovering and on-boarding digitally native beauty brands into its physical stores. Digitally native brand Birchbox is bringing its concept to physical retail with a build your own box (BYOB) at 11 Walgreens and Duane Reade locations. The in-store experience allows consumers to select five sample and full-sized skincare, haircare and makeup brands from over 40 prestige beauty brands, some of which are also digitally native, including RMS Beauty, Winky Lux and Wander Beauty.